- Ethereum orderbook ratio indicated low supply and high demand at $3886.

- ETH could revisit $3500 at the 200EMA before rally continuation.

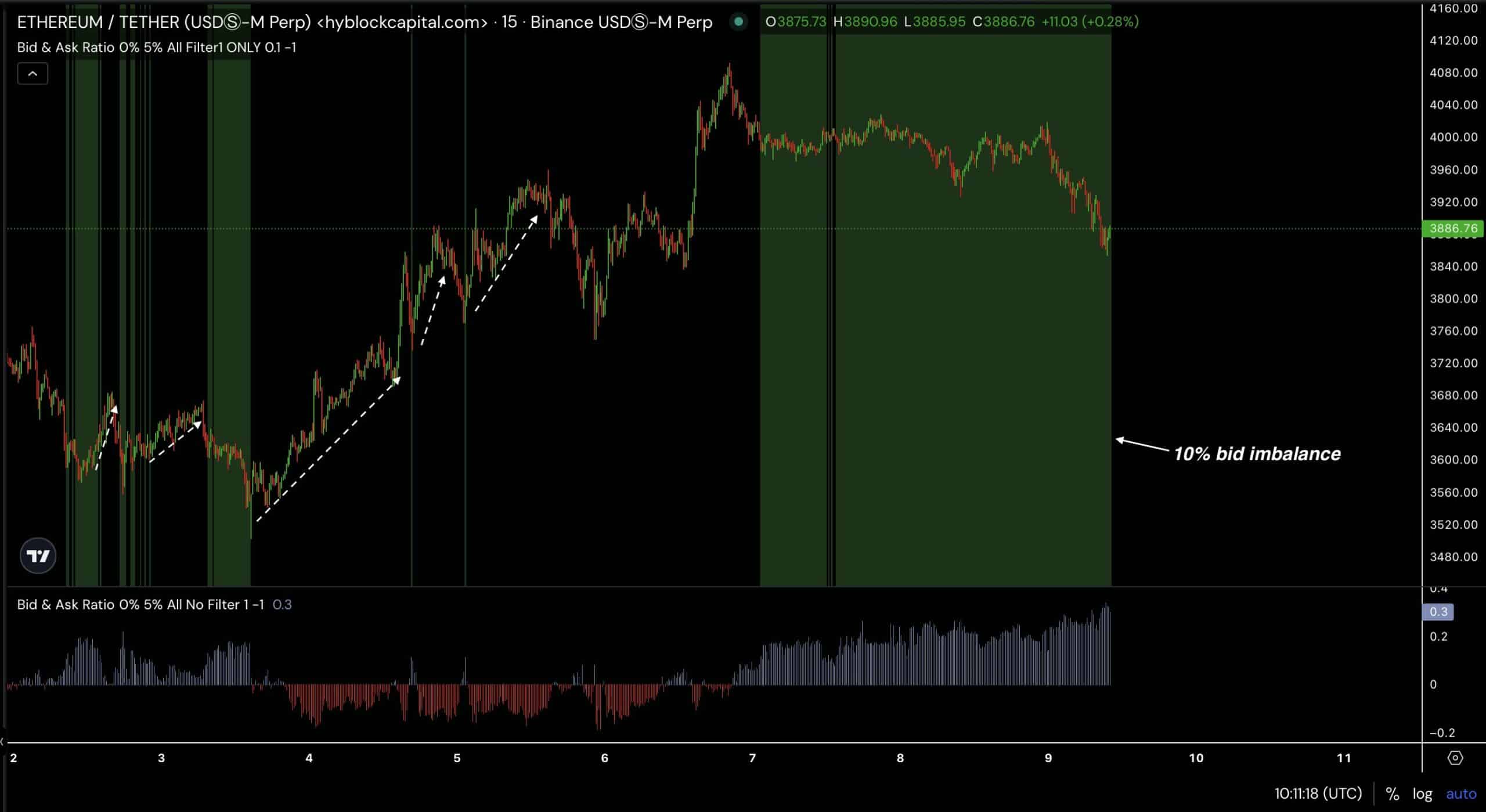

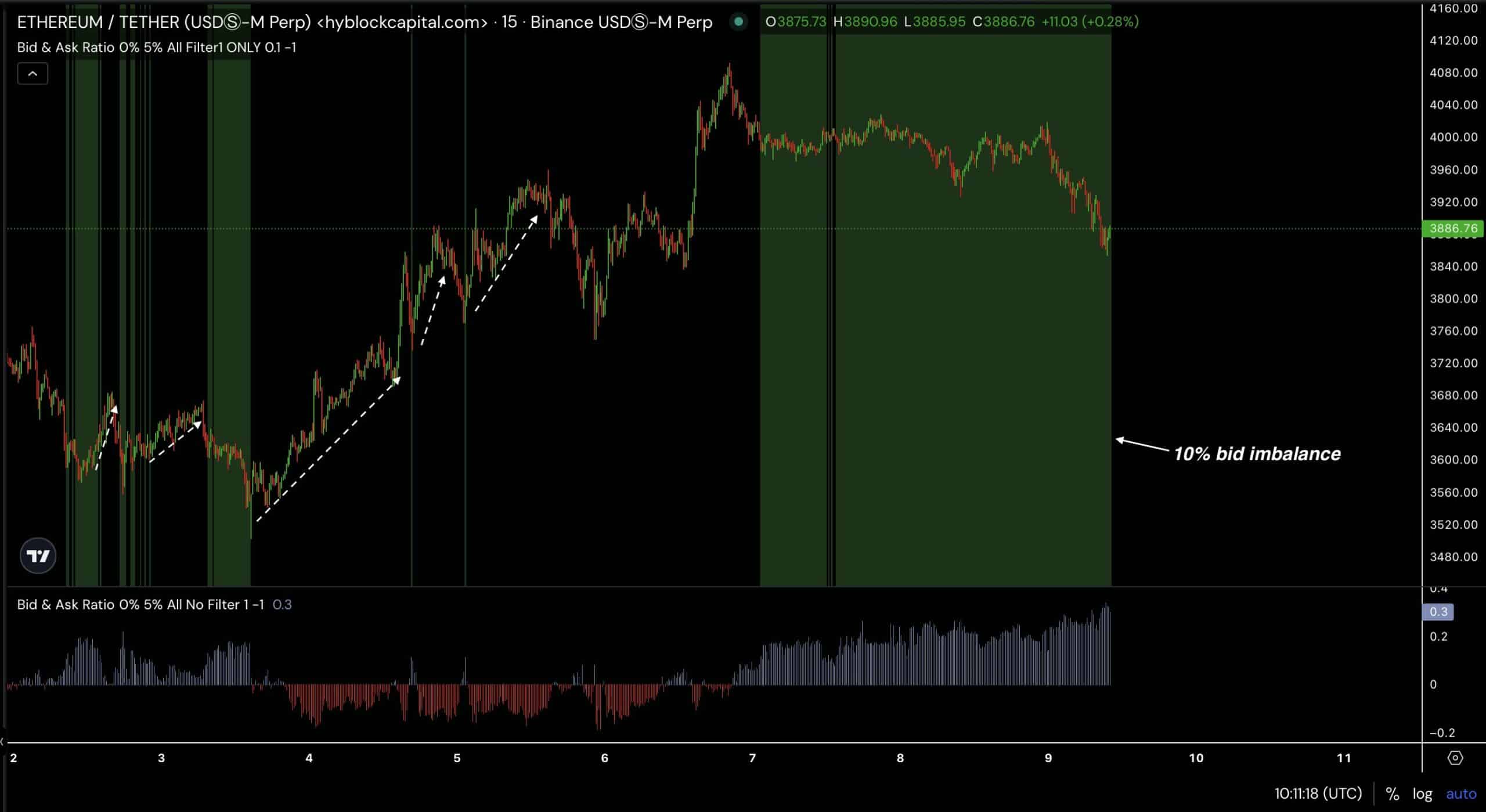

Ethereum [ETH] showed notable 10% bid imbalance within the 0-5% depth range of the order book, signaling a potential supply shortage and demand at the price level around $3,886.76.

These price points favored bids by 10%, suggesting a stronger buying interest than selling pressure.

This imbalance indicated bullish sentiment as more traders were willing to purchase ETH at or above that market price, possibly driving prices higher if the trend persists.

Source: Hyblock Capital

Additionally, there were spikes in volume of trades correlating with significant price movements, both upward and downward.

The increase in bid dominance along with high trade volumes points to possible continued bullish momentum for ETH. Historical trends show such imbalances often precede price increases.

Inflow volume into exchanges

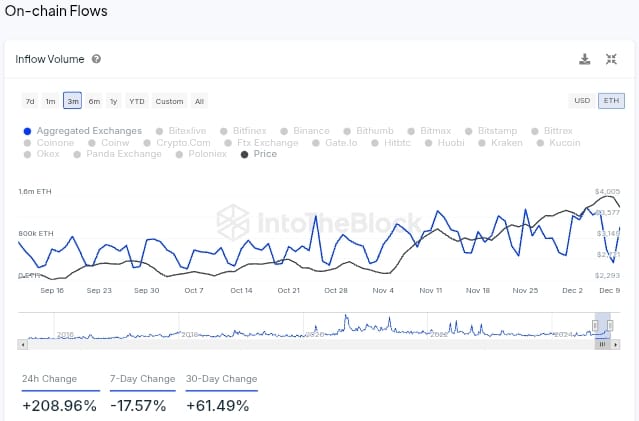

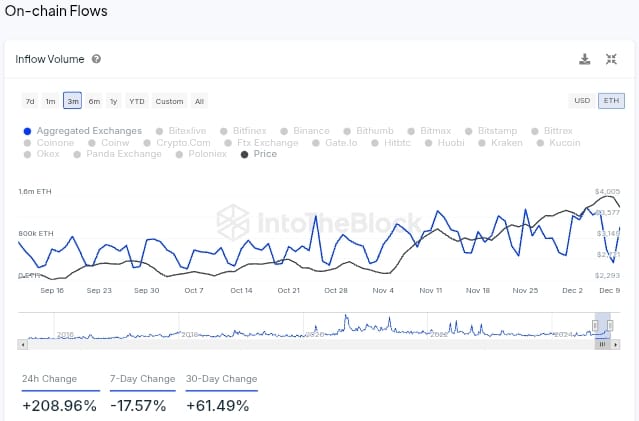

However, ETH saw a surge in inflow volume into exchanges as it rose by 208.96% over the past 24 hours. This suggested that investors could be moving ETH to exchanges possibly to take profits or prepare for potential selling.

The weekly change showed a decrease of 17.57% in inflow volume, indicating less ETH was moved to exchanges compared to the previous week, which could signify a reduction in selling pressure.

Source: IntoTheBlock

Conversely, monthly change increased by 61.49%, suggesting that over the past month, there had been generally higher inclination to transfer ETH to exchanges than in the preceding periods.

The influx could temper the bullish outlook suggested by the orderbook ratio, which indicated low supply and high demand.

As inflows suggest potential selling pressure, it could lead to a temporary decline in ETH prices despite underlying demand signals.

How low can ETH go before bottoming?

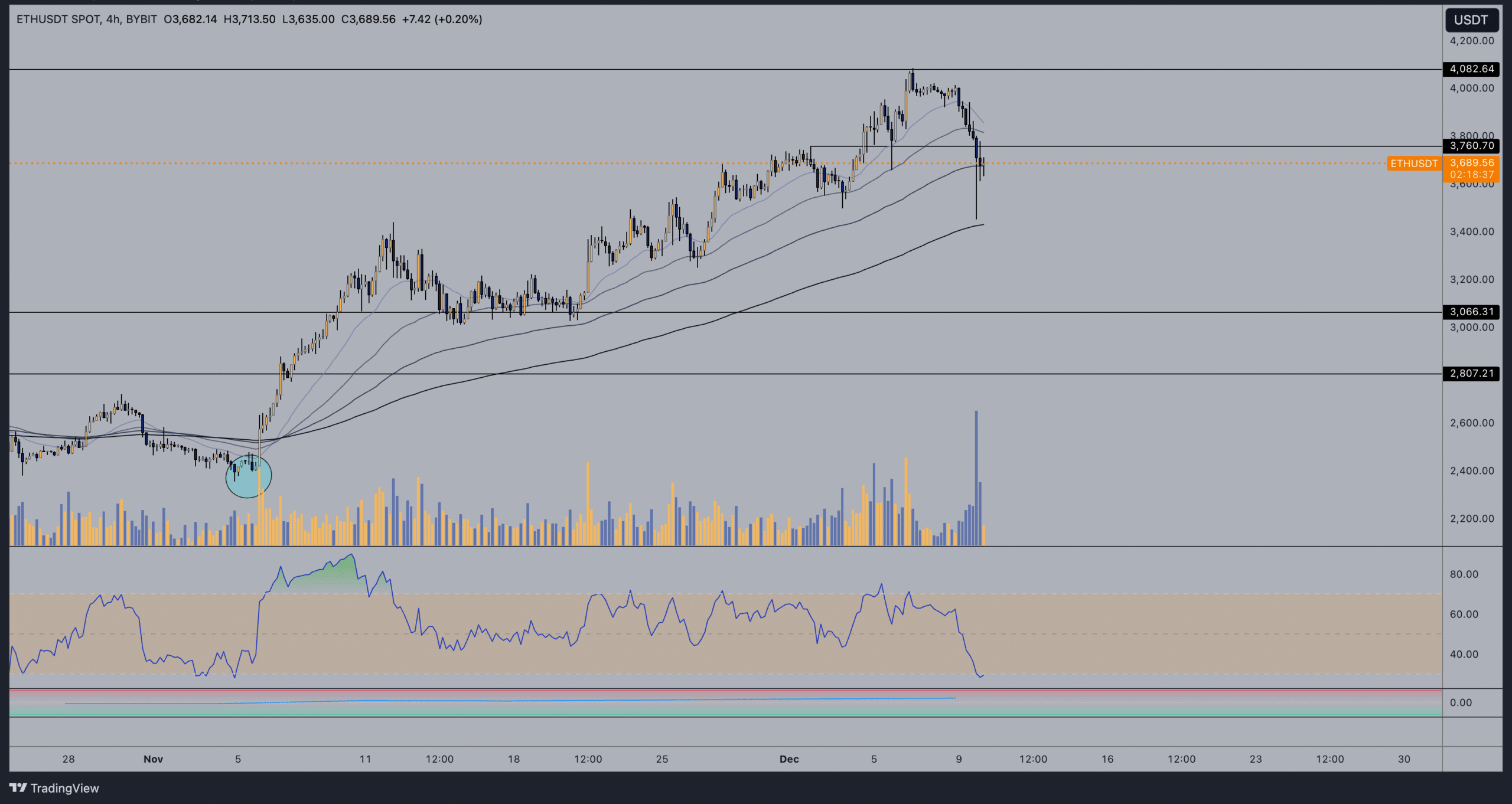

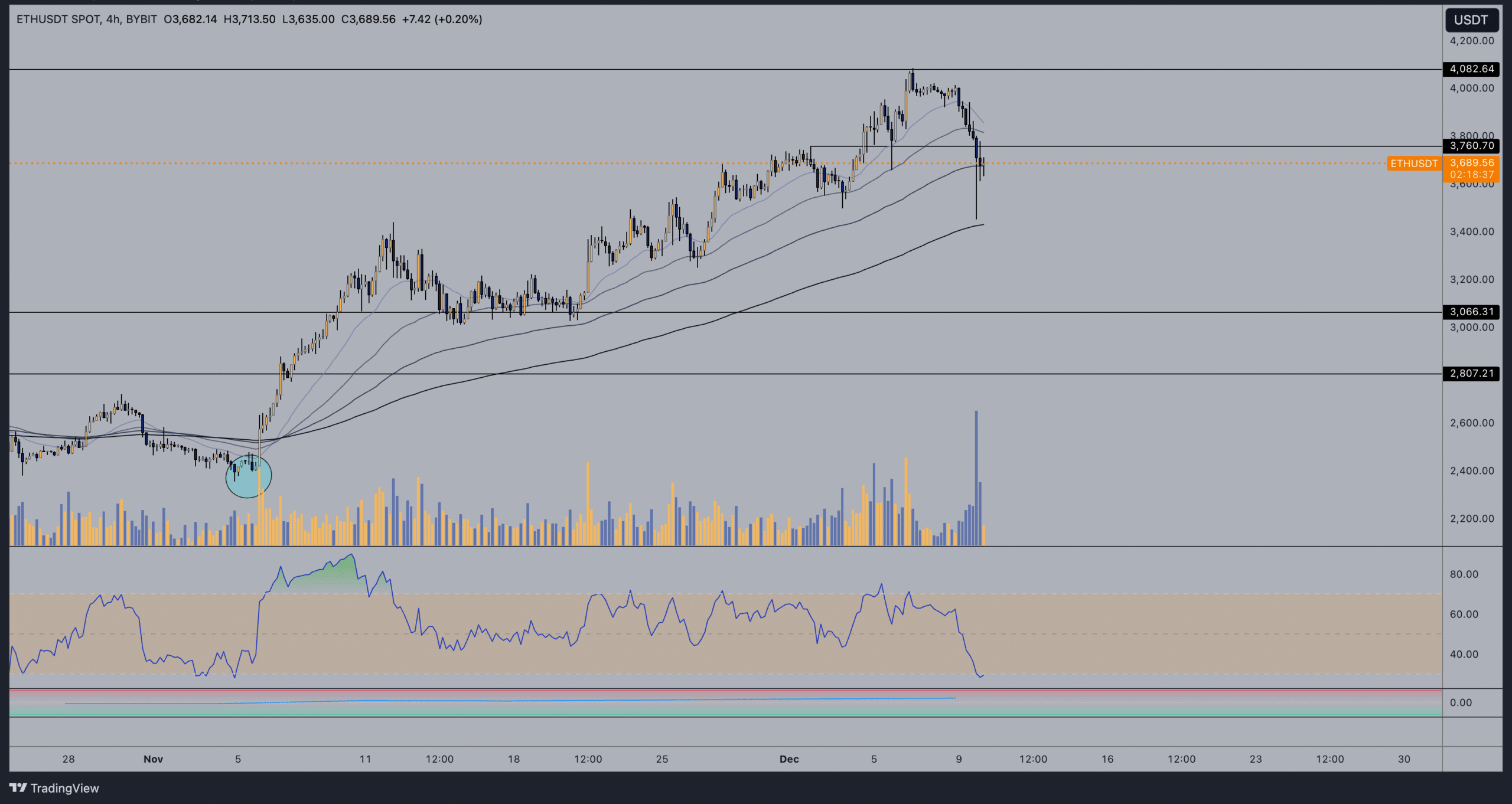

With that in mind, ETH could be poised for a small pullback before reversing for a bullish trend continuation as it traded around $3689, following a descent from the higher resistance near $4,082.

Trading volume increased during sell-offs, hinting at decline but with the RSI near the oversold zone, now below 30, suggested an overextended bear move that could lead to a reversal if buyers step in.

ETH falling below 20EMA and 50EMA signaled short-term bearish momentum, contrasting with the potential long-term support provided by the 200EMA.

Source: Trading View

Ethereum showed signs of testing a key support level at the 200EMA around $3,500, with potential for reversal indicated by an oversold RSI.

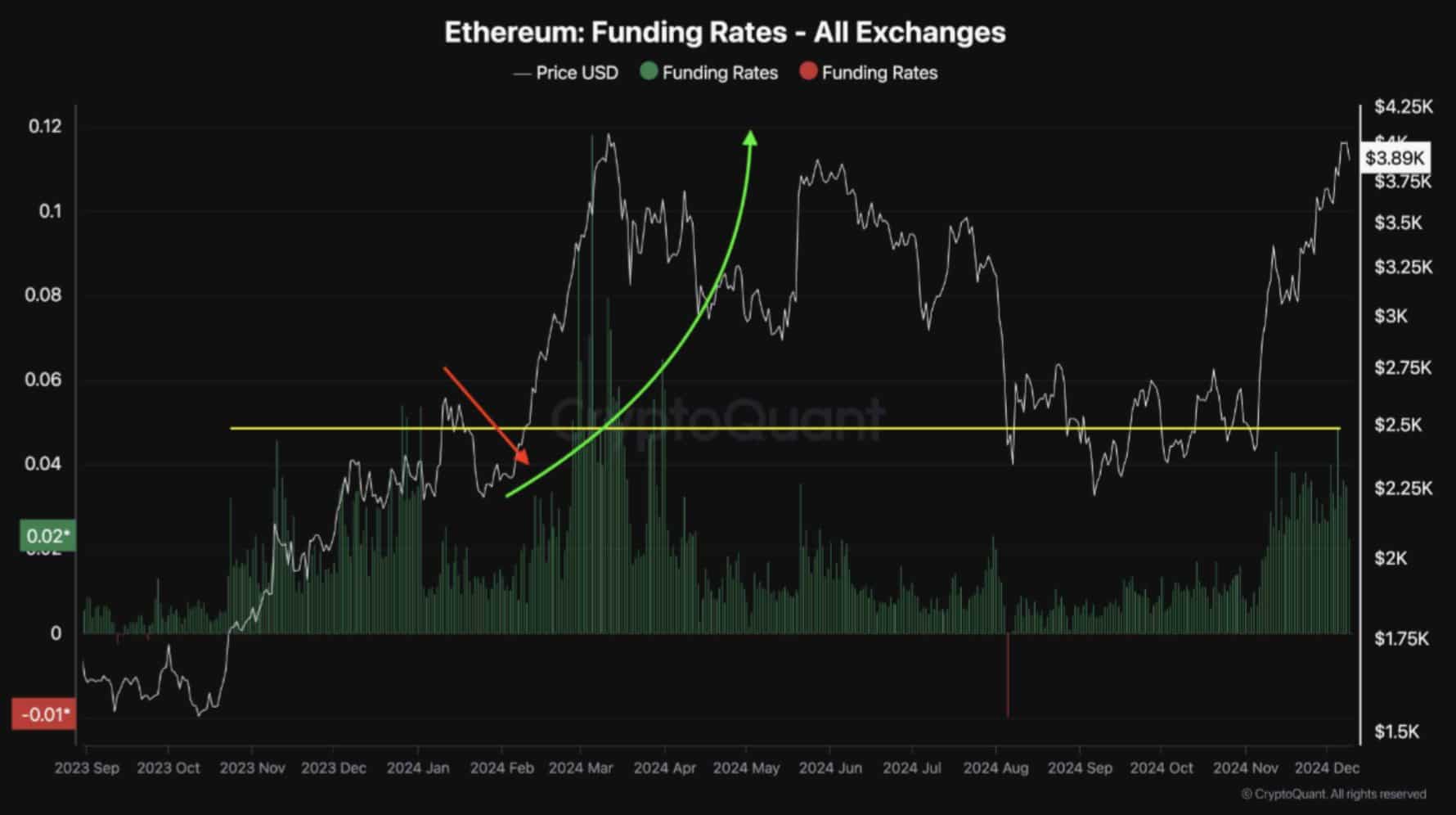

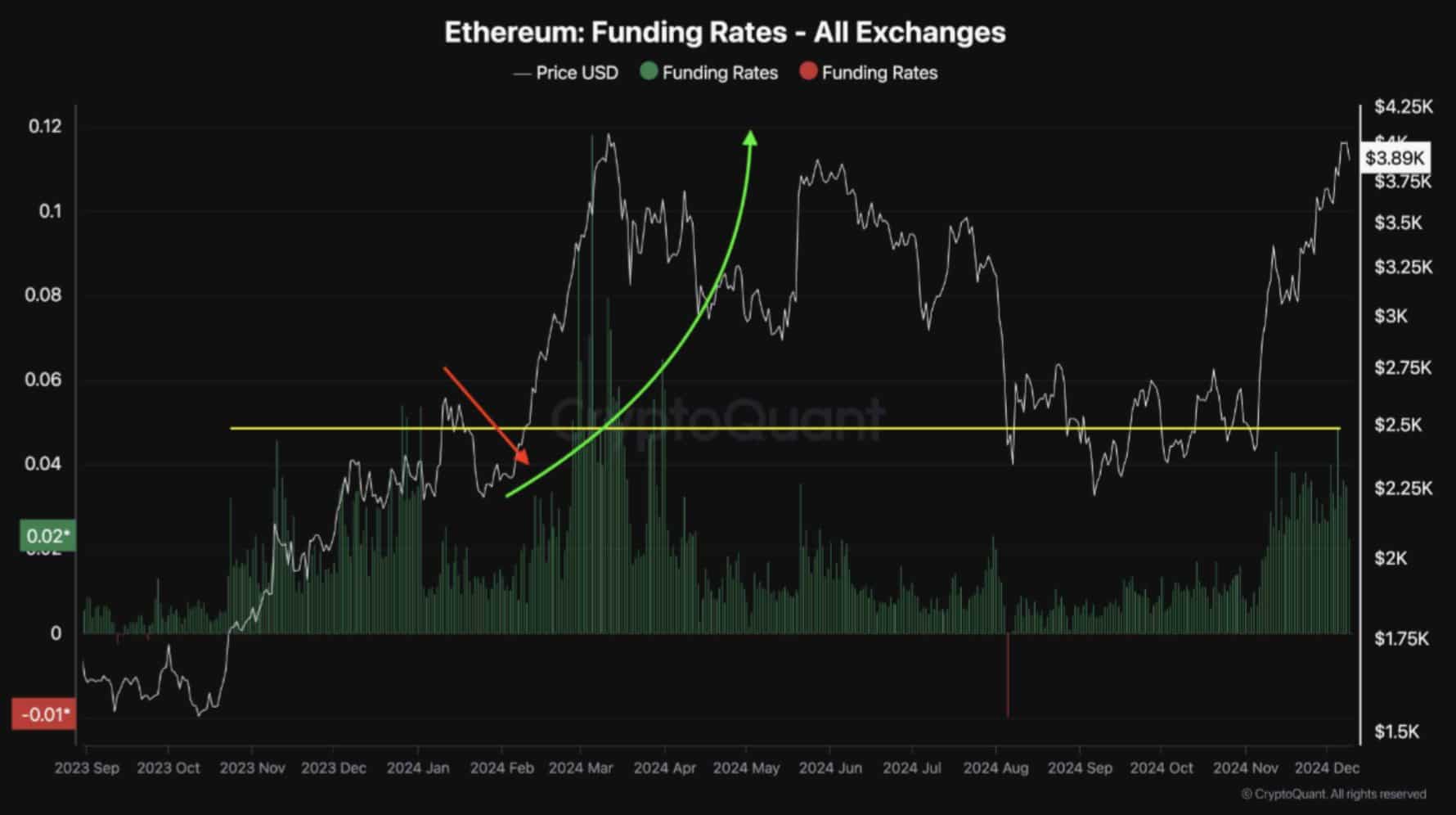

If this level holds, a rally towards higher levels could be anticipated as funding rates hit a multi-month high, indicating increased trader confidence and a potential anticipation of higher prices.

The funding rates’ spike above 0.04% coinciding with price swings represented a sharp increase in trader leverage, often preceding price volatility.

Source: CryptoQuant

Read Ethereum’s [ETH] Price Prediction 2024–2025

High funding rates indicated strong bullish market sentiment, though they may lead to short-term corrections due to over-leveraging.

The resurgence of high funding rates, like those in early 2024, shows significant market involvement and optimism. However, this could risk a correction if the market overheats.

- Ethereum orderbook ratio indicated low supply and high demand at $3886.

- ETH could revisit $3500 at the 200EMA before rally continuation.

Ethereum [ETH] showed notable 10% bid imbalance within the 0-5% depth range of the order book, signaling a potential supply shortage and demand at the price level around $3,886.76.

These price points favored bids by 10%, suggesting a stronger buying interest than selling pressure.

This imbalance indicated bullish sentiment as more traders were willing to purchase ETH at or above that market price, possibly driving prices higher if the trend persists.

Source: Hyblock Capital

Additionally, there were spikes in volume of trades correlating with significant price movements, both upward and downward.

The increase in bid dominance along with high trade volumes points to possible continued bullish momentum for ETH. Historical trends show such imbalances often precede price increases.

Inflow volume into exchanges

However, ETH saw a surge in inflow volume into exchanges as it rose by 208.96% over the past 24 hours. This suggested that investors could be moving ETH to exchanges possibly to take profits or prepare for potential selling.

The weekly change showed a decrease of 17.57% in inflow volume, indicating less ETH was moved to exchanges compared to the previous week, which could signify a reduction in selling pressure.

Source: IntoTheBlock

Conversely, monthly change increased by 61.49%, suggesting that over the past month, there had been generally higher inclination to transfer ETH to exchanges than in the preceding periods.

The influx could temper the bullish outlook suggested by the orderbook ratio, which indicated low supply and high demand.

As inflows suggest potential selling pressure, it could lead to a temporary decline in ETH prices despite underlying demand signals.

How low can ETH go before bottoming?

With that in mind, ETH could be poised for a small pullback before reversing for a bullish trend continuation as it traded around $3689, following a descent from the higher resistance near $4,082.

Trading volume increased during sell-offs, hinting at decline but with the RSI near the oversold zone, now below 30, suggested an overextended bear move that could lead to a reversal if buyers step in.

ETH falling below 20EMA and 50EMA signaled short-term bearish momentum, contrasting with the potential long-term support provided by the 200EMA.

Source: Trading View

Ethereum showed signs of testing a key support level at the 200EMA around $3,500, with potential for reversal indicated by an oversold RSI.

If this level holds, a rally towards higher levels could be anticipated as funding rates hit a multi-month high, indicating increased trader confidence and a potential anticipation of higher prices.

The funding rates’ spike above 0.04% coinciding with price swings represented a sharp increase in trader leverage, often preceding price volatility.

Source: CryptoQuant

Read Ethereum’s [ETH] Price Prediction 2024–2025

High funding rates indicated strong bullish market sentiment, though they may lead to short-term corrections due to over-leveraging.

The resurgence of high funding rates, like those in early 2024, shows significant market involvement and optimism. However, this could risk a correction if the market overheats.

where to buy clomiphene no prescription can i get generic clomid pills cost of clomiphene price cost of cheap clomiphene without rx can i get generic clomiphene without a prescription can i order clomid for sale how to buy clomiphene price

Thanks an eye to sharing. It’s outstrip quality.

Greetings! Extremely gainful par‘nesis within this article! It’s the petty changes which wish espy the largest changes. Thanks a lot for sharing!

buy azithromycin pills – ciplox 500 mg drug buy metronidazole 400mg pill

buy rybelsus sale – buy generic cyproheptadine for sale cyproheptadine 4mg pill

buy domperidone for sale – buy motilium for sale order cyclobenzaprine without prescription

buy generic inderal for sale – propranolol sale order methotrexate 2.5mg without prescription

order generic zithromax 250mg – buy nebivolol without prescription purchase nebivolol for sale

brand augmentin 1000mg – https://atbioinfo.com/ ampicillin cheap

esomeprazole pills – nexiumtous esomeprazole 20mg canada

medex brand – coumamide.com losartan canada

buy mobic 7.5mg without prescription – https://moboxsin.com/ purchase mobic pills

ed pills cheap – ed remedies top rated ed pills

amoxil medication – https://combamoxi.com/ amoxil buy online

forcan where to buy – https://gpdifluca.com/ buy fluconazole tablets

lexapro 10mg for sale – https://escitapro.com/ buy escitalopram 10mg generic

cenforce 100mg brand – https://cenforcers.com/# buy cenforce medication

cialis coupon walmart – how long does tadalafil take to work comprar tadalafil 40 mg en walmart sin receta houston texas

buy ranitidine 300mg generic – https://aranitidine.com/ ranitidine over the counter

cialis manufacturer coupon 2018 – https://strongtadafl.com/# where to buy generic cialis ?

This is the gentle of literature I in fact appreciate. https://gnolvade.com/

viagra buy pakistan – https://strongvpls.com/ buy viagra manchester

The vividness in this piece is exceptional. how to use prednisone inhaler

This is a question which is virtually to my heart… Many thanks! Unerringly where can I notice the contact details in the course of questions? https://ursxdol.com/levitra-vardenafil-online/

This is the gentle of literature I truly appreciate. https://prohnrg.com/product/loratadine-10-mg-tablets/

Thanks for putting this up. It’s well done. prednisolone orodispersible

With thanks. Loads of conception! https://ondactone.com/spironolactone/

Thanks an eye to sharing. It’s top quality.

https://doxycyclinege.com/pro/ranitidine/

Thanks towards putting this up. It’s well done. http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4272502&do=profile

buy forxiga 10mg online – https://janozin.com/ dapagliflozin 10 mg for sale

buy cheap generic xenical – https://asacostat.com/# order generic orlistat 60mg

I’ll certainly bring to read more. http://wightsupport.com/forum/member.php?action=profile&uid=22082