- Ethereum failed to flip the $3.9K price into support, dipping 14% below that level.

- Concerns grow over Ethereum’s long-term price action.

The crypto market is in ‘extreme’ volatility, and Ethereum [ETH] is the perfect example. After a 37% drop following Trump’s pro-tariff stance, it soared after Eric Trump’s pro-ETH post. Two massive swings in four days.

The stakes are high

Ethereum is up just 15% from its election day opening but is still 30% below its $4,016 peak during the Trump rally.

In the past week, ETH broke its support zone, falling below $2,800, three times the drop of Bitcoin. Despite the RSI hitting oversold and OBV showing signs of life, the steep decline wiped out over 14% of its gains, pushing 6.18 million addresses into the red.

Why? Trump’s tough economic policies triggered the biggest 24-hour crypto liquidation ever, wiping out $10 billion in one blow. But it didn’t stop there.

The ETH/BTC pair hit a four-year low, with daily declines over 3%. With little capital flowing from BTC into ETH, Ethereum’s future price action is looking more uncertain by the day.

Source: TradingView

Meanwhile, mid-caps are dominating the weekly gainer’s chart, with DEXE leading the way with a 44% gain. Investors are shifting away from high-caps, either exiting the cycle or moving funds into smaller assets.

So, is Ethereum’s recent dip just a temporary setback, or will the growing lack of confidence prevent it from breaking the $4,000 resistance?

Ethereum’s future unfolded

ETH ETFs have been on a strong run, with a four-day streak and a record $307.8 million in inflows in just one day—the highest this year. Blackrock’s ETHA alone pulled in a massive $276.2 million.

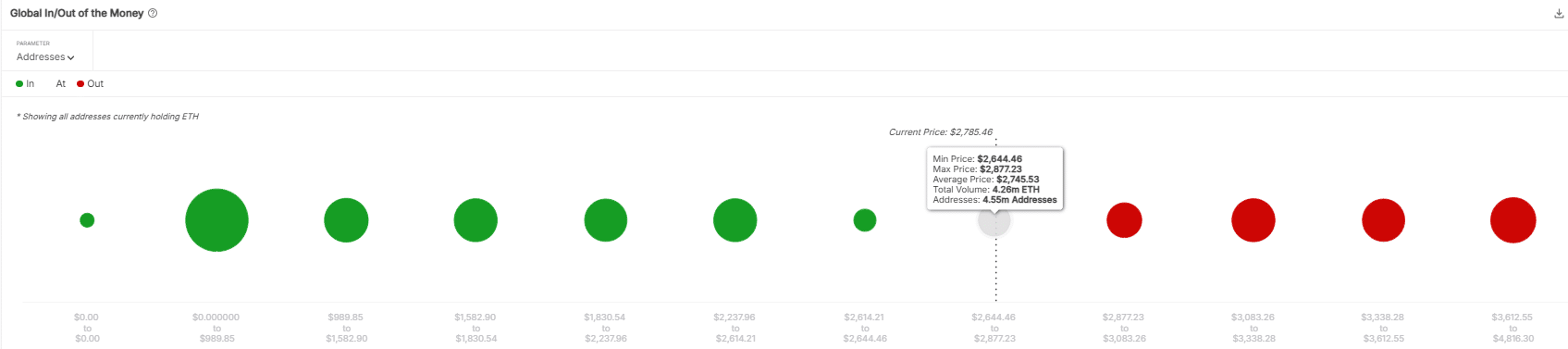

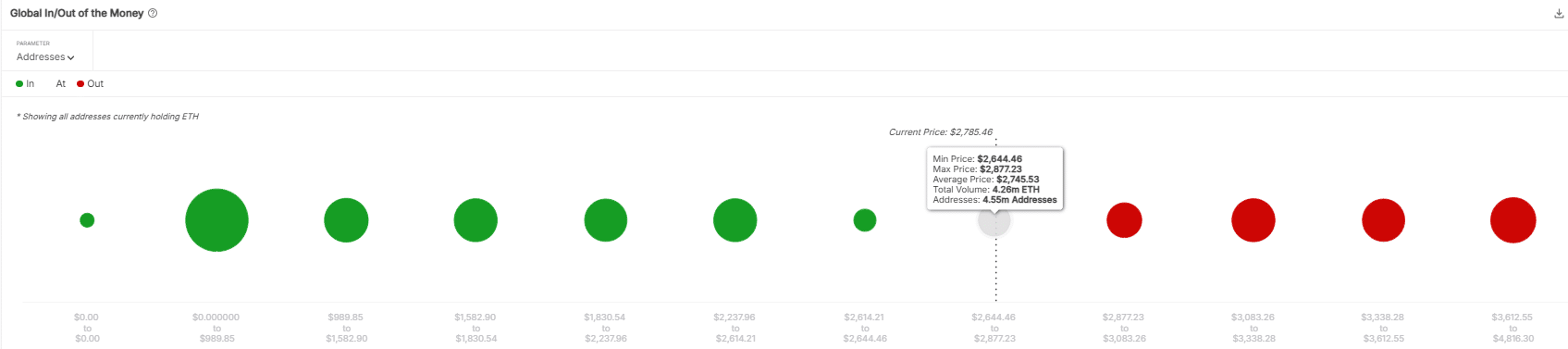

This institutional buying is key to keeping ETH from falling below $2,745. At this level, 4.26 million ETH would be in the red, risking an $11 billion sell-off—something to keep an eye on in the coming days.

Source: IntoTheBlock

With a strong market rebound still nowhere in sight, inflation teetering, and investor sentiment cooling on Ethereum during these volatile times, if ETF inflows falter, ETH could lose the remaining 15% from the election day rally last year.

Is your portfolio green? Check the Ethereum Profit Calculator

And as for breaking $4,000? The conditions above will need to shift. Until then, hold tight – the stakes for Ethereum are higher than ever.

- Ethereum failed to flip the $3.9K price into support, dipping 14% below that level.

- Concerns grow over Ethereum’s long-term price action.

The crypto market is in ‘extreme’ volatility, and Ethereum [ETH] is the perfect example. After a 37% drop following Trump’s pro-tariff stance, it soared after Eric Trump’s pro-ETH post. Two massive swings in four days.

The stakes are high

Ethereum is up just 15% from its election day opening but is still 30% below its $4,016 peak during the Trump rally.

In the past week, ETH broke its support zone, falling below $2,800, three times the drop of Bitcoin. Despite the RSI hitting oversold and OBV showing signs of life, the steep decline wiped out over 14% of its gains, pushing 6.18 million addresses into the red.

Why? Trump’s tough economic policies triggered the biggest 24-hour crypto liquidation ever, wiping out $10 billion in one blow. But it didn’t stop there.

The ETH/BTC pair hit a four-year low, with daily declines over 3%. With little capital flowing from BTC into ETH, Ethereum’s future price action is looking more uncertain by the day.

Source: TradingView

Meanwhile, mid-caps are dominating the weekly gainer’s chart, with DEXE leading the way with a 44% gain. Investors are shifting away from high-caps, either exiting the cycle or moving funds into smaller assets.

So, is Ethereum’s recent dip just a temporary setback, or will the growing lack of confidence prevent it from breaking the $4,000 resistance?

Ethereum’s future unfolded

ETH ETFs have been on a strong run, with a four-day streak and a record $307.8 million in inflows in just one day—the highest this year. Blackrock’s ETHA alone pulled in a massive $276.2 million.

This institutional buying is key to keeping ETH from falling below $2,745. At this level, 4.26 million ETH would be in the red, risking an $11 billion sell-off—something to keep an eye on in the coming days.

Source: IntoTheBlock

With a strong market rebound still nowhere in sight, inflation teetering, and investor sentiment cooling on Ethereum during these volatile times, if ETF inflows falter, ETH could lose the remaining 15% from the election day rally last year.

Is your portfolio green? Check the Ethereum Profit Calculator

And as for breaking $4,000? The conditions above will need to shift. Until then, hold tight – the stakes for Ethereum are higher than ever.

![Ethereum [ETH] ETF gets $500 mln boost in 2 days – What’s next?](https://coininsights.com/wp-content/uploads/2024/12/Screenshot-2024-12-12-144048-120x86.png)

situs togel terbesar di Indonesia, bento4d situs togel platform terbaik di Indonesia

get generic clomiphene for sale get generic clomid online get cheap clomiphene pills can i order clomid for sale how to buy cheap clomiphene pill can i purchase generic clomid for sale clomid one fallopian tube

This is a theme which is virtually to my fundamentals… Myriad thanks! Faithfully where can I find the connection details for questions?

Good blog you have here.. It’s obdurate to on strong worth article like yours these days. I honestly appreciate individuals like you! Take guardianship!!

generic azithromycin – buy azithromycin flagyl 400mg generic

order domperidone generic – order generic tetracycline cyclobenzaprine buy online

amoxiclav over the counter – atbioinfo buy acillin generic

order meloxicam for sale – swelling meloxicam us

deltasone 5mg drug – https://apreplson.com/ buy cheap generic prednisone

mens ed pills – https://fastedtotake.com/ buy ed pills sale

oral amoxil – https://combamoxi.com/ amoxicillin tablets

diflucan pills – https://gpdifluca.com/ order diflucan 100mg online cheap

purchase escitalopram generic – https://escitapro.com/# buy escitalopram medication

cialis 20 mg duration – https://ciltadgn.com/# does cialis make you harder

cialis price walgreens – https://strongtadafl.com/ cialis generic overnite shipping

ranitidine cheap – https://aranitidine.com/ ranitidine 150mg uk

buy viagra online cheap – viagra for sale in the philippines viagra sale online canada

I am actually delighted to glitter at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data. sitio web

Thanks for sharing. It’s top quality. prednisone cheap

I am in fact enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of worthwhile facts, thanks for providing such data. https://ursxdol.com/propecia-tablets-online/

The sagacity in this tune is exceptional. https://prohnrg.com/product/cytotec-online/

Thanks for putting this up. It’s evidently done. https://aranitidine.com/fr/cialis-super-active/

More articles like this would remedy the blogosphere richer. https://ondactone.com/product/domperidone/

Proof blog you possess here.. It’s intricate to find high worth article like yours these days. I justifiably recognize individuals like you! Go through vigilance!!

https://doxycyclinege.com/pro/metoclopramide/

More articles like this would pretence of the blogosphere richer. http://www.fujiapuerbbs.com/home.php?mod=space&uid=3616671

buy generic forxiga over the counter – this buy dapagliflozin pills

buy xenical without a prescription – https://asacostat.com/# buy xenical 120mg pill

The thoroughness in this draft is noteworthy. https://lzdsxxb.com/home.php?mod=space&uid=5112644