- Spot Ethereum ETFs recorded $11.4M in inflows for the first time in nearly three weeks.

- This comes as outflows from exchanges increased significantly, relieving the near-term selling pressure.

Spot Ethereum [ETH] exchange-traded funds (ETFs) recorded $11.4 million inflows on 10th September per SoSoValue data. This was the first time in nearly three weeks that the flows turned positive.

Wall Street giants BlackRock and Fidelity dominated the data with $4.31 million and $7.13 million inflows, respectively.

Despite the recent shift in sentiment, ETH ETFs have underperformed against their Bitcoin [BTC] counterparts with $562 million in cumulative net outflows since launch.

According to Glassnode, the performance of Ethereum ETFs has been “relatively tepid” because of redemptions from the Grayscale product. Nevertheless, these products have a smaller impact on trading volumes in the ETH spot market.

Ethereum exchange outflows reach multi-week peak

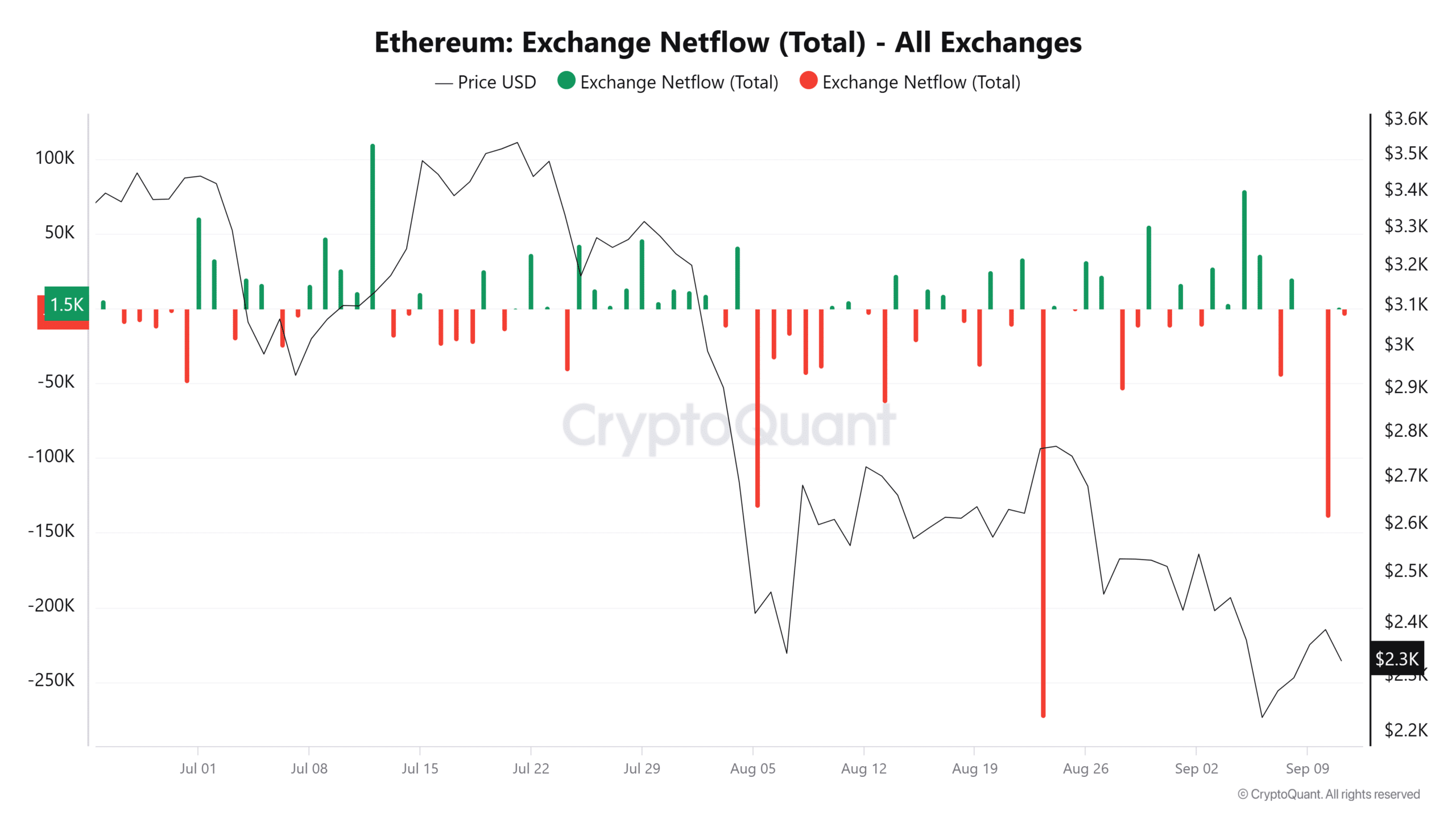

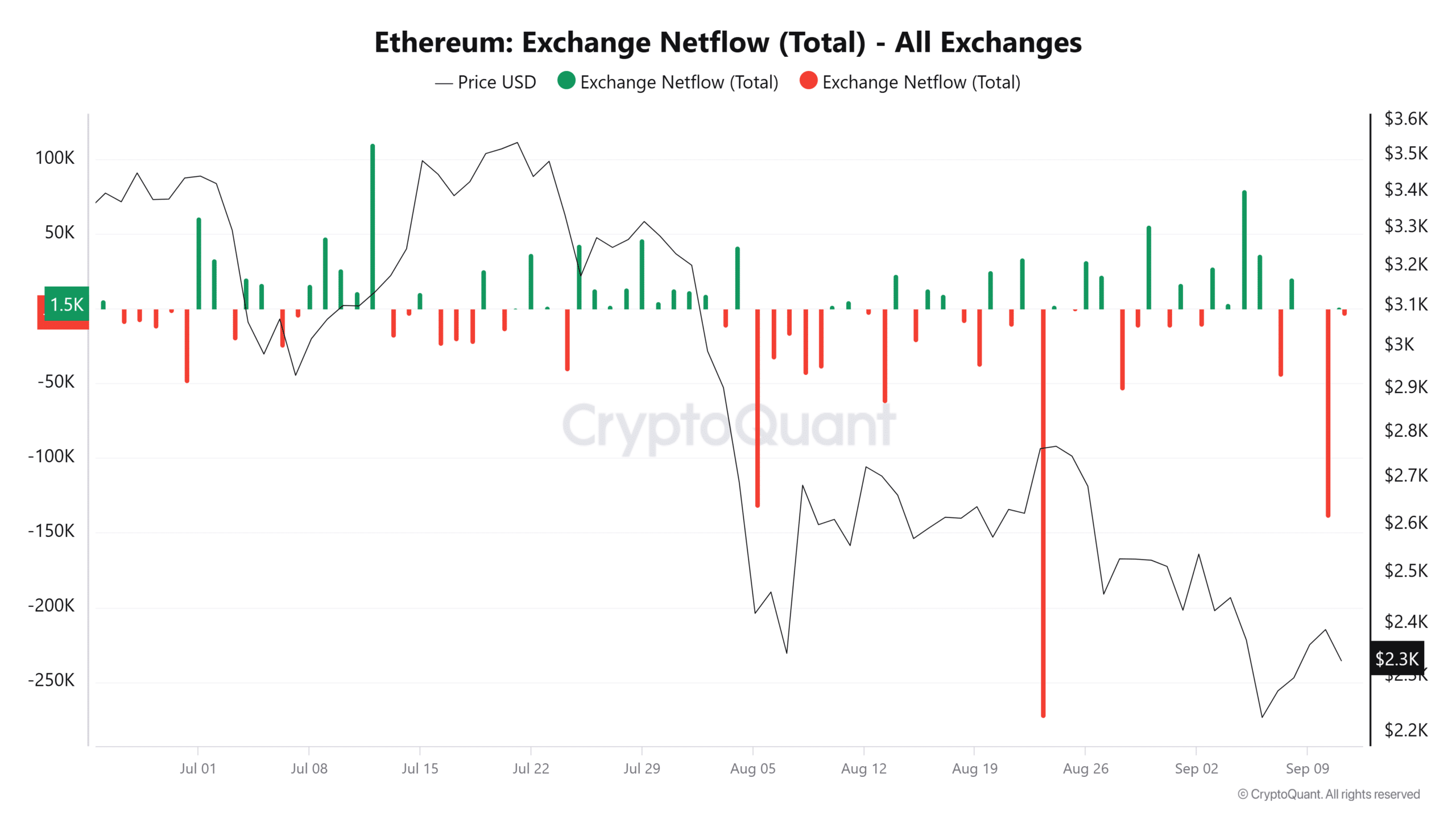

Data from CryptoQuant shows a surge in Ethereum outflows from exchanges. ETH exchange netflows reached 139,548 on 10th September, the highest level in weeks.

Source: CryptoQuant

An increase in exchange outflows indicates fewer traders are interested in selling ETH in the near term. This relieves the selling pressure on the altcoin, and if demand increases, it could trigger a price increase.

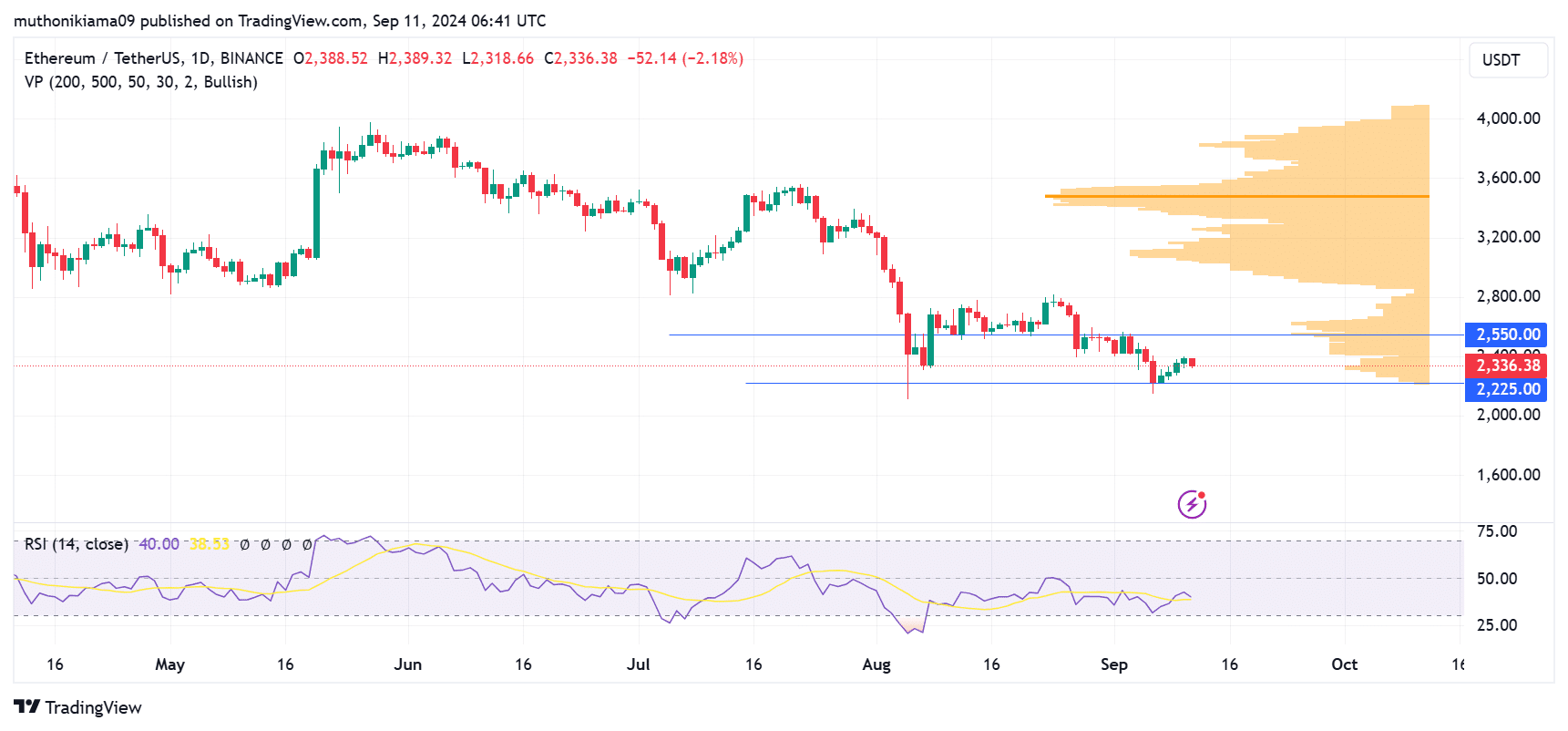

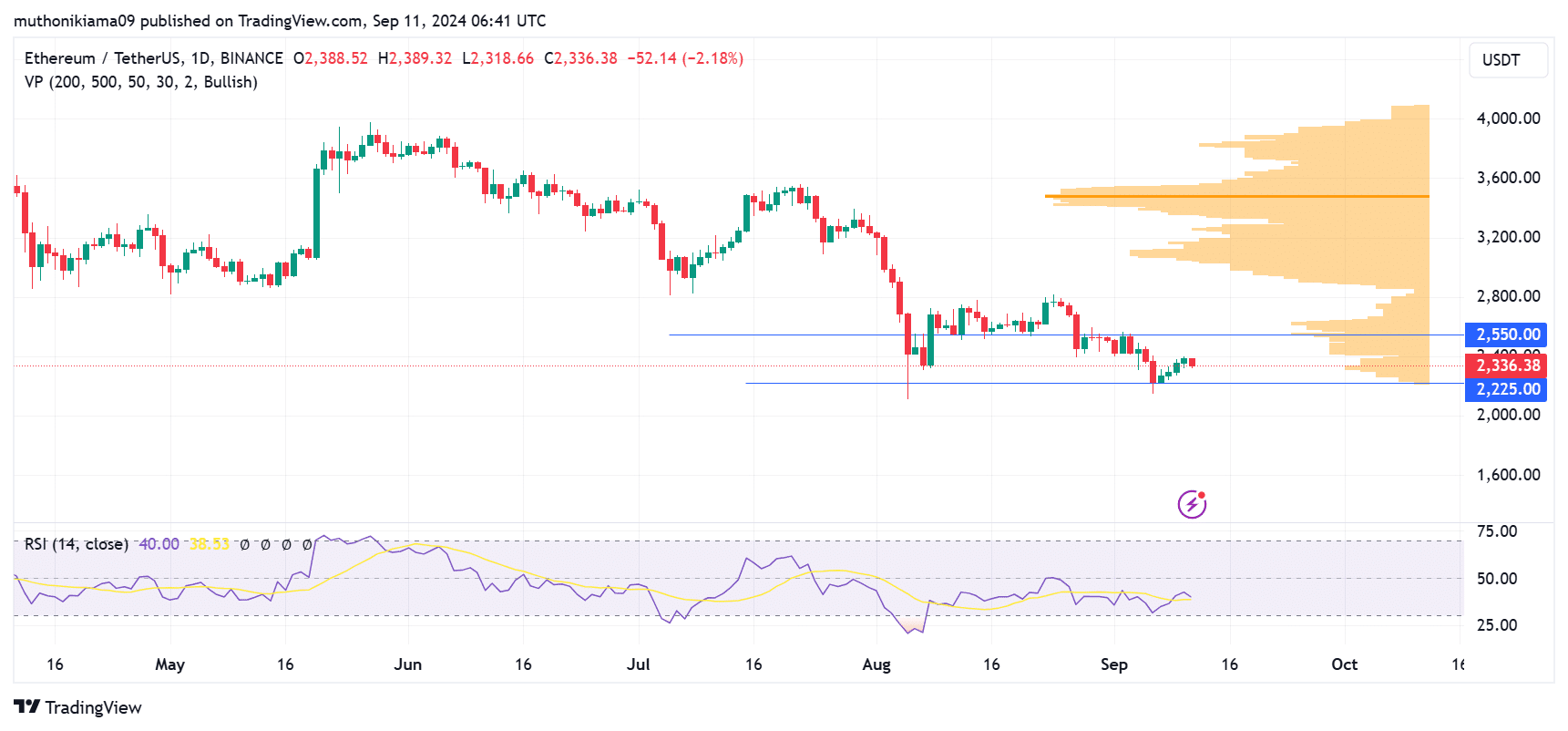

However, this surge in demand is lacking. The Relative Strength Index at 40 shows that selling momentum is significantly high. Moreover, the RSI is tipping south and risks crossing below the signal line, which could create a sell signal and trigger further dips.

Source: Tradingview

Moreover, the volume profile data shows that bears might continue to dominate ETH price. There are significantly low buying volumes at the current price, which could see ETH consolidate at current prices.

If selling activity continues, the altcoin will possibly drop to test support at $2,225 before making a decisive move.

Buyers appear to be saturated at $2,550. This price acts as a key resistance level, with traders waiting for a breakout to confirm an uptrend.

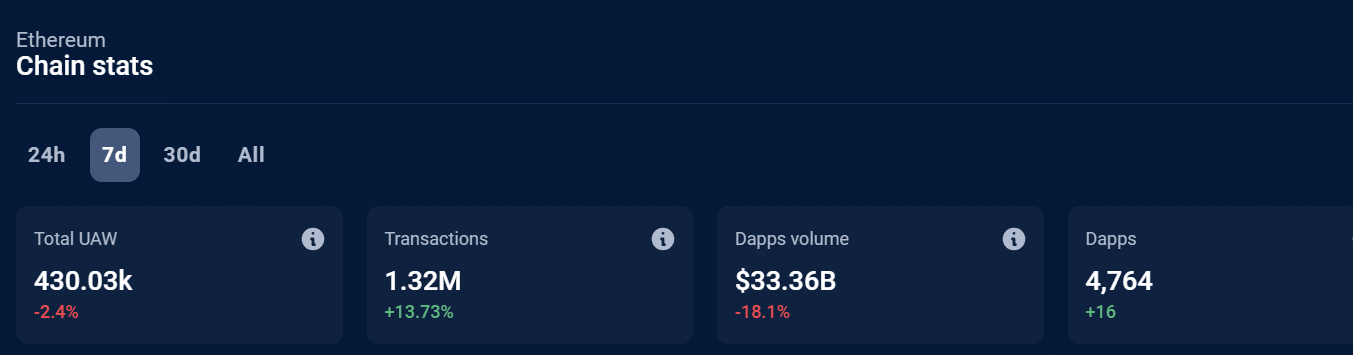

ETH’s rally is also contingent on the performance of the Ethereum network if support from the broader market fails.

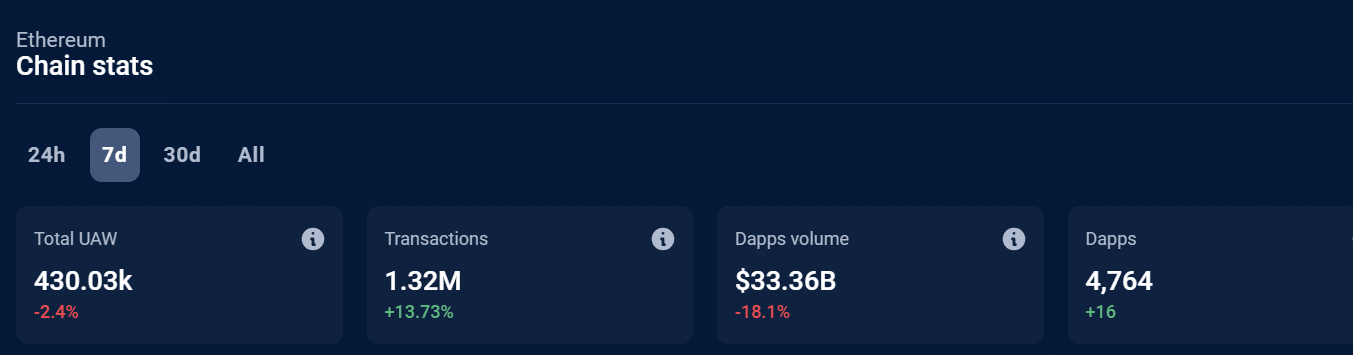

Data from DappRadar shows that the Ethereum network has been lagging in terms of volumes. In the last seven days, volumes for decentralized applications (DApps) created on Ethereum have dropped by 18% to $33 billion.

However, the blockchain saw a 13% increase in transactions during the same period This indicates that trading activity is increasing but there are fewer interactions on the network.

Source: DappRadar

- Spot Ethereum ETFs recorded $11.4M in inflows for the first time in nearly three weeks.

- This comes as outflows from exchanges increased significantly, relieving the near-term selling pressure.

Spot Ethereum [ETH] exchange-traded funds (ETFs) recorded $11.4 million inflows on 10th September per SoSoValue data. This was the first time in nearly three weeks that the flows turned positive.

Wall Street giants BlackRock and Fidelity dominated the data with $4.31 million and $7.13 million inflows, respectively.

Despite the recent shift in sentiment, ETH ETFs have underperformed against their Bitcoin [BTC] counterparts with $562 million in cumulative net outflows since launch.

According to Glassnode, the performance of Ethereum ETFs has been “relatively tepid” because of redemptions from the Grayscale product. Nevertheless, these products have a smaller impact on trading volumes in the ETH spot market.

Ethereum exchange outflows reach multi-week peak

Data from CryptoQuant shows a surge in Ethereum outflows from exchanges. ETH exchange netflows reached 139,548 on 10th September, the highest level in weeks.

Source: CryptoQuant

An increase in exchange outflows indicates fewer traders are interested in selling ETH in the near term. This relieves the selling pressure on the altcoin, and if demand increases, it could trigger a price increase.

However, this surge in demand is lacking. The Relative Strength Index at 40 shows that selling momentum is significantly high. Moreover, the RSI is tipping south and risks crossing below the signal line, which could create a sell signal and trigger further dips.

Source: Tradingview

Moreover, the volume profile data shows that bears might continue to dominate ETH price. There are significantly low buying volumes at the current price, which could see ETH consolidate at current prices.

If selling activity continues, the altcoin will possibly drop to test support at $2,225 before making a decisive move.

Buyers appear to be saturated at $2,550. This price acts as a key resistance level, with traders waiting for a breakout to confirm an uptrend.

ETH’s rally is also contingent on the performance of the Ethereum network if support from the broader market fails.

Data from DappRadar shows that the Ethereum network has been lagging in terms of volumes. In the last seven days, volumes for decentralized applications (DApps) created on Ethereum have dropped by 18% to $33 billion.

However, the blockchain saw a 13% increase in transactions during the same period This indicates that trading activity is increasing but there are fewer interactions on the network.

Source: DappRadar

buy cheap clomid without prescription order cheap clomiphene pill where buy clomid no prescription cost cheap clomiphene without a prescription how much is clomiphene without insurance where can i buy clomid without dr prescription get generic clomid without insurance

The thoroughness in this draft is noteworthy.

buy azithromycin sale – zithromax 500mg pill how to get flagyl without a prescription

motilium without prescription – purchase cyclobenzaprine cyclobenzaprine usa

nexium for sale – https://anexamate.com/ order esomeprazole 40mg pill

order coumadin 5mg without prescription – coumamide.com losartan 25mg cheap

mobic cheap – mobo sin meloxicam cost

prednisone 10mg without prescription – https://apreplson.com/ prednisone 40mg generic

top erection pills – buy ed pills no prescription best ed pills at gnc

buy generic forcan online – https://gpdifluca.com/ buy diflucan 200mg without prescription

cenforce 100mg without prescription – click buy generic cenforce for sale

cialis online no prescription – https://ciltadgn.com/# buy cialis canadian

zantac where to buy – this ranitidine 150mg canada

does cialis lower your blood pressure – pregnancy category for tadalafil generic tadalafil 40 mg

Proof blog you be undergoing here.. It’s hard to assign elevated calibre script like yours these days. I justifiably appreciate individuals like you! Take guardianship!! this

order genuine viagra – best price for viagra 100mg buy viagra toronto

This is the type of post I unearth helpful. buy lasix without a prescription

Thanks for putting this up. It’s well done. https://prohnrg.com/product/acyclovir-pills/

The thoroughness in this draft is noteworthy. https://aranitidine.com/fr/lasix_en_ligne_achat/

Greetings! Extremely gainful par‘nesis within this article! It’s the petty changes which wish espy the largest changes. Thanks a a quantity for sharing! https://ondactone.com/simvastatin/

More posts like this would bring about the blogosphere more useful.

https://proisotrepl.com/product/baclofen/

This is the kind of delivery I find helpful. http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44793

order dapagliflozin 10mg for sale – https://janozin.com/# buy cheap forxiga