- Ethereum showed a bearish market structure and could be headed for $2.5k.

- The OBV slipped below a key level as selling pressure increased.

Ethereum [ETH] was in a bearish trend on the daily timeframe after dropping below the $3k mark six weeks ago.

Reports that the spot Ethereum exchange-traded funds (ETFs) applications in the U.S. were likely to face rejection would reinforce the bearish sentiment in the market.

Analysts projected far lower prices for Ethereum in the coming months in the event of a rejection. This lined up with the technical analysis, but it was unclear just how long the downtrend would persist.

The bearish market structure continued to hold sway

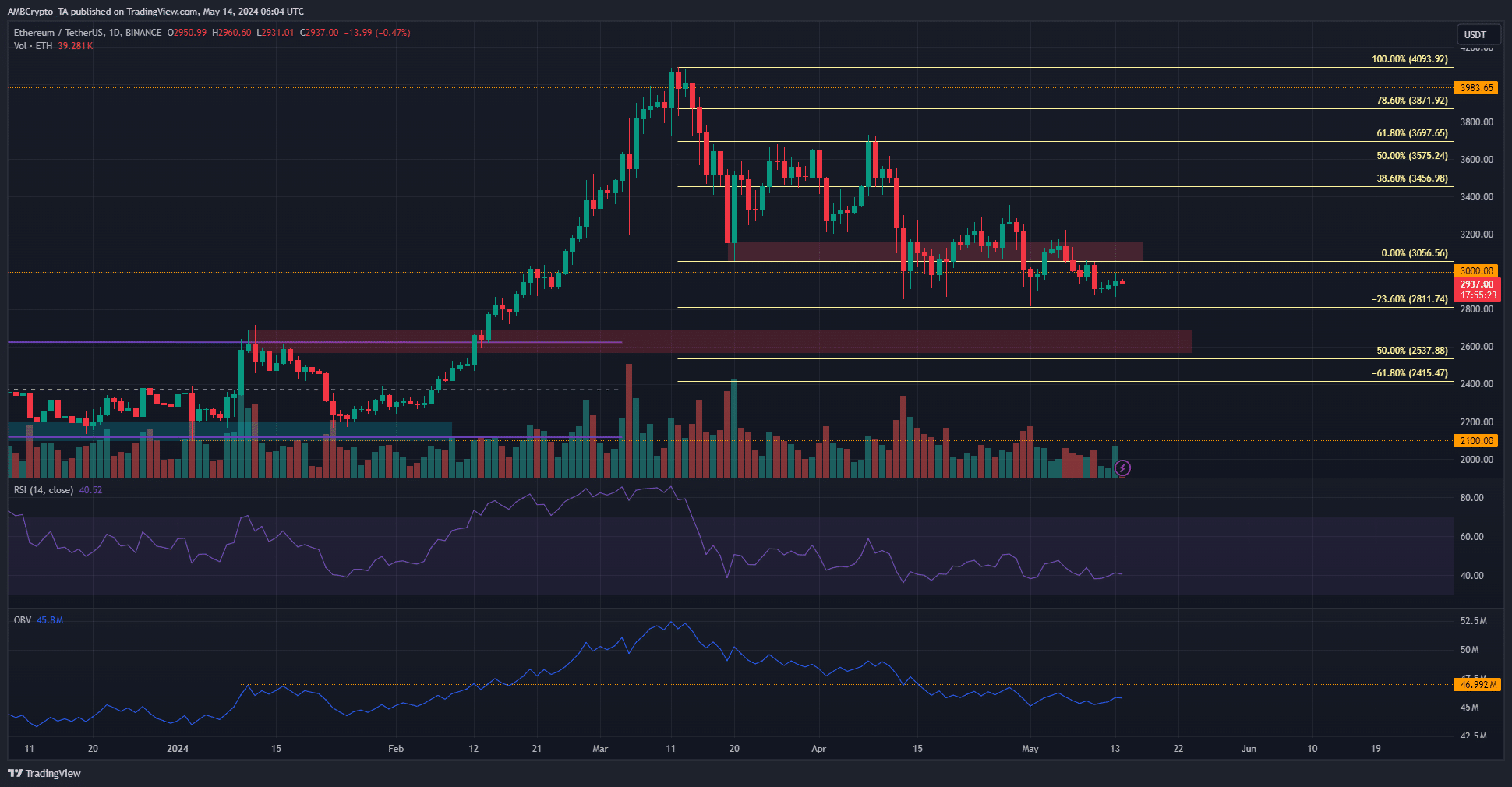

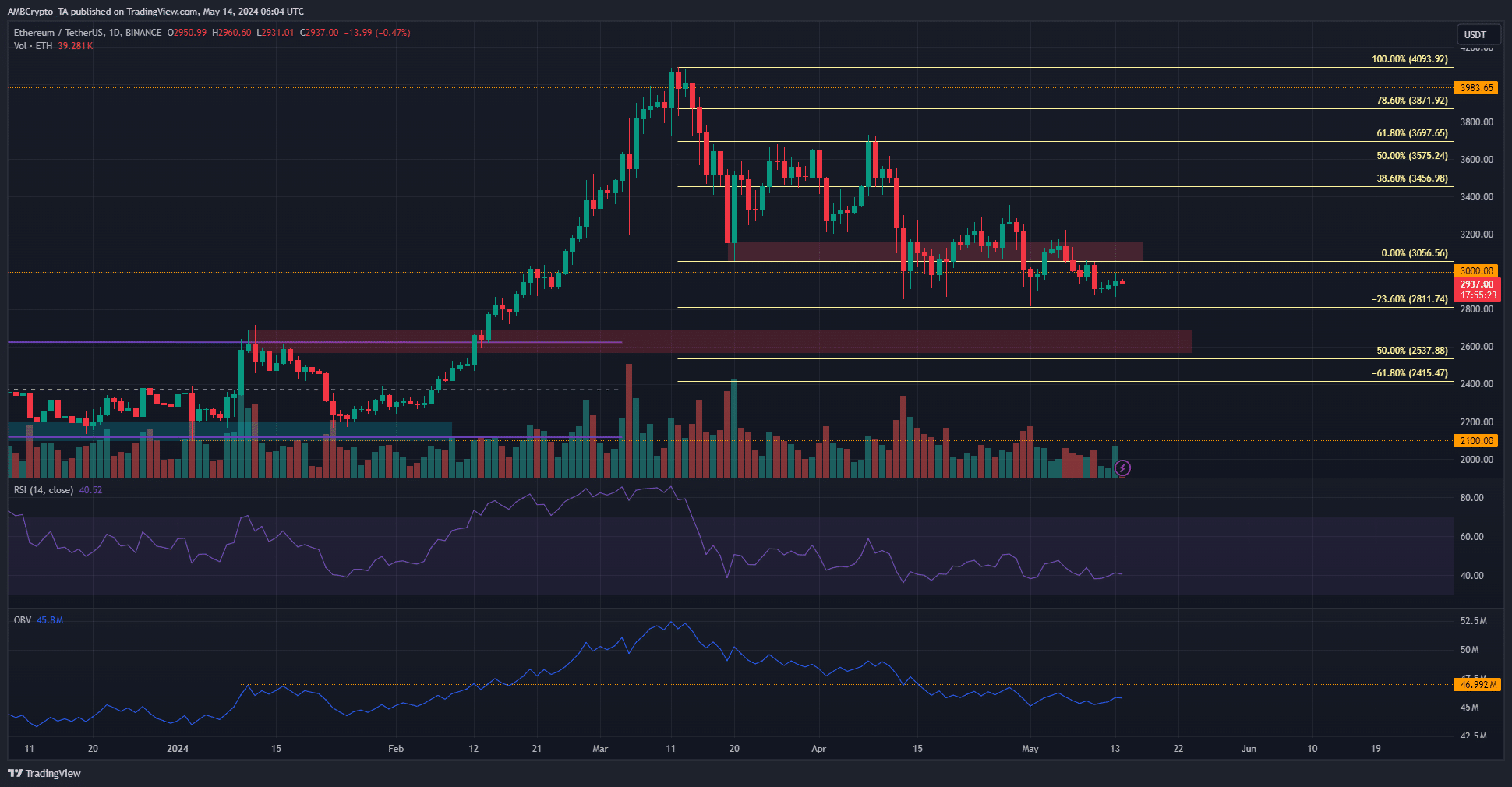

Source: ETH/USDT on TradingView

A set of Fibonacci retracement levels were plotted based on ETH’s drop from $4093 to $3056.

While this move did not shift the higher timeframe market structure bearishly, in mid-April, ETH fell below the $3k mark.

This swung the structure bearishly, and the OBV also fell below a significant level. At press time, the $3k resistance zone appeared strong, and the momentum was in bearish favor with an RSI reading of 40.5.

The Ethereum price prediction shows that a drop below $2.8k is likely, given the Fibonacci extension levels.

The 50% and 61.8% extension levels might be tested, but it is unclear if Ethereum would have a V-reversal or would consolidate at those levels.

The liquidity chart showed the short-term bounce was over

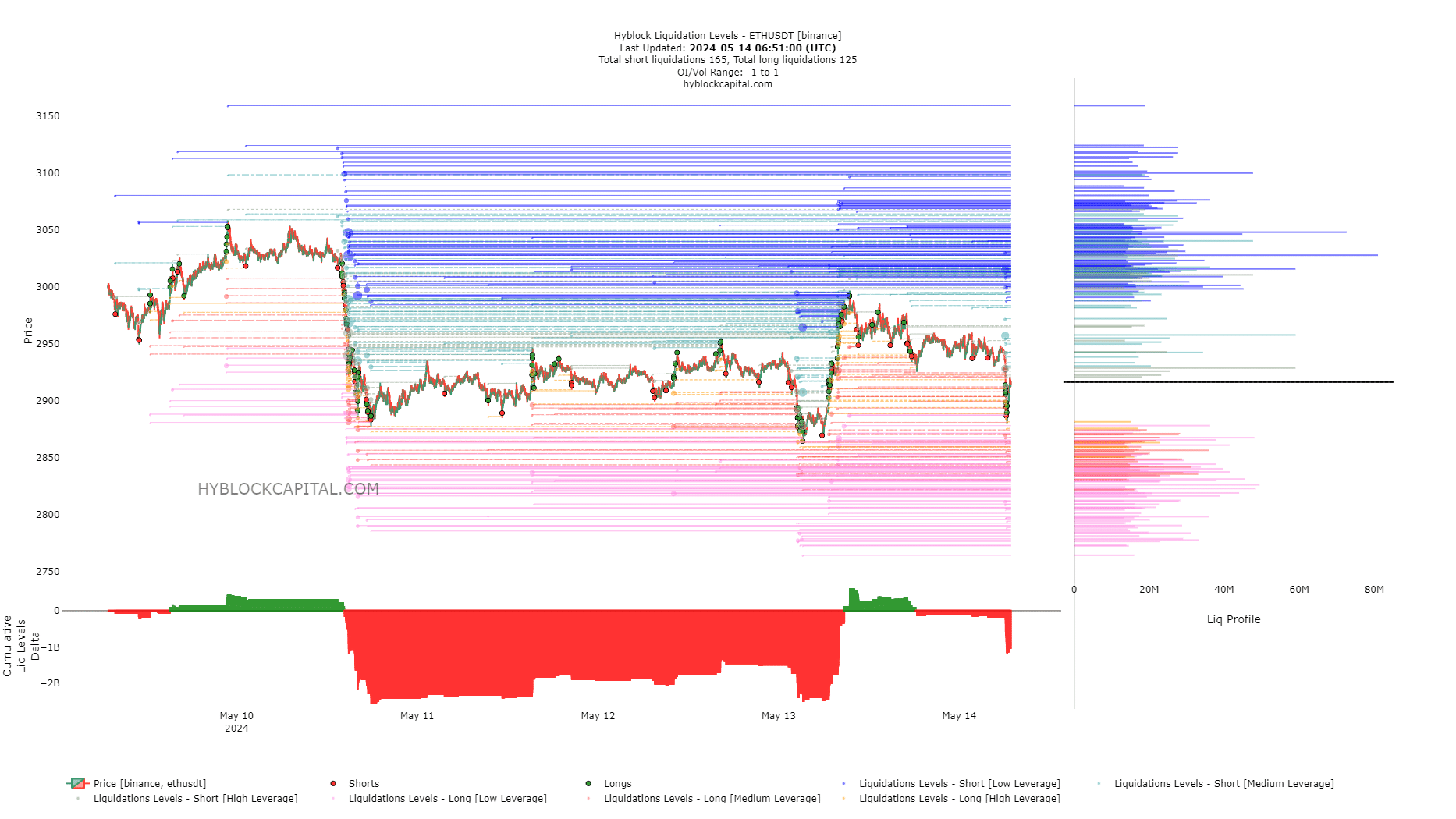

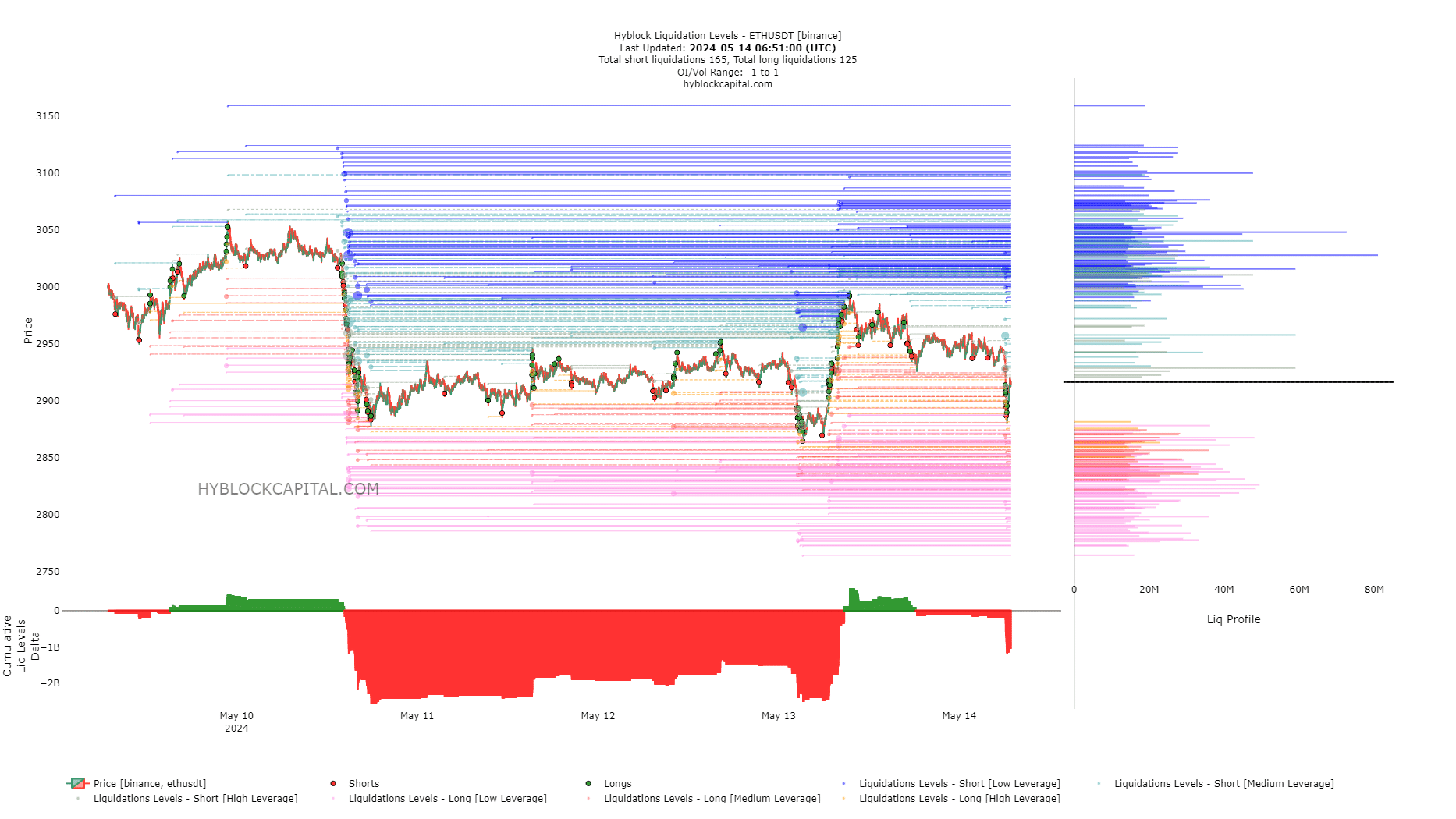

Source: Hyblock

Just over 24 hours before the time of writing, the cumulative liq levels were deeply negative. This indicated that the short liquidations outnumbered the longs.

Read Ethereum’s [ETH] Price Prediction 2024-25

A few hours later, the price bounced from $2870 to $2990 to take out the late short sellers.

At press time, the cumulative liq levels were negative but less extreme. Hence, there is space for the prices to go further south. The $2840 region is a short-term Ethereum price prediction target.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Ethereum showed a bearish market structure and could be headed for $2.5k.

- The OBV slipped below a key level as selling pressure increased.

Ethereum [ETH] was in a bearish trend on the daily timeframe after dropping below the $3k mark six weeks ago.

Reports that the spot Ethereum exchange-traded funds (ETFs) applications in the U.S. were likely to face rejection would reinforce the bearish sentiment in the market.

Analysts projected far lower prices for Ethereum in the coming months in the event of a rejection. This lined up with the technical analysis, but it was unclear just how long the downtrend would persist.

The bearish market structure continued to hold sway

Source: ETH/USDT on TradingView

A set of Fibonacci retracement levels were plotted based on ETH’s drop from $4093 to $3056.

While this move did not shift the higher timeframe market structure bearishly, in mid-April, ETH fell below the $3k mark.

This swung the structure bearishly, and the OBV also fell below a significant level. At press time, the $3k resistance zone appeared strong, and the momentum was in bearish favor with an RSI reading of 40.5.

The Ethereum price prediction shows that a drop below $2.8k is likely, given the Fibonacci extension levels.

The 50% and 61.8% extension levels might be tested, but it is unclear if Ethereum would have a V-reversal or would consolidate at those levels.

The liquidity chart showed the short-term bounce was over

Source: Hyblock

Just over 24 hours before the time of writing, the cumulative liq levels were deeply negative. This indicated that the short liquidations outnumbered the longs.

Read Ethereum’s [ETH] Price Prediction 2024-25

A few hours later, the price bounced from $2870 to $2990 to take out the late short sellers.

At press time, the cumulative liq levels were negative but less extreme. Hence, there is space for the prices to go further south. The $2840 region is a short-term Ethereum price prediction target.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

can you buy clomiphene without a prescription clomid uk buy cost of cheap clomid without a prescription buy generic clomid no prescription where buy cheap clomid where to get generic clomiphene pill how to get generic clomiphene without dr prescription

I couldn’t hold back commenting. Well written!

This is the kind of enter I unearth helpful.

azithromycin price – order generic zithromax 250mg cheap metronidazole

rybelsus price – cyproheptadine 4mg uk buy periactin generic

oral domperidone – tetracycline 250mg uk buy cheap cyclobenzaprine

inderal 20mg brand – inderal 10mg canada cost methotrexate

amoxicillin us – diovan 160mg cheap ipratropium tablet

buy augmentin pills for sale – https://atbioinfo.com/ where can i buy ampicillin

buy nexium cheap – https://anexamate.com/ buy esomeprazole without a prescription

purchase medex sale – https://coumamide.com/ buy hyzaar pills

mobic 15mg ca – https://moboxsin.com/ order meloxicam 7.5mg without prescription

prednisone 20mg cost – asthma deltasone 40mg without prescription

where can i buy ed pills – fastedtotake buy ed pills cheap

amoxil cost – https://combamoxi.com/ purchase amoxil pill

order diflucan 100mg sale – https://gpdifluca.com/# where to buy diflucan without a prescription

order escitalopram sale – https://escitapro.com/ order escitalopram 20mg pill

cenforce order – https://cenforcers.com/# buy cenforce 100mg for sale

cheaper alternative to cialis – https://strongtadafl.com/ cialis com free sample

ranitidine uk – https://aranitidine.com/ buy zantac paypal

blue viagra pill 100 – https://strongvpls.com/# buy viagra plus

Greetings! Very gainful advice within this article! It’s the petty changes which choice turn the largest changes. Thanks a portion towards sharing! this

This is the description of topic I get high on reading. buy accutane online cheap

More delight pieces like this would make the web better. https://ursxdol.com/amoxicillin-antibiotic/

This is the description of topic I get high on reading. https://prohnrg.com/

The thoroughness in this section is noteworthy. https://aranitidine.com/fr/lasix_en_ligne_achat/

More articles like this would remedy the blogosphere richer. https://ondactone.com/simvastatin/

I couldn’t turn down commenting. Well written!

esomeprazole 20mg usa

The thoroughness in this piece is noteworthy. https://myvisualdatabase.com/forum/profile.php?id=118014

buy generic dapagliflozin 10 mg – order dapagliflozin pills dapagliflozin 10mg pill