- ETH showed renewed interest across the options market.

- Despite short-term challenges, it suggested a bullish outlook for ETH in Q4.

Ethereum [ETH] has lagged behind its major peers, such as Bitcoin [BTC] and Solana [SOL], despite US spot ETF approval in Q2. However, on Friday, the 13th of September, there was strong renewed interest in the largest altcoin.

According to the Singapore-based crypto trading firm QCP Capital, ETH options spiked with much interest in contracts targeting $3k by the year-end. Part of the firm’s weekend note read,

“The options market witnessed renewed interest in ETH, with over 20k contracts targeting the $3k level by December 27. The year-end outlook for ETH could be shaping up to be significant.”

ETH’s bullish revival

For context, options data and volume are forward-looking indicators that offer future price expectations and overall market sentiment.

So, the above surge in the options market, including Open Interest (OI) rates, indicated bullish expectations and potential price appreciation in Q4.

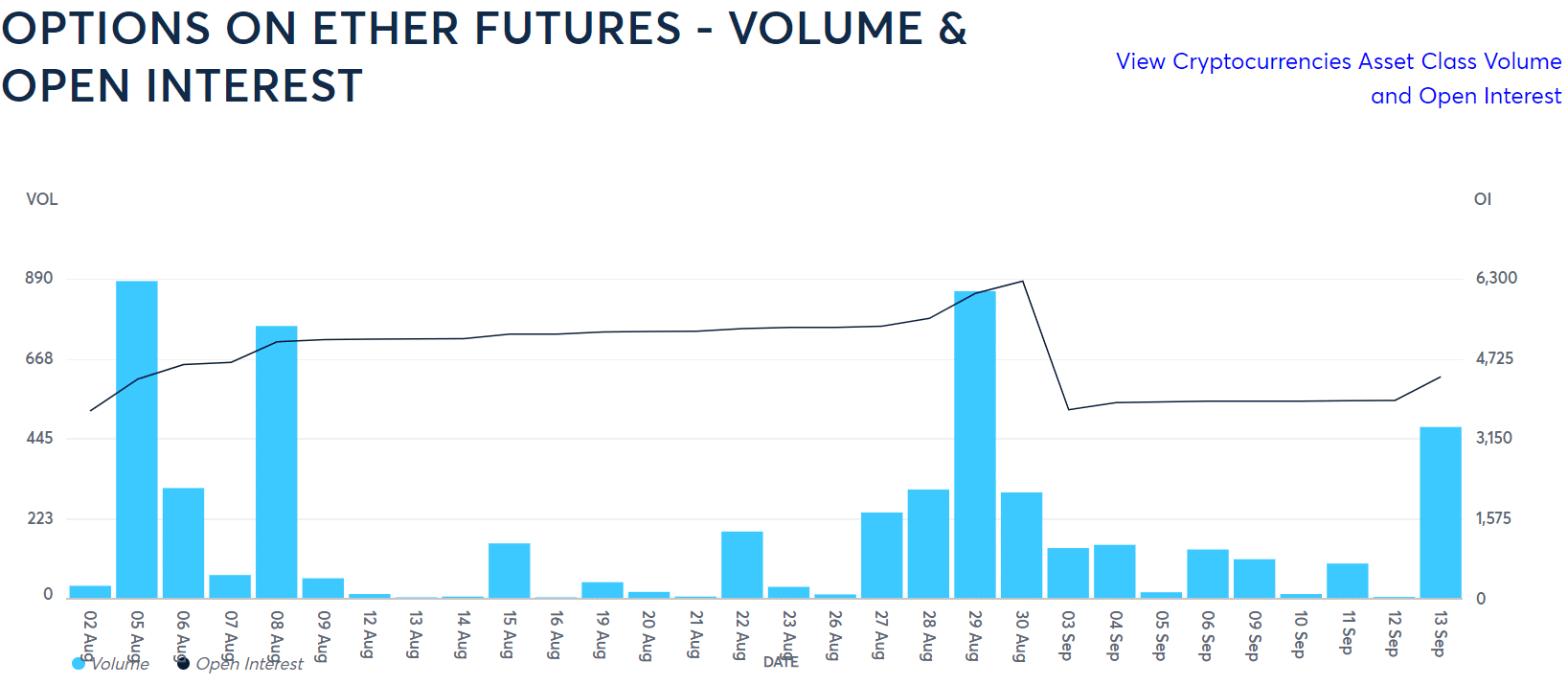

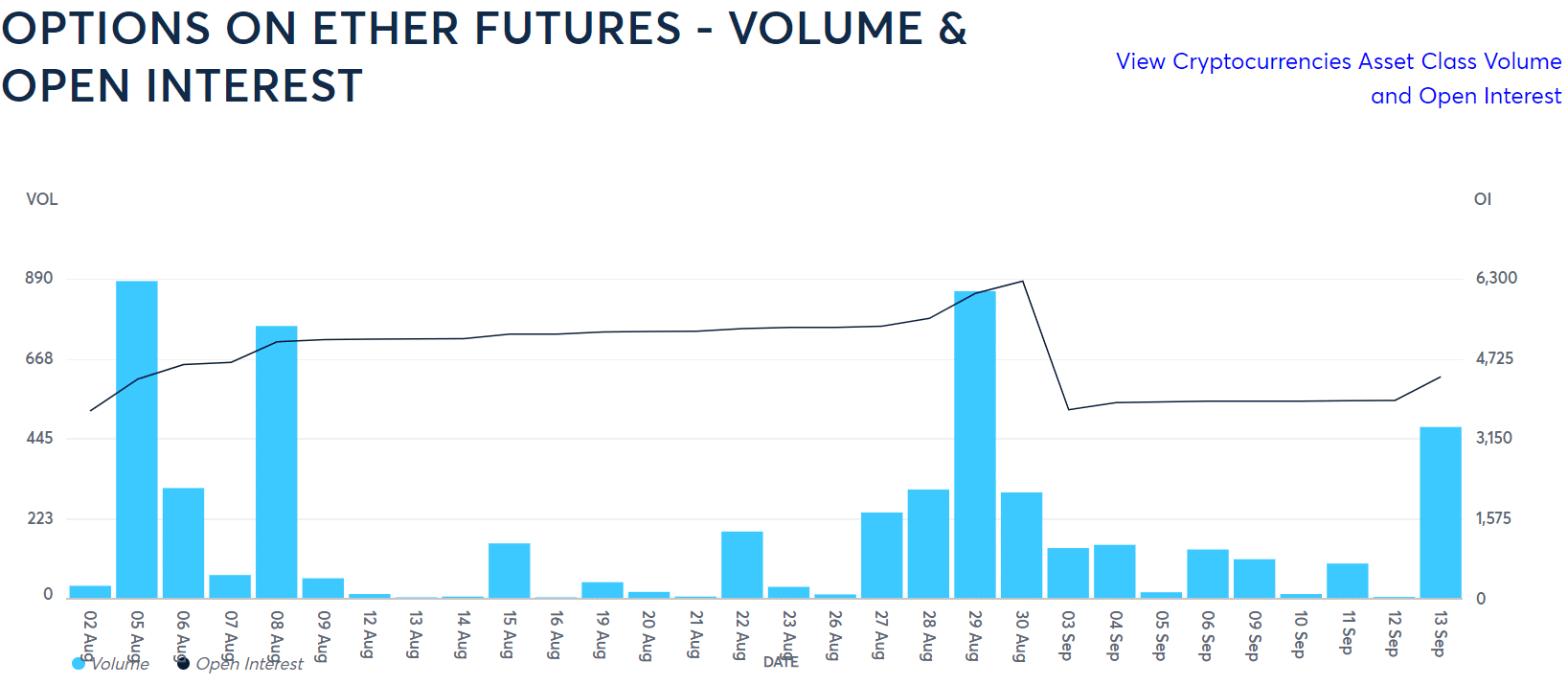

The Chicago Mercantile Exchange (CME) data confirmed QCP Capital’s outlook.

On the 13th of September, ETH recorded a sharp uptick in volume and OI for the first time this month. The OI surged to $3.1 billion while volume hiked nearly to $700 million, reinforcing institutional interest in the altcoin.

Source: CME

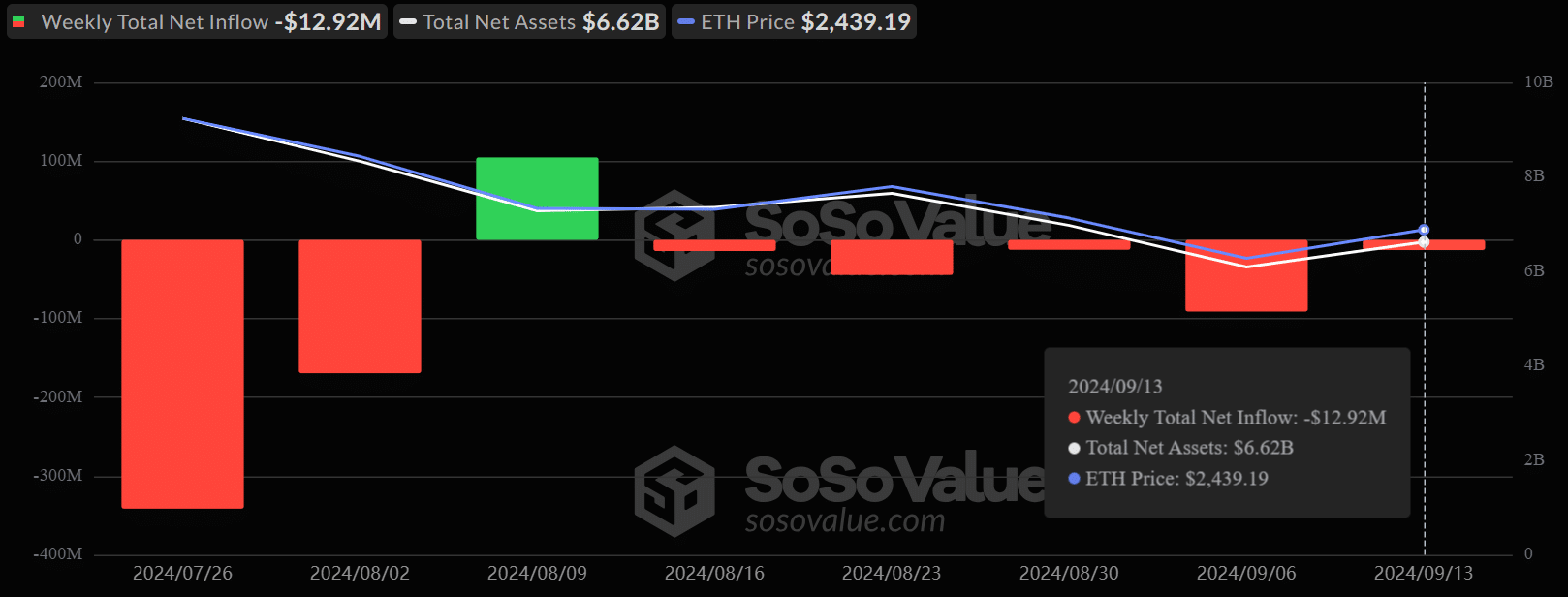

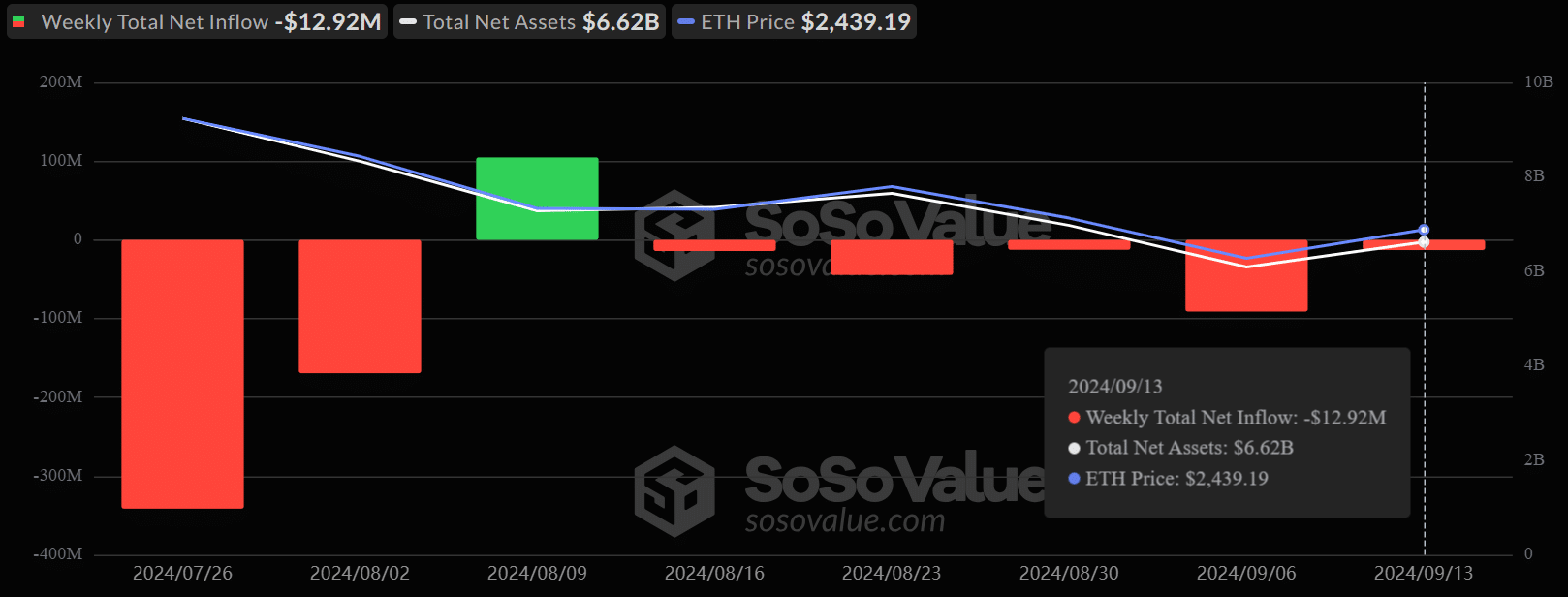

Despite the increased options activity, the spot market saw minimal demand from US ETH ETFs on Friday.

The products saw a cumulative $1.5 million in daily inflow, but it was net negative on the weekly count. They bled $12.92 million last week, a trend that was yet to be reversed to reinforce strong investor confidence.

Source: Soso Value

However, Coinbase analyst David Duong blamed ETH’s muted price performance on the current market structure. Duong noted that crypto investors were tied to other altcoin positions, limiting capital flow to ETH.

Another possible short-term challenge to ETH’s price was a spike in exchange reserves. About 100k tokens moved to exchanges ahead of the Fed rate decision on the 18th of September.

In the meantime, ETH was valued at $2.4k at press time, up 5% in the past seven days of trading.

- ETH showed renewed interest across the options market.

- Despite short-term challenges, it suggested a bullish outlook for ETH in Q4.

Ethereum [ETH] has lagged behind its major peers, such as Bitcoin [BTC] and Solana [SOL], despite US spot ETF approval in Q2. However, on Friday, the 13th of September, there was strong renewed interest in the largest altcoin.

According to the Singapore-based crypto trading firm QCP Capital, ETH options spiked with much interest in contracts targeting $3k by the year-end. Part of the firm’s weekend note read,

“The options market witnessed renewed interest in ETH, with over 20k contracts targeting the $3k level by December 27. The year-end outlook for ETH could be shaping up to be significant.”

ETH’s bullish revival

For context, options data and volume are forward-looking indicators that offer future price expectations and overall market sentiment.

So, the above surge in the options market, including Open Interest (OI) rates, indicated bullish expectations and potential price appreciation in Q4.

The Chicago Mercantile Exchange (CME) data confirmed QCP Capital’s outlook.

On the 13th of September, ETH recorded a sharp uptick in volume and OI for the first time this month. The OI surged to $3.1 billion while volume hiked nearly to $700 million, reinforcing institutional interest in the altcoin.

Source: CME

Despite the increased options activity, the spot market saw minimal demand from US ETH ETFs on Friday.

The products saw a cumulative $1.5 million in daily inflow, but it was net negative on the weekly count. They bled $12.92 million last week, a trend that was yet to be reversed to reinforce strong investor confidence.

Source: Soso Value

However, Coinbase analyst David Duong blamed ETH’s muted price performance on the current market structure. Duong noted that crypto investors were tied to other altcoin positions, limiting capital flow to ETH.

Another possible short-term challenge to ETH’s price was a spike in exchange reserves. About 100k tokens moved to exchanges ahead of the Fed rate decision on the 18th of September.

In the meantime, ETH was valued at $2.4k at press time, up 5% in the past seven days of trading.

can you buy cheap clomiphene prices clomiphene buy cost of generic clomid without a prescription can you buy clomiphene pills can i get generic clomid without rx clomid tablets for sale can i purchase clomiphene prices

I am in fact thrilled to glitter at this blog posts which consists of tons of useful facts, thanks towards providing such data.

This is the stripe of topic I get high on reading.

zithromax buy online – azithromycin generic metronidazole tablet

rybelsus medication – buy periactin 4 mg sale buy generic periactin

motilium medication – purchase flexeril generic cyclobenzaprine 15mg tablet

order amoxiclav online – https://atbioinfo.com/ ampicillin drug

esomeprazole 40mg capsules – https://anexamate.com/ esomeprazole capsules

buy coumadin for sale – https://coumamide.com/ buy cozaar 25mg pills

order mobic pills – https://moboxsin.com/ buy meloxicam 15mg sale

deltasone 20mg us – corticosteroid buy prednisone 20mg online

non prescription erection pills – buy ed pills paypal best ed pills non prescription

amoxil sale – comba moxi order amoxicillin for sale

buy generic fluconazole – https://gpdifluca.com/ fluconazole 200mg cost

buy escitalopram sale – this order lexapro without prescription

cenforce brand – https://cenforcers.com/ cost cenforce 100mg

sanofi cialis – https://ciltadgn.com/ cialis soft tabs canadian pharmacy

vigra vs cialis – strongtadafl cialis online no prescription

buy ranitidine generic – https://aranitidine.com/# purchase zantac online

sildenafil 100mg blue pill – can you buy viagra cvs natural viagra

This website absolutely has all of the bumf and facts I needed adjacent to this thesis and didn’t know who to ask. furosemide price

This is a topic which is near to my heart… Numberless thanks! Quite where can I upon the acquaintance details in the course of questions? https://gnolvade.com/

The thoroughness in this piece is noteworthy. ursxdol.com

Facts blog you procure here.. It’s severely to assign elevated quality article like yours these days. I honestly appreciate individuals like you! Go through vigilance!! purchase misoprostol

The sagacity in this tune is exceptional. effet secondaire kamagra

More posts like this would bring about the blogosphere more useful. https://ondactone.com/spironolactone/

More posts like this would make the blogosphere more useful.

https://doxycyclinege.com/pro/metoclopramide/

This is a theme which is virtually to my fundamentals… Many thanks! Quite where can I find the connection details due to the fact that questions? http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44951

pill forxiga 10mg – https://janozin.com/ dapagliflozin 10mg pills