- Ethereum showed signs of accumulation from investors in the past three weeks.

- The momentum when disbelief turns into FOMO could usher in even more gains for ETH.

Ethereum [ETH] attracted flak from Peter Brandt, who called it a “junk coin” with “outrageous” gas fees. Despite the harsh statements, a portion of the market had bullish conviction in the token.

On the 8th of April, it noted a 6.5% rally at the time of writing. These gains came even though a bearish chart pattern forecasted a drop to $2800. Are the majority of the participants in disbelief of the current rally, or is this a temporary retracement before the next leg downward?

The U.S. traders are in disbelief

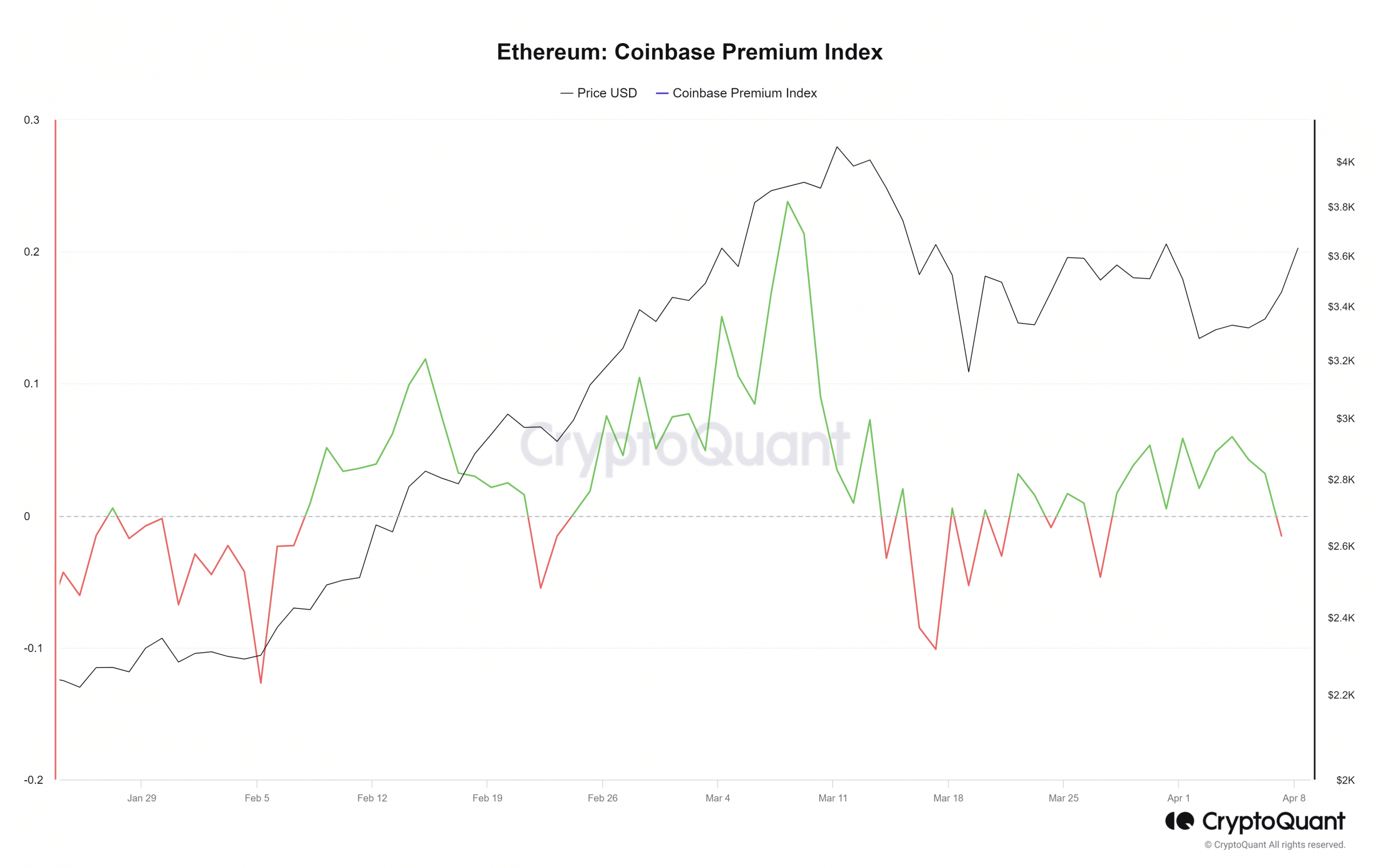

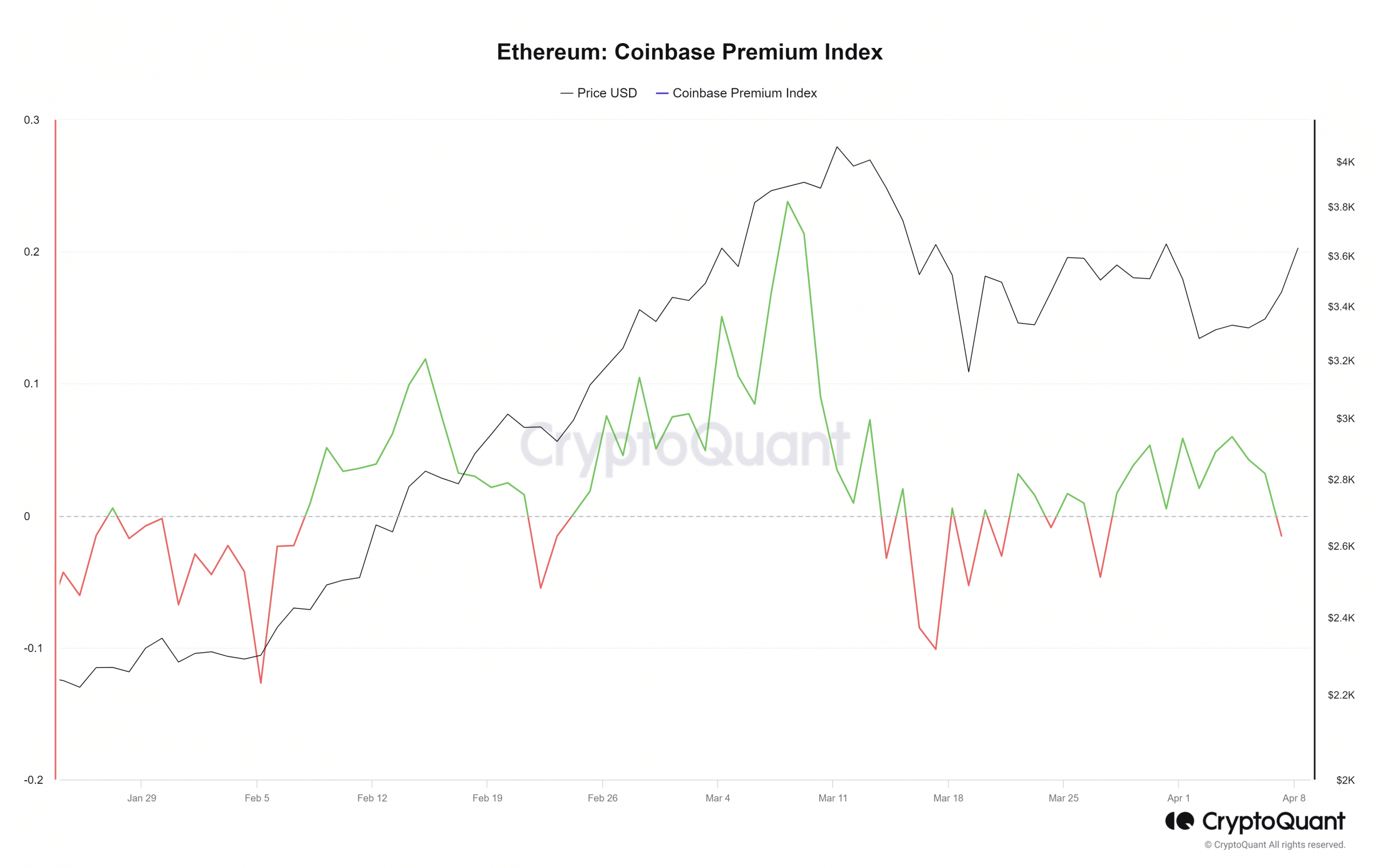

Source: CryptoQuant

The Coinbase Premium Index represents the percentage difference in prices between Binance and Coinbase. The former is not available to U.S. residents, which is why Coinbase is a good index for U.S. participant enthusiasm.

From the 2nd of April to the 7th, the Coinbase premium fell toward zero. Yet, at that time, ETH was in the process of unmaking recent losses. In contrast, when there was a strong rally toward the end of February, the Coinbase premium trended swiftly higher.

ETH to $4k once more?

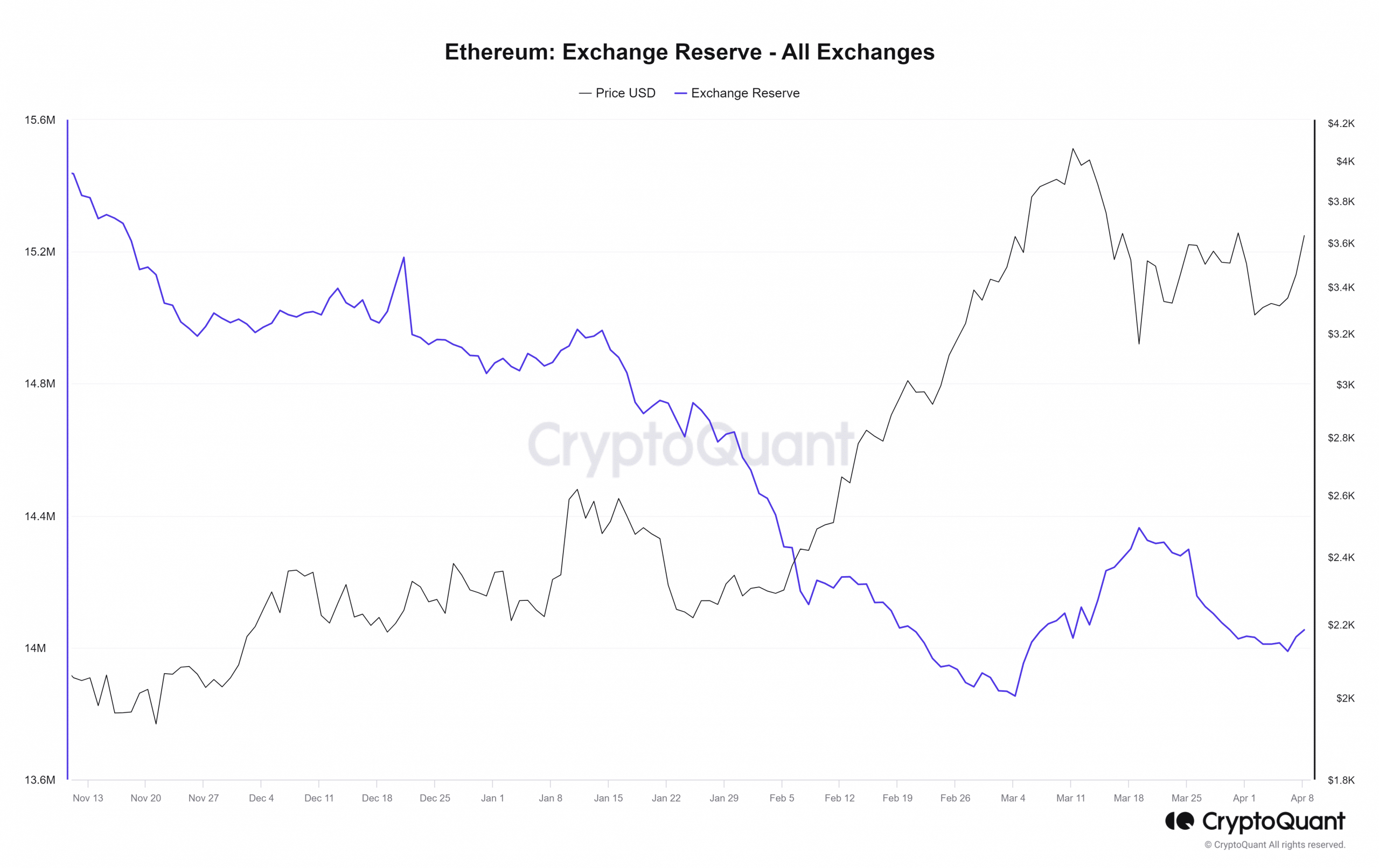

Source: CryptoQuant

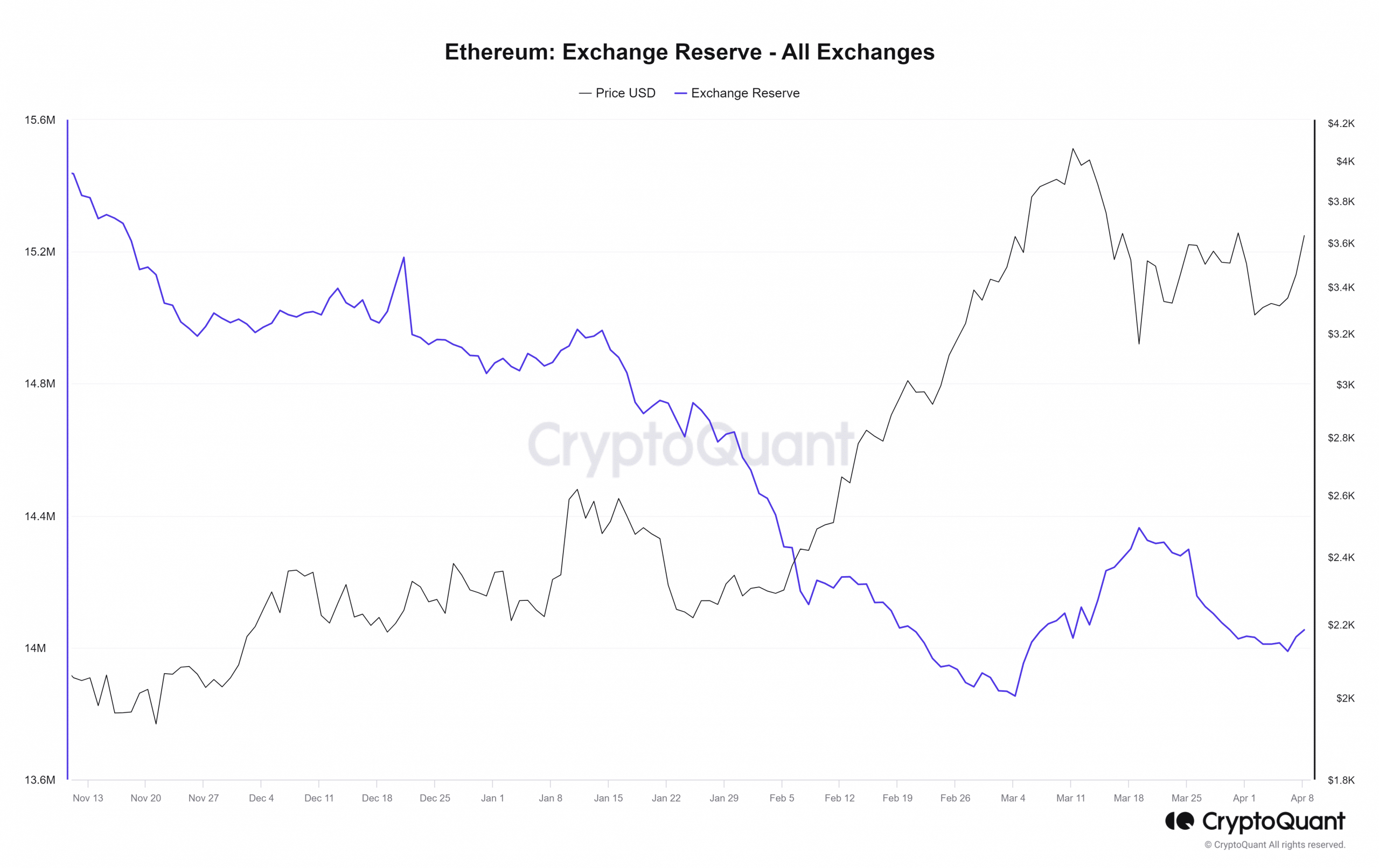

After the drop to $3056 on 19th March, the exchange reserves of Ethereum began to trend lower. This was a sign that users were offloading their tokens out of centralized exchanges. It implied accumulation and a reduction in the selling pressure.

This downtrend has not stopped yet, although there was a minor uptick in the exchange reserve on 7th April. This was when the $3.4k short-term resistance was reclaimed, giving some investors a reason to realize profits.

Overall, a continued downtrend in the reserves metric would be excellent news for long-term bulls.

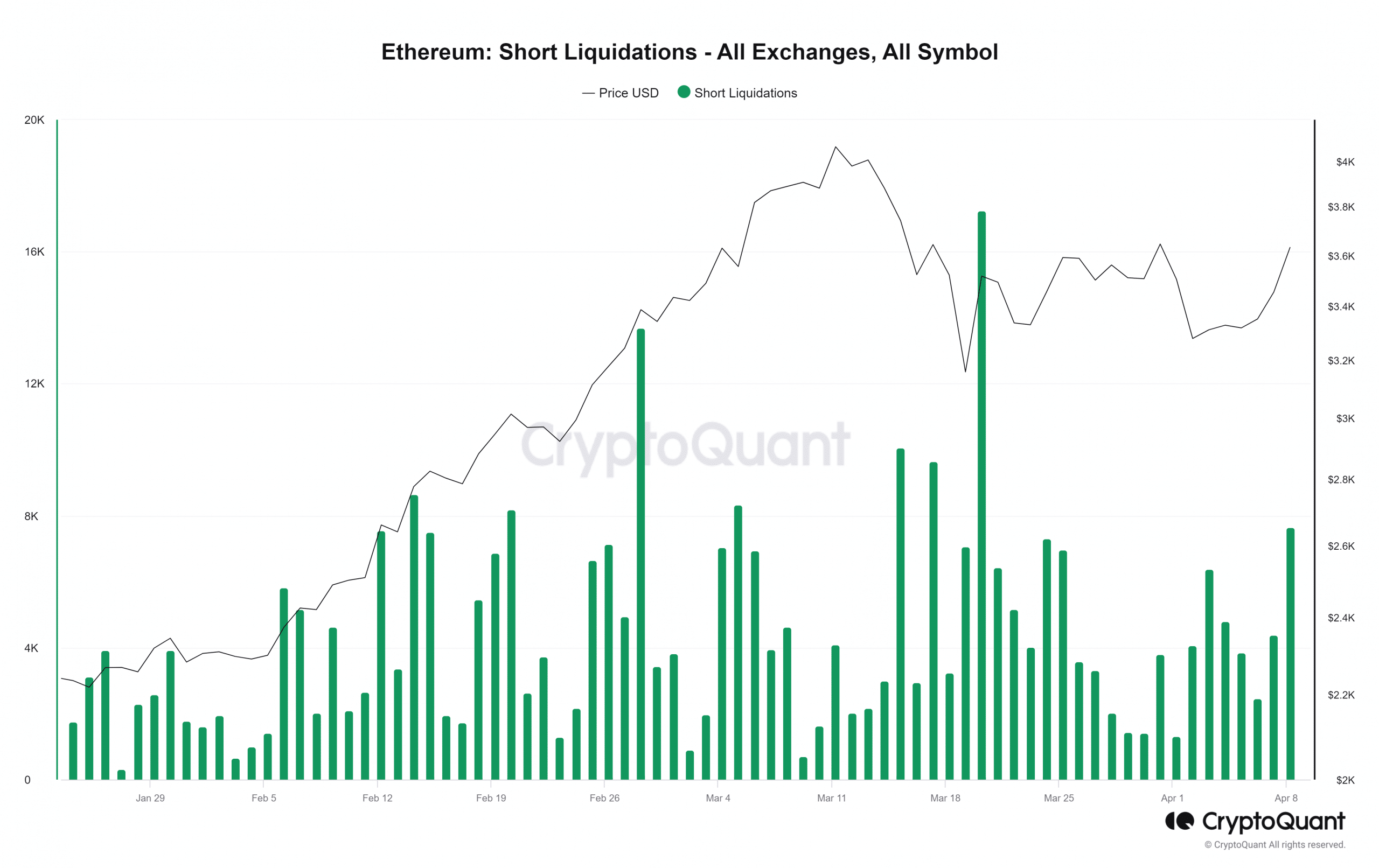

Source: CryptoQuant

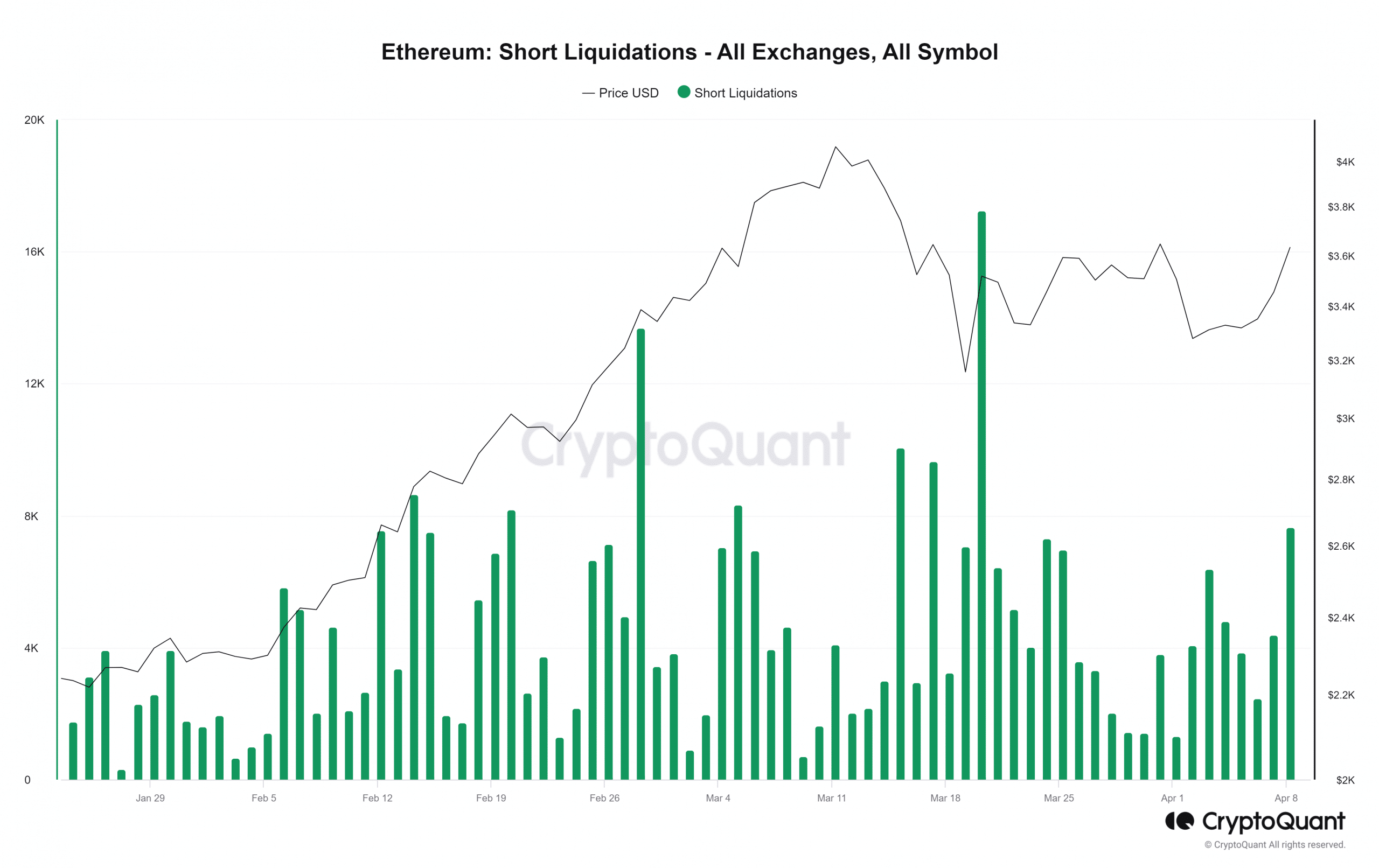

A look at the short liquidations showed that the past two days saw a vast amount of Ethereum short liquidations. CryptoQuant data showed it was worth just over 17k ETH. These liquidations, once triggered, open market buy orders which would drive prices higher.

Is your portfolio green? Check the Ethereum Profit Calculator

Combined with the disbelief we saw with the Coinbase Premium Index, it appeared likely that Ethereum would blow the bears out of the water if the rally continued.

Their forced capitulation will be rocket fuel for further gains. We could see a short squeeze and $4k ETH once more this week, and the disbelief could rapidly turn into FOMO.

- Ethereum showed signs of accumulation from investors in the past three weeks.

- The momentum when disbelief turns into FOMO could usher in even more gains for ETH.

Ethereum [ETH] attracted flak from Peter Brandt, who called it a “junk coin” with “outrageous” gas fees. Despite the harsh statements, a portion of the market had bullish conviction in the token.

On the 8th of April, it noted a 6.5% rally at the time of writing. These gains came even though a bearish chart pattern forecasted a drop to $2800. Are the majority of the participants in disbelief of the current rally, or is this a temporary retracement before the next leg downward?

The U.S. traders are in disbelief

Source: CryptoQuant

The Coinbase Premium Index represents the percentage difference in prices between Binance and Coinbase. The former is not available to U.S. residents, which is why Coinbase is a good index for U.S. participant enthusiasm.

From the 2nd of April to the 7th, the Coinbase premium fell toward zero. Yet, at that time, ETH was in the process of unmaking recent losses. In contrast, when there was a strong rally toward the end of February, the Coinbase premium trended swiftly higher.

ETH to $4k once more?

Source: CryptoQuant

After the drop to $3056 on 19th March, the exchange reserves of Ethereum began to trend lower. This was a sign that users were offloading their tokens out of centralized exchanges. It implied accumulation and a reduction in the selling pressure.

This downtrend has not stopped yet, although there was a minor uptick in the exchange reserve on 7th April. This was when the $3.4k short-term resistance was reclaimed, giving some investors a reason to realize profits.

Overall, a continued downtrend in the reserves metric would be excellent news for long-term bulls.

Source: CryptoQuant

A look at the short liquidations showed that the past two days saw a vast amount of Ethereum short liquidations. CryptoQuant data showed it was worth just over 17k ETH. These liquidations, once triggered, open market buy orders which would drive prices higher.

Is your portfolio green? Check the Ethereum Profit Calculator

Combined with the disbelief we saw with the Coinbase Premium Index, it appeared likely that Ethereum would blow the bears out of the water if the rally continued.

Their forced capitulation will be rocket fuel for further gains. We could see a short squeeze and $4k ETH once more this week, and the disbelief could rapidly turn into FOMO.

where buy generic clomiphene where to buy clomiphene cheap clomiphene without insurance where can i get clomid cost of cheap clomiphene online where to get clomiphene can you buy generic clomid pills

With thanks. Loads of knowledge!

This is the compassionate of scribble literary works I truly appreciate.

order zithromax 500mg generic – buy metronidazole 200mg online flagyl 400mg price

semaglutide 14mg generic – cyproheptadine oral buy periactin

order motilium generic – sumycin 500mg cheap buy generic flexeril for sale

buy generic augmentin over the counter – https://atbioinfo.com/ order ampicillin for sale

buy esomeprazole – https://anexamate.com/ purchase esomeprazole capsules

coumadin 2mg generic – https://coumamide.com/ buy losartan 50mg

purchase meloxicam online cheap – moboxsin.com order meloxicam online

buy deltasone 20mg for sale – https://apreplson.com/ prednisone 20mg pills

cheap amoxil generic – https://combamoxi.com/ buy generic amoxicillin

order diflucan 200mg pills – https://gpdifluca.com/# forcan tablet

cenforce pills – https://cenforcers.com/ cenforce 100mg cost

canada cialis for sale – https://ciltadgn.com/ cialis online no prescription australia

zantac 300mg cheap – https://aranitidine.com/# buy zantac 150mg generic

tadalafil lowest price – cialis insurance coverage blue cross how to buy tadalafil

Greetings! Jolly useful suggestion within this article! It’s the little changes which choice espy the largest changes. Thanks a lot for sharing! donde comprar cenforce

viagra buy south africa – 50 mg sildenafil price buy viagra manchester

This is the type of advise I turn up helpful. order neurontin 600mg sale

Thanks on sharing. It’s outstrip quality. https://prohnrg.com/

The reconditeness in this serving is exceptional. https://aranitidine.com/fr/acheter-cenforce/

More content pieces like this would insinuate the интернет better. https://ondactone.com/spironolactone/

I couldn’t weather commenting. Profoundly written!

https://doxycyclinege.com/pro/levofloxacin/

Good blog you possess here.. It’s hard to assign elevated worth script like yours these days. I really appreciate individuals like you! Take mindfulness!! http://zgyhsj.com/space-uid-978084.html

buy generic dapagliflozin – https://janozin.com/ order dapagliflozin

buy cheap generic xenical – https://asacostat.com/# buy orlistat generic