- Ethereum surged 29% over the past week, reaching a three-month high of $3,184.

- The altcoin could be approaching its YTD high, fueling speculation of a potential Ethereum ATH.

Ethereum [ETH] has experienced a remarkable surge over the past week, climbing 29% to reach a three-month high of $3,184. With this strong upward momentum, the cryptocurrency is on the brink of hitting its year-to-date (YTD) high, drawing the attention of investors and market watchers alike.

With Bitcoin’s [BTC] $89,000 surge, discussions about the possibility of a new ATH for Ethereum are intensifying. Could the leading altcoin be poised for even greater gains, or is this rally a temporary spike?

Ethereum rally driven by traders and holders

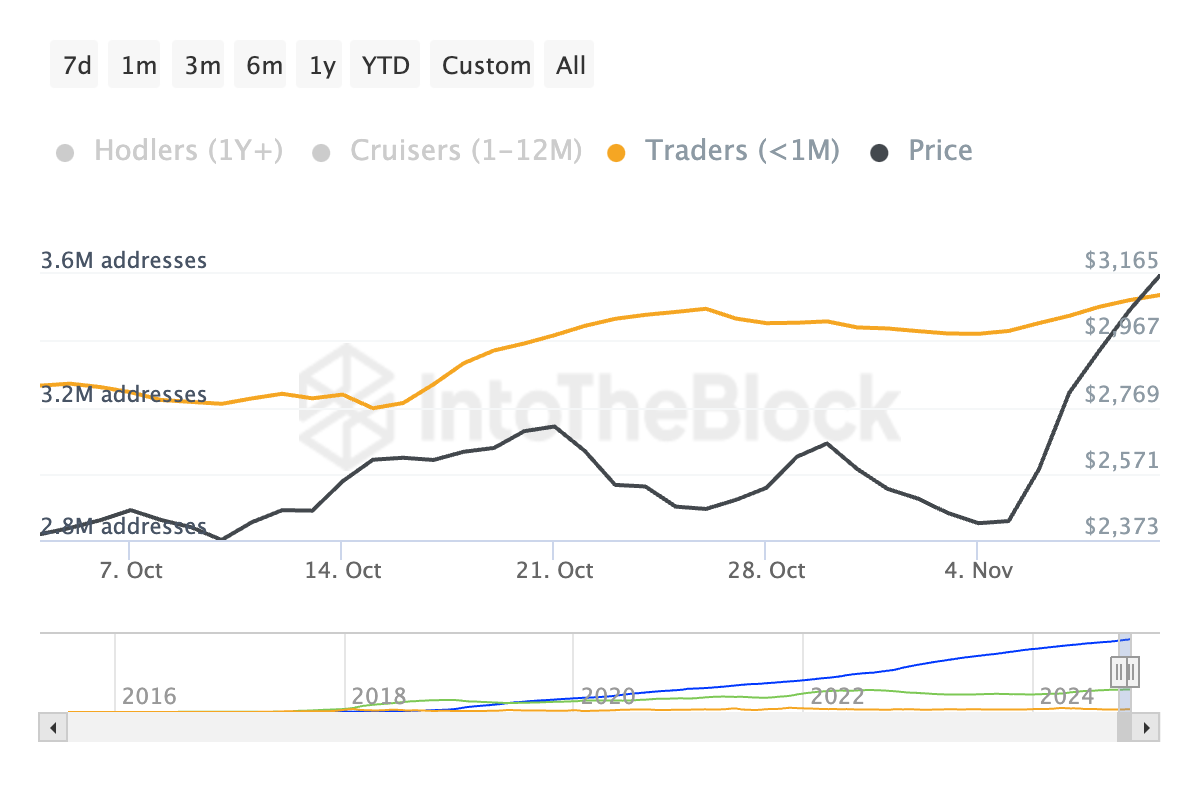

Ethereum’s recent rally was supported by a rising average holding time, indicating increased participation from long-term holders. This trend suggests greater confidence in the ongoing price surge and could signal a stable foundation for further gains.

Source: Into The Block

The concurrent rise in both holding time and price points to a rally with staying power, fueled by stronger market sentiment and reduced selling pressure. Whether this momentum leads to an ATH remains to be seen, but investor optimism is clear.

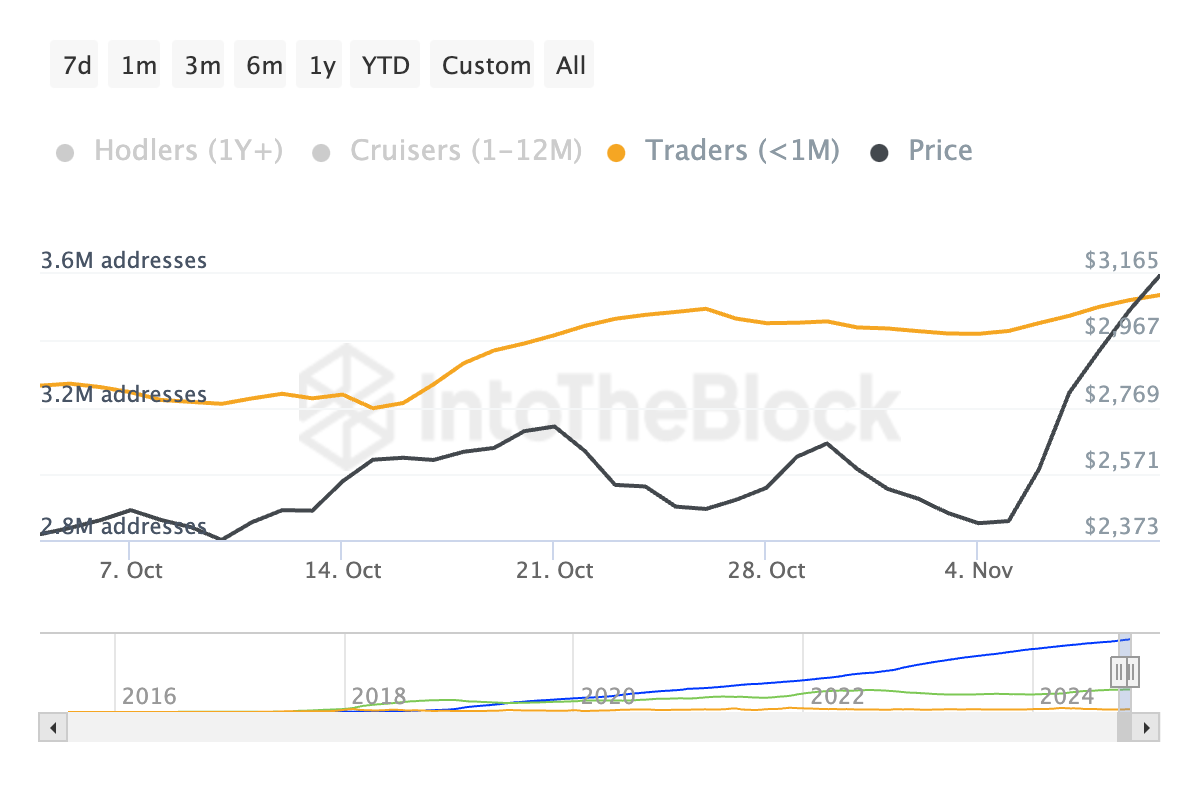

Moreover, Ethereum’s price surge was also fueled by an increase in short-term traders, with around 3.6 million addresses holding for less than a month.

Source: Into The Block

This spike in speculative activity suggests a potential short-term rally, but long-term holders and mid-term holders remain stable, providing a steady base.

Is an Ethereum ATH possible?

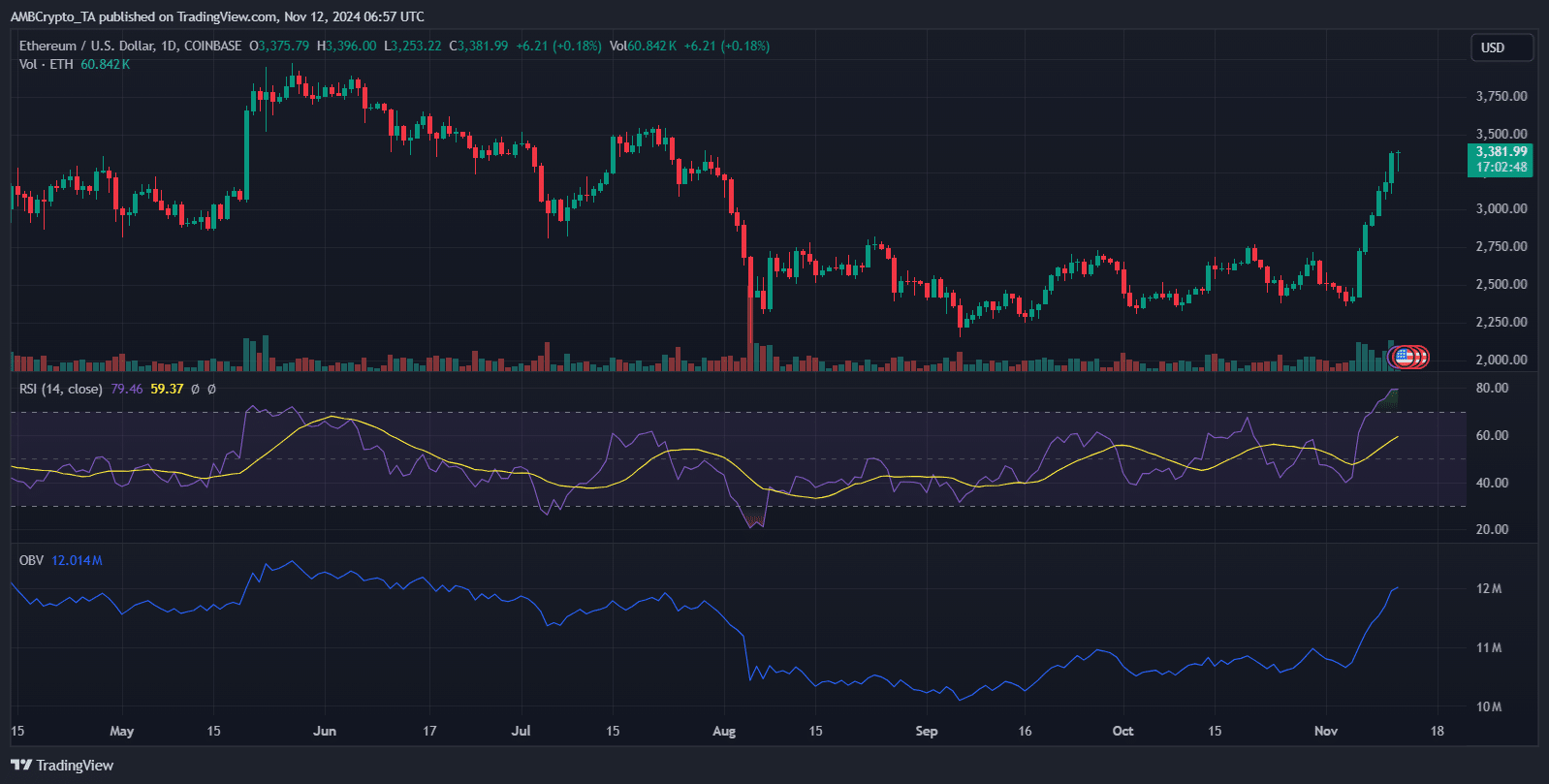

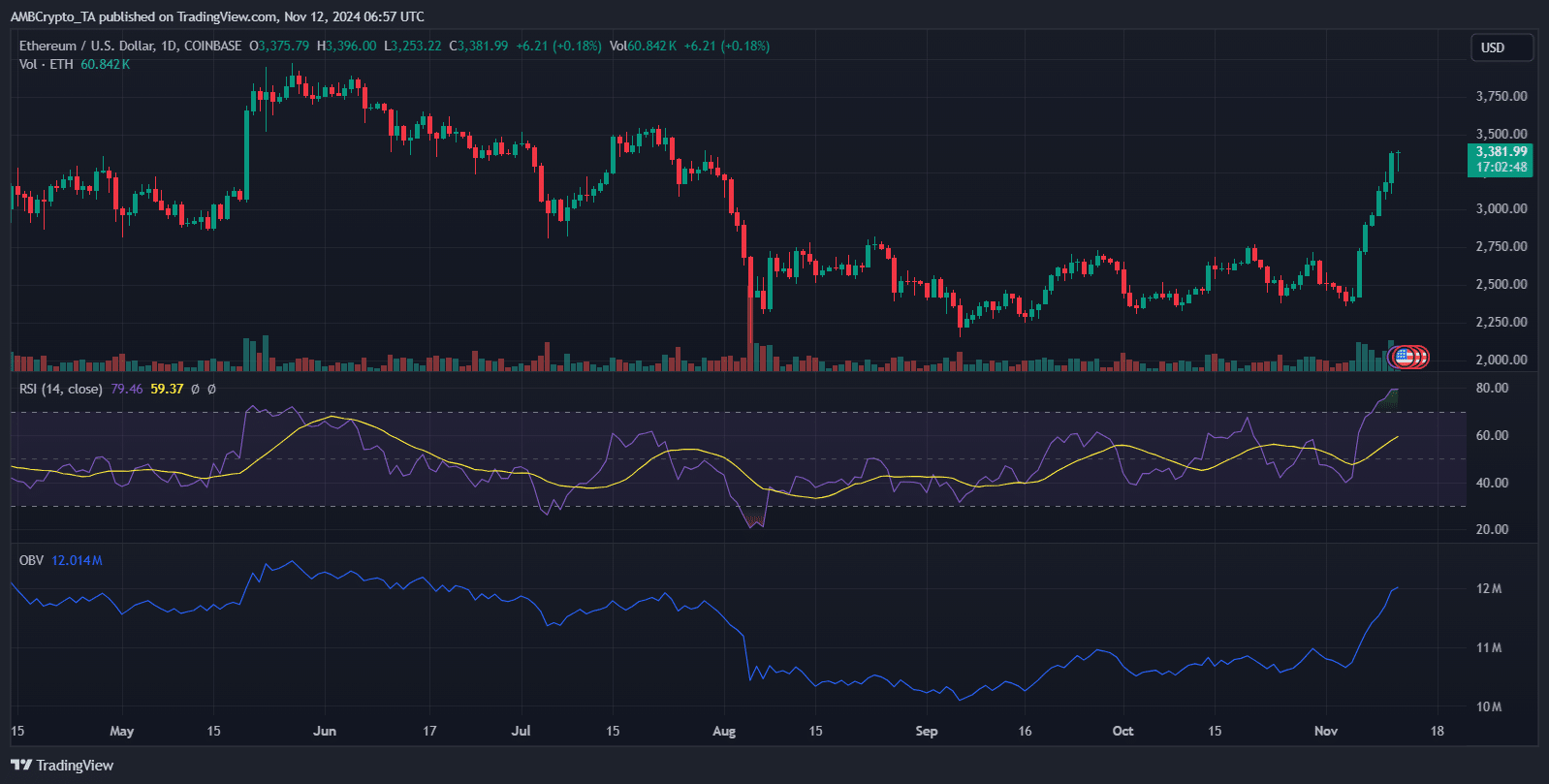

Source: TradingView

Ethereum’s price surge pushed the RSI to 77.45, indicating overbought conditions, which may prompt a short-term correction. The price momentum is supported by a rising OBV, reflecting strong buying interest.

If Ethereum breaks above its current level of $3,348, it could most certainly move toward the YTD high.

However, given the overbought RSI, a pullback to $3,000 may occur before further upside. Traders should be cautious and watch for consolidation around current levels or potential retests before any attempt to reach a new ATH.

Market sentiment and institutional involvement

Ethereum’s rally is driven by strong market sentiment and rising institutional interest, with big players drawn to its expanding role in DeFi and Web3.

Institutions add liquidity and stability, bolstering Ethereum’s long-term outlook and reducing volatility.

Read Ethereum Price Prediction 2024-25

However, with RSI at overbought levels, any shift in sentiment – perhaps due to macroeconomic or regulatory changes – could trigger a pullback.

If institutional confidence remains high, Ethereum may hold its gains and approach a new ATH. This ongoing institutional support could be pivotal in sustaining the current rally, providing a foundation for potential future highs.

- Ethereum surged 29% over the past week, reaching a three-month high of $3,184.

- The altcoin could be approaching its YTD high, fueling speculation of a potential Ethereum ATH.

Ethereum [ETH] has experienced a remarkable surge over the past week, climbing 29% to reach a three-month high of $3,184. With this strong upward momentum, the cryptocurrency is on the brink of hitting its year-to-date (YTD) high, drawing the attention of investors and market watchers alike.

With Bitcoin’s [BTC] $89,000 surge, discussions about the possibility of a new ATH for Ethereum are intensifying. Could the leading altcoin be poised for even greater gains, or is this rally a temporary spike?

Ethereum rally driven by traders and holders

Ethereum’s recent rally was supported by a rising average holding time, indicating increased participation from long-term holders. This trend suggests greater confidence in the ongoing price surge and could signal a stable foundation for further gains.

Source: Into The Block

The concurrent rise in both holding time and price points to a rally with staying power, fueled by stronger market sentiment and reduced selling pressure. Whether this momentum leads to an ATH remains to be seen, but investor optimism is clear.

Moreover, Ethereum’s price surge was also fueled by an increase in short-term traders, with around 3.6 million addresses holding for less than a month.

Source: Into The Block

This spike in speculative activity suggests a potential short-term rally, but long-term holders and mid-term holders remain stable, providing a steady base.

Is an Ethereum ATH possible?

Source: TradingView

Ethereum’s price surge pushed the RSI to 77.45, indicating overbought conditions, which may prompt a short-term correction. The price momentum is supported by a rising OBV, reflecting strong buying interest.

If Ethereum breaks above its current level of $3,348, it could most certainly move toward the YTD high.

However, given the overbought RSI, a pullback to $3,000 may occur before further upside. Traders should be cautious and watch for consolidation around current levels or potential retests before any attempt to reach a new ATH.

Market sentiment and institutional involvement

Ethereum’s rally is driven by strong market sentiment and rising institutional interest, with big players drawn to its expanding role in DeFi and Web3.

Institutions add liquidity and stability, bolstering Ethereum’s long-term outlook and reducing volatility.

Read Ethereum Price Prediction 2024-25

However, with RSI at overbought levels, any shift in sentiment – perhaps due to macroeconomic or regulatory changes – could trigger a pullback.

If institutional confidence remains high, Ethereum may hold its gains and approach a new ATH. This ongoing institutional support could be pivotal in sustaining the current rally, providing a foundation for potential future highs.

where to buy clomiphene pill cost generic clomiphene pills cost of clomiphene without insurance clomiphene prescription cost can i purchase generic clomiphene without rx where to get generic clomid price clomiphene pregnancy

This is the stripe of content I enjoy reading.

More posts like this would persuade the online time more useful.

azithromycin 500mg sale – tetracycline 500mg for sale flagyl cheap

purchase rybelsus pills – rybelsus price order generic cyproheptadine

generic domperidone 10mg – where can i buy domperidone brand flexeril

purchase augmentin generic – https://atbioinfo.com/ buy ampicillin generic

order medex online – coumamide buy losartan pills for sale

mobic medication – relieve pain mobic order

buy prednisone 5mg without prescription – corticosteroid deltasone sale

buy erectile dysfunction medications – fastedtotake best ed pill

amoxicillin canada – combamoxi.com amoxicillin for sale online

buy diflucan tablets – click forcan online order

cenforce 100mg usa – cenforce brand cenforce 100mg us

how much does cialis cost per pill – https://ciltadgn.com/ over the counter drug that works like cialis

cialis dosage for ed – site cheap cialis canada

order ranitidine sale – https://aranitidine.com/# ranitidine 300mg usa

generic viagra 50mg – https://strongvpls.com/# viagra cheap discount

More articles like this would pretence of the blogosphere richer. https://gnolvade.com/es/comprar-viagra-en-espana/

This is the tolerant of enter I find helpful. order gabapentin 100mg online cheap

I couldn’t resist commenting. Profoundly written! https://ursxdol.com/doxycycline-antibiotic/

With thanks. Loads of erudition! https://prohnrg.com/product/atenolol-50-mg-online/

This website really has all of the information and facts I needed there this thesis and didn’t identify who to ask. https://aranitidine.com/fr/clenbuterol/

This is the tolerant of advise I find helpful. https://ondactone.com/spironolactone/

More posts like this would persuade the online elbow-room more useful.

tamsulosin sale

This is a question which is virtually to my callousness… Many thanks! Faithfully where can I find the contact details an eye to questions? http://electronix.ru/redirect.php?https://schoolido.lu/user/adip/

More posts like this would make the online space more useful. https://myvisualdatabase.com/forum/profile.php?id=117927

order dapagliflozin generic – this where can i buy forxiga

orlistat over the counter – purchase xenical without prescription orlistat 120mg without prescription

This is the make of post I find helpful. http://pokemonforever.com/User-Egtqxt