- Strategic ETH accumulation rises as conviction holders absorb supply despite muted market sentiment and DeFi slowdown.

- Long-term wallets hit record inflows, signaling deepening confidence even as Ethereum trades below key resistance.

As market participants grapple with shifting sentiment, Ethereum [ETH] is transforming beneath the surface.

While headlines focus on price swings and DeFi cooling, on-chain data reveals a narrative of strategic accumulation and growing conviction among seasoned holders.

From declining panic selling to record inflows into long-term wallets, Ethereum’s supply behavior contrasts sharply with Bitcoin’s [BTC], pointing to a maturing investor base that may be positioning for the next major move.

Ethereum supply shifts show strategic accumulation

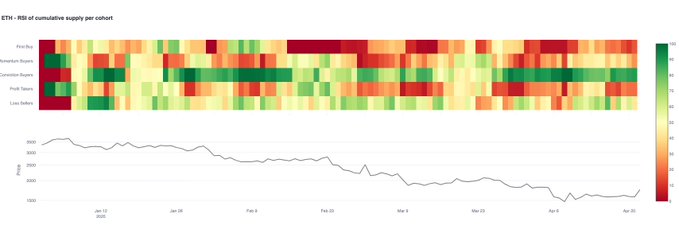

The ETH supply dynamics tell a contrasting story compared to BTC. As shown in the heatmap, there’s no significant resurgence from first buyers or momentum buyers — RSI for these cohorts remains muted.

However, conviction buyers have shown consistent accumulation since late March, maintaining a strong RSI around 80, signaling steady belief despite broader market hesitation.

Source: Glassnode

Notably, loss sellers peaked around the 16th of April but have since decelerated, with RSI falling below 50, suggesting a slowdown in panic selling.

This shift in cohort behavior indicates a more strategic accumulation phase rather than a fear-driven exit, pointing to emerging confidence among seasoned holders.

DeFi cools, but accumulators show conviction

Source: X

Despite a recent uptick in trading activity, Ethereum’s DEX ecosystem is still far from its peak.

TVL in Ethereum-based DEXs has dropped nearly 90% from all-time highs, while monthly trading volume is down about 55%. Users may be shifting to other chains or opting for off-chain solutions amid market uncertainty.

Source: Cryptoquant

However, a deeper trend is emerging. Accumulating addresses — wallets that have never sold — are absorbing ETH at unprecedented levels.

In just the last 48 hours, these addresses took in over 640,000 ETH, the largest inflow since 2018. This behavior, visible in CryptoQuant data, shows growing confidence among long-term holders despite price weakness.

Ethereum’s price outlook

- Strategic ETH accumulation rises as conviction holders absorb supply despite muted market sentiment and DeFi slowdown.

- Long-term wallets hit record inflows, signaling deepening confidence even as Ethereum trades below key resistance.

As market participants grapple with shifting sentiment, Ethereum [ETH] is transforming beneath the surface.

While headlines focus on price swings and DeFi cooling, on-chain data reveals a narrative of strategic accumulation and growing conviction among seasoned holders.

From declining panic selling to record inflows into long-term wallets, Ethereum’s supply behavior contrasts sharply with Bitcoin’s [BTC], pointing to a maturing investor base that may be positioning for the next major move.

Ethereum supply shifts show strategic accumulation

The ETH supply dynamics tell a contrasting story compared to BTC. As shown in the heatmap, there’s no significant resurgence from first buyers or momentum buyers — RSI for these cohorts remains muted.

However, conviction buyers have shown consistent accumulation since late March, maintaining a strong RSI around 80, signaling steady belief despite broader market hesitation.

Source: Glassnode

Notably, loss sellers peaked around the 16th of April but have since decelerated, with RSI falling below 50, suggesting a slowdown in panic selling.

This shift in cohort behavior indicates a more strategic accumulation phase rather than a fear-driven exit, pointing to emerging confidence among seasoned holders.

DeFi cools, but accumulators show conviction

Source: X

Despite a recent uptick in trading activity, Ethereum’s DEX ecosystem is still far from its peak.

TVL in Ethereum-based DEXs has dropped nearly 90% from all-time highs, while monthly trading volume is down about 55%. Users may be shifting to other chains or opting for off-chain solutions amid market uncertainty.

Source: Cryptoquant

However, a deeper trend is emerging. Accumulating addresses — wallets that have never sold — are absorbing ETH at unprecedented levels.

In just the last 48 hours, these addresses took in over 640,000 ETH, the largest inflow since 2018. This behavior, visible in CryptoQuant data, shows growing confidence among long-term holders despite price weakness.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

Here, you can discover a wide selection of slot machines from leading developers.

Visitors can try out traditional machines as well as new-generation slots with high-quality visuals and interactive gameplay.

Whether you’re a beginner or an experienced player, there’s a game that fits your style.

play casino

The games are instantly accessible round the clock and designed for desktop computers and smartphones alike.

All games run in your browser, so you can get started without hassle.

Platform layout is intuitive, making it simple to browse the collection.

Sign up today, and enjoy the world of online slots!

Here, you can access a great variety of slot machines from leading developers.

Visitors can experience retro-style games as well as new-generation slots with high-quality visuals and exciting features.

Whether you’re a beginner or a casino enthusiast, there’s always a slot to match your mood.

casino

Each title are ready to play 24/7 and optimized for laptops and mobile devices alike.

No download is required, so you can get started without hassle.

Platform layout is easy to use, making it quick to explore new games.

Sign up today, and enjoy the world of online slots!

sukaaa-casino.ru

Если вам интересно ознакомиться с инструкциями по установке приложений на мобильные устройства, мы можем предложить общий гайд.

Как установить приложения на Android и iOS

Установка мобильных приложений зависит от операционной системы вашего устройства.

Для Android:

Откройте файл APK — если приложение недоступно в Google Play, его можно скачать через официальный сайт.

Разрешите установку из неизвестных источников — зайдите в Настройки > Безопасность и активируйте соответствующую опцию.

Запустите установку и следуйте инструкциям.

Для iOS:

Скачайте приложение из App Store — большинство сервисов доступны через официальный магазин.

Используйте TestFlight или корпоративный сертификат — если приложение не опубликовано в App Store.

Разрешите установку — в настройках iPhone перейдите в раздел VPN и управление устройствами и подтвердите доверие к разработчику.

Если вас интересует конкретное приложение, проверьте его официальный сайт или магазин приложений. Но помните о безопасности: скачивайте ПО только из проверенных источников, чтобы избежать мошенничества.

Хотите узнать больше? Читайте дополнительные инструкции на сайте по ссылке ниже.sukaaa-casino.ru

buy clomiphene without dr prescription can i buy clomiphene tablets cost of generic clomiphene without rx clomid chance of twins clomid pills at dischem price can you buy cheap clomid without rx where to get generic clomid price

The depth in this piece is exceptional.

More articles like this would frame the blogosphere richer.

azithromycin 250mg oral – buy tindamax no prescription buy generic metronidazole online

buy rybelsus 14mg without prescription – buy periactin sale order cyproheptadine 4mg

inderal 10mg oral – clopidogrel 75mg generic buy methotrexate 5mg for sale