- Security concerns around Ethereum were explored by analysts.

- Activity on the Ethereum network remained high, and interest in NFTs fell.

Ethereum [ETH] is known for its reliability and hasn’t faced any major issues. However, questions were raised about the network’s security recently.

Looking into the security aspect

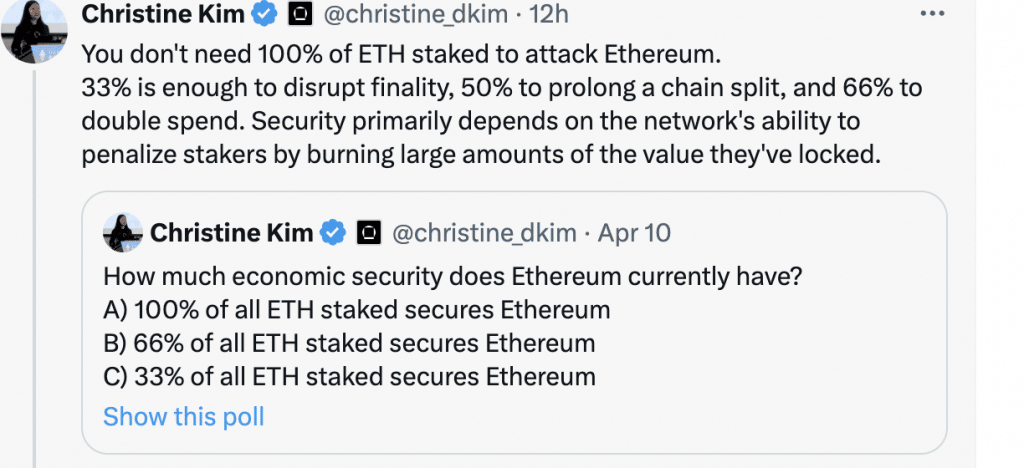

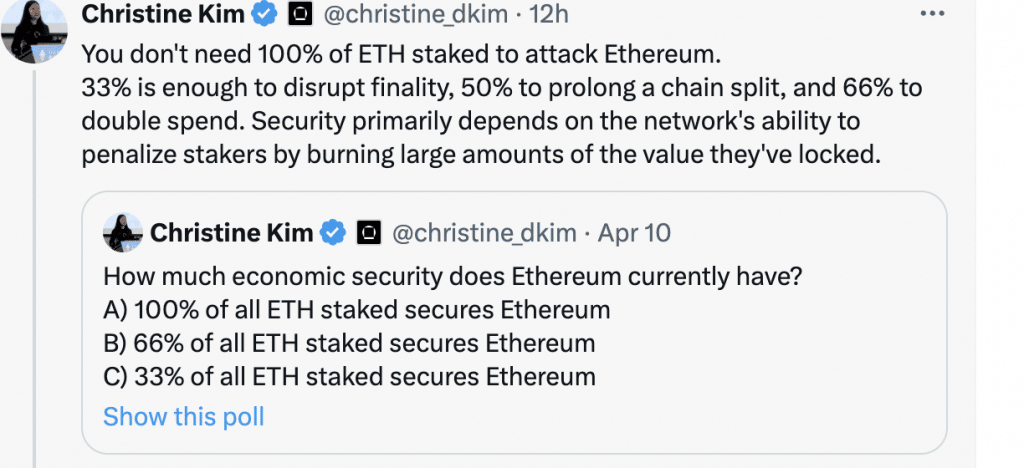

According to the findings of crypto analyst Christine Kim, Ethereum’s security model poses certain vulnerabilities. Her analysis delves into potential exploits that attackers might employ against Ethereum’s proof-of-stake consensus protocol.

It examines scenarios such as reorganizations and finality delays, particularly concerning attackers with varying proportions of the total staked ether.

A key insight is that attackers with more significant stakes wield greater influence, as their stake translates into voting power, enabling them to sway the contents of future blocks.

As the attacker’s stake reaches certain thresholds, their power escalates, leading to outcomes like finality delays, double finality, censorship, and control over both the blockchain’s past and future.

However, attacks involving 34%, 51%, or 66% of staked ether might necessitate out-of-band social coordination for resolution. While this could pose challenges for the community, the Ethereum social layer serves as a robust defense mechanism.

Any technically successful attack could potentially be neutralized by the community’s agreement to adopt an honest fork.

This dynamic creates a race between the attacker and the Ethereum community, where swift social coordination could render the attacker’s investment futile.

Source: X

How is Ethereum doing?

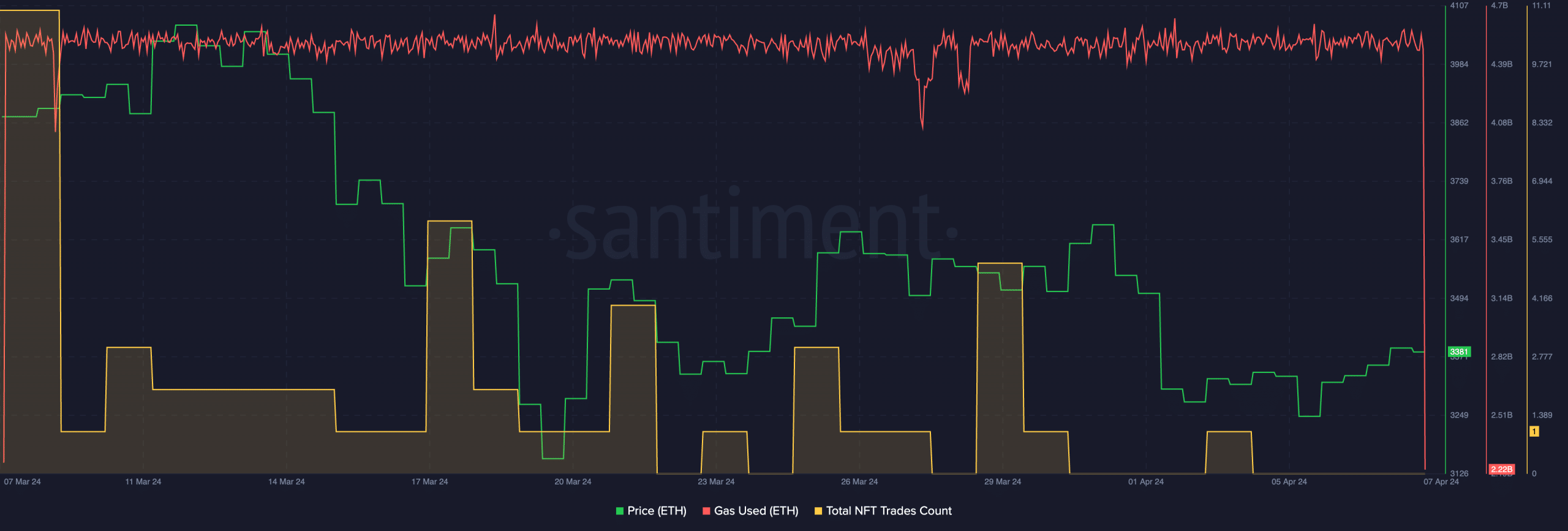

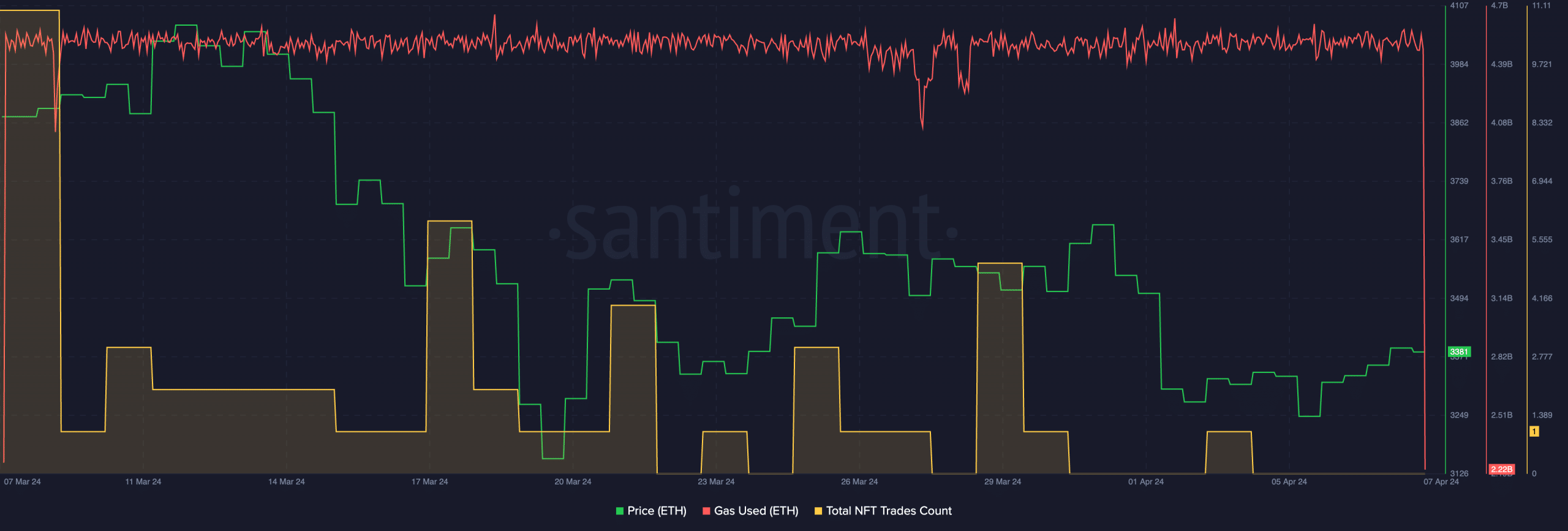

Despite these security concerns, it was business as usual on the Ethereum network. AMBCrypto’s analysis of Santiment’s data revealed that the gas usage on the Ethereum network had remained consistent over the last month.

This indicated that activity on the network had remained the same. However, interest in the NFT sector declined significantly during this period.

The declining NFT trades on the network suggested that the rising activity on the Ethereum network wasn’t driven by interest in NFTs on the network.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2024-25

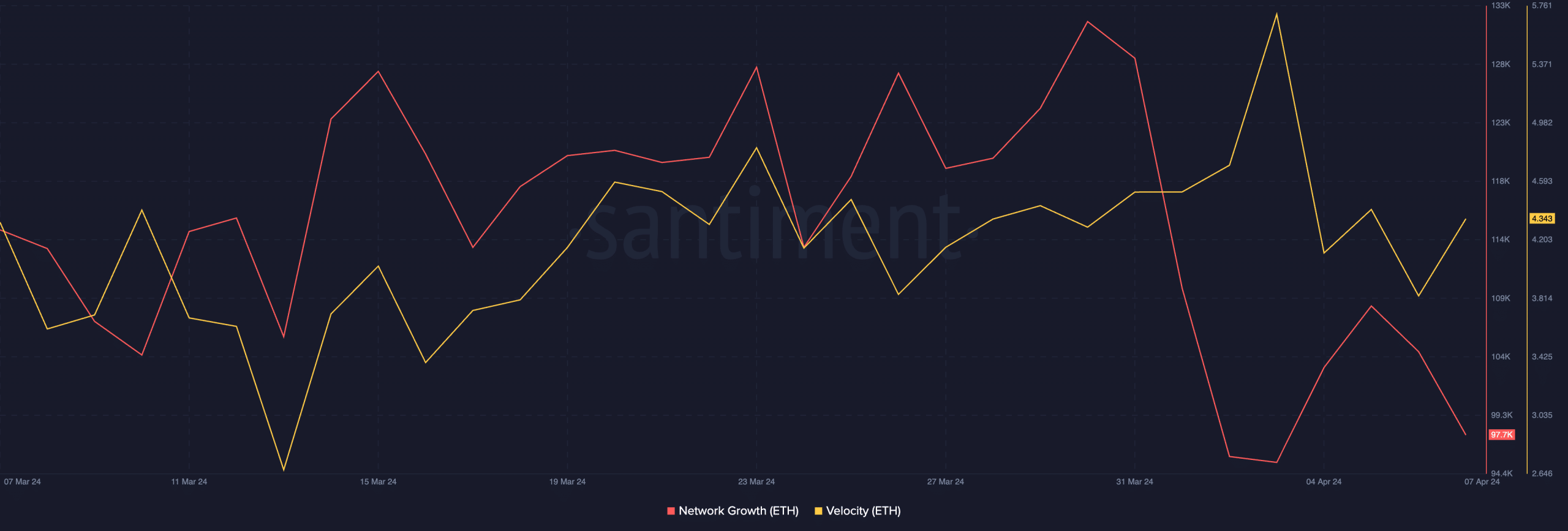

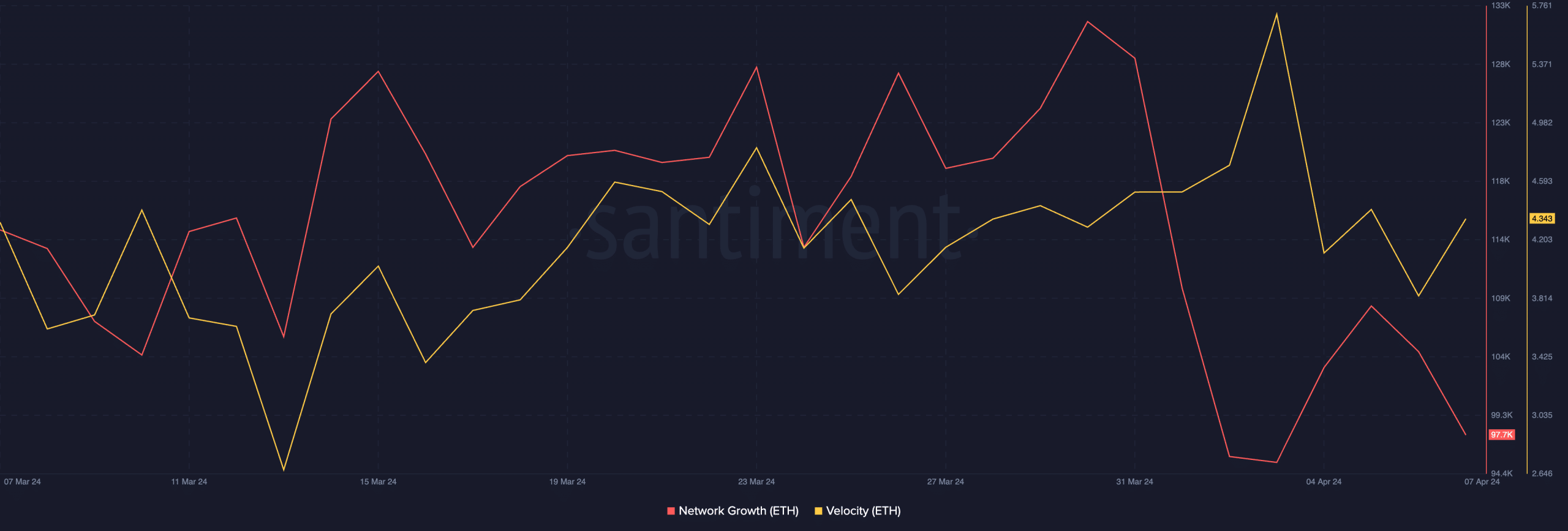

Coming to ETH’s price, it was trading at $3,522.12 and its price had declined by 1.92% in the last 24 hours. Moreover, the network growth of ETH had also plummeted indicating that new addresses had started to lose interest in the token.

Additionally, the velocity at which ETH was trading at had also fallen, implying that the trading frequency of ETH had decreased.

Source: Santiment

- Security concerns around Ethereum were explored by analysts.

- Activity on the Ethereum network remained high, and interest in NFTs fell.

Ethereum [ETH] is known for its reliability and hasn’t faced any major issues. However, questions were raised about the network’s security recently.

Looking into the security aspect

According to the findings of crypto analyst Christine Kim, Ethereum’s security model poses certain vulnerabilities. Her analysis delves into potential exploits that attackers might employ against Ethereum’s proof-of-stake consensus protocol.

It examines scenarios such as reorganizations and finality delays, particularly concerning attackers with varying proportions of the total staked ether.

A key insight is that attackers with more significant stakes wield greater influence, as their stake translates into voting power, enabling them to sway the contents of future blocks.

As the attacker’s stake reaches certain thresholds, their power escalates, leading to outcomes like finality delays, double finality, censorship, and control over both the blockchain’s past and future.

However, attacks involving 34%, 51%, or 66% of staked ether might necessitate out-of-band social coordination for resolution. While this could pose challenges for the community, the Ethereum social layer serves as a robust defense mechanism.

Any technically successful attack could potentially be neutralized by the community’s agreement to adopt an honest fork.

This dynamic creates a race between the attacker and the Ethereum community, where swift social coordination could render the attacker’s investment futile.

Source: X

How is Ethereum doing?

Despite these security concerns, it was business as usual on the Ethereum network. AMBCrypto’s analysis of Santiment’s data revealed that the gas usage on the Ethereum network had remained consistent over the last month.

This indicated that activity on the network had remained the same. However, interest in the NFT sector declined significantly during this period.

The declining NFT trades on the network suggested that the rising activity on the Ethereum network wasn’t driven by interest in NFTs on the network.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2024-25

Coming to ETH’s price, it was trading at $3,522.12 and its price had declined by 1.92% in the last 24 hours. Moreover, the network growth of ETH had also plummeted indicating that new addresses had started to lose interest in the token.

Additionally, the velocity at which ETH was trading at had also fallen, implying that the trading frequency of ETH had decreased.

Source: Santiment

can i order generic clomid without a prescription where buy clomiphene can you get clomid without a prescription can i order clomiphene without rx where can i buy cheap clomiphene without prescription where to buy cheap clomiphene pill can i purchase clomiphene pills

I’ll certainly bring back to review more.

This is the amicable of content I get high on reading.

buy azithromycin 250mg sale – buy ciplox 500mg generic buy metronidazole without prescription

buy semaglutide 14 mg pills – buy semaglutide pills generic periactin 4mg

motilium price – motilium ca buy flexeril generic

augmentin 1000mg us – atbioinfo buy ampicillin pills

order generic esomeprazole 20mg – nexiumtous buy esomeprazole without a prescription

cost prednisone 10mg – https://apreplson.com/ order deltasone without prescription

buy ed pills cheap – best ed pills non prescription uk erectile dysfunction medicines

cheap amoxicillin – amoxicillin over the counter buy amoxil online cheap

buy generic diflucan – flucoan diflucan cheap

cenforce 50mg oral – on this site order cenforce online

buy cialis in las vegas – https://ciltadgn.com/# buying cialis without a prescription

how much does cialis cost at cvs – https://strongtadafl.com/ generic cialis 20 mg from india

buy zantac 150mg online cheap – buy ranitidine online generic ranitidine 300mg

More posts like this would force the blogosphere more useful. https://buyfastonl.com/amoxicillin.html

Good blog you possess here.. It’s hard to assign high calibre article like yours these days. I truly respect individuals like you! Withstand vigilance!! https://ursxdol.com/clomid-for-sale-50-mg/

This is the make of delivery I unearth helpful. https://prohnrg.com/product/lisinopril-5-mg/

Greetings! Very gainful recommendation within this article! It’s the little changes which wish make the largest changes. Thanks a quantity quest of sharing! https://ondactone.com/spironolactone/

I couldn’t turn down commenting. Warmly written!

order generic imitrex 25mg

The thoroughness in this section is noteworthy. https://www.instapaper.com/p/adip