- Ethereum’s realized price upper band at $5.2K mirrors levels seen during the 2021 bull market peak, raising breakout expectations

- Rising exchange inflows and increased activity suggest the possibility of profit-taking.

Ethereum [ETH] is teetering on the edge of a major breakout, with its realized price upper band hitting $5.2K — mirroring levels last seen during the 2021 bull market peak.

On-chain metrics pointed to strong demand, fueling hopes of a rally beyond $5,000.

But as market dynamics evolve, investors are left wondering: is Ethereum poised to reclaim its former glory, or are the conditions fundamentally reshaping its trajectory?

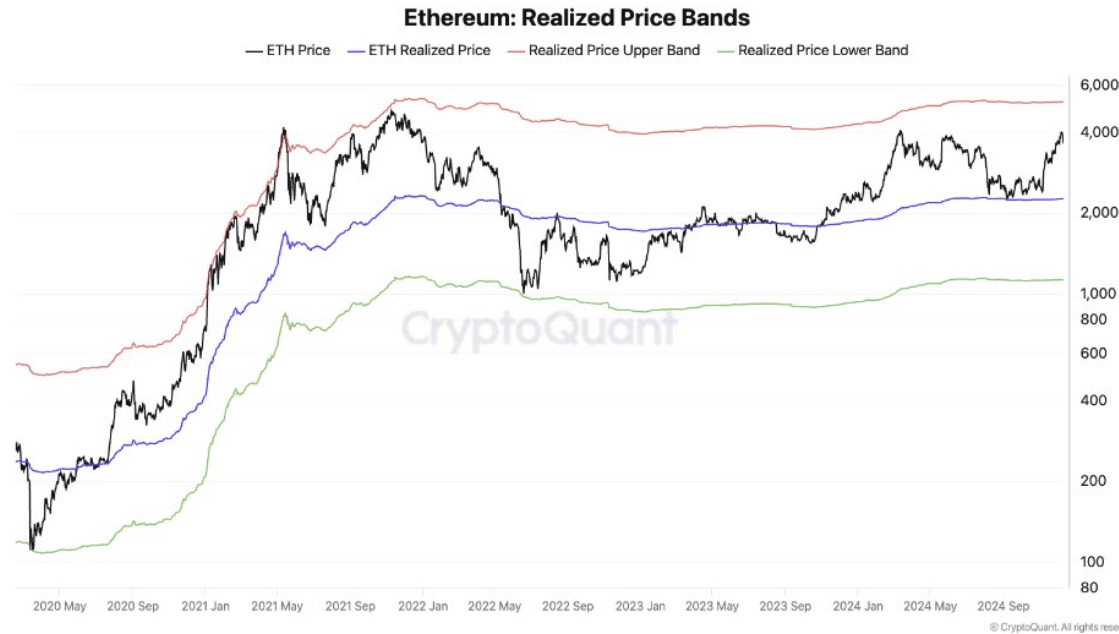

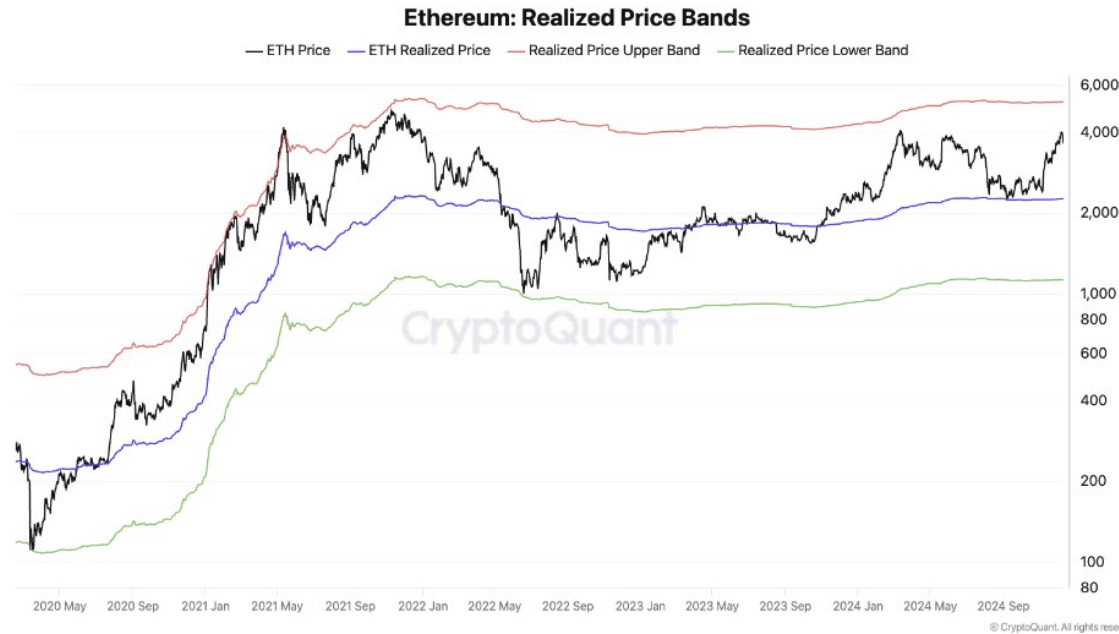

How realized price will affect this current cycle

Source: CryptoQuant

Ethereum’s realized price upper band, at $5.2K at press time, is a key marker in understanding potential market movements.

This metric, which tracks the average price at which each unit of ETH last moved, plays a pivotal role in identifying market trends.

Per AMBCrypto’s look at CryptoQuant data, the current price alignment mirrors the 2021 bull run’s peak, when the realized price upper band coincided with a meteoric rise.

Historically, these upper band levels have signaled overheated conditions or strong bullish momentum, often preceding significant price movements.

Profit-taking ahead?

Source: TradingView

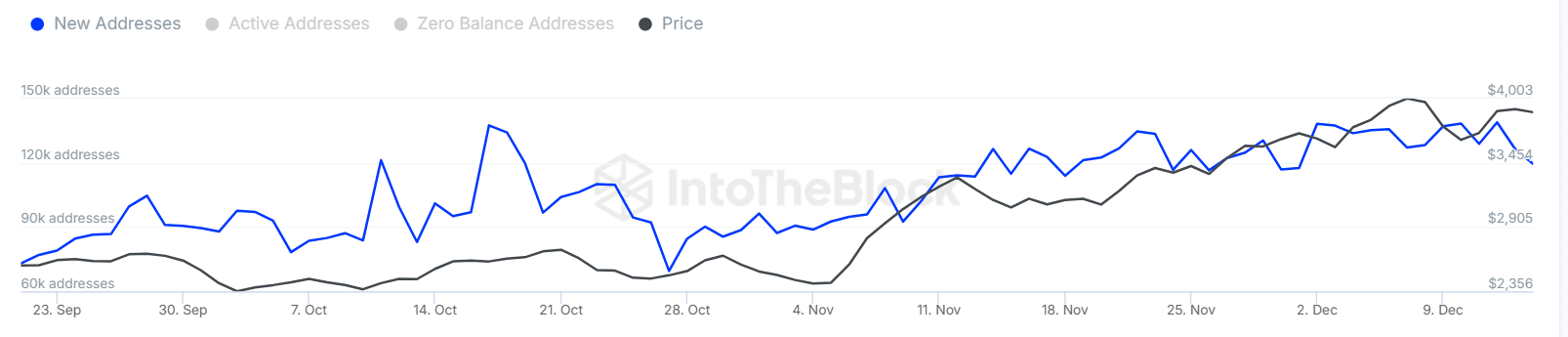

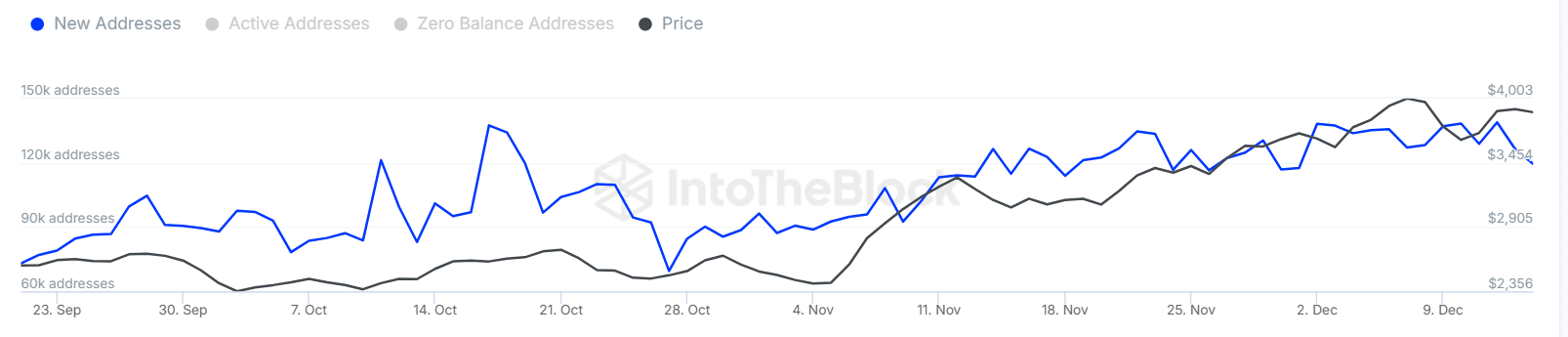

The market is showing mixed signals. The active addresses chart reveals a 10-15% increase in user engagement over the past week, indicating heightened network activity and investor participation.

Simultaneously, trading volumes have surged by nearly 20%, reflecting increased liquidity and trading momentum.

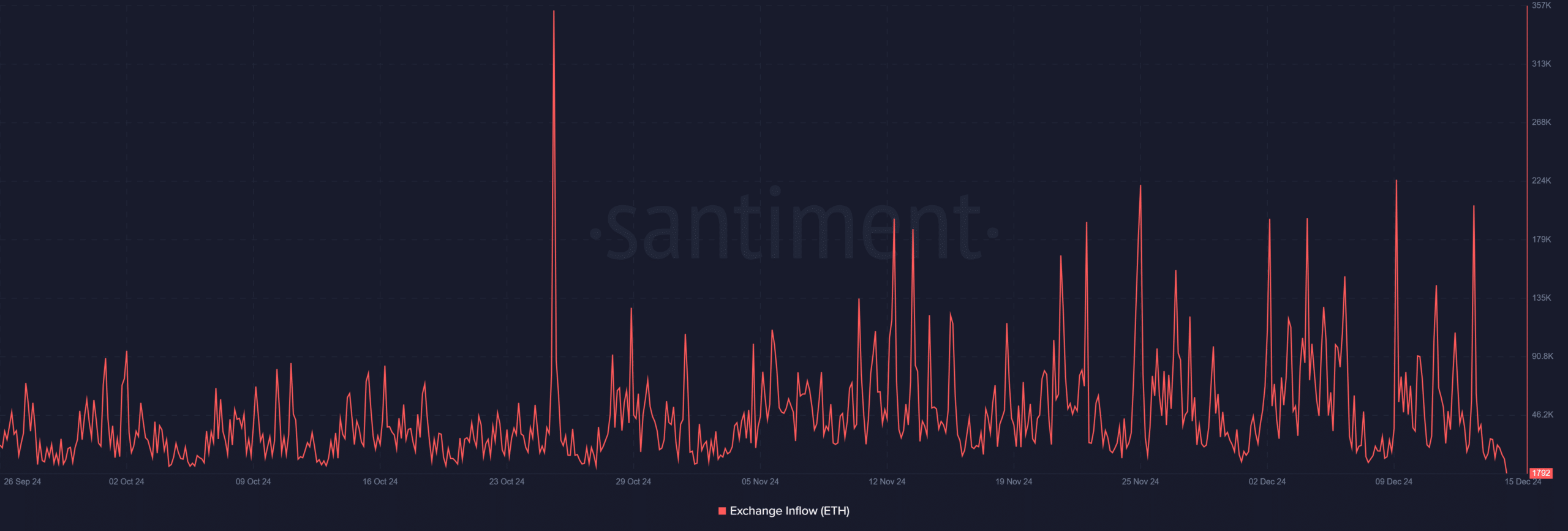

However, the spike in exchange inflows, up by 25%, raises concerns about potential profit-taking behavior.

Source: IntoTheBlock

Historically, such inflow spikes signal that investors may be positioning assets for sell-offs, particularly when paired with rising activity.

This pattern aligns with previous market tops, where increased engagement coincided with short-term corrections.

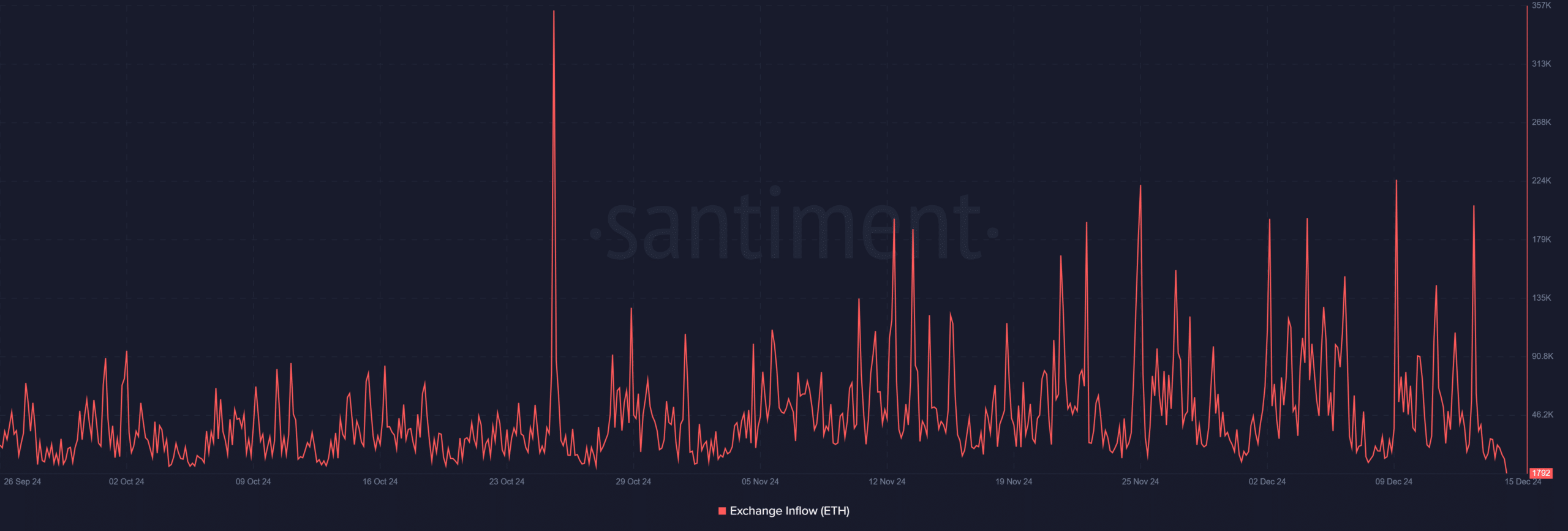

Source: Santiment

The data highlights a delicate balance — while strong participation and trading volumes signal optimism, inflows suggest caution. If inflows sustain, watch for potential downward pressure.

Whether the market consolidates or faces a correction will depend on the coming sessions’ price resilience and broader sentiment shifts.

Market sentiment and the path forward

Recent data reveals a shift in sentiment as Ethereum approaches pivotal levels. The surge in new addresses is counterbalanced by rising exchange inflows, signaling that investors may be capitalizing on gains.

Read Ethereum’s [ETH] Price Prediction 2024-25

With price volatility increasing, a deeper correction could follow if market participants begin to exit positions at these elevated levels.

As Ethereum faces key technical resistance, understanding whether this surge is a sustainable rally or a final push before a larger retreat will be critical for gauging market stability.

- Ethereum’s realized price upper band at $5.2K mirrors levels seen during the 2021 bull market peak, raising breakout expectations

- Rising exchange inflows and increased activity suggest the possibility of profit-taking.

Ethereum [ETH] is teetering on the edge of a major breakout, with its realized price upper band hitting $5.2K — mirroring levels last seen during the 2021 bull market peak.

On-chain metrics pointed to strong demand, fueling hopes of a rally beyond $5,000.

But as market dynamics evolve, investors are left wondering: is Ethereum poised to reclaim its former glory, or are the conditions fundamentally reshaping its trajectory?

How realized price will affect this current cycle

Source: CryptoQuant

Ethereum’s realized price upper band, at $5.2K at press time, is a key marker in understanding potential market movements.

This metric, which tracks the average price at which each unit of ETH last moved, plays a pivotal role in identifying market trends.

Per AMBCrypto’s look at CryptoQuant data, the current price alignment mirrors the 2021 bull run’s peak, when the realized price upper band coincided with a meteoric rise.

Historically, these upper band levels have signaled overheated conditions or strong bullish momentum, often preceding significant price movements.

Profit-taking ahead?

Source: TradingView

The market is showing mixed signals. The active addresses chart reveals a 10-15% increase in user engagement over the past week, indicating heightened network activity and investor participation.

Simultaneously, trading volumes have surged by nearly 20%, reflecting increased liquidity and trading momentum.

However, the spike in exchange inflows, up by 25%, raises concerns about potential profit-taking behavior.

Source: IntoTheBlock

Historically, such inflow spikes signal that investors may be positioning assets for sell-offs, particularly when paired with rising activity.

This pattern aligns with previous market tops, where increased engagement coincided with short-term corrections.

Source: Santiment

The data highlights a delicate balance — while strong participation and trading volumes signal optimism, inflows suggest caution. If inflows sustain, watch for potential downward pressure.

Whether the market consolidates or faces a correction will depend on the coming sessions’ price resilience and broader sentiment shifts.

Market sentiment and the path forward

Recent data reveals a shift in sentiment as Ethereum approaches pivotal levels. The surge in new addresses is counterbalanced by rising exchange inflows, signaling that investors may be capitalizing on gains.

Read Ethereum’s [ETH] Price Prediction 2024-25

With price volatility increasing, a deeper correction could follow if market participants begin to exit positions at these elevated levels.

As Ethereum faces key technical resistance, understanding whether this surge is a sustainable rally or a final push before a larger retreat will be critical for gauging market stability.

clomid prices in south africa order clomiphene online cost clomiphene without rx buy cheap clomiphene price clomid price where buy clomiphene without prescription can i get clomid without rx

With thanks. Loads of erudition!

More articles like this would pretence of the blogosphere richer.

azithromycin pills – buy tindamax pills oral flagyl 400mg

semaglutide buy online – buy semaglutide 14 mg pills cyproheptadine 4 mg uk

motilium 10mg drug – buy tetracycline 500mg online order generic flexeril 15mg

generic propranolol – buy inderal 20mg pill buy cheap generic methotrexate

purchase amoxil online cheap – how to get valsartan without a prescription ipratropium online

buy zithromax for sale – buy bystolic 5mg generic buy nebivolol tablets

buy augmentin for sale – atbio info purchase ampicillin generic

buy generic nexium 20mg – https://anexamate.com/ nexium buy online

warfarin 2mg pills – https://coumamide.com/ brand losartan 50mg

mobic 7.5mg usa – https://moboxsin.com/ mobic 7.5mg uk

order generic prednisone 5mg – asthma buy prednisone generic

where to buy otc ed pills – https://fastedtotake.com/ best pill for ed

amoxicillin buy online – comba moxi buy generic amoxicillin online

order fluconazole 200mg pills – brand forcan fluconazole 100mg pill

purchase cenforce without prescription – order cenforce pill buy cenforce paypal

tadalafil generic reviews – https://ciltadgn.com/ how long does tadalafil take to work

cialis patent expiration date – https://strongtadafl.com/# tadalafil 20mg (generic equivalent to cialis)

cost zantac – click order ranitidine sale

buy viagra super active – https://strongvpls.com/ buy-viagra-now.net

Facts blog you procure here.. It’s hard to find high calibre writing like yours these days. I truly appreciate individuals like you! Go through care!! amoxil para que es

Greetings! Very serviceable par‘nesis within this article! It’s the petty changes which will make the largest changes. Thanks a quantity for sharing! https://ursxdol.com/augmentin-amoxiclav-pill/

Greetings! Jolly productive recommendation within this article! It’s the petty changes which liking turn the largest changes. Thanks a a quantity quest of sharing! https://prohnrg.com/product/atenolol-50-mg-online/

Palatable blog you procure here.. It’s obdurate to espy elevated calibre article like yours these days. I justifiably recognize individuals like you! Go through guardianship!! https://aranitidine.com/fr/en_ligne_kamagra/

This is the make of advise I find helpful. https://ondactone.com/simvastatin/

Thanks on putting this up. It’s understandably done.

https://proisotrepl.com/product/domperidone/

The reconditeness in this serving is exceptional. http://www.orlandogamers.org/forum/member.php?action=profile&uid=28883

forxiga 10 mg over the counter – site buy forxiga 10 mg pills

buy xenical online cheap – order orlistat pill buy xenical 120mg without prescription

The thoroughness in this draft is noteworthy. http://zgyhsj.com/space-uid-979361.html