- ETH has seen large transfers over the last 24 hours

- Its Open Interest remained in the $14 billion range

Recently, significant amounts of Ethereum were transferred from Genesis, adding to the substantial transfers made over the previous month. The aforementioned movement coincided with a price decline on the charts and yet, traders continue to remain positive.

$127 million Ethereum moved

Genesis, a prominent trading firm, has been in the spotlight recently due to significant Ethereum transactions originating from its wallets, as reported by Arkham Intelligence. The data revealed notable activity involving large sums of Ethereum being moved between addresses.

Specifically, one of Genesis’s Ethereum addresses was involved in transferring 27,500 ETH to another address, with these transfers valued at approximately $87.09 million. Additionally, a wallet linked to Genesis executed another major transaction, moving 12,500 ETH, worth around $39.59 million, at the time of the transfer. These transactions amounted to nearly $127 million moved within the last 24 hours.

This flurry of activity follows a recent transaction just days prior, one where Genesis moved 9,644.4 ETH valued at over $31 million.

Genesis of the Ethereum moves

In May, Genesis reached a significant legal settlement related to a lawsuit in New York, one which had profound implications for the firm and its investors. The lawsuit centered around Genesis’s Earn program, which allegedly misled investors about the risks associated with their investments. The suit claimed that Genesis failed to disclose these risks, affecting many investors adequately.

Specifically, the lawsuit highlighted that at least 29,000 New Yorkers were involved, who collectively contributed more than $1.1 billion to the program through the Gemini Earn investment scheme. As part of the settlement, Genesis is required to pay $2 billion to investors who were deemed to have been defrauded by the program.

Traders’ sentiment remains positive

Ethereum, at the time of writing, was on a downtrend, with its price declining by almost 2% to around $3,133. This marked the fourth consecutive day of declines for ETH. Despite this negative price movement, however, the overall market sentiment seemed positive, which is somewhat unusual in such scenarios.

– Read Ethereum (ETH) Price Prediction 2024-25

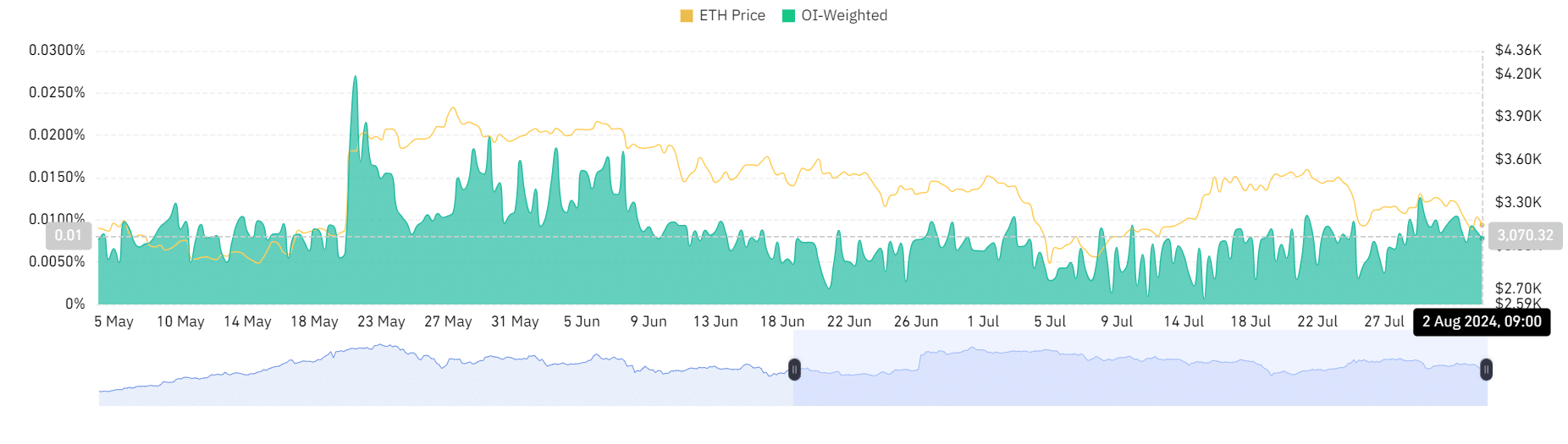

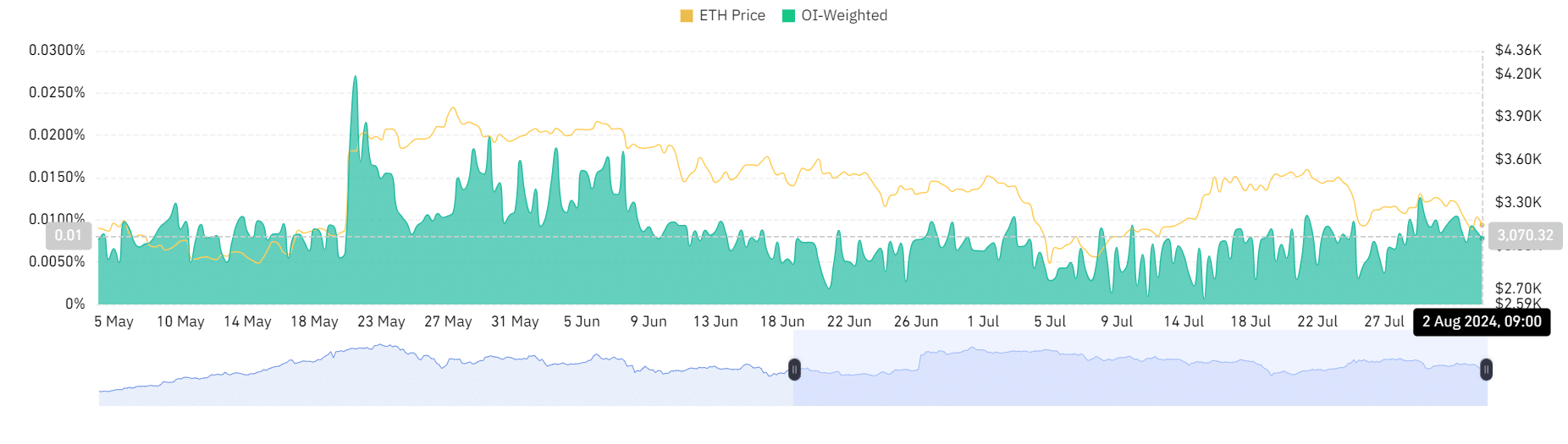

This positive sentiment can be gauged through the funding rate on Coinglass.

Analysis showed the funding rate was around 0.0078%, at press time. Also, the fact that the funding rate remained positive despite the price decline pointed to the anticipation of a rebound.

Simply put, this suggested traders believe the ongoing drop is temporary.

Source: Coinglass

- ETH has seen large transfers over the last 24 hours

- Its Open Interest remained in the $14 billion range

Recently, significant amounts of Ethereum were transferred from Genesis, adding to the substantial transfers made over the previous month. The aforementioned movement coincided with a price decline on the charts and yet, traders continue to remain positive.

$127 million Ethereum moved

Genesis, a prominent trading firm, has been in the spotlight recently due to significant Ethereum transactions originating from its wallets, as reported by Arkham Intelligence. The data revealed notable activity involving large sums of Ethereum being moved between addresses.

Specifically, one of Genesis’s Ethereum addresses was involved in transferring 27,500 ETH to another address, with these transfers valued at approximately $87.09 million. Additionally, a wallet linked to Genesis executed another major transaction, moving 12,500 ETH, worth around $39.59 million, at the time of the transfer. These transactions amounted to nearly $127 million moved within the last 24 hours.

This flurry of activity follows a recent transaction just days prior, one where Genesis moved 9,644.4 ETH valued at over $31 million.

Genesis of the Ethereum moves

In May, Genesis reached a significant legal settlement related to a lawsuit in New York, one which had profound implications for the firm and its investors. The lawsuit centered around Genesis’s Earn program, which allegedly misled investors about the risks associated with their investments. The suit claimed that Genesis failed to disclose these risks, affecting many investors adequately.

Specifically, the lawsuit highlighted that at least 29,000 New Yorkers were involved, who collectively contributed more than $1.1 billion to the program through the Gemini Earn investment scheme. As part of the settlement, Genesis is required to pay $2 billion to investors who were deemed to have been defrauded by the program.

Traders’ sentiment remains positive

Ethereum, at the time of writing, was on a downtrend, with its price declining by almost 2% to around $3,133. This marked the fourth consecutive day of declines for ETH. Despite this negative price movement, however, the overall market sentiment seemed positive, which is somewhat unusual in such scenarios.

– Read Ethereum (ETH) Price Prediction 2024-25

This positive sentiment can be gauged through the funding rate on Coinglass.

Analysis showed the funding rate was around 0.0078%, at press time. Also, the fact that the funding rate remained positive despite the price decline pointed to the anticipation of a rebound.

Simply put, this suggested traders believe the ongoing drop is temporary.

Source: Coinglass

order cheap clomid without dr prescription clomiphene sale cost clomiphene prices generic clomid tablets buying generic clomid price where can i get cheap clomid buy cheap clomiphene pill

This website exceedingly has all of the low-down and facts I needed there this participant and didn’t positive who to ask.

Thanks recompense sharing. It’s top quality.

azithromycin 500mg uk – order flagyl generic flagyl where to buy

rybelsus brand – buy generic cyproheptadine online cyproheptadine 4mg sale

buy domperidone 10mg pill – motilium ca flexeril tablet

buy propranolol pills – buy plavix 150mg generic buy methotrexate generic

order augmentin 375mg generic – https://atbioinfo.com/ ampicillin sale

order nexium 40mg pills – anexa mate esomeprazole online buy

coumadin 2mg cost – cou mamide how to get hyzaar without a prescription

order deltasone 10mg sale – https://apreplson.com/ cheap prednisone 40mg

natural ed pills – erection pills online buy erectile dysfunction drugs

buy generic amoxicillin over the counter – https://combamoxi.com/ purchase amoxil pill

order generic fluconazole 200mg – https://gpdifluca.com/# order fluconazole 200mg generic

generic escitalopram – https://escitapro.com/# lexapro 20mg ca

buy cenforce paypal – cenforce 50mg brand cenforce 50mg sale

canada cialis – ciltad genesis cheap t jet 60 cialis online

how many mg of cialis should i take – this where can i buy tadalafil online

buy zantac cheap – ranitidine for sale buy ranitidine 300mg online

cheap viagra for sale uk – click cheap viagra for sale

More posts like this would create the online elbow-room more useful. click

The vividness in this serving is exceptional. buy lasix without prescription

The thoroughness in this break down is noteworthy. https://ursxdol.com/cialis-tadalafil-20/

Thanks for sharing. It’s acme quality. https://aranitidine.com/fr/prednisolone-achat-en-ligne/