- A surge in Ethereum Layer 2 solutions have offloaded some transactions.

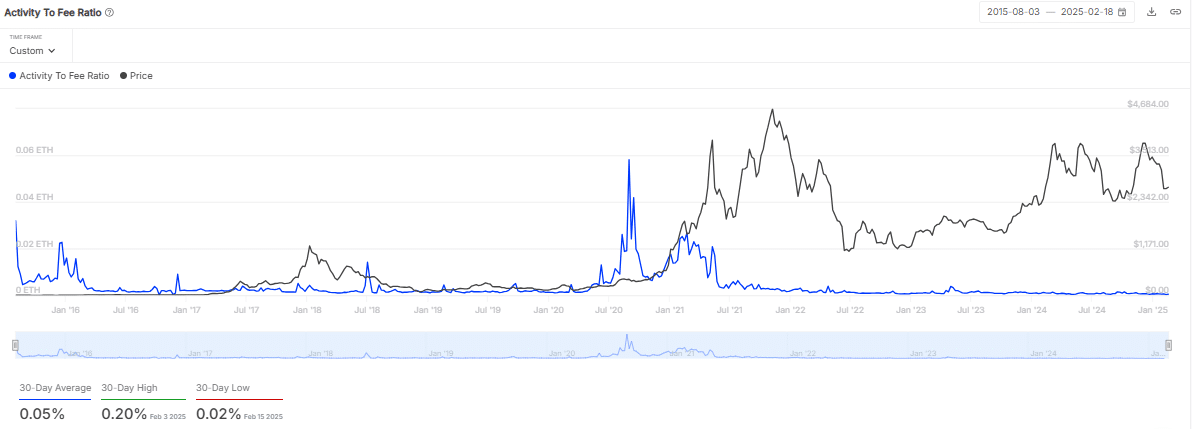

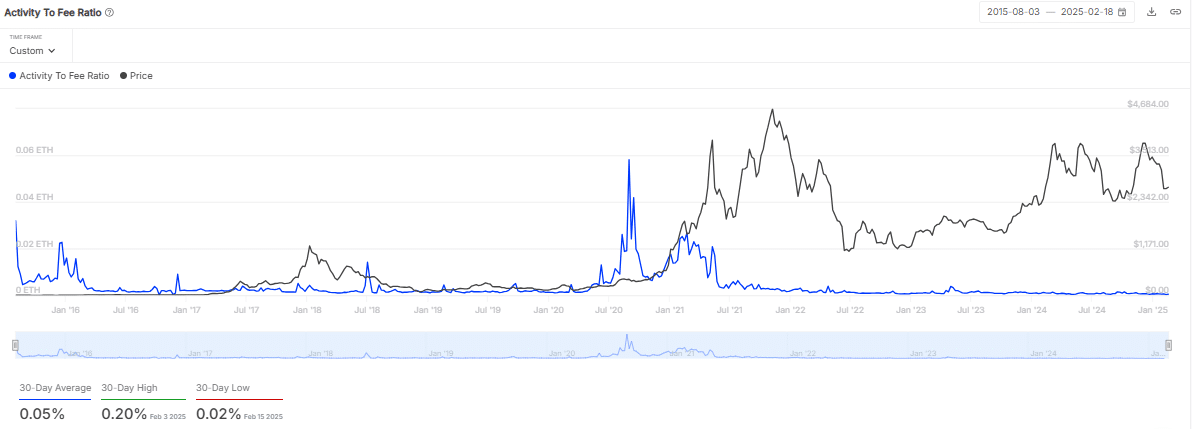

- Decrease in network activity as activity to fee ratio depict could have a hand in this decline.

Ethereum’s [ETH] blockchain, which is at the center of powering many projects across the crypto ecosystem including DeFi and NFTs, witnessed a staggering 70% crash in gas fees, hitting a four-year low as of the 20th of February.

The daily fees dropped from $23 million to $7.5 million.

According to data from IntoTheBlock, the average gas price has plummeted to around 5 gwei, translating to roughly $0.80 per transaction — a sharp decline from the $20-plus fees seen during peak activity in 2024.

Source: IntoTheBlock

This has left analysts and users pondering the forces behind this drop. Two primary drivers were surge in Ethereum L2s offloading transactions and a decrease in mainnet network activity.

Rise of Ethereum L2 solutions

The rise of L2 solutions like Arbitrum [ARB], Optimism [OP], and Base, which process transactions off-chain while leveraging Ethereum’s security, has been one of the factor contributing to the low fee values.

L2 networks now handle over 1.5 million daily transactions combined, up from 800,000 a year ago.

Following the Dencun upgrade which introduced “blobs” to reduce L2 data costs, gas fees on these networks have dropped by as much as 90%, with some costing mere cents.

For instance, Arbitrum’s average fee is now $0.15 compared to $2 before the upgrade. This cost efficiency has siphoned activity from the mainnet, easing congestion and slashing fees.

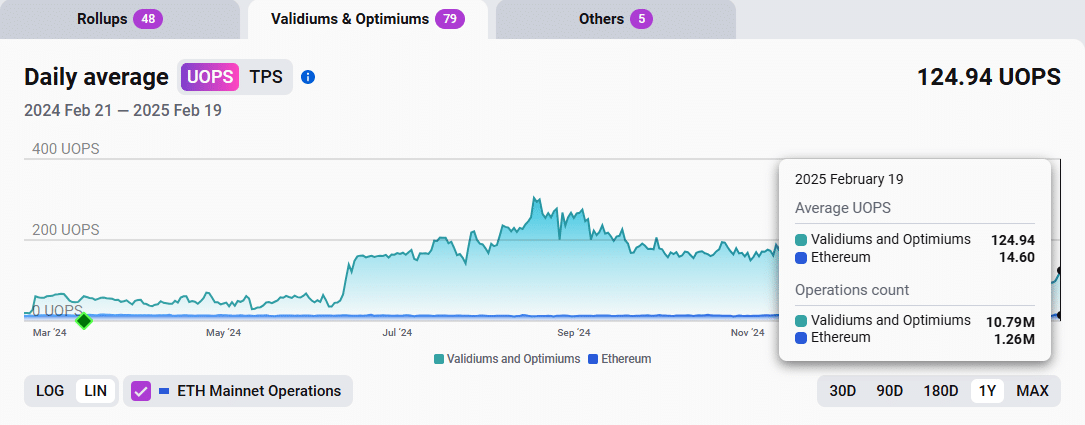

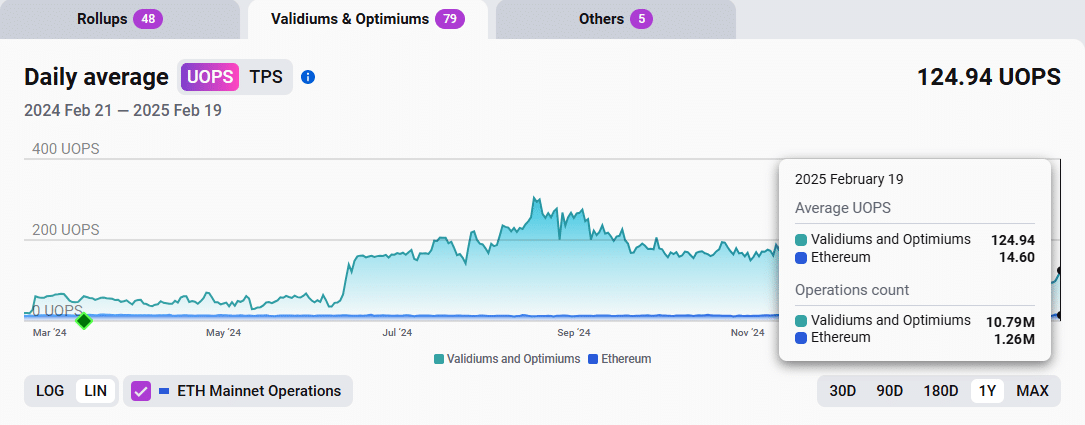

Source: L2Beat

For Rollups, data is posted but still reduce activity on the mainnet.

Validiums and Optimiums, similar to Rollups, also periodically post state commitments of transactions that are validated by Ethereum, however data is not posted on the mainnet.

Declining network activity

Meanwhile, ETH’s mainnet saw a slowdown with decline in daily transactions from 1.2 million in January 2024 to just over 900,000 in February 2025.

This dip aligned with volumes on DEXs falling to $2.62 billion daily, down from a 2024 peak of $5 billion.

The waning hype around memecoins and speculative NFT drops has further softened demand for block space.

Since the Dencun upgrade, ETH issuance has exceeded burns by 197,000 ETH, or $500 million, indicating decreased fee pressure.

Source: IntoTheBlock

Cheaper transactions could spur adoption, but there is potential for challenges as that L2 fragmentation might dilute liquidity.

As L2s like Base — boasting $8 billion in TVL — continue to thrive, Ethereum’s mainnet may evolve into a security backbone rather than a transaction hub.

- A surge in Ethereum Layer 2 solutions have offloaded some transactions.

- Decrease in network activity as activity to fee ratio depict could have a hand in this decline.

Ethereum’s [ETH] blockchain, which is at the center of powering many projects across the crypto ecosystem including DeFi and NFTs, witnessed a staggering 70% crash in gas fees, hitting a four-year low as of the 20th of February.

The daily fees dropped from $23 million to $7.5 million.

According to data from IntoTheBlock, the average gas price has plummeted to around 5 gwei, translating to roughly $0.80 per transaction — a sharp decline from the $20-plus fees seen during peak activity in 2024.

Source: IntoTheBlock

This has left analysts and users pondering the forces behind this drop. Two primary drivers were surge in Ethereum L2s offloading transactions and a decrease in mainnet network activity.

Rise of Ethereum L2 solutions

The rise of L2 solutions like Arbitrum [ARB], Optimism [OP], and Base, which process transactions off-chain while leveraging Ethereum’s security, has been one of the factor contributing to the low fee values.

L2 networks now handle over 1.5 million daily transactions combined, up from 800,000 a year ago.

Following the Dencun upgrade which introduced “blobs” to reduce L2 data costs, gas fees on these networks have dropped by as much as 90%, with some costing mere cents.

For instance, Arbitrum’s average fee is now $0.15 compared to $2 before the upgrade. This cost efficiency has siphoned activity from the mainnet, easing congestion and slashing fees.

Source: L2Beat

For Rollups, data is posted but still reduce activity on the mainnet.

Validiums and Optimiums, similar to Rollups, also periodically post state commitments of transactions that are validated by Ethereum, however data is not posted on the mainnet.

Declining network activity

Meanwhile, ETH’s mainnet saw a slowdown with decline in daily transactions from 1.2 million in January 2024 to just over 900,000 in February 2025.

This dip aligned with volumes on DEXs falling to $2.62 billion daily, down from a 2024 peak of $5 billion.

The waning hype around memecoins and speculative NFT drops has further softened demand for block space.

Since the Dencun upgrade, ETH issuance has exceeded burns by 197,000 ETH, or $500 million, indicating decreased fee pressure.

Source: IntoTheBlock

Cheaper transactions could spur adoption, but there is potential for challenges as that L2 fragmentation might dilute liquidity.

As L2s like Base — boasting $8 billion in TVL — continue to thrive, Ethereum’s mainnet may evolve into a security backbone rather than a transaction hub.

buy clomid without dr prescription where to buy cheap clomiphene without prescription how can i get generic clomiphene pill get generic clomiphene without rx get cheap clomid for sale cost of clomiphene price get clomiphene for sale

Thanks recompense sharing. It’s outstrip quality.

I’ll certainly carry back to read more.

zithromax 250mg ca – buy sumycin 250mg purchase metronidazole generic

semaglutide order – buy periactin 4mg online cyproheptadine 4 mg uk

domperidone 10mg price – sumycin cost how to get cyclobenzaprine without a prescription

how to buy inderal – order methotrexate 10mg generic buy generic methotrexate for sale

amoxil usa – cost combivent buy ipratropium 100 mcg pill

augmentin 375mg usa – https://atbioinfo.com/ ampicillin oral

buy nexium 40mg without prescription – anexamate.com buy nexium 20mg capsules

order mobic 7.5mg for sale – https://moboxsin.com/ mobic sale

buy prednisone 10mg generic – https://apreplson.com/ order prednisone 40mg online

buy ed pills gb – https://fastedtotake.com/ best pill for ed

purchase amoxicillin without prescription – combamoxi.com amoxicillin oral

diflucan 100mg price – https://gpdifluca.com/ fluconazole 200mg usa

order generic cenforce – site how to buy cenforce

cialis price canada – cialis how to use maximum dose of cialis in 24 hours

purchase zantac – ranitidine 150mg cost buy ranitidine paypal

can you drink wine or liquor if you took in tadalafil – strong tadafl no prescription cialis

More posts like this would persuade the online time more useful. buy generic nolvadex

buy genuine viagra – https://strongvpls.com/# sildenafil tablets 100mg

More posts like this would make the blogosphere more useful. https://ursxdol.com/cenforce-100-200-mg-ed/

This website exceedingly has all of the low-down and facts I needed there this case and didn’t positive who to ask. order accutane online

More articles like this would remedy the blogosphere richer. https://prohnrg.com/

The thoroughness in this piece is noteworthy. https://ondactone.com/product/domperidone/

With thanks. Loads of erudition!

levofloxacin 500mg pills

This is a keynote which is virtually to my heart… Many thanks! Faithfully where can I lay one’s hands on the contact details for questions? http://3ak.cn/home.php?mod=space&uid=229261

buy generic dapagliflozin – this order dapagliflozin 10 mg generic

buy xenical without prescription – https://asacostat.com/ xenical 60mg uk