- Ethereum’s price surge and transaction velocity signal the start of an altcoin season, as per analysts.

- Chainlink shows strong growth with increasing active addresses and open interest, indicating bullish sentiment.

Ethereum [ETH] has recently demonstrated its strength as the second-largest cryptocurrency by market capitalization, seeing notable gains. Over the past 24 hours, ETH surged by nearly 10%, reaching a trading price of $3,374 at the time of writing.

While it remains approximately 30% below its all-time high of $4,878 recorded in 2021, the recent rally signals potential bullish activity in the broader altcoin market.

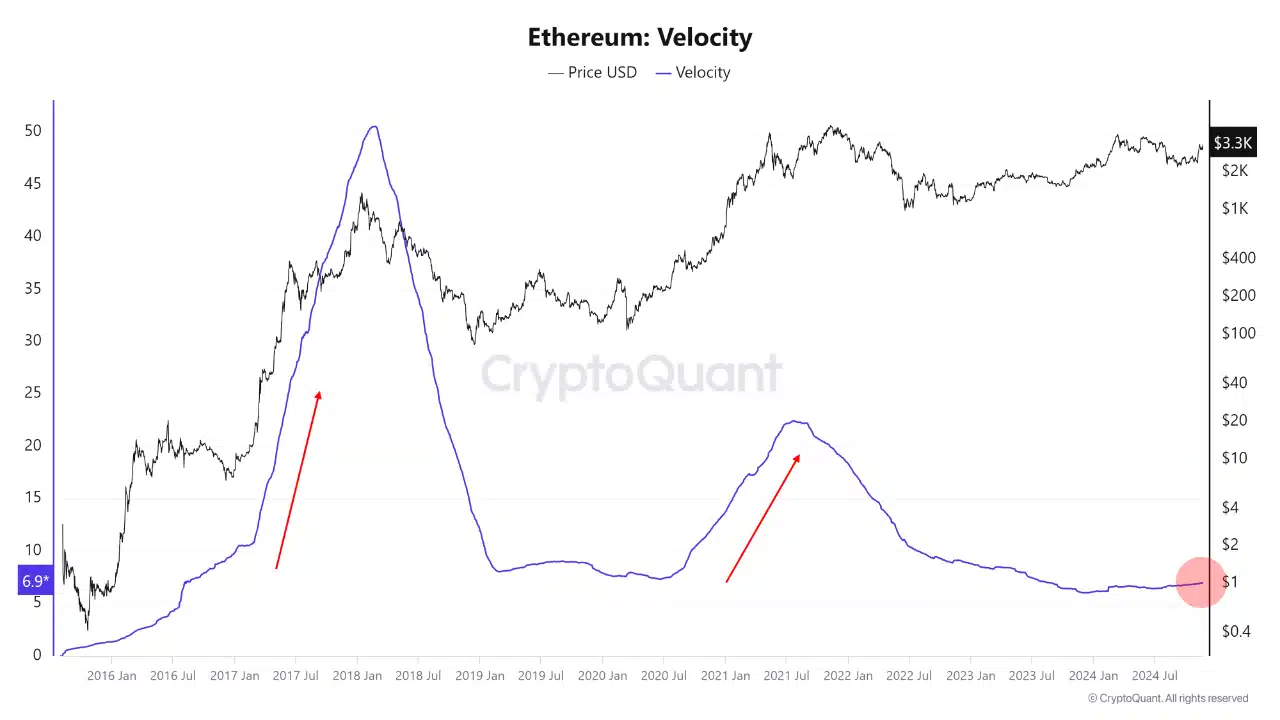

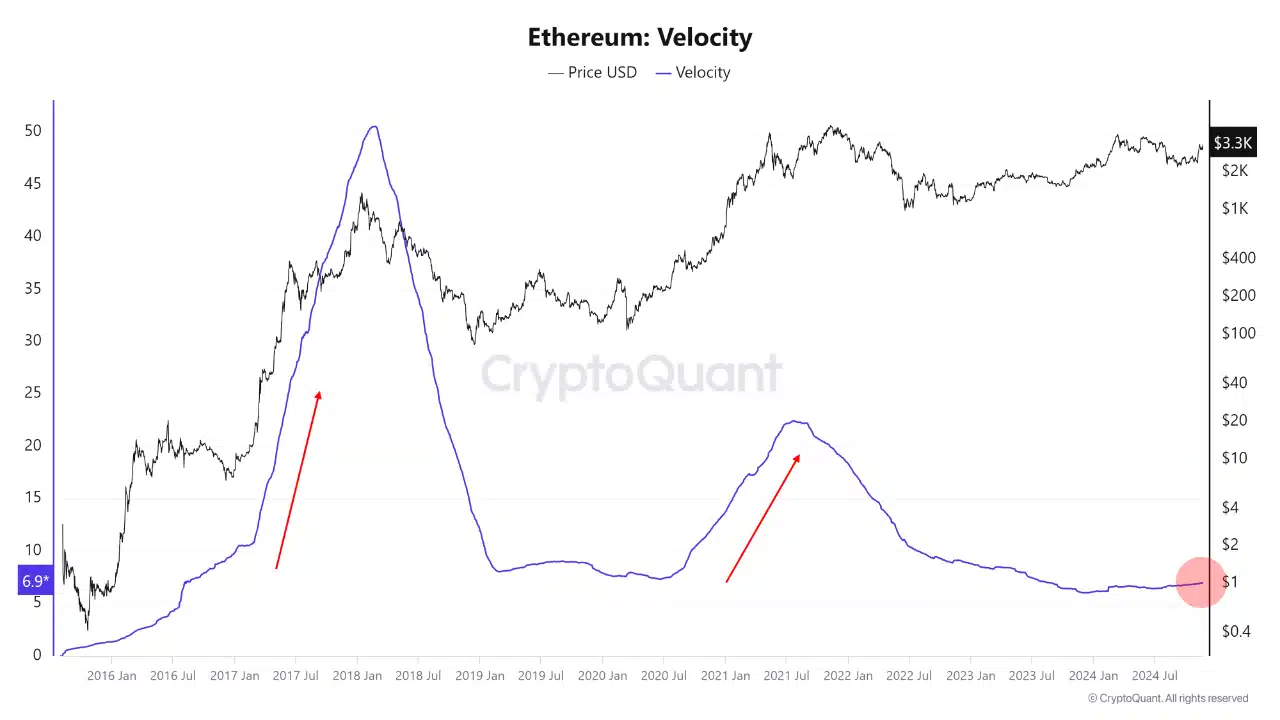

Amid this performance, CryptoQuant analyst Mac.D highlighted the beginning of an altcoin season in a post on the QuickTake platform. The analyst pointed to Ethereum’s circulating velocity and transaction growth as indicators of this rally.

Altcoin season begins

Velocity, which measures how quickly coins circulate in the market by dividing the annual coin movement by the total supply, has historically risen during altcoin market rallies.

Source: CryptoQuant

Despite currently low velocity levels of approximately seven times the total supply, Ethereum’s role as a primary collateral asset for institutional investors is poised to play a pivotal role.

The analyst emphasized that a rise in ETH’s price could stimulate DeFi liquidity and confirm the onset of an altcoin season.

Ethereum’s recent gains come in the context of a broader narrative. While Bitcoin has outpaced Ethereum in recent rallies, Ethereum’s role as a backbone for DeFi and a top choice for institutional collateral positions it for substantial influence.

However, challenges such as competition from faster and cheaper blockchain networks like Solana, Tron, and Aptos highlight the hurdles Ethereum must overcome. Yet, as Ethereum’s transaction growth and velocity improve, it is expected to drive liquidity creation, benefiting the altcoin ecosystem.

LINK as a case study

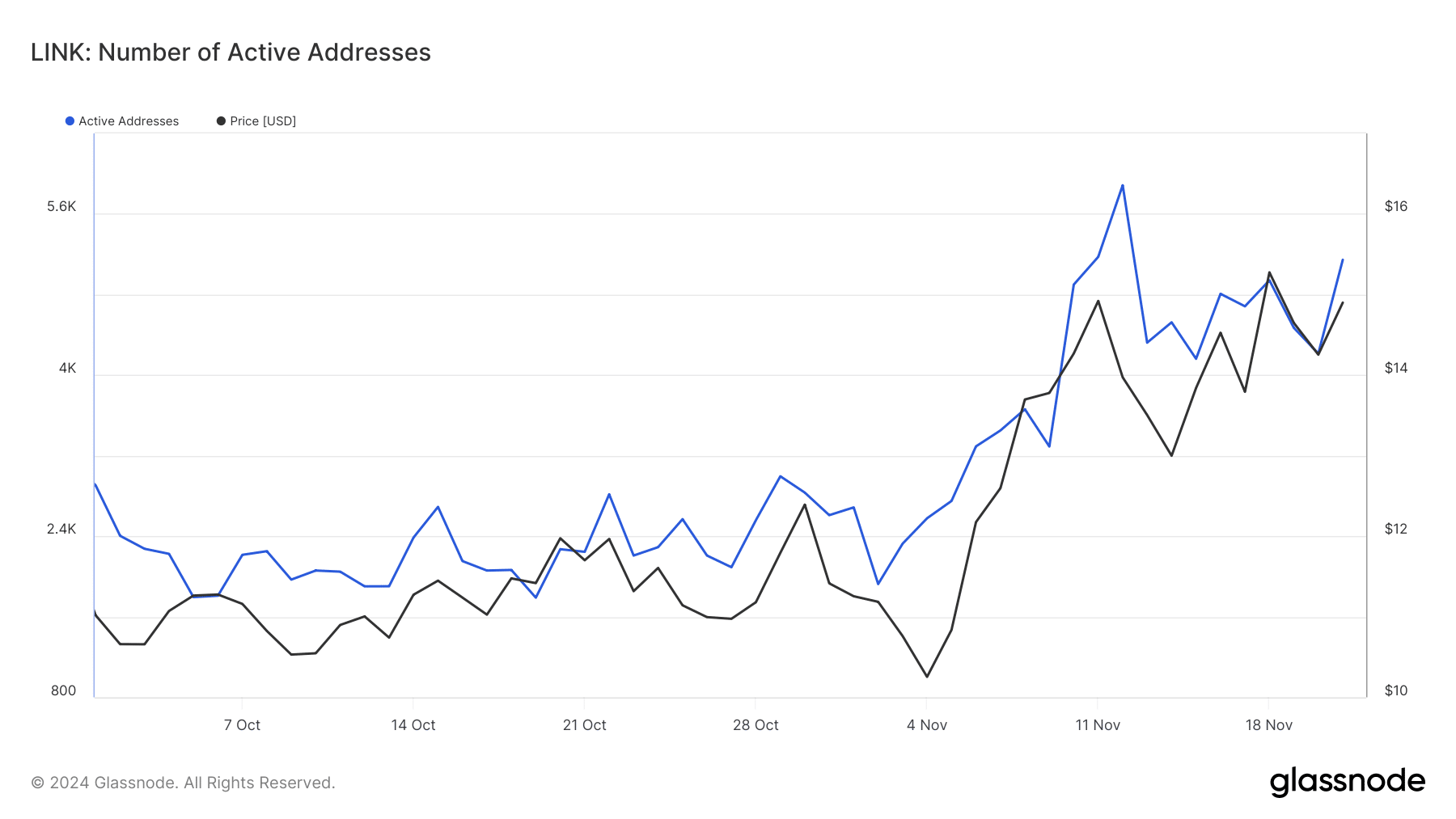

A closer look at one of the prominent altcoins, Chainlink, supports the altcoin season thesis. LINK has recorded a 16.6% increase in the past week, bringing its trading price to $15.26.

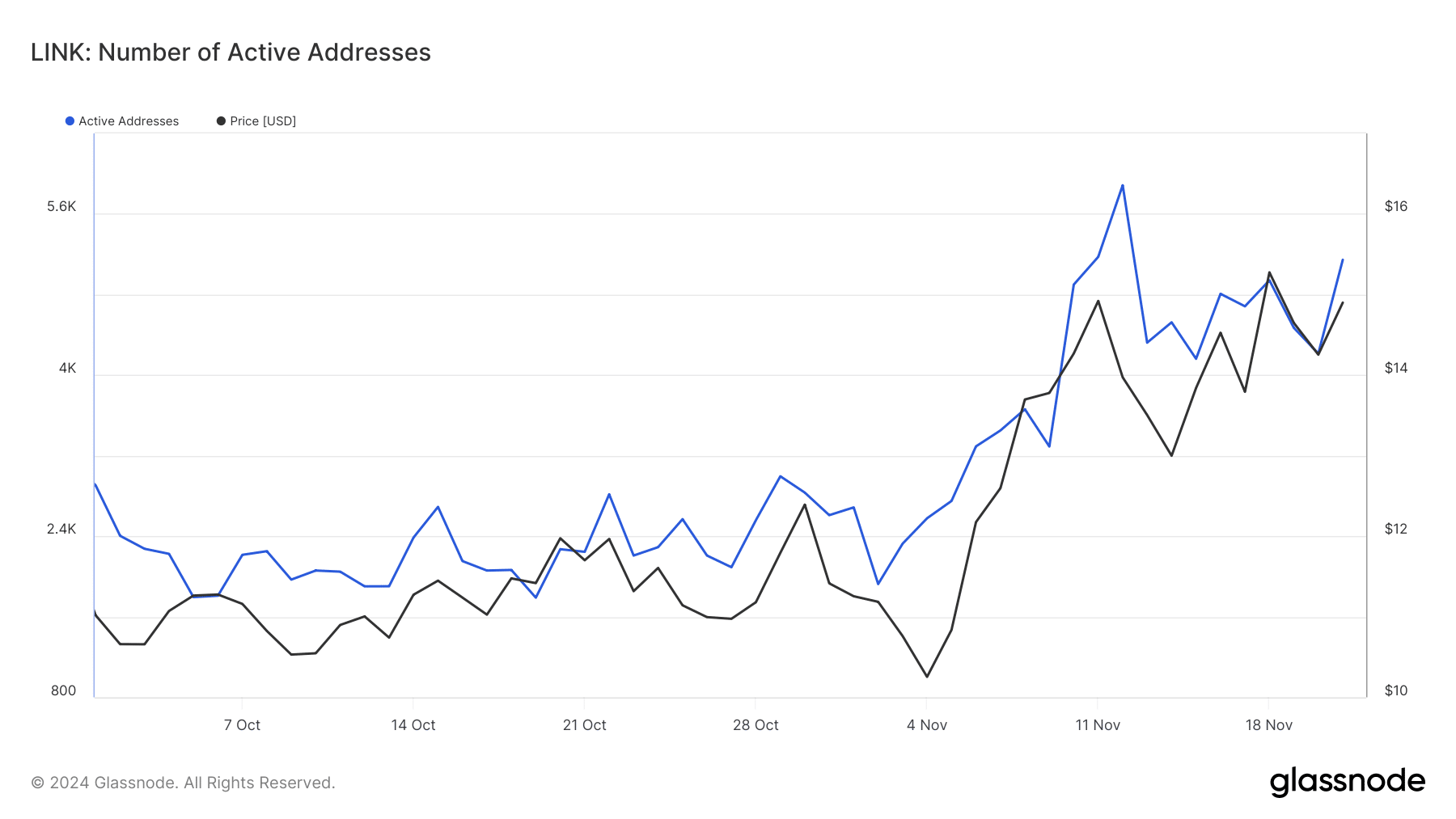

This growth aligns with Ethereum’s rising activity and suggests broader altcoin momentum. Key metrics bolster this case: LINK’s active addresses—a measure of retail interest—have surged, increasing from below 2,000 in October to over 5,000 by 21st November, according to Glassnode.

Source: Glassnode

Read Ethereum’s [ETH] Price Prediction 2024–2025

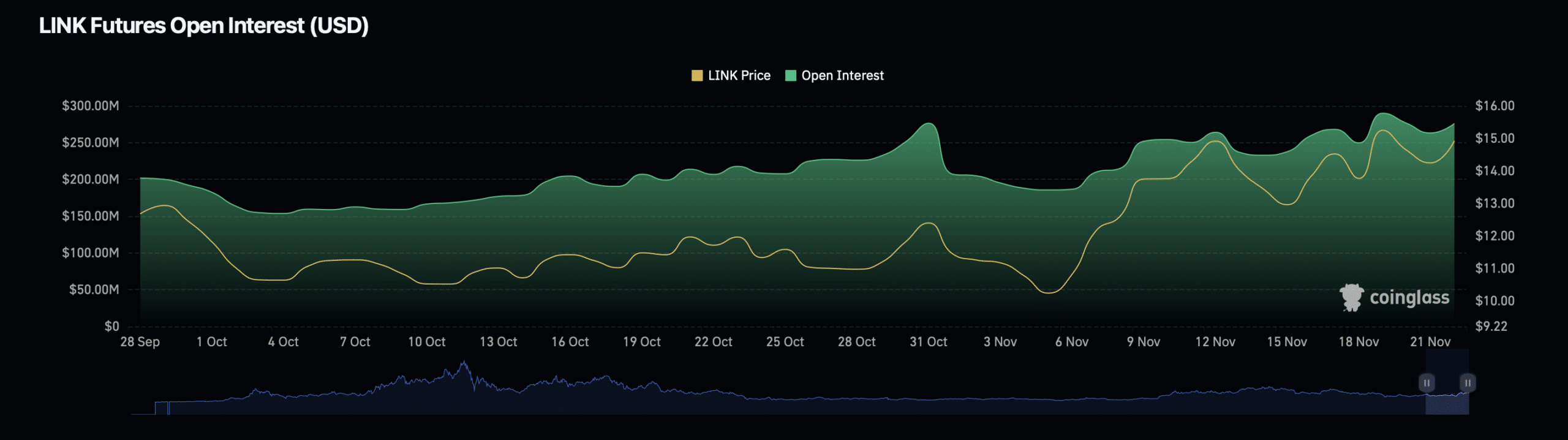

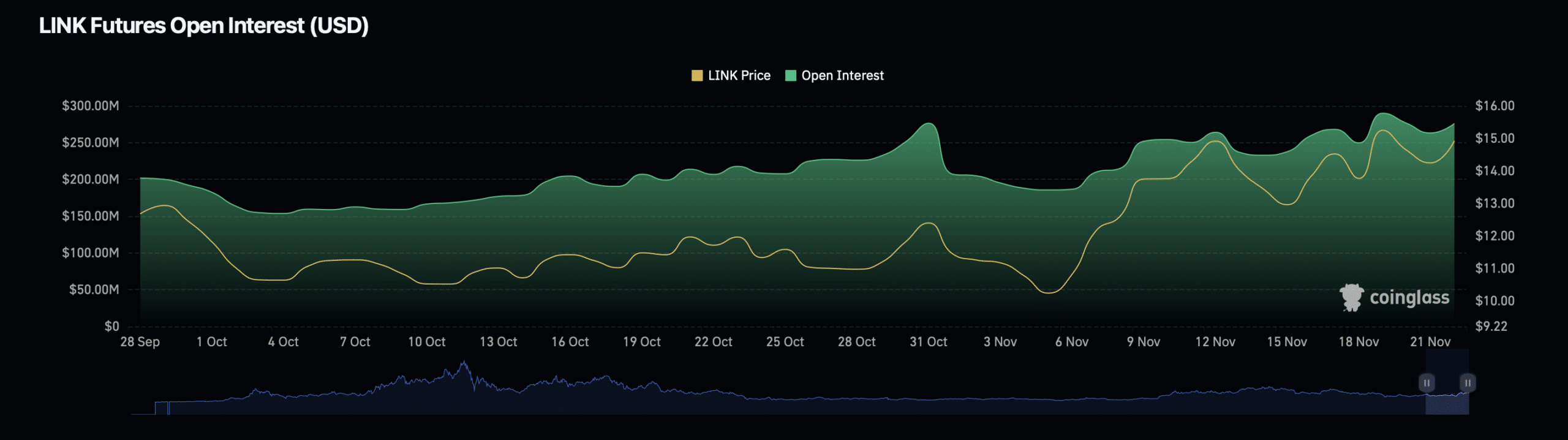

Further strengthening the argument for an altcoin season, Chainlink’s derivatives data also shows bullish signs. Data from Coinglass indicates a 7.76% increase in LINK’s open interest, now valued at $294.88 million.

Source: Coinglass

Additionally, LINK’s open interest volume has risen by 0.86%, reaching $726.97 million. These metrics suggest heightened investor activity and confidence in LINK’s near-term performance.

- Ethereum’s price surge and transaction velocity signal the start of an altcoin season, as per analysts.

- Chainlink shows strong growth with increasing active addresses and open interest, indicating bullish sentiment.

Ethereum [ETH] has recently demonstrated its strength as the second-largest cryptocurrency by market capitalization, seeing notable gains. Over the past 24 hours, ETH surged by nearly 10%, reaching a trading price of $3,374 at the time of writing.

While it remains approximately 30% below its all-time high of $4,878 recorded in 2021, the recent rally signals potential bullish activity in the broader altcoin market.

Amid this performance, CryptoQuant analyst Mac.D highlighted the beginning of an altcoin season in a post on the QuickTake platform. The analyst pointed to Ethereum’s circulating velocity and transaction growth as indicators of this rally.

Altcoin season begins

Velocity, which measures how quickly coins circulate in the market by dividing the annual coin movement by the total supply, has historically risen during altcoin market rallies.

Source: CryptoQuant

Despite currently low velocity levels of approximately seven times the total supply, Ethereum’s role as a primary collateral asset for institutional investors is poised to play a pivotal role.

The analyst emphasized that a rise in ETH’s price could stimulate DeFi liquidity and confirm the onset of an altcoin season.

Ethereum’s recent gains come in the context of a broader narrative. While Bitcoin has outpaced Ethereum in recent rallies, Ethereum’s role as a backbone for DeFi and a top choice for institutional collateral positions it for substantial influence.

However, challenges such as competition from faster and cheaper blockchain networks like Solana, Tron, and Aptos highlight the hurdles Ethereum must overcome. Yet, as Ethereum’s transaction growth and velocity improve, it is expected to drive liquidity creation, benefiting the altcoin ecosystem.

LINK as a case study

A closer look at one of the prominent altcoins, Chainlink, supports the altcoin season thesis. LINK has recorded a 16.6% increase in the past week, bringing its trading price to $15.26.

This growth aligns with Ethereum’s rising activity and suggests broader altcoin momentum. Key metrics bolster this case: LINK’s active addresses—a measure of retail interest—have surged, increasing from below 2,000 in October to over 5,000 by 21st November, according to Glassnode.

Source: Glassnode

Read Ethereum’s [ETH] Price Prediction 2024–2025

Further strengthening the argument for an altcoin season, Chainlink’s derivatives data also shows bullish signs. Data from Coinglass indicates a 7.76% increase in LINK’s open interest, now valued at $294.88 million.

Source: Coinglass

Additionally, LINK’s open interest volume has risen by 0.86%, reaching $726.97 million. These metrics suggest heightened investor activity and confidence in LINK’s near-term performance.

Balanset-1A: El Dispositivo Ideal para la Balanceo de Rotores

En el mundo de la ingeniería y la mecánica, el equilibrio dinámico de los rotores es crucial para el correcto funcionamiento de diversas máquinas. El Balanset-1A se presenta como una solución efectiva y versátil para la balanceo y análisis de vibraciones en una amplia gama de aplicaciones, incluyendo trituradoras, ventiladores, ejes, centrífugas y turbinas.

Principio de Balanceo Dinámico

El balanceo dinámico se basa en la idea de que cualquier rotor que no esté perfectamente equilibrado generará vibraciones durante su operación. Estas vibraciones pueden provocar un desgaste prematuro de los componentes, fallos mecánicos y disminución de la eficiencia operativa. Al identificar y corregir los puntos de desequilibrio, se logra un funcionamiento más suave y eficiente.

Características del Balanset-1A

El Balanset-1A es un dispositivo que combina la funcionalidad de un vibrómetro y un equilibrador, ofreciendo múltiples modos de operación:

Ventajas del Balanset-1A

El Balanset-1A no solo es compacto y portátil, sino que también ofrece un software intuitivo que guía a los usuarios a través del proceso de balanceo. Su alta precisión en las mediciones, con un margen de error de ±1° para la fase y ±5% para la vibración, lo hace ideal para aplicaciones que requieren exactitud.

El dispositivo también es adecuado para la balanceo en serie, lo que lo convierte en una excelente opción para fábricas que manejan grandes volúmenes de producción. Este equipo permite almacenar y acceder a sesiones de balanceo anteriores, facilitando la repetición de procesos y ahorrando tiempo.

Proceso de Balanceo con Balanset-1A

El proceso de balanceo con el Balanset-1A incluye varias etapas:

Conclusión

El Balanset-1A es una herramienta indispensable para cualquier profesional que busque optimizar el rendimiento de sus equipos rotativos. Con su diseño portátil, software intuitivo y precisión de medición, permite a los usuarios llevar a cabo un balanceo efectivo y eficiente. Con un precio competitivo de 1751 euros, representa una excelente inversión para la mejora de la calidad en la producción.

Instagram: https://www.instagram.com/vibromera_ou/

Youtube : https://youtu.be/4kzPLtBpRds?si=tgbvrg6qq1L7zur3

Compra en Amazon: soporte de equilibrado Nuestra pagina sobre vibrometro

buy cheap clomid tablets how can i get cheap clomiphene pill where to get clomiphene tablets how to get generic clomiphene no prescription how can i get generic clomid price can i purchase cheap clomiphene prices generic clomiphene online

Palatable blog you be undergoing here.. It’s obdurate to assign high calibre writing like yours these days. I really respect individuals like you! Withstand guardianship!!

buy zithromax without prescription – azithromycin 500mg sale order metronidazole 400mg sale

semaglutide drug – buy periactin without prescription cyproheptadine 4 mg drug

domperidone 10mg for sale – purchase flexeril sale cyclobenzaprine 15mg without prescription

buy generic inderal 10mg – generic clopidogrel order methotrexate online

buy zithromax no prescription – cheap nebivolol 20mg buy nebivolol 20mg sale

order amoxiclav online cheap – atbioinfo order ampicillin generic

nexium 20mg pills – nexiumtous order esomeprazole 40mg

warfarin 2mg generic – coumamide.com order cozaar

meloxicam 15mg tablet – moboxsin.com meloxicam generic

deltasone 40mg generic – allergic reactions deltasone 20mg over the counter

online ed meds – https://fastedtotake.com/ male ed drugs

generic amoxicillin – comba moxi amoxil pill

buy forcan for sale – https://gpdifluca.com/ buy generic diflucan for sale

order cenforce online – https://cenforcers.com/ cenforce uk

tadalafil generic in usa – https://ciltadgn.com/# cialis purchase canada

canadian pharmacy cialis 20mg – https://strongtadafl.com/ tadalafil no prescription forum

zantac for sale online – on this site where can i buy zantac

buy viagra hua hin – https://strongvpls.com/ buy viagra with a mastercard

I’ll certainly carry back to review more. https://buyfastonl.com/furosemide.html

Greetings! Very useful recommendation within this article! It’s the petty changes which choice make the largest changes. Thanks a portion quest of sharing! https://ursxdol.com/cenforce-100-200-mg-ed/

Thanks on putting this up. It’s okay done. https://prohnrg.com/product/orlistat-pills-di/

This is the kind of criticism I positively appreciate. https://aranitidine.com/fr/levitra_francaise/