- Ethereum’s funding rates underlined growing optimism, but sentiment remains cautious

- Declining active addresses and rising leverage ratios highlighted mixed trends in Ethereum’s retail and Futures markets

Ethereum has seen significant price volatility recently, leading to mixed reactions among investors. After a rally above $2,700 on 30 October, Ethereum renewed investor optimism. However, this sentiment has been challenged lately by its latest downward movement.

Over the last 24 hours, Ethereum’s price dropped by 5.1%, hitting a low of $2,475 before stabilizing around $2,496, at the time of writing. This price dip sparked discussions about Ethereum’s market strength, with particular attention on investor sentiment in Ethereum Futures.

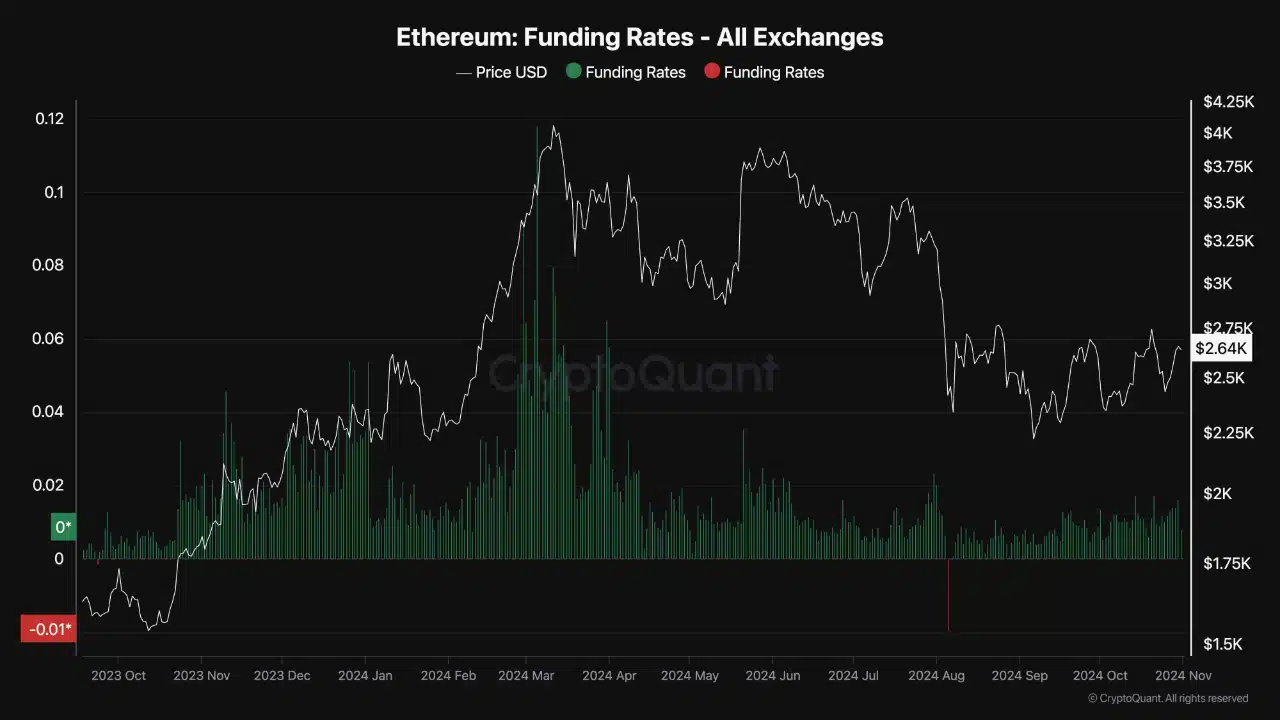

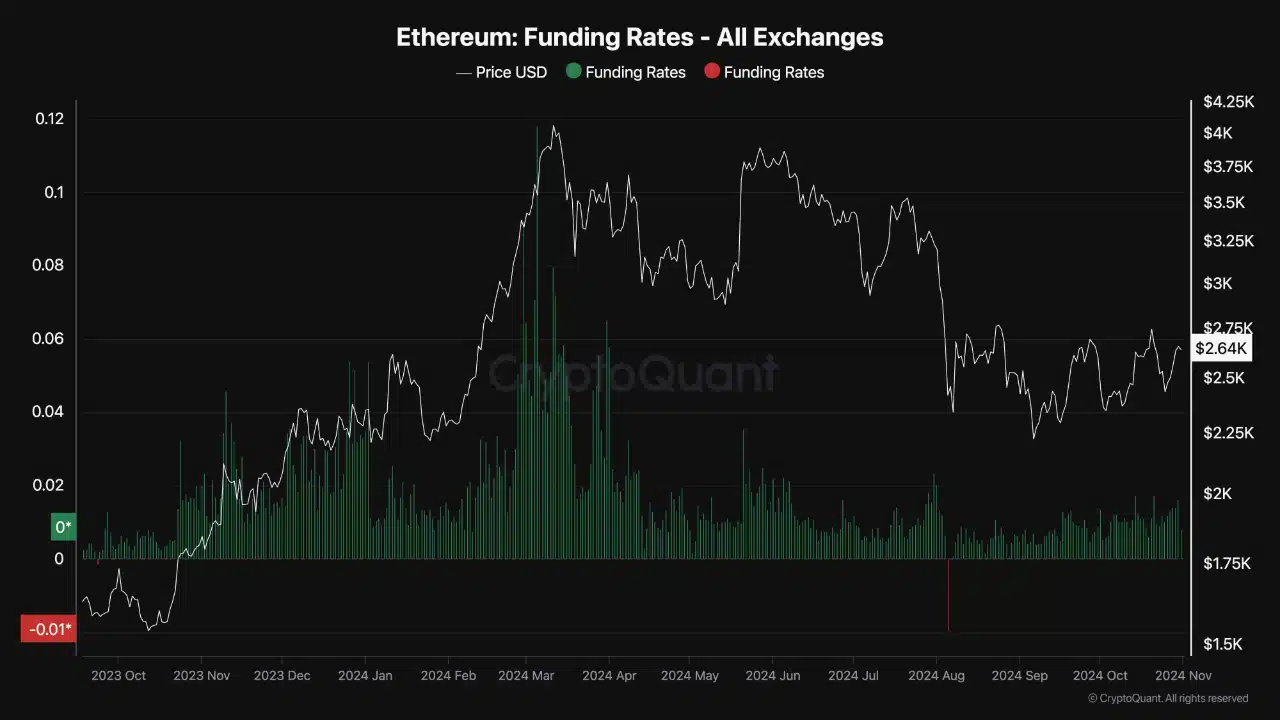

Despite the recent price setback, however, a CryptoQuant analyst highlighted that Ethereum’s Futures market funding rates revealed a positive outlook among traders. The funding rate, which reflects the balance between buyers’ and sellers’ optimism, registered an uptrend recently.

Funding rates and investor sentiment in Ethereum Futures

Positive funding rates are a sign that there is higher demand to go long on Ethereum Futures, indicating optimism among Futures traders. However, these rates remain below the bullish peak seen in March, during which Ethereum’s price was on a strong uptrend. This implied that while optimism exists, it is yet to reach levels sufficient to drive a major breakout.

Funding rates in Ethereum Futures lend insight into market sentiment by showing the level of bullish or bearish pressure among traders. Positive funding rates indicate a greater willingness among traders to hold long positions – A sign of bullish sentiment. Negative rates imply otherwise.

Source: CryptoQuant

The current uptrend in Ethereum’s funding rate alluded to a growing inclination to go long in the Futures market. Especially as investors anticipate potential price gains. However, the lower funding rates compared to the levels earlier this year suggested that while sentiment has been improving, it may not yet be strong enough to drive a major price rally.

The potential for ETH to overcome resistance and maintain upward momentum hinges partly on a sustained rise in funding rates. Higher rates would reflect greater demand for long positions, potentially adding buying pressure on ETH.

For a sustained rally, a hike in these funding rates would signal stronger investor confidence. This could help Ethereum overcome existing resistance levels, potentially pushing its price higher.

This sentiment, combined with market trends, could shape Ethereum’s trajectory in the coming weeks.

Active addresses and leverage ratios indicate market trends

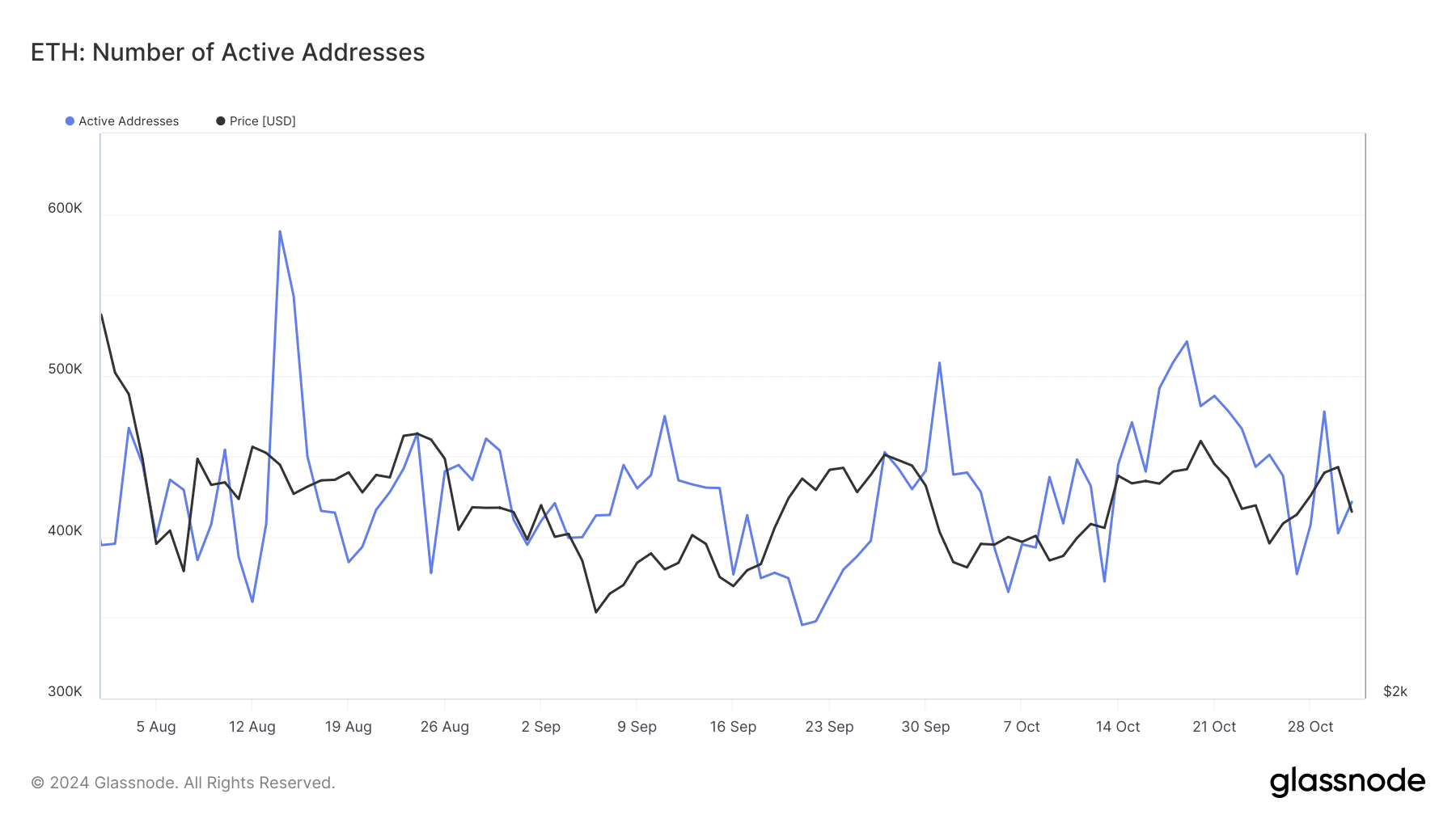

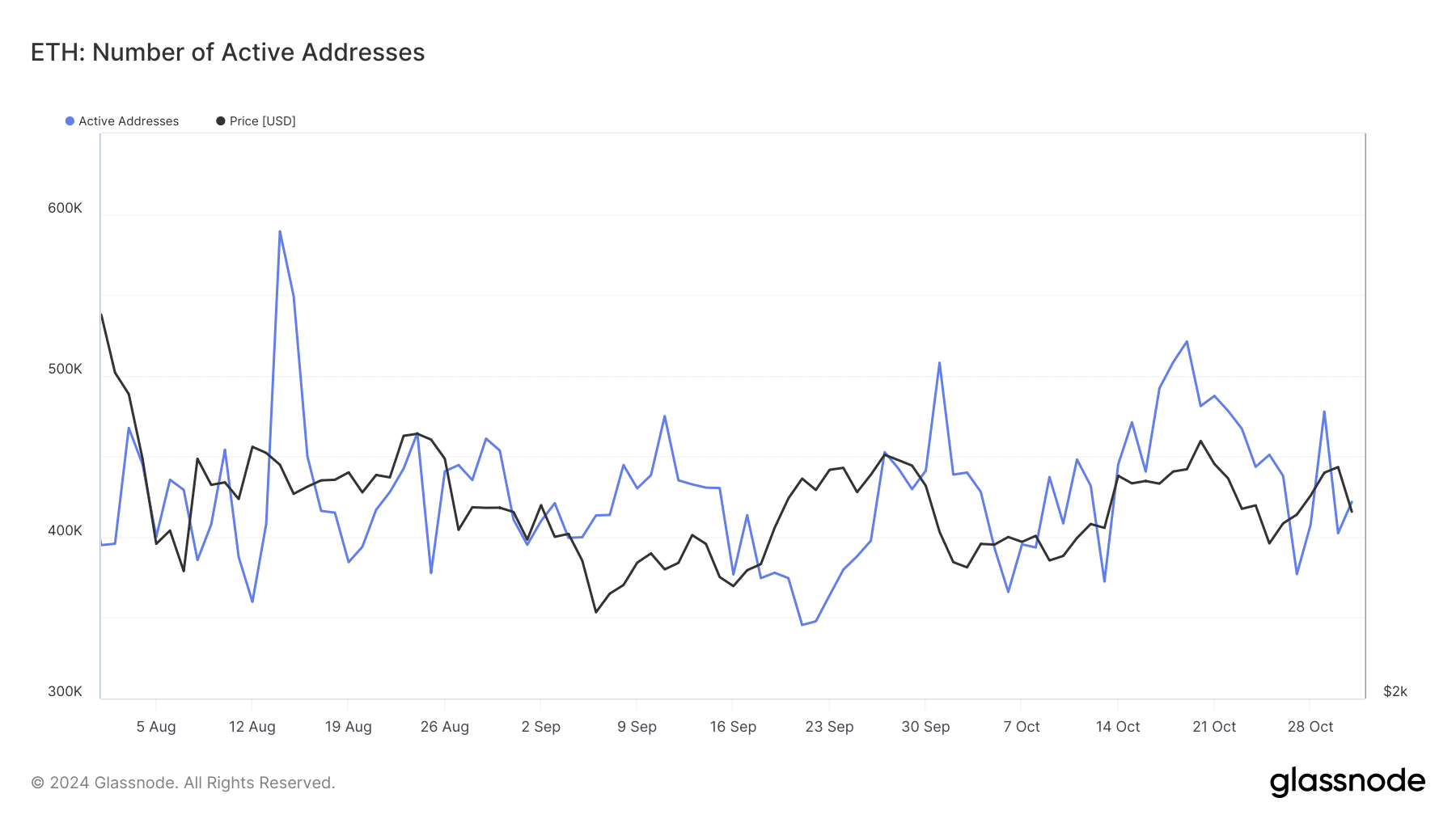

Beyond the Futures market, Ethereum’s active addresses – A measure of retail interest – projected a declining trend. Glassnode data indicated that active addresses decreased from over 550,000 on 14 August to approximately 421,000 at press time.

Source: Glassnode

Such a fall in active addresses may be a sign of waning interest among retail investors, potentially reflecting caution in the broader market. Active addresses are a metric of participation and engagement. And, a decline may suggest that fewer investors are actively trading or transferring ETH, which could dampen buying momentum.

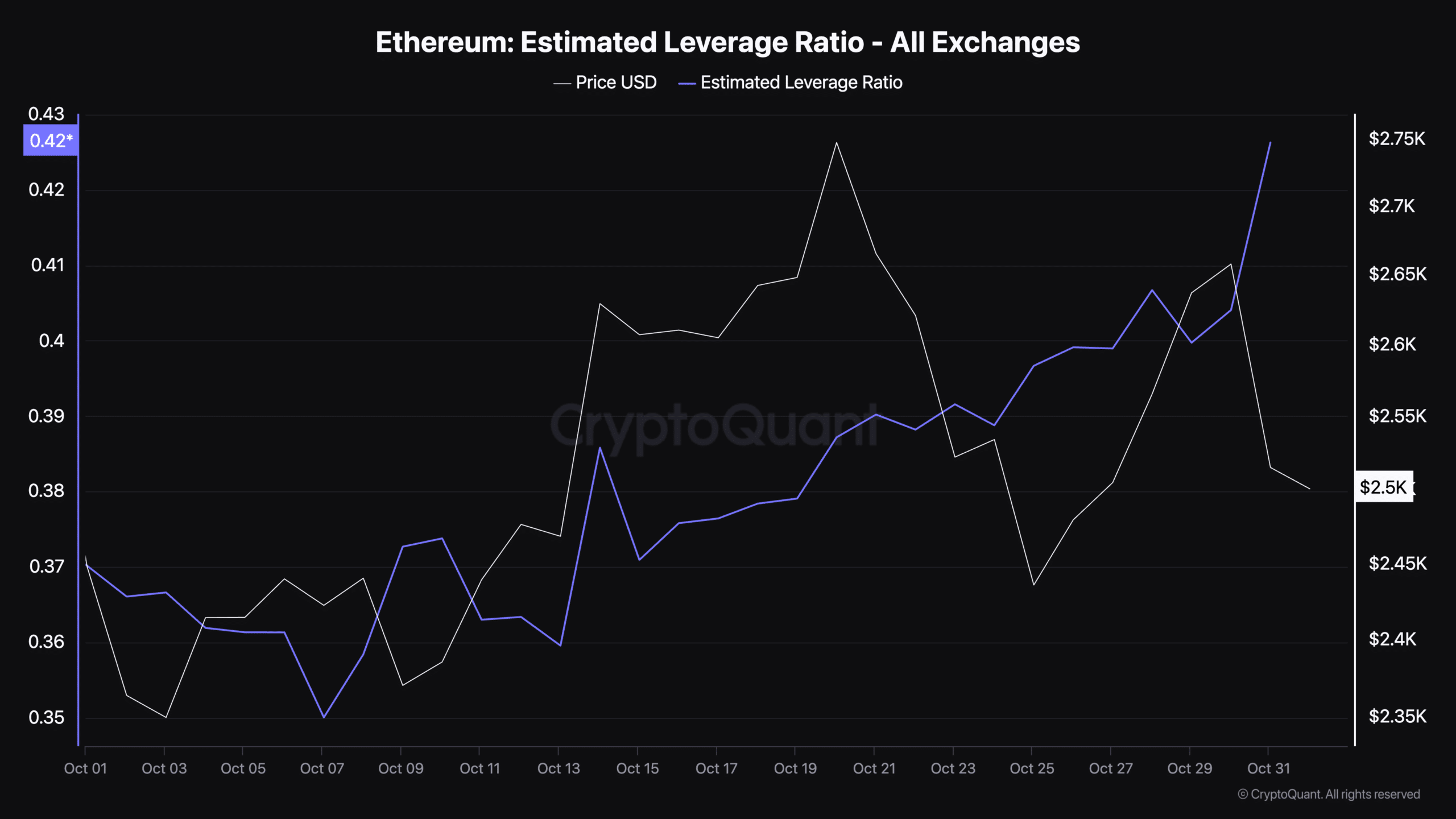

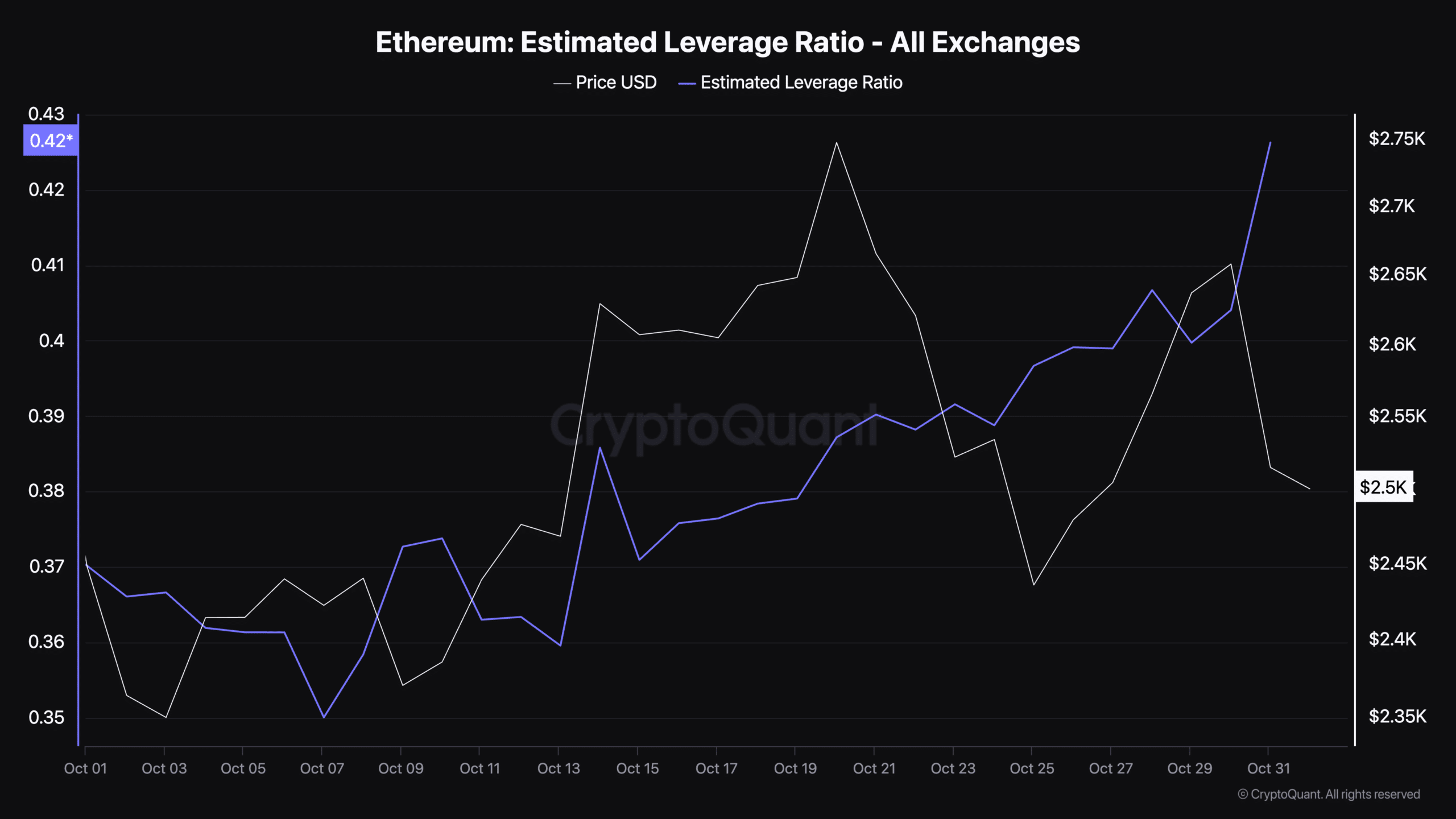

Finally, data from CryptoQuant revealed that Ethereum’s estimated leverage ratio increased, moving from 0.35 in early October to 0.42 at press time. This metric highlights the level of leverage or borrowed funds used by traders, with a higher ratio indicating increased borrowing.

Source: CryptoQuant

An uptrend in the leverage ratio may suggest that traders are taking on more risk, potentially expecting price gains.

However, an elevated leverage ratio can also introduce volatility, as high-leverage positions are more sensitive to price swings. This could lead to sharper moves if Ethereum’s price shifts unexpectedly.

- Ethereum’s funding rates underlined growing optimism, but sentiment remains cautious

- Declining active addresses and rising leverage ratios highlighted mixed trends in Ethereum’s retail and Futures markets

Ethereum has seen significant price volatility recently, leading to mixed reactions among investors. After a rally above $2,700 on 30 October, Ethereum renewed investor optimism. However, this sentiment has been challenged lately by its latest downward movement.

Over the last 24 hours, Ethereum’s price dropped by 5.1%, hitting a low of $2,475 before stabilizing around $2,496, at the time of writing. This price dip sparked discussions about Ethereum’s market strength, with particular attention on investor sentiment in Ethereum Futures.

Despite the recent price setback, however, a CryptoQuant analyst highlighted that Ethereum’s Futures market funding rates revealed a positive outlook among traders. The funding rate, which reflects the balance between buyers’ and sellers’ optimism, registered an uptrend recently.

Funding rates and investor sentiment in Ethereum Futures

Positive funding rates are a sign that there is higher demand to go long on Ethereum Futures, indicating optimism among Futures traders. However, these rates remain below the bullish peak seen in March, during which Ethereum’s price was on a strong uptrend. This implied that while optimism exists, it is yet to reach levels sufficient to drive a major breakout.

Funding rates in Ethereum Futures lend insight into market sentiment by showing the level of bullish or bearish pressure among traders. Positive funding rates indicate a greater willingness among traders to hold long positions – A sign of bullish sentiment. Negative rates imply otherwise.

Source: CryptoQuant

The current uptrend in Ethereum’s funding rate alluded to a growing inclination to go long in the Futures market. Especially as investors anticipate potential price gains. However, the lower funding rates compared to the levels earlier this year suggested that while sentiment has been improving, it may not yet be strong enough to drive a major price rally.

The potential for ETH to overcome resistance and maintain upward momentum hinges partly on a sustained rise in funding rates. Higher rates would reflect greater demand for long positions, potentially adding buying pressure on ETH.

For a sustained rally, a hike in these funding rates would signal stronger investor confidence. This could help Ethereum overcome existing resistance levels, potentially pushing its price higher.

This sentiment, combined with market trends, could shape Ethereum’s trajectory in the coming weeks.

Active addresses and leverage ratios indicate market trends

Beyond the Futures market, Ethereum’s active addresses – A measure of retail interest – projected a declining trend. Glassnode data indicated that active addresses decreased from over 550,000 on 14 August to approximately 421,000 at press time.

Source: Glassnode

Such a fall in active addresses may be a sign of waning interest among retail investors, potentially reflecting caution in the broader market. Active addresses are a metric of participation and engagement. And, a decline may suggest that fewer investors are actively trading or transferring ETH, which could dampen buying momentum.

Finally, data from CryptoQuant revealed that Ethereum’s estimated leverage ratio increased, moving from 0.35 in early October to 0.42 at press time. This metric highlights the level of leverage or borrowed funds used by traders, with a higher ratio indicating increased borrowing.

Source: CryptoQuant

An uptrend in the leverage ratio may suggest that traders are taking on more risk, potentially expecting price gains.

However, an elevated leverage ratio can also introduce volatility, as high-leverage positions are more sensitive to price swings. This could lead to sharper moves if Ethereum’s price shifts unexpectedly.

Absolutely indited subject material, regards for information .

I like the valuable info you provide in your articles. I’ll bookmark your weblog and check again here frequently. I’m quite sure I’ll learn many new stuff right here! Good luck for the next!

Thanks for the sensible critique. Me and my neighbor were just preparing to do a little research about this. We got a grab a book from our local library but I think I learned more clear from this post. I am very glad to see such fantastic information being shared freely out there.

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

What i do not understood is actually how you are not really much more well-liked than you may be right now. You’re so intelligent. You realize therefore considerably relating to this subject, made me personally consider it from numerous varied angles. Its like men and women aren’t fascinated unless it is one thing to do with Lady gaga! Your own stuffs nice. Always maintain it up!

Purdentix

Purdentix review

Purdentix review

The design and usability are top-notch, making everything flow smoothly.

The content is well-organized and highly informative.

This site truly stands out as a great example of quality web design and performance.

The content is well-organized and highly informative.

I love how user-friendly and intuitive everything feels.

It provides an excellent user experience from start to finish.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

This website is amazing, with a clean design and easy navigation.

The content is well-organized and highly informative.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The layout is visually appealing and very functional.

This site truly stands out as a great example of quality web design and performance.

The design and usability are top-notch, making everything flow smoothly.

The layout is visually appealing and very functional.

The design and usability are top-notch, making everything flow smoothly.

The content is well-organized and highly informative.

I’m really impressed by the speed and responsiveness.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The design and usability are top-notch, making everything flow smoothly.

The layout is visually appealing and very functional.

It provides an excellent user experience from start to finish.

The content is engaging and well-structured, keeping visitors interested.

This site truly stands out as a great example of quality web design and performance.

The layout is visually appealing and very functional.

I’m really impressed by the speed and responsiveness.

ICE WATER HACK

The content is engaging and well-structured, keeping visitors interested.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

I’m really impressed by the speed and responsiveness.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The content is engaging and well-structured, keeping visitors interested.

I love how user-friendly and intuitive everything feels.

The layout is visually appealing and very functional.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

I’m really impressed by the speed and responsiveness.

Consistency is key in fitness. You won’t see results overnight, but every workout counts. The small efforts add up over time and create real change.

Open-world games are the best! Nothing beats the feeling of total freedom, exploring vast landscapes, and creating your own adventure.

A good book isn’t just entertainment—it’s a portal to another world. The best stories stay with you long after you’ve turned the last page.

Consistency is key in fitness. You won’t see results overnight, but every workout counts. The small efforts add up over time and create real change.

Consistency is key in fitness. You won’t see results overnight, but every workout counts. The small efforts add up over time and create real change.

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

Time is often called the soul of motion, the great measure of change, but what if it is merely an illusion? What if we are not moving forward but simply circling the same points, like the smoke from a burning fire, curling back onto itself, repeating patterns we fail to recognize? Maybe the past and future are just two sides of the same moment, and all we ever have is now.

Even the gods, if they exist, must laugh from time to time. Perhaps what we call tragedy is merely comedy from a higher perspective, a joke we are too caught up in to understand. Maybe the wisest among us are not the ones who take life the most seriously, but those who can laugh at its absurdity and find joy even in the darkest moments.

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

Even the gods, if they exist, must laugh from time to time. Perhaps what we call tragedy is merely comedy from a higher perspective, a joke we are too caught up in to understand. Maybe the wisest among us are not the ones who take life the most seriously, but those who can laugh at its absurdity and find joy even in the darkest moments.

Virtue, they say, lies in the middle, but who among us can truly say where the middle is? Is it a fixed point, or does it shift with time, perception, and context? Perhaps the middle is not a place but a way of moving, a constant balancing act between excess and deficiency. Maybe to be virtuous is not to reach the middle but to dance around it with grace.

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

Purdentix

I believe other website proprietors should take this website as an example , very clean and wonderful user pleasant design.

how to buy clomiphene tablets clomiphene pct how can i get clomiphene without dr prescription where to get clomiphene without dr prescription cost of cheap clomid online cost generic clomiphene pills where to get cheap clomid price

I’ll certainly bring back to be familiar with more.

With thanks. Loads of conception!

purchase zithromax pill – order generic tindamax order metronidazole generic

where to buy motilium without a prescription – sumycin pill cyclobenzaprine sale

buy propranolol sale – order generic inderal 20mg buy generic methotrexate

augmentin 1000mg pills – atbioinfo purchase ampicillin sale

order esomeprazole 20mg online cheap – https://anexamate.com/ buy nexium 40mg generic

purchase coumadin generic – https://coumamide.com/ cozaar cost

order mobic 7.5mg sale – tenderness order mobic pills

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it.

prednisone 10mg oral – https://apreplson.com/ deltasone 40mg over the counter

home remedies for ed erectile dysfunction – fastedtotake online ed medications

buy amoxil pills for sale – https://combamoxi.com/ purchase amoxil

cenforce 100mg sale – cenforce 50mg without prescription order cenforce online cheap

cialis for sale over the counter – ciltad generic cialis no perscription overnight delivery

why is cialis so expensive – take cialis the correct way can tadalafil cure erectile dysfunction

This is the compassionate of scribble literary works I truly appreciate. click

where to buy viagra in canada – generic viagra cheap uk sildenafil 50 mg price

More peace pieces like this would insinuate the интернет better. amoxicillin generic

Proof blog you possess here.. It’s obdurate to on great status writing like yours these days. I justifiably comprehend individuals like you! Go through care!! https://prohnrg.com/product/cytotec-online/

Very interesting points you have noted, thanks for posting.

Thanks recompense sharing. It’s outstrip quality. prednisolone 20 mg dose poids

This is a theme which is forthcoming to my fundamentals… Many thanks! Faithfully where can I notice the phone details for questions? https://ondactone.com/product/domperidone/

More posts like this would make the blogosphere more useful.

clopidogrel 75mg pill

Proof blog you possess here.. It’s intricate to find great quality article like yours these days. I justifiably appreciate individuals like you! Withstand mindfulness!! http://forum.ttpforum.de/member.php?action=profile&uid=424438

You got a very superb website, Sword lily I discovered it through yahoo.

Wow! Thank you! I always needed to write on my blog something like that. Can I implement a fragment of your post to my blog?

I was very pleased to find this net-site.I wanted to thanks in your time for this excellent learn!! I undoubtedly enjoying every little little bit of it and I have you bookmarked to take a look at new stuff you weblog post.

dapagliflozin 10 mg usa – https://janozin.com/ forxiga buy online

order xenical – https://asacostat.com/# purchase orlistat sale

This is a keynote which is in to my callousness… Myriad thanks! Faithfully where can I find the acquaintance details in the course of questions? http://bbs.51pinzhi.cn/home.php?mod=space&uid=7112703