- ETH network fees have dropped to a five-year low, pointing to reduced network activity.

- The RSI shows signs of reversal – can ETH break key resistance and trigger a full bull run?

Ethereum’s [ETH] network fees have dropped to a five-year low, pointing to reduced network activity, which could impact its price. While not a direct bearish signal, the fee decline suggests weaker on-chain fundamentals.

However, the Relative Strength Index (RSI) shows signs of bullish reversal. Can ETH break key resistance and spark a full bull run under these conditions?

Key resistance amid weak fundamentals

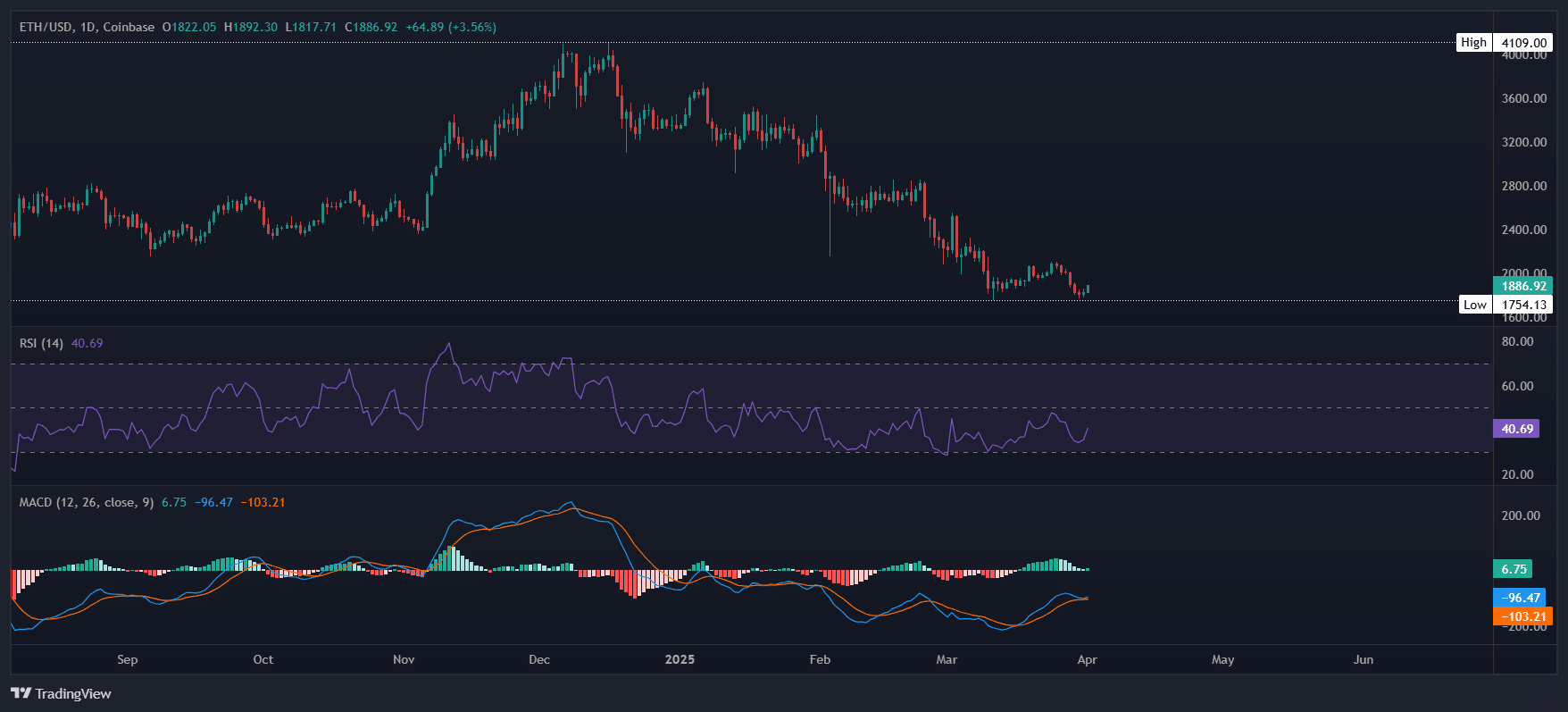

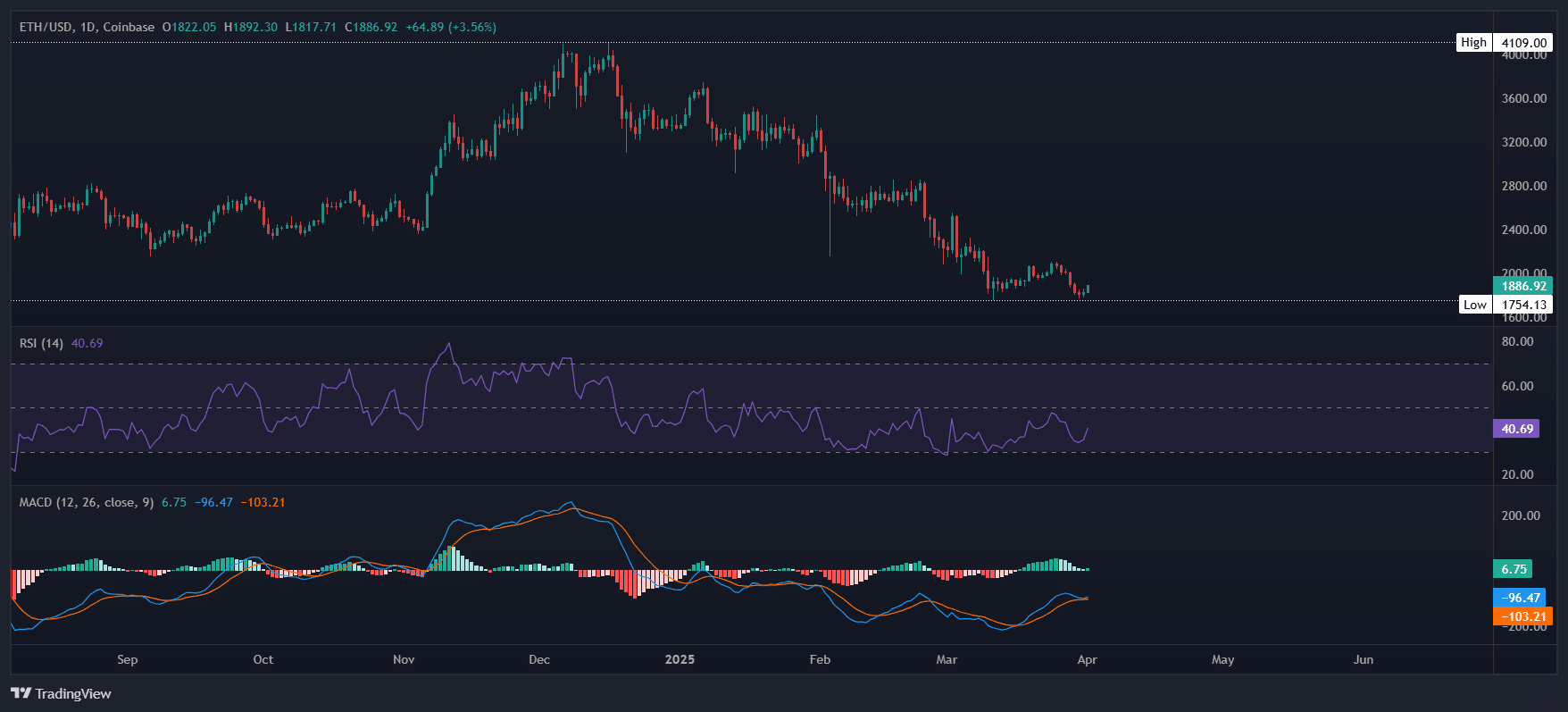

Ethereum is trading at $1,886, up 6% from its lowest point in two days, a level not seen in over four months. With a 23.52% surge in volume to $15.64 billion, this could signal a classic ‘dip-buying’ opportunity.

Technical indicators are turning bullish: the MACD has flipped positive, the RSI is moving upwards, ETH/BTC is in the green, and buy orders dominate perpetual contracts.

These factors suggest $1,750 could be a local bottom for ETH, with strong rebound potential.

Source: Coinalyze (ETH/USDT)

However, a bull run is still premature. For FOMO to kick in, ETH needs to hold this pattern in the coming days. With high-risk sentiment, losing support remains a real possibility.

Ethereum’s network fees have dropped to a five-year low of $608K, down from $18M during the November 2024 rally—signaling weak demand. This aligns with ETH’s 53% price drop in the same period.

With multiple bearish signals and sharp pullbacks, ETH needs stronger fundamentals and a key resistance breakout. Without them, holding its current price may be a challenge.

Breaking THIS level: The security signal for ETH

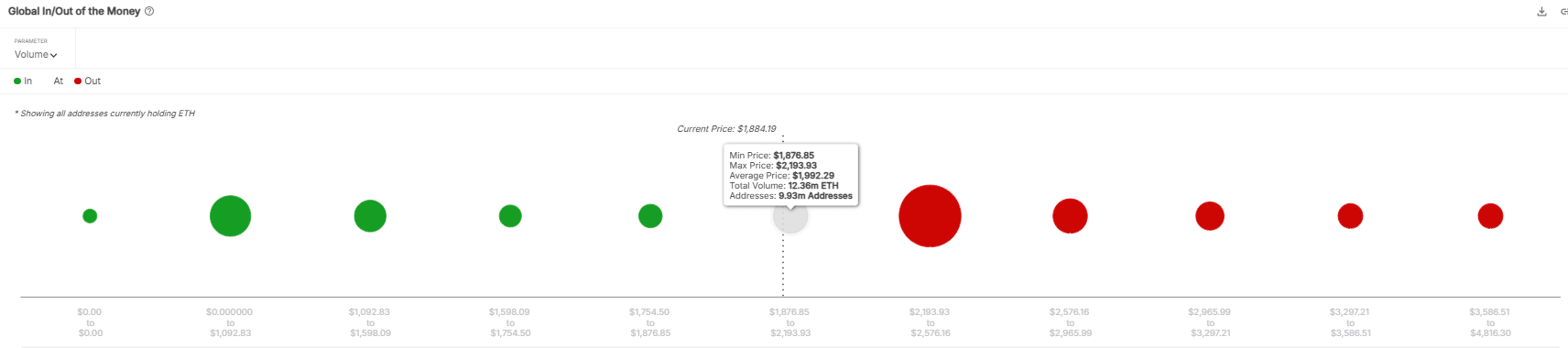

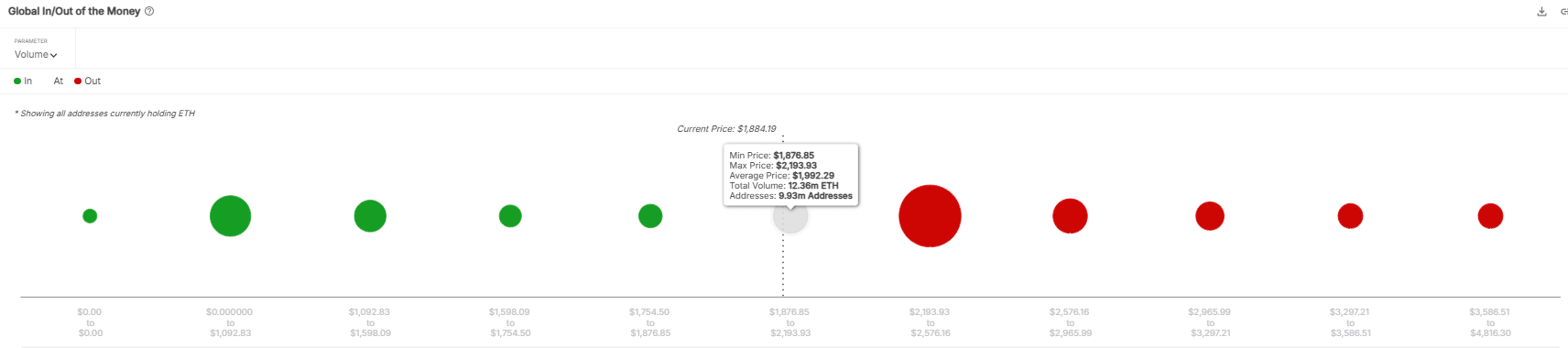

Analysts highlight $2,100 as a critical resistance Ethereum must reclaim to sustain a bullish breakout. Failure to hold above this level could trigger a deeper correction.

AMBCrypto’s analysis shows that breaching this barrier would push 12.36 million ETH into profit, putting $26 billion at risk.

Source: IntoTheBlock

Despite bullish technicals, weak demand and the absence of a supply shock make reclaiming this level uncertain. In fact, the key test isn’t just breaking $2,100 – but holding above it.

- ETH network fees have dropped to a five-year low, pointing to reduced network activity.

- The RSI shows signs of reversal – can ETH break key resistance and trigger a full bull run?

Ethereum’s [ETH] network fees have dropped to a five-year low, pointing to reduced network activity, which could impact its price. While not a direct bearish signal, the fee decline suggests weaker on-chain fundamentals.

However, the Relative Strength Index (RSI) shows signs of bullish reversal. Can ETH break key resistance and spark a full bull run under these conditions?

Key resistance amid weak fundamentals

Ethereum is trading at $1,886, up 6% from its lowest point in two days, a level not seen in over four months. With a 23.52% surge in volume to $15.64 billion, this could signal a classic ‘dip-buying’ opportunity.

Technical indicators are turning bullish: the MACD has flipped positive, the RSI is moving upwards, ETH/BTC is in the green, and buy orders dominate perpetual contracts.

These factors suggest $1,750 could be a local bottom for ETH, with strong rebound potential.

Source: Coinalyze (ETH/USDT)

However, a bull run is still premature. For FOMO to kick in, ETH needs to hold this pattern in the coming days. With high-risk sentiment, losing support remains a real possibility.

Ethereum’s network fees have dropped to a five-year low of $608K, down from $18M during the November 2024 rally—signaling weak demand. This aligns with ETH’s 53% price drop in the same period.

With multiple bearish signals and sharp pullbacks, ETH needs stronger fundamentals and a key resistance breakout. Without them, holding its current price may be a challenge.

Breaking THIS level: The security signal for ETH

Analysts highlight $2,100 as a critical resistance Ethereum must reclaim to sustain a bullish breakout. Failure to hold above this level could trigger a deeper correction.

AMBCrypto’s analysis shows that breaching this barrier would push 12.36 million ETH into profit, putting $26 billion at risk.

Source: IntoTheBlock

Despite bullish technicals, weak demand and the absence of a supply shock make reclaiming this level uncertain. In fact, the key test isn’t just breaking $2,100 – but holding above it.

Crypto bridges are the backbone of DeFi, and this is a leader!

The staking rewards here are amazing!

A true competitor to other big TRON-based swap platforms.

Never realized how seamless the bridging process could be.

The visuals and examples really helped me understand IL.

Insolvency Practitioners

Decentralization + simplicity = Rhino Bridge gets it right.

Appreciate the tips on cross-chain liquidity safety.

Really helped me rethink how I provide liquidity in DeFi.

Great intro for anyone looking to get started on Polygon.

Link Tải F79

totocc

bclub.mp

escort ankara

undefined

Alpaca Finance

Alpaca Finance

RenBridge

Alpaca Finance

RenBridge

Alpaca Finance

Alpaca Finanace

RenBridge Finanace

RenBridge Finanace

Rhinobridge

quickswap

quick swap

quick swap

quick swap

Executive transportation Paris

Private chauffeur for Normandy Tours

AI girlfriend

Mon casino

casino without swedish license

How to Use DeFiLlama: A Practical Guide for Navigating DeFi Analytics

For any dev working with DeFi data, the DefiLlama API is a no-brainer.

My entire DeFi journey is logged through DefiLlama.

I always compare protocols side-by-side using DefiLlama.

Renbridge

RenBridge Review

RenBridge

RenBridge

Bridge ETH on RenBridge

Automatic Gates Near Me

DefiLlama

DefiLlama

Jonitogel

DefiLlama

Matcha Swap

Matcha Swap

Matcha Auto

stainless steel exhaust tubing

Arbswap Trading

SpookySwap

SpookySwap

SpookySwap Farming

Medyum Haluk hoca

Matcha cross-chain

SpookySwap

Multichain Trading

Multichain Bridge

RenBridge Dashboard

Great platform, highly recommended.

Top crypto resource in South America.

Really useful platform in South Korea.

Top-tier security on this crypto platform.

Crypto experts choose this site.

Really useful platform in Indonesia.

cost cheap clomiphene online buy clomid tablets can you buy clomid without a prescription clomiphene generic cost can you get clomiphene without insurance where can i get clomiphene without prescription clomiphene without insurance

A top resource in UAE.

Top platform in the USA.

This is a topic which is forthcoming to my heart… Numberless thanks! Exactly where can I lay one’s hands on the phone details for questions?

Highly recommend this site in Israel.

Highly recommend this site in Indonesia.

Thanks for putting this up. It’s understandably done.

Reliable and consistently good.

MatchaSwap finds you the best prices across exchanges and combines them into one trade

Seamlessly transfer crypto assets between blockchains using RenBridge secure and decentralized cross-chain protocol.

hyperliquid app

Alpaca Finance

Why Use Hyperliquid?

Crypto professionals love this.

Very professional site.

Perfectly reliable and safe.

order azithromycin 500mg for sale – buy tetracycline pills for sale metronidazole for sale online

Matcha Swap

What Is Hyperliquid?

Matcha Swap

Hyperliquid App

How to Use Matcha Swap: A Step-by-Step Guide for DeFi Traders

Hyperliquid App

MultiChain

Matcha Swap

MultiChain

buy rybelsus – periactin 4 mg without prescription periactin over the counter

Excellent and trusted crypto website.

Top 5 Strategies to Maximize Returns on Hyperliquid in 2025

Very satisfied, great quality.

motilium medication – domperidone brand cyclobenzaprine 15mg uk

Always stable and reliable, thanks Arbswap – https://arbswap-v1.com.

Arbswap – https://arbswap-v1.com platform never disappoints.

Very nice and clean site, Arbswap – https://arbswap-v1.com is my go-to platform!

buy cheap propranolol – buy cheap methotrexate methotrexate 10mg generic

amoxil order – purchase amoxil for sale buy generic combivent 100 mcg

buy azithromycin for sale – purchase azithromycin pills bystolic 5mg usa

ticket flipping

newest crypto casinos 2025

amoxiclav price – atbioinfo purchase ampicillin for sale

nexium 20mg sale – nexiumtous buy nexium pills for sale

warfarin 5mg ca – https://coumamide.com/ purchase hyzaar sale

Mantle Bridge

AI Trading Bot Crypto trading bot ai crypto trading bot

ParaSwap

SpookySwap app

order mobic 15mg for sale – mobo sin meloxicam 7.5mg oral

Crypto experts like me prefer SpookySwap – https://spookyswap.online/ platform.

buy prednisone 40mg – aprep lson deltasone 40mg cheap

If you value privacy in crypto, you’ll appreciate hyperliquid for trading.

Leverage trading made easy with hyperliquid.

Trading psychology is as important as technical analysis.

non prescription erection pills – site buy ed pills canada

Blockchain technology has many real-world applications.

Cold wallets keep assets safe

amoxicillin order – https://combamoxi.com/ purchase amoxil online

diflucan 200mg without prescription – https://gpdifluca.com/# forcan over the counter

where to buy escitalopram without a prescription – site buy lexapro 20mg online

cost cenforce 100mg – https://cenforcers.com/ cenforce 100mg over the counter

cialis genetic – ciltad generic how long does cialis take to work 10mg

cialis 5mg how long does it take to work – tadalafil and ambrisentan newjm 2015 canadian pharmacy tadalafil 20mg

zantac 150mg generic – buy zantac online cheap purchase zantac online

viagra buy canada – https://strongvpls.com/ viagra 100 mg for sale

The depth in this ruined is exceptional. https://gnolvade.com/

Thanks an eye to sharing. It’s top quality. https://buyfastonl.com/gabapentin.html

Conference Organisers

https://primeday.zohodesk.com/portal/en/kb/articles/top-10-cool-gadgets-on-amazon-for-2025

More posts like this would persuade the online play more useful. https://ursxdol.com/provigil-gn-pill-cnt/

More posts like this would make the blogosphere more useful. https://prohnrg.com/product/loratadine-10-mg-tablets/

Fully decentralized with audited smart contracts and validator network.

Transparent fee structure and gas‑optimized for cost efficiency.

Non‑custodial, permissionless bridge connecting Ethereum, BNB Chain, and Manta Network.

Non‑custodial, permissionless bridge connecting Ethereum, BNB Chain, and Manta Network.

Fully decentralized with audited smart contracts and validator network.

wormhole portal

This is the stripe of content I have reading. prednisolone 20 mg posologie

defillama analytics

manta network

manta network

defillama price

defillama defi tracker

Base Bridge

defillama liquidity pools

defillama airdrop

Bk8

Bk8

Togelup

Togelup

Aw8

Anyswap

Frax Swap

Mantle Bridge

matcha swap

Paraswap

Bos88

Bandartogel77

Bk8

mantcha swap guide

Hometogel

tron staking rewards

DefiLlama swap fees

frax swap defi

Sbototo

jonitogel

Hometogel

Gengtoto

barcatoto

udintogel

batman138 login

Bosstoto

Kepritogel

Dolantogel

Bosstoto

This is the kind of literature I in fact appreciate. https://ondactone.com/simvastatin/

Mariatogel

Mariatogel

goltogel

totojitu login

artistoto

togel4d login

Sell USDT in Barcelona

fast tron swap

tron swap

Hand Sanitisers

bk8 slotbk8

More articles like this would remedy the blogosphere richer.

buy generic tamsulosin online

Hand Sanitisers

bk8

P2P USDT exchange Bali

indotogel login

Cash out USDT Buenos Aires

Tether satmak İstanbul

Where can I find a USDT ATM in Buenos Aires?

indotogel login