- Ethereum’s fee drop and growing accumulation may signal the start of a market rebound

- Decline in ETH exchange reserves hinted at a potential supply squeeze and upcoming price rally

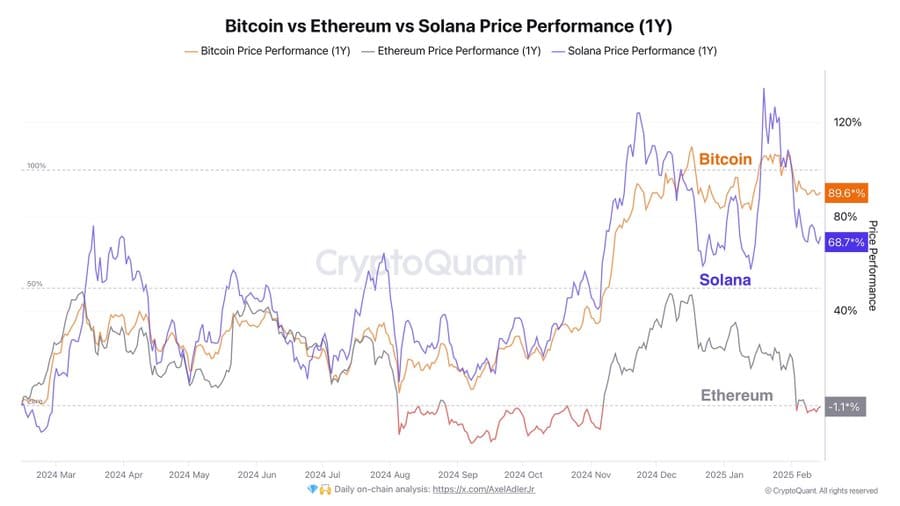

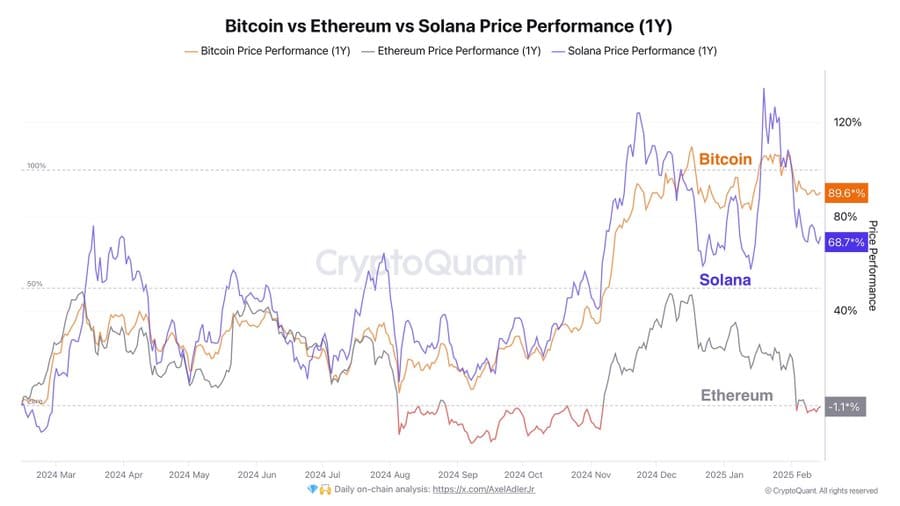

Ethereum [ETH] has underperformed, compared to its peers for over a year. However, new on-chain data might be pointing towards a potential shift. While ETH is down 1.1% year-over-year, Bitcoin [BTC] and Solana [SOL] have posted massive gains.

Now, two key developments – plunging transaction fees and accelerating accumulation – may be signs of growing investor confidence.

Could this signal the start of an Ethereum resurgence?

How lower fees affect network activity and adoption

Ethereum’s transaction fees have dropped by over 70% this week, with total daily fees now at $7.5 million, down from $23 million just weeks prior. This decline follows a recent increase in the gas limit, which effectively expands block capacity and reduces congestion.

Historically, lower fees have correlated with higher network usage. During previous fee declines in 2021 and mid-2023, for instance, daily active addresses and transaction counts surged.

If this pattern holds, Ethereum could see a renewed uptick in on-chain activity. However, what’s crucial is whether this uptick in activity translates into sustained demand rather than short-term speculative surges.

Does the sharp decline in ETH exchange reserves signal a supply squeeze?

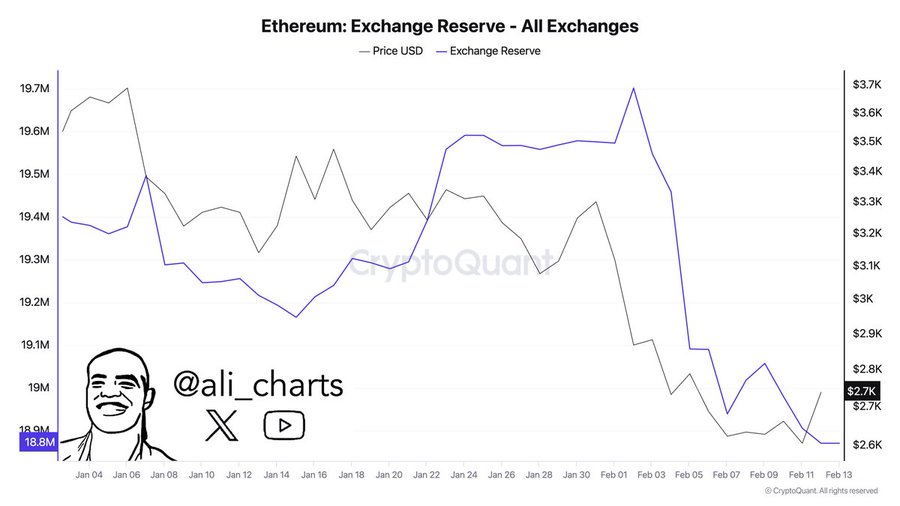

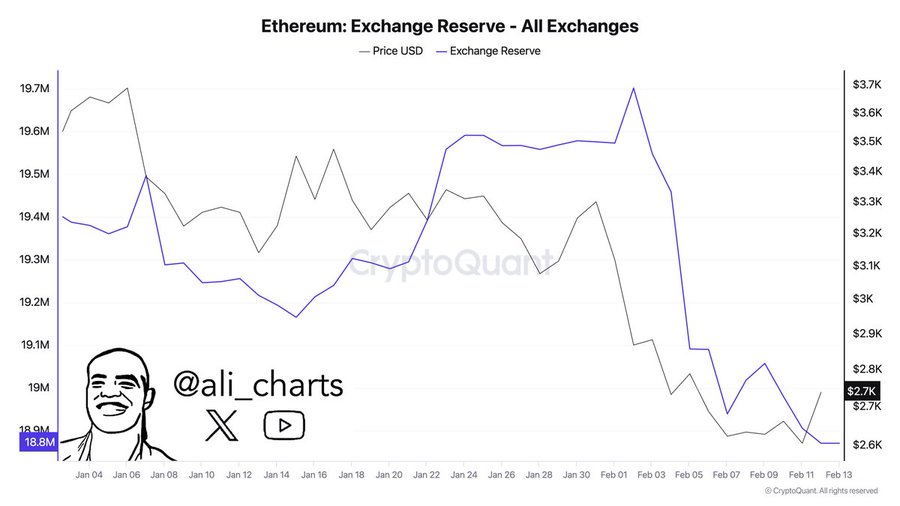

Ethereum exchange reserves have fallen sharply, from 19.7 million ETH in early January to 18.8 million ETH in just 10 days.

Such a sharp decline is a sign that investors are moving assets to self-custody, reducing the immediate supply available for selling.

Source: X

Historically, such sharp drawdowns have often preceded price rallies. The last similar exchange reserve decline occurred in Q4 2023, which was followed by a 35% price surge over the following two months.

If this price trend continues, Ethereum could face a supply squeeze. Particularly if demand rebounds alongside lower fees.

Technical indicators show lack of bullish momentum

Source: X

Despite improving on-chain metrics, however, at press time, Ethereum was still down 1.1% YoY. It was lagging behind Bitcoin (+89.6%) and Solana (+68.7%).

Source: TradingView

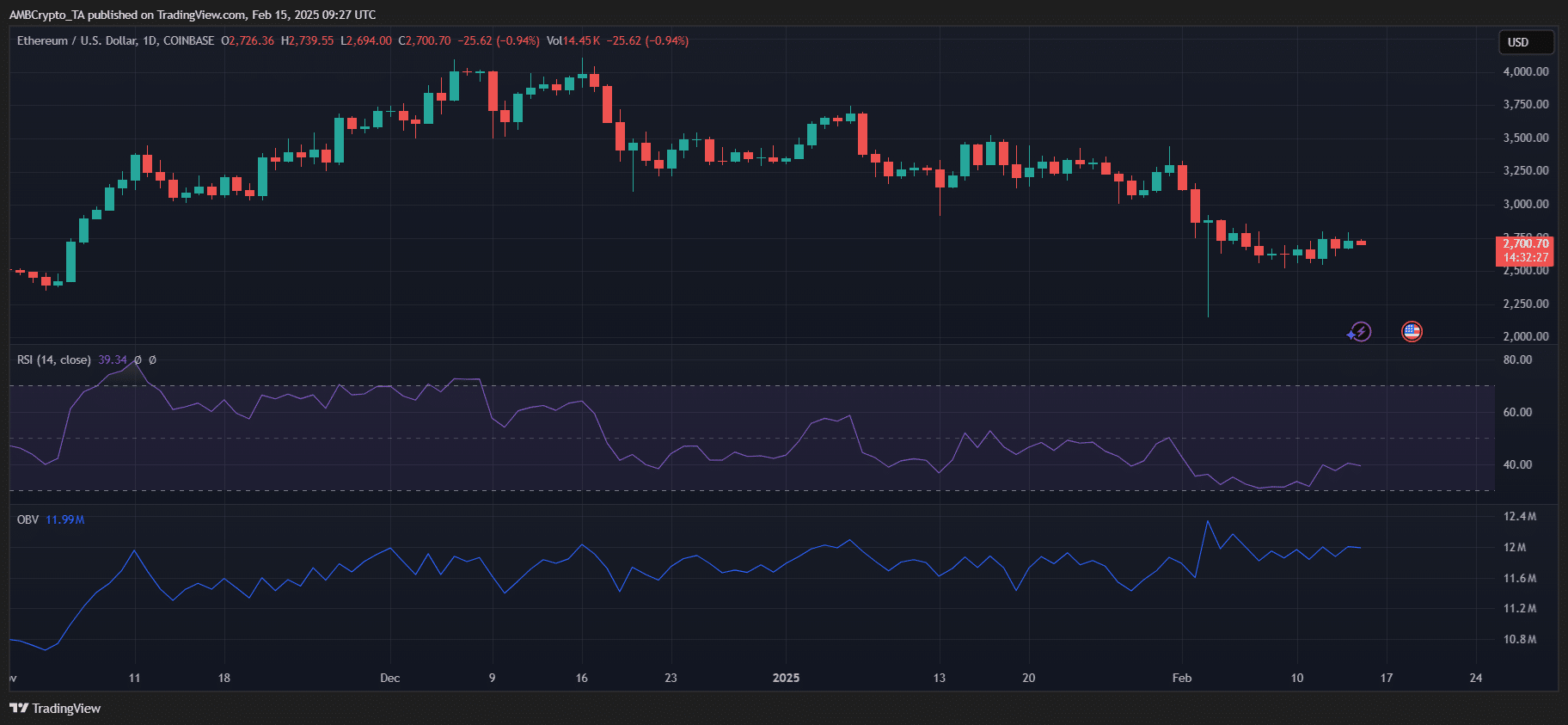

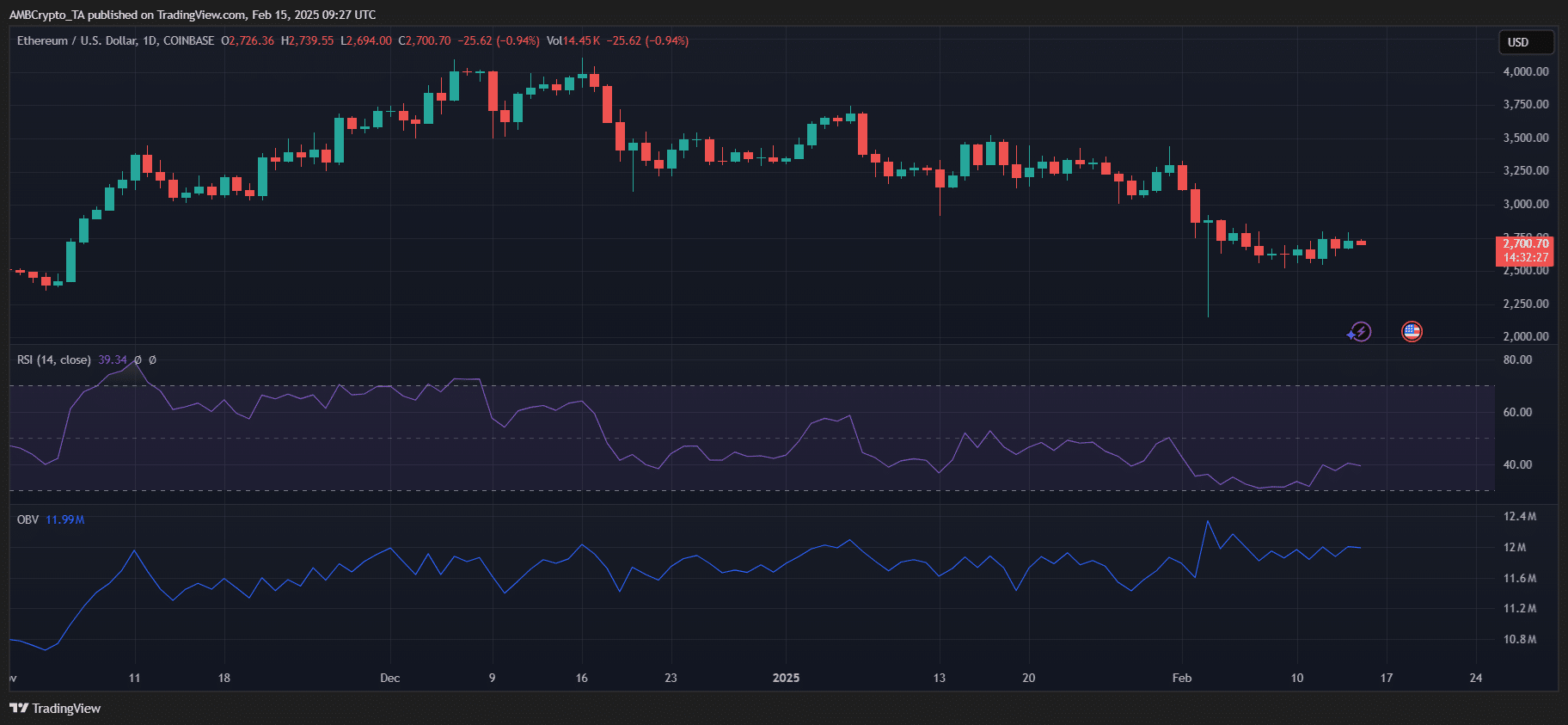

Recent data also highlighted a strong resistance around $2,800, with ETH struggling to break above it despite rising accumulation. The RSI sat at 39.34, indicating that while Ethereum may be near oversold conditions, it is yet to gain bullish momentum.

Additionally, the OBV showed a lack of strong buying pressure – A sign that while supply has been tightening, demand is yet to surge.

For ETH to break out, it needs a decisive push past the $2,800-$2,900 range backed by increasing volume. If this fails, a retest of $2,500 will remain a possibility before any sustained upside.

- Ethereum’s fee drop and growing accumulation may signal the start of a market rebound

- Decline in ETH exchange reserves hinted at a potential supply squeeze and upcoming price rally

Ethereum [ETH] has underperformed, compared to its peers for over a year. However, new on-chain data might be pointing towards a potential shift. While ETH is down 1.1% year-over-year, Bitcoin [BTC] and Solana [SOL] have posted massive gains.

Now, two key developments – plunging transaction fees and accelerating accumulation – may be signs of growing investor confidence.

Could this signal the start of an Ethereum resurgence?

How lower fees affect network activity and adoption

Ethereum’s transaction fees have dropped by over 70% this week, with total daily fees now at $7.5 million, down from $23 million just weeks prior. This decline follows a recent increase in the gas limit, which effectively expands block capacity and reduces congestion.

Historically, lower fees have correlated with higher network usage. During previous fee declines in 2021 and mid-2023, for instance, daily active addresses and transaction counts surged.

If this pattern holds, Ethereum could see a renewed uptick in on-chain activity. However, what’s crucial is whether this uptick in activity translates into sustained demand rather than short-term speculative surges.

Does the sharp decline in ETH exchange reserves signal a supply squeeze?

Ethereum exchange reserves have fallen sharply, from 19.7 million ETH in early January to 18.8 million ETH in just 10 days.

Such a sharp decline is a sign that investors are moving assets to self-custody, reducing the immediate supply available for selling.

Source: X

Historically, such sharp drawdowns have often preceded price rallies. The last similar exchange reserve decline occurred in Q4 2023, which was followed by a 35% price surge over the following two months.

If this price trend continues, Ethereum could face a supply squeeze. Particularly if demand rebounds alongside lower fees.

Technical indicators show lack of bullish momentum

Source: X

Despite improving on-chain metrics, however, at press time, Ethereum was still down 1.1% YoY. It was lagging behind Bitcoin (+89.6%) and Solana (+68.7%).

Source: TradingView

Recent data also highlighted a strong resistance around $2,800, with ETH struggling to break above it despite rising accumulation. The RSI sat at 39.34, indicating that while Ethereum may be near oversold conditions, it is yet to gain bullish momentum.

Additionally, the OBV showed a lack of strong buying pressure – A sign that while supply has been tightening, demand is yet to surge.

For ETH to break out, it needs a decisive push past the $2,800-$2,900 range backed by increasing volume. If this fails, a retest of $2,500 will remain a possibility before any sustained upside.

Безупречный подарок – это красивый букет цветов, созданный с любовью и мастерством. Наши флористы подбирают лучшие цветы и создают уникальные композиции, которые запомнятся надолго.

Thegreen.ru предлагает эксклюзивные цветочные композиции от профессиональных флористов. Находясь по адресу улица Юннатов, дом 4кА, мы доставляем ваши заказы точно в срок. Свяжитесь с нами для заказа по телефону +7(495)144-15-24.

Когда пациент решает обратиться за помощью к наркологу на дом, ему предстоит пройти ряд этапов лечения, каждый из которых будет направлен на устранение последствий алкоголизма. Врач проведет первичный осмотр, выслушает жалобы пациента и на основе собранной информации начнёт индивидуальную программу лечения. При этом многие частные наркологи на дом предлагают конкурентоспособные цены и высококачественные услуги.

Подробнее можно узнать тут – врач нарколог на дом платный екатеринбург

Admiring the persistence you put into your site and in depth information you provide. It’s nice to come across a blog every once in a while that isn’t the same out of date rehashed material. Excellent read! I’ve bookmarked your site and I’m adding your RSS feeds to my Google account.

You could definitely see your skills in the paintings you write. The world hopes for even more passionate writers such as you who aren’t afraid to say how they believe. At all times go after your heart.

You have brought up a very superb points, appreciate it for the post.

clomid other name get generic clomid without insurance can i buy generic clomiphene without dr prescription buying clomiphene tablets clomid uk buy can i order clomiphene for sale how can i get cheap clomiphene pill

This website positively has all of the tidings and facts I needed there this thesis and didn’t comprehend who to ask.

Thanks for sharing. It’s outstrip quality.

azithromycin pill – order ciplox 500mg for sale flagyl 200mg tablet

oral rybelsus 14mg – cyproheptadine pills buy generic periactin

purchase domperidone pills – flexeril 15mg pill how to get flexeril without a prescription

how to get propranolol without a prescription – inderal canada order methotrexate sale

buy amoxil medication – order diovan 80mg online cheap combivent 100 mcg sale

zithromax 500mg canada – azithromycin brand purchase bystolic for sale

buy augmentin online – atbioinfo.com ampicillin cost

order nexium 40mg without prescription – https://anexamate.com/ esomeprazole 20mg over the counter

coumadin 2mg usa – https://coumamide.com/ cozaar price

order mobic 7.5mg sale – swelling meloxicam 7.5mg cheap

deltasone 5mg oral – https://apreplson.com/ oral deltasone 40mg

Hey there! I’ve been reading your weblog for a long time now and finally got the bravery to go ahead and give you a shout out from Humble Texas! Just wanted to say keep up the excellent job!

pills erectile dysfunction – https://fastedtotake.com/ buy erectile dysfunction medications

cheap amoxicillin online – amoxicillin over the counter cheap generic amoxil

buy fluconazole generic – buy generic diflucan buy forcan for sale

brand cenforce 50mg – https://cenforcers.com/# cenforce for sale

combitic global caplet pvt ltd tadalafil – cialis ingredients tadalafil tamsulosin combination

cheap zantac 150mg – zantac 150mg pill order ranitidine online cheap

pharmacy 365 cialis – https://strongtadafl.com/ e-cialis hellocig e-liquid

Greetings! Very gainful recommendation within this article! It’s the crumb changes which liking turn the largest changes. Thanks a a quantity towards sharing! fildena 50 opiniones

sildenafil citrate tablets 50 mg – click order viagra online australia

The reconditeness in this piece is exceptional. https://ursxdol.com/prednisone-5mg-tablets/

This is a keynote which is near to my heart… Many thanks! Quite where can I find the contact details for questions? buy generic amoxicillin

This is the gentle of writing I truly appreciate. https://prohnrg.com/product/get-allopurinol-pills/

I went over this website and I think you have a lot of good info , saved to bookmarks (:.

With thanks. Loads of erudition! stromectol prix france

More posts like this would prosper the blogosphere more useful. https://ondactone.com/simvastatin/

More posts like this would persuade the online space more useful.

buy generic dutasteride over the counter

Good day! This is kind of off topic but I need some help from an established blog. Is it hard to set up your own blog? I’m not very techincal but I can figure things out pretty quick. I’m thinking about creating my own but I’m not sure where to start. Do you have any ideas or suggestions? Thanks

After examine a couple of of the blog posts in your web site now, and I truly like your approach of blogging. I bookmarked it to my bookmark web site list and shall be checking back soon. Pls check out my website online as properly and let me know what you think.

This is a question which is near to my heart… Many thanks! Unerringly where can I find the contact details an eye to questions? http://bbs.dubu.cn/home.php?mod=space&uid=395576

Youre so cool! I dont suppose Ive learn something like this before. So nice to find somebody with some original ideas on this subject. realy thank you for starting this up. this website is something that is wanted on the web, someone with a little originality. useful job for bringing something new to the web!

cost forxiga – forxiga 10 mg brand dapagliflozin for sale online

Thanks for sharing superb informations. Your site is very cool. I’m impressed by the details that you’ve on this web site. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for more articles. You, my pal, ROCK! I found simply the info I already searched everywhere and simply couldn’t come across. What an ideal web-site.

order orlistat online – https://asacostat.com/# order generic orlistat 60mg

This is the make of enter I find helpful. https://www.forum-joyingauto.com/member.php?action=profile&uid=49461