- More than $46M worth of ETH was moved to exchanges on the 8th of January, marking the highest net inflows in nearly three weeks.

- The sell-off comes amid weak demand after spot ETH ETFs posted the second-highest outflows since launch.

Ethereum [ETH] has yet to record any significant gains in 2025. In the last two days, the largest altcoin has dropped from around $3,700 to trade at $3,324 at press time.

One of the factors behind Ethereum’s bearish trend is weakened demand. For instance, on the 8th of January, the outflows from spot Ethereum exchange-traded funds (ETFs) reached $159M per SoSoValue.

This was the second-highest level of outflows since the products launched in July last year.

Besides institutional investors, retail traders also seem to be in a distribution phase, causing a surge in selling activity.

ETH faces intense selling pressure

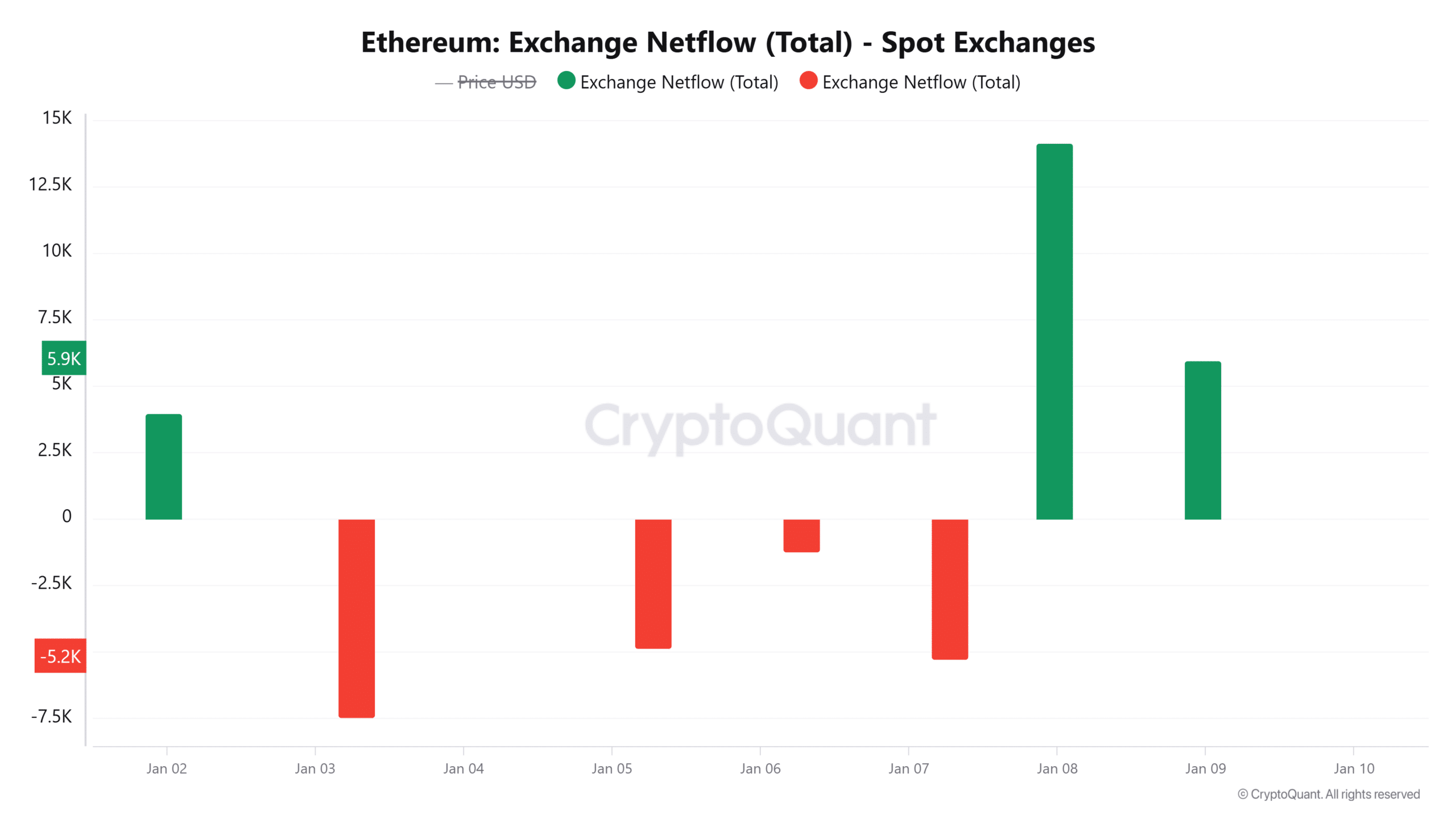

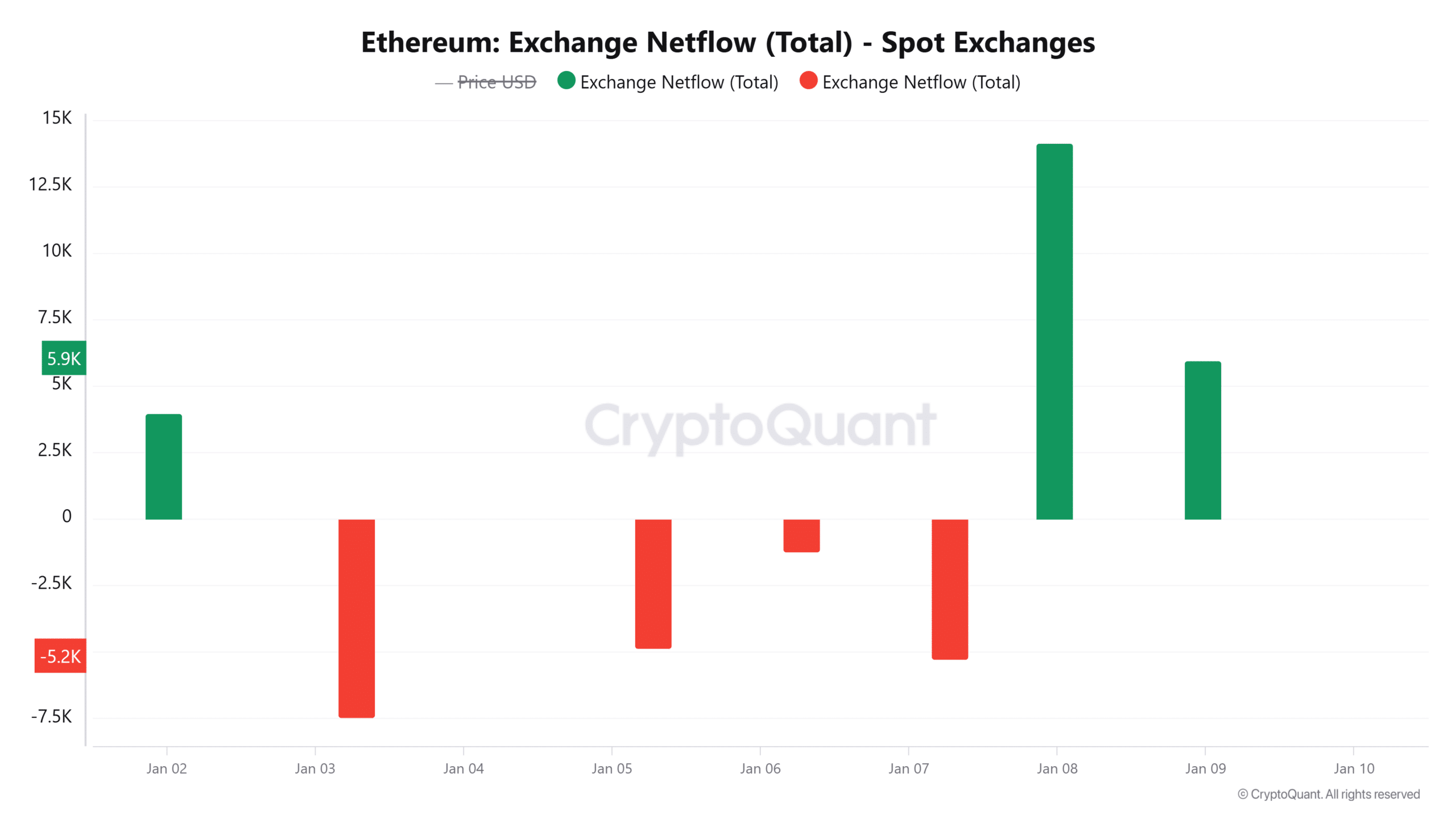

Data from CryptoQuant shows that on the 8th of January, the net inflows for ETH to spot exchanges hit 14,143, valued at more than $46M. This was the highest level of positive netflows in nearly three weeks.

Source: CryptoQuant

These inflows led to a surge in exchange reserves to 8.06M ETH, which is also at its highest level in a week.

When more ETH tokens are transferred to exchanges, it shows an intent by traders to sell. This could result in bearish sentiment, and once these tokens are dumped into the market, it leads to a negative price momentum.

Will sellers push ETH below $3,000?

Ethereum’s weekly chart shows that a crucial support level lies at $2,870. Going by past trends, a breach below this support has coincided with significant price declines.

If selling activity continues amid a lack of demand to absorb these sold coins, ETH could drop further towards this support level. However, selling activity has yet to overpower buying pressure.

This was seen in the Relative Strength Index (RSI) indicator that stood at 52 at press time, which was a near-neutral level.

Source: TradingView

If neither buyers nor sellers have the upper hand, ETH could enter into a consolidation range. However, traders should watch out for the bearish pressure depicted by the red Awesome Oscillator (AO) histogram bars.

Ethereum’s leverage ratio hits record highs

Ethereum’s estimated leverage ratio, which measures the risk appetite among traders, has surged to 0.605, setting a new record high.

Source: CryptoQuant

This rising ratio indicates that derivative traders are keen on opening new positions. It could also indicate that these traders are looking to capitalize on the short-term price movements as speculative interest grows.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Rising leverage could also stir volatile price movements if there are forced liquidations due to unexpected price movements.

However, despite the rising speculative interest, the demand for long positions has decreased as seen in funding rates. This indicates that the bullish sentiment has cooled.

Source: Coinglass

- More than $46M worth of ETH was moved to exchanges on the 8th of January, marking the highest net inflows in nearly three weeks.

- The sell-off comes amid weak demand after spot ETH ETFs posted the second-highest outflows since launch.

Ethereum [ETH] has yet to record any significant gains in 2025. In the last two days, the largest altcoin has dropped from around $3,700 to trade at $3,324 at press time.

One of the factors behind Ethereum’s bearish trend is weakened demand. For instance, on the 8th of January, the outflows from spot Ethereum exchange-traded funds (ETFs) reached $159M per SoSoValue.

This was the second-highest level of outflows since the products launched in July last year.

Besides institutional investors, retail traders also seem to be in a distribution phase, causing a surge in selling activity.

ETH faces intense selling pressure

Data from CryptoQuant shows that on the 8th of January, the net inflows for ETH to spot exchanges hit 14,143, valued at more than $46M. This was the highest level of positive netflows in nearly three weeks.

Source: CryptoQuant

These inflows led to a surge in exchange reserves to 8.06M ETH, which is also at its highest level in a week.

When more ETH tokens are transferred to exchanges, it shows an intent by traders to sell. This could result in bearish sentiment, and once these tokens are dumped into the market, it leads to a negative price momentum.

Will sellers push ETH below $3,000?

Ethereum’s weekly chart shows that a crucial support level lies at $2,870. Going by past trends, a breach below this support has coincided with significant price declines.

If selling activity continues amid a lack of demand to absorb these sold coins, ETH could drop further towards this support level. However, selling activity has yet to overpower buying pressure.

This was seen in the Relative Strength Index (RSI) indicator that stood at 52 at press time, which was a near-neutral level.

Source: TradingView

If neither buyers nor sellers have the upper hand, ETH could enter into a consolidation range. However, traders should watch out for the bearish pressure depicted by the red Awesome Oscillator (AO) histogram bars.

Ethereum’s leverage ratio hits record highs

Ethereum’s estimated leverage ratio, which measures the risk appetite among traders, has surged to 0.605, setting a new record high.

Source: CryptoQuant

This rising ratio indicates that derivative traders are keen on opening new positions. It could also indicate that these traders are looking to capitalize on the short-term price movements as speculative interest grows.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Rising leverage could also stir volatile price movements if there are forced liquidations due to unexpected price movements.

However, despite the rising speculative interest, the demand for long positions has decreased as seen in funding rates. This indicates that the bullish sentiment has cooled.

Source: Coinglass

can i get generic clomid prices where can i buy clomiphene pill get generic clomid online can i purchase generic clomid without a prescription clomid for sale buying generic clomid no prescription where can i buy cheap clomiphene without prescription

Greetings! Very useful suggestion within this article! It’s the petty changes which will turn the largest changes. Thanks a lot in the direction of sharing!

More text pieces like this would make the интернет better.

zithromax price – buy tinidazole no prescription flagyl cost

semaglutide 14mg cheap – buy generic cyproheptadine online oral cyproheptadine 4 mg

purchase domperidone generic – buy domperidone 10mg pill generic flexeril 15mg

amoxicillin order online – cheap amoxicillin pills ipratropium us

zithromax 250mg over the counter – bystolic 5mg over the counter order nebivolol 5mg pills

buy clavulanate generic – atbioinfo buy acillin without prescription

order nexium 20mg online – nexiumtous order nexium 40mg pill

coumadin 5mg tablet – anticoagulant cozaar 25mg usa

buy meloxicam 7.5mg online cheap – tenderness buy mobic online cheap

deltasone pills – allergic reactions order deltasone 10mg

buy ed pill – https://fastedtotake.com/ new ed pills

cheap amoxicillin – comba moxi amoxicillin order

cenforce us – https://cenforcers.com/ cenforce 50mg cheap

where can i buy cialis online in canada – reddit cialis what possible side effect should a patient taking tadalafil report to a physician quizlet

free cialis samples – why does tadalafil say do not cut pile cheap cialis free shipping

zantac 150mg cost – https://aranitidine.com/ zantac over the counter

viagra cheap canada – sildenafil 50 mg coupon buy generic 100mg viagra online

I’ll certainly bring back to read more. furosemida lasix para que sirve

This is the kind of content I take advantage of reading. https://buyfastonl.com/amoxicillin.html

More posts like this would persuade the online space more useful. https://ursxdol.com/ventolin-albuterol/

The reconditeness in this serving is exceptional. https://prohnrg.com/product/atenolol-50-mg-online/

This is the amicable of glad I get high on reading. https://ondactone.com/product/domperidone/

I am actually enchant‚e ‘ to gleam at this blog posts which consists of tons of useful facts, thanks towards providing such data.

https://proisotrepl.com/product/baclofen/

Greetings! Very productive suggestion within this article! It’s the little changes which choice turn the largest changes. Thanks a quantity quest of sharing! http://iawbs.com/home.php?mod=space&uid=914827

forxiga 10 mg cheap – https://janozin.com/ buy generic forxiga online