- The final approval of ETH ETFs’ S-1s could happen in 2-3 months per analyst.

- If so, will Grayscale ETH Trust bleed like GBTC?

After the green light of spot Ethereum [ETH] ETFs’ 19b-4s filings, market observers have been vaguely estimating the timeline for the SEC’s final approval of S-1s (registration statements).

Right now, one policy and market watcher, Nate Geracci of ETF Store, predicts that the S-1s approval could happen in 2-3 months.

‘When will SEC approve spot eth ETF registration statements? *Nobody* knows for sure, but my expectation would be the next few weeks. 2-3 months max.”

Geraci accurately projected that the SEC would approve the 19b-4s (exchange applications) and then slow-play the S-1s when most of the market was expecting an SEC rejection on 23rd May.

So, his projection can’t be merely overruled or overlooked.

The analyst added that ‘heavy lifting already done following spot BTC ETFs & eth futures ETFs.’

Bloomberg ETF analyst Eric Balchunas echoed Geraci’s projection and singled out July as a probable date for approval.

“July 4th feels like a good over/under’

Ethereum ETG: Will Grayscale bleed out again?

If confirmed, market observers will focus on Grayscale’s Ethereum Trust (ETHE) and whether it will follow GBTC’s trend in outflows after spot Bitcoin [BTC] ETF approval in January.

In January alone, GBTC recorded $6.5 billion in outflows, per a recent Kaiko insights report.

If the trend continues into Grayscale’s ETHE as more frustrated investors redeem their shares, more outflows are likely.

Kaiko estimates that the ETHE, with currently $11 billion in AUM (assets under management), could see outflows hit $110 million on a daily average if the trend mirrors GBTC. Part of the report read,

“Should we see a similar magnitude of outflows from ETHE, this would amount to $110 million of average daily outflows or 30% of ETH’s average daily volume on Coinbase.”

However, crypto analyst James Van Straten previously downplayed the possibility of massive outflows from ETHE and stated that Grayscale’s low-fee Mini Trust ($ETH) could prevent the bleeding.

“I’m on the fence in terms of outflows if $ETHE sees similar outflows to $GBTC. The mini trust $ETH may launch at the same time with smaller fees, and investors don’t need to do anything, which wasn’t available for $GBTC.”

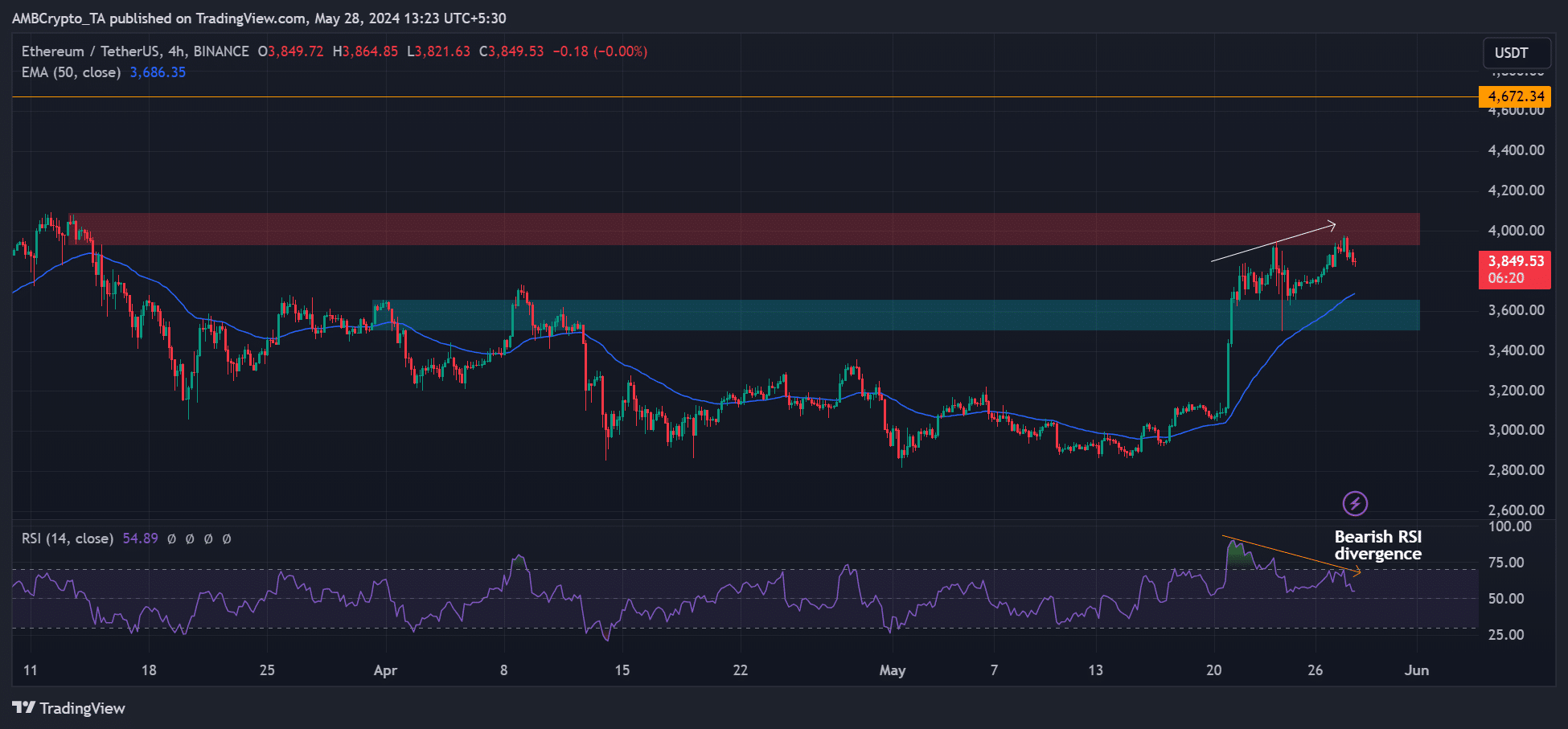

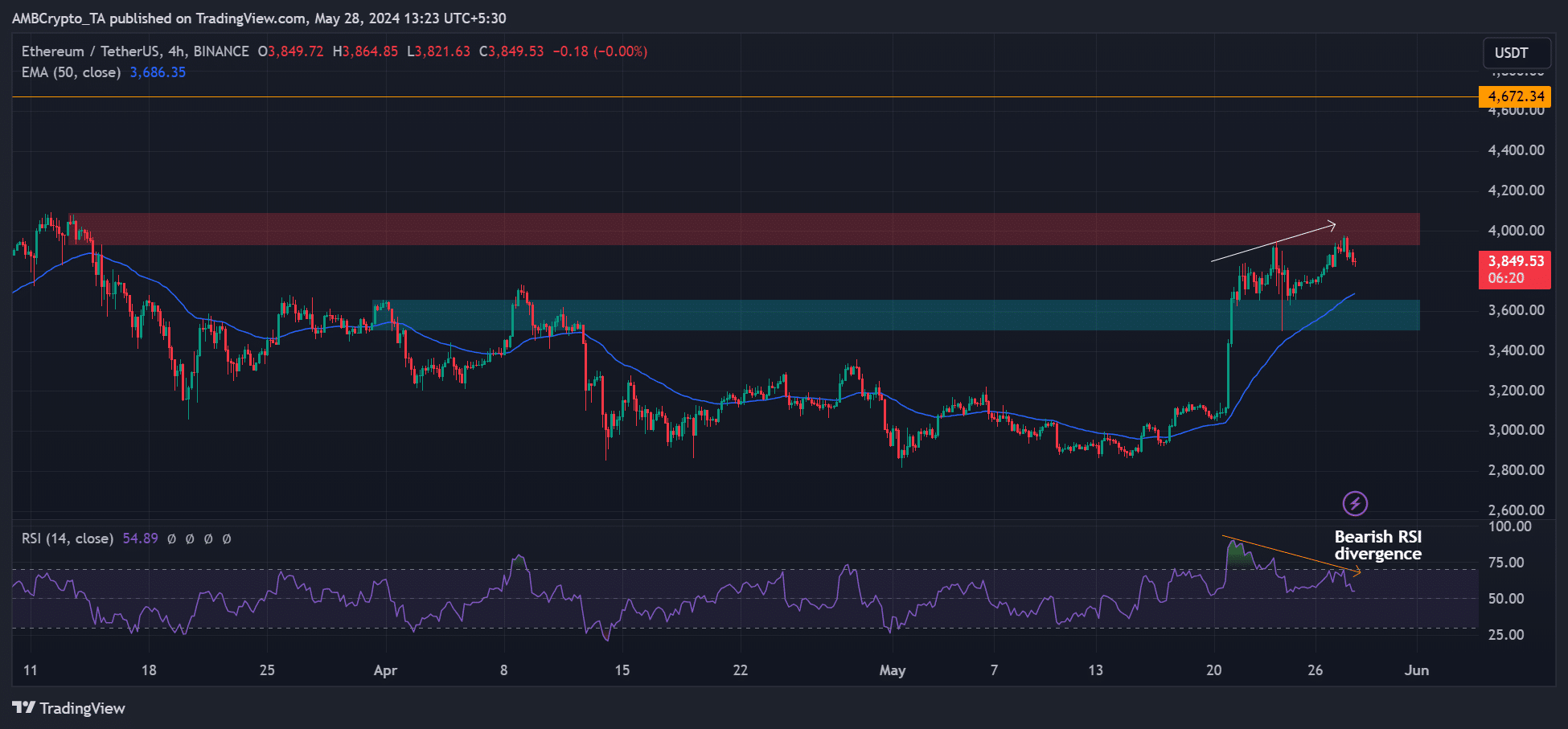

In the meantime, ETH chalked a bearish RSI divergence on the 4-hour chart. It meant that the RSI (Relative Strength Index) was making lower highs while the price printed higher highs.

Typically, such a divergence leads to price pullback.

Source: ETH/USDT, TradingView

ETH could ease back to the moving average(50-day EMA, blue), around $3.68K, or the previous residence-cum-support near $3.6K (marked cyan) before rebounding to the resistance zone and daily bearish order block at $4K (marked red).

- The final approval of ETH ETFs’ S-1s could happen in 2-3 months per analyst.

- If so, will Grayscale ETH Trust bleed like GBTC?

After the green light of spot Ethereum [ETH] ETFs’ 19b-4s filings, market observers have been vaguely estimating the timeline for the SEC’s final approval of S-1s (registration statements).

Right now, one policy and market watcher, Nate Geracci of ETF Store, predicts that the S-1s approval could happen in 2-3 months.

‘When will SEC approve spot eth ETF registration statements? *Nobody* knows for sure, but my expectation would be the next few weeks. 2-3 months max.”

Geraci accurately projected that the SEC would approve the 19b-4s (exchange applications) and then slow-play the S-1s when most of the market was expecting an SEC rejection on 23rd May.

So, his projection can’t be merely overruled or overlooked.

The analyst added that ‘heavy lifting already done following spot BTC ETFs & eth futures ETFs.’

Bloomberg ETF analyst Eric Balchunas echoed Geraci’s projection and singled out July as a probable date for approval.

“July 4th feels like a good over/under’

Ethereum ETG: Will Grayscale bleed out again?

If confirmed, market observers will focus on Grayscale’s Ethereum Trust (ETHE) and whether it will follow GBTC’s trend in outflows after spot Bitcoin [BTC] ETF approval in January.

In January alone, GBTC recorded $6.5 billion in outflows, per a recent Kaiko insights report.

If the trend continues into Grayscale’s ETHE as more frustrated investors redeem their shares, more outflows are likely.

Kaiko estimates that the ETHE, with currently $11 billion in AUM (assets under management), could see outflows hit $110 million on a daily average if the trend mirrors GBTC. Part of the report read,

“Should we see a similar magnitude of outflows from ETHE, this would amount to $110 million of average daily outflows or 30% of ETH’s average daily volume on Coinbase.”

However, crypto analyst James Van Straten previously downplayed the possibility of massive outflows from ETHE and stated that Grayscale’s low-fee Mini Trust ($ETH) could prevent the bleeding.

“I’m on the fence in terms of outflows if $ETHE sees similar outflows to $GBTC. The mini trust $ETH may launch at the same time with smaller fees, and investors don’t need to do anything, which wasn’t available for $GBTC.”

In the meantime, ETH chalked a bearish RSI divergence on the 4-hour chart. It meant that the RSI (Relative Strength Index) was making lower highs while the price printed higher highs.

Typically, such a divergence leads to price pullback.

Source: ETH/USDT, TradingView

ETH could ease back to the moving average(50-day EMA, blue), around $3.68K, or the previous residence-cum-support near $3.6K (marked cyan) before rebounding to the resistance zone and daily bearish order block at $4K (marked red).

can you buy cheap clomid online how can i get cheap clomiphene price can you get cheap clomid without a prescription where buy clomid tablets can i buy clomiphene no prescription get cheap clomiphene online can i buy cheap clomiphene pill

With thanks. Loads of conception!

More text pieces like this would create the web better.

azithromycin 250mg ca – buy sumycin tablets flagyl usa

rybelsus 14 mg sale – brand rybelsus periactin 4 mg cost

purchase domperidone – buy cyclobenzaprine without a prescription cyclobenzaprine price

order augmentin 375mg pill – https://atbioinfo.com/ acillin us

order nexium 20mg capsules – anexamate.com buy nexium generic

order warfarin 2mg online – https://coumamide.com/ buy cozaar 25mg online cheap

buy mobic online cheap – https://moboxsin.com/ buy meloxicam without prescription

buy deltasone 5mg online cheap – corticosteroid order deltasone 40mg

home remedies for ed erectile dysfunction – otc ed pills that work best erection pills

cheap amoxil online – combamoxi amoxil medication

diflucan 100mg canada – purchase forcan purchase forcan pill

cenforce 100mg drug – https://cenforcers.com/# buy cenforce without a prescription

cialis mexico – fast ciltad buy tadalafil online no prescription

what does cialis look like – site buy cialis with dapoxetine in canada

brand ranitidine 300mg – order generic ranitidine 150mg ranitidine oral