- Bitcoin ETFs outperform Ethereum, with BTC inflows surging while ETH ETFs struggle with outflows.

- Bitcoin’s dominance and first-mover advantage reinforce its lead over Ethereum in the ETF market.

Bitcoin [BTC] Exchange Traded Funds (ETFs) have significantly impacted the crypto market, showing strong performance since their launch.

Bitcoin and Ethereum ETF analysis

According to the latest update from Farside Investors, BTC ETFs recorded net inflows of $252 million.

Leading the pack was BlackRock’s IBIT, with $86.8 million in inflows, followed by Fidelity’s FBTC, which saw $64 million.

However, amidst this inflow race, Grayscale’s GBTC faced challenges, recording $35.6 million in outflows as of 23rd August.

On the other hand, Ethereum [ETH] ETFs have struggled, primarily experiencing outflows since their inception. As of 23rd August, ETH ETFs recorded $5.7 million in outflows.

Notably, BlackRock’s ETHA saw zero inflows, while Fidelity’s FETH, Bitwise’s ETHW, and VanEck managed to record some inflows.

However, Grayscale’s ETHE faced significant outflows, recording $9.8 million, surpassing the outflows of all other Ethereum ETFs combined.

Remarking on the same, an X handle with the username- Crypto Crib noted,

“Last week, $ETH spot ETFs had a net outflow of $44 million.$BTC spot ETFs had a net inflow of $506 million.”

Not so surprising!

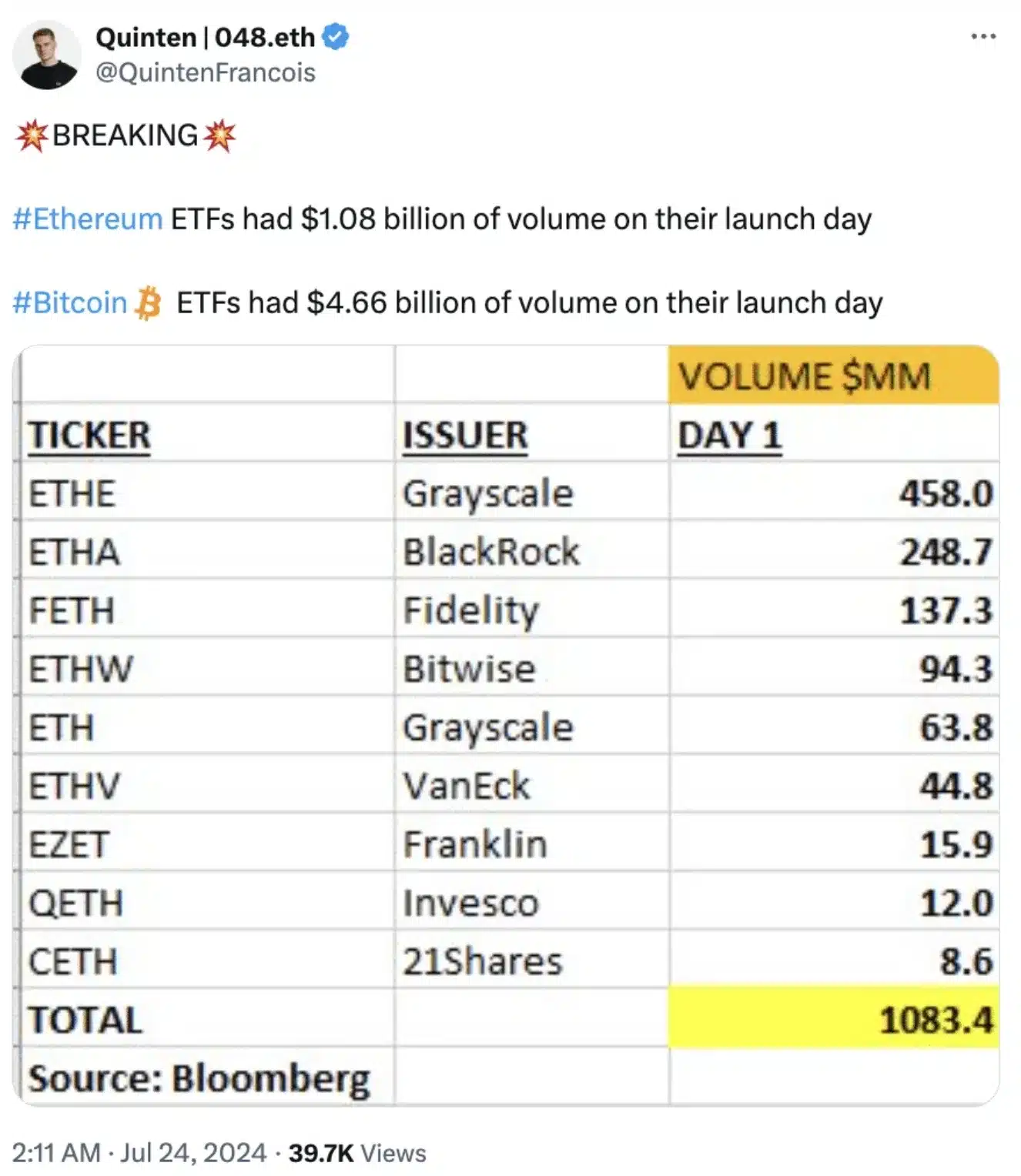

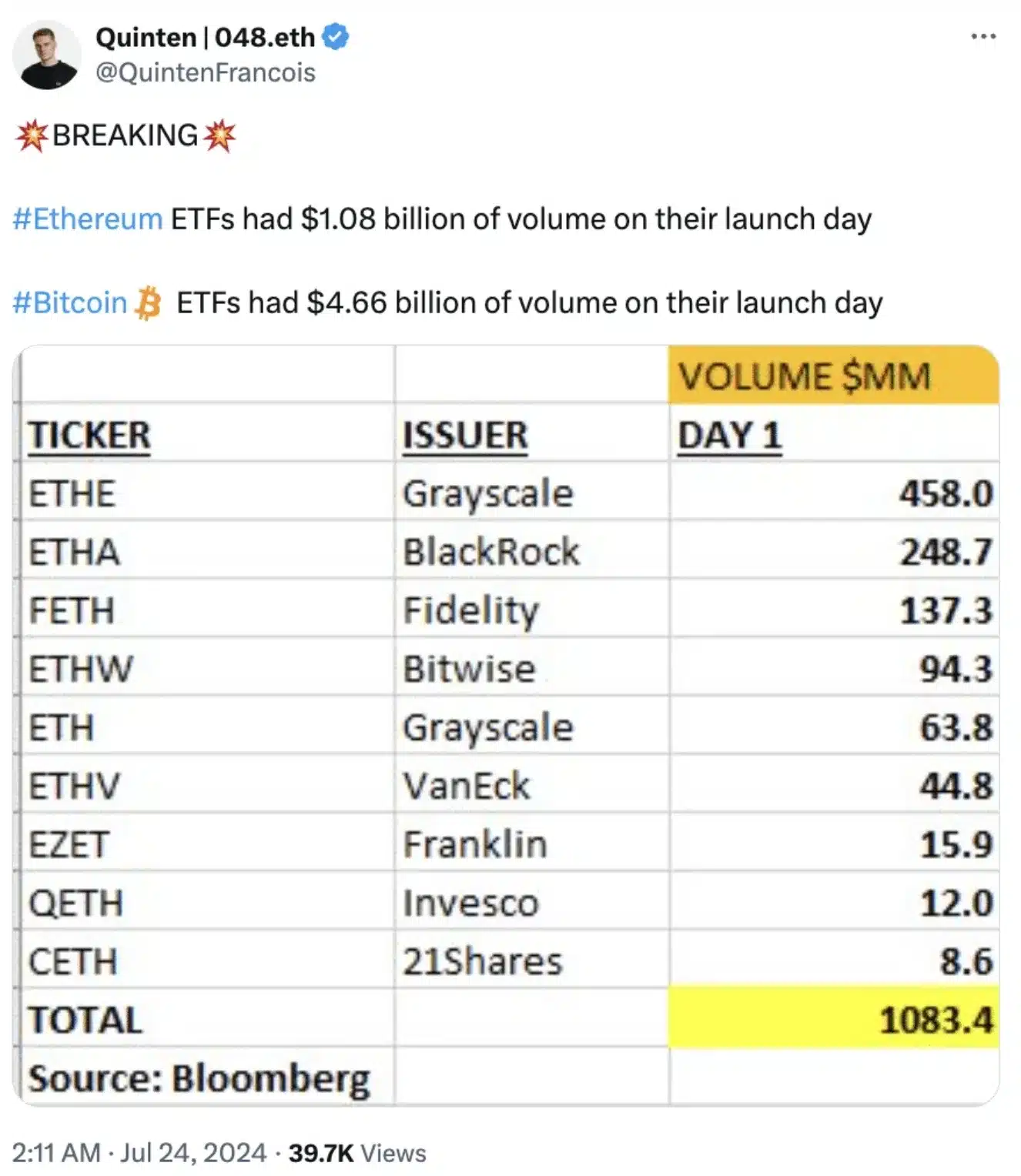

However, this shouldn’t come as a surprise, given that Ethereum ETFs’ trading volumes on their first day were only a quarter of what spot Bitcoin ETFs achieved on their debut.

Source: Quinten/X

The launch of Spot Bitcoin ETFs created significant excitement in the market, setting a high standard that Ethereum ETFs have yet to match.

While Bitcoin ETFs saw impressive trading volumes right from the start, Ethereum ETFs have struggled to generate similar interest, reflecting a more subdued market response and indicating that they have not captured the same level of enthusiasm.

Impact on the token’s prices

That being said, following the launch of Bitcoin ETFs, BTC soared to a new all-time high of $73K in March.

In contrast, Ethereum has faced challenges, struggling to surpass the $3K mark.

As per the latest CoinMarketCap update, ETH was trading at $2,735, falling short of the earlier anticipated $4K level.

What’s behind this?

This divergence could also be attributed to Bitcoin’s established dominance and its first-mover advantage, which has solidified its position as the preferred choice for many traders.

Additionally, Bitcoin’s robust proof-of-work system, often hailed as the pinnacle of decentralization, further strengthens its appeal compared to alternatives like Ethereum.

- Bitcoin ETFs outperform Ethereum, with BTC inflows surging while ETH ETFs struggle with outflows.

- Bitcoin’s dominance and first-mover advantage reinforce its lead over Ethereum in the ETF market.

Bitcoin [BTC] Exchange Traded Funds (ETFs) have significantly impacted the crypto market, showing strong performance since their launch.

Bitcoin and Ethereum ETF analysis

According to the latest update from Farside Investors, BTC ETFs recorded net inflows of $252 million.

Leading the pack was BlackRock’s IBIT, with $86.8 million in inflows, followed by Fidelity’s FBTC, which saw $64 million.

However, amidst this inflow race, Grayscale’s GBTC faced challenges, recording $35.6 million in outflows as of 23rd August.

On the other hand, Ethereum [ETH] ETFs have struggled, primarily experiencing outflows since their inception. As of 23rd August, ETH ETFs recorded $5.7 million in outflows.

Notably, BlackRock’s ETHA saw zero inflows, while Fidelity’s FETH, Bitwise’s ETHW, and VanEck managed to record some inflows.

However, Grayscale’s ETHE faced significant outflows, recording $9.8 million, surpassing the outflows of all other Ethereum ETFs combined.

Remarking on the same, an X handle with the username- Crypto Crib noted,

“Last week, $ETH spot ETFs had a net outflow of $44 million.$BTC spot ETFs had a net inflow of $506 million.”

Not so surprising!

However, this shouldn’t come as a surprise, given that Ethereum ETFs’ trading volumes on their first day were only a quarter of what spot Bitcoin ETFs achieved on their debut.

Source: Quinten/X

The launch of Spot Bitcoin ETFs created significant excitement in the market, setting a high standard that Ethereum ETFs have yet to match.

While Bitcoin ETFs saw impressive trading volumes right from the start, Ethereum ETFs have struggled to generate similar interest, reflecting a more subdued market response and indicating that they have not captured the same level of enthusiasm.

Impact on the token’s prices

That being said, following the launch of Bitcoin ETFs, BTC soared to a new all-time high of $73K in March.

In contrast, Ethereum has faced challenges, struggling to surpass the $3K mark.

As per the latest CoinMarketCap update, ETH was trading at $2,735, falling short of the earlier anticipated $4K level.

What’s behind this?

This divergence could also be attributed to Bitcoin’s established dominance and its first-mover advantage, which has solidified its position as the preferred choice for many traders.

Additionally, Bitcoin’s robust proof-of-work system, often hailed as the pinnacle of decentralization, further strengthens its appeal compared to alternatives like Ethereum.

can you get clomiphene prices can i purchase generic clomiphene without rx order clomid pill how can i get cheap clomid price clomiphene price cvs cost clomid for sale cost clomiphene prices

I couldn’t weather commenting. Warmly written!

More articles like this would pretence of the blogosphere richer.

buy azithromycin 250mg sale – cost ciprofloxacin 500mg buy flagyl 200mg online cheap

buy semaglutide online – buy rybelsus pills for sale cheap periactin 4 mg

cheap domperidone 10mg – order tetracycline 500mg pills buy cyclobenzaprine 15mg for sale

brand amoxiclav – atbioinfo.com acillin brand

buy esomeprazole 20mg generic – anexa mate buy nexium 20mg without prescription

warfarin without prescription – blood thinner order losartan sale

meloxicam canada – https://moboxsin.com/ mobic cheap

deltasone 20mg price – https://apreplson.com/ prednisone 20mg us

ed pills – best ed pills buy ed pills us

amoxil for sale online – combamoxi.com buy generic amoxicillin

purchase diflucan generic – https://gpdifluca.com/ buy diflucan 100mg

buy cenforce cheap – https://cenforcers.com/ cenforce 50mg usa

where can i buy zantac – https://aranitidine.com/ ranitidine over the counter

order generic viagra cialis – https://strongvpls.com/ blue viagra pill 100

This website absolutely has all of the information and facts I needed adjacent to this subject and didn’t comprehend who to ask. https://gnolvade.com/

I am in point of fact thrilled to gleam at this blog posts which consists of tons of profitable facts, thanks towards providing such data. https://ursxdol.com/augmentin-amoxiclav-pill/

The depth in this serving is exceptional. https://prohnrg.com/product/loratadine-10-mg-tablets/