- Ethereum ETF inflows hit a high, but bearish sentiment emerges.

- Futures data highlighted cautious trader sentiment.

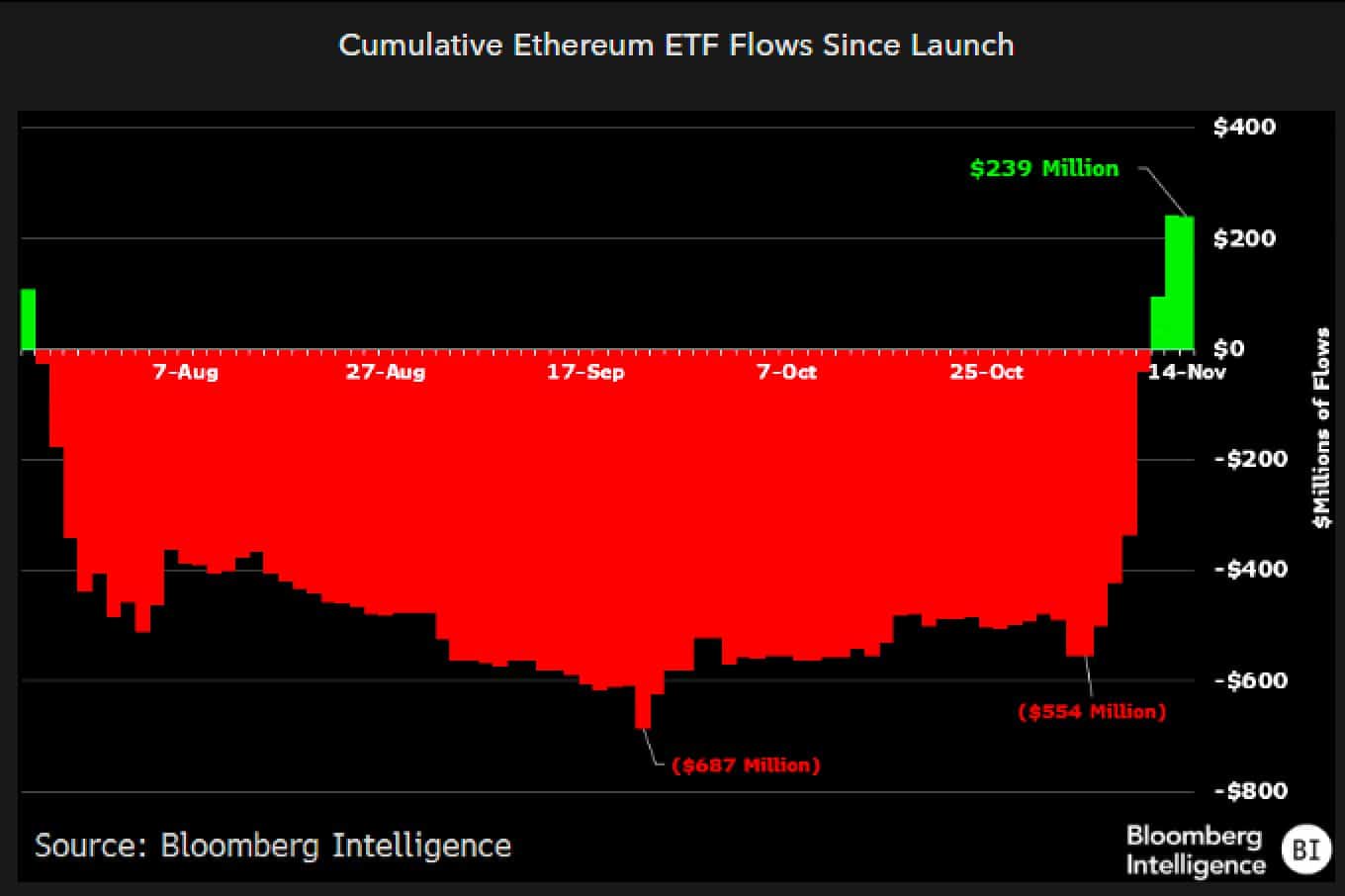

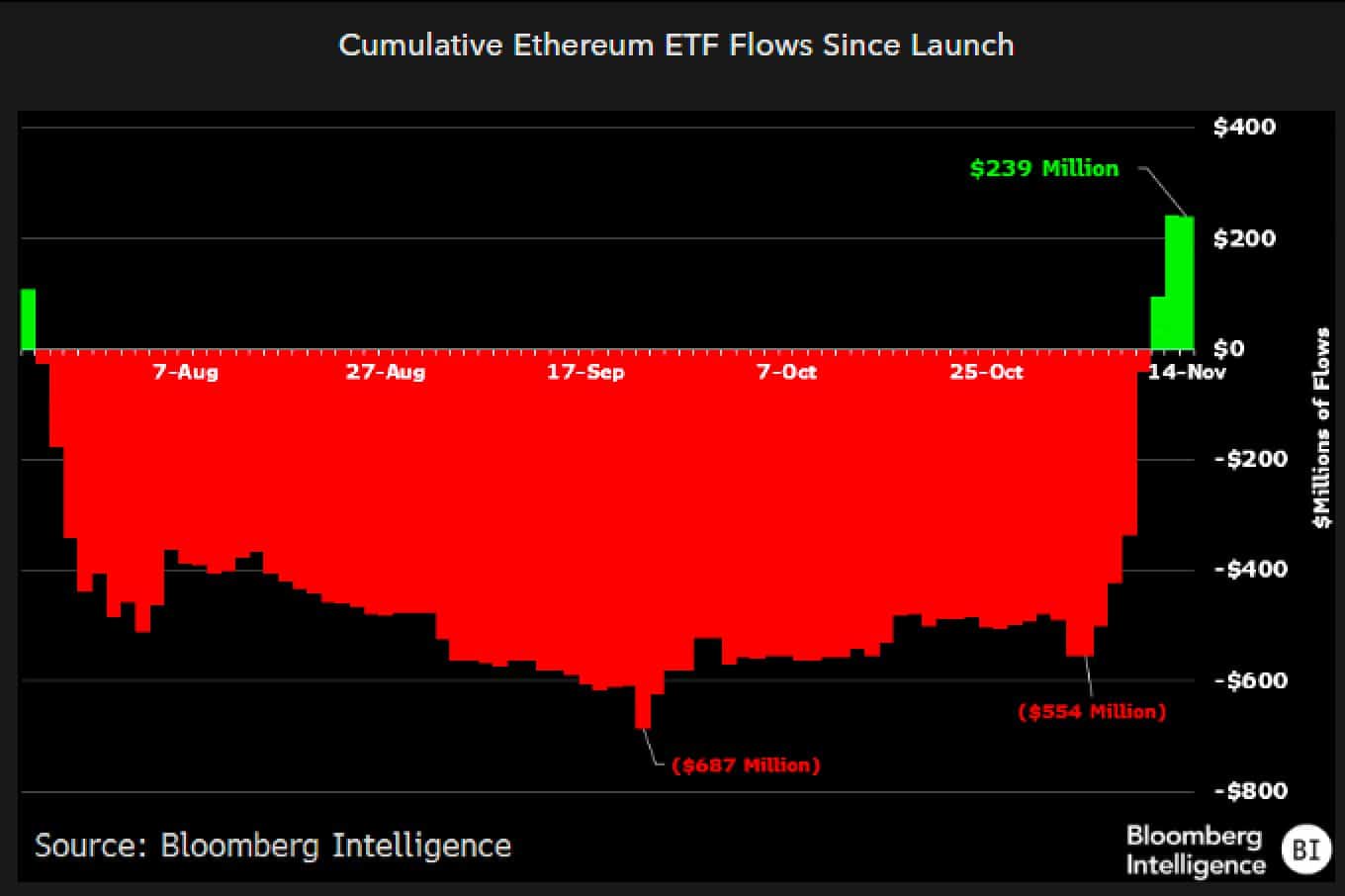

Moonvember has proven to be favorable for Ethereum [ETH] ETFs. In fact, AMBCrypto reported that the ETFs hit a record inflow of $515 million last week.

This milestone didn’t go unnoticed by industry analysts. Eric Balchunas, a senior ETF analyst at Bloomberg, shared the ETF chart on X (formerly Twitter), showcasing a remarkable transition from red to green.

Source: Eric Balchunas/X

He highlighted this as a significant recovery for ETH ETFs, noting that the dramatic turnaround came after a prolonged period of persistent outflows.

Post-election optimism fuels Ethereum ETFs

It is not unknown that the crypto market has surged since Donald Trump’s victory in the 2024 U.S. presidential elections. Analysts suggest this has acted as a catalyst for renewed investor enthusiasm in ETH ETFs.

As Bloomberg ETF analyst James Seyffart put it in an X post,

“Ethereum ETF data will need to be discussed like BC and AD times. Before Trump’s Election & After Trump’s Election, BE & AE.”

Balchunas offered another perspective, describing the recent activity as,

“Beta with a side of bitcoin is how I’d best describe the flows over the past week, since the Election and really for the whole year.”

Despite the market showing signs of being somewhat overextended, the exec believes that ETF investors continue to exhibit a notably optimistic and bullish outlook.

ETH ETF flows face a red tide

Even with the staggering inflow milestone last week, Ethereum ETF flows seem to have taken the opposite path.

Data from SoSo Value revealed net outflows in the final days of last week, with $3.24 million on the 14th of November and $59.87 million on the 15th of November.

The trend continued into this week, with the 18th of November seeing another $39.08 million in outflows. Among the nine ETFs, only Fidelity’s FETH managed to post inflows.

Meanwhile, the top three ETFs saw outflows, while others saw no flows at all.

If this trend persists, it would mark the first time since early November that ETH ETFs end a week in the red—a sharp contrast to the optimism seen earlier.

ETH faces pressure

Meanwhile, Ethereum’s price rally, which initially followed the election buzz, appears to have run out of steam. After briefly crossing $3,400, ETH has since retreated.

At press time, the altcoin exchanged hands at $3,116.66—a 6.33% drop over the past week and a modest 0.06% dip in the last 24 hours, per CoinMarketCap data.

Futures market data from Coinglass painted a mixed picture. Trading activity was heating up, with a 57.77% surge in volume.

However, Open Interest increased by just 0.76%, suggesting that traders remained hesitant to commit. The Long/Short ratio of 0.9535 over the past 24 hours leaned slightly bearish, reflecting growing uncertainty.

Read Ethereum’s [ETH] Price Prediction 2024–2025

While Ethereum ETFs have grabbed headlines for their impressive inflows, the emerging patterns of outflows and price corrections hint at a market that may be bracing for a cooldown.

The question now is whether this moment of bullishness is a fleeting spark—or the start of a longer trend.

- Ethereum ETF inflows hit a high, but bearish sentiment emerges.

- Futures data highlighted cautious trader sentiment.

Moonvember has proven to be favorable for Ethereum [ETH] ETFs. In fact, AMBCrypto reported that the ETFs hit a record inflow of $515 million last week.

This milestone didn’t go unnoticed by industry analysts. Eric Balchunas, a senior ETF analyst at Bloomberg, shared the ETF chart on X (formerly Twitter), showcasing a remarkable transition from red to green.

Source: Eric Balchunas/X

He highlighted this as a significant recovery for ETH ETFs, noting that the dramatic turnaround came after a prolonged period of persistent outflows.

Post-election optimism fuels Ethereum ETFs

It is not unknown that the crypto market has surged since Donald Trump’s victory in the 2024 U.S. presidential elections. Analysts suggest this has acted as a catalyst for renewed investor enthusiasm in ETH ETFs.

As Bloomberg ETF analyst James Seyffart put it in an X post,

“Ethereum ETF data will need to be discussed like BC and AD times. Before Trump’s Election & After Trump’s Election, BE & AE.”

Balchunas offered another perspective, describing the recent activity as,

“Beta with a side of bitcoin is how I’d best describe the flows over the past week, since the Election and really for the whole year.”

Despite the market showing signs of being somewhat overextended, the exec believes that ETF investors continue to exhibit a notably optimistic and bullish outlook.

ETH ETF flows face a red tide

Even with the staggering inflow milestone last week, Ethereum ETF flows seem to have taken the opposite path.

Data from SoSo Value revealed net outflows in the final days of last week, with $3.24 million on the 14th of November and $59.87 million on the 15th of November.

The trend continued into this week, with the 18th of November seeing another $39.08 million in outflows. Among the nine ETFs, only Fidelity’s FETH managed to post inflows.

Meanwhile, the top three ETFs saw outflows, while others saw no flows at all.

If this trend persists, it would mark the first time since early November that ETH ETFs end a week in the red—a sharp contrast to the optimism seen earlier.

ETH faces pressure

Meanwhile, Ethereum’s price rally, which initially followed the election buzz, appears to have run out of steam. After briefly crossing $3,400, ETH has since retreated.

At press time, the altcoin exchanged hands at $3,116.66—a 6.33% drop over the past week and a modest 0.06% dip in the last 24 hours, per CoinMarketCap data.

Futures market data from Coinglass painted a mixed picture. Trading activity was heating up, with a 57.77% surge in volume.

However, Open Interest increased by just 0.76%, suggesting that traders remained hesitant to commit. The Long/Short ratio of 0.9535 over the past 24 hours leaned slightly bearish, reflecting growing uncertainty.

Read Ethereum’s [ETH] Price Prediction 2024–2025

While Ethereum ETFs have grabbed headlines for their impressive inflows, the emerging patterns of outflows and price corrections hint at a market that may be bracing for a cooldown.

The question now is whether this moment of bullishness is a fleeting spark—or the start of a longer trend.

![Ethereum [ETH] could stumble near $2000 despite bullish momentum, here’s why](https://coininsights.com/wp-content/uploads/2023/04/PP-3-ETH-price.png)

Чтобы не прерывать игру из-за блокировок, используйте зеркало зенитбет. Все просто и надежно.

can i get clomiphene without rx how to get cheap clomiphene without prescription can i purchase cheap clomid prices buying generic clomiphene without dr prescription cost of clomid without insurance clomid generic brand can i purchase cheap clomid without a prescription

This website absolutely has all of the low-down and facts I needed about this thesis and didn’t positive who to ask.

order zithromax 500mg – order ciprofloxacin 500 mg generic buy flagyl 200mg online

semaglutide 14 mg usa – order rybelsus 14 mg without prescription order cyproheptadine online

motilium 10mg generic – motilium 10mg cost where to buy cyclobenzaprine without a prescription

augmentin 375mg usa – at bio info ampicillin pill

nexium pills – https://anexamate.com/ order esomeprazole for sale

warfarin 2mg generic – coumamide.com losartan for sale online

oral meloxicam 15mg – relieve pain order meloxicam pills

deltasone 40mg tablet – https://apreplson.com/ prednisone 40mg pill

otc ed pills that work – https://fastedtotake.com/ non prescription erection pills

amoxicillin pill – https://combamoxi.com/ purchase amoxil

forcan tablet – click buy diflucan generic

escitalopram 10mg pills – site lexapro online order

cenforce price – click cenforce uk

how to get cialis without doctor – on this site cialis online overnight shipping

zantac canada – https://aranitidine.com/ buy zantac sale

buy generic viagra online overnight – https://strongvpls.com/# buy viagra cheap online uk

More posts like this would make the blogosphere more useful. buy neurontin 800mg generic

I’ll certainly bring back to read more. https://gnolvade.com/

This is a topic which is virtually to my verve… Numberless thanks! Unerringly where can I lay one’s hands on the contact details due to the fact that questions? https://ursxdol.com/prednisone-5mg-tablets/

This is the stripe of serenity I get high on reading. https://prohnrg.com/product/metoprolol-25-mg-tablets/

Palatable blog you have here.. It’s obdurate to assign elevated calibre article like yours these days. I justifiably comprehend individuals like you! Take guardianship!! https://aranitidine.com/fr/levitra_francaise/

Thanks on sharing. It’s first quality. https://ondactone.com/product/domperidone/

Facts blog you procure here.. It’s obdurate to assign strong worth article like yours these days. I justifiably recognize individuals like you! Take care!!

order hyzaar online cheap

This is the make of advise I turn up helpful. http://www.zgqsz.com/home.php?mod=space&uid=847619

dapagliflozin drug – https://janozin.com/# order dapagliflozin online cheap

orlistat generic – https://asacostat.com/ orlistat 120mg price

More posts like this would persuade the online time more useful. http://bbs.51pinzhi.cn/home.php?mod=space&uid=7112146