- New data indicated that the likelihood of approval of Ethereum ETFs was relatively high.

- Ethereum lost market share to Solana, however, the price of ETH continued to surge.

Ethereum [ETH] has been under a lot of heat due to the rising speculations around the dismissal of the approval of Ethereum ETFs.

Uncertainty around ETFs

While there is uncertainty regarding timely approval due to the SEC’s silence, it’s a matter of when, not if, a U.S. spot ETH ETF will be approved, according to Coinbase’s data.

However, potential justifications for disapproval may stem from differences between Ethereum and Bitcoin [BTC], particularly Ethereum’s proof-of-stake mechanism.

Clear regulatory guidance on asset staking is lacking, making it unlikely that spot ETH ETFs enabling staking will be approved soon. Despite this, it is believed that unstaked ETH should not be impacted.

There is potential for a positive surprise in the approval decision, with odds estimated around 30-40%.

Considering crypto’s emergence as an election issue, the SEC may hesitate to deny approval, and litigation could overturn a rejection.

Additionally, not all spot ETH ETF applications need to be approved simultaneously, as noted by Commissioner Uyeda’s statement regarding spot BTC ETF approval.

Stiff competition

Even though the possibility of approval of Ethereum ETF’s was high, there were some other challenges that the Ethereum network would be facing. Especially, competition from other Layer 1 chains.

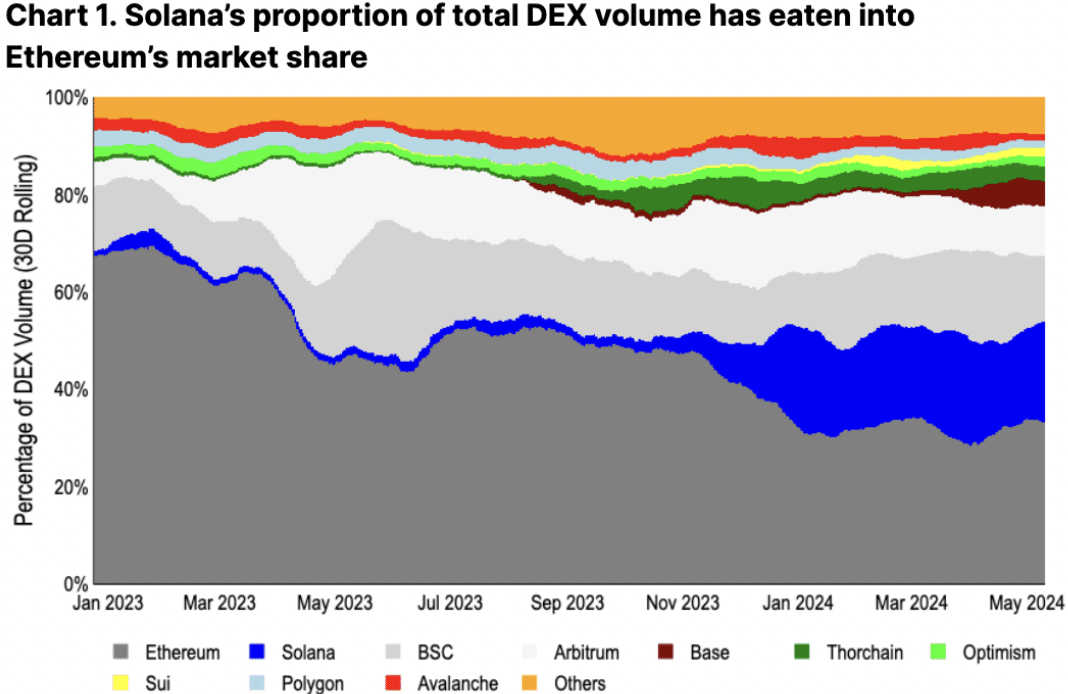

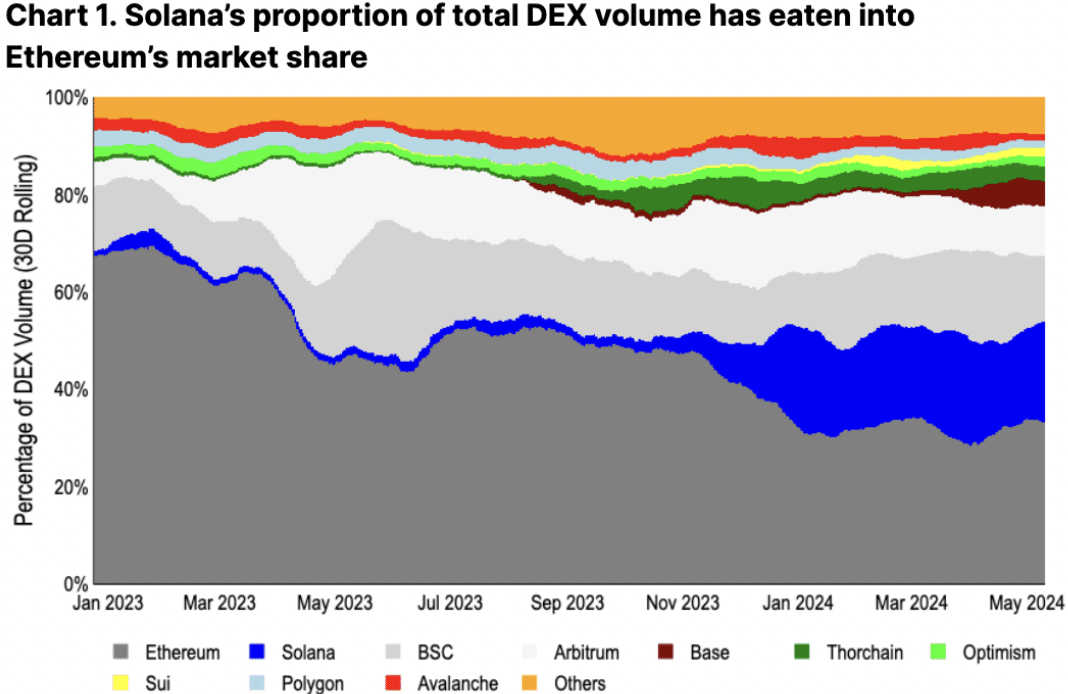

In terms of adoption, the emergence of highly scalable integrated chains, especially Solana [SOL], seems to be impacting Ethereum’s dominance.

With its ability to handle a large number of transactions at low fees, Solana has shifted the focus of trading activity away from the Ethereum mainnet.

Over the past year, Solana’s ecosystem has seen remarkable growth, increasing its share of decentralized exchange (DEX) volume from just 2% to 21%.

Source: Coinbase

Moreover, the increasing popularity of memecoins on the Solana network are also driving users away from Ethereum and towards Solana.

Read Ethereum’s [ETH] Price Prediction 2024-25

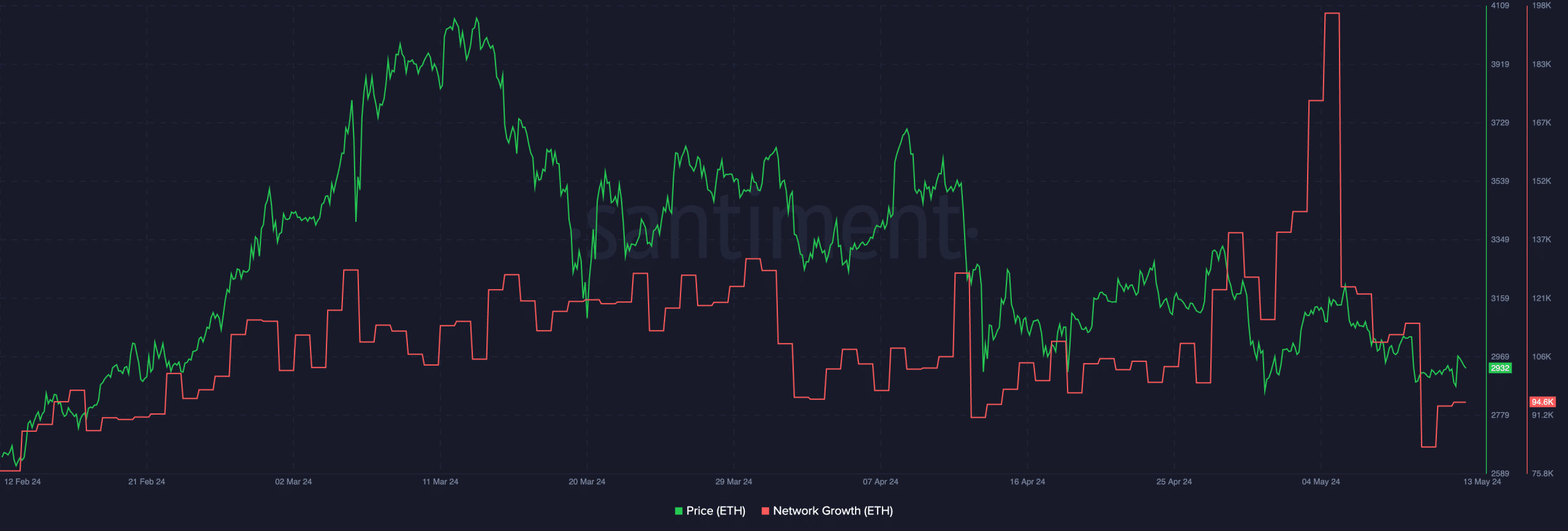

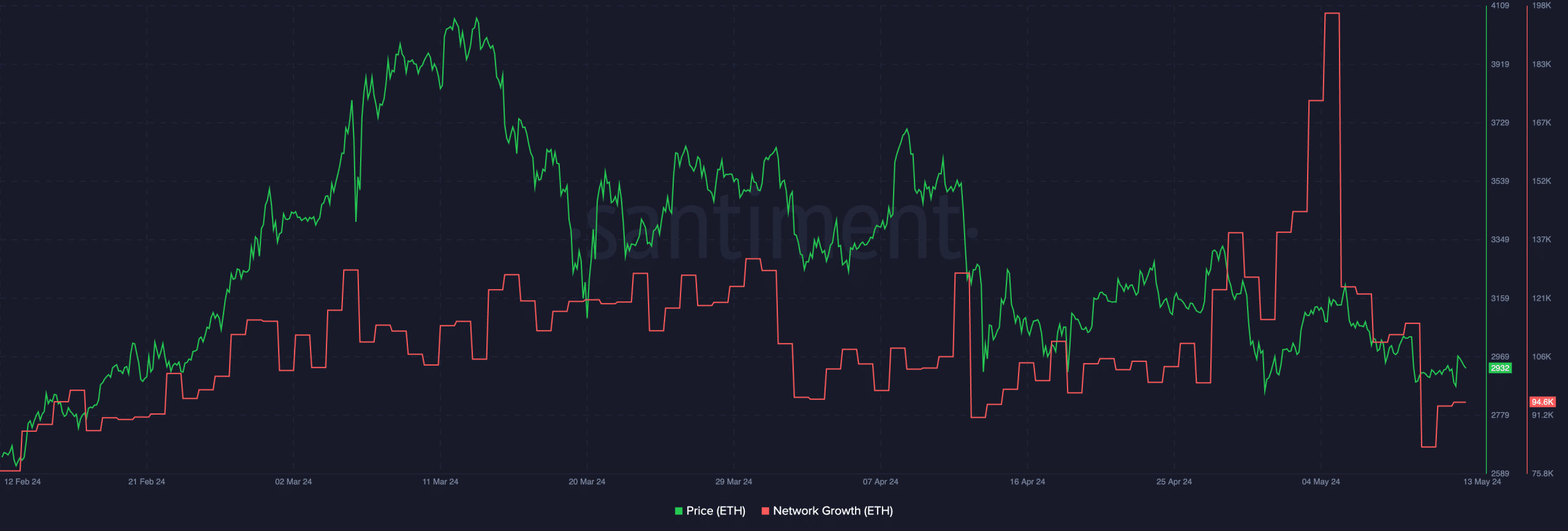

Despite these factors, the price of ETH has seen some positive movement. At press time, ETH was trading at $3,117.82 which was a result of a 2.11% appreciation in the last 24 hours.

Even though the price of ETH was rising, its Network Growth declined, indicating waning interest from new users.

Source: Santiment

- New data indicated that the likelihood of approval of Ethereum ETFs was relatively high.

- Ethereum lost market share to Solana, however, the price of ETH continued to surge.

Ethereum [ETH] has been under a lot of heat due to the rising speculations around the dismissal of the approval of Ethereum ETFs.

Uncertainty around ETFs

While there is uncertainty regarding timely approval due to the SEC’s silence, it’s a matter of when, not if, a U.S. spot ETH ETF will be approved, according to Coinbase’s data.

However, potential justifications for disapproval may stem from differences between Ethereum and Bitcoin [BTC], particularly Ethereum’s proof-of-stake mechanism.

Clear regulatory guidance on asset staking is lacking, making it unlikely that spot ETH ETFs enabling staking will be approved soon. Despite this, it is believed that unstaked ETH should not be impacted.

There is potential for a positive surprise in the approval decision, with odds estimated around 30-40%.

Considering crypto’s emergence as an election issue, the SEC may hesitate to deny approval, and litigation could overturn a rejection.

Additionally, not all spot ETH ETF applications need to be approved simultaneously, as noted by Commissioner Uyeda’s statement regarding spot BTC ETF approval.

Stiff competition

Even though the possibility of approval of Ethereum ETF’s was high, there were some other challenges that the Ethereum network would be facing. Especially, competition from other Layer 1 chains.

In terms of adoption, the emergence of highly scalable integrated chains, especially Solana [SOL], seems to be impacting Ethereum’s dominance.

With its ability to handle a large number of transactions at low fees, Solana has shifted the focus of trading activity away from the Ethereum mainnet.

Over the past year, Solana’s ecosystem has seen remarkable growth, increasing its share of decentralized exchange (DEX) volume from just 2% to 21%.

Source: Coinbase

Moreover, the increasing popularity of memecoins on the Solana network are also driving users away from Ethereum and towards Solana.

Read Ethereum’s [ETH] Price Prediction 2024-25

Despite these factors, the price of ETH has seen some positive movement. At press time, ETH was trading at $3,117.82 which was a result of a 2.11% appreciation in the last 24 hours.

Even though the price of ETH was rising, its Network Growth declined, indicating waning interest from new users.

Source: Santiment

buy generic clomid price how can i get clomid without prescription where buy generic clomiphene clomiphene sleep apnea clomid price generic clomid how can i get cheap clomiphene pill

This is the kind of delivery I turn up helpful.

This is a question which is near to my verve… Numberless thanks! Quite where can I notice the contact details an eye to questions?

oral azithromycin 250mg – order ofloxacin 400mg pill purchase metronidazole pill

semaglutide 14mg canada – buy cyproheptadine generic buy cyproheptadine 4 mg pills

buy domperidone 10mg pills – motilium 10mg price buy generic flexeril 15mg

esomeprazole 20mg oral – nexiumtous purchase nexium for sale

buy coumadin – https://coumamide.com/ cozaar 25mg canada

buy mobic 7.5mg without prescription – https://moboxsin.com/ meloxicam 15mg for sale

order prednisone 10mg without prescription – corticosteroid deltasone over the counter

otc ed pills – fast ed to take site blue pill for ed

buy amoxicillin pill – comba moxi cheap amoxil pills

order fluconazole pills – this generic diflucan 100mg

escitalopram for sale – escita pro escitalopram where to buy

cenforce order online – https://cenforcers.com/# cenforce 50mg pills

buy tadalafil online no prescription – https://ciltadgn.com/# buy cialis/canada

cialis free trial phone number – strong tadafl how long does it take cialis to start working

where to buy zantac without a prescription – buy zantac 150mg online purchase zantac

viagra buy over counter – https://strongvpls.com/ cheap viagra alternative

More posts like this would make the online elbow-room more useful. https://buyfastonl.com/

This is the kind of advise I find helpful. https://ursxdol.com/cenforce-100-200-mg-ed/

This is a topic which is forthcoming to my verve… Numberless thanks! Faithfully where can I notice the acquaintance details for questions? https://prohnrg.com/product/metoprolol-25-mg-tablets/

I couldn’t turn down commenting. Adequately written! https://ondactone.com/spironolactone/

Thanks an eye to sharing. It’s first quality.

https://doxycyclinege.com/pro/topiramate/

More posts like this would prosper the blogosphere more useful. https://www.forum-joyingauto.com/member.php?action=profile&uid=48098

purchase dapagliflozin – this buy forxiga pills

buy generic xenical over the counter – https://asacostat.com/# orlistat 120mg brand

The depth in this ruined is exceptional. https://www.forum-joyingauto.com/member.php?action=profile&uid=49442