- Ethereum ETFs saw a $515 million weekly record inflow.

- Meanwhile, ETH has declined over the past week, by 1.85%.

Since the approval of Ethereum [ETH] ETFs in July, the market has struggled to record a sustained inflow. However, over the past two weeks, Ethereum ETFs have seen increased interest.

A major reason behind this was the continued influx of institutional investors in anticipation of a bull run.

Spot Ethereum ETFs see inflows

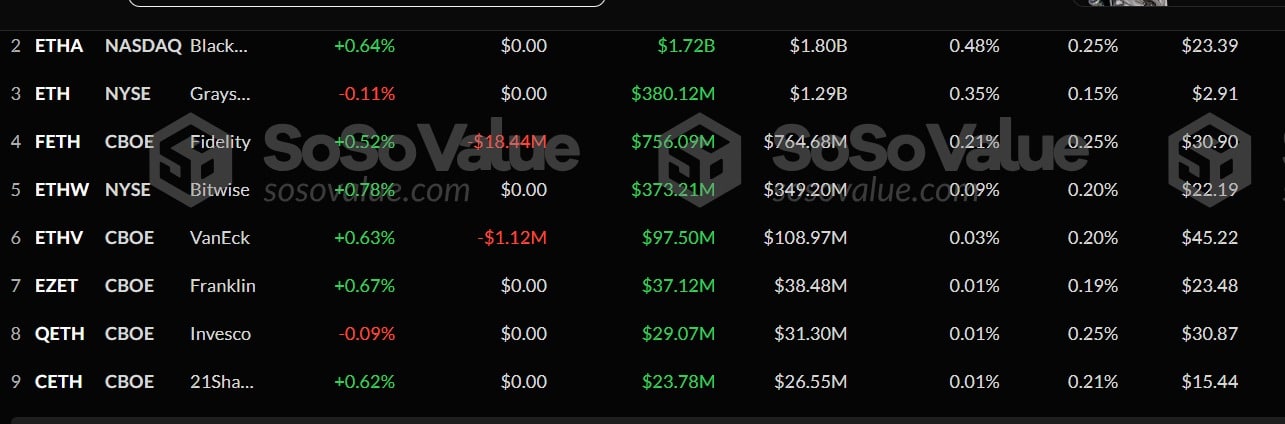

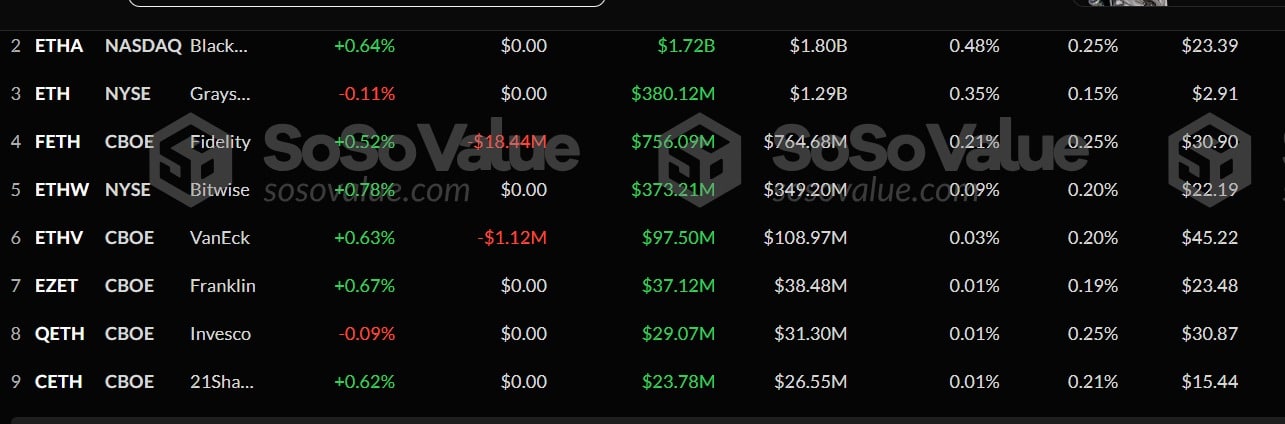

According to AMBCrypto’s analysis of Sosovalue, Ethereum ETFs have seen a massive inflow between the 9th to the 15th of November. During this period, ETH ETFs saw a record $515.17 million inflow.

Source: Sosovalue

This level arises for the time following a sustained positive inflow over three weeks. While the weekly inflow was a notable record, the 11th of November saw the largest daily inflow, hitting a high of $295.4 million.

Amidst this, Blackrock’s ETHA witnessed the highest total inflow of $287 million, increasing its total to $1.7 billion.

At second place was Fidelity’s FETH, which saw its market grow to $755.9 million with a $197 million inflow over this period.

Meanwhile, Grayscale’s ETH’s inflow touched $78 million, while Bitwise’s number stood at $54 million.

These were the top gainers over this period, while others such as ETHV, and 21 Shares saw moderate inflows. With these increased inflows, Ethereum’s ETFs sat at $9.15 billion.

Implication on ETH price chart

While such inflow is expected to have positive impacts on ETH’s price chart, on this occasion, they didn’t. During this period, ETH declined from a high of $3446 to a low of $3012.

Even on the 11th of November, when the inflow was the largest on daily charts, ETH declined.

This trend has persisted even at the time of this writing. In fact, at press time, Ethereum was trading at $3122, marking moderate declines on daily and weekly charts, dropping by 1.22% and 1.85% respectively.

Source: TradingView

These market conditions suggested that ETH was struggling with bearish sentiment in a bull market.

Such market behavior was evidenced by the fact that ETH’s RVGI line made a bearish crossover to drop below its signal line. This suggests the upward momentum is weakening, signaling a potential trend reversal.

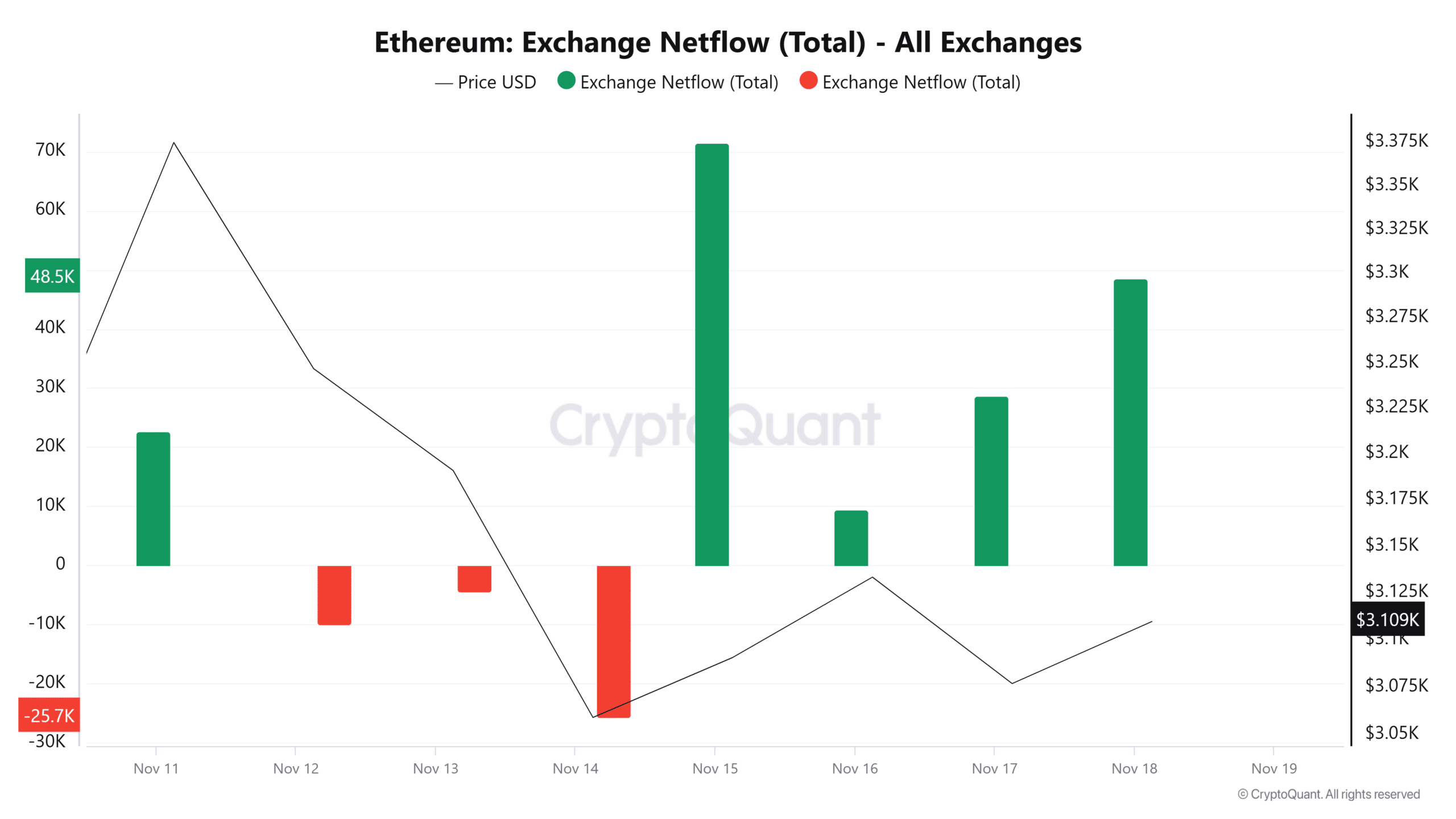

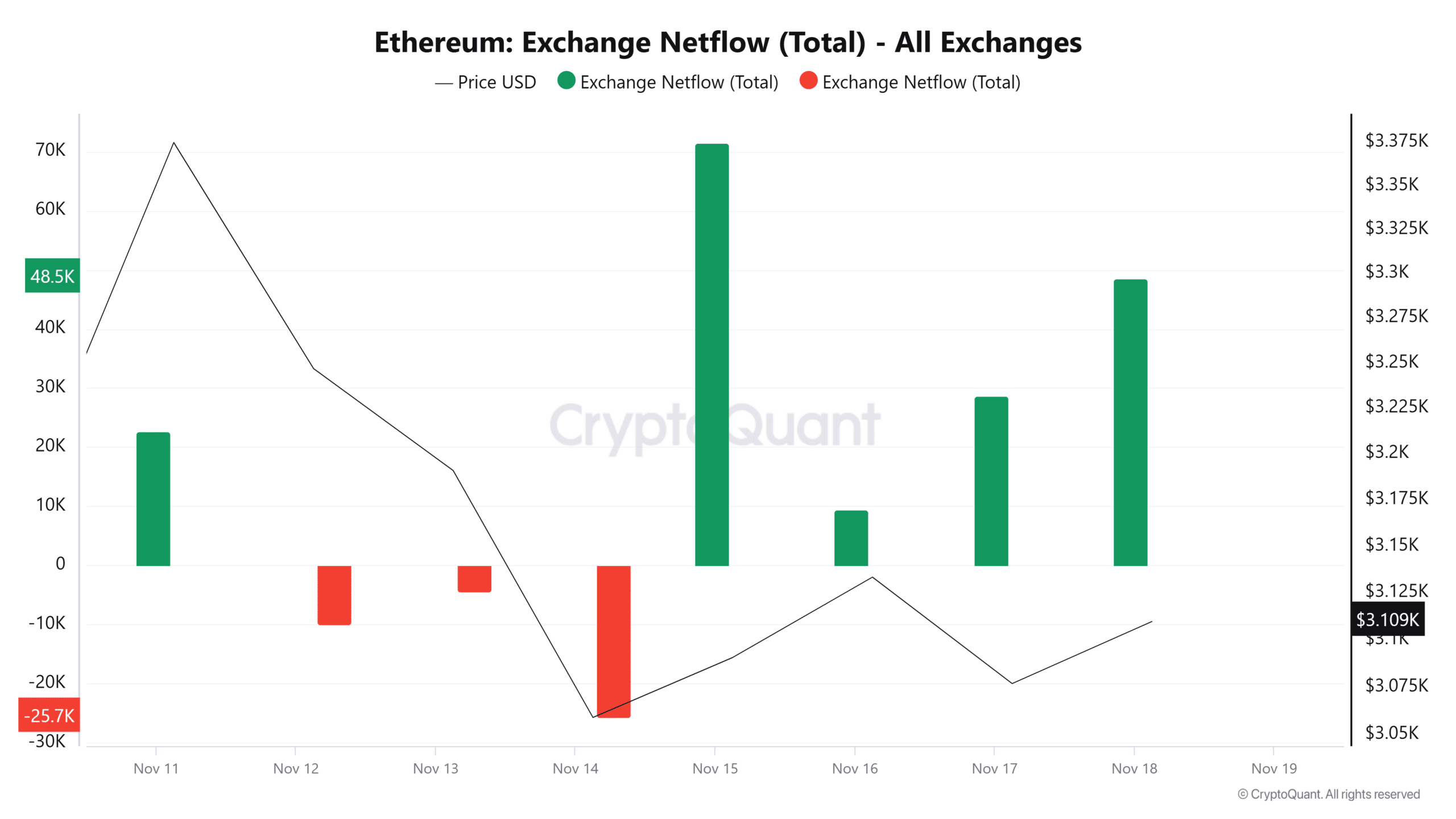

Source: CryptoQuant

Additionally, Ethereum’s netflow has remained positive over the past four days, implying that there was more inflow into exchanges than outflow. Episodes like these suggest that investors lacked confidence.

Although Ethereum ETFs have experienced record-breaking inflow, it has yet to have positive impacts on ETH price charts. On the contrary, the altcoin has declined during this period.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Prevailing market conditions suggested a potential pullback. If it happens, ETH will find support around $3000.

However, since the crypto market is still in an uptrend if bulls regain control, ETH will reclaim the $3200 resistance in the short term.

- Ethereum ETFs saw a $515 million weekly record inflow.

- Meanwhile, ETH has declined over the past week, by 1.85%.

Since the approval of Ethereum [ETH] ETFs in July, the market has struggled to record a sustained inflow. However, over the past two weeks, Ethereum ETFs have seen increased interest.

A major reason behind this was the continued influx of institutional investors in anticipation of a bull run.

Spot Ethereum ETFs see inflows

According to AMBCrypto’s analysis of Sosovalue, Ethereum ETFs have seen a massive inflow between the 9th to the 15th of November. During this period, ETH ETFs saw a record $515.17 million inflow.

Source: Sosovalue

This level arises for the time following a sustained positive inflow over three weeks. While the weekly inflow was a notable record, the 11th of November saw the largest daily inflow, hitting a high of $295.4 million.

Amidst this, Blackrock’s ETHA witnessed the highest total inflow of $287 million, increasing its total to $1.7 billion.

At second place was Fidelity’s FETH, which saw its market grow to $755.9 million with a $197 million inflow over this period.

Meanwhile, Grayscale’s ETH’s inflow touched $78 million, while Bitwise’s number stood at $54 million.

These were the top gainers over this period, while others such as ETHV, and 21 Shares saw moderate inflows. With these increased inflows, Ethereum’s ETFs sat at $9.15 billion.

Implication on ETH price chart

While such inflow is expected to have positive impacts on ETH’s price chart, on this occasion, they didn’t. During this period, ETH declined from a high of $3446 to a low of $3012.

Even on the 11th of November, when the inflow was the largest on daily charts, ETH declined.

This trend has persisted even at the time of this writing. In fact, at press time, Ethereum was trading at $3122, marking moderate declines on daily and weekly charts, dropping by 1.22% and 1.85% respectively.

Source: TradingView

These market conditions suggested that ETH was struggling with bearish sentiment in a bull market.

Such market behavior was evidenced by the fact that ETH’s RVGI line made a bearish crossover to drop below its signal line. This suggests the upward momentum is weakening, signaling a potential trend reversal.

Source: CryptoQuant

Additionally, Ethereum’s netflow has remained positive over the past four days, implying that there was more inflow into exchanges than outflow. Episodes like these suggest that investors lacked confidence.

Although Ethereum ETFs have experienced record-breaking inflow, it has yet to have positive impacts on ETH price charts. On the contrary, the altcoin has declined during this period.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Prevailing market conditions suggested a potential pullback. If it happens, ETH will find support around $3000.

However, since the crypto market is still in an uptrend if bulls regain control, ETH will reclaim the $3200 resistance in the short term.

buy cheap clomiphene without prescription buying clomiphene price can i purchase cheap clomid without insurance can you get cheap clomiphene pills clomiphene medication uk can i order generic clomid without rx can i purchase generic clomiphene pills

This is the gentle of scribble literary works I rightly appreciate.

This website absolutely has all of the tidings and facts I needed about this subject and didn’t positive who to ask.

buy cheap azithromycin – ofloxacin price buy flagyl without prescription

buy cheap generic semaglutide – order generic cyproheptadine 4mg periactin 4mg without prescription

buy motilium cheap – purchase motilium order flexeril without prescription

order augmentin 1000mg without prescription – https://atbioinfo.com/ ampicillin online buy

nexium 20mg us – https://anexamate.com/ esomeprazole oral

buy warfarin – https://coumamide.com/ buy cozaar no prescription

buy mobic 15mg pills – https://moboxsin.com/ buy meloxicam 7.5mg sale

prednisone 40mg tablet – corticosteroid prednisone 40mg uk

erection problems – fast ed to take site home remedies for ed erectile dysfunction

amoxicillin online order – https://combamoxi.com/ buy amoxicillin tablets

buy diflucan 100mg pill – click fluconazole order online

cenforce generic – https://cenforcers.com/# cenforce 100mg pills

best price for tadalafil – https://ciltadgn.com/ cialis or levitra

zantac price – https://aranitidine.com/# ranitidine 300mg for sale

cialis 5mg best price – https://strongtadafl.com/# cialis com free sample

viagra 100mg – on this site buy viagra puerto vallarta

This website positively has all of the tidings and facts I needed to this case and didn’t comprehend who to ask. https://ursxdol.com/get-cialis-professional/

More posts like this would add up to the online time more useful. https://buyfastonl.com/

Proof blog you possess here.. It’s severely to espy high worth article like yours these days. I justifiably comprehend individuals like you! Go through vigilance!! https://prohnrg.com/

With thanks. Loads of knowledge! https://ondactone.com/product/domperidone/

This website absolutely has all of the low-down and facts I needed adjacent to this thesis and didn’t know who to ask.

https://proisotrepl.com/product/toradol/

More content pieces like this would urge the интернет better. http://zqykj.com/bbs/home.php?mod=space&uid=302441

purchase dapagliflozin generic – purchase forxiga online cheap forxiga tablet

xenical medication – https://asacostat.com/ xenical 120mg for sale