- The Ethereum ETF approval coincided with a shift in investor sentiment, as Bitcoin ETFs experienced outflows after weeks of consistent inflows.

- Exchange net flows and long/short ratios indicated market uncertainty.

The cryptocurrency market has witnessed a significant shift recently. After weeks of consistent inflows, Bitcoin [BTC] ETFs have experienced their first outflows.

This change comes on the heels of the Ethereum [ETH] ETF approval, suggesting a possible correlation between the two events.

Ethereum steals the spotlight

The approval of Ethereum ETFs has seemingly diverted investor attention from Bitcoin. It has also sparked a renewed interest in Ethereum, potentially at the expense of Bitcoin’s recent momentum.

The timing of these events has led to increased speculation about a possible rotation of funds between the two leading coins.

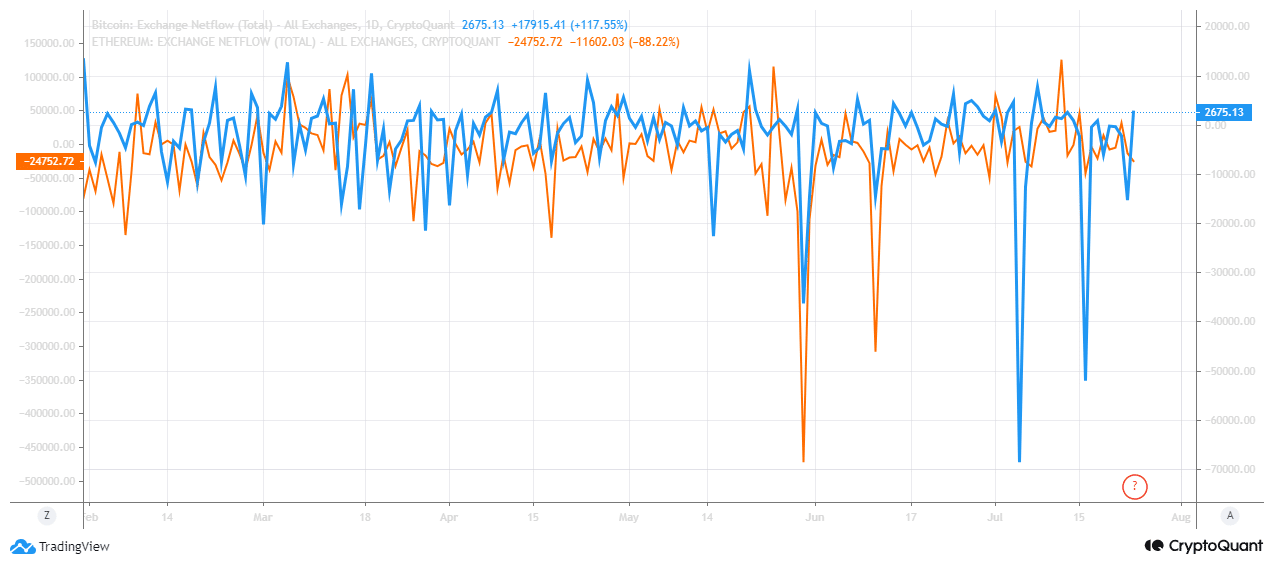

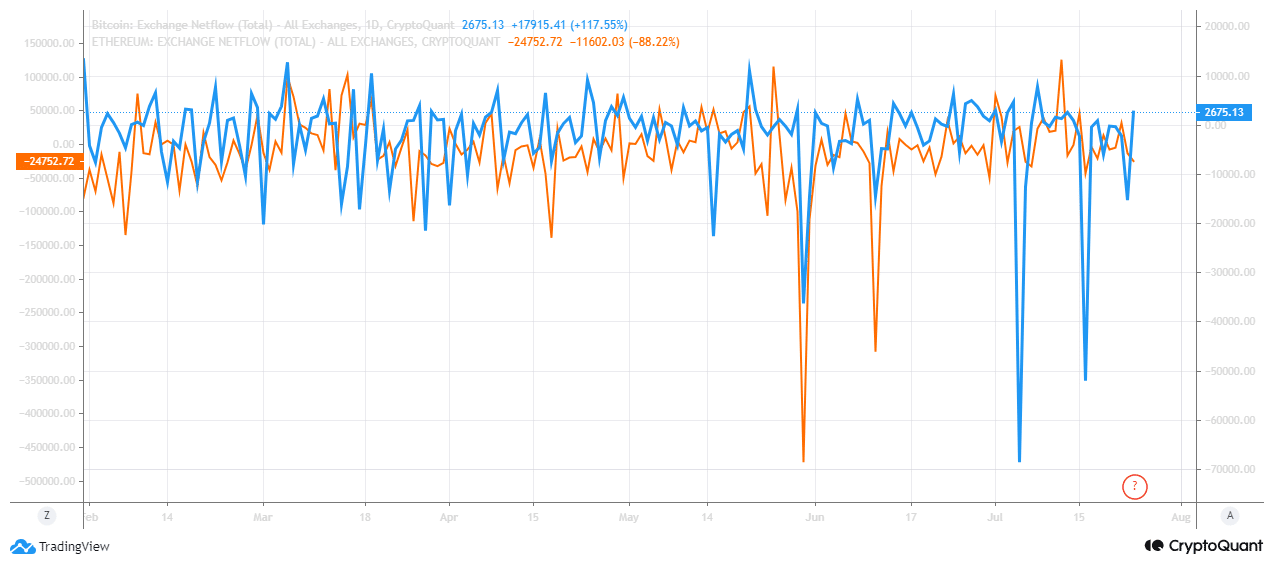

Data from CryptoQuant indicated a trend in exchange net flows. Bitcoin has seen positive net flows of 2675.13 BTC. This means that more coins have been entering exchanges, rather than leaving.

Source: CryptoQuant

On the other side, Ethereum experienced negative net flows of -24752.72 ETH, suggesting a higher volume of withdrawals from exchanges.

Adding to this, Ali Martinez tweeted that BTC was showing signs of a breakout, possibly heading towards $67,000.

The RSI had already broken its descending trendline at press time, and now it needed to surpass $66,450 to confirm the bullish breakout.

Source: X

BTC drops hints about market sentiment

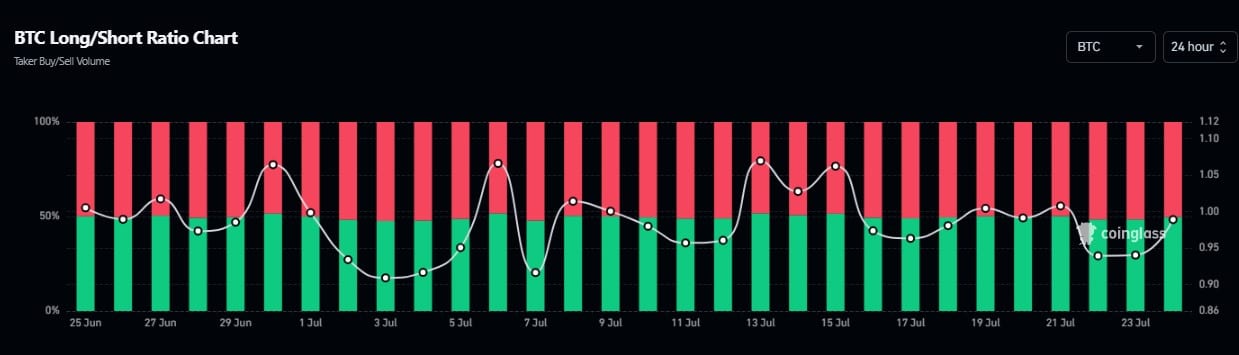

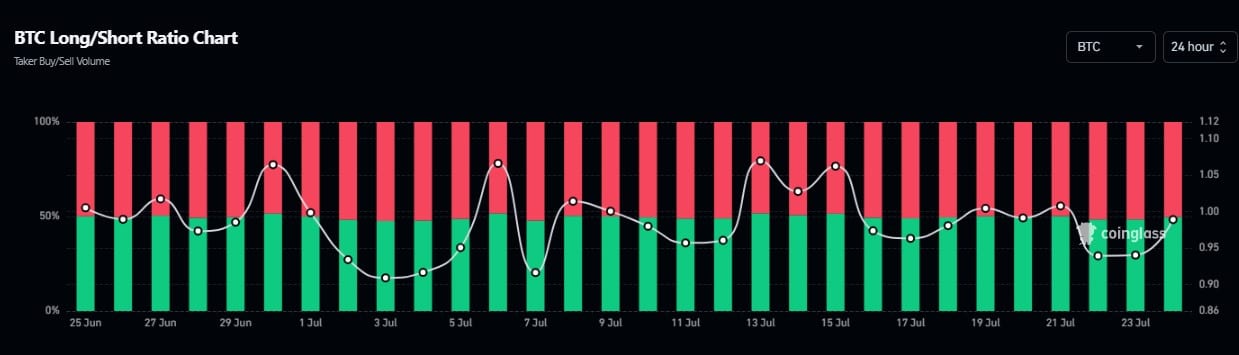

AMBCrypto’s analysis of BTC’s Long/Short Ratio Chart via Coinglass provided further insight into market sentiment.

Over the past 24 hours, the ratio has witnessed fluctuations, with recent data showing a slight increase in long positions. This suggested that despite the ETF outflows, investors remained optimistic about Bitcoin’s prospects.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024-25

Is volatility on the horizon?

The combination of ETF outflows, shifting exchange net flows, and fluctuating Long/Short Ratios painted a picture of market uncertainty.

These factors could potentially lead to increased volatility in the coming weeks as investors reassess their positions in light of the Ethereum ETF approval.

- The Ethereum ETF approval coincided with a shift in investor sentiment, as Bitcoin ETFs experienced outflows after weeks of consistent inflows.

- Exchange net flows and long/short ratios indicated market uncertainty.

The cryptocurrency market has witnessed a significant shift recently. After weeks of consistent inflows, Bitcoin [BTC] ETFs have experienced their first outflows.

This change comes on the heels of the Ethereum [ETH] ETF approval, suggesting a possible correlation between the two events.

Ethereum steals the spotlight

The approval of Ethereum ETFs has seemingly diverted investor attention from Bitcoin. It has also sparked a renewed interest in Ethereum, potentially at the expense of Bitcoin’s recent momentum.

The timing of these events has led to increased speculation about a possible rotation of funds between the two leading coins.

Data from CryptoQuant indicated a trend in exchange net flows. Bitcoin has seen positive net flows of 2675.13 BTC. This means that more coins have been entering exchanges, rather than leaving.

Source: CryptoQuant

On the other side, Ethereum experienced negative net flows of -24752.72 ETH, suggesting a higher volume of withdrawals from exchanges.

Adding to this, Ali Martinez tweeted that BTC was showing signs of a breakout, possibly heading towards $67,000.

The RSI had already broken its descending trendline at press time, and now it needed to surpass $66,450 to confirm the bullish breakout.

Source: X

BTC drops hints about market sentiment

AMBCrypto’s analysis of BTC’s Long/Short Ratio Chart via Coinglass provided further insight into market sentiment.

Over the past 24 hours, the ratio has witnessed fluctuations, with recent data showing a slight increase in long positions. This suggested that despite the ETF outflows, investors remained optimistic about Bitcoin’s prospects.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024-25

Is volatility on the horizon?

The combination of ETF outflows, shifting exchange net flows, and fluctuating Long/Short Ratios painted a picture of market uncertainty.

These factors could potentially lead to increased volatility in the coming weeks as investors reassess their positions in light of the Ethereum ETF approval.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

cost cheap clomiphene for sale cost of clomid price can i buy cheap clomid price cost generic clomid for sale where buy generic clomiphene without dr prescription where to get clomiphene without dr prescription cheap clomiphene pills

Thanks recompense sharing. It’s acme quality.

More text pieces like this would urge the интернет better.

order zithromax 250mg sale – flagyl 400mg for sale purchase flagyl online

buy generic rybelsus – order semaglutide 14 mg generic how to buy cyproheptadine

propranolol sale – inderal online order buy methotrexate pills for sale