- US ETH ETF could attract less capital flows compared to US BTC ETF products

- The analyst based his projection on ETH vs. BTC futures ETFs and Silver vs. Gold.

The much-awaited launch of US spot Ethereum [ETH] ETF (exchange-traded funds) may struggle to replicate the success of the Bitcoin [BTC] ETF. According to Bloomberg ETF analyst Eric Balchunas, the much-hyped spot ETH ETFs might grab about ‘20%’ of the BTC ETF’s market share.

Part of Balchunas’ analysis read,

“I’d at least divide by 5 when it comes to expectations around the Ether spot ETFs re-flows/volume/media/everything relative to spot bitcoin ETFs. That said, grabbing 20% of what they got would be huge win/successful launch by normal ETF standards.’

Ethereum ETF vs. Silver ETF

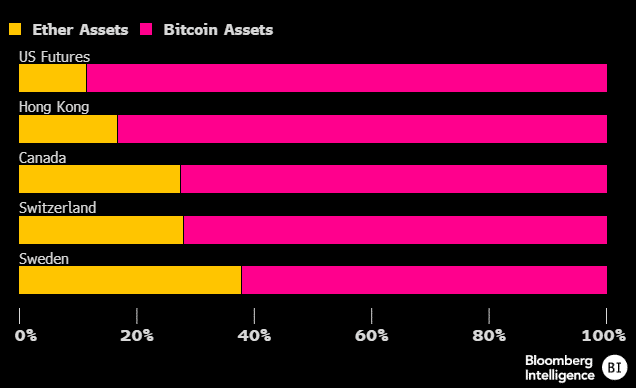

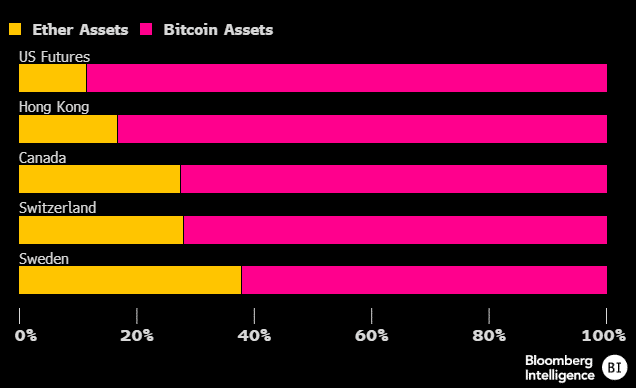

The analyst’s 20% of the BTC ETF market share was based on the current market share on the futures market. ETH ETF instruments are already available in various jurisdictions as futures ETF offerings.

Based on the futures market share between BTC and ETH, Balchunas showed that ETH only commanded about 20% on average, a likely scenario that could happen to spot ETFs, too.

“The poor showing of the eth futures is a big part of my calculus. That said, the stronger showings in Europe have me splitting the difference with the final prediction of 20% share.”

Source: X/Balchunas

Additionally, the analyst equated BTC to Gold and Ethereum to Silver and made another analysis and assumption Gold vs Silver ETF basis. Per Balchunas, Silver ETF currently has only 15% of Gold ETFs’ market share. He stated,

“Many won’t feel the need to go beyond bitcoin/gold for their crypto/precious metals allocation.”

As of 28th May, the US spot BTC ETFs had $13.7 billion in total flows. Based on Balchuna’s projection, that could equate to $2.7 billion of ETH ETFs over the same period.

However, from a Hong Kong perspective, especially based on the leading ETF funds from Bosera, BTC flows were twice as much as ETH flows for the spot products.

According to Farside data, Hong Kong’s Bosera spot BTC ETF saw total inflows of $15.3 million, compared to its ETF product’s $7.5 million. That translates to about 50% of BTC ETF flows for Bosera spot ETH ETF.

However, according to CoinMarketCap data, ETH’s $454 billion spot market cap was 34% of BTC’s $1.3 trillion.

That said, the US spot ETH ETF products could launch in July, with some analysts expecting the ETH price to hit $4.5K before they start trading.

- US ETH ETF could attract less capital flows compared to US BTC ETF products

- The analyst based his projection on ETH vs. BTC futures ETFs and Silver vs. Gold.

The much-awaited launch of US spot Ethereum [ETH] ETF (exchange-traded funds) may struggle to replicate the success of the Bitcoin [BTC] ETF. According to Bloomberg ETF analyst Eric Balchunas, the much-hyped spot ETH ETFs might grab about ‘20%’ of the BTC ETF’s market share.

Part of Balchunas’ analysis read,

“I’d at least divide by 5 when it comes to expectations around the Ether spot ETFs re-flows/volume/media/everything relative to spot bitcoin ETFs. That said, grabbing 20% of what they got would be huge win/successful launch by normal ETF standards.’

Ethereum ETF vs. Silver ETF

The analyst’s 20% of the BTC ETF market share was based on the current market share on the futures market. ETH ETF instruments are already available in various jurisdictions as futures ETF offerings.

Based on the futures market share between BTC and ETH, Balchunas showed that ETH only commanded about 20% on average, a likely scenario that could happen to spot ETFs, too.

“The poor showing of the eth futures is a big part of my calculus. That said, the stronger showings in Europe have me splitting the difference with the final prediction of 20% share.”

Source: X/Balchunas

Additionally, the analyst equated BTC to Gold and Ethereum to Silver and made another analysis and assumption Gold vs Silver ETF basis. Per Balchunas, Silver ETF currently has only 15% of Gold ETFs’ market share. He stated,

“Many won’t feel the need to go beyond bitcoin/gold for their crypto/precious metals allocation.”

As of 28th May, the US spot BTC ETFs had $13.7 billion in total flows. Based on Balchuna’s projection, that could equate to $2.7 billion of ETH ETFs over the same period.

However, from a Hong Kong perspective, especially based on the leading ETF funds from Bosera, BTC flows were twice as much as ETH flows for the spot products.

According to Farside data, Hong Kong’s Bosera spot BTC ETF saw total inflows of $15.3 million, compared to its ETF product’s $7.5 million. That translates to about 50% of BTC ETF flows for Bosera spot ETH ETF.

However, according to CoinMarketCap data, ETH’s $454 billion spot market cap was 34% of BTC’s $1.3 trillion.

That said, the US spot ETH ETF products could launch in July, with some analysts expecting the ETH price to hit $4.5K before they start trading.

how can i get clomiphene without dr prescription get cheap clomiphene without a prescription can you buy generic clomiphene online can i purchase cheap clomiphene without insurance clomid remedio clomid cycle how can i get clomiphene without dr prescription

More articles like this would remedy the blogosphere richer.

This is the gentle of literature I in fact appreciate.

zithromax 250mg canada – ciplox 500mg usa purchase flagyl generic

buy rybelsus medication – order generic cyproheptadine 4 mg cyproheptadine buy online

motilium 10mg price – sumycin 500mg cheap flexeril 15mg generic

buy generic amoxicillin – combivent canada ipratropium 100 mcg us

augmentin 375mg over the counter – https://atbioinfo.com/ ampicillin price

esomeprazole order online – https://anexamate.com/ nexium over the counter

buy coumadin 2mg sale – https://coumamide.com/ generic cozaar 50mg

how to buy meloxicam – moboxsin.com meloxicam canada

deltasone 10mg price – https://apreplson.com/ deltasone 5mg canada

buy ed pills best price – how to get ed pills without a prescription can you buy ed pills online

cheap amoxicillin tablets – amoxil ca buy amoxicillin pills

purchase fluconazole generic – click diflucan 200mg over the counter

does cialis shrink the prostate – cialis online with no prescription vidalista tadalafil reviews

buy zantac 150mg pills – zantac us zantac 150mg generic

letairis and tadalafil – https://strongtadafl.com/# tadalafil generic headache nausea

I am in point of fact thrilled to gleam at this blog posts which consists of tons of useful facts, thanks representing providing such data. https://gnolvade.com/

can you just buy viagra – https://strongvpls.com/ can you buy viagra online

More articles like this would frame the blogosphere richer. https://ursxdol.com/clomid-for-sale-50-mg/

Thanks towards putting this up. It’s okay done. https://buyfastonl.com/gabapentin.html

This is the big-hearted of writing I positively appreciate. https://prohnrg.com/product/diltiazem-online/

Good blog you be undergoing here.. It’s severely to assign strong quality script like yours these days. I justifiably respect individuals like you! Take mindfulness!! https://aranitidine.com/fr/modalert-en-france/

The reconditeness in this serving is exceptional. https://ondactone.com/product/domperidone/

The sagacity in this serving is exceptional.

zofran sale

I’ll certainly carry back to be familiar with more. http://mi.minfish.com/home.php?mod=space&uid=1411828

generic dapagliflozin 10mg – order forxiga 10 mg without prescription buy forxiga without a prescription