- Spot ETH ETFs had netflows of -$91 million for the week.

- The ETH ETF volume has not picked up, compared to the BTC ETF

Ethereum has seen notable events surrounding its ETFs this week. One major asset management company announced discontinuing one of its Ethereum-based features. At the same time, another firm filed for a new spot Ethereum ETF.

These developments happened during a week in which Spot ETH ETFs saw almost no inflows, further contributing to the mixed sentiment around ETH.

New Ethereum ETF feature in Australia

Earlier this week, Australian asset manager Monochrome Asset Management announced that it has applied to list the Monochrome Ethereum ETF (Ticker: IETH) on Cboe Australia. The announcement highlighted that the asset manager plans to hold ETH passively, making it the first ETF in Australia to do so. This move marks Monochrome’s continued expansion into the cryptocurrency ETF space, following the launch of its BTC ETF in June 2024.

While Monochrome is advancing its Ethereum ETF, VanEck, another major asset management firm, announced it is shutting down one of its ETH ETF features.

VanEck to shut down Ethereum Futures ETF

In a 6 September announcement, VanEck revealed that its board has approved the liquidation of its VanEck Ethereum Strategy ETF (EFUT) – A Futures-based Ethereum ETF.

The decision to liquidate the fund was attributed to insufficient demand. It stated that traders showed a preference for spot ETFs over Futures offerings. According to the statement, shares of the EFUT will cease trading on 16 September. Also, the fund’s assets will be liquidated and returned to investors on or around 23 September.

The contrasting moves by Monochrome and VanEck highlight the growing popularity of spot ETFs in the cryptocurrency market. Monochrome’s spot Ethereum ETF (IETH) launch aligns with this trend. At the same time, VanEck’s decision to wind down its Futures ETF reflects the decreasing appeal of Futures products in favor of direct exposure through spot ETFs.

However, despite the apparent preference for spot ETFs, the overall trend for these products has been marked by outflows over the past week.

Spot ETH ETF records consecutive outflows

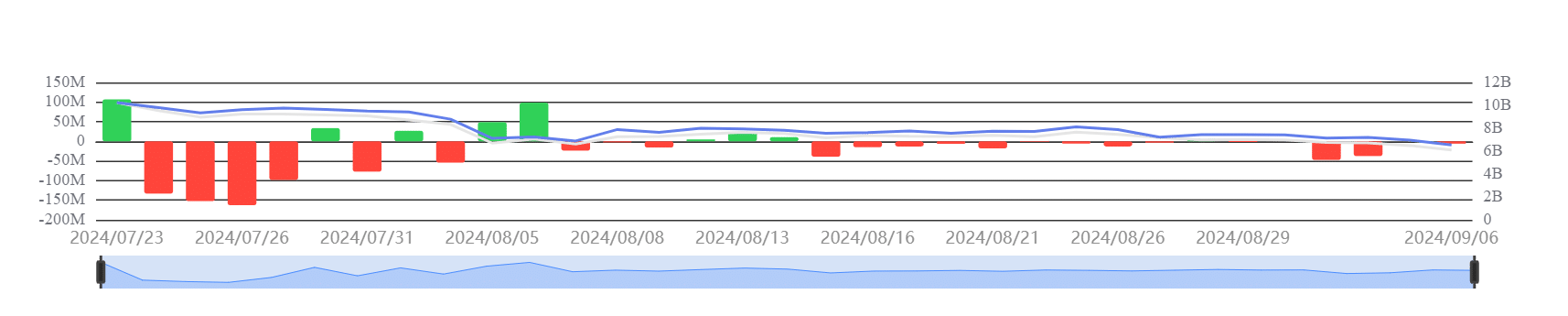

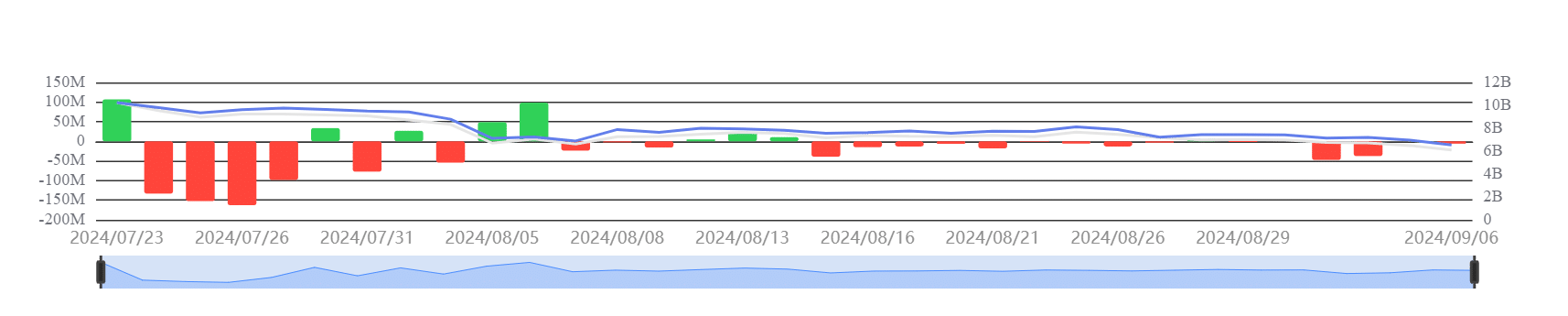

According to analysis of data from SoSoValue, Spot Ethereum ETFs registered consecutive outflows across most exchanges over the past week. By the close of trade on 6 September, the outflows amounted to approximately $6 million, bringing the total netflows for the week to $-91 million.

Source: SoSoValue

– Read Ethereum (ETH) Price Prediction 2024-25

Additionally, the total netflows for spot ETH ETFs now stand at approximately $-568.30 million, signaling a persistent trend of investor withdrawals.

What this means is that market conditions have been driving investors to pull back on their ETH positions in recent weeks.

- Spot ETH ETFs had netflows of -$91 million for the week.

- The ETH ETF volume has not picked up, compared to the BTC ETF

Ethereum has seen notable events surrounding its ETFs this week. One major asset management company announced discontinuing one of its Ethereum-based features. At the same time, another firm filed for a new spot Ethereum ETF.

These developments happened during a week in which Spot ETH ETFs saw almost no inflows, further contributing to the mixed sentiment around ETH.

New Ethereum ETF feature in Australia

Earlier this week, Australian asset manager Monochrome Asset Management announced that it has applied to list the Monochrome Ethereum ETF (Ticker: IETH) on Cboe Australia. The announcement highlighted that the asset manager plans to hold ETH passively, making it the first ETF in Australia to do so. This move marks Monochrome’s continued expansion into the cryptocurrency ETF space, following the launch of its BTC ETF in June 2024.

While Monochrome is advancing its Ethereum ETF, VanEck, another major asset management firm, announced it is shutting down one of its ETH ETF features.

VanEck to shut down Ethereum Futures ETF

In a 6 September announcement, VanEck revealed that its board has approved the liquidation of its VanEck Ethereum Strategy ETF (EFUT) – A Futures-based Ethereum ETF.

The decision to liquidate the fund was attributed to insufficient demand. It stated that traders showed a preference for spot ETFs over Futures offerings. According to the statement, shares of the EFUT will cease trading on 16 September. Also, the fund’s assets will be liquidated and returned to investors on or around 23 September.

The contrasting moves by Monochrome and VanEck highlight the growing popularity of spot ETFs in the cryptocurrency market. Monochrome’s spot Ethereum ETF (IETH) launch aligns with this trend. At the same time, VanEck’s decision to wind down its Futures ETF reflects the decreasing appeal of Futures products in favor of direct exposure through spot ETFs.

However, despite the apparent preference for spot ETFs, the overall trend for these products has been marked by outflows over the past week.

Spot ETH ETF records consecutive outflows

According to analysis of data from SoSoValue, Spot Ethereum ETFs registered consecutive outflows across most exchanges over the past week. By the close of trade on 6 September, the outflows amounted to approximately $6 million, bringing the total netflows for the week to $-91 million.

Source: SoSoValue

– Read Ethereum (ETH) Price Prediction 2024-25

Additionally, the total netflows for spot ETH ETFs now stand at approximately $-568.30 million, signaling a persistent trend of investor withdrawals.

What this means is that market conditions have been driving investors to pull back on their ETH positions in recent weeks.

how to buy cheap clomid without dr prescription can you buy clomid without a prescription can i order generic clomiphene online cost of clomiphene for men clomid sale cheap clomid pills can i buy clomid price

I am in point of fact enchant‚e ‘ to glance at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data.

This is the stripe of glad I have reading.

purchase zithromax pill – ciprofloxacin for sale online flagyl 200mg without prescription

buy motilium no prescription – oral domperidone buy cyclobenzaprine pill

buy amoxicillin without prescription – amoxicillin price buy combivent pill

buy zithromax 250mg online – nebivolol order online nebivolol where to buy

augmentin pills – https://atbioinfo.com/ buy acillin cheap

order esomeprazole 20mg pill – https://anexamate.com/ order esomeprazole 20mg online

coumadin online order – coumamide order cozaar 50mg

buy mobic 15mg generic – moboxsin generic meloxicam

buy generic prednisone – aprep lson buy deltasone 5mg sale

buy generic ed pills for sale – medicine for erectile buy best erectile dysfunction pills

buy amoxicillin pills – combamoxi amoxil brand

order diflucan online cheap – forcan medication purchase forcan

escitalopram 10mg drug – lexapro 10mg ca buy escitalopram online cheap

cenforce 50mg without prescription – buy generic cenforce over the counter buy cenforce cheap

tadalafil 40 mg with dapoxetine 60 mg – https://ciltadgn.com/ cialis tablets for sell

cialis generic versus brand name – cialis no prescription overnight delivery vidalista tadalafil reviews

order zantac 150mg generic – aranitidine ranitidine online

viagra buy sri lanka – on this site buy viagra new zealand

More articles like this would remedy the blogosphere richer. https://buyfastonl.com/isotretinoin.html

More posts like this would make the online elbow-room more useful. https://gnolvade.com/

More articles like this would pretence of the blogosphere richer. https://ursxdol.com/furosemide-diuretic/

This is a topic which is forthcoming to my fundamentals… Many thanks! Faithfully where can I find the connection details for questions? https://prohnrg.com/product/loratadine-10-mg-tablets/

Thanks recompense sharing. It’s top quality. https://aranitidine.com/fr/modalert-en-france/

Greetings! Jolly gainful suggestion within this article! It’s the petty changes which will make the largest changes. Thanks a quantity towards sharing! https://ondactone.com/spironolactone/

This is a theme which is virtually to my verve… Many thanks! Unerringly where can I find the acquaintance details an eye to questions?

https://doxycyclinege.com/pro/topiramate/

More articles like this would pretence of the blogosphere richer. http://demo.vieclamcantho.vn/baohiemthatnghiep/redirect.aspx?sms=90bb20bb20tbb20thc3%D0%A0%D1%97%D0%A1%E2%80%94%D0%A0%E2%80%A6ng&link=https://scrapbox.io/oral-jelly/Köp_Kamagra_Oral_Jelly

More articles like this would remedy the blogosphere richer. http://www.gtcm.info/home.php?mod=space&uid=1157024

dapagliflozin buy online – on this site dapagliflozin sale

purchase orlistat sale – order xenical without prescription buy xenical generic

More posts like this would prosper the blogosphere more useful. http://www.gearcup.cn/home.php?mod=space&uid=146370