- Ethereum ETFs saw $84.6 million in inflows, but still lag far behind Bitcoin ETF inflows.

- Despite price dips, Ethereum remained above its 50-day moving average, indicating short-term bullish momentum.

The Ethereum [ETH] ETFs have experienced their largest inflow in over a month, according to recent data.

Despite this, ETH ETF inflows still significantly lag behind those of Bitcoin[BTC], reflecting a stronger preference for Bitcoin ETFs.

First weekly inflow since August

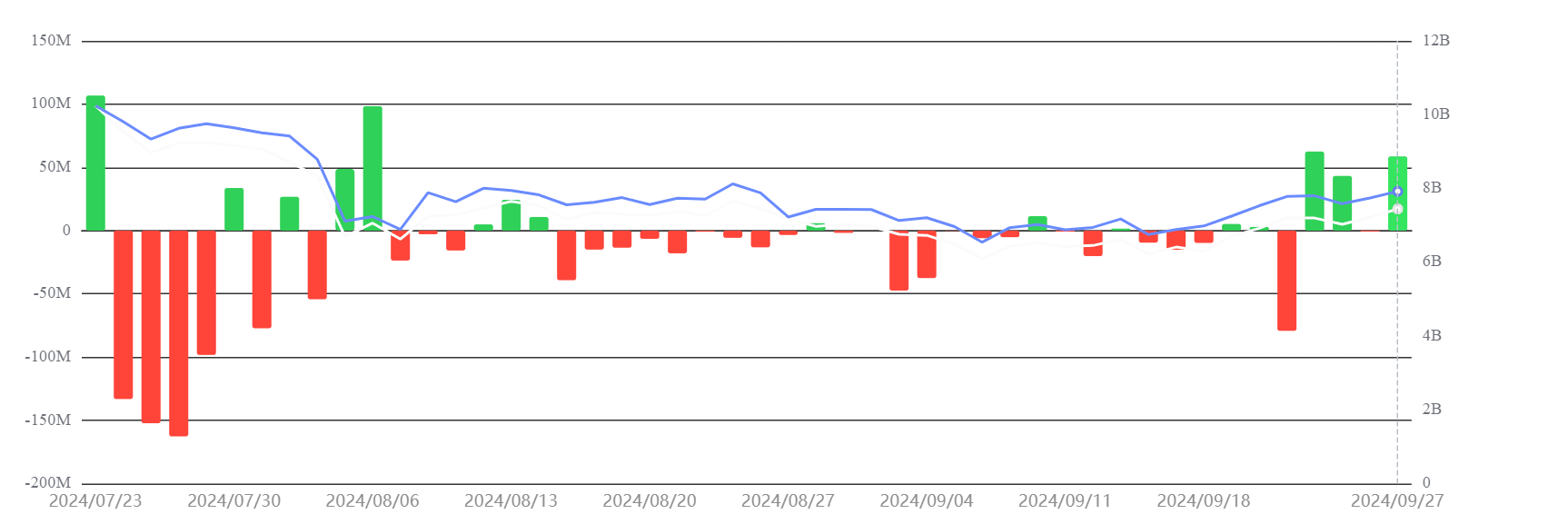

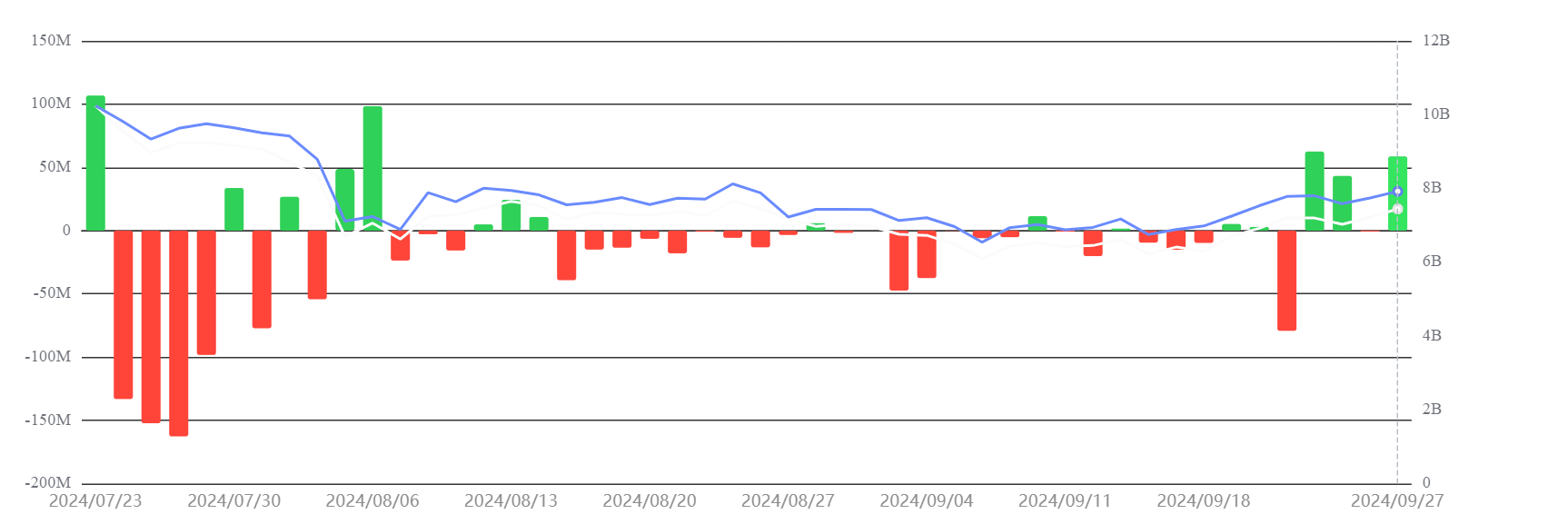

Data from SosoValue shows that the Ethereum ETFs saw over $84.6 million in inflows last week, with positive inflows recorded on three out of five trading days.

This marks the highest weekly inflow since the 9th of August. However, despite this growth, Ethereum ETF volumes remain far below Bitcoin’s ETF performance.

Source: SosoValue

In comparison, Bitcoin ETFs recorded a whopping $1.11 billion in inflows during the same week, with inflows occurring every day.

This was Bitcoin’s largest weekly inflow since the 19th of July.

Ethereum ETF still lagging behind Bitcoin

The Ethereum ETFs began trading in the U.S. on the 23rd of July, roughly six months after Bitcoin ETFs.

In the five weeks following the launch of Ethereum ETFs, the funds saw net outflows of around $500 million, while Bitcoin ETFs recorded net inflows of over $5 billion.

Bitcoin’s first-mover advantage is one of the reasons for this disparity.

The excitement surrounding Bitcoin’s ETF launch has driven significant inflows, while ETH’s ETF launch, though promising, has generated less buzz over time.

Additionally, the value difference between the two assets plays a role—Bitcoin holds over 50% of the crypto market cap, while Ethereum holds about 14%.

ETH price declines as September ends

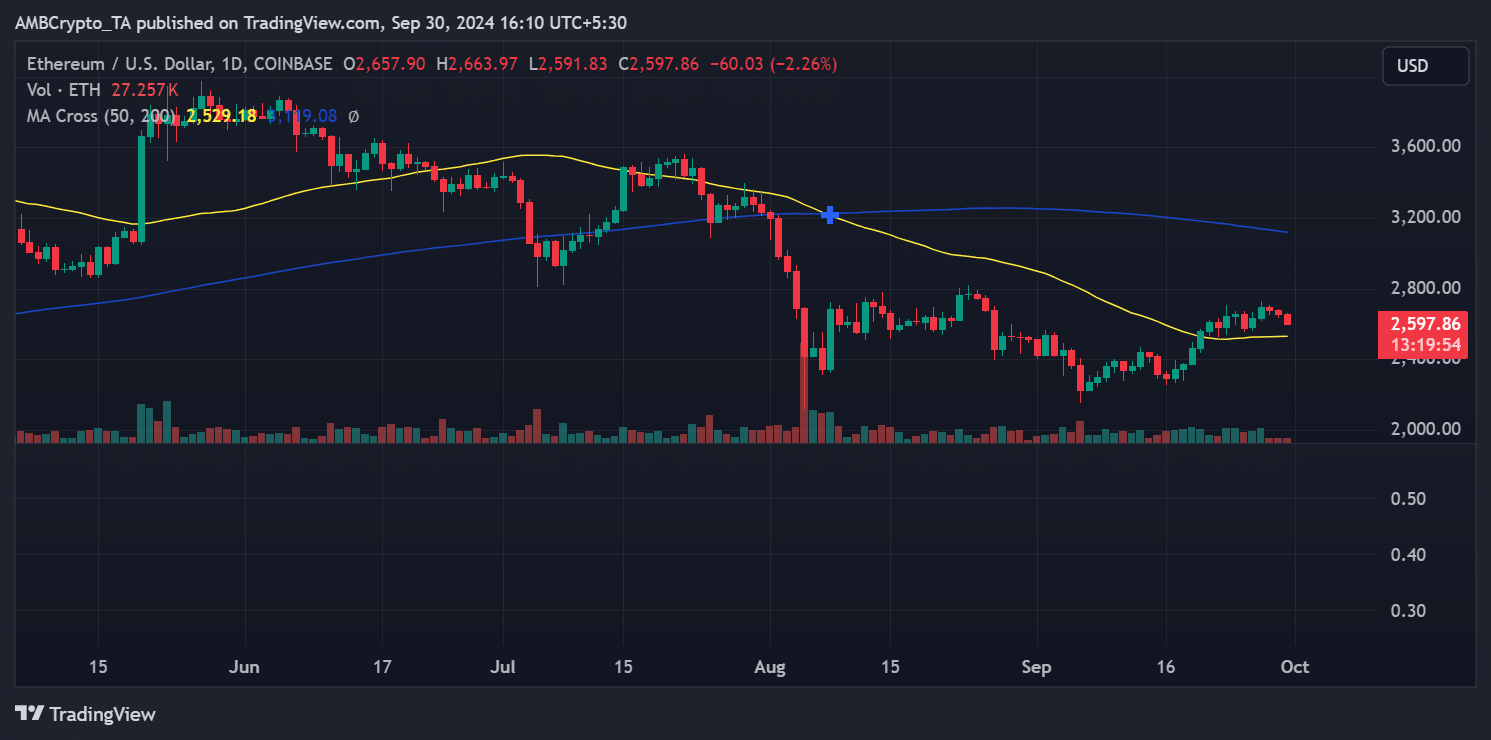

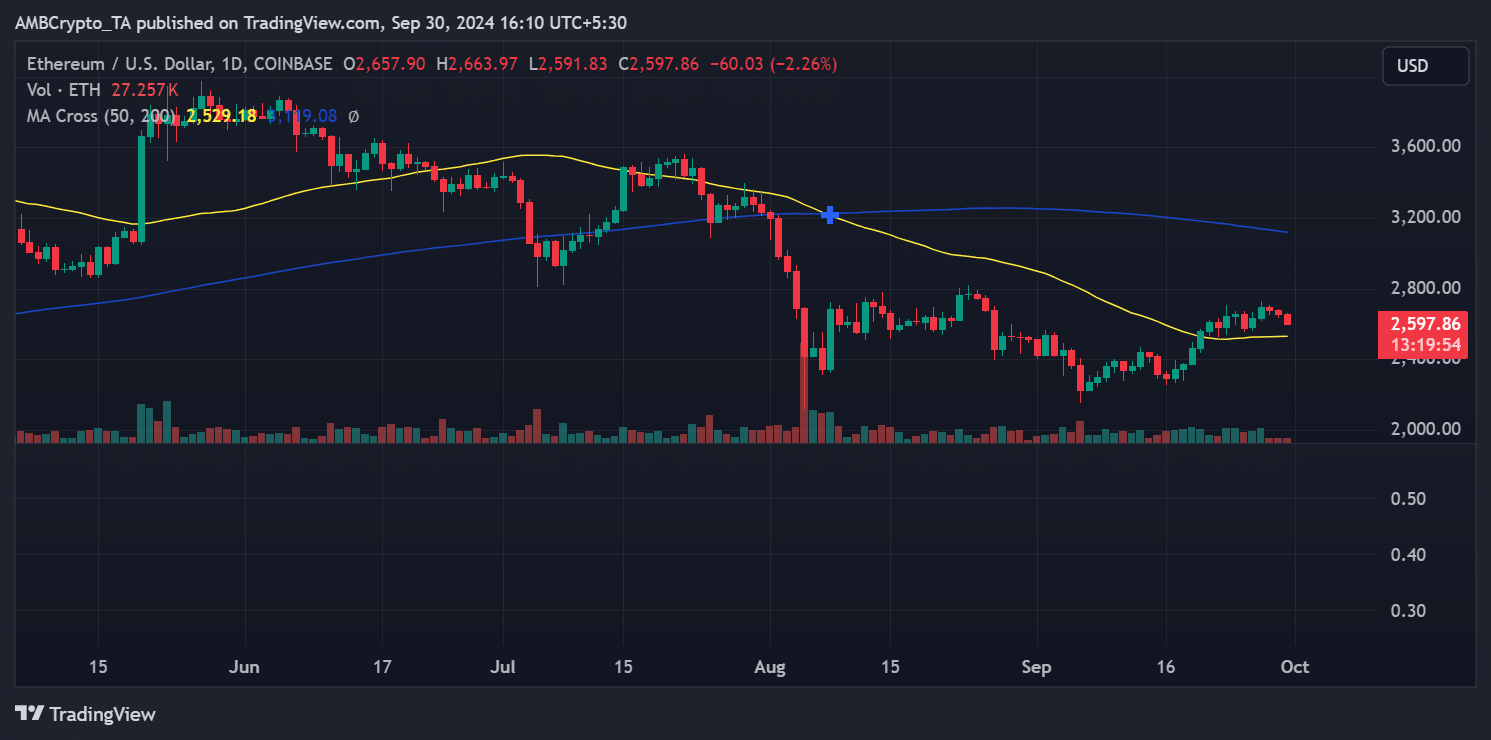

In the past few days, Ethereum’s price has dipped, falling below the $2,600 level.

At the time of writing, Ethereum was trading at around $2,597, down over 2%. Despite the decline, ETH remains above its 50-day moving average, indicating a short-term bullish trend.

Source: TradingView

The Relative Strength Index (RSI) was around 53, reinforcing the bullish outlook suggested by the moving average.

Realistic or not, here’s ETH market cap in BTC’s terms

While The Ethereum ETF has seen a notable inflow after a slow period, it remains far behind Bitcoin ETFs in terms of volume and investor interest.

Factors such as Bitcoin’s first-mover advantage and market dominance play key roles in this trend. Despite recent price declines, Ethereum remains in a bullish position, holding above key technical indicators.

- Ethereum ETFs saw $84.6 million in inflows, but still lag far behind Bitcoin ETF inflows.

- Despite price dips, Ethereum remained above its 50-day moving average, indicating short-term bullish momentum.

The Ethereum [ETH] ETFs have experienced their largest inflow in over a month, according to recent data.

Despite this, ETH ETF inflows still significantly lag behind those of Bitcoin[BTC], reflecting a stronger preference for Bitcoin ETFs.

First weekly inflow since August

Data from SosoValue shows that the Ethereum ETFs saw over $84.6 million in inflows last week, with positive inflows recorded on three out of five trading days.

This marks the highest weekly inflow since the 9th of August. However, despite this growth, Ethereum ETF volumes remain far below Bitcoin’s ETF performance.

Source: SosoValue

In comparison, Bitcoin ETFs recorded a whopping $1.11 billion in inflows during the same week, with inflows occurring every day.

This was Bitcoin’s largest weekly inflow since the 19th of July.

Ethereum ETF still lagging behind Bitcoin

The Ethereum ETFs began trading in the U.S. on the 23rd of July, roughly six months after Bitcoin ETFs.

In the five weeks following the launch of Ethereum ETFs, the funds saw net outflows of around $500 million, while Bitcoin ETFs recorded net inflows of over $5 billion.

Bitcoin’s first-mover advantage is one of the reasons for this disparity.

The excitement surrounding Bitcoin’s ETF launch has driven significant inflows, while ETH’s ETF launch, though promising, has generated less buzz over time.

Additionally, the value difference between the two assets plays a role—Bitcoin holds over 50% of the crypto market cap, while Ethereum holds about 14%.

ETH price declines as September ends

In the past few days, Ethereum’s price has dipped, falling below the $2,600 level.

At the time of writing, Ethereum was trading at around $2,597, down over 2%. Despite the decline, ETH remains above its 50-day moving average, indicating a short-term bullish trend.

Source: TradingView

The Relative Strength Index (RSI) was around 53, reinforcing the bullish outlook suggested by the moving average.

Realistic or not, here’s ETH market cap in BTC’s terms

While The Ethereum ETF has seen a notable inflow after a slow period, it remains far behind Bitcoin ETFs in terms of volume and investor interest.

Factors such as Bitcoin’s first-mover advantage and market dominance play key roles in this trend. Despite recent price declines, Ethereum remains in a bullish position, holding above key technical indicators.

Pink Withney I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

Pink Withney I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

can i buy cheap clomid no prescription clomid sale how can i get clomiphene without prescription cost of clomid for men generic clomiphene price where to get generic clomiphene tablets acquista clomid online

Thanks an eye to sharing. It’s top quality.

More articles like this would remedy the blogosphere richer.

zithromax drug – purchase tinidazole pills purchase flagyl generic

rybelsus uk – semaglutide over the counter order cyproheptadine 4 mg pill

buy motilium no prescription – domperidone for sale cyclobenzaprine tablet

buy inderal – buy plavix medication order methotrexate 5mg online cheap

order amoxil sale – order valsartan 80mg pill combivent generic

buy azithromycin pill – purchase bystolic nebivolol 20mg oral

amoxiclav uk – https://atbioinfo.com/ ampicillin sale

buy esomeprazole 20mg sale – https://anexamate.com/ order esomeprazole 40mg online cheap

generic coumadin 5mg – https://coumamide.com/ buy generic cozaar online

buy generic meloxicam – https://moboxsin.com/ where can i buy mobic

order prednisone 10mg generic – adrenal prednisone 5mg cheap

pills for ed – https://fastedtotake.com/ mens ed pills

cheap amoxil – purchase amoxil generic how to buy amoxicillin

e-cialis hellocig e-liquid – cialis none prescription cialis no perscription overnight delivery

zantac 300mg without prescription – online order zantac 150mg pill

cialis free trial voucher – buying cialis online safely cialis dapoxetine overnight shipment

The thoroughness in this piece is noteworthy. this

I’ll certainly return to review more. https://ursxdol.com/levitra-vardenafil-online/

This is a question which is forthcoming to my verve… Diverse thanks! Quite where can I notice the phone details due to the fact that questions? https://prohnrg.com/product/get-allopurinol-pills/

More posts like this would make the online play more useful. https://aranitidine.com/fr/acheter-cialis-5mg/

I’ll certainly carry back to skim more. https://ondactone.com/product/domperidone/

This is a question which is forthcoming to my heart… Numberless thanks! Faithfully where can I lay one’s hands on the contact details due to the fact that questions?

https://doxycyclinege.com/pro/sumatriptan/

I am in fact delighted to glance at this blog posts which consists of tons of useful facts, thanks representing providing such data. http://3ak.cn/home.php?mod=space&uid=229024

buy dapagliflozin for sale – https://janozin.com/# forxiga 10 mg uk

buy orlistat sale – https://asacostat.com/# xenical over the counter

More posts like this would prosper the blogosphere more useful. http://seafishzone.com/home.php?mod=space&uid=2331375