- The 1st of August saw a $26.7 million net inflow into U.S. Ether ETFs, led by ETHA.

- Grayscale Ethereum Trust (ETHE) faced $2 billion in outflows, marking a significant investor shift.

Despite ongoing cumulative outflows from the Grayscale Ethereum Trust (ETHE) surpassing $2 billion, recent trends in U.S. spot Ethereum [ETH] exchange-traded funds (ETFs) present a contrasting picture.

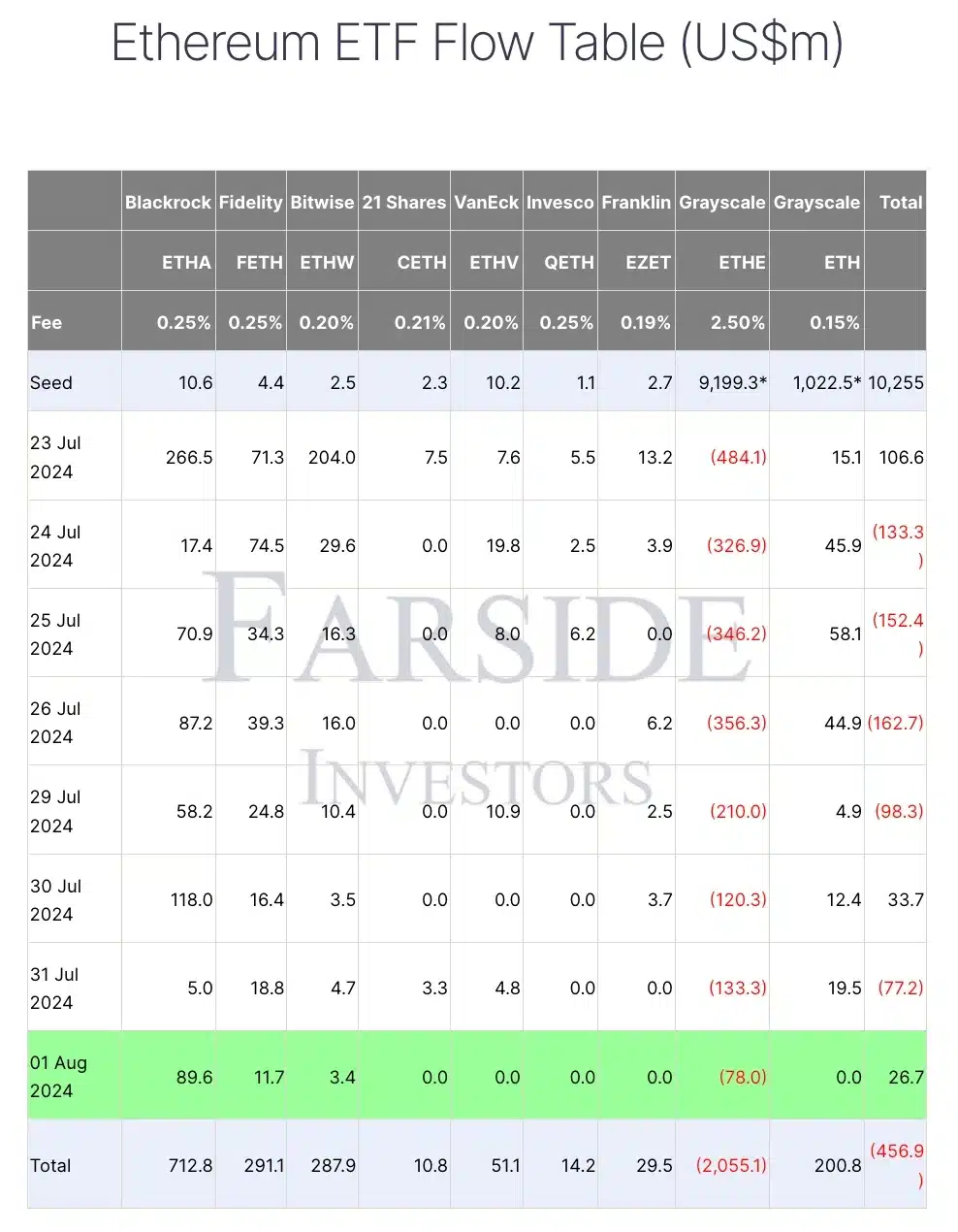

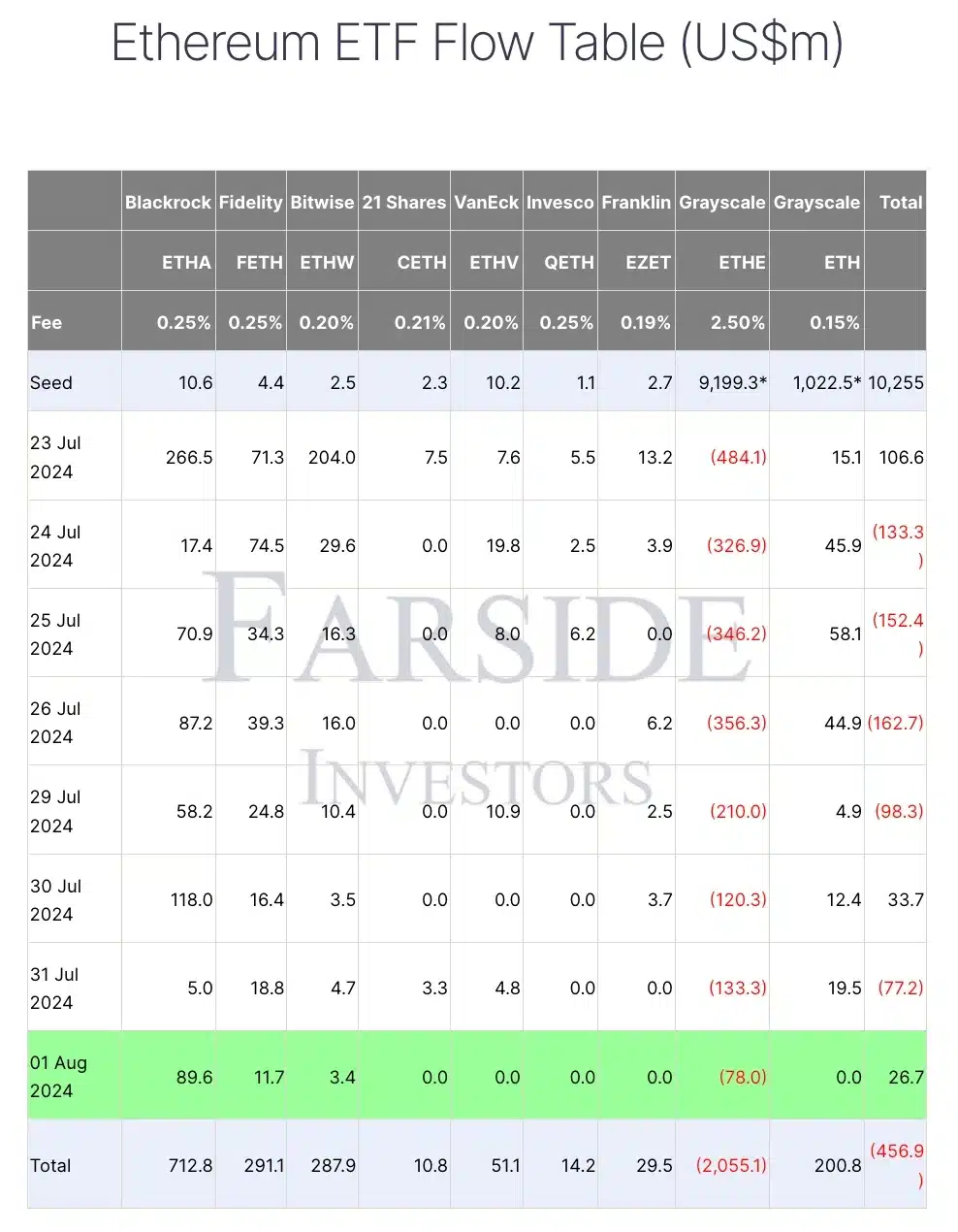

Ethereum ETF flow analysis

On the 1st of August, Ether ETFs recorded a notable turnaround with a net inflow of $26.7 million.

This positive shift was driven largely by a substantial $89.6 million inflow into BlackRock’s iShares Ethereum Trust (ETHA).

On the other hand, ETHE recorded inflows worth $78 million, according to data from Farside Investors.

Source: Farside Investors

Remarking on the same, Ted Pillows, a distinguished investor and entrepreneur, took to X and noted,

“Ethereum ETFs had a net inflow of $33,700,000. BlackRock bought $118,000,000 $ETH. ETH is just getting started, my bags are ready.”

Trend shift

This development is particularly remarkable given that Ether ETFs had primarily been recording outflows since their launch on the 23rd of July.

With the exceptions of the 23rd of July, the 30th of July, and the 1st of August, the trend had been predominantly negative.

Notably, while the Grayscale Ethereum Trust (ETHE) experienced the largest outflows since the inception of ETH ETFs, the inflows around the 1st of August into BlackRock’s iShares Ethereum Trust (ETHA) successfully surpassed these outflows, marking a significant shift in the ETF landscape.

It’s crucial to highlight that, unlike the eight-spot Ether ETFs introduced as “newborn” funds on the 23rd of July, the Grayscale Ethereum Trust (ETHE) was an established trust offering institutional exposure to Ether.

Prior to its recent conversion, ETHE held a substantial $9 billion in Ether.

However, by the 1st of August, outflows from ETHE had exceeded 22% of its initial value, underscoring a significant shift in investor sentiment despite the overall positive movement in Ether ETF inflows.

Dedic’s unique perspective on Ether

Despite the recent positive shift in ETH ETF performance, not all investors are satisfied. Reiterating the same, Simon Dedic, Founder and CEO of Moonrock Capital, remarked,

“Despite the ETF going live, $ETH has been the worst performing asset MTD of the whole Top 50.”

But he further suggested that, given the current poor performance of ETH, this situation might present a compelling buying opportunity.

“Turn off your emotions for a second and then tell me this isn’t one of the easiest buys you’ve ever seen.”

On the price front at press time, ETH was trading at $3,143.34, reflecting a 1.67% decline over the past 24 hours.

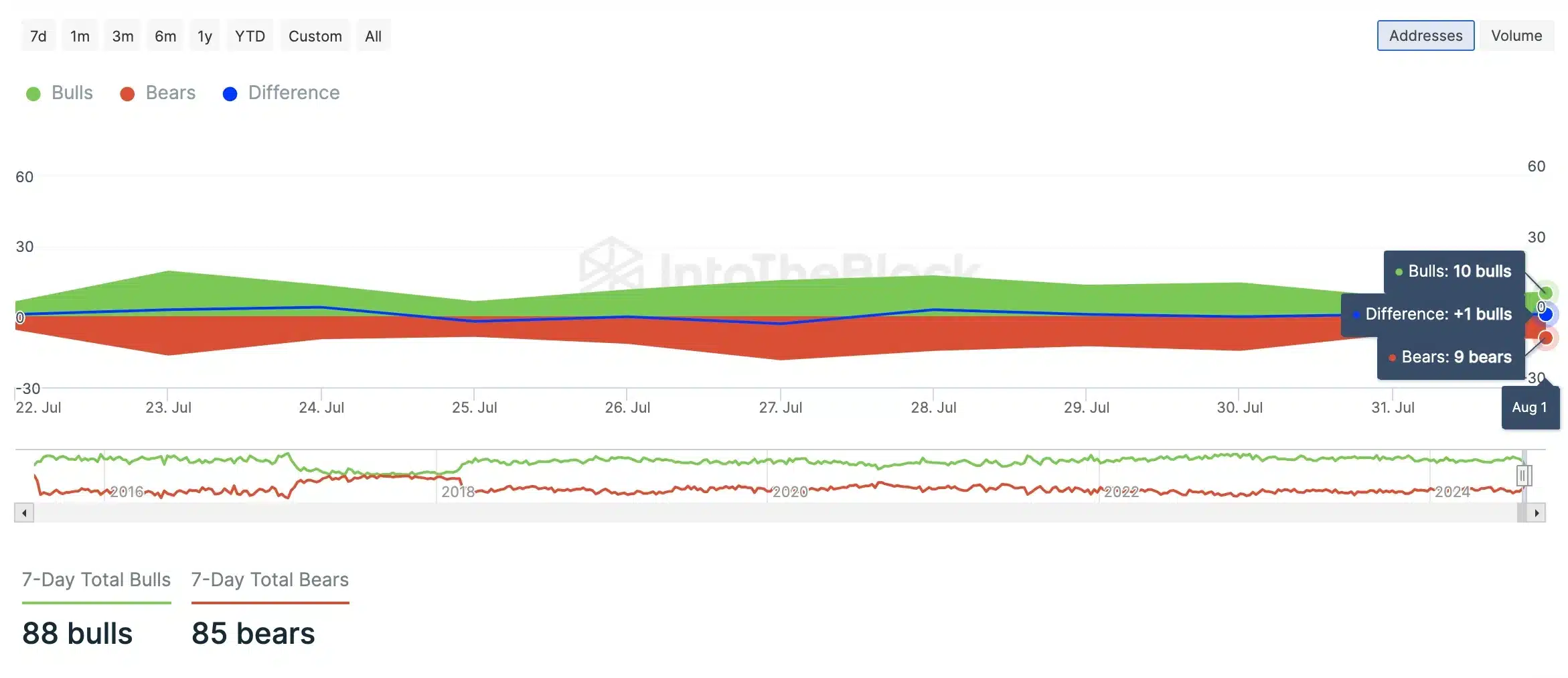

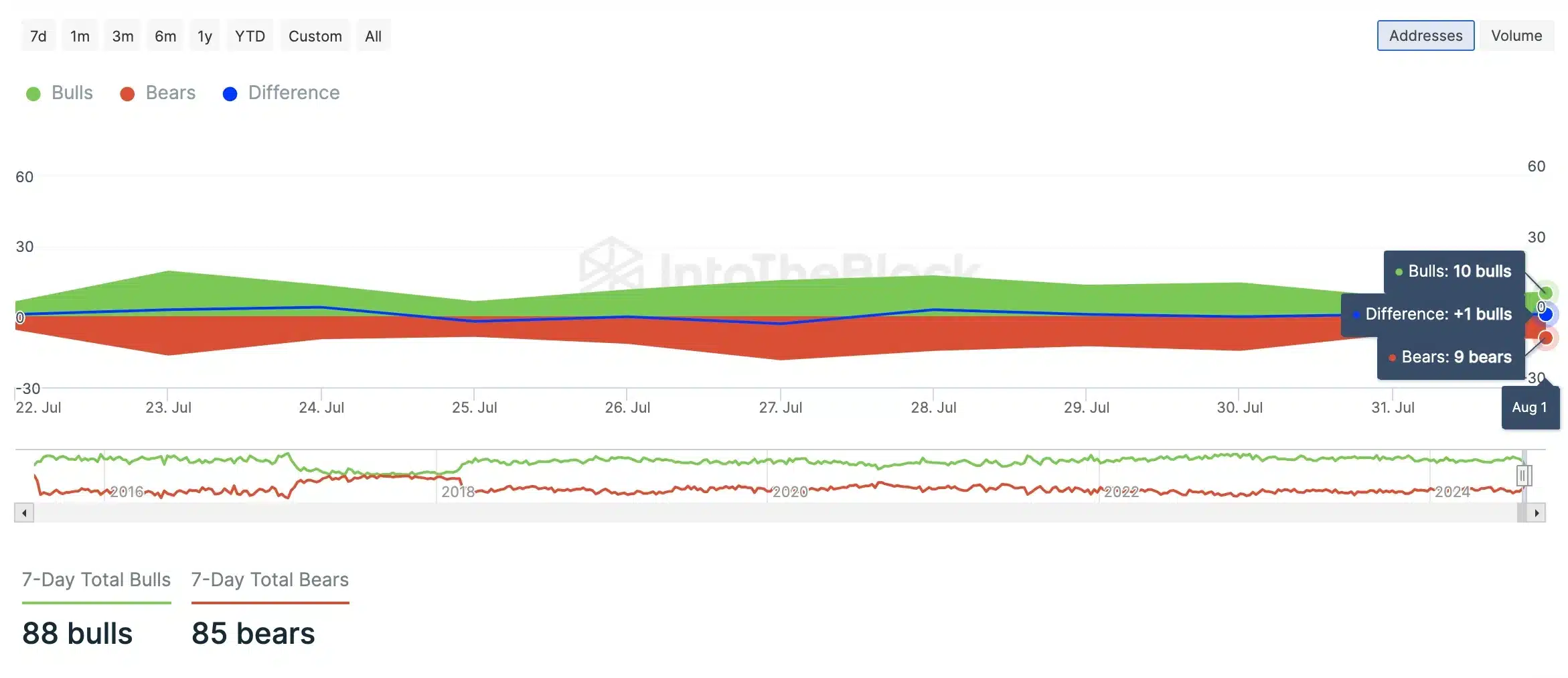

However, despite this drop, an analysis by AMBCrypto, using data from IntoTheBlock, indicated that bullish sentiment was outpacing bearish sentiment.

Source: IntoTheBlock

- The 1st of August saw a $26.7 million net inflow into U.S. Ether ETFs, led by ETHA.

- Grayscale Ethereum Trust (ETHE) faced $2 billion in outflows, marking a significant investor shift.

Despite ongoing cumulative outflows from the Grayscale Ethereum Trust (ETHE) surpassing $2 billion, recent trends in U.S. spot Ethereum [ETH] exchange-traded funds (ETFs) present a contrasting picture.

Ethereum ETF flow analysis

On the 1st of August, Ether ETFs recorded a notable turnaround with a net inflow of $26.7 million.

This positive shift was driven largely by a substantial $89.6 million inflow into BlackRock’s iShares Ethereum Trust (ETHA).

On the other hand, ETHE recorded inflows worth $78 million, according to data from Farside Investors.

Source: Farside Investors

Remarking on the same, Ted Pillows, a distinguished investor and entrepreneur, took to X and noted,

“Ethereum ETFs had a net inflow of $33,700,000. BlackRock bought $118,000,000 $ETH. ETH is just getting started, my bags are ready.”

Trend shift

This development is particularly remarkable given that Ether ETFs had primarily been recording outflows since their launch on the 23rd of July.

With the exceptions of the 23rd of July, the 30th of July, and the 1st of August, the trend had been predominantly negative.

Notably, while the Grayscale Ethereum Trust (ETHE) experienced the largest outflows since the inception of ETH ETFs, the inflows around the 1st of August into BlackRock’s iShares Ethereum Trust (ETHA) successfully surpassed these outflows, marking a significant shift in the ETF landscape.

It’s crucial to highlight that, unlike the eight-spot Ether ETFs introduced as “newborn” funds on the 23rd of July, the Grayscale Ethereum Trust (ETHE) was an established trust offering institutional exposure to Ether.

Prior to its recent conversion, ETHE held a substantial $9 billion in Ether.

However, by the 1st of August, outflows from ETHE had exceeded 22% of its initial value, underscoring a significant shift in investor sentiment despite the overall positive movement in Ether ETF inflows.

Dedic’s unique perspective on Ether

Despite the recent positive shift in ETH ETF performance, not all investors are satisfied. Reiterating the same, Simon Dedic, Founder and CEO of Moonrock Capital, remarked,

“Despite the ETF going live, $ETH has been the worst performing asset MTD of the whole Top 50.”

But he further suggested that, given the current poor performance of ETH, this situation might present a compelling buying opportunity.

“Turn off your emotions for a second and then tell me this isn’t one of the easiest buys you’ve ever seen.”

On the price front at press time, ETH was trading at $3,143.34, reflecting a 1.67% decline over the past 24 hours.

However, despite this drop, an analysis by AMBCrypto, using data from IntoTheBlock, indicated that bullish sentiment was outpacing bearish sentiment.

Source: IntoTheBlock

My brother suggested I might like this website He was totally right This post actually made my day You cannt imagine just how much time I had spent for this information Thanks

where can i buy clomid pill buying generic clomiphene without prescription can i purchase cheap clomid without a prescription can i purchase cheap clomiphene without insurance cost cheap clomiphene online how to buy cheap clomiphene without prescription can you buy clomiphene without a prescription

This is the description of content I have reading.

More posts like this would make the blogosphere more useful.

rybelsus 14mg pills – periactin pill where can i buy cyproheptadine

order generic domperidone – buy generic domperidone 10mg order flexeril 15mg generic

inderal 20mg pills – inderal 10mg drug methotrexate tablet

where can i buy clavulanate – https://atbioinfo.com/ buy ampicillin paypal

esomeprazole generic – anexa mate order esomeprazole 20mg online

warfarin 2mg canada – https://coumamide.com/ order losartan 50mg online cheap

buy mobic 15mg without prescription – mobo sin mobic 15mg uk

buy prednisone 20mg for sale – https://apreplson.com/ generic prednisone 10mg

top erection pills – fastedtotake.com buy erectile dysfunction drugs

buy amoxil online cheap – https://combamoxi.com/ cheap amoxicillin pill

fluconazole 200mg brand – flucoan buy diflucan 100mg pill

purchase cenforce online cheap – https://cenforcers.com/# cenforce 50mg price

tadalafil long term usage – ciltad generic tadalafil 5 mg tablet

buy zantac without prescription – on this site buy zantac tablets

real viagra for sale – https://strongvpls.com/ cheap 100mg viagra

More articles like this would frame the blogosphere richer. https://buyfastonl.com/

I am in fact thrilled to glance at this blog posts which consists of tons of of use facts, thanks for providing such data. online

This is the make of advise I find helpful.

https://doxycyclinege.com/pro/esomeprazole/

This is the kind of glad I have reading. http://ledyardmachine.com/forum/User-Vfeest

dapagliflozin generic – https://janozin.com/# buy forxiga 10 mg generic