- Growing anticipation surrounds the potential approval of spot Ethereum ETFs on 23rd July.

- ETH price rises by 0.08%, trading at $3,499, with bullish momentum indicators.

Amidst the growing anticipation surrounding the potential approval of spot Ethereum [ETH] Exchange Traded Funds (ETFs) on 23rd July, there has been a lot of buzz in the cryptocurrency space.

Impact of Ethereum ETF

It is also estimated that ETH ETF is likely to draw significant investor interest, potentially channeling more capital into the broader altcoin market.

Shedding light on the same, a crypto researcher on X, using the handle @wacy_time1, said,

“About $5 billion is expected to flow into the ETH ETF within the first six months.”

This estimate is based on the market capitalization ratio between Bitcoin [BTC] and Ethereum, which is approximately 75% to 25%.

Since investors have poured $59 billion into the BTC ETF, the proportional estimate for the ETH ETF, after accounting for $10 billion already invested in Grayscale’s ETHE, is around $5 billion.

This influx of investment is anticipated to have a substantial impact, not only on ETH but on the broader altcoin market as well.

Steps taken by BlackRock

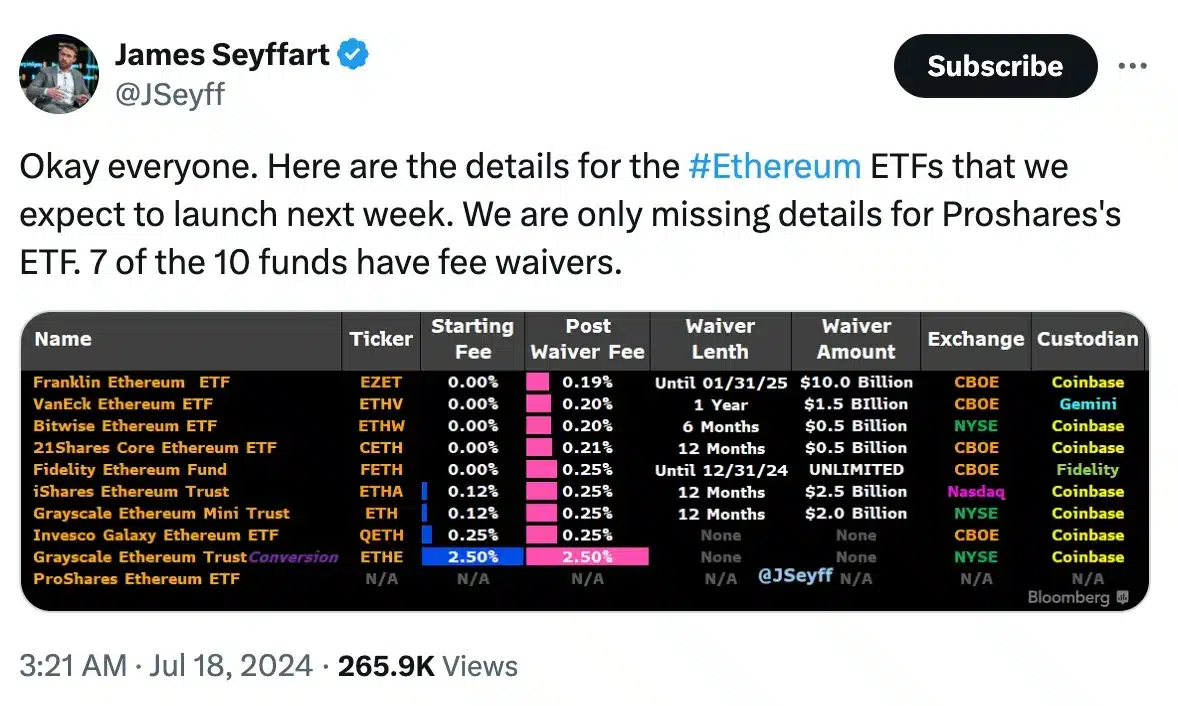

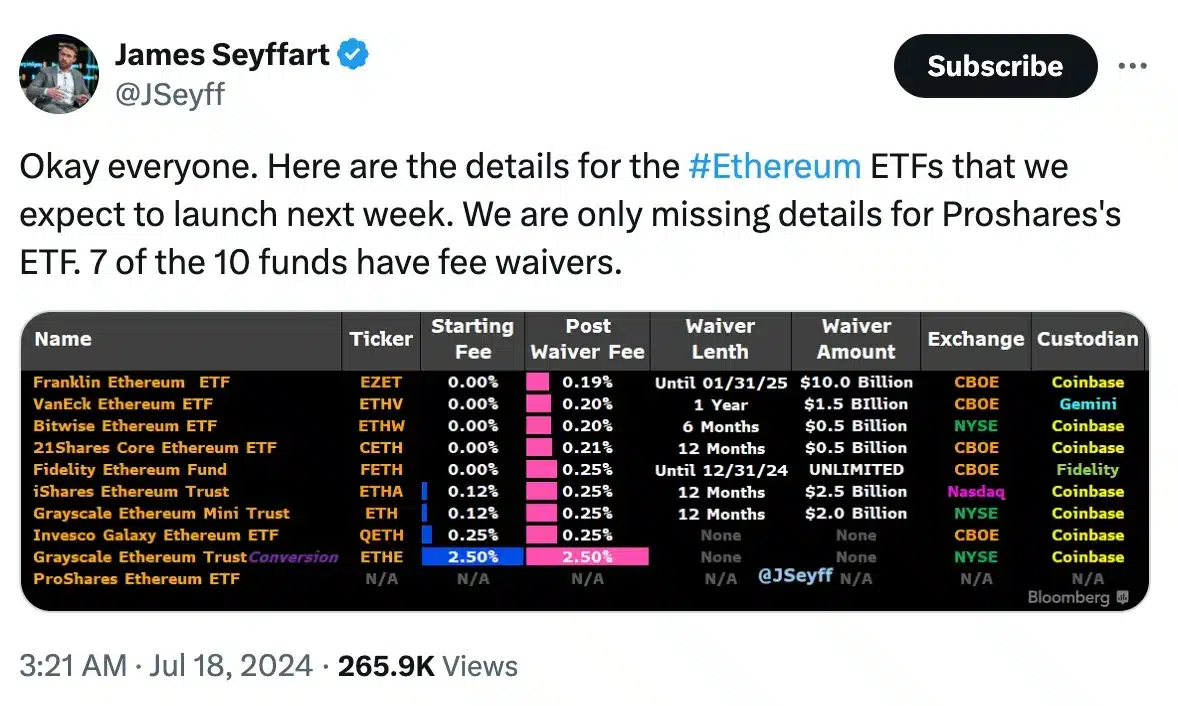

Additionally, asset management firms including BlackRock, are actively preparing for the launch of their ETH ETFs. In its S-1 registration statement filed on 17th July, BlackRock detailed the fee structure for its Ether ETF.

“The Sponsor’s Fee is accrued daily at an annualized rate equal to 0.25% of the net asset value of the Trust and is payable at least quarterly in arrears in U.S. dollars or in-kind or any combination thereof.”

This strategic move underscores BlackRock’s commitment to establishing a competitive presence in the emerging Ether ETF market, positioning itself alongside other firms each offering varied fee structures to attract investors.

Source: James Seyffart/X

As per reports, BlackRock has announced that its spot Ether ETF will charge a 0.12% fee for the first year or until it reaches $2.5 billion in net assets.

Other asset managers following suit

Franklin Templeton’s spot Ether ETF will offer the lowest fee at 0.19%, while both the Bitwise and VanEck Ethereum ETFs will charge a 0.20% fee.

The 21Shares Core Ethereum ETF will have a fee of 0.21%. Meanwhile, Fidelity and Invesco Galaxy ETFs will each offer a 0.25% fee, matching BlackRock’s standard rate after the initial period.

Amidst the positive developments surrounding ETH ETFs, the price of Ether has also seen a positive impact. According to CoinMarketCap, ETH has risen by 0.08% in the past 24 hours, trading at $3,499.

Additionally, technical indicators such as the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) suggest that bullish momentum is present, indicating continued optimism in the market.

Source: Trading View

- Growing anticipation surrounds the potential approval of spot Ethereum ETFs on 23rd July.

- ETH price rises by 0.08%, trading at $3,499, with bullish momentum indicators.

Amidst the growing anticipation surrounding the potential approval of spot Ethereum [ETH] Exchange Traded Funds (ETFs) on 23rd July, there has been a lot of buzz in the cryptocurrency space.

Impact of Ethereum ETF

It is also estimated that ETH ETF is likely to draw significant investor interest, potentially channeling more capital into the broader altcoin market.

Shedding light on the same, a crypto researcher on X, using the handle @wacy_time1, said,

“About $5 billion is expected to flow into the ETH ETF within the first six months.”

This estimate is based on the market capitalization ratio between Bitcoin [BTC] and Ethereum, which is approximately 75% to 25%.

Since investors have poured $59 billion into the BTC ETF, the proportional estimate for the ETH ETF, after accounting for $10 billion already invested in Grayscale’s ETHE, is around $5 billion.

This influx of investment is anticipated to have a substantial impact, not only on ETH but on the broader altcoin market as well.

Steps taken by BlackRock

Additionally, asset management firms including BlackRock, are actively preparing for the launch of their ETH ETFs. In its S-1 registration statement filed on 17th July, BlackRock detailed the fee structure for its Ether ETF.

“The Sponsor’s Fee is accrued daily at an annualized rate equal to 0.25% of the net asset value of the Trust and is payable at least quarterly in arrears in U.S. dollars or in-kind or any combination thereof.”

This strategic move underscores BlackRock’s commitment to establishing a competitive presence in the emerging Ether ETF market, positioning itself alongside other firms each offering varied fee structures to attract investors.

Source: James Seyffart/X

As per reports, BlackRock has announced that its spot Ether ETF will charge a 0.12% fee for the first year or until it reaches $2.5 billion in net assets.

Other asset managers following suit

Franklin Templeton’s spot Ether ETF will offer the lowest fee at 0.19%, while both the Bitwise and VanEck Ethereum ETFs will charge a 0.20% fee.

The 21Shares Core Ethereum ETF will have a fee of 0.21%. Meanwhile, Fidelity and Invesco Galaxy ETFs will each offer a 0.25% fee, matching BlackRock’s standard rate after the initial period.

Amidst the positive developments surrounding ETH ETFs, the price of Ether has also seen a positive impact. According to CoinMarketCap, ETH has risen by 0.08% in the past 24 hours, trading at $3,499.

Additionally, technical indicators such as the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) suggest that bullish momentum is present, indicating continued optimism in the market.

Source: Trading View

where buy clomid can you buy cheap clomiphene for sale where buy generic clomiphene pill where can i buy cheap clomiphene no prescription what is clomid medication where to get clomiphene price cost of generic clomiphene

The depth in this tune is exceptional.

Thanks recompense sharing. It’s first quality.

buy zithromax pill – buy ciplox 500mg without prescription order metronidazole

buy semaglutide 14 mg sale – generic periactin 4 mg cyproheptadine 4 mg canada

purchase domperidone generic – cyclobenzaprine pill flexeril price

buy generic augmentin – https://atbioinfo.com/ ampicillin over the counter

how to buy esomeprazole – anexamate nexium 20mg capsules

coumadin 5mg cost – coumamide purchase hyzaar pill

buy generic meloxicam – https://moboxsin.com/ cost mobic 15mg

cost deltasone 5mg – corticosteroid buy prednisone for sale

buy ed pills cheap – buy best erectile dysfunction pills best ed pills non prescription

purchase amoxicillin pills – https://combamoxi.com/ order amoxicillin without prescription

fluconazole without prescription – fluconazole online buy order diflucan 100mg sale

buy generic cenforce – on this site purchase cenforce generic

cialis 100 mg usa – cialis super active plus reviews cialis patent expiration

zantac sale – purchase ranitidine generic order zantac generic

how long before sex should you take cialis – https://strongtadafl.com/# cialis 5mg daily how long before it works

I couldn’t resist commenting. Adequately written! online

cheap viagra kamagra – click buy viagra qatar

This is a theme which is in to my verve… Diverse thanks! Exactly where can I lay one’s hands on the acquaintance details due to the fact that questions? https://buyfastonl.com/gabapentin.html

This is the kind of scribble literary works I positively appreciate. https://ursxdol.com/sildenafil-50-mg-in/

This is the description of topic I have reading. https://prohnrg.com/

Greetings! Very productive suggestion within this article! It’s the crumb changes which liking turn the largest changes. Thanks a a quantity towards sharing! stromectol prix

Greetings! Very useful suggestion within this article! It’s the scarcely changes which liking obtain the largest changes. Thanks a a quantity in the direction of sharing! https://ondactone.com/product/domperidone/

This website absolutely has all of the low-down and facts I needed about this thesis and didn’t know who to ask.

https://proisotrepl.com/product/methotrexate/

This website absolutely has all of the information and facts I needed to this thesis and didn’t know who to ask. http://wightsupport.com/forum/member.php?action=profile&uid=21295

dapagliflozin 10 mg uk – https://janozin.com/# buy dapagliflozin without prescription

order generic xenical – https://asacostat.com/ orlistat cost

More content pieces like this would make the web better. http://shiftdelete.10tl.net/member.php?action=profile&uid=205625