- Ethereum’s price drops 10.40%, nearing $2,000 support, while whales accumulate 330,000 ETH, signaling potential rebound.

- The next move hinges on holding onto this level; a breakdown could trigger further liquidations

Ethereum [ETH] has been caught in a bearish spiral, shedding 10.40% in the past week and nearing the crucial $2,000 support level.

The latest 10.40% drop has raised concerns among investors, as macroeconomic pressures and market-wide sell-offs continue to weigh on assets.

While short-term traders are exiting their positions, large Ethereum whales have taken a contrarian approach, accumulating 330,000 ETH in just 48 hours.

This divergence between price action and whale behavior raises an important question — are we witnessing the start of a deeper correction, or is this a strategic accumulation phase before a potential rebound?

Ethereum price outlook and key levels

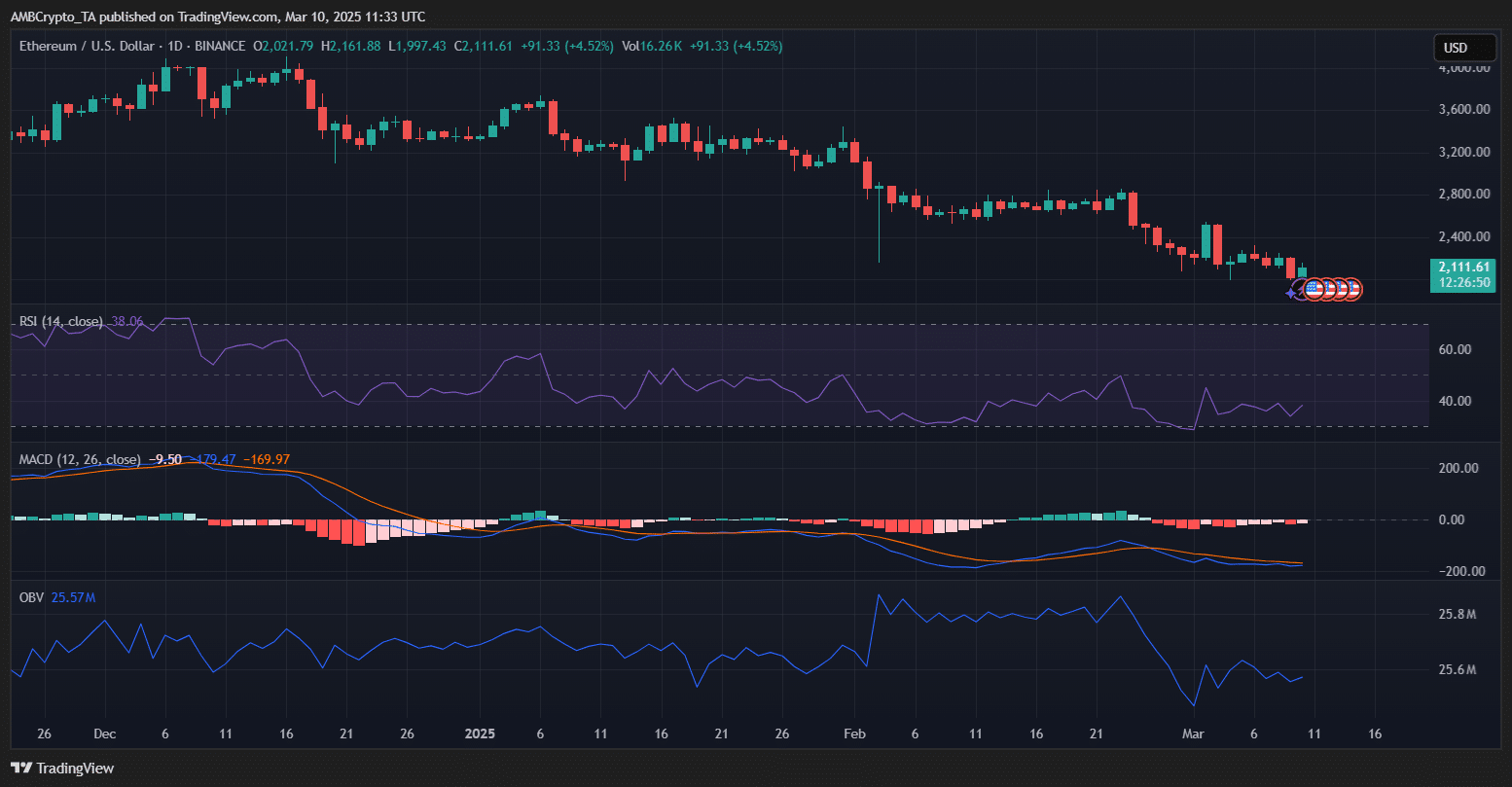

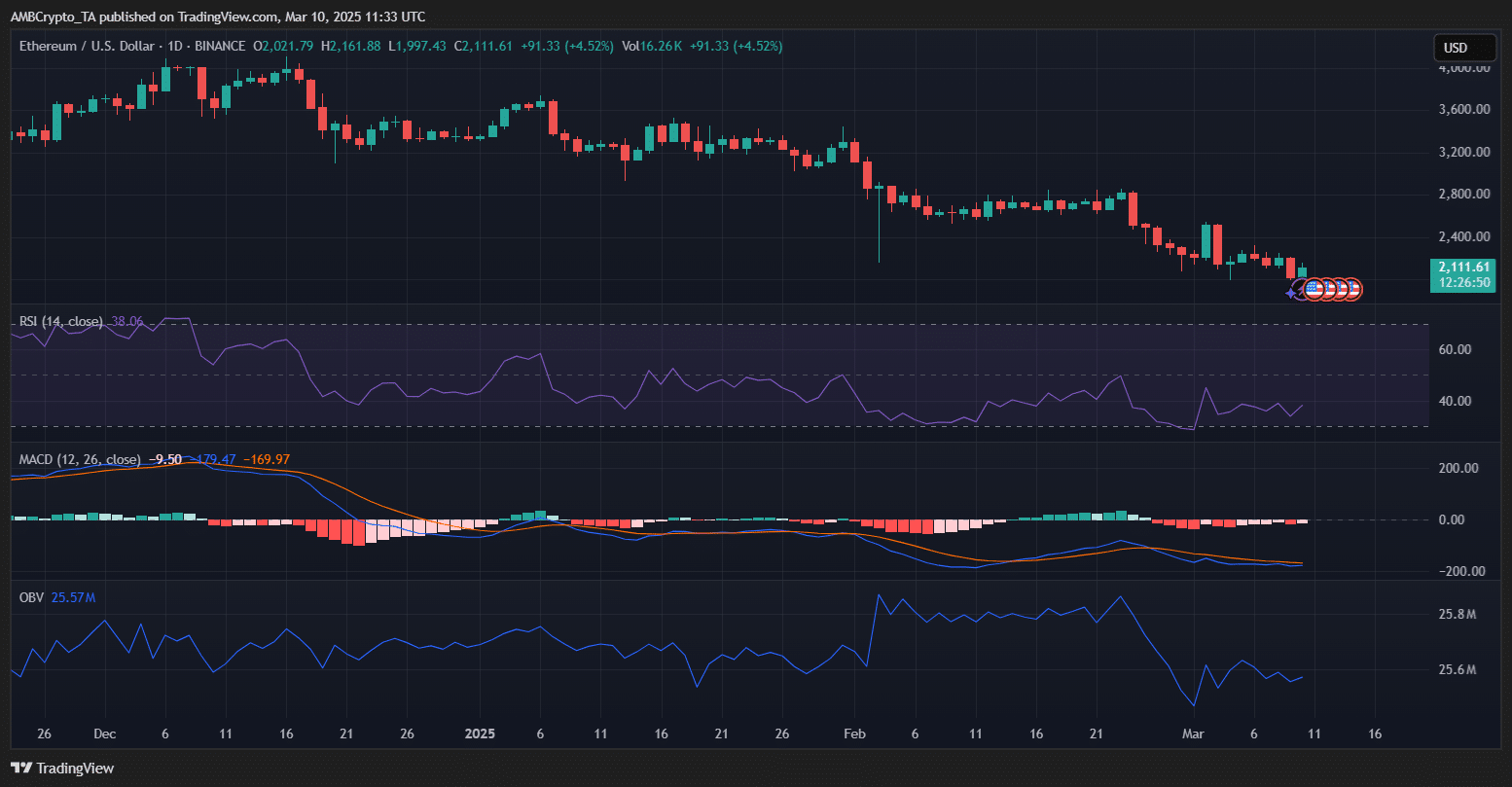

Ethereum’s recent 10.40% weekly drop, is reflected in key technical indicators signaling bearish momentum.

The RSI sat at 38.06 at press time, nearing the oversold region, suggesting that selling pressure was dominant, but a potential reversal could emerge if buyers step in.

Source: TradingView

The MACD indicator remained in negative territory, with the MACD line at -9.50 and the signal line below zero, reinforcing the ongoing bearish trend.

Additionally, the OBV showed a slight decline, indicating reduced buying activity and weaker demand.

Ethereum must hold the $2,000 support level, as past data suggests that losing this zone could trigger cascading liquidations.

However, if buyers capitalize on current whale accumulation, a recovery toward $2,200 could be possible.

Whale accumulation: A sign of confidence or caution?

Ethereum’s price has dipped significantly, yet on-chain data reveals that large holders have accumulated 330,000 ETH in the past 48 hours.

There’s been a sharp increase in balances held by wallets with 100,000+ ETH, indicating strategic buying by deep-pocketed investors.

Source: X

These major players could include institutions, long-term holders, or market makers positioning themselves ahead of potential price swings.

The timing suggests that whales might be buying the dip, expecting a recovery, or hedging against further volatility.

Historically, such whale accumulation has preceded price rebounds, but with Ethereum hovering around the critical $2,000 level, the next move will depend on whether buying pressure sustains or broader market conditions force another leg downward.

On-chain metrics and market sentiment

Source: Cryptoquant

- Ethereum’s price drops 10.40%, nearing $2,000 support, while whales accumulate 330,000 ETH, signaling potential rebound.

- The next move hinges on holding onto this level; a breakdown could trigger further liquidations

Ethereum [ETH] has been caught in a bearish spiral, shedding 10.40% in the past week and nearing the crucial $2,000 support level.

The latest 10.40% drop has raised concerns among investors, as macroeconomic pressures and market-wide sell-offs continue to weigh on assets.

While short-term traders are exiting their positions, large Ethereum whales have taken a contrarian approach, accumulating 330,000 ETH in just 48 hours.

This divergence between price action and whale behavior raises an important question — are we witnessing the start of a deeper correction, or is this a strategic accumulation phase before a potential rebound?

Ethereum price outlook and key levels

Ethereum’s recent 10.40% weekly drop, is reflected in key technical indicators signaling bearish momentum.

The RSI sat at 38.06 at press time, nearing the oversold region, suggesting that selling pressure was dominant, but a potential reversal could emerge if buyers step in.

Source: TradingView

The MACD indicator remained in negative territory, with the MACD line at -9.50 and the signal line below zero, reinforcing the ongoing bearish trend.

Additionally, the OBV showed a slight decline, indicating reduced buying activity and weaker demand.

Ethereum must hold the $2,000 support level, as past data suggests that losing this zone could trigger cascading liquidations.

However, if buyers capitalize on current whale accumulation, a recovery toward $2,200 could be possible.

Whale accumulation: A sign of confidence or caution?

Ethereum’s price has dipped significantly, yet on-chain data reveals that large holders have accumulated 330,000 ETH in the past 48 hours.

There’s been a sharp increase in balances held by wallets with 100,000+ ETH, indicating strategic buying by deep-pocketed investors.

Source: X

These major players could include institutions, long-term holders, or market makers positioning themselves ahead of potential price swings.

The timing suggests that whales might be buying the dip, expecting a recovery, or hedging against further volatility.

Historically, such whale accumulation has preceded price rebounds, but with Ethereum hovering around the critical $2,000 level, the next move will depend on whether buying pressure sustains or broader market conditions force another leg downward.

On-chain metrics and market sentiment

Source: Cryptoquant

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

Si eres fanatico de los casinos online en Espana, has llegado al sitio adecuado.

Aqui encontraras analisis completos sobre los mejores casinos disponibles en Espana.

### Ventajas de jugar en casinos de Espana

– **Plataformas seguras** para jugar con total confianza.

– **Promociones especiales** que aumentan tus posibilidades de ganar.

– **Amplia variedad de juegos** con premios atractivos.

– **Pagos rapidos y seguros** con multiples metodos de pago, incluyendo tarjetas, PayPal y criptomonedas.

?Donde encontrar los mejores casinos?

En este portal hemos recopilado las **valoraciones detalladas** sobre los mejores casinos en linea de Espana. Consulta la informacion aqui: casinotorero.info.

**Abre tu cuenta en un sitio seguro y aprovecha todas las ventajas.**

Are you upgrade your hairstyle with authentic dreadlocks? Browse our selection of human hair dreadlock extensions at our official store – human hair dreadlock extensions, offering the highest quality options for achieving a flawless, natural look.

Carefully designed using real human hair, these dreadlocks are ideal for natural styling. Whether you’re into temporary installs, we have options that fit all hair types.

Choose your vibe with:

– dread natural

– dreadlock extensions

Achieve that natural dreadlock vibe with premium-quality extensions that look and feel real. Discreet packaging available across the USA and beyond!

Claim yours today – your new hair era starts here.

Are you upgrade your vibe with genuine dreadlocks? Check out this selection of real dreadlock extensions at our official store – handmade dreadlocks, offering the highest quality options for achieving a flawless, natural look.

Carefully designed using premium natural hair, these dreadlocks are perfect for a bold new look. Whether you’re into full-head transformations, we have options that match curly, coily, or straight textures.

Express yourself with:

– human hair dreadlock extensions

– dreads real hair

Stand out confidently with premium-quality extensions that look and feel real. Discreet packaging available across the USA and beyond!

Transform your look – you were meant to stand out.

Are you transform your hairstyle with genuine dreadlocks? Check out a stunning selection of dreads real hair at this link – real dreadlock extensions, offering the highest quality options for achieving a flawless, natural look.

Made with ethically sourced hair, these dreadlocks are perfect for a bold new look. Whether you’re into temporary installs, we have options that match curly, coily, or straight textures.

Find your fit with:

– real dreadlock extensions

– dreadlock extensions

Make a statement with premium-quality extensions that look and feel real. Smooth checkout available across the USA and beyond!

Claim yours today – you were meant to stand out.

can i buy cheap clomid without dr prescription where can i get cheap clomid can i order generic clomid without rx cost cheap clomiphene for sale where can i get clomid how to get clomiphene price clomiphene pill

I couldn’t weather commenting. Warmly written!

Thanks on putting this up. It’s okay done.

azithromycin canada – order zithromax 250mg without prescription flagyl 200mg over the counter

semaglutide for sale – order rybelsus online cheap order periactin

order motilium – how to get sumycin without a prescription flexeril price