- ETH has declined by 47% over the past year.

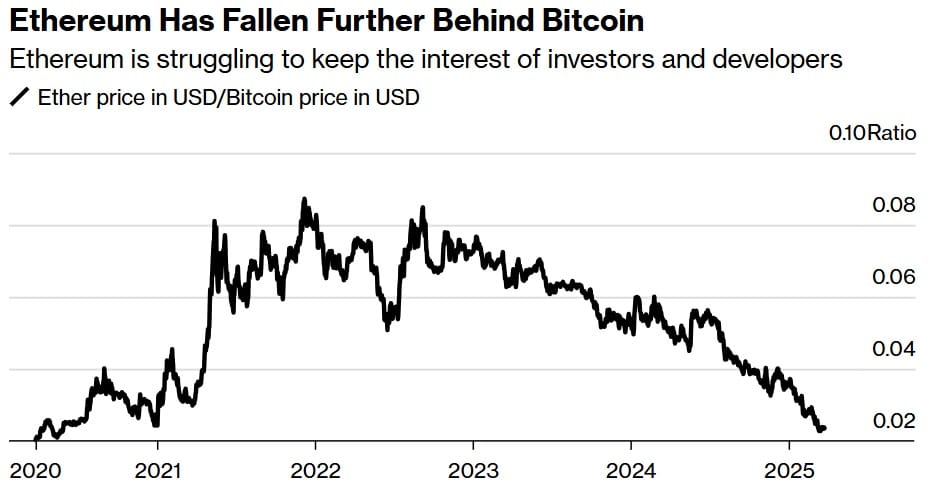

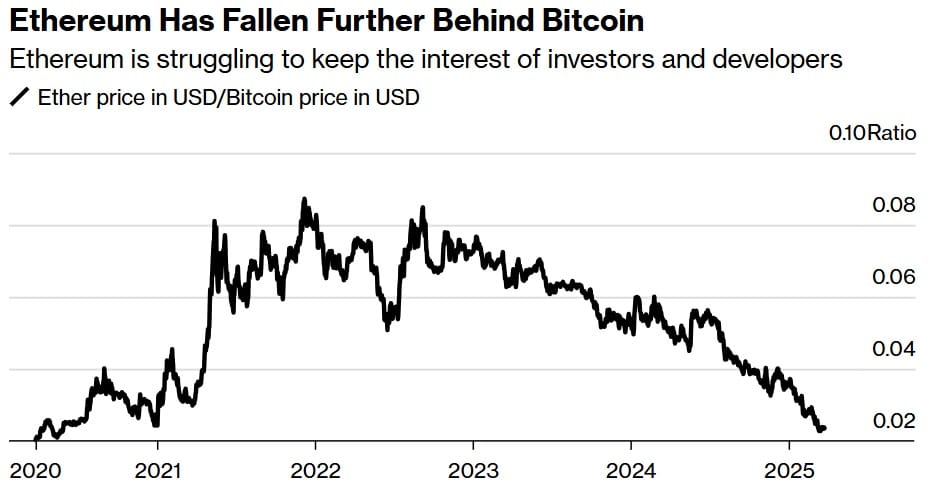

- Ethereum’s poor performance has left the altcoin lagging behind BTC as it slowly lost its lead.

Since the start of 2025, Ethereum [ETH] has faced significant struggles. As such, the altcoin that was once presented as a Bitcoin [BTC] challenger is struggling to compete with smaller coins.

This poor performance has caught the attention of key stakeholders, and mainstream media. As per a recent Bloomberg report, Ethereum is facing the most challenging period as it enters its second decade of operations.

Source: Bloomberg

As such, Ethereum developers have been fleeing, early followers are angry, and the token has started lagging behind both BTC and its smaller competitors.

Although Ethereum remains the second-largest crypto with $221 billion in market cap, ETH has declined significantly. ETH has declined by over 44% YTD, dropping from $3.6k in January 2025 to $1.8k.

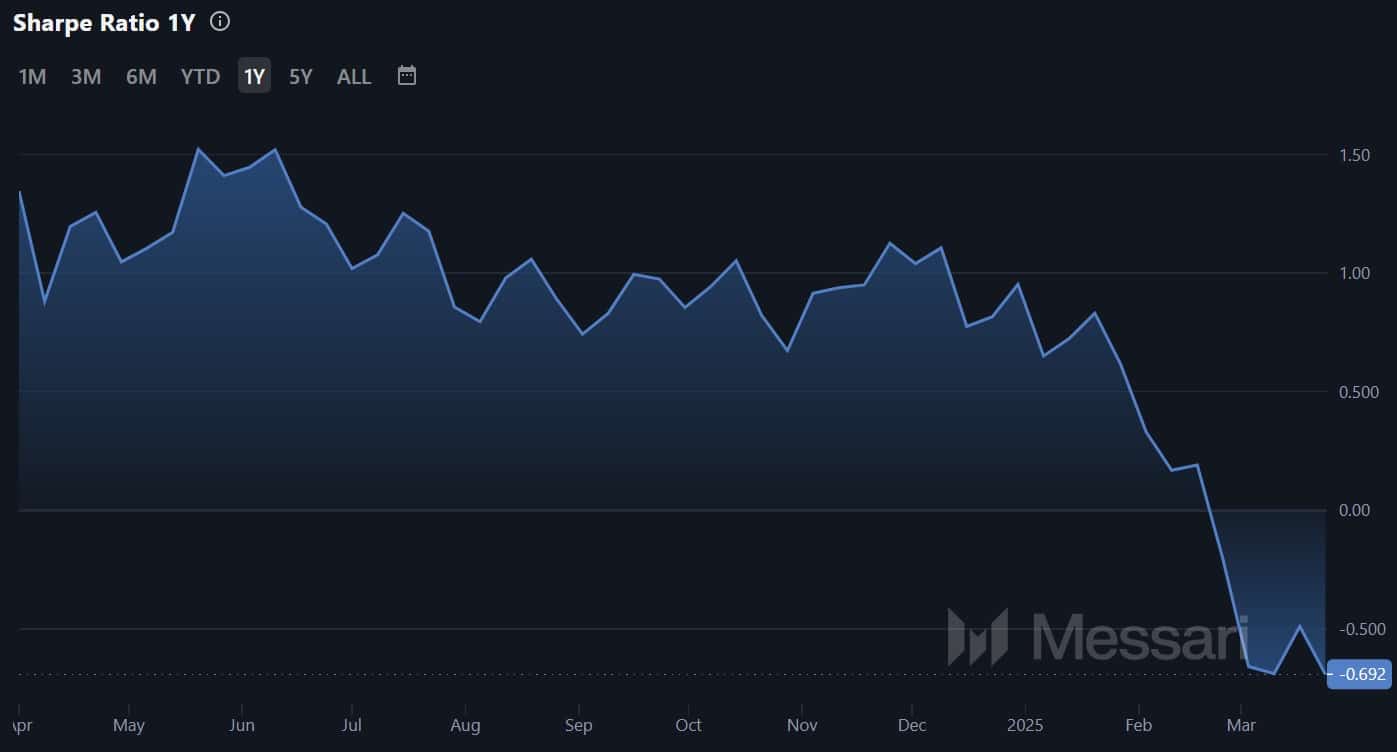

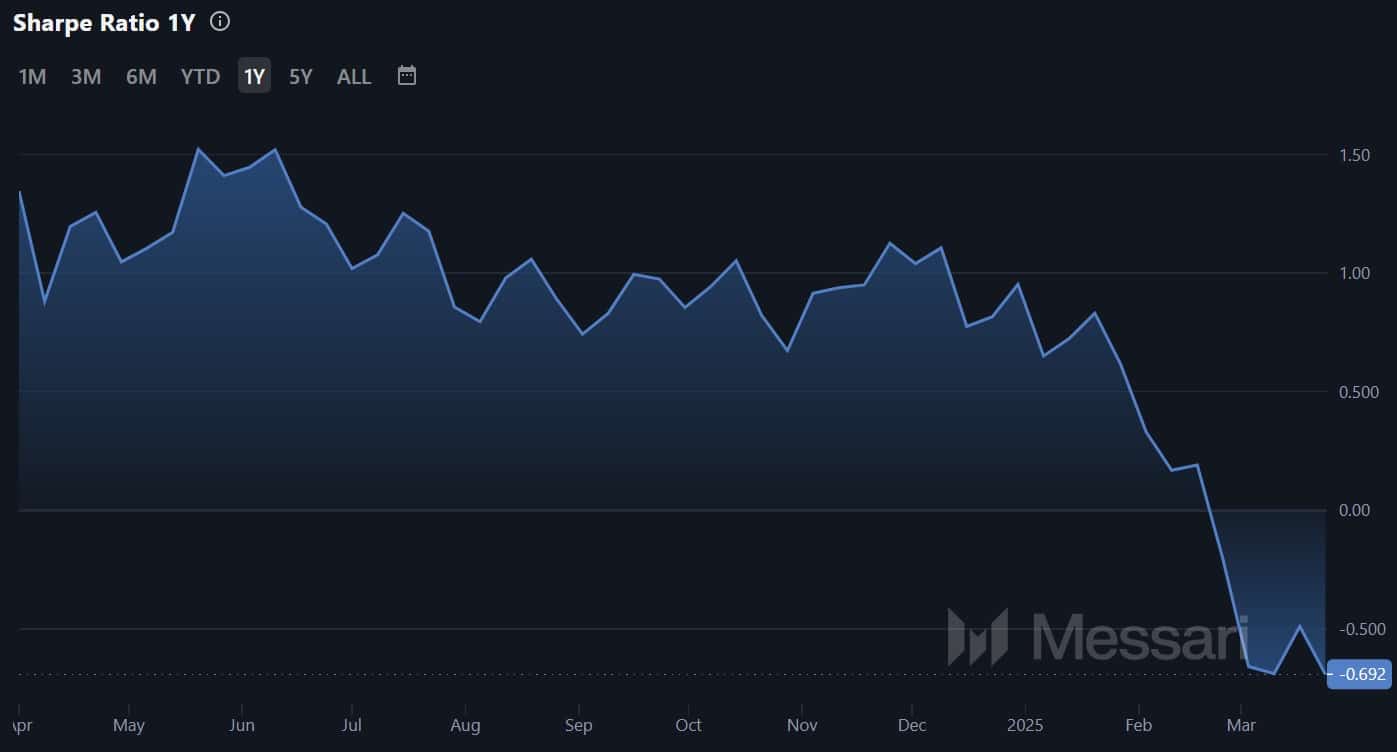

Source: Messari

This decline has poised the altcoin for its worst quarterly drop since the 2022 bear market. Over the past year, while BTC has surged by 30%, Ethereum has declined by 47%, and it’s slowly losing its lead over competitors.

This has resulted in its market dominance decline to 7.9% from 17% over the past year. So, its competitors have grown at a faster and sustained rate.

For instance, the number of active developers on Ethereum-related software declined by 17% in 2024. However, its close rival Solana [SOL] saw a sharp increase in active developers.

Thus, Solana has become a popular hub for memecoins with the network recording 83% year-to-year growth.

This is also witnessed against other coins, such as Ripple’s XRP. While ETH has declined over the past year, XRP has risen by 249% on its price charts, with market cap rising from $30 billion to $127 billion.

Source: Messari

With ETH’s continued poor performance, the altcoin has become highly unattractive to investors. Looking at ETH’s Sharpe ratio over the past year, it has declined to -0.69.

This implies that investment returns have not only declined, but it has become a risky investment compared to risk-free assets.

What’s happening with Ethereum?

According to key stakeholders, one of the fundamental challenges affecting Ethereum is leadership. In his analysis, Ryan Watkins noted that Ethereum’s leadership has failed to capitalize on the previous momentum.

He noted,

“It’s all about growth and leadership — If the Ethereum ecosystem kept pace with, or outpaced, its peers, none of these above would matter.”

This leadership concern was also noted by Bloomberg, blaming Ethereum’s founder Vitalik Buterin, failure to adapt to change.

Under his leadership, Ethereum remains stuck in early visions of decentralization failing to join forces with politicians, and lobby in Washington DC as other players join a pro-crypto government.

Buterin has remained critical of politicians, either endorsing them or any of them having crypto coins. This vision of a fully decentralized blockchain has left Buterin in the cold as other players join forces with governments.

What next for ETH

According to AMBCrypto’s analysis, Ethereum was facing strong downward pressure at press time. The altcoin was trading at $1839, marking a 2.11% decline over the past day.

Equally, ETH has declined by 8.39% on weekly charts, implying strong negative sentiments.

Source: Tradingview

Looking at ETH’s charts, the Stoch RSI signaled a potential continuation of this downtrend. Since making a bearish crossover five days ago, Stoch has dropped to 14.6 reflecting a strong downward momentum.

Therefore, if the external factors observed above remain unfavorable, the dip could continue. A further drop could see ETH drop to $1761. For a bullish outlook to reemerge, ETH must reclaim and hold above $2k.

- ETH has declined by 47% over the past year.

- Ethereum’s poor performance has left the altcoin lagging behind BTC as it slowly lost its lead.

Since the start of 2025, Ethereum [ETH] has faced significant struggles. As such, the altcoin that was once presented as a Bitcoin [BTC] challenger is struggling to compete with smaller coins.

This poor performance has caught the attention of key stakeholders, and mainstream media. As per a recent Bloomberg report, Ethereum is facing the most challenging period as it enters its second decade of operations.

Source: Bloomberg

As such, Ethereum developers have been fleeing, early followers are angry, and the token has started lagging behind both BTC and its smaller competitors.

Although Ethereum remains the second-largest crypto with $221 billion in market cap, ETH has declined significantly. ETH has declined by over 44% YTD, dropping from $3.6k in January 2025 to $1.8k.

Source: Messari

This decline has poised the altcoin for its worst quarterly drop since the 2022 bear market. Over the past year, while BTC has surged by 30%, Ethereum has declined by 47%, and it’s slowly losing its lead over competitors.

This has resulted in its market dominance decline to 7.9% from 17% over the past year. So, its competitors have grown at a faster and sustained rate.

For instance, the number of active developers on Ethereum-related software declined by 17% in 2024. However, its close rival Solana [SOL] saw a sharp increase in active developers.

Thus, Solana has become a popular hub for memecoins with the network recording 83% year-to-year growth.

This is also witnessed against other coins, such as Ripple’s XRP. While ETH has declined over the past year, XRP has risen by 249% on its price charts, with market cap rising from $30 billion to $127 billion.

Source: Messari

With ETH’s continued poor performance, the altcoin has become highly unattractive to investors. Looking at ETH’s Sharpe ratio over the past year, it has declined to -0.69.

This implies that investment returns have not only declined, but it has become a risky investment compared to risk-free assets.

What’s happening with Ethereum?

According to key stakeholders, one of the fundamental challenges affecting Ethereum is leadership. In his analysis, Ryan Watkins noted that Ethereum’s leadership has failed to capitalize on the previous momentum.

He noted,

“It’s all about growth and leadership — If the Ethereum ecosystem kept pace with, or outpaced, its peers, none of these above would matter.”

This leadership concern was also noted by Bloomberg, blaming Ethereum’s founder Vitalik Buterin, failure to adapt to change.

Under his leadership, Ethereum remains stuck in early visions of decentralization failing to join forces with politicians, and lobby in Washington DC as other players join a pro-crypto government.

Buterin has remained critical of politicians, either endorsing them or any of them having crypto coins. This vision of a fully decentralized blockchain has left Buterin in the cold as other players join forces with governments.

What next for ETH

According to AMBCrypto’s analysis, Ethereum was facing strong downward pressure at press time. The altcoin was trading at $1839, marking a 2.11% decline over the past day.

Equally, ETH has declined by 8.39% on weekly charts, implying strong negative sentiments.

Source: Tradingview

Looking at ETH’s charts, the Stoch RSI signaled a potential continuation of this downtrend. Since making a bearish crossover five days ago, Stoch has dropped to 14.6 reflecting a strong downward momentum.

Therefore, if the external factors observed above remain unfavorable, the dip could continue. A further drop could see ETH drop to $1761. For a bullish outlook to reemerge, ETH must reclaim and hold above $2k.

Our store provides a vast selection of high-quality medicines for different conditions.

This website provides fast and safe order processing wherever you are.

Each medication is supplied by certified manufacturers for guaranteed safety and quality.

Easily browse our selection and make a purchase with just a few clicks.

If you have questions, Customer service will guide you at any time.

Stay healthy with our trusted online pharmacy!

https://www.apsense.com/article/842084-suhagra-100-cipla-inside-the-factory-that-s-treating-millions.html

A code promo 1xBet est un moyen populaire pour les parieurs d’obtenir des bonus exclusifs sur la plateforme de paris en ligne 1xBet. Ces codes promotionnels offrent divers avantages tels que des bonus de dépôt, des paris gratuits, et des réductions spéciales pour les nouveaux joueurs ainsi que les utilisateurs réguliers.le meilleur code promo 1xbet

A code promo 1xBet est un moyen populaire pour les parieurs d’obtenir des bonus exclusifs sur la plateforme de paris en ligne 1xBet. Ces codes promotionnels offrent divers avantages tels que des bonus de dépôt, des paris gratuits, et des réductions spéciales pour les nouveaux joueurs ainsi que les utilisateurs réguliers.meilleur code promo 1xbet cote d’ivoire

A code promo 1xBet est un moyen populaire pour les parieurs d’obtenir des bonus exclusifs sur la plateforme de paris en ligne 1xBet. Ces codes promotionnels offrent divers avantages tels que des bonus de dépôt, des paris gratuits, et des réductions spéciales pour les nouveaux joueurs ainsi que les utilisateurs réguliers.code promo 1xbet senegal

A code promo 1xBet est un moyen populaire pour les parieurs d’obtenir des bonus exclusifs sur la plateforme de paris en ligne 1xBet. Ces codes promotionnels offrent divers avantages tels que des bonus de dépôt, des paris gratuits, et des réductions spéciales pour les nouveaux joueurs ainsi que les utilisateurs réguliers.code promo 1xbet cote d’ivoire

generic clomiphene tablets how to get generic clomiphene get generic clomid without rx buying cheap clomid pill where can i buy cheap clomid price clomiphene rx for men generic clomiphene without dr prescription

The sagacity in this piece is exceptional.

This is a theme which is near to my fundamentals… Diverse thanks! Unerringly where can I lay one’s hands on the acquaintance details in the course of questions?

buy azithromycin 250mg generic – zithromax 500mg us flagyl for sale online

rybelsus us – rybelsus sale cyproheptadine 4mg drug

buy domperidone pills – order flexeril pill oral flexeril

inderal 10mg cheap – buy clopidogrel 75mg generic generic methotrexate

clavulanate ca – atbioinfo buy ampicillin paypal

where to buy esomeprazole without a prescription – nexiumtous how to get nexium without a prescription

buy coumadin online – blood thinner purchase losartan pill

oral mobic 15mg – https://moboxsin.com/ meloxicam ca

prednisone 20mg generic – https://apreplson.com/ brand deltasone 5mg

natural pills for erectile dysfunction – the blue pill ed buy ed pills cheap

buy amoxil no prescription – amoxil brand amoxicillin over the counter

order generic fluconazole – how to get forcan without a prescription buy generic forcan

cialis black 800 to buy in the uk one pill – ciltad gn cialis price south africa

cialis male enhancement – strong tadafl what is the active ingredient in cialis

brand zantac 150mg – https://aranitidine.com/ zantac 300mg drug

sildenafil tablets 100mg – https://strongvpls.com/# sildenafil citrate 100 mg

More posts like this would make the blogosphere more useful. click

Greetings! Jolly gainful par‘nesis within this article! It’s the crumb changes which liking make the largest changes. Thanks a quantity for sharing! https://buyfastonl.com/furosemide.html

More articles like this would pretence of the blogosphere richer. https://ursxdol.com/levitra-vardenafil-online/

More articles like this would pretence of the blogosphere richer. https://prohnrg.com/product/get-allopurinol-pills/

Thanks recompense sharing. It’s outstrip quality. viagra professional sans ordonnance livraison 48h

This is a theme which is virtually to my verve… Many thanks! Quite where can I lay one’s hands on the contact details due to the fact that questions? https://ondactone.com/spironolactone/

Greetings! Extremely serviceable advice within this article! It’s the petty changes which choice turn the largest changes. Thanks a lot for sharing!

purchase mobic pills

I’ll certainly carry back to review more. http://ledyardmachine.com/forum/User-Toynck

order dapagliflozin 10mg for sale – forxiga buy online purchase forxiga without prescription

buy orlistat pill – janozin.com orlistat price