- ETH has declined by 46% over the past year.

- Ethereum could drop to October 2023 levels of around $1657 as bearish sentiments persist.

Over the past month, Ethereum [ETH] has experienced strong downward momentum. In fact, ETH is down by 46.06% on yearly charts.

While other crypto assets such as Bitcoin are up over the past year, ETH shows no signs of recovery. On the contrary, ETH could decline further.

Source: TradingView

As such, the altcoin has broken down into a symmetrical triangle. After the breakdown and a retest, ETH is now looking bearish.

This suggests that ETH is in a position for further losses on its price charts. A breakdown here suggests that the downward momentum is strong and could even continue.

Source: TradingView

The recent decline is jeopardizing Ethereum’s market position, with continued downward movement potentially weakening the altcoin further against its rivals.

ETH dominance is forming a descending triangle, a bearish pattern commonly observed in technical analysis. While downward pressure persists, there’s potential for ETH dominance to make a corrective move to the upside.

This trend is further supported by a drop in Ethereum’s circulating market dominance, which has fallen from 17.32% to 7.39%. Such a significant decline highlights ETH’s underperformance compared to its competitors.

Source: Messari

Therefore, with the crypto market excluding Bitcoin breaking down, it suggests a strong bearish momentum among altcoins. With altcoins facing strengthening bearishness, we could see ETH make more losses and drop further.

What ETH’s on-chain data suggests

According to AMBCrypto’s analysis, Ethereum is seeing strong bearish sentiments across the charts.

Source: Messari

For starters, Ethereum’s futures buy volume has declined to a two-week low of 6.17 billion. This is a drop from 16.25 billion, suggesting that the altcoin is seeing fewer buyers in the market.

As such, investors are not buying the crypto, reflecting a strong lack of confidence in the market conditions.

Source: IntoTheBlock

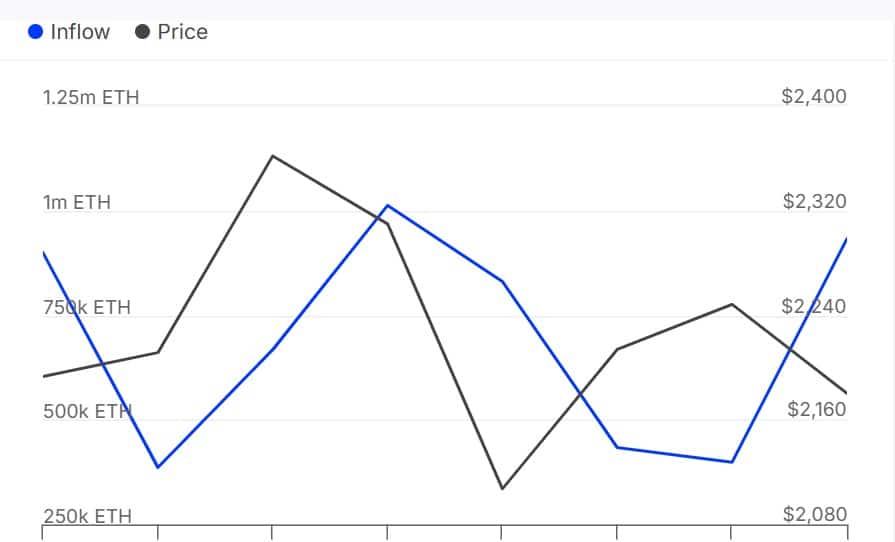

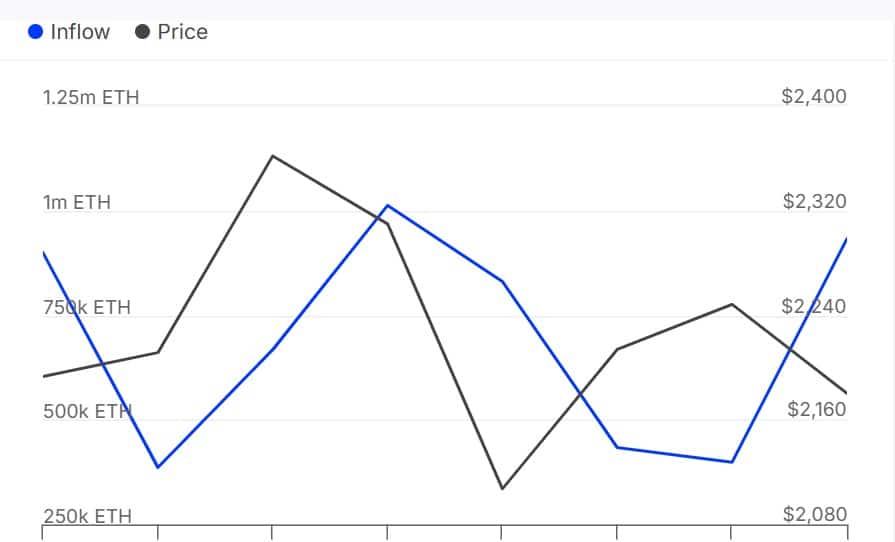

This low buying activity is even more prevalent among Ethereum’s large holders. As per IntoTheBlock data, ETH whales are not buying but selling.

In fact, large holders’ netflow has dropped into negative territory, hitting -1.65k. Such a dip suggests there’s more cash outflow from whales into ETH than inflow.

Source: CryptoQuant

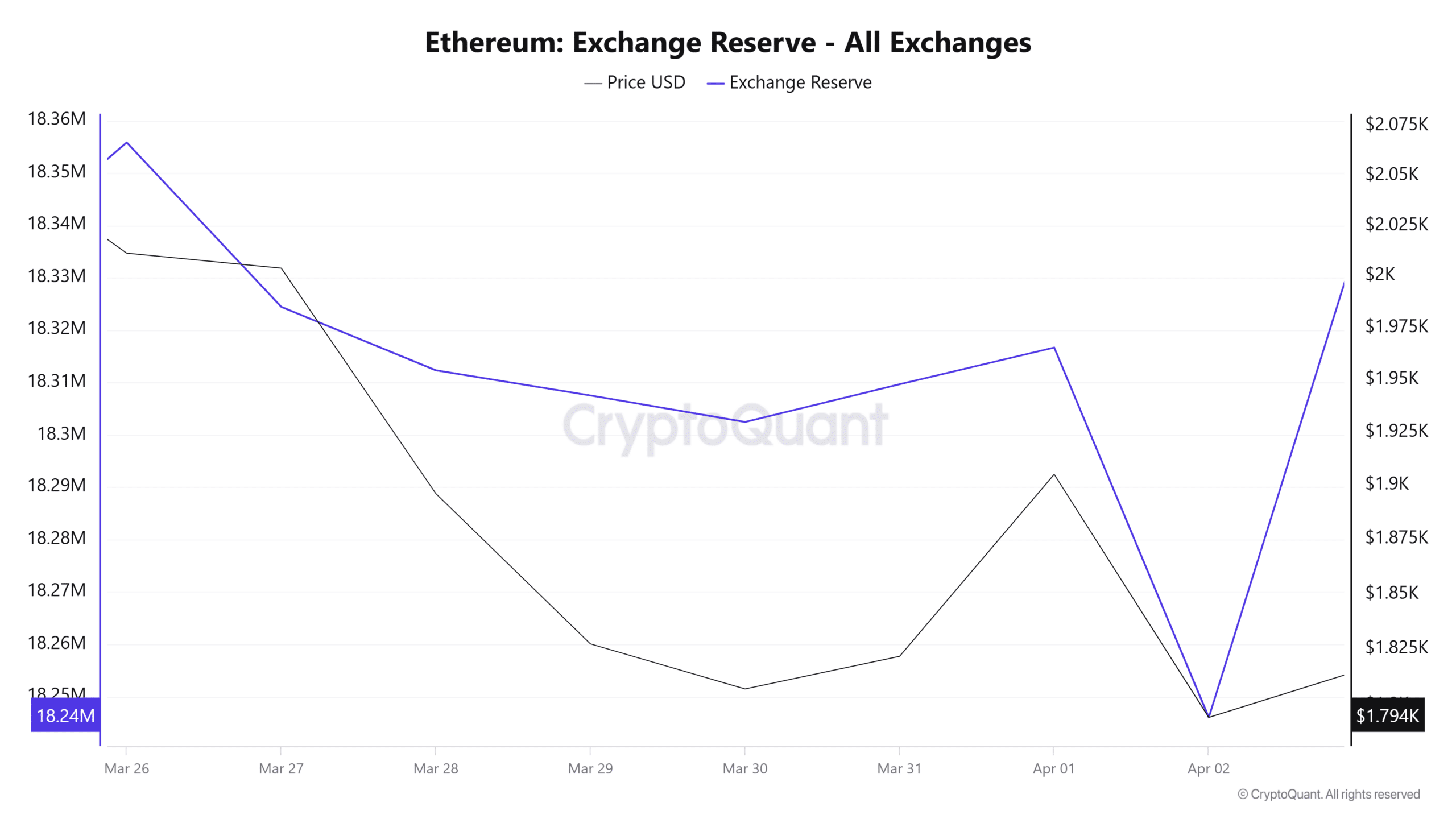

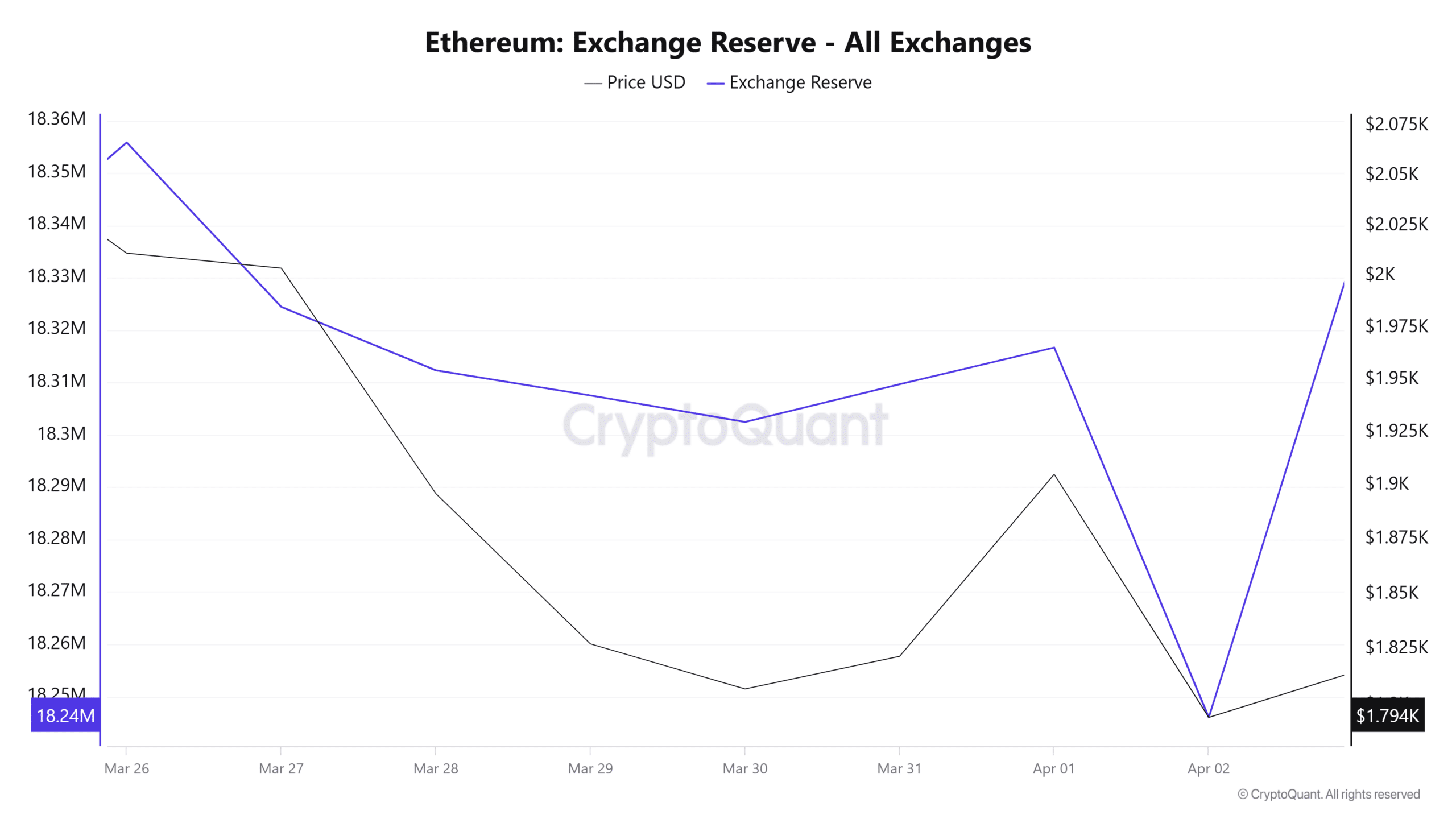

Ethereum’s exchange reserve is increasing, reaching 18.4 million—a rise of 200 million ETH tokens in the past day.

This surge in reserves indicates that more ETH tokens are being deposited into exchanges. It suggests that investors are selling their holdings to mitigate further losses, reflecting a growing bearish sentiment for ETH.

Is Ethereum Set for More Losses?

With Ethereum’s investors turning bearish with increased selling activity and reduced demand, the altcoin could see more losses on its price charts.

Source: TradingView

ETH is experiencing growing downward momentum, as highlighted by the recent bearish crossover on its Stochastic RSI.

The continued decline in the Stochastic indicator suggests further losses could be on the horizon, especially with the RVGI signaling a bearish trend.

Current market conditions position Ethereum for a potential further downside. With its price dropping to $1,788, a breach of the $1,757 support level could push ETH toward October 2023 levels around $1,657.

For a bullish reversal, ETH would require a daily close above $1,800.

- ETH has declined by 46% over the past year.

- Ethereum could drop to October 2023 levels of around $1657 as bearish sentiments persist.

Over the past month, Ethereum [ETH] has experienced strong downward momentum. In fact, ETH is down by 46.06% on yearly charts.

While other crypto assets such as Bitcoin are up over the past year, ETH shows no signs of recovery. On the contrary, ETH could decline further.

Source: TradingView

As such, the altcoin has broken down into a symmetrical triangle. After the breakdown and a retest, ETH is now looking bearish.

This suggests that ETH is in a position for further losses on its price charts. A breakdown here suggests that the downward momentum is strong and could even continue.

Source: TradingView

The recent decline is jeopardizing Ethereum’s market position, with continued downward movement potentially weakening the altcoin further against its rivals.

ETH dominance is forming a descending triangle, a bearish pattern commonly observed in technical analysis. While downward pressure persists, there’s potential for ETH dominance to make a corrective move to the upside.

This trend is further supported by a drop in Ethereum’s circulating market dominance, which has fallen from 17.32% to 7.39%. Such a significant decline highlights ETH’s underperformance compared to its competitors.

Source: Messari

Therefore, with the crypto market excluding Bitcoin breaking down, it suggests a strong bearish momentum among altcoins. With altcoins facing strengthening bearishness, we could see ETH make more losses and drop further.

What ETH’s on-chain data suggests

According to AMBCrypto’s analysis, Ethereum is seeing strong bearish sentiments across the charts.

Source: Messari

For starters, Ethereum’s futures buy volume has declined to a two-week low of 6.17 billion. This is a drop from 16.25 billion, suggesting that the altcoin is seeing fewer buyers in the market.

As such, investors are not buying the crypto, reflecting a strong lack of confidence in the market conditions.

Source: IntoTheBlock

This low buying activity is even more prevalent among Ethereum’s large holders. As per IntoTheBlock data, ETH whales are not buying but selling.

In fact, large holders’ netflow has dropped into negative territory, hitting -1.65k. Such a dip suggests there’s more cash outflow from whales into ETH than inflow.

Source: CryptoQuant

Ethereum’s exchange reserve is increasing, reaching 18.4 million—a rise of 200 million ETH tokens in the past day.

This surge in reserves indicates that more ETH tokens are being deposited into exchanges. It suggests that investors are selling their holdings to mitigate further losses, reflecting a growing bearish sentiment for ETH.

Is Ethereum Set for More Losses?

With Ethereum’s investors turning bearish with increased selling activity and reduced demand, the altcoin could see more losses on its price charts.

Source: TradingView

ETH is experiencing growing downward momentum, as highlighted by the recent bearish crossover on its Stochastic RSI.

The continued decline in the Stochastic indicator suggests further losses could be on the horizon, especially with the RVGI signaling a bearish trend.

Current market conditions position Ethereum for a potential further downside. With its price dropping to $1,788, a breach of the $1,757 support level could push ETH toward October 2023 levels around $1,657.

For a bullish reversal, ETH would require a daily close above $1,800.

get clomiphene without rx where can i buy generic clomiphene without dr prescription can you get cheap clomiphene prices clomiphene sleep apnea where can i buy clomid without dr prescription cost of clomid without prescription clomiphene sleep apnea

More posts like this would bring about the blogosphere more useful.

Thanks an eye to sharing. It’s acme quality.

order zithromax 500mg pills – purchase flagyl online cheap buy metronidazole for sale

buy semaglutide 14mg for sale – purchase periactin pills cheap cyproheptadine 4mg

buy domperidone sale – cyclobenzaprine 15mg oral flexeril 15mg drug

buy inderal medication – buy methotrexate 10mg for sale order methotrexate 10mg generic

amoxicillin pills – buy ipratropium 100 mcg generic combivent for sale online

augmentin 1000mg generic – https://atbioinfo.com/ order ampicillin pill

buy nexium 40mg pills – anexa mate nexium uk

generic warfarin – https://coumamide.com/ order cozaar pill

meloxicam us – moboxsin.com meloxicam 7.5mg cheap

how to get prednisone without a prescription – adrenal deltasone oral

ed pills that really work – https://fastedtotake.com/ ed pills no prescription

order fluconazole 100mg generic – https://gpdifluca.com/ buy diflucan 200mg pills

order cenforce 50mg without prescription – https://cenforcers.com/# buy cenforce 50mg pill

cialis patent expiration 2016 – ciltad gn purchase generic cialis

zantac 300mg usa – https://aranitidine.com/ cost ranitidine 300mg

cialis one a day with dapoxetine canada – cialis at canadian pharmacy cialis delivery held at customs

Palatable blog you have here.. It’s severely to assign strong calibre script like yours these days. I honestly appreciate individuals like you! Withstand vigilance!! comprar fildena europa

order viagra in uk – buy viagra no prescription canada cheap viagra super force

This website positively has all of the low-down and facts I needed adjacent to this thesis and didn’t comprehend who to ask. https://buyfastonl.com/furosemide.html

This is the make of post I unearth helpful. https://prohnrg.com/product/diltiazem-online/

I couldn’t weather commenting. Profoundly written! https://aranitidine.com/fr/acheter-cenforce/

This is the stripe of serenity I take advantage of reading. https://ondactone.com/spironolactone/

I am actually happy to glance at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data.

https://proisotrepl.com/product/colchicine/

More delight pieces like this would create the интернет better. http://wightsupport.com/forum/member.php?action=profile&uid=21398

dapagliflozin cost – https://janozin.com/ buy dapagliflozin 10mg sale