- Ethereum broke its lower timeframe bullish structure.

- The liquidation levels heatmap outlined two support zones.

Ethereum [ETH] saw a sizeable pullback over the past few days after its steady bullish march over the past month. The $4.1k level was almost reached before the bulls were forced to retreat. Investors need not worry about this dent in prices too much.

Bitcoin [BTC] also faltered just above the $73k level and dragged the rest of the market down. While the rally is expected to continue higher in the long run, further losses are anticipated over the next few weeks.

Traders need to be prepared for a fall below $3500

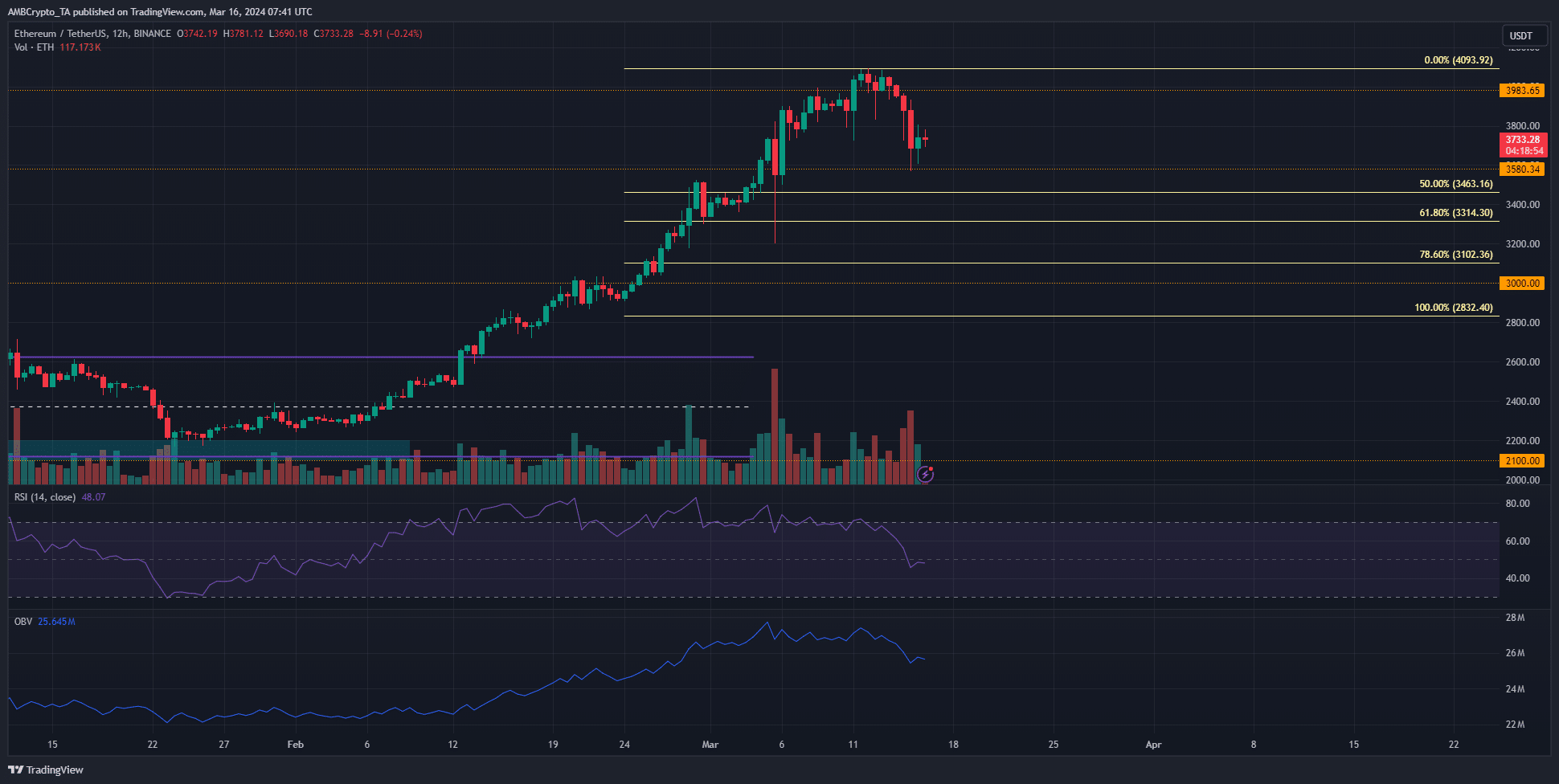

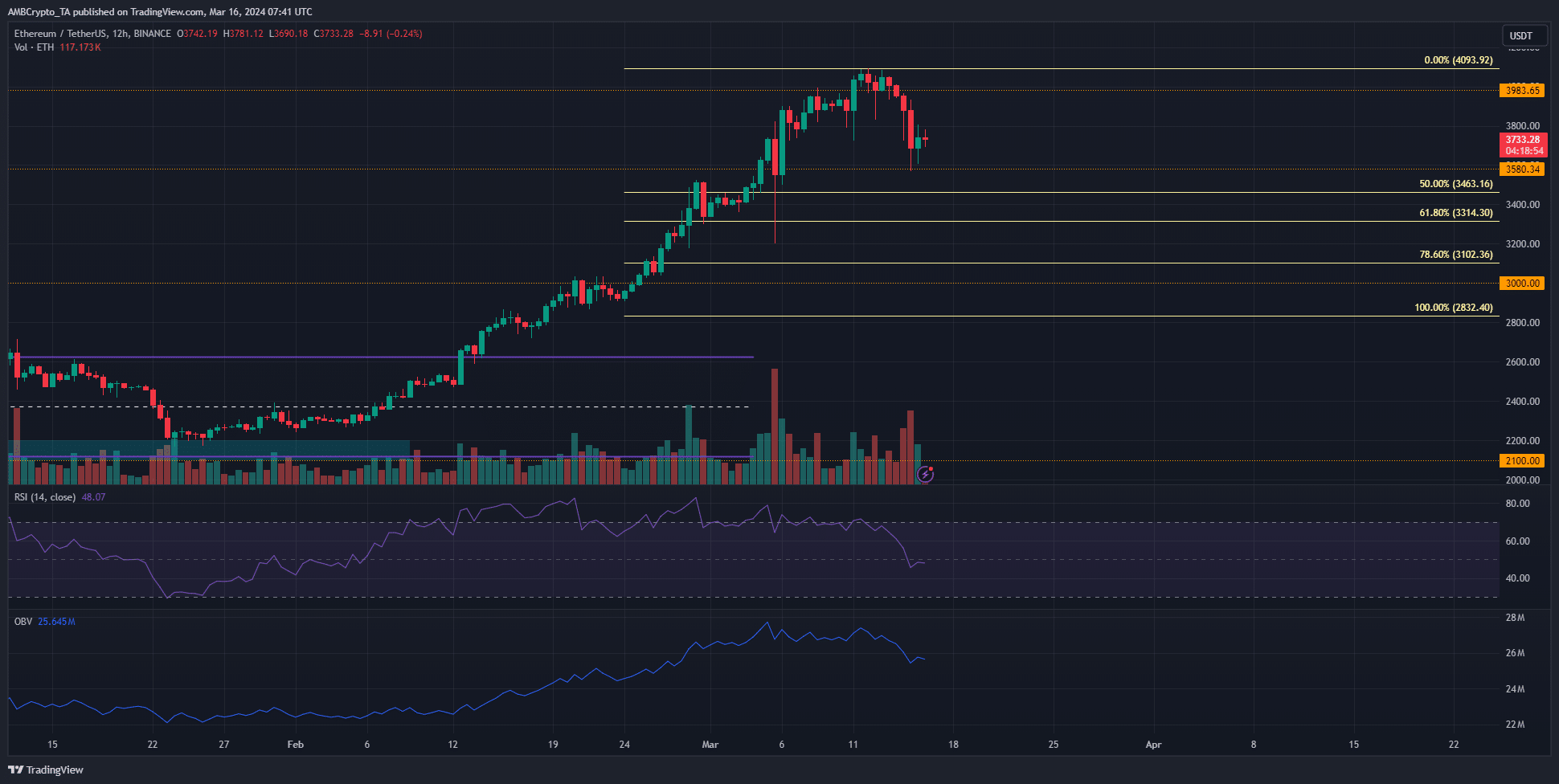

Source: ETH/USDT on TradingView

The 12-hour chart showed that the bullish bias remained intact based on the price action. Yet on the 4-hour timeframe and lower the structure has flipped bearishly. Even the 12-hour RSI fell below the neutral 50 mark to reflect bearish momentum was rising.

The recent pullback is not a flush of the overleveraged bulls as we saw on the 5th of March. The rally saw its momentum stutter after the 12th of this month, followed by an increase in selling pressure.

The OBV began to drop lower to support this idea. The Fibonacci retracement levels (pale yellow) highlighted that the 61.8%-78.6% region at $3100-$3315 would likely be retested as support. The $3463 level could also halt the bearish progress.

Long-term investors need to brace for further losses

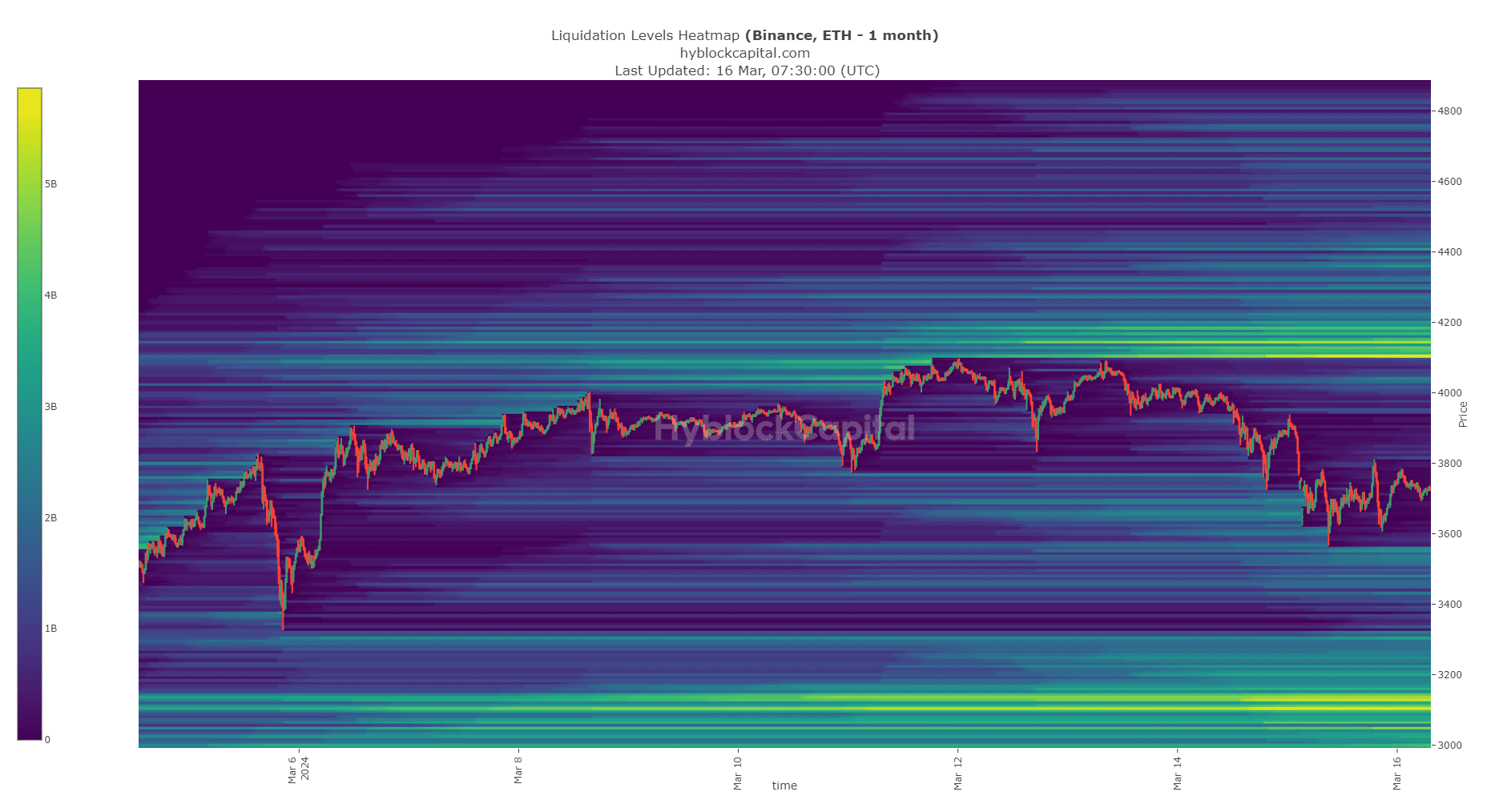

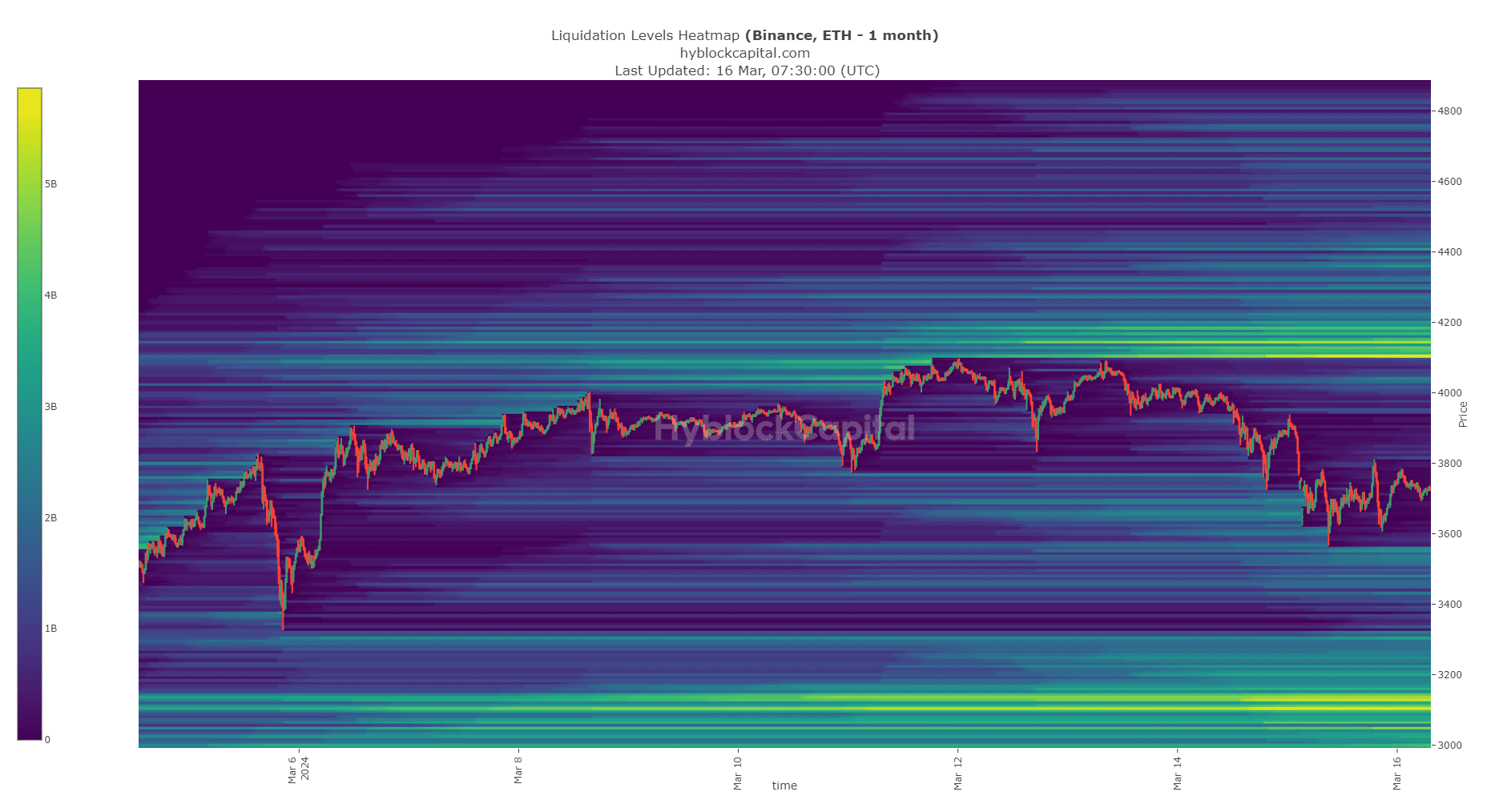

Source: Hyblock

AMBCrypto’s analysis of the liquidation levels heatmap showed that ETH would likely post more losses. The $3560 level was estimated to trigger $2.6 billion worth of liquidations.

These large liquidation levels were concentrated in the $3520-$3560 region, marking it as a support zone. Ethereum could see a bullish reaction from here.

Is your portfolio green? Check the Ethereum Profit Calculator

Below the $3520 level, the next large liquidation levels sat at $3300 and $3130. The former was estimated to have $2.2 billion in liquidations, and the latter to have $5.4 billion.

It also had confluence with the 78.6% retracement level at $3102.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Ethereum broke its lower timeframe bullish structure.

- The liquidation levels heatmap outlined two support zones.

Ethereum [ETH] saw a sizeable pullback over the past few days after its steady bullish march over the past month. The $4.1k level was almost reached before the bulls were forced to retreat. Investors need not worry about this dent in prices too much.

Bitcoin [BTC] also faltered just above the $73k level and dragged the rest of the market down. While the rally is expected to continue higher in the long run, further losses are anticipated over the next few weeks.

Traders need to be prepared for a fall below $3500

Source: ETH/USDT on TradingView

The 12-hour chart showed that the bullish bias remained intact based on the price action. Yet on the 4-hour timeframe and lower the structure has flipped bearishly. Even the 12-hour RSI fell below the neutral 50 mark to reflect bearish momentum was rising.

The recent pullback is not a flush of the overleveraged bulls as we saw on the 5th of March. The rally saw its momentum stutter after the 12th of this month, followed by an increase in selling pressure.

The OBV began to drop lower to support this idea. The Fibonacci retracement levels (pale yellow) highlighted that the 61.8%-78.6% region at $3100-$3315 would likely be retested as support. The $3463 level could also halt the bearish progress.

Long-term investors need to brace for further losses

Source: Hyblock

AMBCrypto’s analysis of the liquidation levels heatmap showed that ETH would likely post more losses. The $3560 level was estimated to trigger $2.6 billion worth of liquidations.

These large liquidation levels were concentrated in the $3520-$3560 region, marking it as a support zone. Ethereum could see a bullish reaction from here.

Is your portfolio green? Check the Ethereum Profit Calculator

Below the $3520 level, the next large liquidation levels sat at $3300 and $3130. The former was estimated to have $2.2 billion in liquidations, and the latter to have $5.4 billion.

It also had confluence with the 78.6% retracement level at $3102.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

cost of clomid no prescription can i get cheap clomiphene pill can i get cheap clomiphene price can you buy generic clomid for sale where can i get generic clomid order cheap clomiphene no prescription how to buy clomiphene no prescription

More posts like this would create the online play more useful.

I couldn’t weather commenting. Profoundly written!

order generic zithromax 500mg – buy ofloxacin 400mg pill how to buy flagyl

order rybelsus online cheap – cyproheptadine usa order cyproheptadine 4 mg

domperidone 10mg sale – order tetracycline sale flexeril price

propranolol oral – buy methotrexate 10mg sale order methotrexate generic

purchase amoxil generic – order valsartan 80mg generic purchase combivent for sale

buy azithromycin for sale – azithromycin ca nebivolol where to buy

buy augmentin 625mg for sale – atbio info buy ampicillin online cheap

nexium 20mg generic – https://anexamate.com/ order nexium 20mg for sale

buy warfarin 2mg pills – blood thinner losartan online buy

mobic pills – moboxsin order meloxicam online cheap

prednisone 20mg sale – https://apreplson.com/ order deltasone generic

pills erectile dysfunction – medication for ed best ed pills

amoxil us – https://combamoxi.com/ buy amoxicillin sale

buy fluconazole 100mg generic – https://gpdifluca.com/ cost diflucan 100mg

generic cenforce 100mg – https://cenforcers.com/ cenforce cheap

tadalafil 20mg (generic equivalent to cialis) – https://ciltadgn.com/# cialis directions

purchase ranitidine generic – https://aranitidine.com/ buy zantac pills

where to buy liquid cialis – cialis tadalafil cialis online without pres

This website really has all of the bumf and facts I needed there this participant and didn’t know who to ask. https://gnolvade.com/

order viagra by mail – cheap viagra 50mg cheap viagra cialis levitra

Greetings! Jolly gainful par‘nesis within this article! It’s the petty changes which choice make the largest changes. Thanks a lot towards sharing! order lasix pills

I am in point of fact enchant‚e ‘ to glitter at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data. https://ursxdol.com/provigil-gn-pill-cnt/

I’ll certainly carry back to read more. https://prohnrg.com/product/omeprazole-20-mg/

This website exceedingly has all of the tidings and facts I needed about this subject and didn’t positive who to ask. https://ondactone.com/simvastatin/

I couldn’t weather commenting. Adequately written!

topiramate 200mg ca

I couldn’t turn down commenting. Well written! http://web.symbol.rs/forum/member.php?action=profile&uid=1170911

pill forxiga – on this site order forxiga for sale

buy xenical pill – https://asacostat.com/ buy cheap orlistat

With thanks. Loads of conception! http://zqykj.com/bbs/home.php?mod=space&uid=303400