- ETH’s short-term outlook shows signs of a bullish reversal around the $3,000 psychological level.

- On-chain metrics suggest selling pressure, but most ETH holders remain in profit.

Ethereum [ETH] was also hit by the recent altcoin correction, dipping over 20% after being rejected at the $4,000 resistance level.

However, this downtrend may not be significant, as Ethereum’s technical patterns and on-chain metrics show mixed signals of a potential price recovery or further volatility.

ETH approaching key support at $2.8k

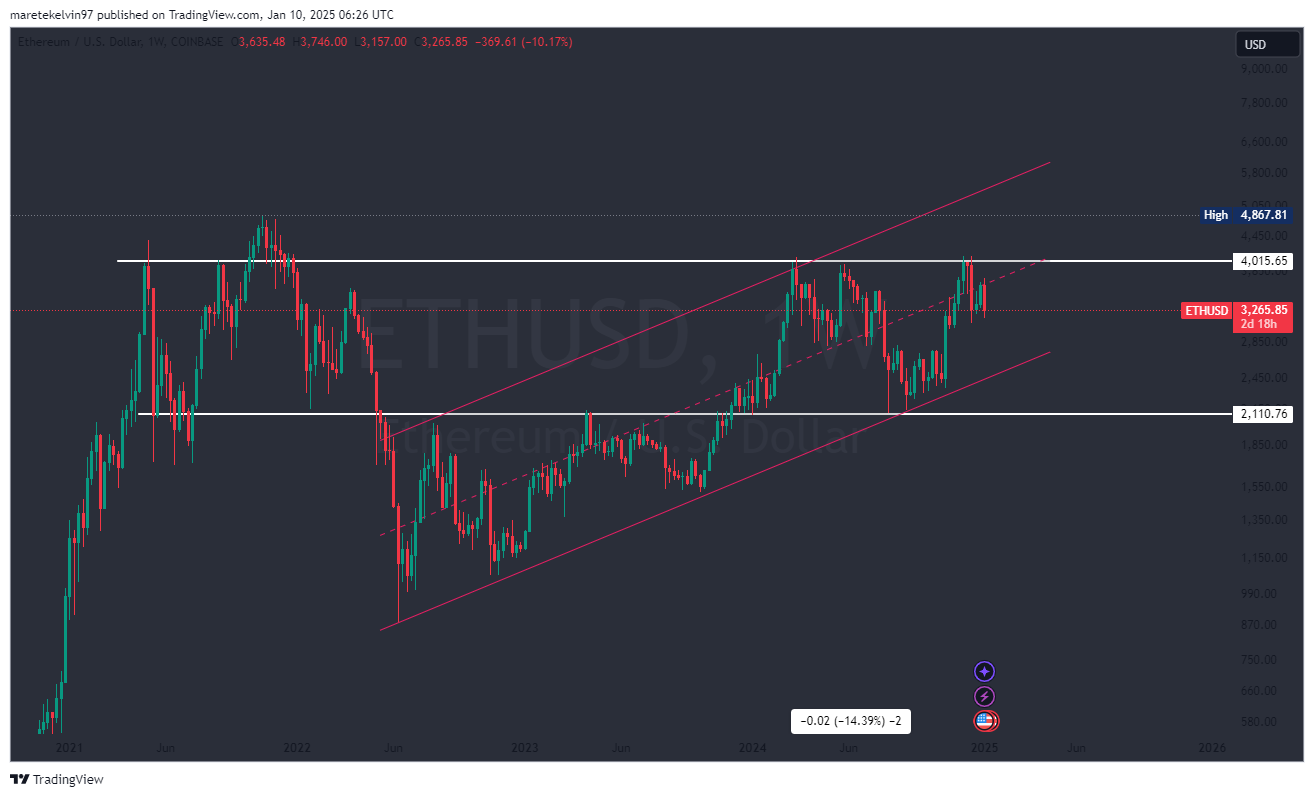

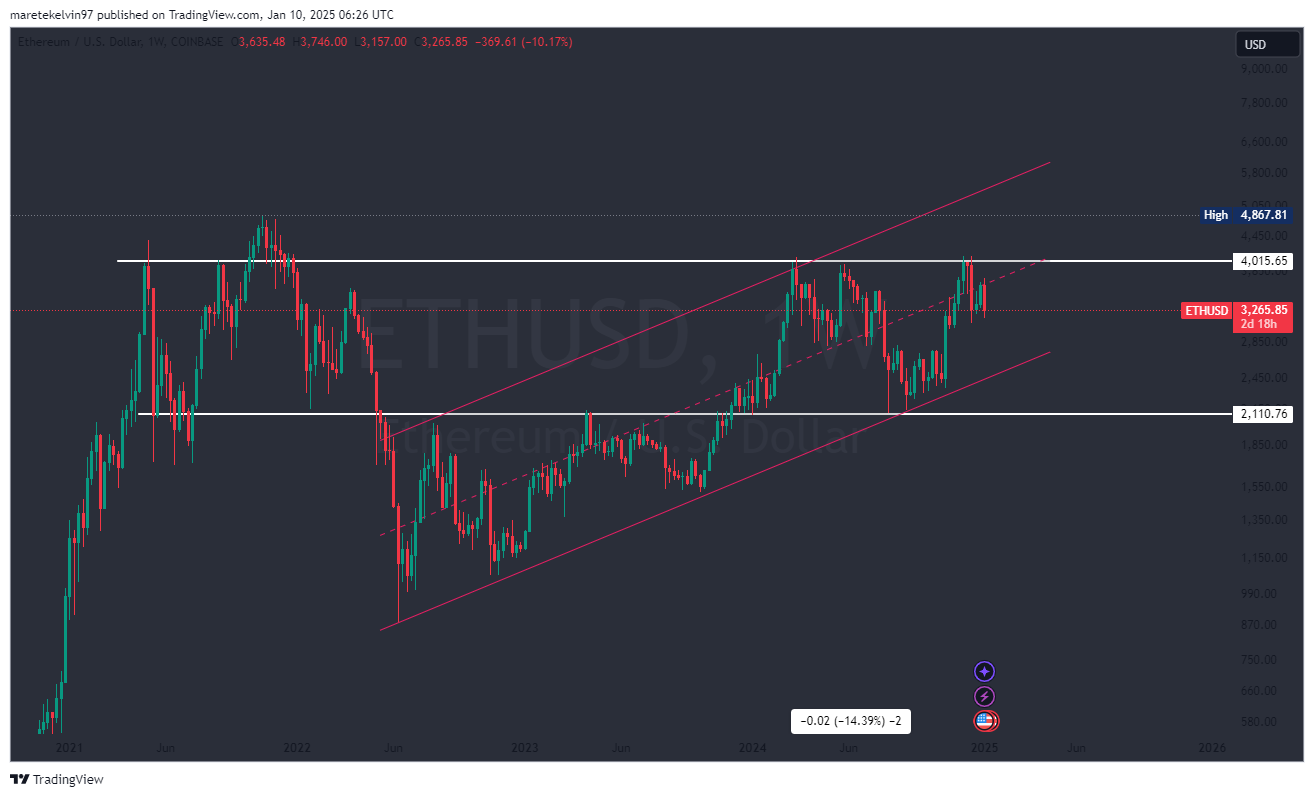

On the weekly chart, Ethereum’s price movement shows consolidation in a bullish flag pattern—a pattern that often precedes a breakout. The recent dip has brought ETH close to the lower boundary of this ascending flag at $2,800.

If this level holds strong, it could act as a springboard for a massive upward rally. A successful rebound here may push Ethereum toward its next key target of $6,000.

However, failure to maintain this support could expose ETH to further downside.

Source: TradingView

Signs of a short-term reversal at $3,000

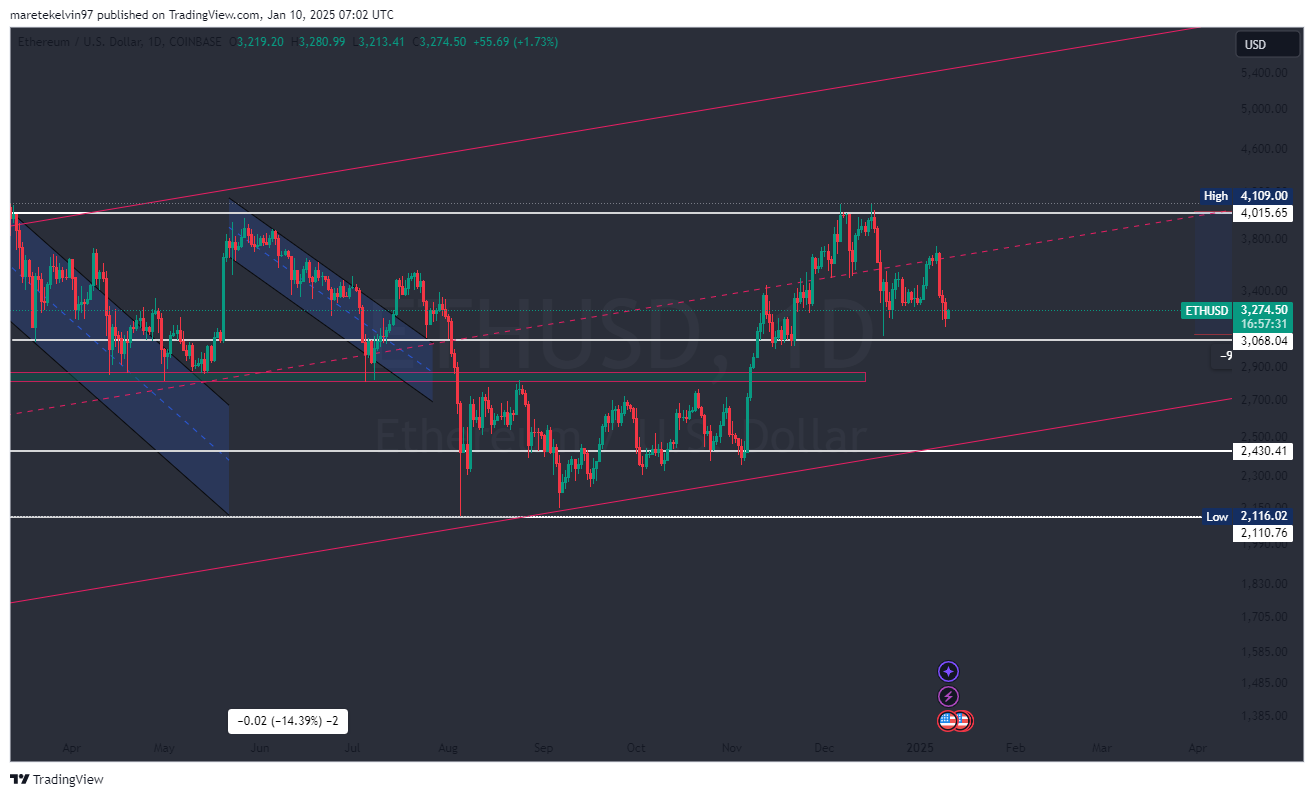

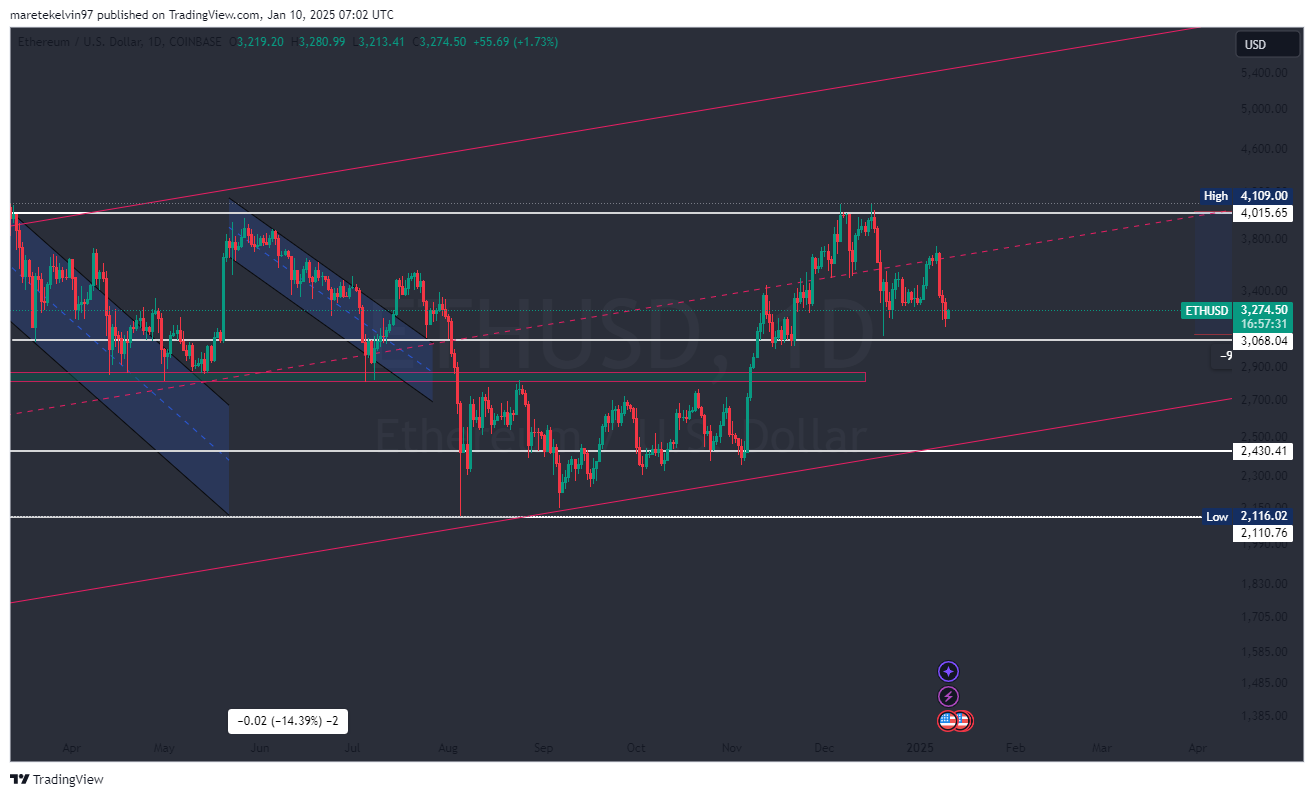

Zooming down to the daily chart, Ethereum’s price action indicates a potential short-term bullish reversal.

The $3,000 psychological level appears pivotal, as ETH trading activity has increased slightly over the last 24 hours.

Source: TradingVew

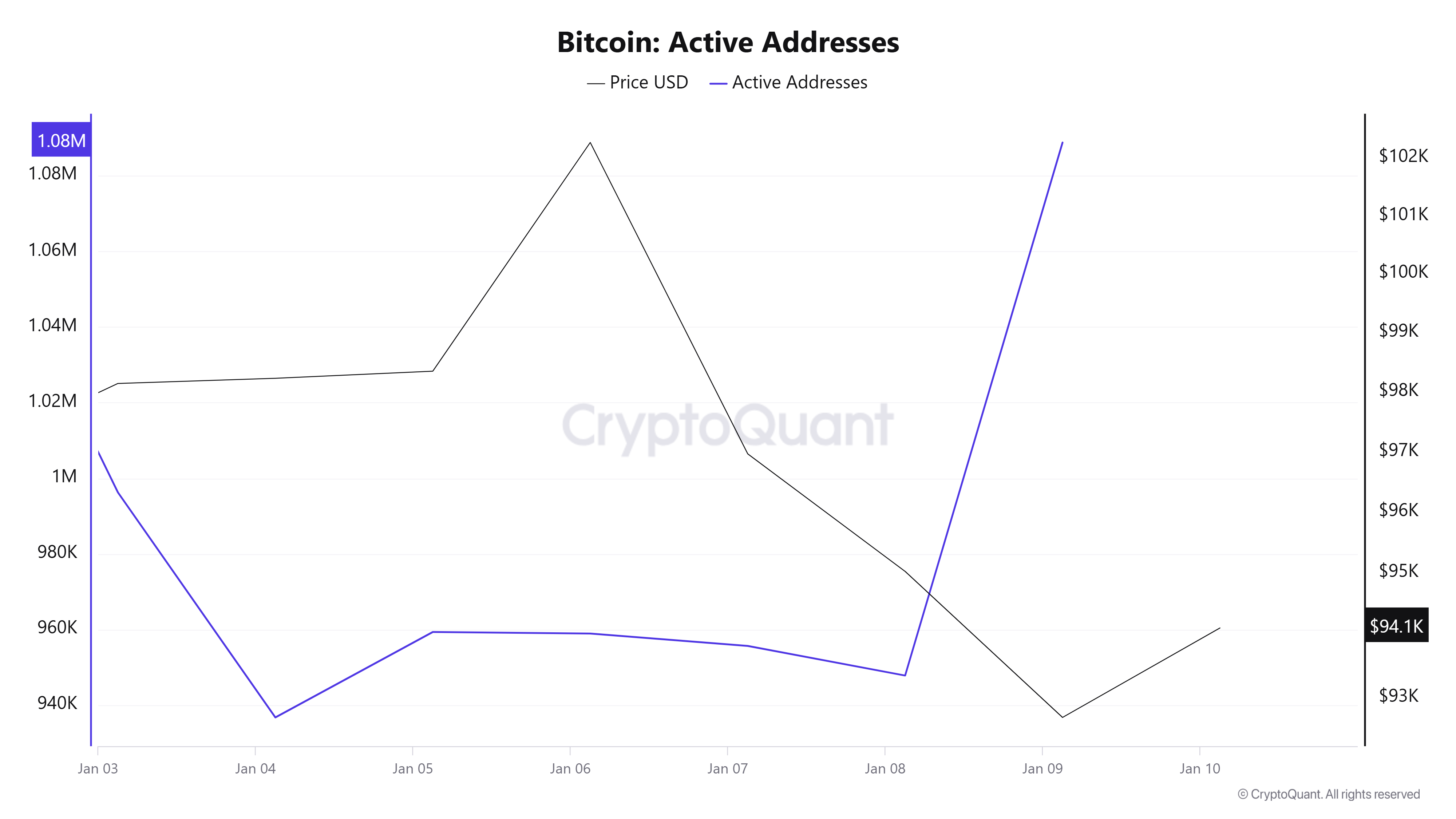

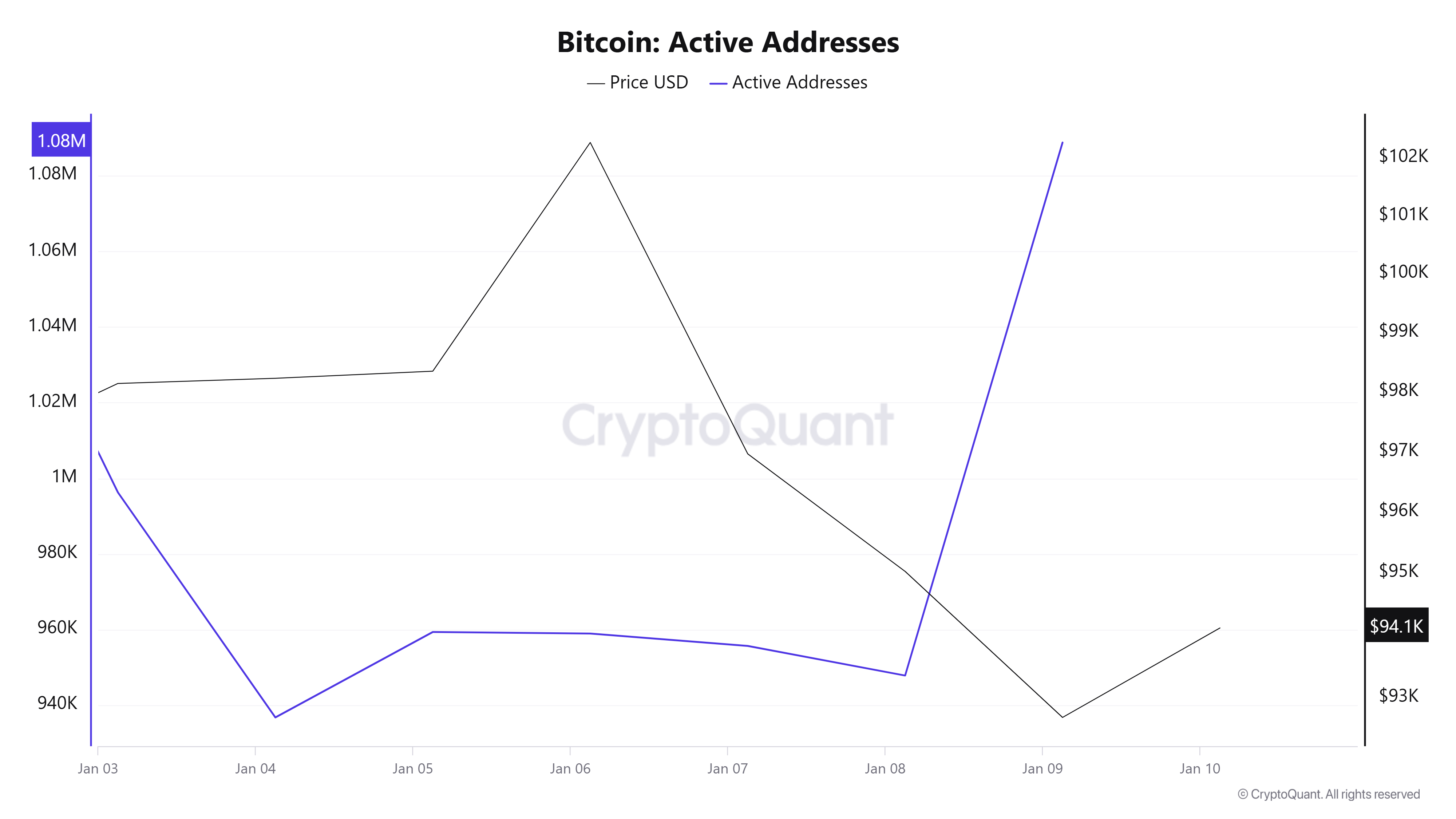

CryptoQuant data supports this, showing a sharp surge in active addresses during the same period. Increased network activity often signals renewed interest, potentially stabilizing prices or sparking an upward move.

Source: CryptoQuant

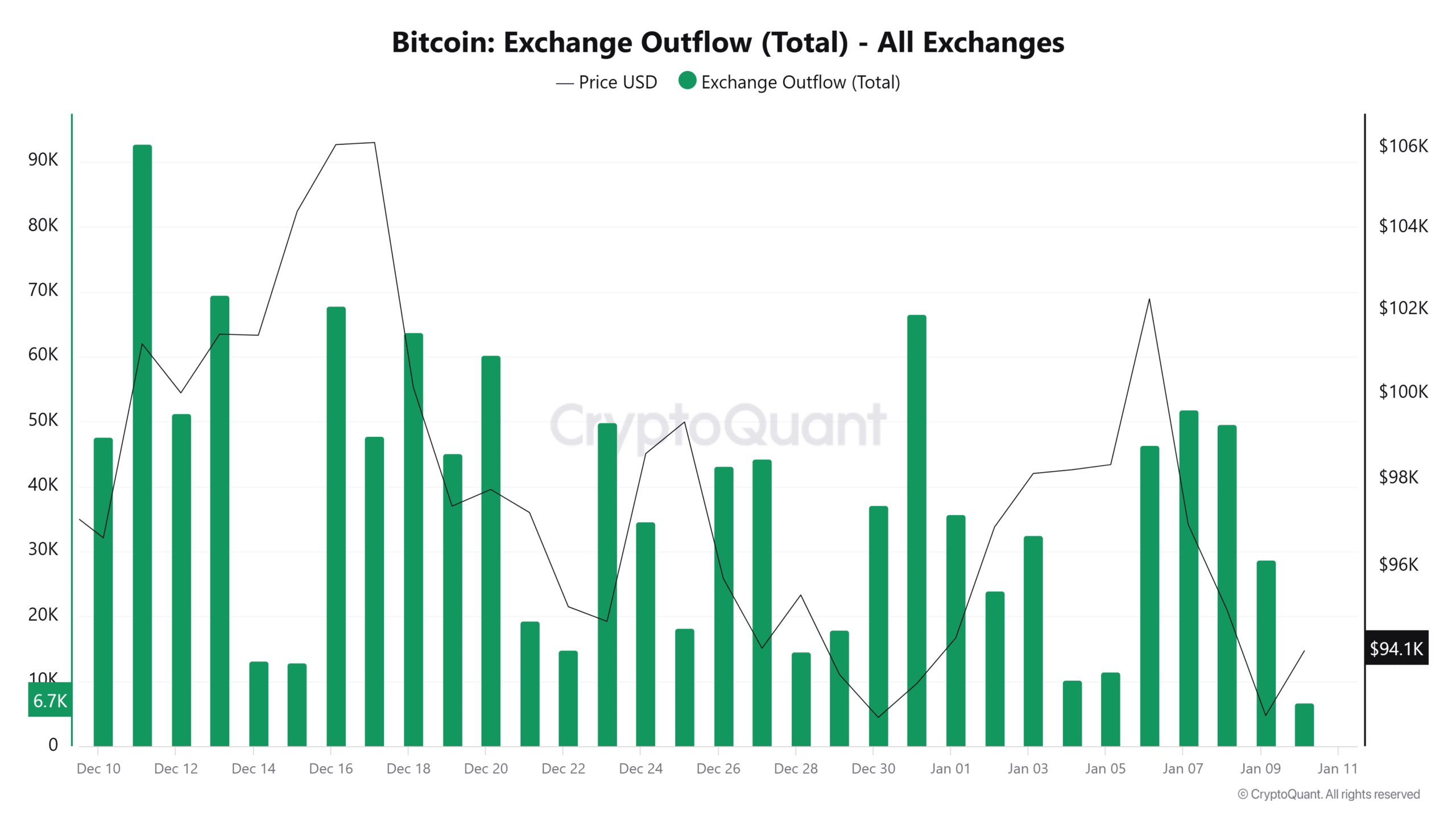

Rising exchange outflows indicate profit-taking

While short-term signals are relatively bullish, the on-chain metrics tell a different story for the long term.

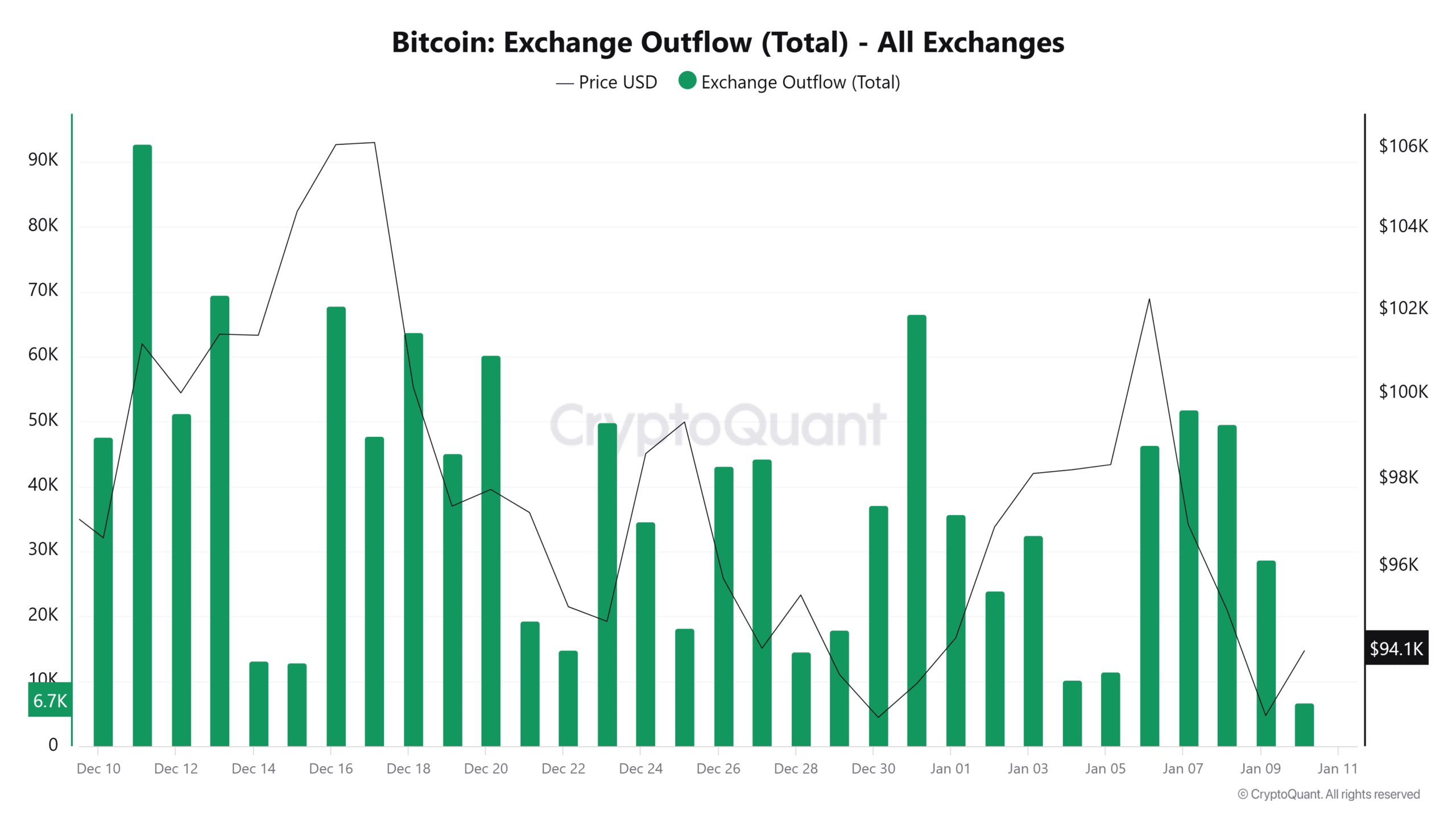

According to CryptoQuant, ETH’s exchange outflows spiked in the last 24 hours, indicating increasing selling pressure as investors book profits around the $3K psychological level.

Historically, these outflow cycles alternate between peaks and dips, and the current upswing could signify an accumulation of sell-side activity.

Source: CryptoQuant

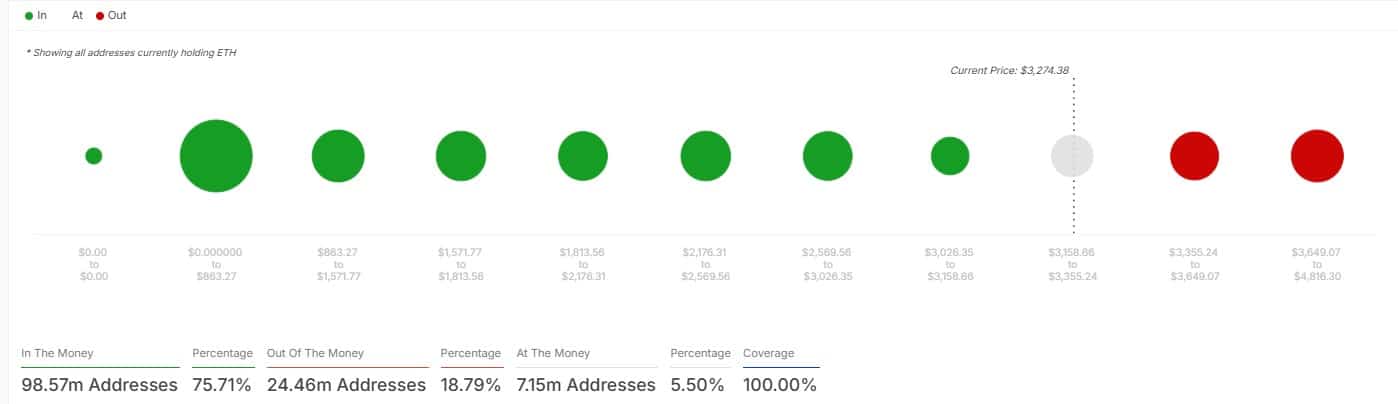

ETH holders remain profitable despite…

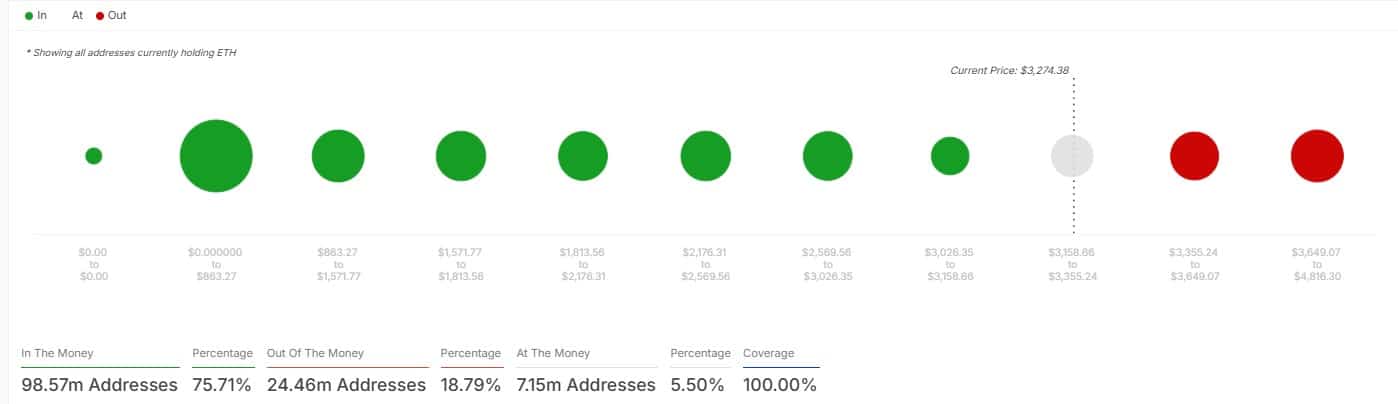

Despite short-term corrections, most ETH holders remain in profit. Data from IntoTheBlock reveals that 76% of all addresses holding ETH are profitable at current price levels. This mirrors the confidence among long-term investors and indicates a strong foundation for Ethereum’s potential continuous rally.

Source: IntoTheBlock

Read Ethereum’s [ETH] Price Prediction 2025–2026

The short- and long-term price action of Ethereum hinges on a couple of key levels. The $2.8K flag support level could pave the way for a significant rally if it holds, while increased network activity around the $3K psychological level supports a bullish outlook.

With most holders still in profit, ETH long-term trajectory remains optimistic.

- ETH’s short-term outlook shows signs of a bullish reversal around the $3,000 psychological level.

- On-chain metrics suggest selling pressure, but most ETH holders remain in profit.

Ethereum [ETH] was also hit by the recent altcoin correction, dipping over 20% after being rejected at the $4,000 resistance level.

However, this downtrend may not be significant, as Ethereum’s technical patterns and on-chain metrics show mixed signals of a potential price recovery or further volatility.

ETH approaching key support at $2.8k

On the weekly chart, Ethereum’s price movement shows consolidation in a bullish flag pattern—a pattern that often precedes a breakout. The recent dip has brought ETH close to the lower boundary of this ascending flag at $2,800.

If this level holds strong, it could act as a springboard for a massive upward rally. A successful rebound here may push Ethereum toward its next key target of $6,000.

However, failure to maintain this support could expose ETH to further downside.

Source: TradingView

Signs of a short-term reversal at $3,000

Zooming down to the daily chart, Ethereum’s price action indicates a potential short-term bullish reversal.

The $3,000 psychological level appears pivotal, as ETH trading activity has increased slightly over the last 24 hours.

Source: TradingVew

CryptoQuant data supports this, showing a sharp surge in active addresses during the same period. Increased network activity often signals renewed interest, potentially stabilizing prices or sparking an upward move.

Source: CryptoQuant

Rising exchange outflows indicate profit-taking

While short-term signals are relatively bullish, the on-chain metrics tell a different story for the long term.

According to CryptoQuant, ETH’s exchange outflows spiked in the last 24 hours, indicating increasing selling pressure as investors book profits around the $3K psychological level.

Historically, these outflow cycles alternate between peaks and dips, and the current upswing could signify an accumulation of sell-side activity.

Source: CryptoQuant

ETH holders remain profitable despite…

Despite short-term corrections, most ETH holders remain in profit. Data from IntoTheBlock reveals that 76% of all addresses holding ETH are profitable at current price levels. This mirrors the confidence among long-term investors and indicates a strong foundation for Ethereum’s potential continuous rally.

Source: IntoTheBlock

Read Ethereum’s [ETH] Price Prediction 2025–2026

The short- and long-term price action of Ethereum hinges on a couple of key levels. The $2.8K flag support level could pave the way for a significant rally if it holds, while increased network activity around the $3K psychological level supports a bullish outlook.

With most holders still in profit, ETH long-term trajectory remains optimistic.

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

I am impressed with this website , real I am a big fan .

I really appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thx again!

Purdentix review

Purdentix

Purdentix review

It provides an excellent user experience from start to finish.

The layout is visually appealing and very functional.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

I’m really impressed by the speed and responsiveness.

This site truly stands out as a great example of quality web design and performance.

I love how user-friendly and intuitive everything feels.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The design and usability are top-notch, making everything flow smoothly.

The content is well-organized and highly informative.

The content is engaging and well-structured, keeping visitors interested.

This website is amazing, with a clean design and easy navigation.

I love how user-friendly and intuitive everything feels.

The content is well-organized and highly informative.

It provides an excellent user experience from start to finish.

Absolutely composed content, thanks for selective information.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

Wow! This blog looks just like my old one! It’s on a completely different subject but it has pretty much the same layout and design. Great choice of colors!

I envy your piece of work, thanks for all the interesting articles.

This really answered my problem, thank you!

clomid tablet price where to buy generic clomid without dr prescription clomiphene generico buy clomiphene tablets buying clomid generic clomiphene for sale how can i get generic clomiphene tablets

Thanks towards putting this up. It’s well done.

More content pieces like this would urge the web better.

buy azithromycin online cheap – buy ofloxacin generic buy flagyl 400mg online cheap

semaglutide cost – semaglutide 14 mg oral how to buy cyproheptadine

domperidone brand – order domperidone 10mg without prescription brand cyclobenzaprine

clavulanate price – atbioinfo.com ampicillin where to buy

esomeprazole 20mg us – nexiumtous nexium where to buy

buy warfarin online – anticoagulant buy hyzaar without a prescription

meloxicam pills – moboxsin.com order mobic without prescription

I truly enjoy reading through on this site, it holds good blog posts. “Never fight an inanimate object.” by P. J. O’Rourke.

prednisone 20mg generic – allergic reactions order deltasone 5mg generic

best drug for ed – buy cheap generic ed pills buy ed pills tablets

purchase amoxicillin online cheap – where can i buy amoxicillin purchase amoxil generic

forcan oral – https://gpdifluca.com/ diflucan 100mg uk

cenforce 50mg pills – click buy cenforce generic

cheap cialis canada – https://ciltadgn.com/# can you drink wine or liquor if you took in tadalafil

why is cialis so expensive – strong tadafl cialis 5mg best price

ranitidine pill – https://aranitidine.com/ zantac 150mg for sale