- ETH dropped below $2k again after remaining above this level for two days.

- Ethereum buyers were aggressively buying, with a negative netflow hitting 150,000 ETH.

Over the past three days, Ethereum [ETH] saw a shift in fortunes, reclaiming $2k. Amidst this trend reverse, is a higher activity from the buy side.

According to CryptoQuant, Ethereum saw a negative netflow of over 150,000 ETH on derivative exchanges.

Source: CryptoQuant

Such a large outflow indicates reduced selling pressure as investors move ETH to cold storage or DeFi. Therefore, the large outflow indicates increased accumulation by large entities signaling bullish sentiments from these investors.

This accumulation by large entities is further evidenced by the recent whale-buying activity.

As per Onchain Lens, a whale withdrew 8,313 ETH worth $16.46 million from Binance after two months of inactivity. After this transaction, the whale now holds 11,197 ETH worth $22.17 million.

Source: Onchain Lens

When whales begin accumulating, it signals strong bullish sentiment, indicating they believe current prices are undervalued and likely to rebound soon.

Sustained accumulation by smart money often boosts market confidence, attracting increased demand from speculative buyers.

What it means for ETH

Despite the rising demand from large holders, ETH prices continue to struggle.

In fact, on daily charts, ETH has dropped below $2k again, hitting a low of $1,963. This suggests that other market participants remain bearish and are less optimistic about potential price recovery.

Source: CryptoQuant

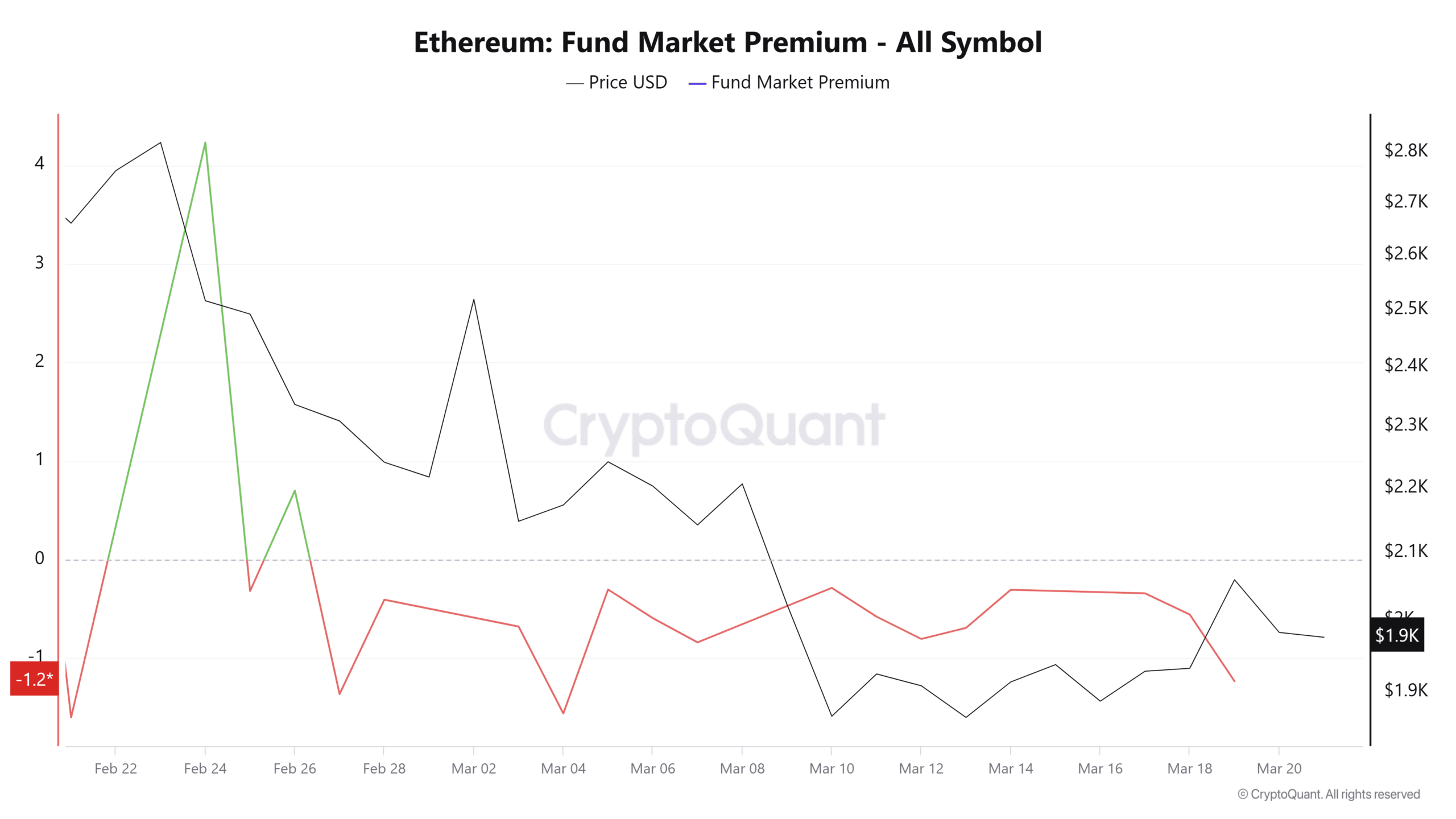

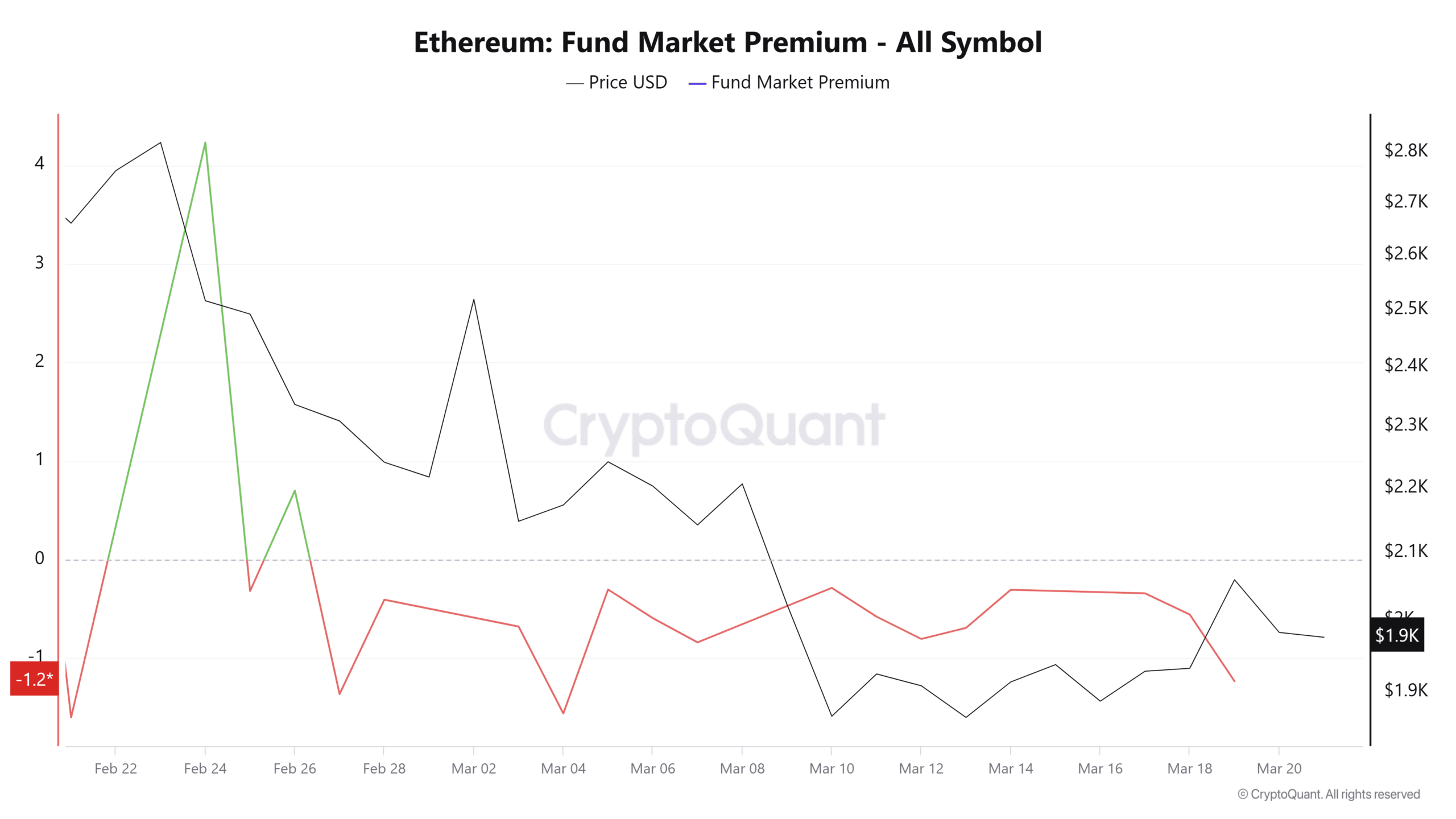

AMBCrypto observed bearish market sentiment as Ethereum’s Fund Market Premium stayed negative throughout the past week.

A sustained negative premium indicates that investors are closing positions faster than new buyers are entering, suggesting a preference to sell at a discount rather than hold. While buyers are participating, seller activity remains notably high.

Source: CryptoQuant

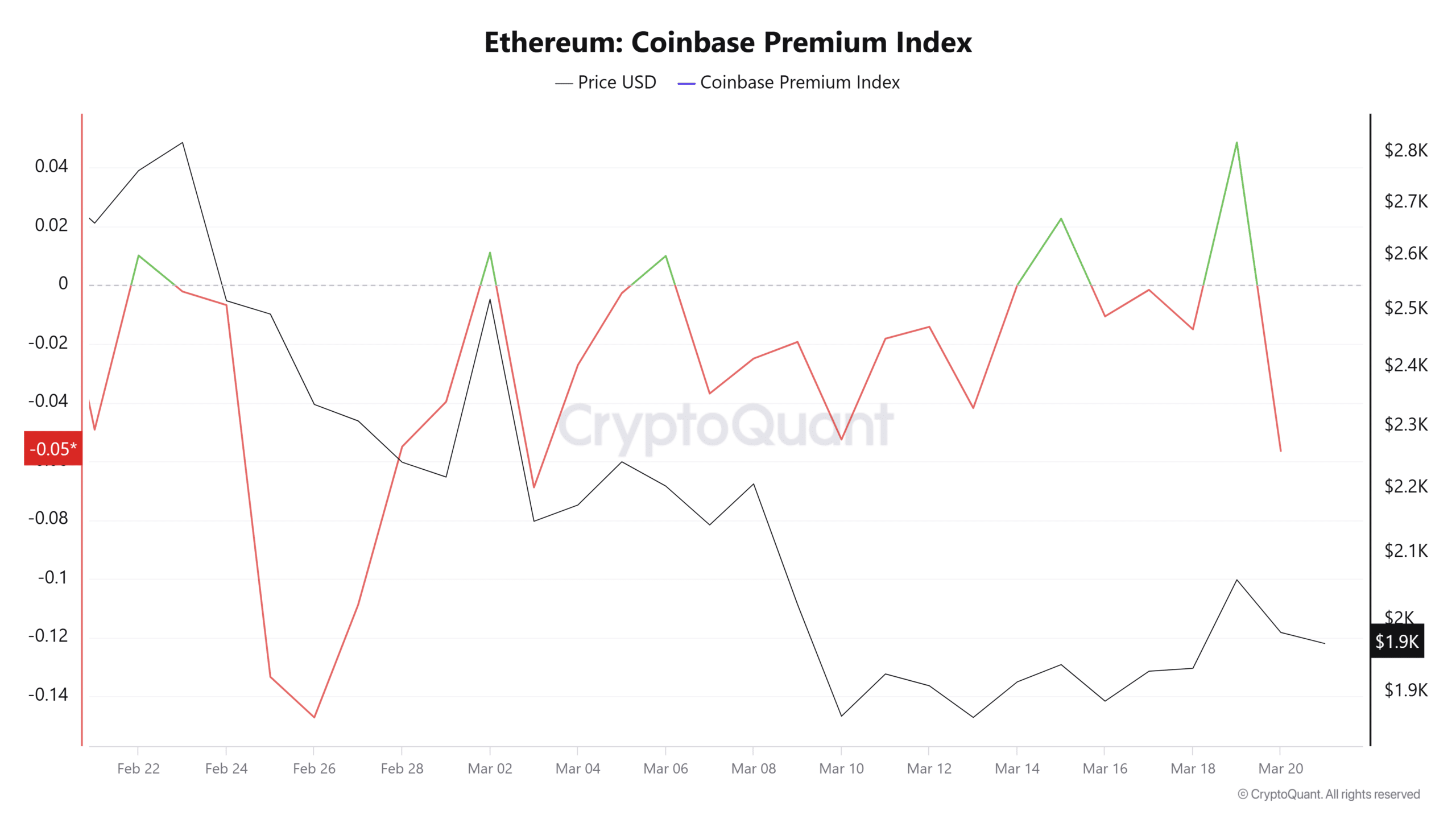

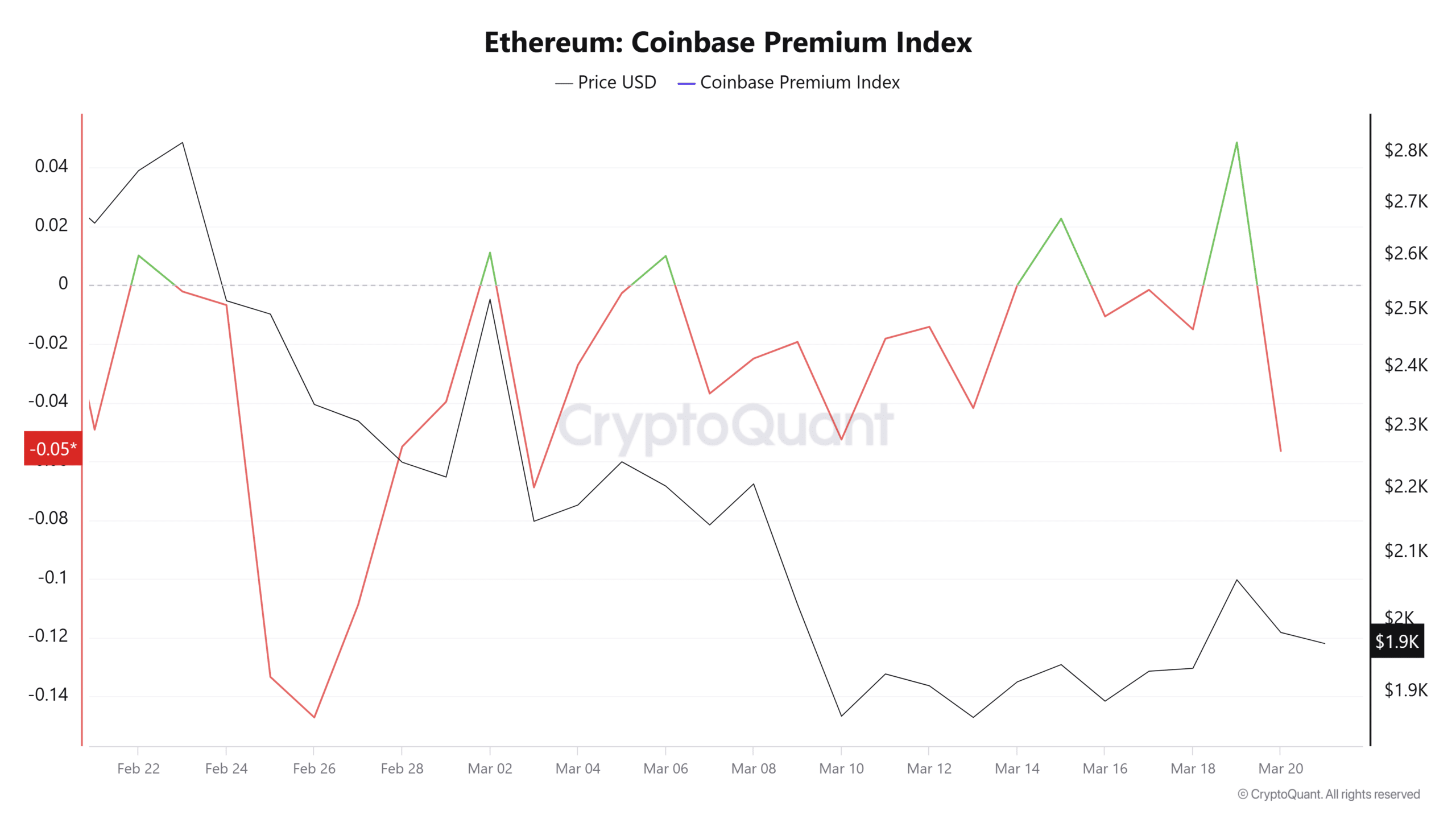

Bearish sentiments are particularly pronounced among U.S. institutional investors. The Coinbase premium index, currently at -0.05, indicates active selling by Coinbase investors, reflecting a notable lack of market confidence.

This sentiment places Ethereum under significant downward pressure.

Despite increased negative netflows and whale accumulation, Ethereum’s demand remains weak. The ongoing tug-of-war between buyers and sellers may keep ETH prices confined to a consolidation range.

Under current conditions, Ethereum is likely to trade between $1,862 and $2,100.

- ETH dropped below $2k again after remaining above this level for two days.

- Ethereum buyers were aggressively buying, with a negative netflow hitting 150,000 ETH.

Over the past three days, Ethereum [ETH] saw a shift in fortunes, reclaiming $2k. Amidst this trend reverse, is a higher activity from the buy side.

According to CryptoQuant, Ethereum saw a negative netflow of over 150,000 ETH on derivative exchanges.

Source: CryptoQuant

Such a large outflow indicates reduced selling pressure as investors move ETH to cold storage or DeFi. Therefore, the large outflow indicates increased accumulation by large entities signaling bullish sentiments from these investors.

This accumulation by large entities is further evidenced by the recent whale-buying activity.

As per Onchain Lens, a whale withdrew 8,313 ETH worth $16.46 million from Binance after two months of inactivity. After this transaction, the whale now holds 11,197 ETH worth $22.17 million.

Source: Onchain Lens

When whales begin accumulating, it signals strong bullish sentiment, indicating they believe current prices are undervalued and likely to rebound soon.

Sustained accumulation by smart money often boosts market confidence, attracting increased demand from speculative buyers.

What it means for ETH

Despite the rising demand from large holders, ETH prices continue to struggle.

In fact, on daily charts, ETH has dropped below $2k again, hitting a low of $1,963. This suggests that other market participants remain bearish and are less optimistic about potential price recovery.

Source: CryptoQuant

AMBCrypto observed bearish market sentiment as Ethereum’s Fund Market Premium stayed negative throughout the past week.

A sustained negative premium indicates that investors are closing positions faster than new buyers are entering, suggesting a preference to sell at a discount rather than hold. While buyers are participating, seller activity remains notably high.

Source: CryptoQuant

Bearish sentiments are particularly pronounced among U.S. institutional investors. The Coinbase premium index, currently at -0.05, indicates active selling by Coinbase investors, reflecting a notable lack of market confidence.

This sentiment places Ethereum under significant downward pressure.

Despite increased negative netflows and whale accumulation, Ethereum’s demand remains weak. The ongoing tug-of-war between buyers and sellers may keep ETH prices confined to a consolidation range.

Under current conditions, Ethereum is likely to trade between $1,862 and $2,100.

can you buy generic clomiphene online cost of cheap clomid pills where can i buy generic clomid tablets where can i buy clomiphene cost of cheap clomiphene prices where to get clomiphene clomiphene for men

I couldn’t turn down commenting. Adequately written!

I am in point of fact thrilled to gleam at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data.

order zithromax online cheap – buy tetracycline without prescription metronidazole 400mg pill

rybelsus online – semaglutide 14mg price periactin 4mg us

buy propranolol tablets – buy clopidogrel 75mg pill how to get methotrexate without a prescription

azithromycin over the counter – buy bystolic 20mg pill nebivolol 20mg uk

cheap augmentin 375mg – atbioinfo buy ampicillin generic

buy nexium 40mg generic – anexamate.com buy esomeprazole 20mg capsules

order coumadin generic – coumamide losartan usa

buy meloxicam generic – moboxsin order generic mobic

deltasone 40mg generic – aprep lson purchase deltasone for sale

best ed drugs – best ed pills non prescription buy erectile dysfunction drugs

purchase forcan sale – click fluconazole buy online

escitalopram online buy – https://escitapro.com/# buy escitalopram 10mg

buy cenforce 50mg generic – buy cenforce 50mg sale cenforce 50mg ca

cialis where can i buy – https://ciltadgn.com/ cialis dosages

does tadalafil lower blood pressure – on this site tadalafil and sildenafil taken together

where to buy zantac without a prescription – on this site cost zantac 300mg

buy viagra cheap canada – buy generic 100mg viagra online buy sildenafil citrate 50mg

With thanks. Loads of erudition! https://buyfastonl.com/azithromycin.html

Palatable blog you possess here.. It’s obdurate to espy elevated worth script like yours these days. I truly respect individuals like you! Rent guardianship!! click

Greetings! Jolly productive recommendation within this article! It’s the little changes which will make the largest changes. Thanks a lot in the direction of sharing! order amoxiclav

The thoroughness in this piece is noteworthy. https://prohnrg.com/product/acyclovir-pills/

More posts like this would force the blogosphere more useful. https://aranitidine.com/fr/sibelium/

Thanks on sharing. It’s first quality. https://ondactone.com/product/domperidone/

The depth in this ruined is exceptional.

cheap avodart 0.5mg

This website exceedingly has all of the information and facts I needed there this participant and didn’t know who to ask. http://ledyardmachine.com/forum/User-Nkqdww

dapagliflozin 10mg cost – https://janozin.com/ forxiga tablet

xenical tablet – this buy generic orlistat 60mg

Thanks for putting this up. It’s well done. http://zgyhsj.com/space-uid-979404.html