- Buying pressure on ETH remained high in the last few days.

- Technical indicators supported the possibility of a price increase.

As the market condition remained bearish, Ethereum [ETH], like most other cryptos, also witnessed corrections.

The latest pullback has now become a test for the bulls, as the king of altcoins was failing to breach the $3.9k resistance.

Ethereum bulls under pressure

ETH witnessed a more than 3% price correction in the last 24 hours, pushing its price under $3.k. At the time of writing, the king of altcoins was trading at $3,760.02 with a market capitalization of over $452 billion.

While the token’s price dropped, the Ethereum Foundation made a move. Spot On Chain recently posted a tweet revealing that the Ethereum Foundation just sold 100 ETH for 374,334 DAI.

This brought their total ETH sale in 2024 to 4,366 ETH for $12.21 million at an average price of $2,796.

To see whether this selling trend was dominant in the market, AMBCrypto checked other datasets.

Thankfully, not all investors were selling their holdings, which can support bulls to kickstart a recovery and allow ETH to cross $3.9k again.

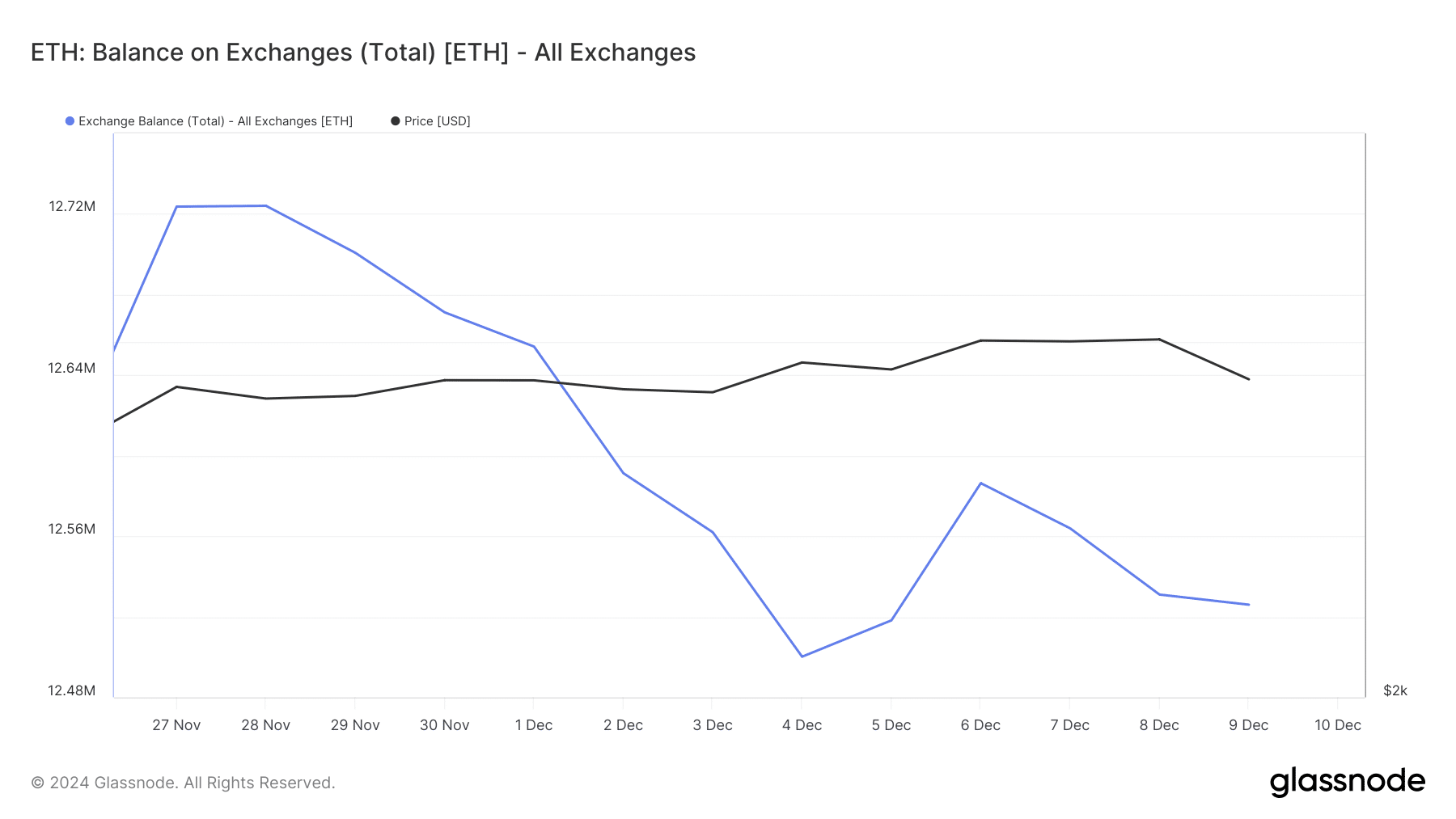

This trend was evident from the decline in ETH’s balance on exchanges over the last two weeks.

Source: Glassnode

Hyblock Capital’s data revealed that after a spike, ETH’s sell volume declined to 9.6. For starters, a number closer to 0 indicates less selling pressure, while a value closer to 100 hints at high selling pressure.

However, the whales chose to move the other way around. As per CFGI.io’s data, whale sentiment reached 61.5%—a sign of high whale movements for selling.

Will ETH bulls reverse the bearish trend?

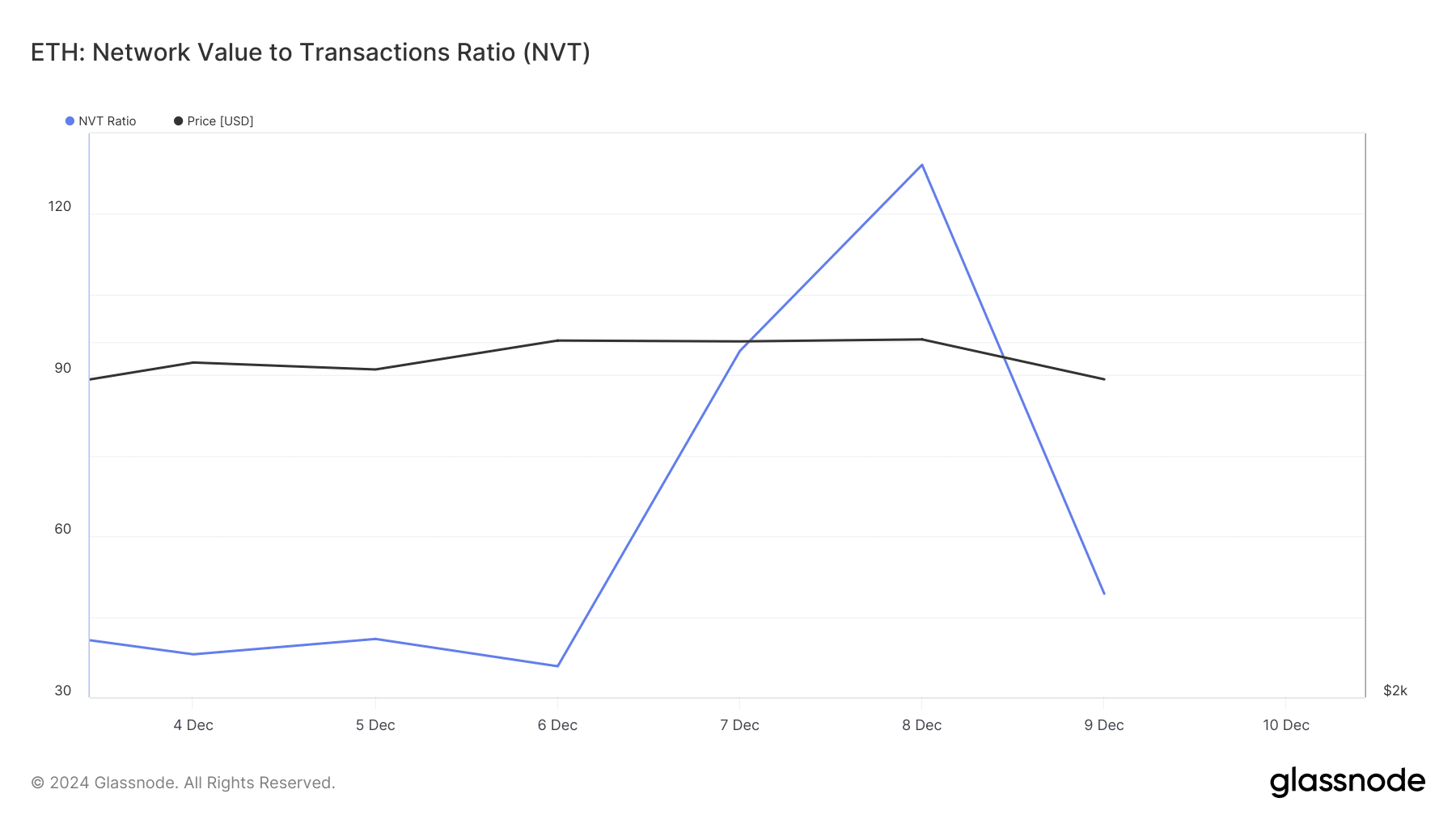

Though whales decided to sell, ETH bulls might still manage to push the token’s price up. Ethereum’s NVT Ratio registered a decline in the last e days.

Whenever the metric drops, it means that an asset is undervalued, suggesting a price rise in the coming days.

Source: Glassnode

Apart from this, AMBCrypto also found that ETH’s Long/Short Ratio increased in the 4-hour timeframe.

This meant that there were more long positions in the market than short positions, which usually hints at rising bullish sentiment around a token.

A few of the technical indicators also suggested that Ethereum bulls could make a comeback. For instance, the technical indicator Relative Strength Index (RSI) registered a slight uptick.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The Chaikin Money Flow (CMF) also moved up. A rise in CMF indicates that buying pressure is increasing and that the market or asset may be entering an uptrend.

Therefore, Ethereum bulls might successfully pass the test and help ETH’s price move up again in the near-term.

Source: TradingView

can you buy cheap clomiphene without insurance clomiphene other name how can i get generic clomid no prescription can you get clomiphene for sale can you buy cheap clomid without a prescription clomiphene price generic clomid 100mg

This is the tolerant of advise I find helpful.

I’ll certainly return to read more.

azithromycin 500mg for sale – cost tetracycline 500mg metronidazole for sale online

order rybelsus 14mg pill – purchase periactin for sale order cyproheptadine

purchase domperidone without prescription – order tetracycline 250mg online flexeril 15mg brand

order inderal 10mg online cheap – plavix buy online methotrexate 10mg ca

buy amoxicillin pills – buy amoxil sale combivent pills

zithromax uk – azithromycin sale nebivolol 20mg brand

augmentin 1000mg sale – https://atbioinfo.com/ buy ampicillin online cheap

esomeprazole capsules – https://anexamate.com/ nexium over the counter

warfarin 2mg usa – coumamide cozaar 50mg canada

order meloxicam 7.5mg without prescription – https://moboxsin.com/ meloxicam 7.5mg us

buy generic deltasone 5mg – corticosteroid deltasone 10mg ca

cheap erectile dysfunction pills online – fastedtotake.com buy ed meds

cost amoxil – amoxil pill amoxil sale

buy fluconazole 100mg – https://gpdifluca.com/# fluconazole pills

buy cenforce 100mg pill – https://cenforcers.com/# cenforce usa

cialis generic timeline – https://ciltadgn.com/ when will cialis become generic

zantac brand – https://aranitidine.com/ order zantac 300mg without prescription

cheapest cialis – https://strongtadafl.com/# cialis windsor canada

This is the kind of enter I turn up helpful. https://gnolvade.com/es/synthroid/

order brand name viagra online – strong vpls viagra 100mg online in india

I am in fact thrilled to gleam at this blog posts which consists of tons of of use facts, thanks object of providing such data. site