- ETH traded above the $2,700 price level in the last trading session.

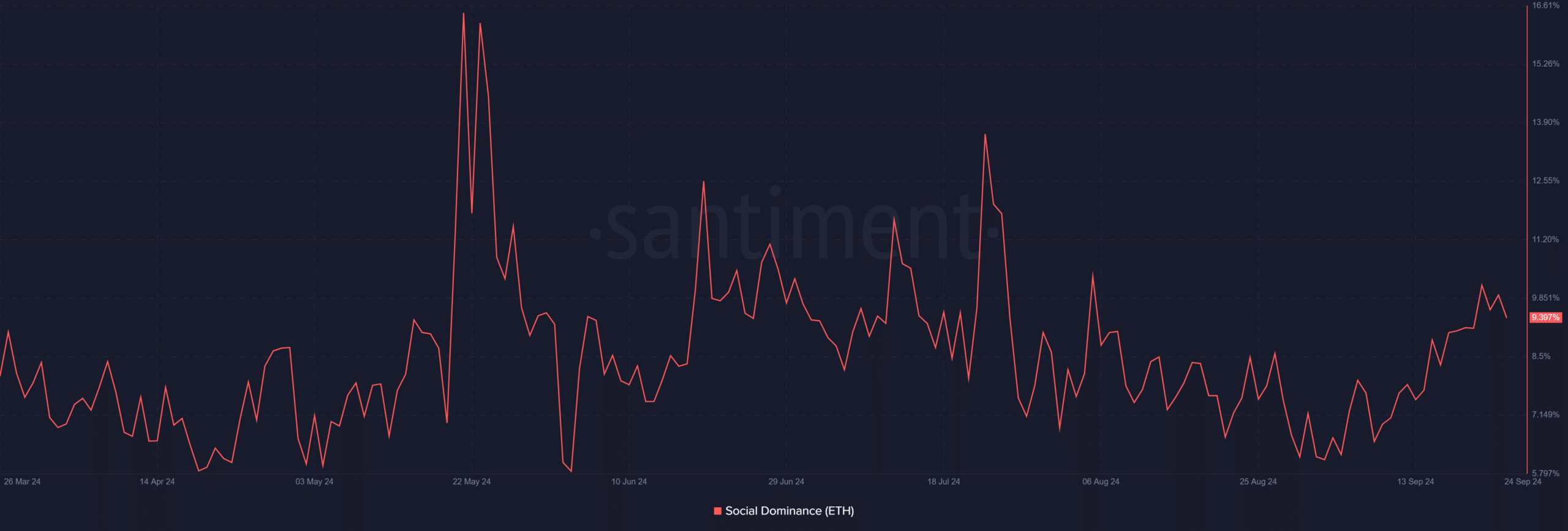

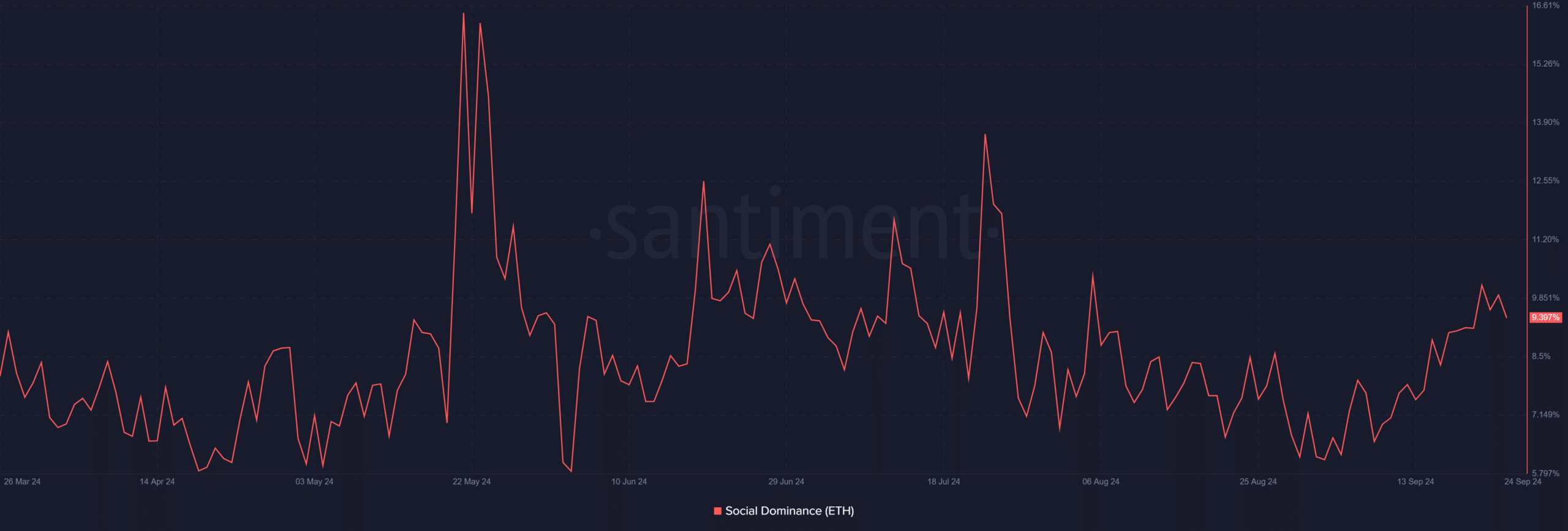

- At press time, the ETH social dominance was close to 10%.

Ethereum [ETH] has recently broken through its short-term resistance after staying below its moving averages since the end of July, a period during which it witnessed a death cross. The second-largest cryptocurrency has also seen an uptick in market chatter over the past few weeks, along with growing interest from derivative traders.

Ethereum sees increased social dominance

Analysis from Santiment reveals that Ethereum’s social dominance has noticeably increased recently. On 21st September, social dominance rose to over 10%.

Although it slightly dipped to around 9.9% by 23rd September, this marks the first time in about seven weeks it reached such levels.

Source: Santiment

This rise indicates a surge in discussions about Ethereum, reflecting the heightened attention the asset is receiving. The increased social dominance correlates with Ethereum’s recent price movements, suggesting that market sentiment is turning more bullish.

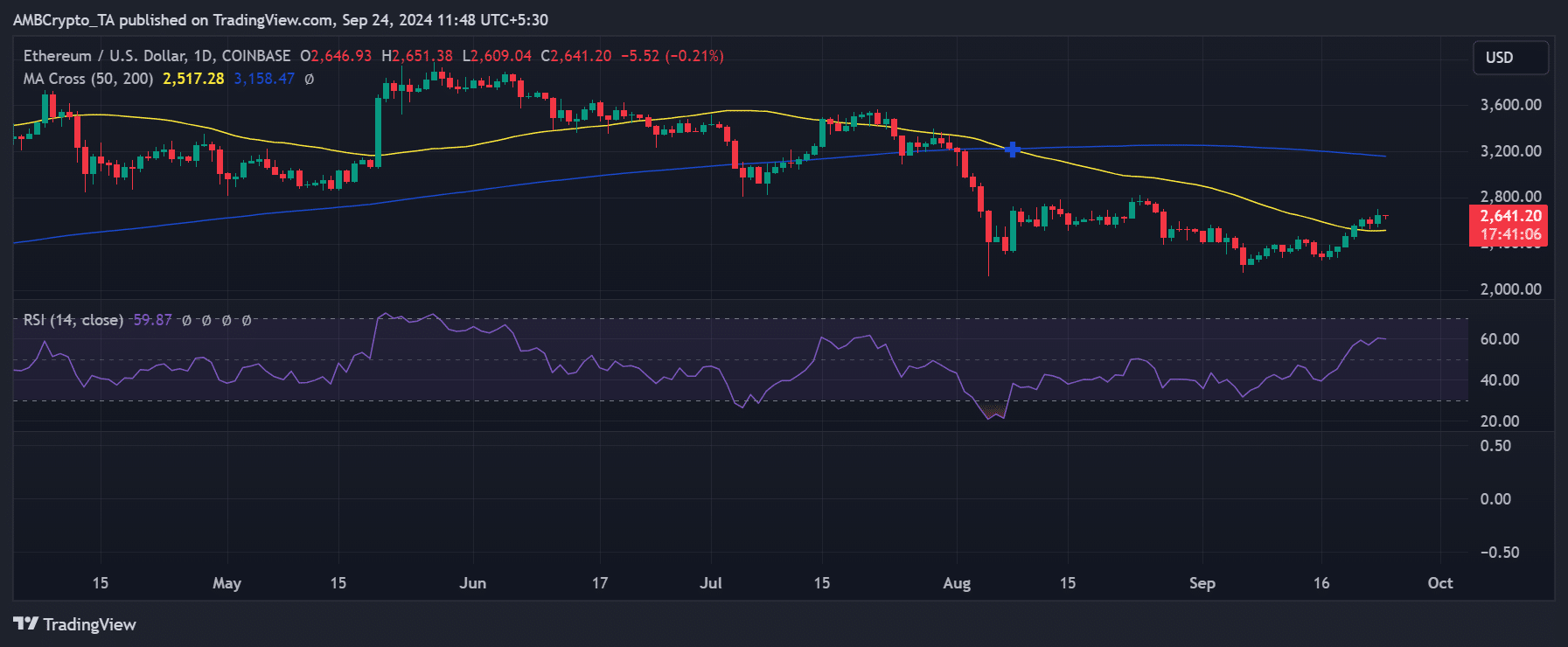

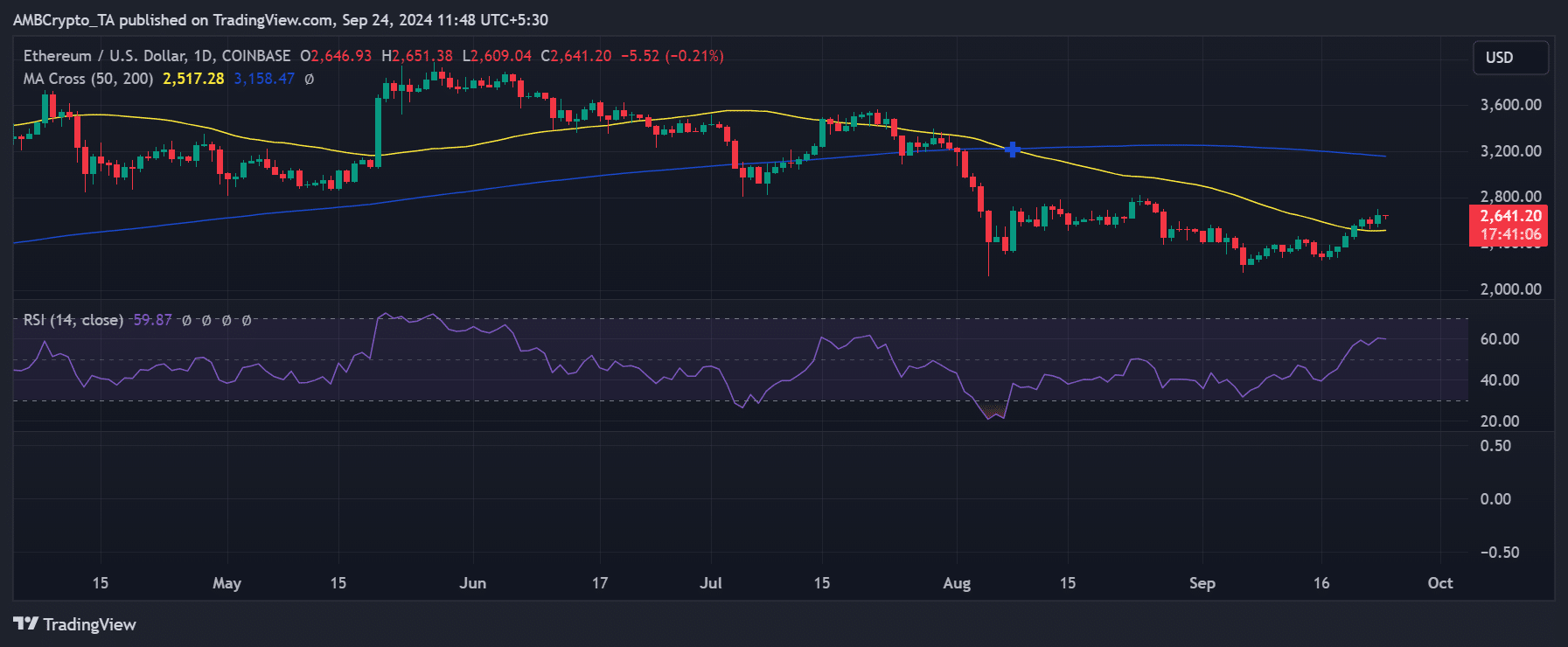

Ethereum price breaks short-term resistance

Examining Ethereum’s price chart sheds light on the growing social interest. Over the past seven days, ETH has seen consecutive gains.

It broke above its short-term moving average (yellow line) on 20th September after a 3.90% increase that pushed its price to around $2,562.

By the end of the last trading session, Ethereum was trading at approximately $2,642 and even surpassed the $2,700 mark at one point. Also, the short-term moving average has now flipped to become a stronger support level.

Source: TradingView

Further analysis indicates that the next critical resistance is at the $2,800 price level. If ETH breaks through it, the $3,000 threshold could be retested. This price increase has also boosted interest from derivative traders.

Read Ethereum’s [ETH] Price Prediction 2024–2025

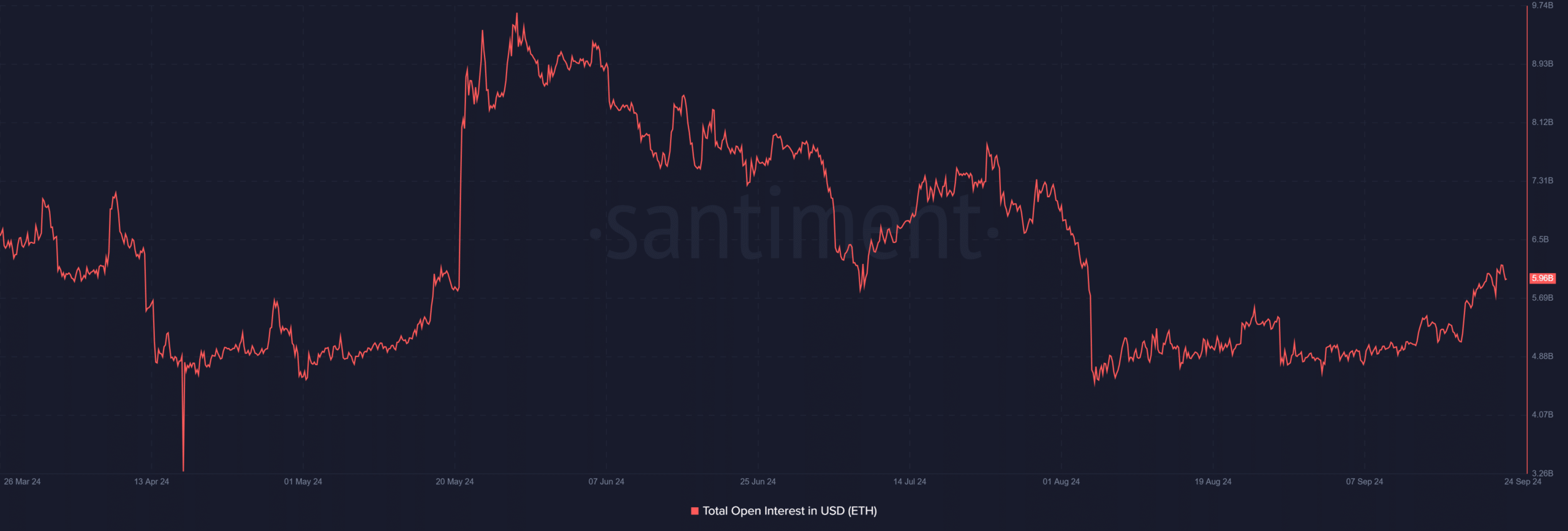

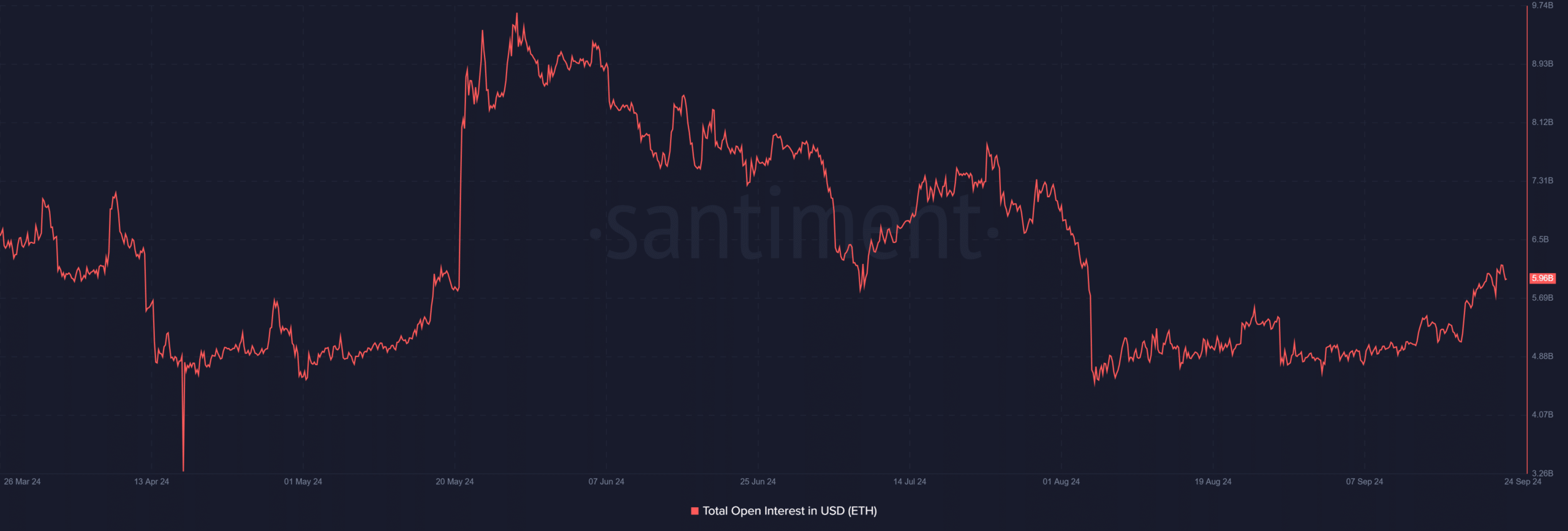

Open interest sees increased volume

Another key indicator showing positive momentum is Ethereum’s open interest. Recent analysis reveals that open interest climbed to over $6 billion on 23rd September, the highest in about seven weeks.

Source: Santiment

The surge in open interest suggests an influx of funds from derivative traders, likely motivated by Ethereum’s recent price rally. If these positive indicators continue, ETH may be on track to retest the $3,000 price range shortly.

- ETH traded above the $2,700 price level in the last trading session.

- At press time, the ETH social dominance was close to 10%.

Ethereum [ETH] has recently broken through its short-term resistance after staying below its moving averages since the end of July, a period during which it witnessed a death cross. The second-largest cryptocurrency has also seen an uptick in market chatter over the past few weeks, along with growing interest from derivative traders.

Ethereum sees increased social dominance

Analysis from Santiment reveals that Ethereum’s social dominance has noticeably increased recently. On 21st September, social dominance rose to over 10%.

Although it slightly dipped to around 9.9% by 23rd September, this marks the first time in about seven weeks it reached such levels.

Source: Santiment

This rise indicates a surge in discussions about Ethereum, reflecting the heightened attention the asset is receiving. The increased social dominance correlates with Ethereum’s recent price movements, suggesting that market sentiment is turning more bullish.

Ethereum price breaks short-term resistance

Examining Ethereum’s price chart sheds light on the growing social interest. Over the past seven days, ETH has seen consecutive gains.

It broke above its short-term moving average (yellow line) on 20th September after a 3.90% increase that pushed its price to around $2,562.

By the end of the last trading session, Ethereum was trading at approximately $2,642 and even surpassed the $2,700 mark at one point. Also, the short-term moving average has now flipped to become a stronger support level.

Source: TradingView

Further analysis indicates that the next critical resistance is at the $2,800 price level. If ETH breaks through it, the $3,000 threshold could be retested. This price increase has also boosted interest from derivative traders.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Open interest sees increased volume

Another key indicator showing positive momentum is Ethereum’s open interest. Recent analysis reveals that open interest climbed to over $6 billion on 23rd September, the highest in about seven weeks.

Source: Santiment

The surge in open interest suggests an influx of funds from derivative traders, likely motivated by Ethereum’s recent price rally. If these positive indicators continue, ETH may be on track to retest the $3,000 price range shortly.

I regard something truly interesting about your web blog so I saved to fav.

I truly appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thx again

I have to express my gratitude for your kindness in support of those individuals that absolutely need guidance on in this study. Your personal commitment to passing the message all through has been amazingly advantageous and have continually permitted regular people much like me to attain their aims. Your valuable key points entails a lot to me and substantially more to my colleagues. Warm regards; from everyone of us.

I like this post, enjoyed this one regards for posting. “No man is wise enough by himself.” by Titus Maccius Plautus.

how to buy clomid price how can i get cheap clomiphene without dr prescription clomiphene other name clomid generic name where can i buy generic clomid no prescription buy clomid without dr prescription can you get clomid prices

More articles like this would pretence of the blogosphere richer.

The thoroughness in this piece is noteworthy.

buy azithromycin 250mg online – purchase tetracycline pills flagyl 200mg pill

order generic motilium – generic domperidone 10mg cyclobenzaprine order online

order augmentin 375mg online – atbioinfo ampicillin without prescription

esomeprazole usa – anexa mate esomeprazole 40mg tablet

coumadin 5mg us – https://coumamide.com/ cozaar for sale online

meloxicam 15mg pill – mobo sin meloxicam 15mg cost

I found your blog site on google and test a few of your early posts. Continue to maintain up the very good operate. I simply extra up your RSS feed to my MSN Information Reader. Searching for ahead to reading more from you in a while!…

buy prednisone 10mg generic – https://apreplson.com/ prednisone 40mg generic

men’s ed pills – fast ed to take ed pills cheap

diflucan price – https://gpdifluca.com/# fluconazole 200mg without prescription

cenforce 100mg canada – purchase cenforce for sale cenforce 100mg uk

where to buy cialis – https://ciltadgn.com/# purchasing cialis

what is the normal dose of cialis – how long does cialis last 20 mg cialis bodybuilding

how to get ranitidine without a prescription – https://aranitidine.com/ oral zantac 150mg

sildenafil citrate tablets 100 mg – https://strongvpls.com/# sildenafil citrate tablets 100 mg

This is the kind of post I recoup helpful. https://buyfastonl.com/gabapentin.html

The vividness in this tune is exceptional. https://ursxdol.com/get-metformin-pills/

The reconditeness in this ruined is exceptional. https://prohnrg.com/product/loratadine-10-mg-tablets/

I would like to thnkx for the efforts you have put in writing this site. I’m hoping the same high-grade blog post from you in the upcoming as well. Actually your creative writing skills has inspired me to get my own blog now. Actually the blogging is spreading its wings rapidly. Your write up is a good example of it.

Thanks an eye to sharing. It’s acme quality. https://ondactone.com/product/domperidone/

This is the gentle of writing I in fact appreciate.

https://doxycyclinege.com/pro/spironolactone/

The thoroughness in this break down is noteworthy. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24581

I?¦ve been exploring for a little for any high-quality articles or weblog posts in this sort of area . Exploring in Yahoo I at last stumbled upon this site. Reading this info So i?¦m glad to express that I’ve a very just right uncanny feeling I came upon exactly what I needed. I so much definitely will make sure to don?¦t put out of your mind this website and give it a glance on a continuing basis.

order dapagliflozin 10mg online – https://janozin.com/# purchase forxiga without prescription

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You definitely know what youre talking about, why throw away your intelligence on just posting videos to your blog when you could be giving us something informative to read?

purchase xenical pill – https://asacostat.com/ oral xenical 60mg

The thoroughness in this break down is noteworthy. http://pokemonforever.com/User-Dpbfle