- Ethereum has surpassed 5 million active addresses across its mainnet and Layer 2 networks.

- Despite this surge in network activity, its price remains stable, trading around $2,642.

Data indicates that Ethereum [ETH] is leading the charge among Layer 1 (L1) and Layer 2 (L2) platforms regarding active addresses. Over 5 million active addresses are now recorded across the Ethereum mainnet and its L2 networks as of October 2024.

This growth in active addresses is a significant indicator of Ethereum’s increasing dominance in the blockchain space. However, the key question is: Has Ethereum’s price responded to this surge in network activity, or is there a disconnect between its usage and market performance?

Ethereum sees active address dominance

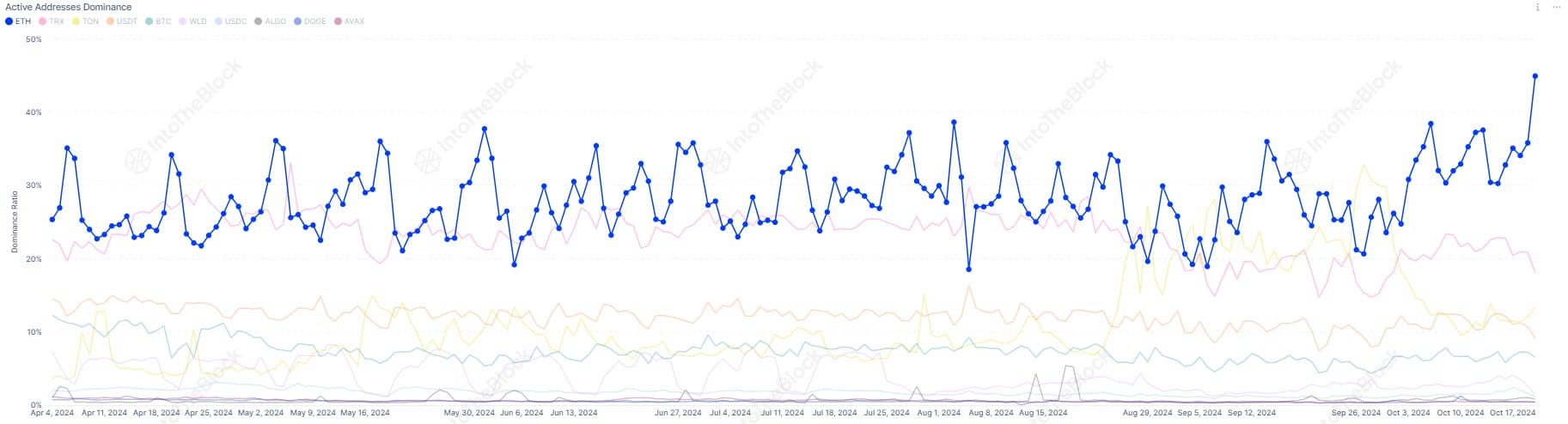

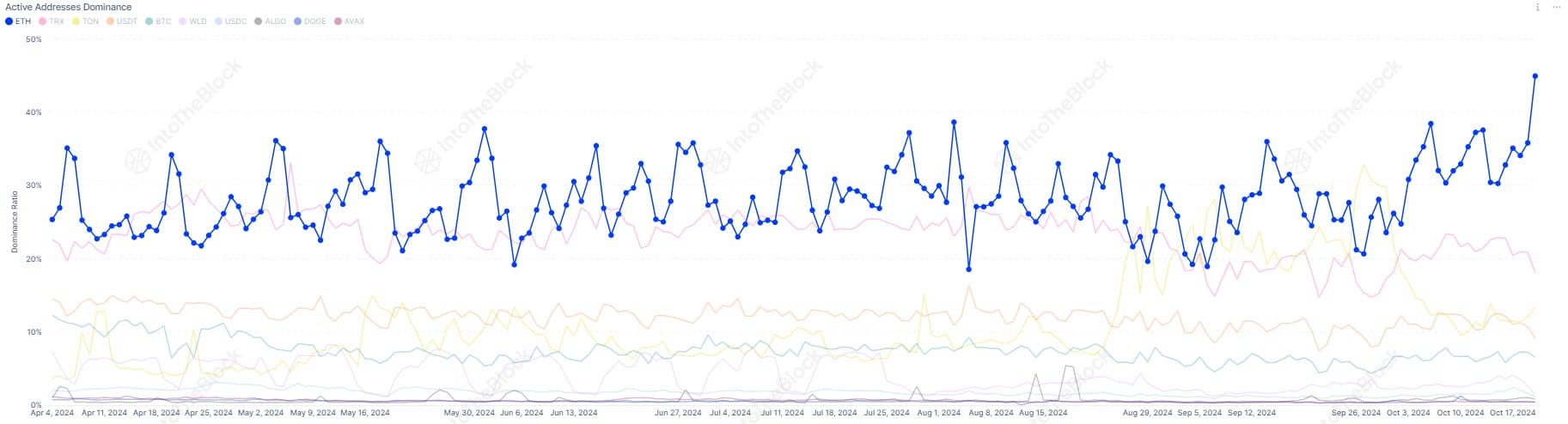

An analysis of Ethereum’s active address chart on IntoTheBlock reveals that it is outpacing other networks in growth. The data shows that Ethereum now holds a dominant position, with a notable rise in daily active addresses across both its mainnet and Layer 2 solutions like Arbitrum and Optimism.

Source: IntoTheBlock

This surge in activity has pushed Ethereum’s share of active addresses to exceed 40%, driven by multiple factors. The development and increasing adoption of L2 networks have played a pivotal role in boosting Ethereum’s network usage.

Additionally, data shows a consistent climb in active addresses throughout 2024, with a significant spike in early October.

Has Ethereum’s price reacted to this network growth?

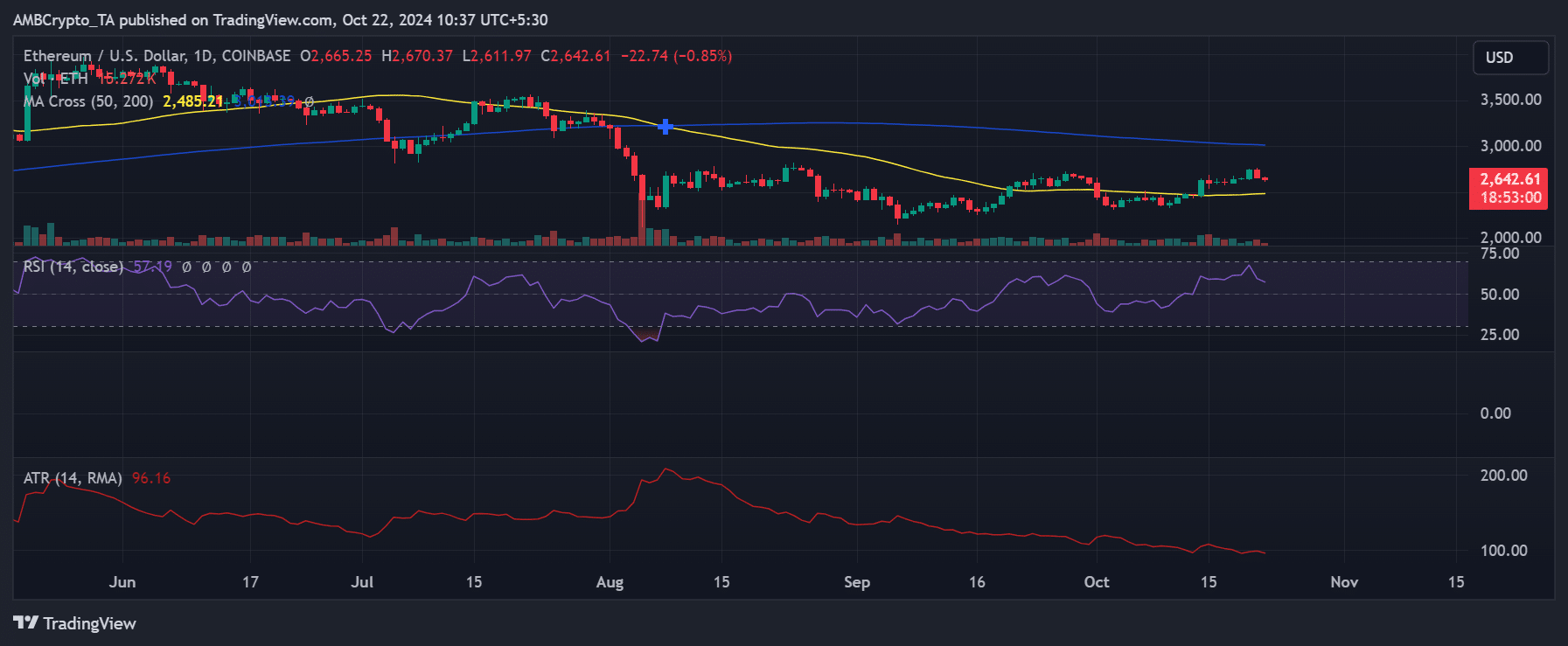

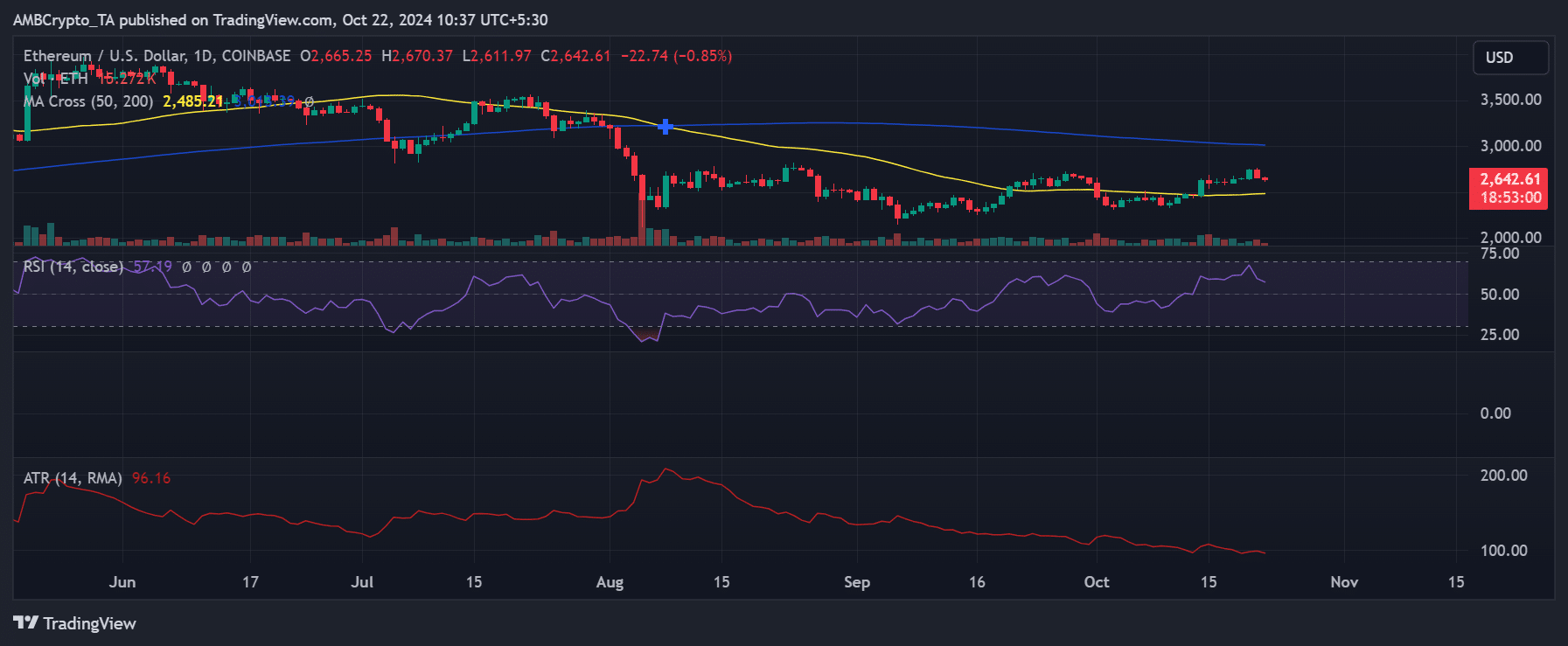

Despite the significant increase in active addresses, Ethereum’s price movement has remained relatively modest. As of October 22, 2024, Ethereum is trading at $2,642, marking a slight decline of 0.85% in the last 24 hours.

The price has been fluctuating within the $2,600 to $2,670 range, finding support near its 50-day moving average of $2,485.

Source; TradingView

While the rise in active addresses demonstrates ETH’s growing utility, the price has yet to reflect this increase in network activity fully. The Relative Strength Index (RSI) currently sits at 57.19, indicating neutral market momentum without being overbought or oversold.

Additionally, the Average True Range (ATR) of 96.16 shows a small uptick in volatility but not enough to suggest a major price movement.

These indicators suggest that, although ETH’s usage is on the rise, external market factors and broader investor sentiment are playing a larger role in determining price action.

ETH price still playing catch-up

The increase in active addresses underscores Ethereum’s expanding ecosystem and growing demand.

If Ethereum can maintain this momentum, with continued adoption of Layer 2 networks and strong staking participation (over 34 million ETH currently staked), there is potential for the price to catch up to its on-chain growth.

Read Ethereum (ETH) Price Prediction 2024-25

However, despite these positive signals, ETH’s price remains cautious. Technical indicators point to mixed signals, suggesting that while ETH’s network is flourishing, the market may be waiting for stronger catalysts to drive the price higher.

- Ethereum has surpassed 5 million active addresses across its mainnet and Layer 2 networks.

- Despite this surge in network activity, its price remains stable, trading around $2,642.

Data indicates that Ethereum [ETH] is leading the charge among Layer 1 (L1) and Layer 2 (L2) platforms regarding active addresses. Over 5 million active addresses are now recorded across the Ethereum mainnet and its L2 networks as of October 2024.

This growth in active addresses is a significant indicator of Ethereum’s increasing dominance in the blockchain space. However, the key question is: Has Ethereum’s price responded to this surge in network activity, or is there a disconnect between its usage and market performance?

Ethereum sees active address dominance

An analysis of Ethereum’s active address chart on IntoTheBlock reveals that it is outpacing other networks in growth. The data shows that Ethereum now holds a dominant position, with a notable rise in daily active addresses across both its mainnet and Layer 2 solutions like Arbitrum and Optimism.

Source: IntoTheBlock

This surge in activity has pushed Ethereum’s share of active addresses to exceed 40%, driven by multiple factors. The development and increasing adoption of L2 networks have played a pivotal role in boosting Ethereum’s network usage.

Additionally, data shows a consistent climb in active addresses throughout 2024, with a significant spike in early October.

Has Ethereum’s price reacted to this network growth?

Despite the significant increase in active addresses, Ethereum’s price movement has remained relatively modest. As of October 22, 2024, Ethereum is trading at $2,642, marking a slight decline of 0.85% in the last 24 hours.

The price has been fluctuating within the $2,600 to $2,670 range, finding support near its 50-day moving average of $2,485.

Source; TradingView

While the rise in active addresses demonstrates ETH’s growing utility, the price has yet to reflect this increase in network activity fully. The Relative Strength Index (RSI) currently sits at 57.19, indicating neutral market momentum without being overbought or oversold.

Additionally, the Average True Range (ATR) of 96.16 shows a small uptick in volatility but not enough to suggest a major price movement.

These indicators suggest that, although ETH’s usage is on the rise, external market factors and broader investor sentiment are playing a larger role in determining price action.

ETH price still playing catch-up

The increase in active addresses underscores Ethereum’s expanding ecosystem and growing demand.

If Ethereum can maintain this momentum, with continued adoption of Layer 2 networks and strong staking participation (over 34 million ETH currently staked), there is potential for the price to catch up to its on-chain growth.

Read Ethereum (ETH) Price Prediction 2024-25

However, despite these positive signals, ETH’s price remains cautious. Technical indicators point to mixed signals, suggesting that while ETH’s network is flourishing, the market may be waiting for stronger catalysts to drive the price higher.

Hi there very cool website!! Guy .. Beautiful .. Superb .. I’ll bookmark your website and take the feeds additionallyKI’m glad to find so many useful information here in the put up, we need work out extra techniques on this regard, thanks for sharing. . . . . .

My wife and i were really delighted Michael could deal with his researching with the ideas he acquired in your web pages. It’s not at all simplistic just to be handing out guidance which usually some others might have been making money from. And we all fully grasp we need you to be grateful to for that. These explanations you made, the straightforward blog navigation, the relationships you assist to create – it’s mostly amazing, and it’s really aiding our son and us reckon that that situation is exciting, which is certainly very indispensable. Thank you for all the pieces!

I believe you have remarked some very interesting details, appreciate it for the post.

You made some respectable points there. I regarded on the web for the problem and located most individuals will associate with with your website.

You actually make it appear so easy together with your presentation however I to find this topic to be actually one thing which I think I might by no means understand. It kind of feels too complicated and very wide for me. I’m taking a look forward in your subsequent submit, I will attempt to get the cling of it!

generic clomid price clomid usa clomiphene prices how to get clomiphene no prescription where to get clomid without dr prescription generic clomid pill clomiphene price in usa

More articles like this would remedy the blogosphere richer.

This is the kind of criticism I positively appreciate.

brand azithromycin – zithromax 500mg us buy flagyl 200mg sale

order semaglutide for sale – cyproheptadine us cyproheptadine 4 mg canada

purchase domperidone sale – how to buy flexeril buy flexeril

Unquestionably believe that which you said. Your favorite reason seemed to be on the internet the simplest thing to be aware of. I say to you, I certainly get annoyed while people think about worries that they just don’t know about. You managed to hit the nail upon the top as well as defined out the whole thing without having side effect , people could take a signal. Will likely be back to get more. Thanks

inderal medication – order clopidogrel sale order methotrexate 10mg online

You really make it appear so easy together with your presentation but I to find this matter to be actually one thing that I feel I’d by no means understand. It seems too complex and extremely extensive for me. I’m taking a look ahead on your next submit, I will try to get the dangle of it!

buy generic amoxil – cheap amoxicillin without prescription combivent 100mcg over the counter

order augmentin 1000mg for sale – https://atbioinfo.com/ buy ampicillin online

buy esomeprazole 20mg generic – https://anexamate.com/ order generic esomeprazole 40mg

mobic over the counter – tenderness mobic 15mg brand

I was just searching for this info for some time. After 6 hours of continuous Googleing, at last I got it in your website. I wonder what’s the lack of Google strategy that don’t rank this type of informative sites in top of the list. Usually the top web sites are full of garbage.

prednisone 5mg for sale – apreplson.com buy prednisone 20mg sale

medications for ed – buy ed pills medication how to buy ed pills

amoxicillin without prescription – buy amoxil pills for sale cheap amoxicillin

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

fluconazole 100mg cheap – this diflucan sale

order cenforce 50mg online – fast cenforce rs buy cenforce 50mg sale

does cialis make you harder – when will cialis become generic cialis canada prices

zantac 300mg uk – zantac online order buy ranitidine 300mg pills

cialis online pharmacy australia – strongtadafl is tadalafil as effective as cialis

Facts blog you have here.. It’s severely to on high calibre script like yours these days. I honestly recognize individuals like you! Take care!! neurontin contraindicaciones

order viagra online fast delivery – this buy viagra in mexico

This website really has all of the information and facts I needed there this case and didn’t identify who to ask. https://buyfastonl.com/

This is a theme which is virtually to my verve… Many thanks! Quite where can I find the phone details for questions? order levitra sale

Thanks on putting this up. It’s evidently done. https://prohnrg.com/

This blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen

This is the type of advise I find helpful. this