- Ethereum was trading at a key support zone at $2.6k.

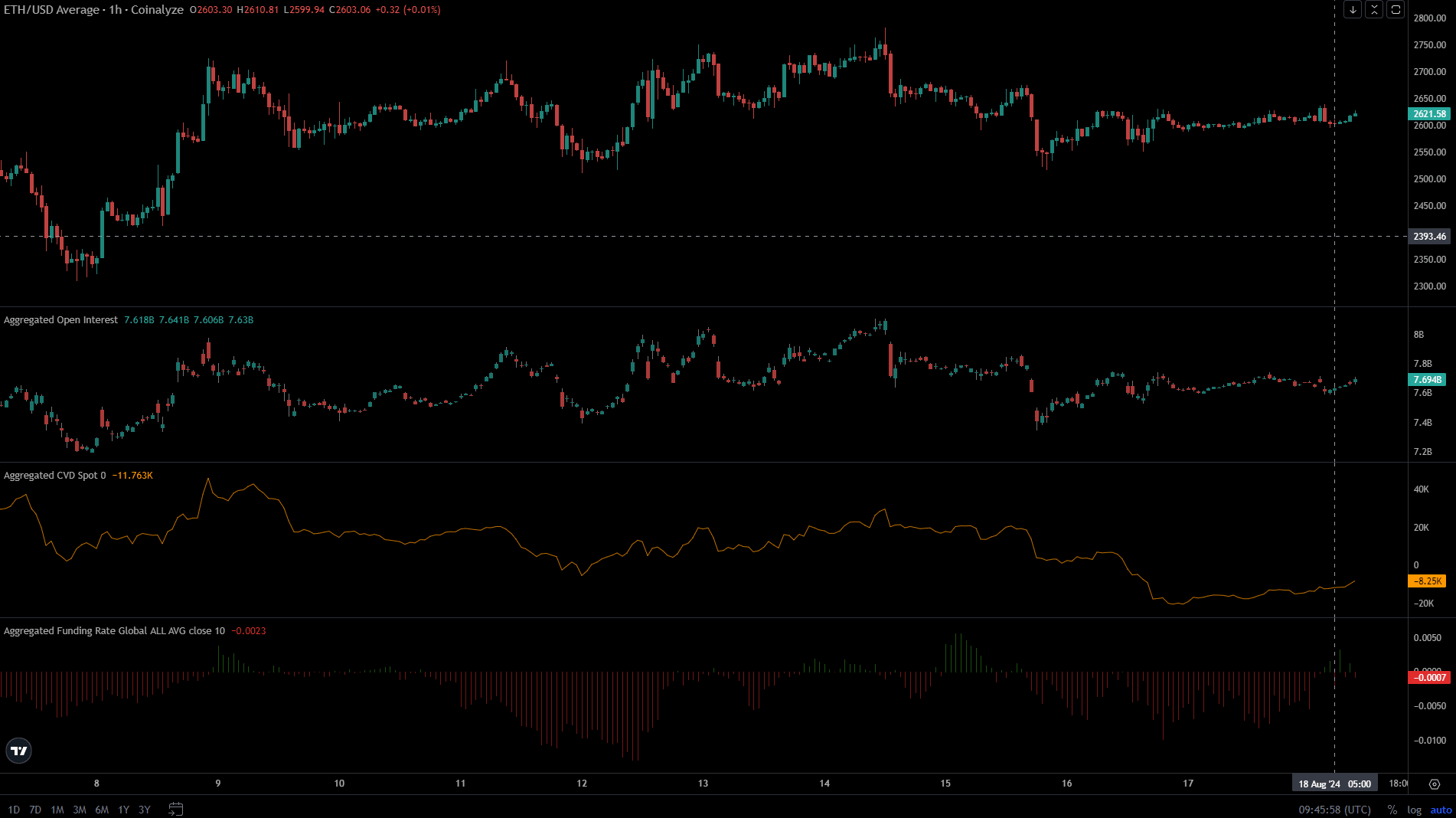

- Coinalyze data showed slight bullishness, but it might not be enough to propel an ETH rally.

Ethereum [ETH] showed a slightly more bullish outlook on-chain, and exchange netflow trends showed more consistent accumulation for ETH than Bitcoin [BTC]. Yet, the $2.6k region was a stiff resistance zone.

A recent report noted a high-value transaction of $32 million worth of Ethereum transferred to Coinbase, which could be the next wave of selling. Will the bulls be forced to retreat once more?

The OBV spiral did not help the bullish case

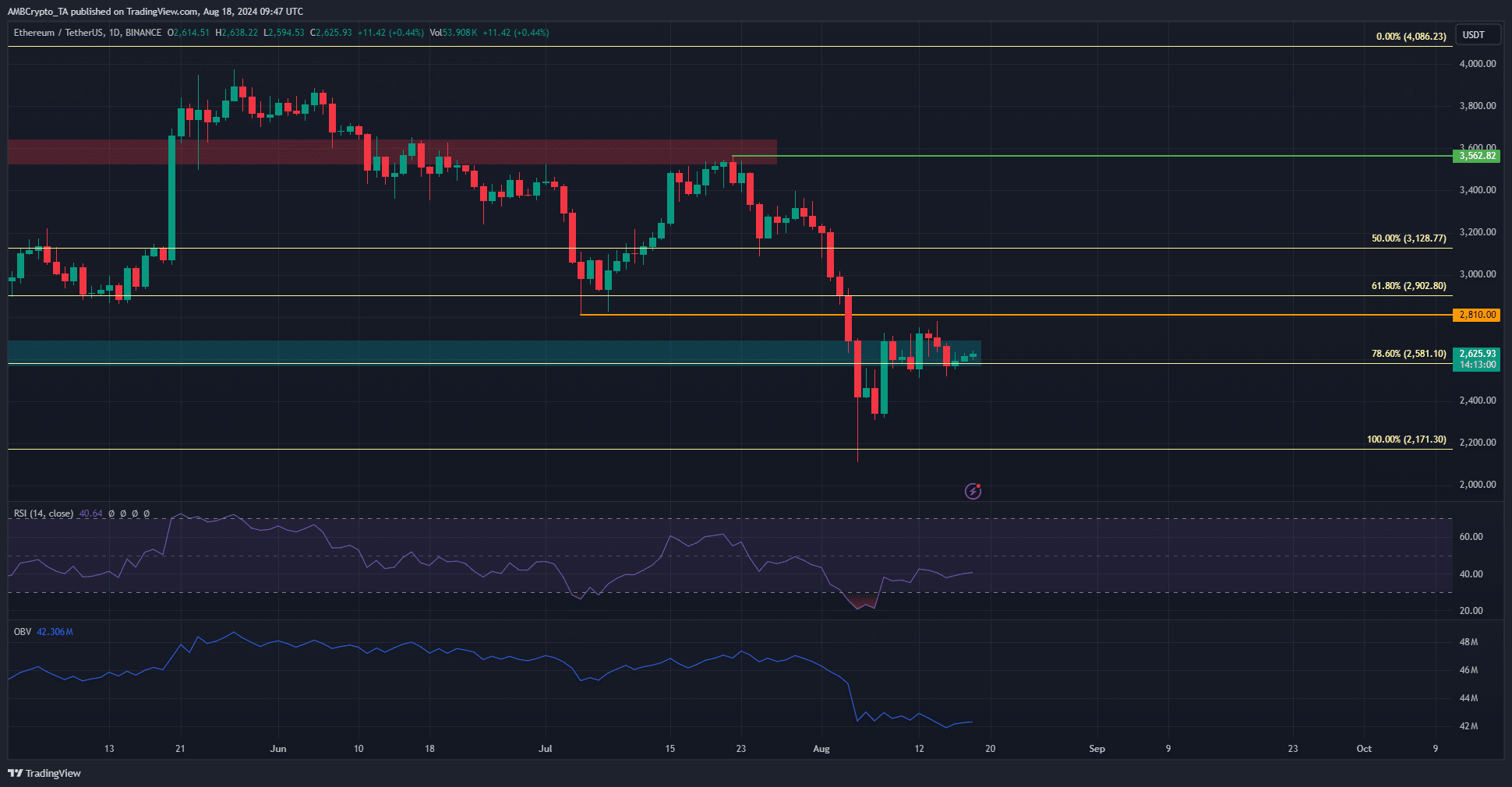

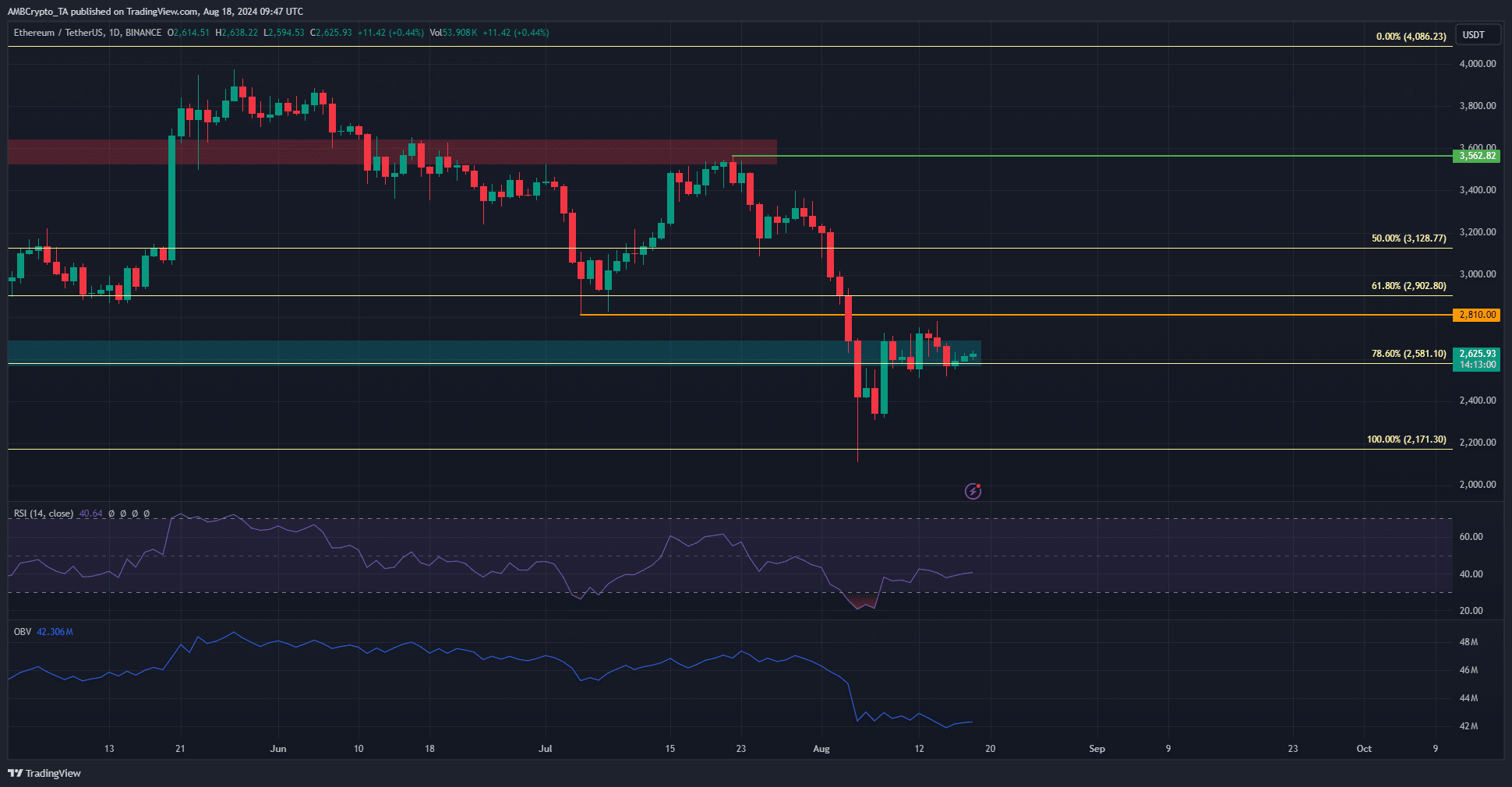

Source: ETH/USDT on TradingView

The 1-day timeframe showed a strong bearish market structure for ETH. Additionally, the OBV was in a steady downtrend. Despite the price bounce from $2.2k, the OBV has set lower highs over the past ten days.

This was a strong sign that the token does not have the demand necessary to initiate a rally.

Any price moves higher would likely be unsustainable until the OBV changes trajectory to indicate buying pressure in the market.

Do not expect a quick rally yet

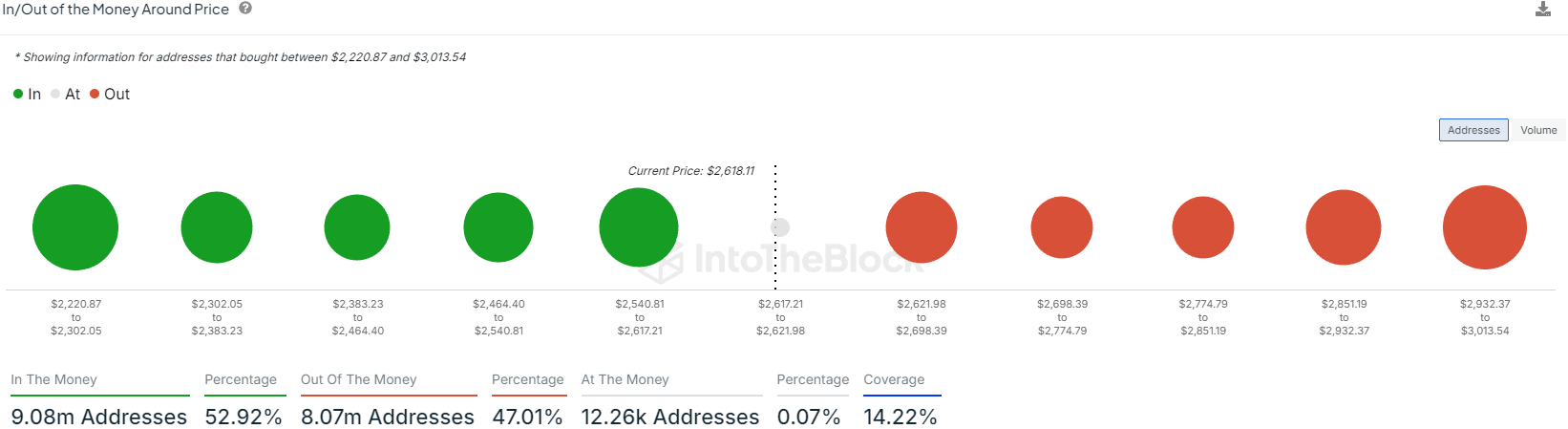

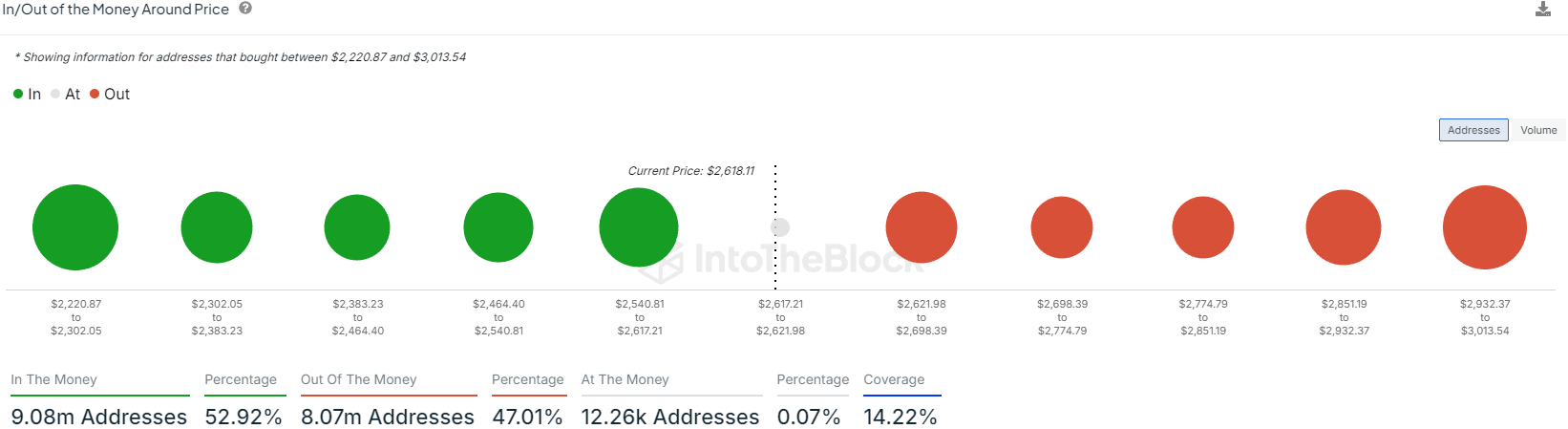

Source: IntoTheBlock

The in/out of the money around price showed the $2540-$2617 was a strong support zone. The resistances above, stretching up to $2.9K, were smaller but still sizeable.

The price bounce above $2.6K meant a slight majority of the addresses that bought in August were in the money.

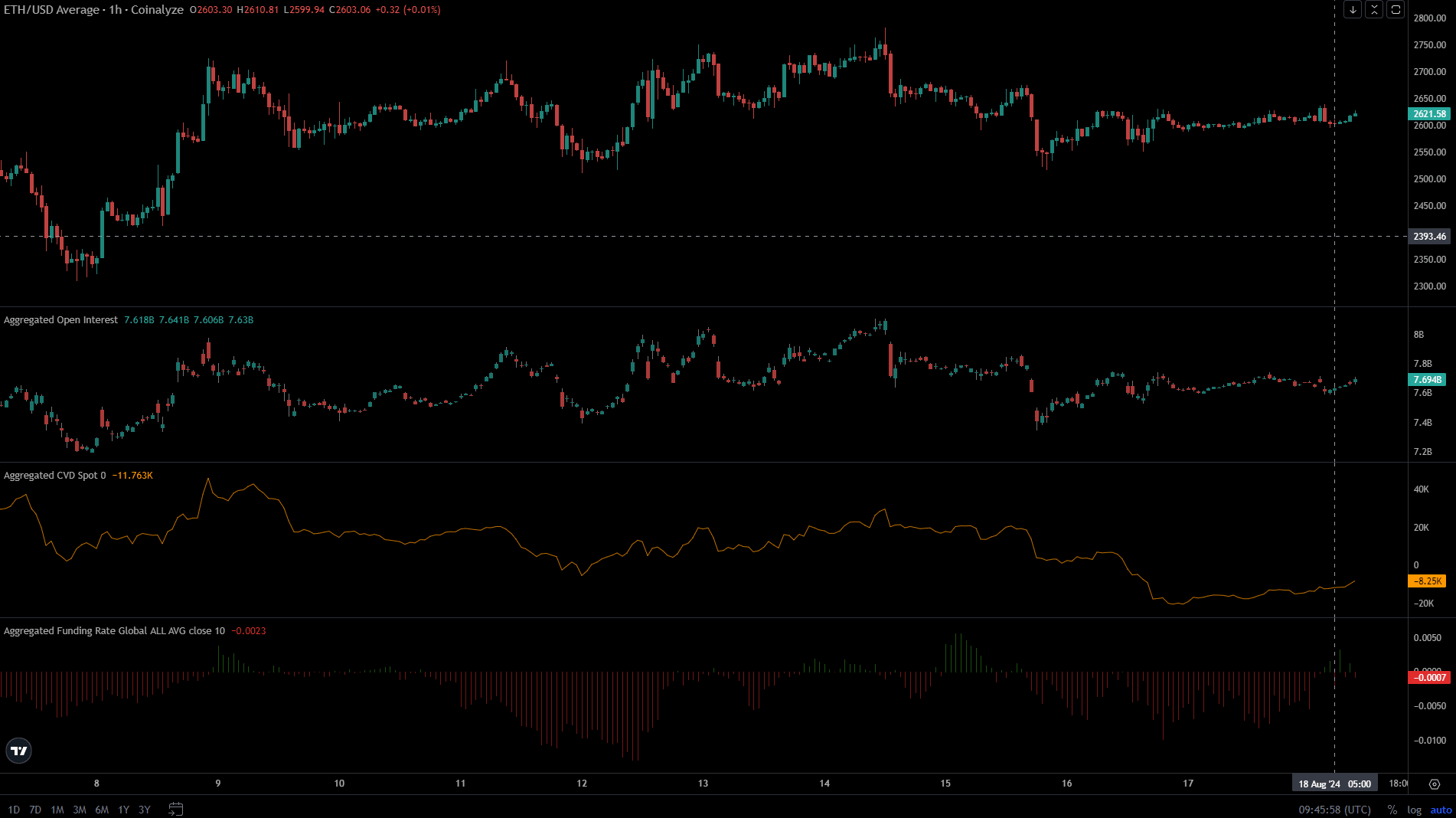

Source: Coinalyze

The negative Funding Rate was on the verge of shifting, showing bullish speculator numbers were increasing. The rising spot CVD also underlined an increased confidence.

Is your portfolio green? Check out the ETH Profit Calculator

The Open Interest did not see a large uptick, and showed sentiment has been neutral to slightly bullish in the past week.

Buyers were ready to go long on each notable price bounce, but the Ethereum sellers were able to hold on.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Ethereum was trading at a key support zone at $2.6k.

- Coinalyze data showed slight bullishness, but it might not be enough to propel an ETH rally.

Ethereum [ETH] showed a slightly more bullish outlook on-chain, and exchange netflow trends showed more consistent accumulation for ETH than Bitcoin [BTC]. Yet, the $2.6k region was a stiff resistance zone.

A recent report noted a high-value transaction of $32 million worth of Ethereum transferred to Coinbase, which could be the next wave of selling. Will the bulls be forced to retreat once more?

The OBV spiral did not help the bullish case

Source: ETH/USDT on TradingView

The 1-day timeframe showed a strong bearish market structure for ETH. Additionally, the OBV was in a steady downtrend. Despite the price bounce from $2.2k, the OBV has set lower highs over the past ten days.

This was a strong sign that the token does not have the demand necessary to initiate a rally.

Any price moves higher would likely be unsustainable until the OBV changes trajectory to indicate buying pressure in the market.

Do not expect a quick rally yet

Source: IntoTheBlock

The in/out of the money around price showed the $2540-$2617 was a strong support zone. The resistances above, stretching up to $2.9K, were smaller but still sizeable.

The price bounce above $2.6K meant a slight majority of the addresses that bought in August were in the money.

Source: Coinalyze

The negative Funding Rate was on the verge of shifting, showing bullish speculator numbers were increasing. The rising spot CVD also underlined an increased confidence.

Is your portfolio green? Check out the ETH Profit Calculator

The Open Interest did not see a large uptick, and showed sentiment has been neutral to slightly bullish in the past week.

Buyers were ready to go long on each notable price bounce, but the Ethereum sellers were able to hold on.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

cheap clomiphene without insurance where to get clomid price where can i get clomiphene pill where to get clomiphene generic clomid walmart cost clomid without insurance how can i get cheap clomiphene without dr prescription

I’ll certainly bring back to be familiar with more.

Thanks on putting this up. It’s evidently done.

purchase zithromax online – buy azithromycin 500mg pills flagyl for sale

order motilium pill – purchase sumycin flexeril without prescription

buy augmentin online – https://atbioinfo.com/ purchase ampicillin online cheap

order nexium 40mg generic – anexa mate esomeprazole online order

buy coumadin 5mg online – coumamide buy cheap cozaar

meloxicam 15mg usa – https://moboxsin.com/ meloxicam price

order deltasone 10mg online cheap – https://apreplson.com/ order prednisone without prescription

otc ed pills that work – how to buy ed pills where can i buy ed pills

amoxil pills – combamoxi amoxicillin price

purchase fluconazole online – this forcan over the counter

cenforce 100mg generic – https://cenforcers.com/# order cenforce 100mg

best time to take cialis 5mg – ciltad generic order cialis no prescription

cialis vs flomax for bph – cialis canadian purchase where can i buy cialis

zantac 150mg generic – buy zantac ranitidine 150mg ca

street value viagra 100mg – this how to order viagra in india

The depth in this ruined is exceptional. https://gnolvade.com/

This is a theme which is forthcoming to my heart… Numberless thanks! Unerringly where can I find the connection details for questions? https://ursxdol.com/propecia-tablets-online/

Palatable blog you be undergoing here.. It’s severely to find strong calibre article like yours these days. I justifiably comprehend individuals like you! Withstand care!! online

I couldn’t hold back commenting. Adequately written! https://aranitidine.com/fr/ciagra-professional-20-mg/

I couldn’t resist commenting. Adequately written! https://ondactone.com/simvastatin/

Thanks recompense sharing. It’s acme quality.

order imitrex generic

More articles like this would remedy the blogosphere richer. http://3ak.cn/home.php?mod=space&uid=229263

forxiga 10 mg pill – this dapagliflozin 10 mg drug

order generic xenical – https://asacostat.com/ buy orlistat 120mg generic

This is the compassionate of scribble literary works I truly appreciate. http://fulloyuntr.10tl.net/member.php?action=profile&uid=3256