- Ethereum broke out of a symmetrical wedge on the price charts

- ETH scooped up 70% in RWA tokenization

Ethereum’s (ETH) charts saw the first signs that may shut down the narrative of “ETH is Dead.” This, after the altcoin recently broke out of a symmetrical wedge pattern and surged to trade around its $3,000 resistance level, at the time of writing.

The aforementioned breakout indicated strong bullish momentum – A sign that ETH may hold its position above $3,000. Here, it’s worth noting that such a decisive move past the wedge’s upper boundary was spurred by couple of metrics in Ethereum’s ecosystem.

Source: Trading View

If the prevailing market trend persists, ETH could soon challenge its higher resistance levels.

If ETH continues to trade above $3k, it might confirm the likelihood of further gains and a potential new resistance test at $4,000. Especially if talk of an incoming altseason grows.

ETH/BTC signals and prediction

Ethereum flashed oversold conditions on its RSI on the weekly chart, marking only the fifth occurrence of such an event.

Historically, similar RSI levels have alluded to a strong potential for bullish reversal. This time, the RSI also projected a bullish divergence, enhancing the likelihood of a price recovery on the charts. Taken together, this suggested that the asset’s price is unlikely to stay close to the $3k-level for a long time.

Source: Trading View

A bullish engulfing candle pattern appeared, signaling possible upward momentum. Given these technical indicators, Ethereum could start outperforming expectations soon. If an altseason falls in place, ETH could hit a new high, potentially $5000.

This would disappoint those who believed that Ethereum’s potential was diminishing. More signs of reversal confirmation in the coming weeks will be crucial for capitalizing on potential uptrends in ETH’s price.

Share in RWA and sentiment

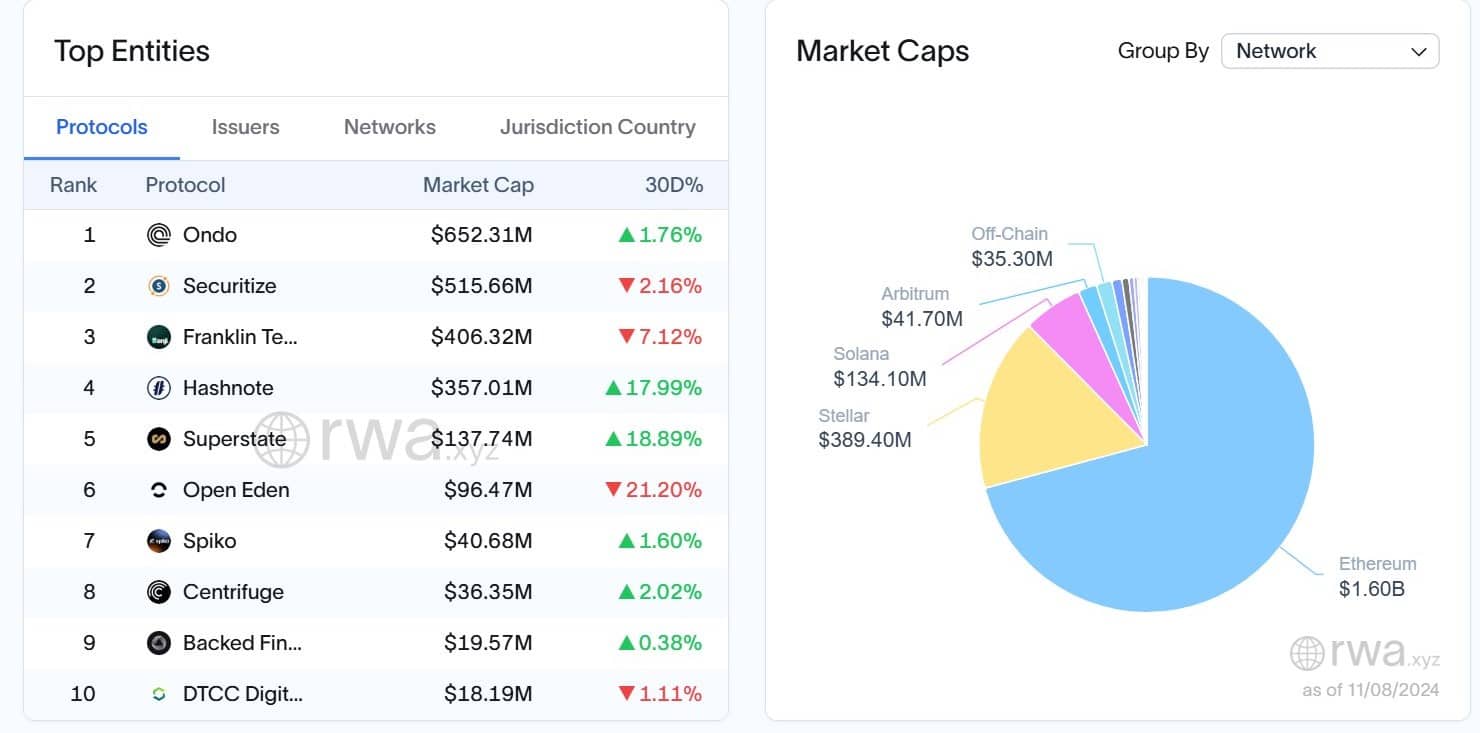

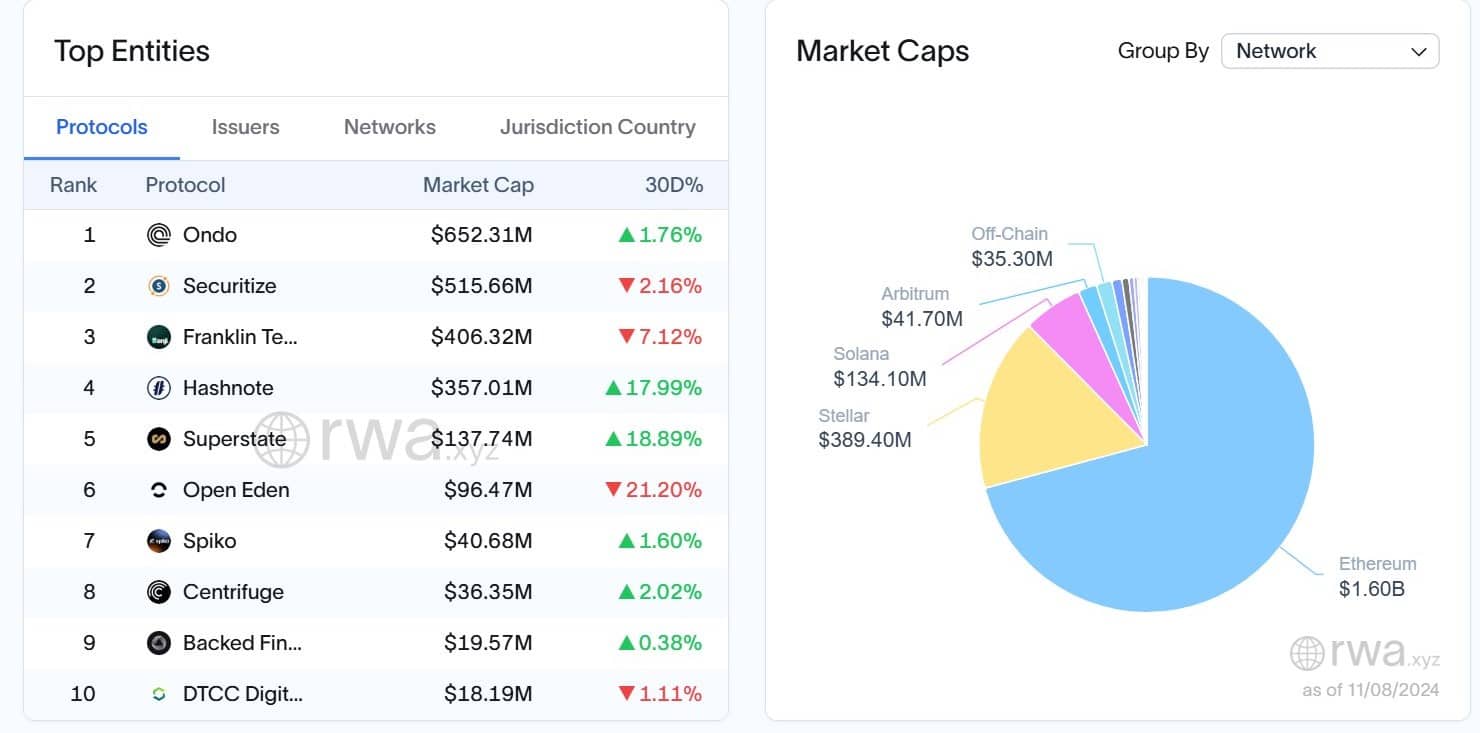

Tokenized U.S Treasuries hit an all-time high of over $2.33 billion on-chain, revealing significant growth in tokenized assets, as Leon Waidmann noted on X.

At the time of writing, Ethereum continued to dominate the real-world assets (RWA) space, hosting 70% of the assets – A sign of its sustained relevance and utility in the blockchain ecosystem.

Source: X

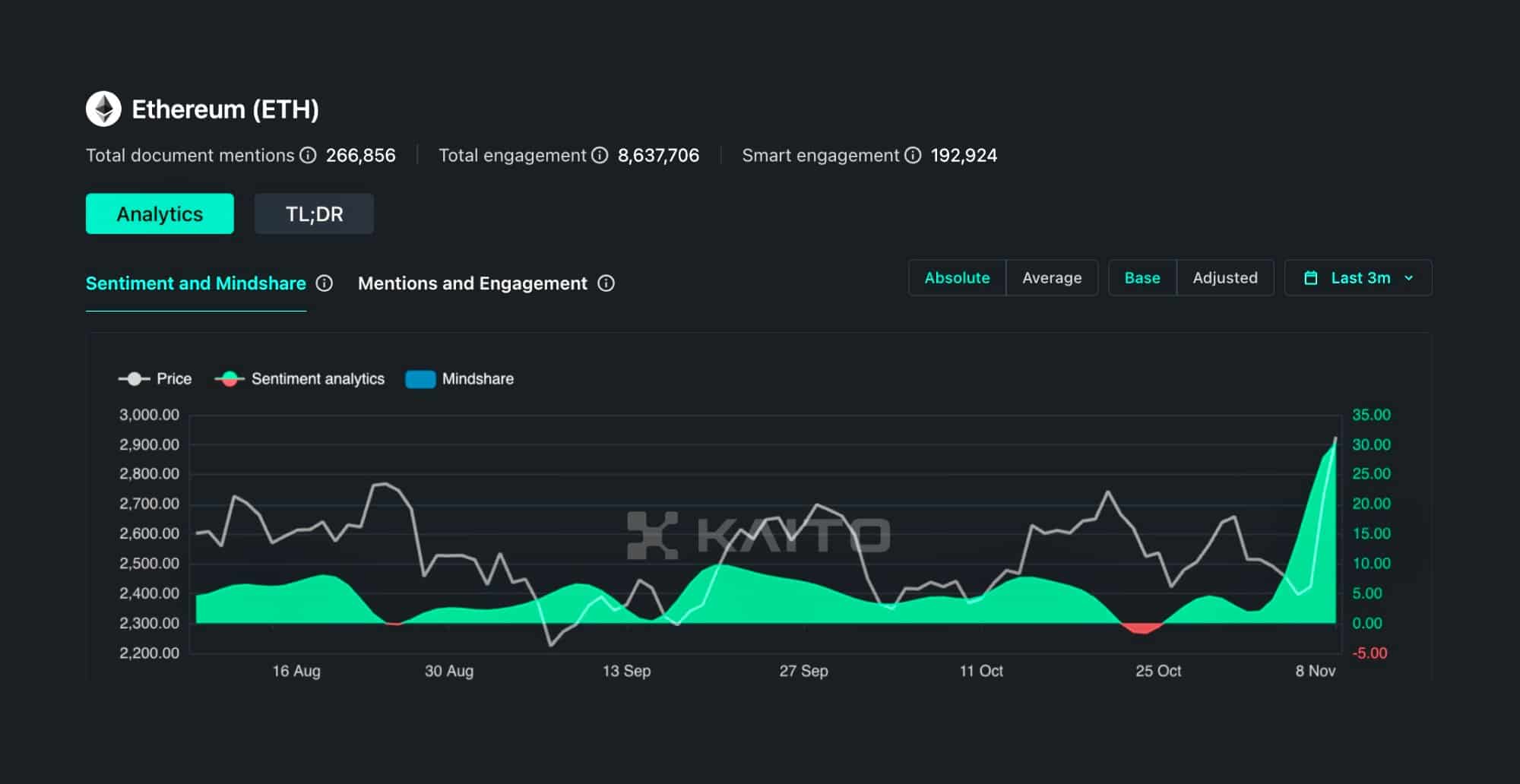

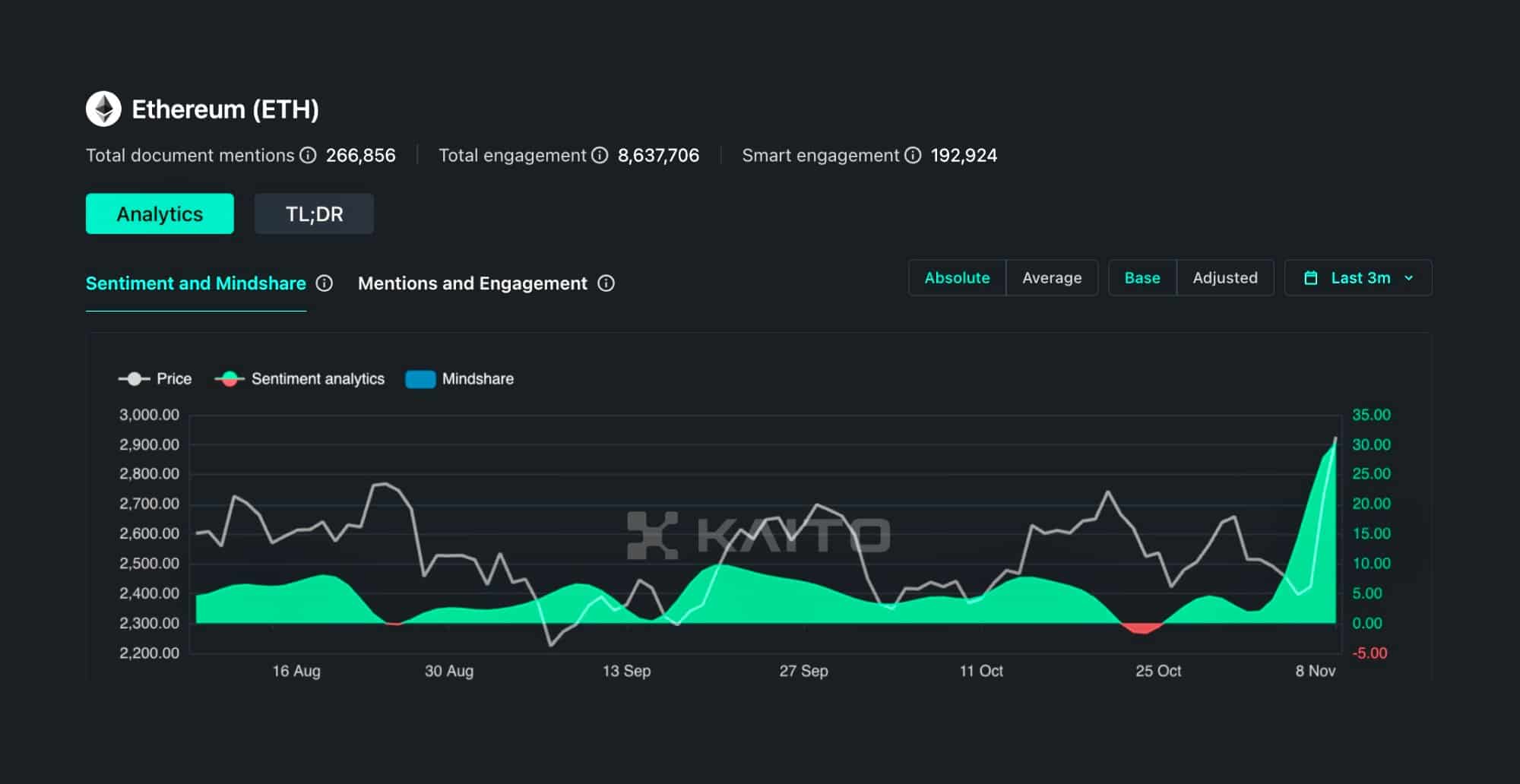

In fact, Kaito AI also revealed a sharp uptick in ETH sentiment recently, signaling a strong recovery in its perception and confidence.

As market sentiment surged, Ethereum’s price and market engagement significantly rose too, demonstrating revived interest in the platform.

Source: Kaito AI

Together, the analysis suggested that Ethereum is far from dead – An indication that the $3k level might be left behind. The significant tokenization of U.S Treasuries and the positive sentiment shift underscored Ethereum’s robust position in the market, poised for further growth and adoption.

The resurgence in sentiment and utility could drive Ethereum’s next moves in the market, potentially leading to sustained price appreciation and broader adoption within the financial sector.

- Ethereum broke out of a symmetrical wedge on the price charts

- ETH scooped up 70% in RWA tokenization

Ethereum’s (ETH) charts saw the first signs that may shut down the narrative of “ETH is Dead.” This, after the altcoin recently broke out of a symmetrical wedge pattern and surged to trade around its $3,000 resistance level, at the time of writing.

The aforementioned breakout indicated strong bullish momentum – A sign that ETH may hold its position above $3,000. Here, it’s worth noting that such a decisive move past the wedge’s upper boundary was spurred by couple of metrics in Ethereum’s ecosystem.

Source: Trading View

If the prevailing market trend persists, ETH could soon challenge its higher resistance levels.

If ETH continues to trade above $3k, it might confirm the likelihood of further gains and a potential new resistance test at $4,000. Especially if talk of an incoming altseason grows.

ETH/BTC signals and prediction

Ethereum flashed oversold conditions on its RSI on the weekly chart, marking only the fifth occurrence of such an event.

Historically, similar RSI levels have alluded to a strong potential for bullish reversal. This time, the RSI also projected a bullish divergence, enhancing the likelihood of a price recovery on the charts. Taken together, this suggested that the asset’s price is unlikely to stay close to the $3k-level for a long time.

Source: Trading View

A bullish engulfing candle pattern appeared, signaling possible upward momentum. Given these technical indicators, Ethereum could start outperforming expectations soon. If an altseason falls in place, ETH could hit a new high, potentially $5000.

This would disappoint those who believed that Ethereum’s potential was diminishing. More signs of reversal confirmation in the coming weeks will be crucial for capitalizing on potential uptrends in ETH’s price.

Share in RWA and sentiment

Tokenized U.S Treasuries hit an all-time high of over $2.33 billion on-chain, revealing significant growth in tokenized assets, as Leon Waidmann noted on X.

At the time of writing, Ethereum continued to dominate the real-world assets (RWA) space, hosting 70% of the assets – A sign of its sustained relevance and utility in the blockchain ecosystem.

Source: X

In fact, Kaito AI also revealed a sharp uptick in ETH sentiment recently, signaling a strong recovery in its perception and confidence.

As market sentiment surged, Ethereum’s price and market engagement significantly rose too, demonstrating revived interest in the platform.

Source: Kaito AI

Together, the analysis suggested that Ethereum is far from dead – An indication that the $3k level might be left behind. The significant tokenization of U.S Treasuries and the positive sentiment shift underscored Ethereum’s robust position in the market, poised for further growth and adoption.

The resurgence in sentiment and utility could drive Ethereum’s next moves in the market, potentially leading to sustained price appreciation and broader adoption within the financial sector.

clomid risks cost clomid prices how can i get clomiphene price how to buy clomiphene pill clomiphene tablets uses in urdu how can i get cheap clomiphene without prescription can you get cheap clomid for sale

The sagacity in this serving is exceptional.

Thanks on sharing. It’s acme quality.

azithromycin 250mg canada – ofloxacin buy online cost flagyl 200mg

domperidone 10mg sale – order domperidone without prescription cyclobenzaprine cheap

zithromax price – buy zithromax 500mg without prescription buy nebivolol for sale

augmentin 625mg generic – https://atbioinfo.com/ how to get ampicillin without a prescription

esomeprazole oral – https://anexamate.com/ order esomeprazole 40mg without prescription

warfarin 5mg pills – https://coumamide.com/ losartan brand

meloxicam 7.5mg ca – tenderness buy mobic 7.5mg for sale

purchase prednisone without prescription – inflammatory bowel diseases deltasone medication

how to get ed pills without a prescription – https://fastedtotake.com/ fda approved over the counter ed pills

amoxil cheap – combamoxi buy generic amoxicillin for sale

fluconazole 100mg us – https://gpdifluca.com/# diflucan order

cheap cenforce 50mg – cenforce where to buy order cenforce pill

cialis soft tabs – https://ciltadgn.com/ no prescription cialis

cialis and dapoxetime tabs in usa – site mambo 36 tadalafil 20 mg reviews

where to buy zantac without a prescription – https://aranitidine.com/ purchase zantac pill