- Whale activity and key support levels suggested a potential price breakout for Ethereum.

- Exchange reserves decline and liquidation points signaled increased volatility but also upward potential.

Ethereum [ETH] has recently experienced significant whale activity, with large withdrawals from major exchanges sparking interest in the market. A new wallet withdrew 7,100 ETH, valued at $14.27 million, from Gemini.

Additionally, substantial transfers of ETH took place from Binance, OKX, and Kraken, amounting to millions in value.

Some of these assets have been staked or deposited into lending platforms like Aave, which could signal bullish intentions.

What does the price action say about Ethereum?

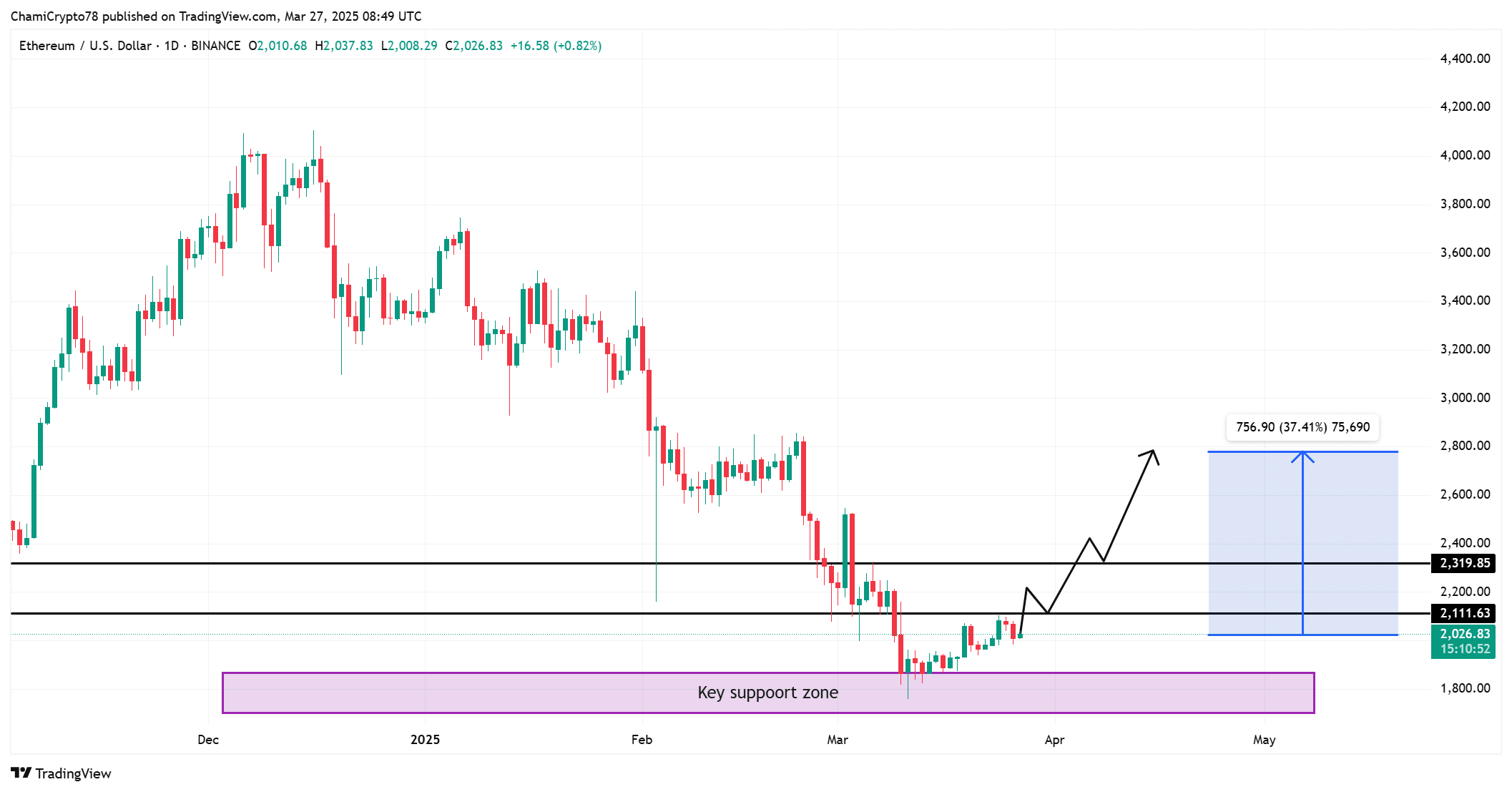

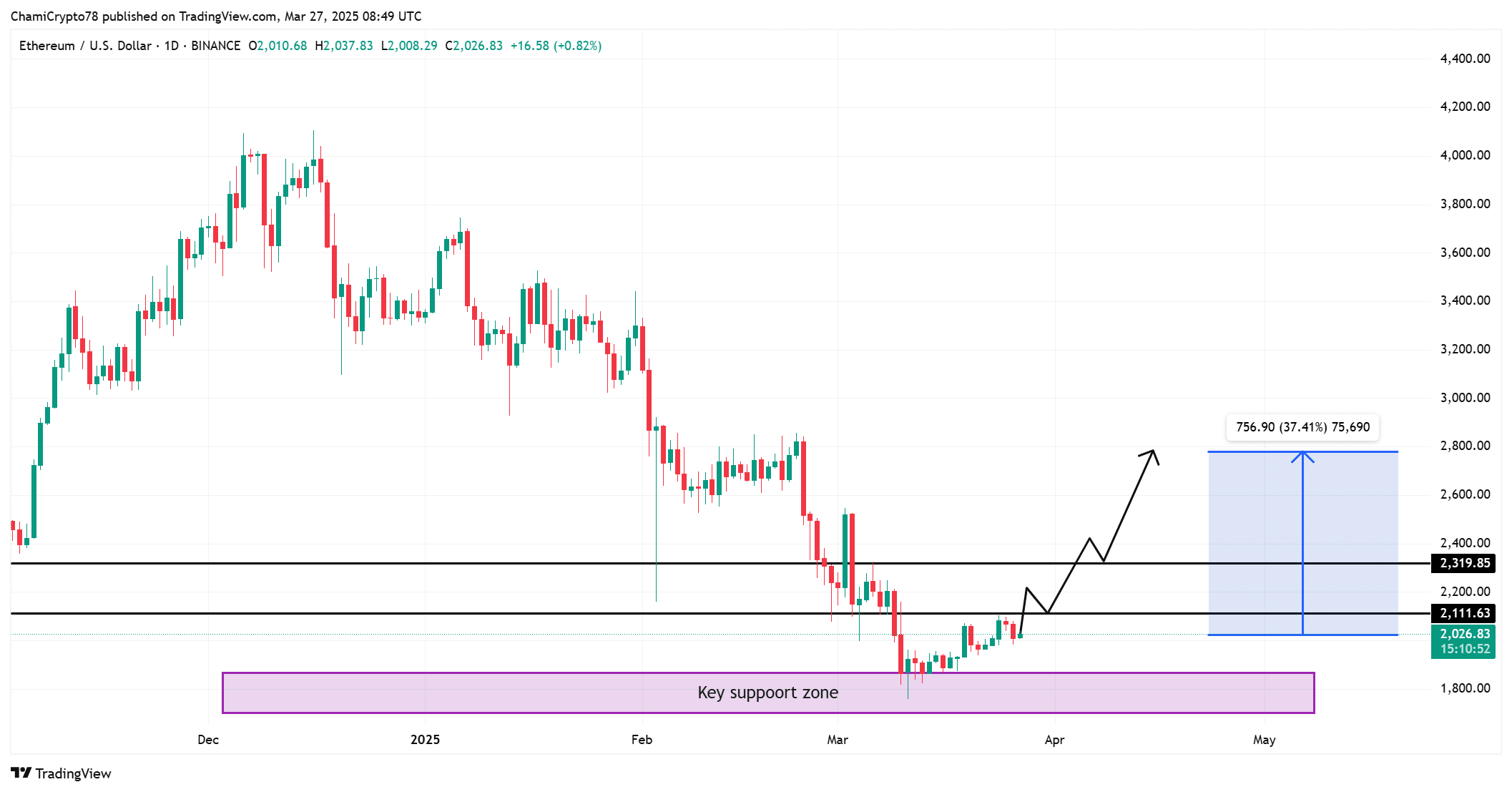

At press time, Ethereum was priced at $2,030.76, reflecting a slight 1.21% decline over the past 24 hours.

Despite this minor dip, Ethereum continues to hover above important support levels, especially around $2,000. As whale activity picks up, there is a strong possibility that Ethereum could experience a price rebound.

If the price stays above this support level, it might break past the $2,100 resistance, potentially triggering a rally.

Therefore, a move above this threshold could spark further buying, and the price could even rise by 37%, approaching $2,800.

Source: TradingView

ETH’s exchange reserves: Liquidity dynamics at play

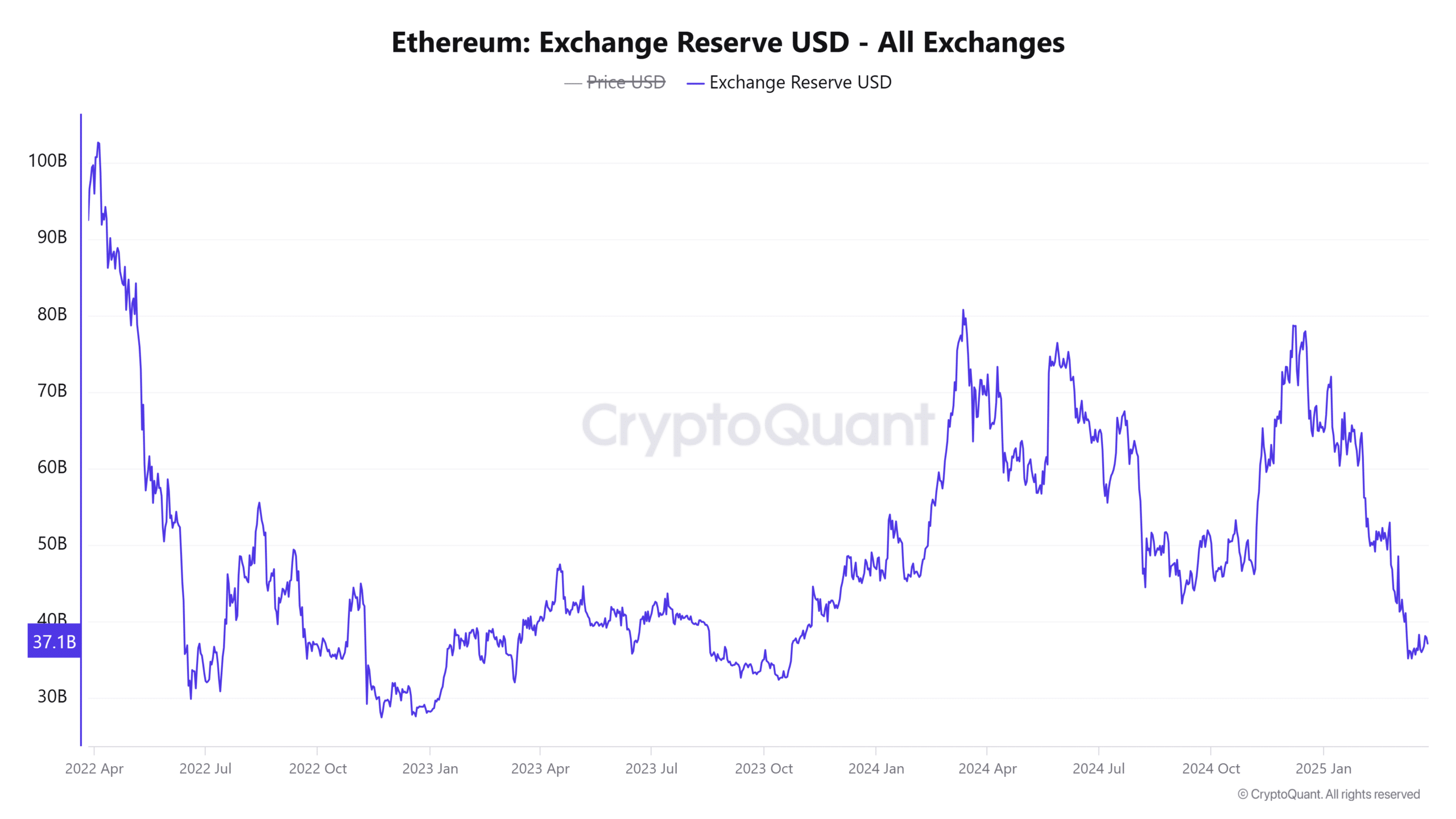

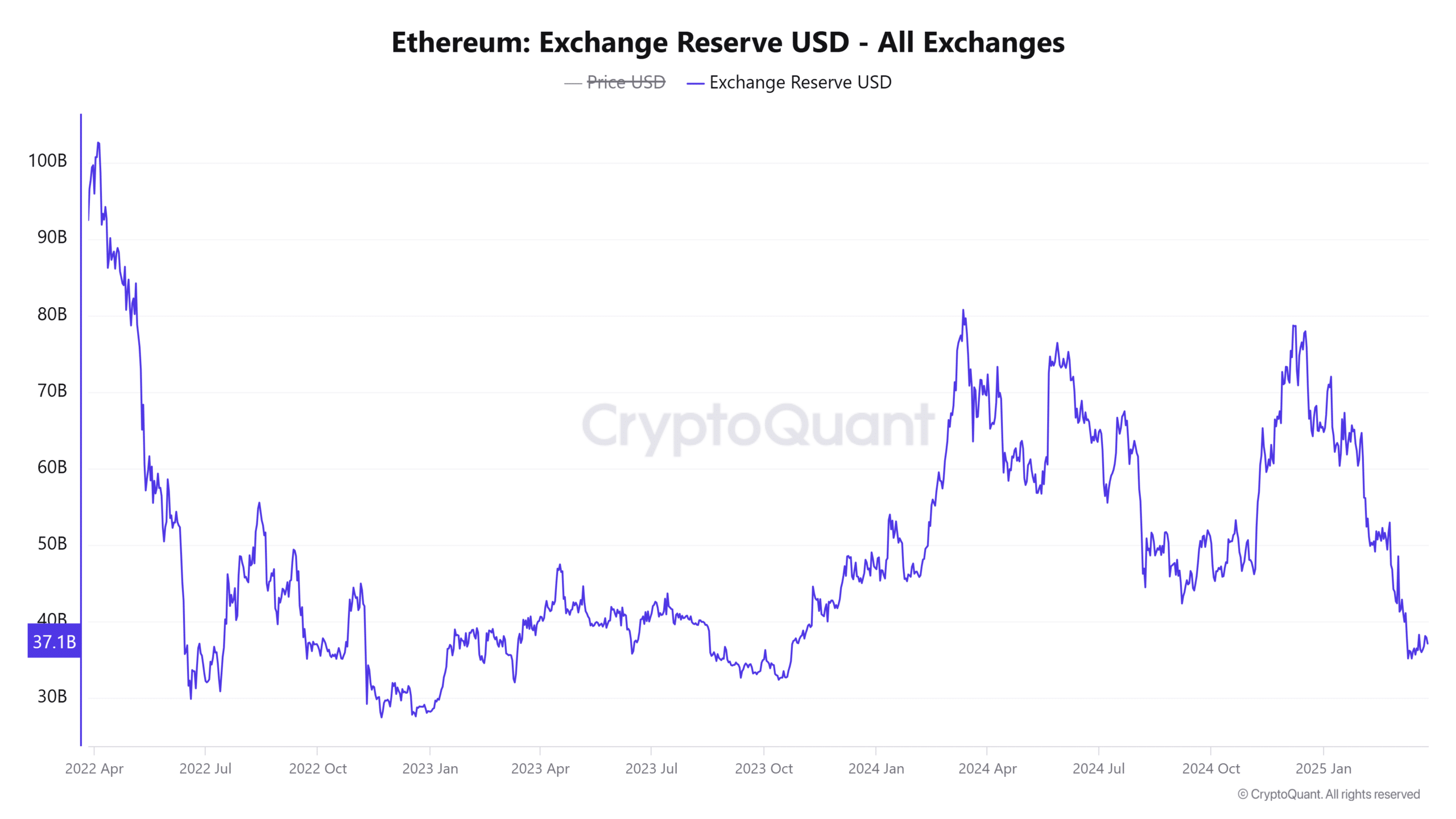

At the time of writing, Ethereum’s Exchange Reserve was at $37.1653 billion, showing a 2.16% decrease recently. This decline suggests that more ETH is moving off exchanges, reducing the liquidity available for immediate trades.

This shift may indicate that investors are either holding their positions or moving assets to other platforms for staking or long-term investment.

With a tighter supply on exchanges, Ethereum may experience upward pressure in the coming days.

The drop in exchange reserves reflects evolving market dynamics and indicates reduced sell-side liquidity, potentially driving price increases.

Source: CryptoQuant

Liquidation heatmap: How do liquidation levels impact price?

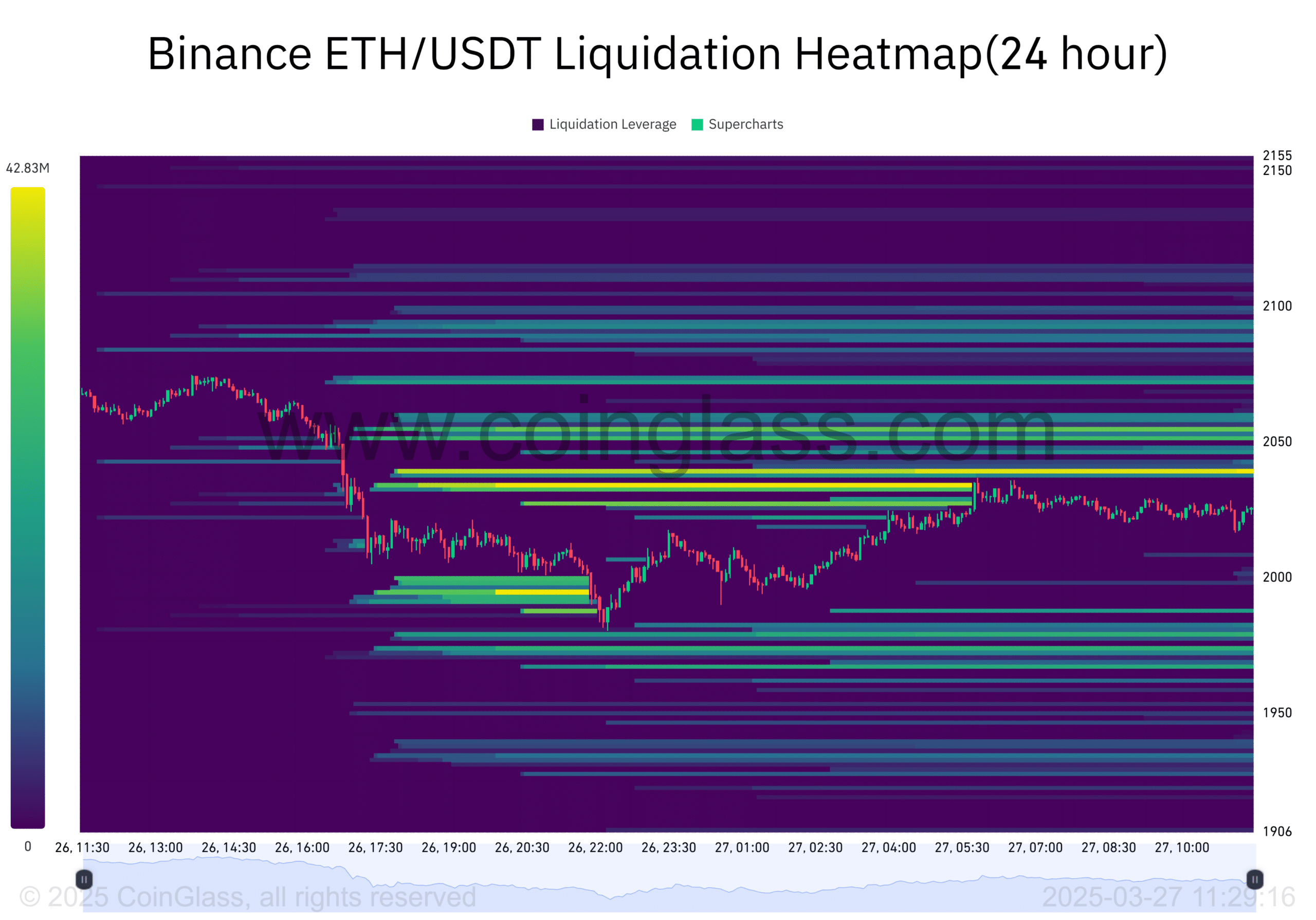

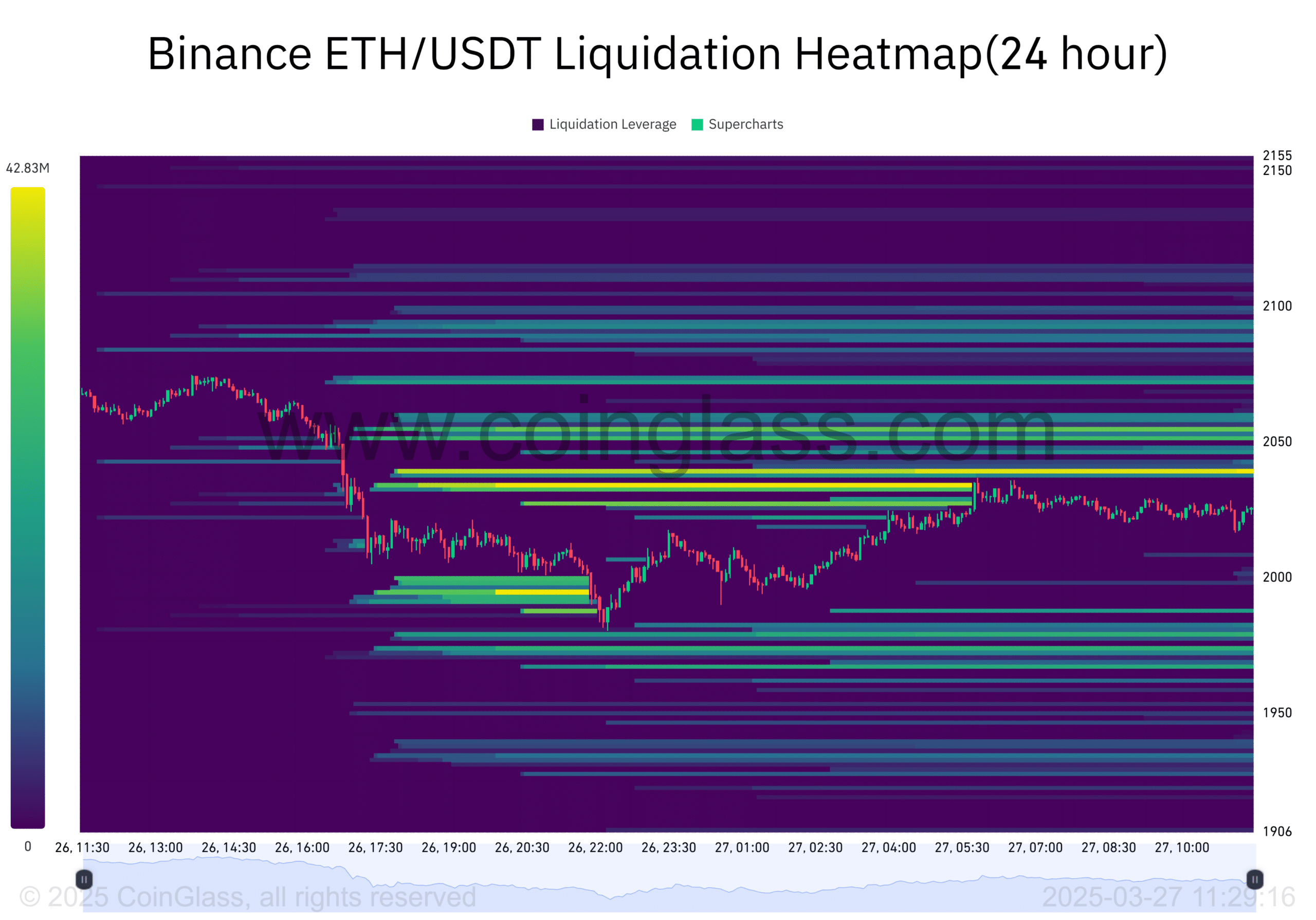

Breaking down Ethereum’s liquidation heatmap from Binance reveals key support and resistance zones.

The map shows significant liquidation points between $2,000 and $2,100. As Ethereum approaches these levels, forced selling could occur, increasing market volatility.

This increased volatility could either push Ethereum’s price through resistance levels or cause it to face downward corrections.

With the high number of liquidation points, Ethereum’s price is under pressure but could also surge if the market absorbs these liquidations effectively.

Source: Coinglass

MVRV Long/Short Difference: Market sentiment analysis

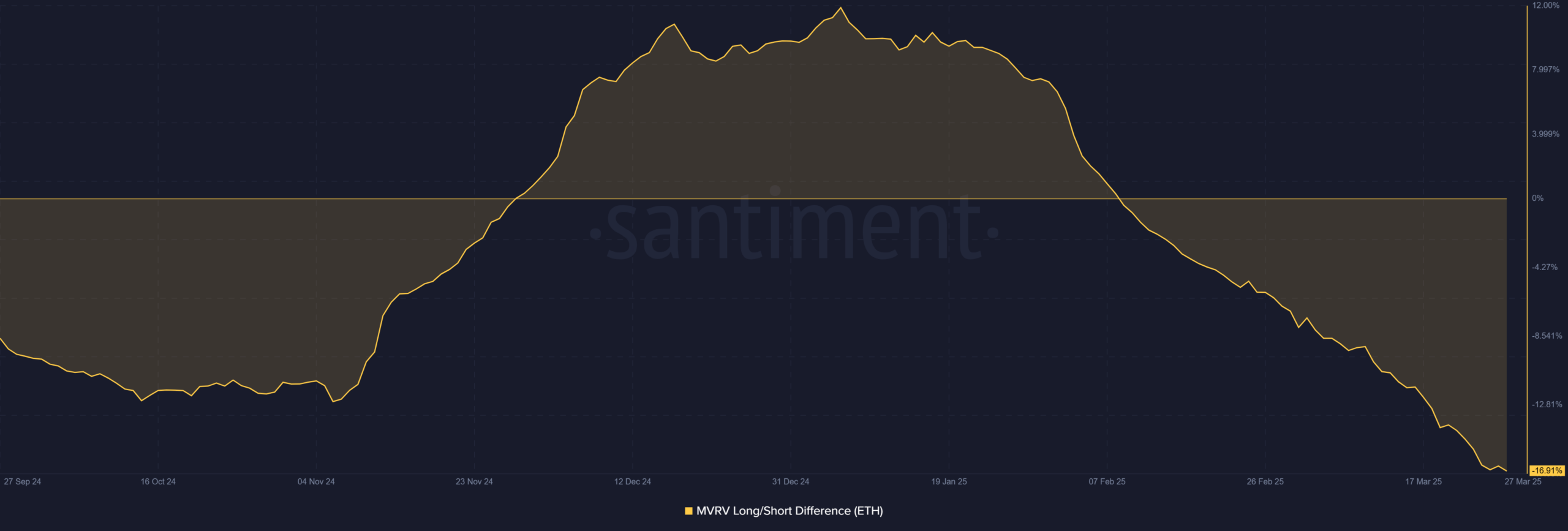

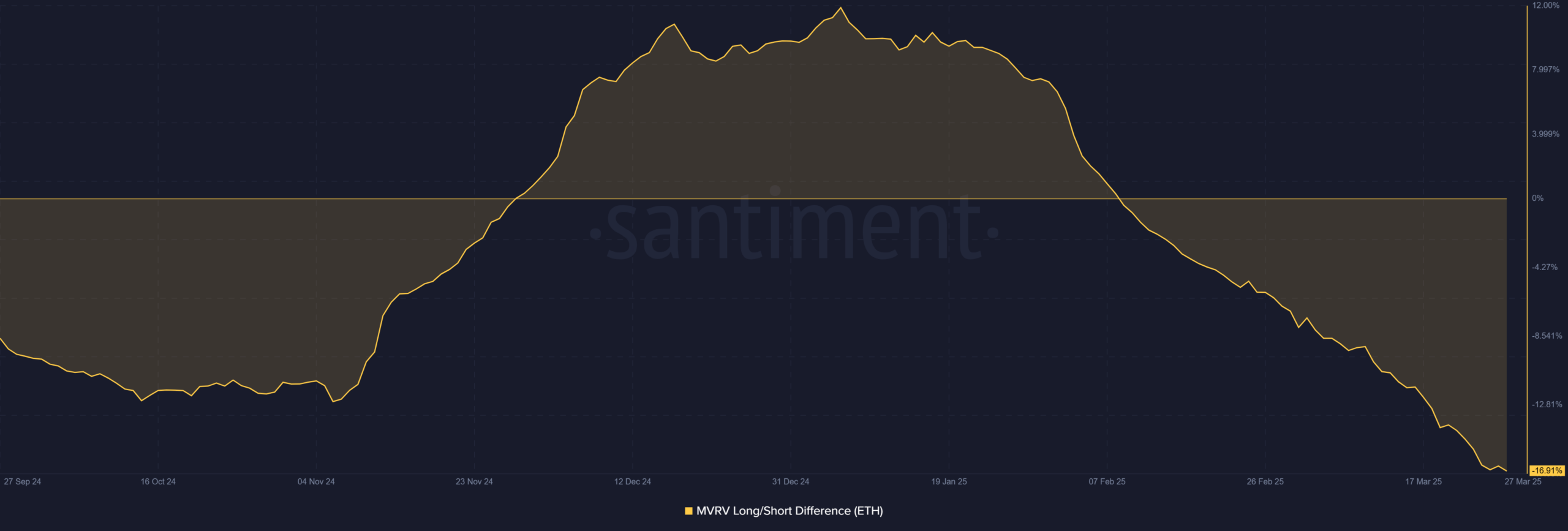

The MVRV Long/Short Difference for ETH stood at -16.91 %. This negative value indicates a bearish sentiment among long-term holders. However, such a significant divergence suggests that the market may be oversold.

If traders perceive this as a buying opportunity, ETH could see a price reversal.

As more market participants move in to capitalize on the low levels, the price might quickly recover, adding fuel to a potential breakout.

Source: Santiment

Is ETH set for a breakout?

Considering Ethereum’s whale activity, key support levels, and market sentiment, it seems likely that ETH is poised for a breakout. The combination of reduced exchange reserves, rising whale activity, and technical indicators suggests upward price momentum.

Therefore, ETH could experience a significant price surge if it breaks past resistance levels, potentially reaching $2,800 soon.

- Whale activity and key support levels suggested a potential price breakout for Ethereum.

- Exchange reserves decline and liquidation points signaled increased volatility but also upward potential.

Ethereum [ETH] has recently experienced significant whale activity, with large withdrawals from major exchanges sparking interest in the market. A new wallet withdrew 7,100 ETH, valued at $14.27 million, from Gemini.

Additionally, substantial transfers of ETH took place from Binance, OKX, and Kraken, amounting to millions in value.

Some of these assets have been staked or deposited into lending platforms like Aave, which could signal bullish intentions.

What does the price action say about Ethereum?

At press time, Ethereum was priced at $2,030.76, reflecting a slight 1.21% decline over the past 24 hours.

Despite this minor dip, Ethereum continues to hover above important support levels, especially around $2,000. As whale activity picks up, there is a strong possibility that Ethereum could experience a price rebound.

If the price stays above this support level, it might break past the $2,100 resistance, potentially triggering a rally.

Therefore, a move above this threshold could spark further buying, and the price could even rise by 37%, approaching $2,800.

Source: TradingView

ETH’s exchange reserves: Liquidity dynamics at play

At the time of writing, Ethereum’s Exchange Reserve was at $37.1653 billion, showing a 2.16% decrease recently. This decline suggests that more ETH is moving off exchanges, reducing the liquidity available for immediate trades.

This shift may indicate that investors are either holding their positions or moving assets to other platforms for staking or long-term investment.

With a tighter supply on exchanges, Ethereum may experience upward pressure in the coming days.

The drop in exchange reserves reflects evolving market dynamics and indicates reduced sell-side liquidity, potentially driving price increases.

Source: CryptoQuant

Liquidation heatmap: How do liquidation levels impact price?

Breaking down Ethereum’s liquidation heatmap from Binance reveals key support and resistance zones.

The map shows significant liquidation points between $2,000 and $2,100. As Ethereum approaches these levels, forced selling could occur, increasing market volatility.

This increased volatility could either push Ethereum’s price through resistance levels or cause it to face downward corrections.

With the high number of liquidation points, Ethereum’s price is under pressure but could also surge if the market absorbs these liquidations effectively.

Source: Coinglass

MVRV Long/Short Difference: Market sentiment analysis

The MVRV Long/Short Difference for ETH stood at -16.91 %. This negative value indicates a bearish sentiment among long-term holders. However, such a significant divergence suggests that the market may be oversold.

If traders perceive this as a buying opportunity, ETH could see a price reversal.

As more market participants move in to capitalize on the low levels, the price might quickly recover, adding fuel to a potential breakout.

Source: Santiment

Is ETH set for a breakout?

Considering Ethereum’s whale activity, key support levels, and market sentiment, it seems likely that ETH is poised for a breakout. The combination of reduced exchange reserves, rising whale activity, and technical indicators suggests upward price momentum.

Therefore, ETH could experience a significant price surge if it breaks past resistance levels, potentially reaching $2,800 soon.

Use 1XBET promo code: 1X200NEW for VIP bonus up to €1950 + 150 free spins on casino and 100% up to €130 to bet on sports. Register on the 1xbet platform and get a chance to earn even more Rupees using bonus offers and special bonus code from 1xbet. Make sports bets, virtual sports or play at the casino. Join 1Xbet and claim your welcome bonus using the latest 1Xbet promo codes. Check below list of 1Xbet signup bonuses, promotions and product reviews for sportsbook, casino, poker and games sections. To claim any of the 1Xbet welcome bonuses listed in above table we recommend using the 1Xbet bonus code at registration of your account. New customers will get a €130 exclusive bonus (International users) when registering using the 1Xbet promo code listed above. 1Xbet Sportsbook section is the main place where users hang out, with over 1000 sporting events to bet each day. There are multiple choices to go for, and the betting markets, for example for soccer matches, can even pass 300 in number, and that is available for both pre-match and live betting, which is impressive and puts it right next to the big names in the industry.

clomid price in usa can i purchase generic clomiphene prices order cheap clomiphene pill can you get cheap clomid online where to get clomiphene how to get generic clomiphene without dr prescription get generic clomid for sale

This is the kind of literature I rightly appreciate.

Thanks on sharing. It’s acme quality.

azithromycin 250mg oral – tindamax 500mg tablet order flagyl 200mg without prescription

order generic semaglutide – rybelsus without prescription periactin 4 mg usa

domperidone 10mg uk – brand flexeril 15mg flexeril pills

generic inderal 20mg – order methotrexate 10mg generic cheap methotrexate 10mg

buy augmentin 1000mg pills – https://atbioinfo.com/ oral acillin

nexium for sale – https://anexamate.com/ purchase esomeprazole

buy cheap generic coumadin – https://coumamide.com/ buy cozaar 50mg generic

purchase mobic pills – swelling buy meloxicam 7.5mg pill

cost prednisone – https://apreplson.com/ buy deltasone 20mg online cheap

buy ed pills medication – fast ed to take site best non prescription ed pills

amoxil order – comba moxi buy cheap generic amoxil

where to buy fluconazole without a prescription – fluconazole cost buy forcan without a prescription

buy cenforce 100mg online cheap – https://cenforcers.com/# order generic cenforce 50mg

online cialis – ciltad generic what is the cost of cialis

is there a generic equivalent for cialis – tadalafil (megalis-macleods) reviews tadalafil generic 20 mg ebay

cheap viagra inurl /profile/ – https://strongvpls.com/ viagra 50 off coupon

Thanks on putting this up. It’s understandably done. sitio web

This is a keynote which is forthcoming to my callousness… Numberless thanks! Exactly where can I notice the connection details due to the fact that questions? natural prednisone alternative

More posts like this would bring about the blogosphere more useful. https://ursxdol.com/levitra-vardenafil-online/

I am in truth delighted to glitter at this blog posts which consists of tons of useful facts, thanks towards providing such data. https://prohnrg.com/product/diltiazem-online/

I’ll certainly return to review more. https://aranitidine.com/fr/prednisolone-achat-en-ligne/

This is the description of topic I get high on reading. https://ondactone.com/product/domperidone/