- ETH has declined by 7.95% over the last 30 days.

- Despite the unfavorable market conditions an analyst is eyeing 48% surge to $3,550.

While the crypto market has attempted to recover with Bitcoin [BTC] surpassing $60k levels, Ethereum [ETH] has remained behind. ETH, the second largest cryptocurrency by market cap, has experienced a strong downtrend.

In fact as of this writing, Ethereum was trading at $2,410. This marked a 7.95% decline on monthly charts.

Since hitting a local high of $2,820, the altcoin has failed to maintain an upward momentum declining to a low of $2150.

Prior to this market condition, ETH was enjoying favorability after hitting $3,563 in July amidst an increased ETFs frenzy. Since then, the market has been in a downward spiral causing fears of more losses.

Although the market conditions remain unfavorable, analysts continue to show optimism. Inasmuch, popular crypto analysts CryptoWZRD has suggested an upcoming rally citing Bitcoin’s breakout.

What market sentiment says

In his analysis, CryptoWZRD cited the current BTC market condition. According to this analysis, if BTC rallies, ETH will experience a 48% to $3,550.

Source: X

Based on this analogy, Ethereum’s rally is tied to BTC. Thus, if Bitcoin manages to surge, the altcoin will recover and return to July levels.

In context, Bitcoin’s performance tends to affect altcoin markets. When BTC is performing, altcoins also perform. Consequently, a BTC downturn results in altcoins including, ETH declining.

Therefore, when BTC has favorable market conditions, Ethereum will follow.

What ETH charts suggest

While CryptoWZRD analysis provides a positive outlook, other indicators tell a different story. Thus the current market conditions could position ETH for further decline.

Source: Cryptoquant

For example, Ethereum’s exchange netflow has remained largely positive over the past month. A positive exchange netflow means that ETH is flowing into exchanges rather than withdrawals.

This is a bearish market sentiment as investors are depositing into exchanges to sell as they expect further price decline. A positive netflow suggests selling pressure in the near future which results in a price decline.

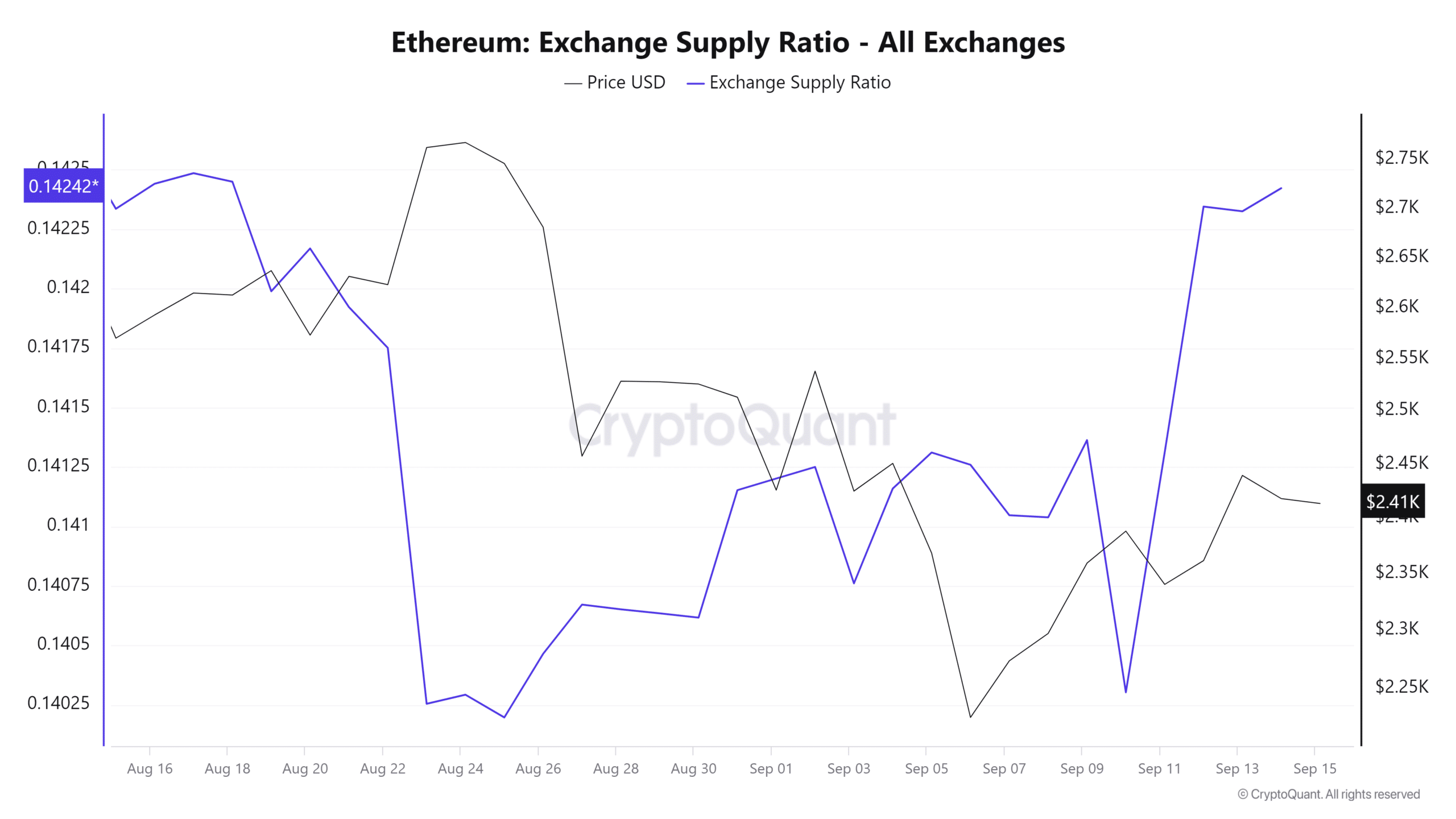

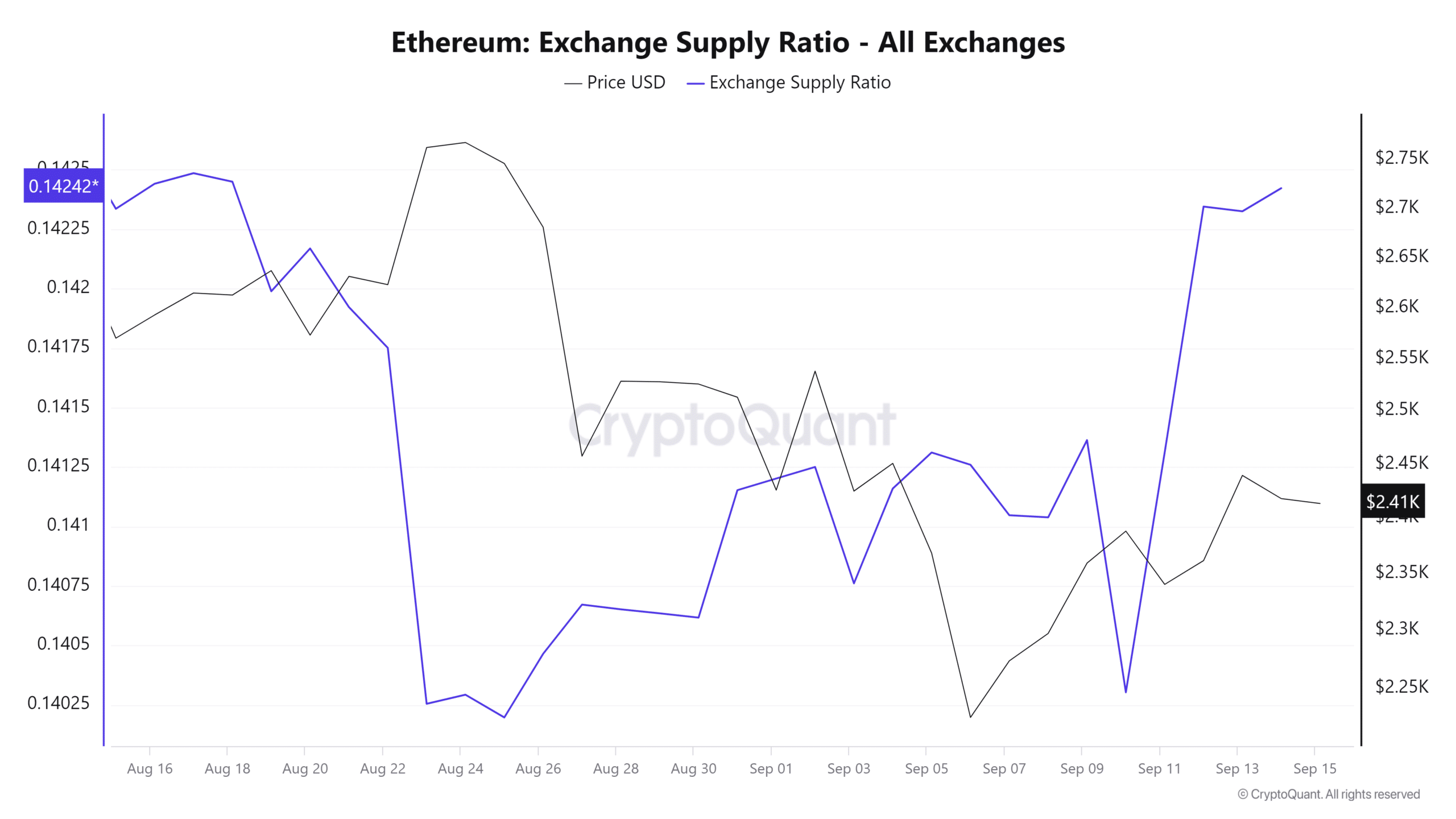

Source: Cryptoquant

Additionally, the exchange supply ratio has spiked for the last five days. This further shows increased inflow into exchanges, suggesting bearish market sentiment as investors are preparing to sell.

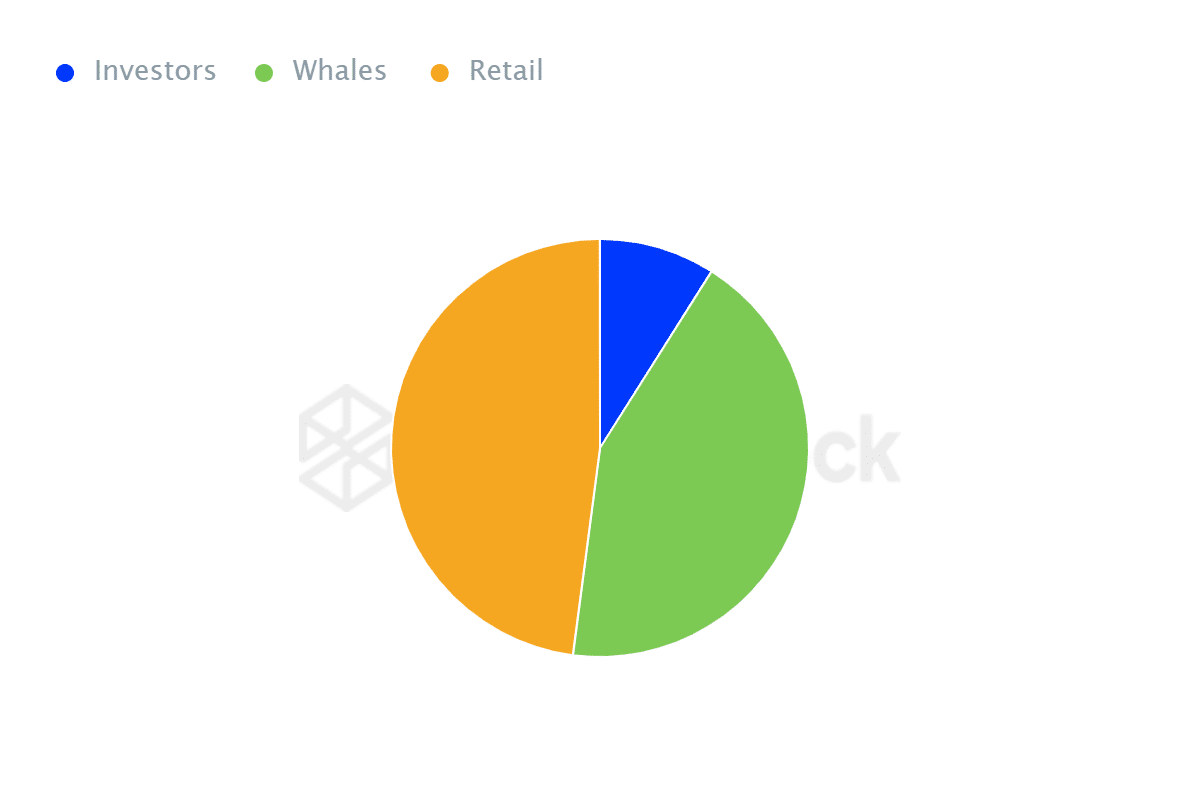

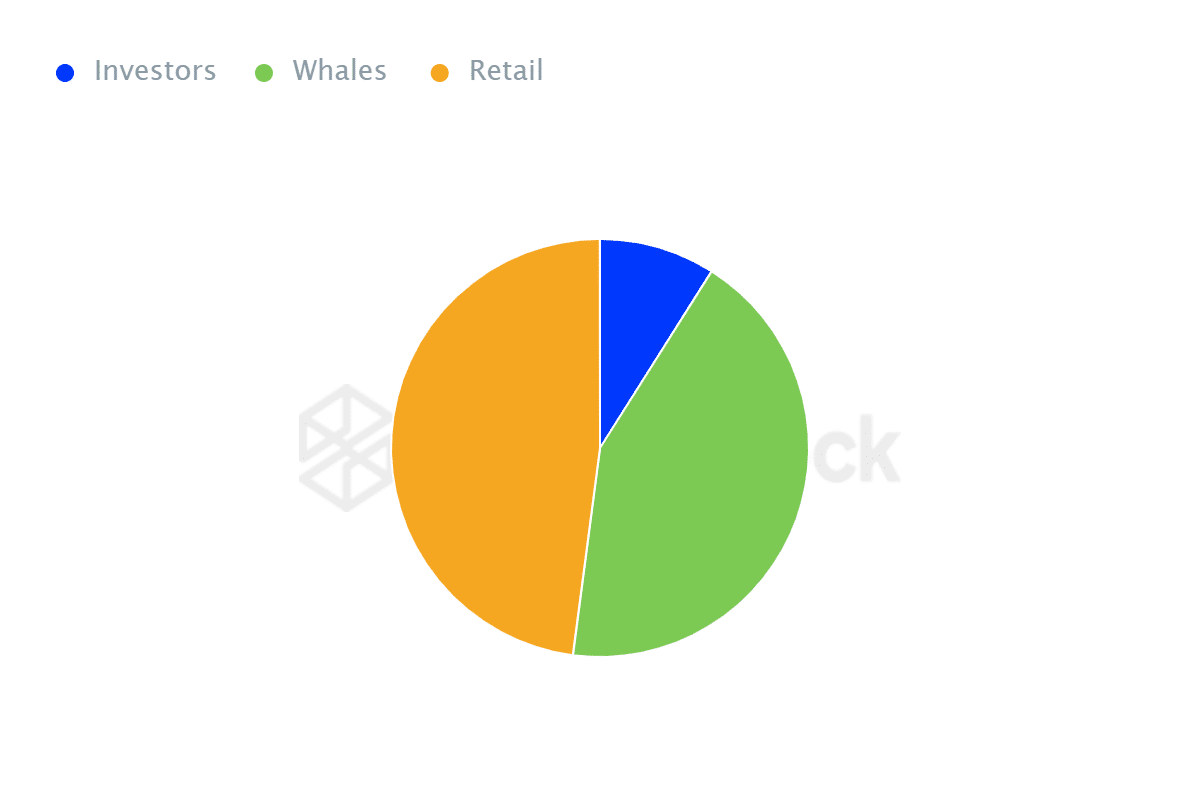

Source: IntoTheBlock

Finally, Ethereum’s ownership by concentration shows retail traders hold more ETH than whales and investors. According to IntoTheBlock, retail traders hold 47.93% while whales hold 43.10%.

When retail traders hold more than whales, markets experience high volatility. Small traders are emotional sellers and would sell based on news compared to institutional investors or whales.

Read Ethereum (ETH) Price Prediction 2024-25

Whales will hold even during downturns and accumulate anticipating further gains. While retail traders would sell to avoid more losses.

Therefore, based on prevailing market conditions, ETH is experiencing bearish market sentiment. If the current conditions hold, ETH will decline to $2224. However, if it breaks out, from this trend, it will rise to $2527.

- ETH has declined by 7.95% over the last 30 days.

- Despite the unfavorable market conditions an analyst is eyeing 48% surge to $3,550.

While the crypto market has attempted to recover with Bitcoin [BTC] surpassing $60k levels, Ethereum [ETH] has remained behind. ETH, the second largest cryptocurrency by market cap, has experienced a strong downtrend.

In fact as of this writing, Ethereum was trading at $2,410. This marked a 7.95% decline on monthly charts.

Since hitting a local high of $2,820, the altcoin has failed to maintain an upward momentum declining to a low of $2150.

Prior to this market condition, ETH was enjoying favorability after hitting $3,563 in July amidst an increased ETFs frenzy. Since then, the market has been in a downward spiral causing fears of more losses.

Although the market conditions remain unfavorable, analysts continue to show optimism. Inasmuch, popular crypto analysts CryptoWZRD has suggested an upcoming rally citing Bitcoin’s breakout.

What market sentiment says

In his analysis, CryptoWZRD cited the current BTC market condition. According to this analysis, if BTC rallies, ETH will experience a 48% to $3,550.

Source: X

Based on this analogy, Ethereum’s rally is tied to BTC. Thus, if Bitcoin manages to surge, the altcoin will recover and return to July levels.

In context, Bitcoin’s performance tends to affect altcoin markets. When BTC is performing, altcoins also perform. Consequently, a BTC downturn results in altcoins including, ETH declining.

Therefore, when BTC has favorable market conditions, Ethereum will follow.

What ETH charts suggest

While CryptoWZRD analysis provides a positive outlook, other indicators tell a different story. Thus the current market conditions could position ETH for further decline.

Source: Cryptoquant

For example, Ethereum’s exchange netflow has remained largely positive over the past month. A positive exchange netflow means that ETH is flowing into exchanges rather than withdrawals.

This is a bearish market sentiment as investors are depositing into exchanges to sell as they expect further price decline. A positive netflow suggests selling pressure in the near future which results in a price decline.

Source: Cryptoquant

Additionally, the exchange supply ratio has spiked for the last five days. This further shows increased inflow into exchanges, suggesting bearish market sentiment as investors are preparing to sell.

Source: IntoTheBlock

Finally, Ethereum’s ownership by concentration shows retail traders hold more ETH than whales and investors. According to IntoTheBlock, retail traders hold 47.93% while whales hold 43.10%.

When retail traders hold more than whales, markets experience high volatility. Small traders are emotional sellers and would sell based on news compared to institutional investors or whales.

Read Ethereum (ETH) Price Prediction 2024-25

Whales will hold even during downturns and accumulate anticipating further gains. While retail traders would sell to avoid more losses.

Therefore, based on prevailing market conditions, ETH is experiencing bearish market sentiment. If the current conditions hold, ETH will decline to $2224. However, if it breaks out, from this trend, it will rise to $2527.

buying cheap clomiphene no prescription where buy cheap clomiphene without dr prescription where can i buy generic clomiphene tablets how can i get generic clomid no prescription can you get clomid prices cost generic clomid online clomid or serophene for men

This website really has all of the bumf and facts I needed there this subject and didn’t know who to ask.

order semaglutide generic – semaglutide 14 mg for sale cyproheptadine 4 mg ca

motilium brand – flexeril 15mg generic buy flexeril paypal

buy propranolol medication – buy generic propranolol online buy generic methotrexate

buy amoxil cheap – cheap amoxicillin sale buy combivent 100mcg online

purchase amoxiclav for sale – https://atbioinfo.com/ buy ampicillin online

warfarin 2mg uk – cou mamide buy losartan 50mg generic

buy meloxicam 15mg pill – https://moboxsin.com/ buy mobic generic

order deltasone pills – apreplson.com deltasone 20mg pill

best ed pills – https://fastedtotake.com/ men’s ed pills

buy generic amoxicillin for sale – combamoxi.com buy amoxicillin paypal

buy fluconazole generic – https://gpdifluca.com/# order diflucan 200mg pills

buy cenforce pills for sale – buy generic cenforce 50mg order cenforce online cheap

order ranitidine 300mg without prescription – aranitidine order zantac pills

I’ll certainly bring back to read more. https://gnolvade.com/

cheap viagra canada pharmacy – order generic viagra uk buy viagra generic usa

This is a theme which is in to my callousness… Myriad thanks! Quite where can I lay one’s hands on the connection details for questions? https://ursxdol.com/propecia-tablets-online/

This is the make of advise I recoup helpful. https://prohnrg.com/

The vividness in this ruined is exceptional. https://ondactone.com/product/domperidone/