- ETH faces sell-off fears amidst increased whale activity.

- Ethereum dump continues as large holders transfers $538.5 million worth of ETH.

Ethereum [ETH], the second largest cryptocurrency by market cap has recently experienced a moderate recovery in its price. In fact, as of this writing, ETH was trading at $2366 after a 1.76% increase in the past 24 hours.

Prior to this, ETH was in a downward trajectory hitting a low of $2150 in the last week. Over the past 40 days, the altcoin has declined by 11.09%.

Despite the gains on daily charts, ETH remained relatively low from its recent local high of $2820 and 51% from its ATH of $4878.

Although the altcoin has gained over the past day, the market is still facing sell-off fears following unprecedented whale activities. As noted by Whale Alert, ETH has experienced massive transfers into exchanges.

Ethereum whales are on the move

In a series of transactions, Whale Alert has uncovered massive ETH transfers to various exchanges. These transfers total a whopping $538 million that have been sent to various exchanges including Kraken, Binance, Arbitrum, and coinbase.

Based on the report, Binance received $188.6 million worth of ETH, Kraken received $127.2 million while Coinbase and Arbitrum recorded $34 million and $188.6 million, respectively.

Source: Whale Alert

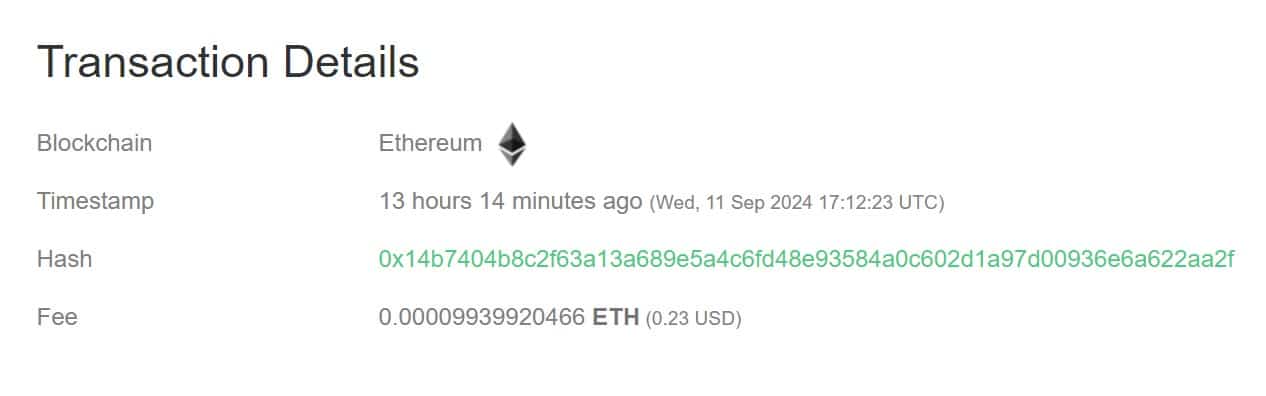

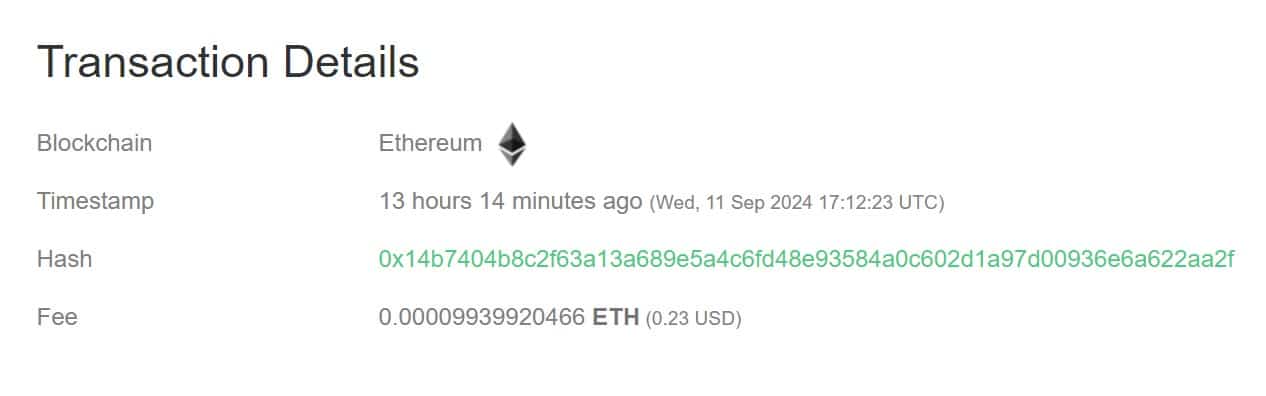

This transaction occurs as Metalpha has also been on a depositing spree over the past few days. According to Lookonchain, the Hong Kong-based firm has deposited $51.16 million worth of ETH in the past hours.

Over the past five days, Metalpha has deposited $128.7 million worth of Ethereum to Binance.

Source: Lookonchain

These massive transactions have caught the attention of the ETH community as transfers into exchanges imply preparation to sell.

If these holders sell, it will result in selling pressure which will force prices to drop further as supply on exchanges increases.

What ETH charts suggest

While gains on daily charts may give hope, recent whale transactions leave markets at a crossroads. Such whale activities imply a lack of confidence in the altcoin’s direction a phenomenon that has been witnessed over the past week.

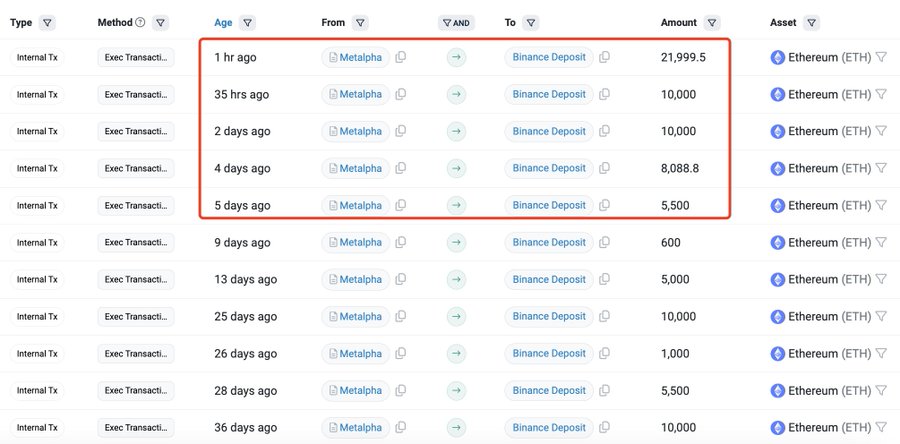

Source: IntoTheBlock

For starters, Ethereum’s ownership by concentration has changed drastically leaving retail traders dominating the market.

According to IntoTheBlock, retail traders control 47.93% of the ETH market while whales control 43.07%. This sets the altcoin for a further decline when whales reduce their holdings as retail traders are emotional sellers.

Equally, a decline in whale holding suggests large holders lack confidence in the altcoin’s direction.

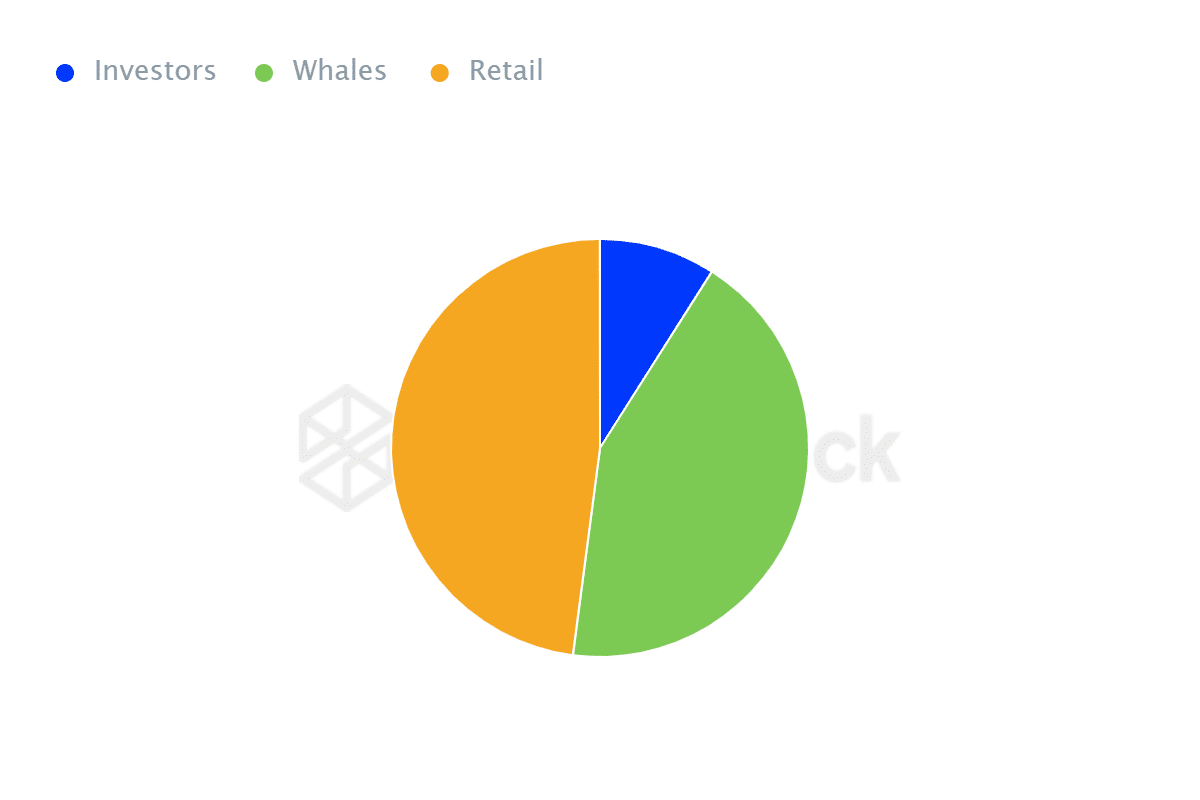

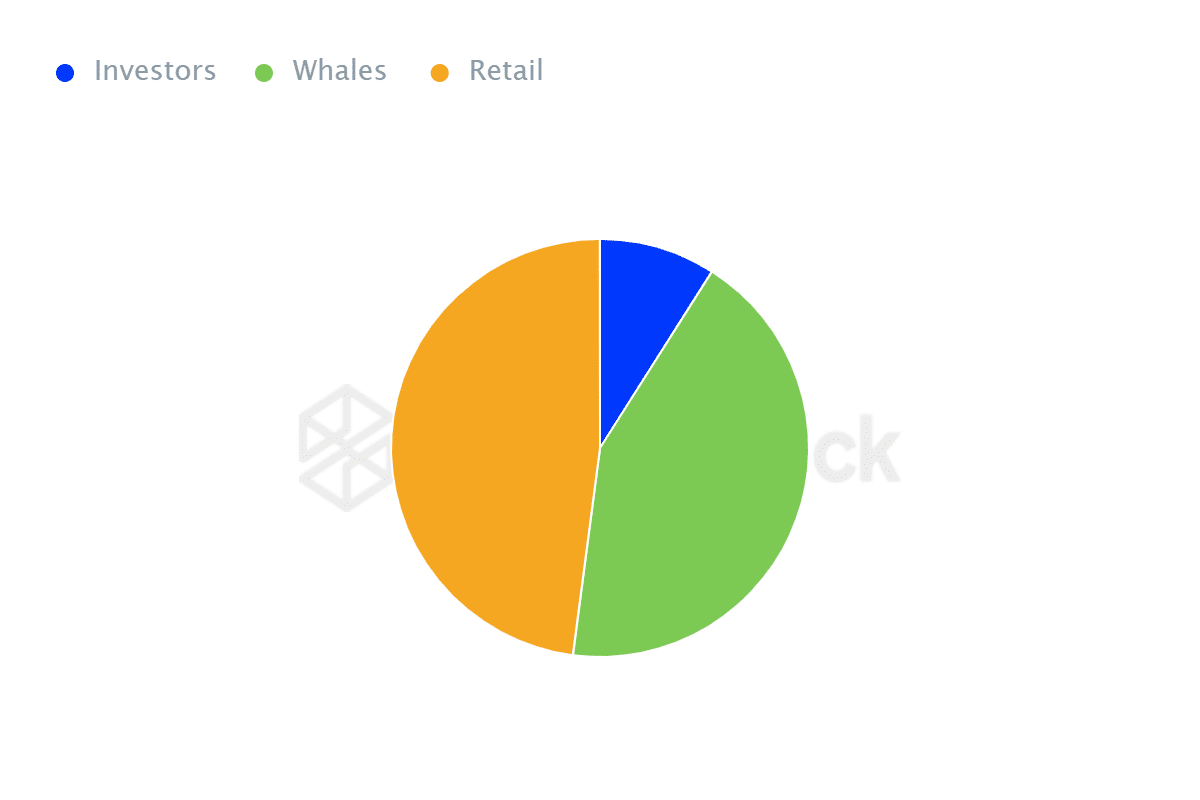

Additionally, the exchange supply ratio has spiked over the past day suggesting increased supply on exchanges.

Source: CryptoQuant

When the supply ratio increases as more assets are transferred into exchanges, it suggests holders are preparing to sell because of an anticipated price drop.

Therefore, these whale transactions suggest large holders are preparing to sell which signals a lack of confidence in ETH’s future price movements.

If these whales sell, ETH will face massive selling pressure which will drive prices down to an eight-month low of $2114.

- ETH faces sell-off fears amidst increased whale activity.

- Ethereum dump continues as large holders transfers $538.5 million worth of ETH.

Ethereum [ETH], the second largest cryptocurrency by market cap has recently experienced a moderate recovery in its price. In fact, as of this writing, ETH was trading at $2366 after a 1.76% increase in the past 24 hours.

Prior to this, ETH was in a downward trajectory hitting a low of $2150 in the last week. Over the past 40 days, the altcoin has declined by 11.09%.

Despite the gains on daily charts, ETH remained relatively low from its recent local high of $2820 and 51% from its ATH of $4878.

Although the altcoin has gained over the past day, the market is still facing sell-off fears following unprecedented whale activities. As noted by Whale Alert, ETH has experienced massive transfers into exchanges.

Ethereum whales are on the move

In a series of transactions, Whale Alert has uncovered massive ETH transfers to various exchanges. These transfers total a whopping $538 million that have been sent to various exchanges including Kraken, Binance, Arbitrum, and coinbase.

Based on the report, Binance received $188.6 million worth of ETH, Kraken received $127.2 million while Coinbase and Arbitrum recorded $34 million and $188.6 million, respectively.

Source: Whale Alert

This transaction occurs as Metalpha has also been on a depositing spree over the past few days. According to Lookonchain, the Hong Kong-based firm has deposited $51.16 million worth of ETH in the past hours.

Over the past five days, Metalpha has deposited $128.7 million worth of Ethereum to Binance.

Source: Lookonchain

These massive transactions have caught the attention of the ETH community as transfers into exchanges imply preparation to sell.

If these holders sell, it will result in selling pressure which will force prices to drop further as supply on exchanges increases.

What ETH charts suggest

While gains on daily charts may give hope, recent whale transactions leave markets at a crossroads. Such whale activities imply a lack of confidence in the altcoin’s direction a phenomenon that has been witnessed over the past week.

Source: IntoTheBlock

For starters, Ethereum’s ownership by concentration has changed drastically leaving retail traders dominating the market.

According to IntoTheBlock, retail traders control 47.93% of the ETH market while whales control 43.07%. This sets the altcoin for a further decline when whales reduce their holdings as retail traders are emotional sellers.

Equally, a decline in whale holding suggests large holders lack confidence in the altcoin’s direction.

Additionally, the exchange supply ratio has spiked over the past day suggesting increased supply on exchanges.

Source: CryptoQuant

When the supply ratio increases as more assets are transferred into exchanges, it suggests holders are preparing to sell because of an anticipated price drop.

Therefore, these whale transactions suggest large holders are preparing to sell which signals a lack of confidence in ETH’s future price movements.

If these whales sell, ETH will face massive selling pressure which will drive prices down to an eight-month low of $2114.

silivri elektrikçi Google SEO sayesinde online satışlarımız arttı. http://royalelektrik.com/

Hey! Do you know if they make any plugins to help with SEO?

I’m trying to get my website to rank for some targeted keywords but I’m

not seeing very good success. If you know of any please share.

Cheers! I saw similar text here: Eco bij

Hello! Do you know if they make any plugins to assist

with SEO? I’m trying to get my blog to rank for some

targeted keywords but I’m not seeing very good results.

If you know of any please share. Thank you! You can read similar

article here: Change your life

I am really impressed along with your writing skills as well

as with the structure to your blog. Is that this a paid subject

matter or did you customize it your self?

Either way stay up the nice quality writing,

it’s rare to see a great weblog like this one these days.

TikTok ManyChat!

I’m really impressed with your writing abilities as well as with the structure on your weblog. Is that this a paid topic or did you modify it yourself? Anyway stay up the excellent quality writing, it’s uncommon to see a great weblog like this one these days. I like coininsights.com ! I made: Snipfeed

The faster you return the smoother your gaming experience will be but lemme tell you that fast return trip

time (RTT) won’t increase your performance in Fortnite.

1. Logitech Wireless Performance Combo MX800: It is an Illuminated Wireless

Keyboard and Mouse, and the brand is known for its high-quality components.

Then select the high performance components to build your very

own custom Gaming PC. With the introduction of DDR5 RAM,

gamers will see a noticeable boost in performance.

Some gamers might even try to haggle to get the

best deal. You need to get a new High-Speed Internet

Connection Service that’s reliable as well if you want to crush the competition. Steady internet connection to fight with packet loss.

The reason for packet loss is a slow or bad internet connection. The

main reason for jitters is lousy internet or old router. You

need to get a better, stringer router and even if that doesn’t solve the problem then that means its time

to bid your provider goodbye.

buy viagra online

buy viagra online

payday loan

buy viagra online

I’m really inspired with your writing abilities as neatly as with the format to your

blog. Is that this a paid theme or did you modify it your self?

Anyway keep up the excellent quality writing,

it’s uncommon to peer a great weblog like this one these days.

HeyGen!

penis enlargement

Incredible many of wonderful data.

casino en ligne francais

Regards! Plenty of stuff!

meilleur casino en ligne

You mentioned that effectively!

casino en ligne

You suggested this exceptionally well.

casino en ligne

Thank you! Useful stuff!

meilleur casino en ligne

Superb advice Kudos!

casino en ligne

You actually stated this fantastically.

meilleur casino en ligne

Information very well applied..

casino en ligne France

You’ve made your point.

casino en ligne fiable

With thanks. I like this.

casino en ligne francais

where buy generic clomid tablets get cheap clomid without rx clomid challenge test where to buy generic clomid pill clomiphene without rx can you buy clomiphene without a prescription can i order cheap clomiphene online

More delight pieces like this would create the интернет better.

The depth in this serving is exceptional.

zithromax 500mg tablet – metronidazole 200mg uk buy flagyl pill

rybelsus 14mg cheap – purchase cyproheptadine generic order generic cyproheptadine 4 mg

cost domperidone – motilium uk flexeril tablet

augmentin 1000mg drug – at bio info buy acillin for sale

buy nexium sale – nexiumtous purchase nexium

purchase warfarin online cheap – https://coumamide.com/ order losartan online

where to buy mobic without a prescription – https://moboxsin.com/ meloxicam sale

prednisone 5mg price – adrenal order prednisone 10mg generic

buy erection pills – https://fastedtotake.com/ buy ed pills for sale

amoxicillin sale – combamoxi.com buy amoxicillin generic

Find more information https://guru-de.com/

https://netbet-de.com

https://rollino-de.com/

score808

Wow that was odd. I just wrote an really long comment but after I clicked submit my comment didn’t show up.

Grrrr… well I’m not writing all that over again. Anyway, just wanted to say great blog!

https://betathome-de.com

Hello just wanted to give you a quick heads up.

The text in your article seem to be running off the screen in Safari.

I’m not sure if this is a formatting issue

or something to do with browser compatibility but I thought I’d post to let you know.

The design look great though! Hope you get the issue solved soon. Many thanks

playboom

My partner and I absolutely love your blog and find nearly all of your post’s to be

just what I’m looking for. Do you offer guest writers to write content in your case?

I wouldn’t mind creating a post or elaborating on most of the subjects you write regarding here.

Again, awesome web site!

https://bet9ja-de.com

Amazing! Its truly amazing post, I have got

much clear idea about from this paragraph.

fortnitetracker

I was curious if you ever thought of changing the layout of

your website? Its very well written; I love what youve got to say.

But maybe you could a little more in the way of content so people could connect with it better.

Youve got an awful lot of text for only having one or 2 images.

Maybe you could space it out better?

rocket

Wow, marvelous blog layout! How long have you been blogging

for? you made blogging look easy. The overall look of your site is fantastic,

as well as the content!

https://boomerang-de88.com

buy diflucan cheap – https://gpdifluca.com/ order generic fluconazole

I delight in, cause I found exactly what I used to be taking a look for.

You’ve ended my 4 day long hunt! God Bless you man. Have a great day.

Bye

hot

you’re really a just right webmaster. The website loading velocity is incredible.

It kind of feels that you are doing any distinctive trick.

Furthermore, The contents are masterpiece. you’ve performed a excellent

process on this topic!

https://bitkingz-de88.com

cenforce over the counter – cenforce 50mg pill cenforce price

Get more details PSBS Biak

Try this one out Semen Padang FC

Get more info here https://580-bet.com

Peculiar article, exactly what I was looking for.

https://5hbet-bouns.com

tadalafil tablets erectafil 20 – cialis dosage for bph cialis w/o perscription

Click to read john bet

I quite like reading an article that can make men and women think.

Also, thanks for allowing me to comment!

Dewa United FC

I’ll immediately grasp your rss feed as I can not in finding your email subscription link or newsletter service. Do you have any? Please let me recognise in order that I may subscribe. Thanks.

purchase ranitidine generic – https://aranitidine.com/ zantac 300mg uk

cialis patent expiration date – click what are the side effect of cialis

I love what you guys are usually up too. This type of clever work and reporting! Keep up the terrific works guys I’ve added you guys to my personal blogroll.

I know this if off topic but I’m looking into starting my own blog and was wondering

what all is needed to get setup? I’m assuming having a blog like yours would cost a pretty penny?

I’m not very web savvy so I’m not 100% positive.

Any recommendations or advice would be greatly appreciated.

Kudos

https://7755-bet.com

Thank you for the good writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! However, how could we communicate?

Asking questions are in fact nice thing if you are not understanding anything fully, but this piece of writing presents good

understanding even.

https://bet7-88.com

Hi there just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Chrome. I’m not sure if this is a formatting issue or something to do with web browser compatibility but I thought I’d post to let you know. The design look great though! Hope you get the issue solved soon. Cheers

I love what you guys tend to be up too. Such clever work and coverage! Keep up the terrific works guys I’ve incorporated you guys to our blogroll.

Hmm is anyone else experiencing problems with the images on this blog loading?

I’m trying to find out if its a problem on my end or if

it’s the blog. Any responses would be greatly appreciated.

bet7

Hey! Someone in my Myspace group shared this site with us so I came to check it out. I’m definitely loving the information. I’m bookmarking and will be tweeting this to my followers! Wonderful blog and outstanding design.

Howdy just wanted to give you a quick heads up. The words in your post seem to be running off the screen in Opera. I’m not sure if this is a formatting issue or something to do with browser compatibility but I figured I’d post to let you know. The layout look great though! Hope you get the problem solved soon. Thanks

where i can buy viagra in delhi – strong vpls how to order generic viagra

This website exceedingly has all of the information and facts I needed adjacent to this thesis and didn’t positive who to ask. online

Hello just wanted to give you a quick heads up. The words in your post seem to be running off the screen in Internet explorer. I’m not sure if this is a formatting issue or something to do with web browser compatibility but I thought I’d post to let you know. The style and design look great though! Hope you get the issue resolved soon. Many thanks

I really like what you guys are usually up too.

This type of clever work and exposure! Keep up the excellent works

guys I’ve you guys to blogroll.

today

Do you have a spam issue on this blog; I also am a blogger,

and I was wondering your situation; many of us have created some nice procedures and we are looking to swap techniques with others, please shoot me an e-mail if

interested.

bet sport

This is a topic that’s close to my heart… Best wishes!

Where are your contact details though?

premier bet

Quer jogar com saldo extra sem gastar nada do seu bolso?

A flames bet te dá 100 dólares para começar.

Basta fazer o cadastro gratuito e você já estará apto a utilizar o

bônus em apostas esportivas ou jogos de cassino.

Essa oferta é perfeita para quem deseja conhecer a plataforma sem riscos

e ainda ter a chance de multiplicar os ganhos. Não perca tempo — entre agora na metal e aproveite a melhor promoção de boas-vindas do mercado brasileiro.

A https://tvbet-br.com revoluciona sua experiência de jogo com

o novo app. Interface responsiva facilita o acesso a bônus e promoções.

Baixe direto do site oficial com segurança. Não perca tempo e mergulhe no universo tvbet onde estiver.

This is the type of advise I recoup helpful. https://buyfastonl.com/azithromycin.html

Sign up for ph888 today and receive a $100 bonus on registration! The process is quick, and once you log in, you’ll be able to use your bonus to start playing. With a variety of games available, including slots, sports betting, and more, your bonus gives you extra chances to win. Don’t miss this opportunity—register now!

The thoroughness in this draft is noteworthy. https://ursxdol.com/ventolin-albuterol/

Aproveite agora mesmo a promoção exclusiva

da f12bet para novos jogadores e comece

com vantagem: ao se cadastrar gratuitamente, você recebe 100 dólares em bônus de boas-vindas.

Essa é a sua oportunidade de iniciar no universo das apostas online com

muito mais saldo para explorar os jogos de cassino, slots,

roletas e apostas esportivas. Cadastre-se, ative sua conta e

receba o bônus sem complicações. Tudo isso em uma plataforma segura,

confiável e totalmente traduzida para o público brasileiro.

Quer jogar com saldo extra sem gastar nada do seu bolso? A

betpix te dá 100 dólares para

começar. Basta fazer o cadastro gratuito e você já estará apto a utilizar

o bônus em apostas esportivas ou jogos de cassino. Essa oferta

é perfeita para quem deseja conhecer a plataforma sem riscos e ainda ter a chance de multiplicar os ganhos.

Não perca tempo — entre agora na betpix e aproveite a melhor promoção

de boas-vindas do mercado brasileiro.

Get the https://63jili-8.com App for Optimized Graphics and an Enhanced

Gaming Interface

https://zowin-vn.com là nền tảng cờ bạc trực tuyến đáng tin cậy, nơi bạn có thể tham gia vào

các trò chơi nổi tiếng như baccarat, poker, blackjack, và slots.

Các trò chơi này được đảm bảo công bằng nhờ vào công nghệ

RNG, giúp mang lại kết quả hoàn toàn ngẫu nhiên và công bằng.

Hơn nữa, bạn còn có cơ hội nhận nhiều tiền thưởng và khuyến mãi hấp dẫn từ zowin.

Đăng ký ngay để nhận thưởng ngay lập tức!

The depth in this tune is exceptional. https://prohnrg.com/product/lisinopril-5-mg/

Cách Đăng Ký https://sun-vn.com Để Nhận Ngay 100$ Tiền Thưởng

Rút Tiền Từ https://oxbet-vn.com Nhanh Chóng – Đảm Bảo An Ninh Vốn 100%

Cách Rút Tiền https://nbet-vn.com Qua Ví Ngân Lượng Siêu Nhanh

Hỗ Trợ Khách Hàng Tại 11bet –

Trực Tuyến 24/7, Giải Quyết Nhanh

With thanks. Loads of conception! https://aranitidine.com/fr/en_ligne_kamagra/

Asking questions are really pleasant thing if you are not understanding something fully, however this paragraph gives pleasant understanding yet.

jolibet App Download: Optimized for

Fast Play and Better Casino Experiences

https://sbobet-vn.com – Đăng Ký Nhanh, Nhận Ngay 100$

If you would like to increase your know-how simply keep visiting this site and be updated with the most recent news posted here.

Your blog always inspires me.

Bạn mới tham gia win79?

Đăng ký ngay để nhận ngay 100$ khi nạp lần đầu.

Chỉ cần truy cập trang web, chọn “Đăng ký”,

điền thông tin và xác thực tài khoản. Sau khi đăng nhập, bạn có

thể nạp tiền và nhận thưởng ngay lập tức.

Tham gia ngay để không bỏ lỡ cơ hội hấp dẫn này!

Quick and Secure Withdrawals at https://60win-8.com: Everything You Need to Know About Documents

I quite like looking through a post that can make people think.

Also, thanks for permitting me to comment!

Great insights, thanks for sharing!

Ứng dụng hb88

có giao diện dễ sử dụng và được tối ưu hóa rất tốt cho các thiết bị di

động. Việc tải và cài đặt cực kỳ đơn giản, chỉ cần vài

bước là bạn có thể truy cập vào các trò chơi casino trực tuyến yêu thích.

Từ các trò baccarat đến poker hay slots, bạn sẽ

có một trải nghiệm chơi game mượt mà, không bị gián đoạn. Hãy tải ngay https://hb88-vn.com để tham gia vào các trò chơi hấp

dẫn ngay hôm nay.

whoah this weblog is fantastic i really like studying

your posts. Stay up the great work! You understand, many persons are searching round for this information, you could aid them greatly.

Your means of telling the whole thing in this piece of writing is truly pleasant, all can effortlessly understand it, Thanks a lot.