- ETH volume soars past $1 billion during the first 24 hours.

- The recent surge sparks investors optimism.

After long months of waiting, Ethereum [ETH] Exchange-traded funds (ETFs) went live on 23rd July. The crypto community has been eagerly awaiting the approval of ETH ETFs.

Since the approval of BTC ETFs early this year, the market has been buzzing with speculation about the approval of other ETFs.

ETH ETF hits past $1 billion

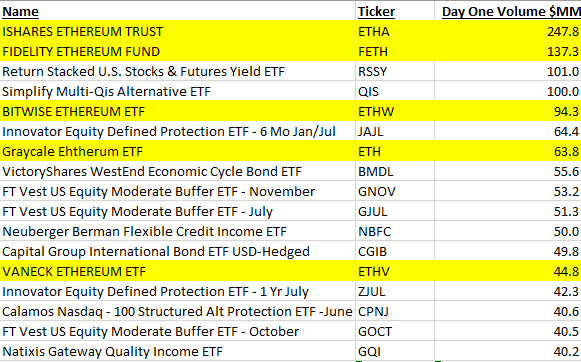

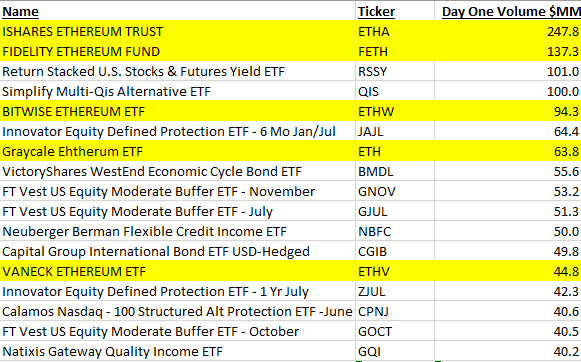

CBOE approved nine ETH ETFs last week, and the NYSE cleared them for trading. Within the first few hours of trading, volumes started at $110 million and reached $600 million shortly.

Since the trading started, ETH ETF trading volume has surged by over $1 billion by the close of business day. The record shocked the market by hitting over 23% of what BTC ETFs did on the first day of trading.

During these trading hours, Ishares ETH Trust (ETHA) did a 25% over the counterpart IBIT’s volume. For instance, ETHA recorded $694.5 million on the first trading day, while ETHE reached $248 million.

This shows that ETH exchange-traded funds are doing much better than BTC, and there is heightened excitement around Ethereum ETFs because of market affordability.

Source: X

Notably, the surge has brought increased discussion within the community as analysts share different opinions. For Instance, Eric Balchunas shared his analysis on his X page comparing Ether’s ETF performance with BTC ETF’s months ago. He noted that,

“I was curious how the Eth ETFs would rank in Day One volume vs all 600 or so new launches in the past 12mo, but *excluding* the BTC ETFs and $ETHA would be #1 (by a lot), $FETH #2, $ETHW #5 and $ETH 7th, and $ETHV in 13th spot. And $CETH, which was lowest among the group, would still rank in the Top 10% vs a normal new launch. Just another way to illustrate how unusual all this is.”

Increased whale activity

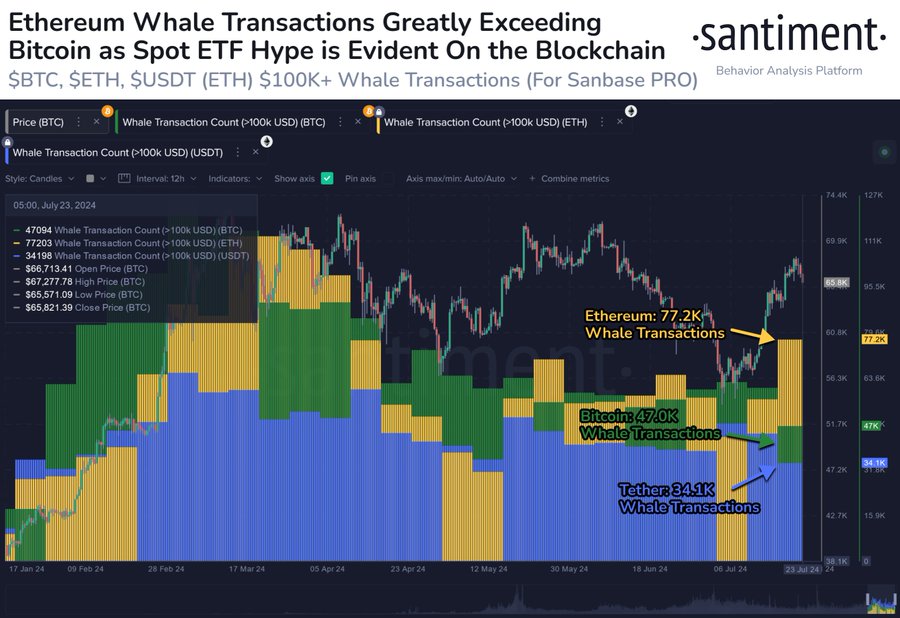

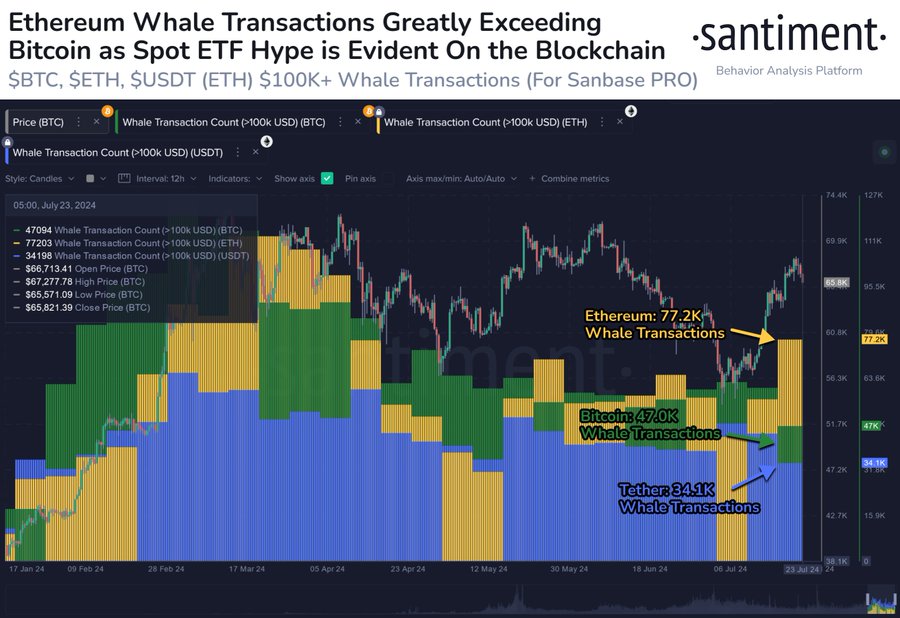

Notably, the approval of Ethereum ETFs has resulted in higher speculations with various stakeholders, especially ETH whales, taking action.

According to Santiment, ETH ETFs have caused increased whale activity since CBOE announced the start of the trading date. Through their official X (formerly Twitter) page, Santiment noted the whale activity, noting that,

” Whale activity is clearly being impacted by the release of Ethereum’s 9 new spot ETFs. Since July 17th, the amount of ETH transfers exceeding $100K in value is +64% higher than the amount of BTC transfers, and +126% than the amount of USDT (on ETH) transfers.”

Source: Santiment

The increased whale activity suggests investors are confident about the altcoin’s direction. Therefore, whales believe ETH ETFs will drive prices up, thus increasing profitability. This shows trust in the direction and potential prospects for the crypto.

Impacts on price charts

As of this writing, ETH was trading at $3449 after a 0.06% decline in the past 24 hours. Equally, its prices have declined by 1.10% on weekly charts.

Despite having a positive trading volume, ETH has declined by 12% from pre-approval. ETH trading volume surged by 30% pre-approval, but declined to 18.57% after approval.

This suggests that Ether ETFs approval has not positively impacted price charts.

Source: Tradingview

However, the overall market sentiment remains positive as MACD shows a higher buying pressure. The MACD shows that the short-term moving average is above the long-term, suggesting a positive market sentiment.

Read Ethereum’s [ETH] Price Prediction 2024-25

Equally, a positive AO further confirms this, indicating that the short-term period is trending higher than the long-term period.

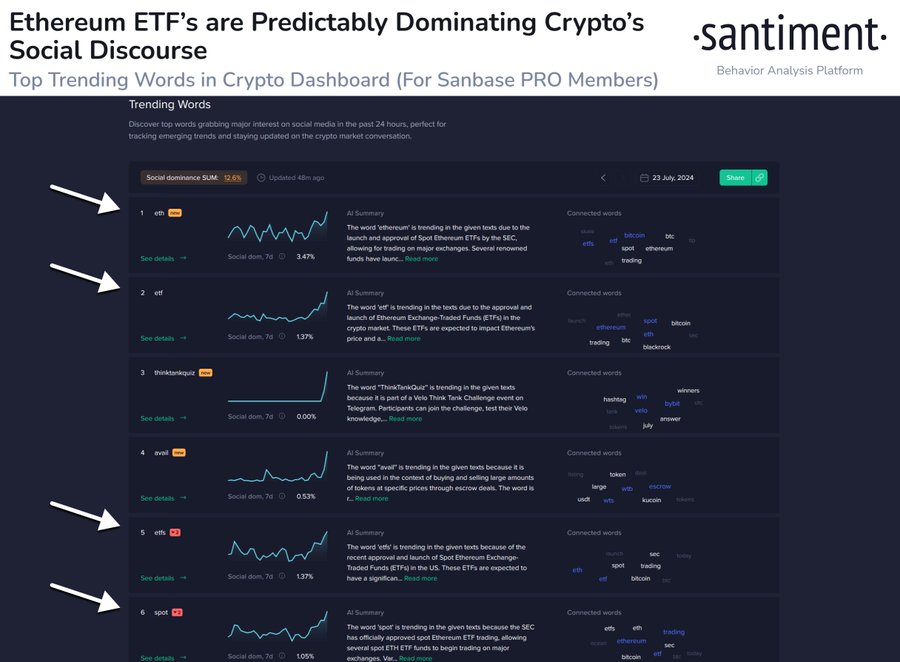

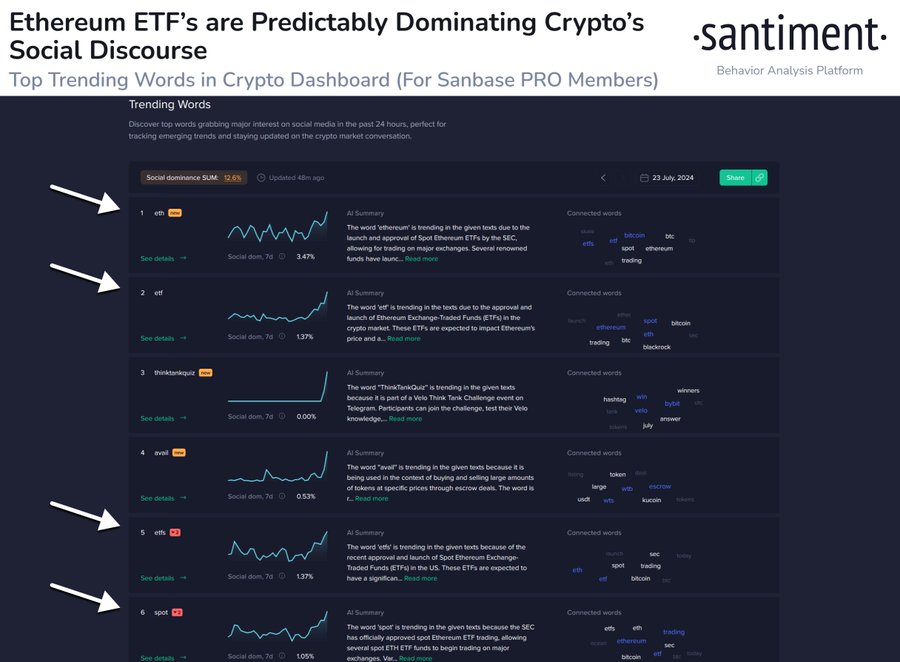

According to Santiment, the traction for ETH spot ETFs are off the charts over the ETFs launch. Through their X page, Santiment shared that,

“The social volume toward any keywords related to ‘Ethereum’, ‘Spot’, or ‘ETF’ are off the charts on a historic day. In the past 24 hours, the ETH/BTC is +3.4%, and traders are anticipating the bullish momentum for crypto’s #2 market cap asset is just getting started.”

Source: Santiment

- ETH volume soars past $1 billion during the first 24 hours.

- The recent surge sparks investors optimism.

After long months of waiting, Ethereum [ETH] Exchange-traded funds (ETFs) went live on 23rd July. The crypto community has been eagerly awaiting the approval of ETH ETFs.

Since the approval of BTC ETFs early this year, the market has been buzzing with speculation about the approval of other ETFs.

ETH ETF hits past $1 billion

CBOE approved nine ETH ETFs last week, and the NYSE cleared them for trading. Within the first few hours of trading, volumes started at $110 million and reached $600 million shortly.

Since the trading started, ETH ETF trading volume has surged by over $1 billion by the close of business day. The record shocked the market by hitting over 23% of what BTC ETFs did on the first day of trading.

During these trading hours, Ishares ETH Trust (ETHA) did a 25% over the counterpart IBIT’s volume. For instance, ETHA recorded $694.5 million on the first trading day, while ETHE reached $248 million.

This shows that ETH exchange-traded funds are doing much better than BTC, and there is heightened excitement around Ethereum ETFs because of market affordability.

Source: X

Notably, the surge has brought increased discussion within the community as analysts share different opinions. For Instance, Eric Balchunas shared his analysis on his X page comparing Ether’s ETF performance with BTC ETF’s months ago. He noted that,

“I was curious how the Eth ETFs would rank in Day One volume vs all 600 or so new launches in the past 12mo, but *excluding* the BTC ETFs and $ETHA would be #1 (by a lot), $FETH #2, $ETHW #5 and $ETH 7th, and $ETHV in 13th spot. And $CETH, which was lowest among the group, would still rank in the Top 10% vs a normal new launch. Just another way to illustrate how unusual all this is.”

Increased whale activity

Notably, the approval of Ethereum ETFs has resulted in higher speculations with various stakeholders, especially ETH whales, taking action.

According to Santiment, ETH ETFs have caused increased whale activity since CBOE announced the start of the trading date. Through their official X (formerly Twitter) page, Santiment noted the whale activity, noting that,

” Whale activity is clearly being impacted by the release of Ethereum’s 9 new spot ETFs. Since July 17th, the amount of ETH transfers exceeding $100K in value is +64% higher than the amount of BTC transfers, and +126% than the amount of USDT (on ETH) transfers.”

Source: Santiment

The increased whale activity suggests investors are confident about the altcoin’s direction. Therefore, whales believe ETH ETFs will drive prices up, thus increasing profitability. This shows trust in the direction and potential prospects for the crypto.

Impacts on price charts

As of this writing, ETH was trading at $3449 after a 0.06% decline in the past 24 hours. Equally, its prices have declined by 1.10% on weekly charts.

Despite having a positive trading volume, ETH has declined by 12% from pre-approval. ETH trading volume surged by 30% pre-approval, but declined to 18.57% after approval.

This suggests that Ether ETFs approval has not positively impacted price charts.

Source: Tradingview

However, the overall market sentiment remains positive as MACD shows a higher buying pressure. The MACD shows that the short-term moving average is above the long-term, suggesting a positive market sentiment.

Read Ethereum’s [ETH] Price Prediction 2024-25

Equally, a positive AO further confirms this, indicating that the short-term period is trending higher than the long-term period.

According to Santiment, the traction for ETH spot ETFs are off the charts over the ETFs launch. Through their X page, Santiment shared that,

“The social volume toward any keywords related to ‘Ethereum’, ‘Spot’, or ‘ETF’ are off the charts on a historic day. In the past 24 hours, the ETH/BTC is +3.4%, and traders are anticipating the bullish momentum for crypto’s #2 market cap asset is just getting started.”

Source: Santiment

Wow wonderful blog layout How long have you been blogging for you make blogging look easy The overall look of your site is great as well as the content

Нужна отделка дома в Москве и области? Наша бригада из опытных строителей из Белоруссии готова воплотить ваши идеи в реальность! Современные технологии, индивидуальный подход, и качество – это наши гарантии. Посетите наш сайт отделка домов и начните строительство вашего уюта прямо сейчас! #БелорусскаяБригада #Отделка #Ремонт #Достройка

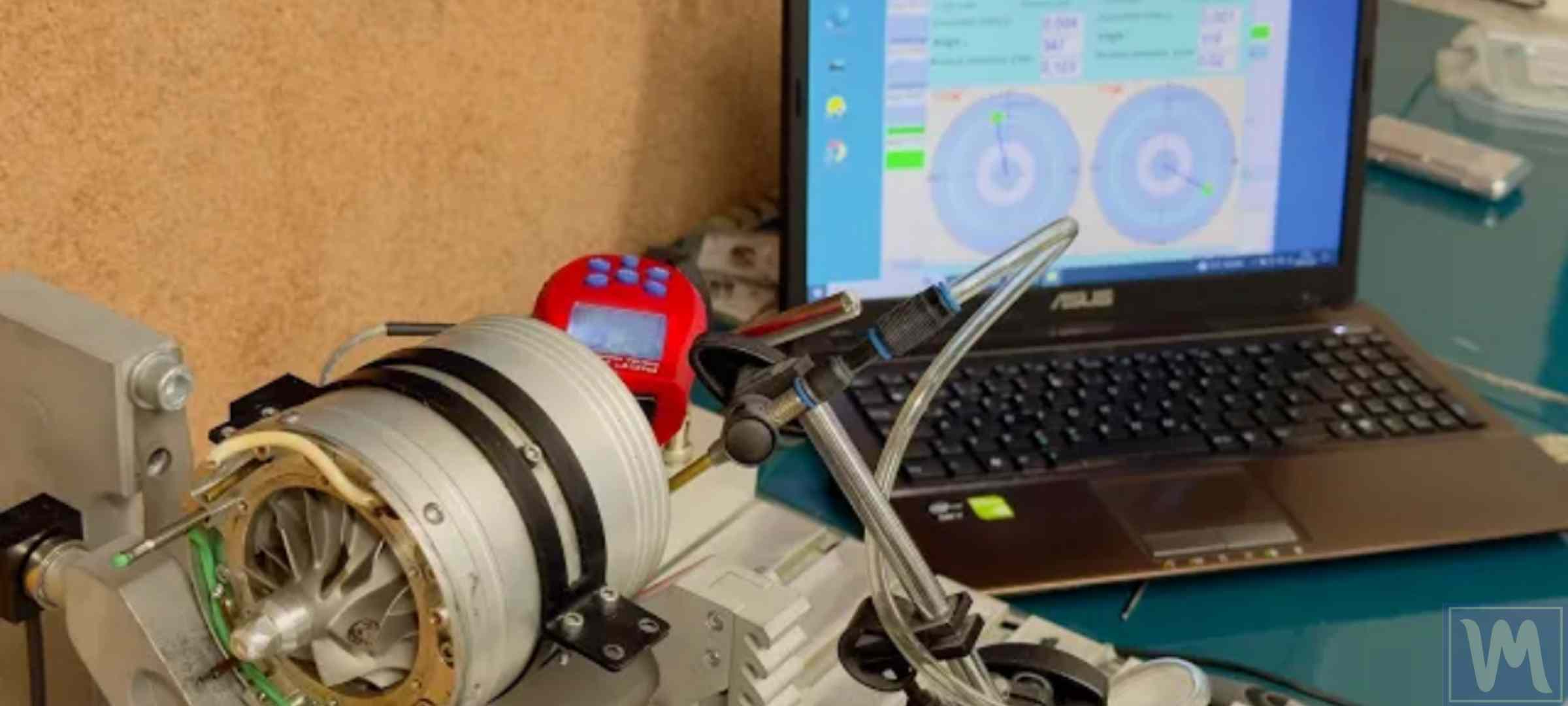

Monitoreo de condicion

Equipos de balanceo: clave para el operacion suave y eficiente de las dispositivos.

En el ambito de la innovacion moderna, donde la eficiencia y la confiabilidad del aparato son de gran importancia, los dispositivos de balanceo desempenan un rol vital. Estos equipos especificos estan desarrollados para balancear y asegurar componentes moviles, ya sea en maquinaria de fabrica, medios de transporte de desplazamiento o incluso en dispositivos domesticos.

Para los especialistas en reparacion de sistemas y los profesionales, manejar con dispositivos de balanceo es crucial para promover el desempeno estable y estable de cualquier aparato giratorio. Gracias a estas alternativas tecnologicas avanzadas, es posible minimizar sustancialmente las movimientos, el sonido y la carga sobre los rodamientos, prolongando la duracion de partes importantes.

Igualmente relevante es el tarea que tienen los dispositivos de calibracion en la servicio al usuario. El soporte tecnico y el soporte constante usando estos dispositivos habilitan brindar servicios de alta calidad, mejorando la agrado de los clientes.

Para los titulares de negocios, la inversion en estaciones de equilibrado y dispositivos puede ser importante para optimizar la eficiencia y rendimiento de sus dispositivos. Esto es sobre todo significativo para los emprendedores que dirigen pequenas y medianas negocios, donde cada punto cuenta.

Tambien, los aparatos de calibracion tienen una gran aplicacion en el sector de la prevencion y el control de nivel. Habilitan encontrar probables defectos, evitando mantenimientos onerosas y perjuicios a los dispositivos. Mas aun, los datos generados de estos equipos pueden utilizarse para perfeccionar metodos y mejorar la reconocimiento en motores de busqueda.

Las areas de utilizacion de los dispositivos de calibracion abarcan multiples sectores, desde la fabricacion de vehiculos de dos ruedas hasta el monitoreo ecologico. No influye si se considera de importantes manufacturas de fabrica o pequenos locales caseros, los sistemas de balanceo son indispensables para asegurar un operacion efectivo y sin riesgo de detenciones.

Permanent makeup eyebrows Austin TX

Discover the Top Beauty Clinic in Austin, Texas: Icon Beauty Clinic.

Situated in TX, this clinic offers personalized beauty services. With a team committed to excellence, they ensure every client feels appreciated and confident.

Let’s Look at Some Main Treatments:

Lash Enhancement

Boost your eyes with eyelash lift, adding length that lasts for weeks.

Lip Fillers

Achieve full, luscious lips with hyaluronic acid fillers, lasting 6-12 months.

Permanent Makeup Eyebrows

Get natural-looking brows with precision techniques.

Injectables

Restore youthfulness with anti-aging injections that smooth lines.

What Sets Icon Apart?

The clinic combines skill and creativity to deliver excellent results.

Final Thoughts

This top clinic empowers you to feel confident. Visit to discover how their services can elevate your confidence.

Summary:

Top-rated clinic in Austin, TX offers exceptional services including brow procedures and ink fading, making it the perfect destination for ageless allure.

Equilibrado de piezas

El Balanceo de Componentes: Elemento Clave para un Desempeño Óptimo

¿ En algún momento te has dado cuenta de movimientos irregulares en una máquina? ¿O tal vez escuchaste ruidos anómalos? Muchas veces, el problema está en algo tan básico como una falta de simetría en un elemento móvil. Y créeme, ignorarlo puede costarte caro .

El equilibrado de piezas es un procedimiento clave en la producción y cuidado de equipos industriales como ejes, volantes, rotores y partes de motores eléctricos . Su objetivo es claro: evitar vibraciones innecesarias que pueden causar daños serios a largo plazo .

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene una rueda desequilibrada . Al acelerar, empiezan los temblores, el manubrio se mueve y hasta puede aparecer cierta molestia al manejar . En maquinaria industrial ocurre algo similar, pero con consecuencias considerablemente más serias:

Aumento del desgaste en cojinetes y rodamientos

Sobrecalentamiento de componentes

Riesgo de fallos mecánicos repentinos

Paradas no planificadas y costosas reparaciones

En resumen: si no se corrige a tiempo, una mínima falla podría derivar en una situación compleja.

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Perfecto para elementos que operan a velocidades altas, tales como ejes o rotores . Se realiza en máquinas especializadas que detectan el desequilibrio en varios niveles simultáneos. Es el método más exacto para asegurar un movimiento uniforme .

Equilibrado estático

Se usa principalmente en piezas como llantas, platos o poleas . Aquí solo se corrige el peso excesivo en una sola superficie . Es rápido, sencillo y eficaz para ciertos tipos de maquinaria .

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se elimina material en la zona más pesada

Colocación de contrapesos: como en ruedas o anillos de volantes

Ajuste de masas: habitual en ejes de motor y partes relevantes

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones disponibles y altamente productivas, por ejemplo :

✅ Balanset-1A — Tu aliado portátil para equilibrar y analizar vibraciones

Equilibrado de piezas

La Nivelación de Partes Móviles: Esencial para una Operación Sin Vibraciones

¿Alguna vez has notado vibraciones extrañas en una máquina? ¿O tal vez ruidos que no deberían estar ahí? Muchas veces, el problema está en algo tan básico como una irregularidad en un componente giratorio . Y créeme, ignorarlo puede costarte más de lo que imaginas.

El equilibrado de piezas es un procedimiento clave en la producción y cuidado de equipos industriales como ejes, volantes, rotores y partes de motores eléctricos . Su objetivo es claro: impedir oscilaciones que, a la larga, puedan provocar desperfectos graves.

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene un neumático con peso desigual. Al acelerar, empiezan los temblores, el manubrio se mueve y hasta puede aparecer cierta molestia al manejar . En maquinaria industrial ocurre algo similar, pero con consecuencias considerablemente más serias:

Aumento del desgaste en cojinetes y rodamientos

Sobrecalentamiento de elementos sensibles

Riesgo de colapsos inesperados

Paradas no planificadas y costosas reparaciones

En resumen: si no se corrige a tiempo, un pequeño desequilibrio puede convertirse en un gran dolor de cabeza .

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Ideal para piezas que giran a alta velocidad, como rotores o ejes . Se realiza en máquinas especializadas que detectan el desequilibrio en varios niveles simultáneos. Es el método más fiable para lograr un desempeño estable.

Equilibrado estático

Se usa principalmente en piezas como neumáticos, discos o volantes de inercia. Aquí solo se corrige el peso excesivo en una sola superficie . Es ágil, práctico y efectivo para determinados sistemas.

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se elimina material en la zona más pesada

Colocación de contrapesos: por ejemplo, en llantas o aros de volantes

Ajuste de masas: común en cigüeñales y otros componentes críticos

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones disponibles y altamente productivas, por ejemplo :

✅ Balanset-1A — Tu aliado portátil para equilibrar y analizar vibraciones

Equilibrar rápidamente

Equilibrado dinámico portátil:

Reparación ágil sin desensamblar

Imagina esto: tu rotor comienza a vibrar, y cada minuto de inactividad cuesta dinero. ¿Desmontar la máquina y esperar días por un taller? Ni pensarlo. Con un equipo de equilibrado portátil, corriges directamente en el lugar en horas, sin mover la maquinaria.

¿Por qué un equilibrador móvil es como un “kit de supervivencia” para máquinas rotativas?

Pequeño, versátil y eficaz, este dispositivo es el recurso básico en cualquier intervención. Con un poco de práctica, puedes:

✅ Corregir vibraciones antes de que dañen otros componentes.

✅ Minimizar tiempos muertos y mantener la operación.

✅ Actuar incluso en sitios de difícil acceso.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Contar con visibilidad al sistema giratorio.

– Ubicar dispositivos de medición sin inconvenientes.

– Realizar ajustes de balance mediante cambios de carga.

Casos típicos donde conviene usarlo:

La máquina rueda más de lo normal o emite sonidos extraños.

No hay tiempo para desmontajes (producción crítica).

El equipo es difícil de parar o caro de inmovilizar.

Trabajas en campo abierto o lugares sin talleres cercanos.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Sin esperas (acción inmediata) | ❌ Demoras por agenda y logística |

| ✔ Monitoreo preventivo (evitas fallas mayores) | ❌ Suele usarse solo cuando hay emergencias |

| ✔ Reducción de costos operativos con uso continuo | ❌ Costos recurrentes por servicios |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: espacio para instalar sensores y realizar ajustes.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Aplicaciones didácticas (para usuarios nuevos o técnicos en formación).

Análisis en tiempo real (gráficos claros de vibraciones).

Batería de larga duración (perfecto para zonas remotas).

Ejemplo práctico:

Un molino en una mina empezó a generar riesgos estructurales. Con un equipo portátil, el técnico localizó el error rápidamente. Lo corrigió añadiendo contrapesos y evitó una parada de 3 días.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Formato claro ayuda a captar ideas clave.

– Enfoque práctico: Ofrece aplicaciones tangibles del método.

– Lenguaje persuasivo: Frases como “recurso vital” o “previenes consecuencias críticas” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más comercial) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

Equilibrio in situ

La Nivelación de Partes Móviles: Esencial para una Operación Sin Vibraciones

¿ Has percibido alguna vez temblores inusuales en un equipo industrial? ¿O sonidos fuera de lo común? Muchas veces, el problema está en algo tan básico como una falta de simetría en un elemento móvil. Y créeme, ignorarlo puede costarte bastante dinero .

El equilibrado de piezas es un procedimiento clave en la producción y cuidado de equipos industriales como ejes, volantes, rotores y partes de motores eléctricos . Su objetivo es claro: impedir oscilaciones que, a la larga, puedan provocar desperfectos graves.

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene una llanta mal nivelada . Al acelerar, empiezan los temblores, el manubrio se mueve y hasta puede aparecer cierta molestia al manejar . En maquinaria industrial ocurre algo similar, pero con consecuencias considerablemente más serias:

Aumento del desgaste en cojinetes y rodamientos

Sobrecalentamiento de elementos sensibles

Riesgo de averías súbitas

Paradas no planificadas y costosas reparaciones

En resumen: si no se corrige a tiempo, un pequeño desequilibrio puede convertirse en un gran dolor de cabeza .

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Perfecto para elementos que operan a velocidades altas, tales como ejes o rotores . Se realiza en máquinas especializadas que detectan el desequilibrio en dos o más planos . Es el método más fiable para lograr un desempeño estable.

Equilibrado estático

Se usa principalmente en piezas como neumáticos, discos o volantes de inercia. Aquí solo se corrige el peso excesivo en una única dirección. Es rápido, fácil y funcional para algunos equipos .

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se elimina material en la zona más pesada

Colocación de contrapesos: como en ruedas o anillos de volantes

Ajuste de masas: habitual en ejes de motor y partes relevantes

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones económicas pero potentes, tales como:

✅ Balanset-1A — Tu compañero compacto para medir y ajustar vibraciones

analizador de vibrasiones

Solución rápida de equilibrio:

Respuesta inmediata sin mover equipos

Imagina esto: tu rotor comienza a vibrar, y cada minuto de inactividad afecta la productividad. ¿Desmontar la máquina y esperar días por un taller? Ni pensarlo. Con un equipo de equilibrado portátil, resuelves sobre el terreno en horas, sin alterar su posición.

¿Por qué un equilibrador móvil es como un “kit de supervivencia” para máquinas rotativas?

Pequeño, versátil y eficaz, este dispositivo es una pieza clave en el arsenal del ingeniero. Con un poco de práctica, puedes:

✅ Evitar fallos secundarios por vibraciones excesivas.

✅ Minimizar tiempos muertos y mantener la operación.

✅ Actuar incluso en sitios de difícil acceso.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Tener acceso físico al elemento rotativo.

– Ubicar dispositivos de medición sin inconvenientes.

– Modificar la distribución de masa (agregar o quitar contrapesos).

Casos típicos donde conviene usarlo:

La máquina muestra movimientos irregulares o ruidos atípicos.

No hay tiempo para desmontajes (producción crítica).

El equipo es costoso o difícil de detener.

Trabajas en áreas donde no hay asistencia mecánica disponible.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Sin esperas (acción inmediata) | ❌ Demoras por agenda y logística |

| ✔ Monitoreo preventivo (evitas fallas mayores) | ❌ Suele usarse solo cuando hay emergencias |

| ✔ Reducción de costos operativos con uso continuo | ❌ Gastos periódicos por externalización |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: espacio para instalar sensores y realizar ajustes.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Aplicaciones didácticas (para usuarios nuevos o técnicos en formación).

Evaluación continua (informes gráficos comprensibles).

Autonomía prolongada (ideales para trabajo en campo).

Ejemplo práctico:

Un molino en una mina comenzó a vibrar peligrosamente. Con un equipo portátil, el técnico localizó el error rápidamente. Lo corrigió añadiendo contrapesos y evitó una parada de 3 días.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Formato claro ayuda a captar ideas clave.

– Enfoque práctico: Se añaden ejemplos reales y comparaciones concretas.

– Lenguaje persuasivo: Frases como “herramienta estratégica” o “minimizas riesgos importantes” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más comercial) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

Vibración de motor

¡Vendemos máquinas para balanceo!

Fabricamos directamente, elaborando en tres ubicaciones al mismo tiempo: Portugal, Argentina y España.

✨Ofrecemos equipos altamente calificados y debido a que somos productores directos, nuestras tarifas son más bajas que las del mercado.

Disponemos de distribución global sin importar la ubicación, consulte los detalles técnicos en nuestra página oficial.

El equipo de equilibrio es portátil, de bajo peso, lo que le permite ajustar cualquier elemento giratorio en cualquier condición.

El Equilibrado de Piezas: Clave para un Funcionamiento Eficiente

¿ Has percibido alguna vez temblores inusuales en un equipo industrial? ¿O sonidos fuera de lo común? Muchas veces, el problema está en algo tan básico como una falta de simetría en un elemento móvil. Y créeme, ignorarlo puede costarte más de lo que imaginas.

El equilibrado de piezas es una tarea fundamental tanto en la fabricación como en el mantenimiento de maquinaria agrícola, ejes, volantes, rotores y componentes de motores eléctricos . Su objetivo es claro: evitar vibraciones innecesarias que pueden causar daños serios a largo plazo .

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene una rueda desequilibrada . Al acelerar, empiezan los temblores, el manubrio se mueve y hasta puede aparecer cierta molestia al manejar . En maquinaria industrial ocurre algo similar, pero con consecuencias aún peores :

Aumento del desgaste en cojinetes y rodamientos

Sobrecalentamiento de elementos sensibles

Riesgo de averías súbitas

Paradas no planificadas y costosas reparaciones

En resumen: si no se corrige a tiempo, un pequeño desequilibrio puede convertirse en un gran dolor de cabeza .

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Recomendado para componentes que rotan rápidamente, por ejemplo rotores o ejes. Se realiza en máquinas especializadas que detectan el desequilibrio en dos o más planos . Es el método más exacto para asegurar un movimiento uniforme .

Equilibrado estático

Se usa principalmente en piezas como llantas, platos o poleas . Aquí solo se corrige el peso excesivo en una sola superficie . Es rápido, sencillo y eficaz para ciertos tipos de maquinaria .

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se quita peso en el punto sobrecargado

Colocación de contrapesos: como en ruedas o anillos de volantes

Ajuste de masas: típico en bielas y elementos estratégicos

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones económicas pero potentes, tales como:

✅ Balanset-1A — Tu asistente móvil para analizar y corregir oscilaciones

analizador de vibrasiones

Solución rápida de equilibrio:

Reparación ágil sin desensamblar

Imagina esto: tu rotor empieza a temblar, y cada minuto de inactividad afecta la productividad. ¿Desmontar la máquina y esperar días por un taller? Descartado. Con un equipo de equilibrado portátil, resuelves sobre el terreno en horas, sin alterar su posición.

¿Por qué un equilibrador móvil es como un “herramienta crítica” para máquinas rotativas?

Compacto, adaptable y potente, este dispositivo es el recurso básico en cualquier intervención. Con un poco de práctica, puedes:

✅ Evitar fallos secundarios por vibraciones excesivas.

✅ Evitar paradas prolongadas, manteniendo la producción activa.

✅ Actuar incluso en sitios de difícil acceso.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Tener acceso físico al elemento rotativo.

– Colocar sensores sin interferencias.

– Ajustar el peso (añadiendo o removiendo masa).

Casos típicos donde conviene usarlo:

La máquina rueda más de lo normal o emite sonidos extraños.

No hay tiempo para desmontajes (producción crítica).

El equipo es difícil de parar o caro de inmovilizar.

Trabajas en campo abierto o lugares sin talleres cercanos.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Sin esperas (acción inmediata) | ❌ Demoras por agenda y logística |

| ✔ Mantenimiento proactivo (previenes daños serios) | ❌ Suele usarse solo cuando hay emergencias |

| ✔ Reducción de costos operativos con uso continuo | ❌ Gastos periódicos por externalización |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: hábitat adecuado para trabajar con precisión.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Apps intuitivas (guían paso a paso, sin cálculos manuales).

Evaluación continua (informes gráficos comprensibles).

Batería de larga duración (perfecto para zonas remotas).

Ejemplo práctico:

Un molino en una mina comenzó a vibrar peligrosamente. Con un equipo portátil, el técnico identificó el problema en menos de media hora. Lo corrigió añadiendo contrapesos y evitó una parada de 3 días.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Formato claro ayuda a captar ideas clave.

– Enfoque práctico: Incluye casos ilustrativos y contrastes útiles.

– Lenguaje persuasivo: Frases como “kit de supervivencia” o “minimizas riesgos importantes” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más comercial) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

Analizador de vibrasiones

El equipo de balanceo Balanset-1A representa el fruto de años de trabajo duro y dedicación.

Como desarrolladores de esta herramienta puntera, tenemos el honor de cada aparato que se envía de nuestras fábricas.

No es solamente un artículo, sino también una respuesta que hemos optimizado para resolver problemas críticos relacionados con vibraciones en maquinaria rotativa.

Conocemos la dificultad que implica enfrentar paradas inesperadas o costosas reparaciones.

Por eso creamos Balanset-1A enfocándonos en las demandas específicas de nuestros clientes. ❤️

Distribuimos Balanset 1A desde las oficinas centrales en nuestras sedes en Portugal , España y Argentina , asegurando entregas rápidas y eficientes a cualquier parte del mundo.

Los agentes regionales están siempre disponibles para proporcionar ayuda técnica especializada y consultoría en el idioma local.

¡No somos solo una empresa, sino un equipo que está aquí para ayudarte!

La Nivelación de Partes Móviles: Esencial para una Operación Sin Vibraciones

¿ En algún momento te has dado cuenta de movimientos irregulares en una máquina? ¿O tal vez escuchaste ruidos anómalos? Muchas veces, el problema está en algo tan básico como una falta de simetría en un elemento móvil. Y créeme, ignorarlo puede costarte caro .

El equilibrado de piezas es un procedimiento clave en la producción y cuidado de equipos industriales como ejes, volantes, rotores y partes de motores eléctricos . Su objetivo es claro: evitar vibraciones innecesarias que pueden causar daños serios a largo plazo .

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene una rueda desequilibrada . Al acelerar, empiezan los temblores, el manubrio se mueve y hasta puede aparecer cierta molestia al manejar . En maquinaria industrial ocurre algo similar, pero con consecuencias aún peores :

Aumento del desgaste en cojinetes y rodamientos

Sobrecalentamiento de elementos sensibles

Riesgo de averías súbitas

Paradas no planificadas y costosas reparaciones

En resumen: si no se corrige a tiempo, un pequeño desequilibrio puede convertirse en un gran dolor de cabeza .

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Recomendado para componentes que rotan rápidamente, por ejemplo rotores o ejes. Se realiza en máquinas especializadas que detectan el desequilibrio en varios niveles simultáneos. Es el método más exacto para asegurar un movimiento uniforme .

Equilibrado estático

Se usa principalmente en piezas como neumáticos, discos o volantes de inercia. Aquí solo se corrige el peso excesivo en una única dirección. Es rápido, fácil y funcional para algunos equipos .

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se elimina material en la zona más pesada

Colocación de contrapesos: tal como en neumáticos o perfiles de poleas

Ajuste de masas: común en cigüeñales y otros componentes críticos

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones disponibles y altamente productivas, por ejemplo :

✅ Balanset-1A — Tu aliado portátil para equilibrar y analizar vibraciones

¡Vendemos equipos de equilibrio!

Producimos nosotros mismos, elaborando en tres países a la vez: Argentina, España y Portugal.

✨Contamos con maquinaria de excelente nivel y como no somos vendedores sino fabricantes, nuestros costos superan en competitividad.

Hacemos entregas internacionales sin importar la ubicación, revise la información completa en nuestra página oficial.

El equipo de equilibrio es portátil, ligero, lo que le permite ajustar cualquier elemento giratorio en cualquier condición.

singapore vape shop

Vaping Culture in Singapore: A Lifestyle Beyond the Hype

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become a preferred method . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a stylish escape. It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for users who want instant satisfaction who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one easy-to-use device. Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s smarter designs .

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with a built-in screen , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a better deal . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Nicotine-Free Range gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re taking your first puff, or an experienced user , the experience is all about what feels right to you — made personal for you.

vape supplier singapore

The Rise of Vaping in Singapore: Not Just a Fad

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become an essential part of their routine . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a stylish escape. It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for people on the move who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one easy-to-use device. Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s richer flavors .

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with a built-in screen , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a great value choice. No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Nicotine-Free Range gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re taking your first puff, or a long-time fan, the experience is all about what feels right to you — your way, your flavor, your style .

Kingcobratoto

order ddos

Why Choose DDoS.Market?

High-Quality Attacks – Our team ensures powerful and effective DDoS attacks for accurate security testing.

Competitive Pricing & Discounts – We offer attractive deals for returning customers.

Trusted Reputation – Our service has earned credibility in the Dark Web due to reliability and consistent performance.

Who Needs This?

Security professionals assessing network defenses.

Businesses conducting penetration tests.

IT administrators preparing for real-world threats.

The Rise of Vaping in Singapore: Not Just a Fad

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become a preferred method . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a fresh way to relax . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for people on the move who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one portable solution . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s enhanced user experience.

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with a built-in screen , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a better deal . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Pure Flavor Collection gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re just starting out , or a long-time fan, the experience is all about what feels right to you — your way, your flavor, your style .

truyện tranh online

vape supplier singapore

Vape Scene in Singapore: Embracing Modern Relaxation

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become an essential part of their routine . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a stylish escape. It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for people on the move who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one easy-to-use device. Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s smarter designs .

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with a built-in screen , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a cost-effective option . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Nicotine-Free Range gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re new to the scene , or a long-time fan, the experience is all about what feels right to you — tailored to your preferences .

situs cucukakek89

clomiphene price walmart how to buy clomid no prescription buying generic clomid pill can i get cheap clomiphene without prescription can i buy generic clomiphene pill where can i get generic clomiphene no prescription can you get cheap clomid for sale

truyện giả dược, giả dược truyện

monkey mart game?

מערכת טלגראס|המדריך המלא לאיתור והזמנת קנאביס בקלות ובמהירות

כיום, השימוש בטכנולוגיות מתקדמות נותן לנו את האפשרות להפוך תהליכים מורכבים לפשוטים משמעותית. השירות הנפוץ ביותר בתחום הקנאביס בישראל הוא טלגראס כיוונים , שמאפשר למשתמשים למצוא ולהזמין קנאביס בצורה מהירה ובטוחה באמצעות הרשת החברתית טלגרם. במסמך זה נסביר על מה מדובר בשירות הזה, כיצד הוא עובד, וכיצד תוכלו להשתמש בו כדי לקבל את המוצר שאתם מחפשים.

מה זה טלגראס כיוונים?

טלגראס כיוונים הוא מערכת אינטרנט שמשמש כאתר עזר למשתמשים (קבוצות וערוצים באפליקציה של טלגרם) המתמקדים בהזמנת ושילוח חומר לצריכה. האתר מספק מידע עדכני לערוצים מומלצים ופעילים ברחבי הארץ, המאפשרים למשתמשים להזמין קנאביס בצורה מובנית היטב.

ההרעיון הבסיסי מאחורי טלגראס כיוונים הוא לחבר בין לקוחות למפיצים, תוך שימוש בכלי הטכנולוגיה של הרשת החברתית. כל מה שאתם צריכים לעשות הוא למצוא את הערוץ הקרוב אליכם, ליצור קשר עם הספק הקרוב למקום מגוריכם, ולבקש את המשלוח שלכם – הכל נעשה באופן מבוקר ומדויק.

איך работает טלגראס כיוונים?

השימוש בטulgראס כיוונים הוא מובנה בצורה אינטואיטיבית. הנה ההוראות הראשוניות:

גישה למרכז המידע:

הכינו עבורכם את דף התמיכה עבור טלגראס כיוונים, שבו תוכלו למצוא את כל הנתונים הנדרשים לערוצים שעברו בדיקה ואימות. האתר כולל גם הדרכות מובנות כיצד לפעול נכון.

בחירת ערוץ מתאים:

האתר מספק רשימה של ערוצים מומלצים שעוברים בדיקת איכות. כל ערוץ אומת על ידי משתמשים מקומיים שדיווחו על החוויה שלהם, כך שתדעו שאתם נכנסים לערוץ איכותי ונוח.

קישור ישיר לספק:

לאחר בחירה מהרשימה, תוכלו ליצור קשר עם האחראי על השילוח. השליח יקבל את ההזמנה שלכם וישלח לכם את המוצר במהירות.

העברת המוצר:

אחת הנקודות החשובות ביותר היא שהמשלוחים נעשים באופן ממוקד ואמין. השליחים עובדים בצורה מקצועית כדי להבטיח שהמוצר יגיע אליכם בדיוק.

למה לבחור את טלגראס?

השימוש בטulgראס כיוונים מציע מספר יתרונות מרכזיים:

سهولة: אין צורך לצאת מהבית או לחפש סוחרים בעצמכם. כל התהליך מתבצע דרך הפלטפורמה.

יעילות: הזמנת המשלוח נעשית תוך דקות, והשליח בדרך אליכם בתוך זמן קצר מאוד.

ביטחון: כל הערוצים באתר עוברות תהליך אימות על ידי משתמשים אמיתיים.

זמינות בכל הארץ: האתר מספק קישורים לערוצים פעילים בכל אזורים בארץ, מהצפון ועד הדרום.

מדוע חשוב לבחור ערוצים מאומתים?

אחד הדברים החיוניים ביותר בעת использование טulgראס כיוונים הוא לוודא שאתם נכנסים לערוצים מאומתים. ערוצים אלו עברו בדיקה קפדנית ונבדקו על ידי לקוחות קודמים על החוויה והתוצאות. זה מבטיח לכם:

חומרים ברמה גבוהה: השליחים והסוחרים בערוצים המאומתים מספקים מוצרים באיכות גבוהה.

ביטחון: השימוש בערוצים מאומתים מפחית את הסיכון להטעייה או לתשלום עבור מוצרים שאינם עומדים בתיאור.

שירות מקצועי: השליחים בערוצים המומלצים עובדים בצורה מאובטחת ומספקים שירות מדויק וטוב.

האם זה חוקי?

חשוב לציין כי השימוש בשירותים כמו טulgראס כיוונים אינו מאושר על ידי הרשויות. למרות זאת, רבים בוחרים להשתמש בשיטה זו בשל הנוחות שהיא מספקת. אם אתם בוחרים להשתמש בשירותים אלו, חשוב לפעול באופן מושכל ולבחור ערוצים מאומתים בלבד.

ההתחלה שלך: מה לעשות?

אם אתם מחפשים דרך פשוטה ויעילה להשגת קנאביס בישראל, טulgראס כיוונים עשוי להיות הדרך הנוחה והיעילה. האתר מספק את כל הנתונים, כולל נתוני חיבור לערוצים אמינים, מדריכים והסברים כיצד לפעול נכון. עם טulgראס כיוונים, שליח הקנאביס יכול להיות בדרך אליכם בזמן קצר מאוד.

אל תחכו יותר – פתחו את המערכת, מצאו את הערוץ המתאים לכם, ותוכלו להנות מחוויית הזמנה קלה ומהירה!

טלגראס כיוונים – המקום שבו הקנאביס מגיע עד לדלת ביתכם.

Thanks for sharing. It’s acme quality.

טלגראס כיוונים|המדריך המלא לקניית קנאביס בקלות ובמהירות

כיום, הטמעת פתרונות דיגיטליים נותן לנו את האפשרות להפוך תהליכים מורכבים לפשוטים משמעותית. אחד מהשירותים הפופולריים ביותר בתחום הקנאביס בישראל הוא טלגראס כיוונים , שמאפשר למשתמשים למצוא ולהזמין קנאביס בצורה מהירה ובטוחה באמצעות אפליקציה של טלגרם. במסמך זה נסביר מהו טלגראס כיוונים, כיצד הוא עובד, וכיצד תוכלו להשתמש בו כדי לקבל את המוצר שאתם מחפשים.

על מה מבוססת שירות טלגראס?

טלגראס כיוונים הוא מערכת אינטרנט שמשמש כאתר עזר למשתמשים (קבוצות וערוצים באפליקציה של טלגרם) המתמקדים בהזמנת ושילוח מוצרים קשורים. האתר מספק קישורים מעודכנים לערוצים איכותיים ברחבי הארץ, המאפשרים למשתמשים להזמין קנאביס בצורה מובנית היטב.

העיקרון המרכזי מאחורי טלגראס כיוונים הוא לחבר בין צרכנים לבין שליחים או סוחרים, תוך שימוש בכלי הטכנולוגיה של הרשת החברתית. כל מה שאתם צריכים לעשות הוא לבחור ערוץ מתאים, ליצור קשר עם השליח הקרוב אליכם, ולבקש את המשלוח שלכם – הכל נעשה באופן מבוקר ומדויק.

איך מתחילים את התהליך?

השימוש בטulgראס כיוונים הוא קל ויישומי. הנה השלבים הבסיסיים:

התחברות למערכת האינטרנט:

הכינו עבורכם את מרכז המידע עבור טלגראס כיוונים, שבו תוכלו למצוא את כל הרשימות החדשות לערוצים פעילים וממומלצים. האתר כולל גם מדריכים והסברים כיצד לפעול נכון.

איתור הערוץ הטוב ביותר:

האתר מספק רשימה של ערוצים מומלצים שעוברים וידוא תקינות. כל ערוץ אומת על ידי משתמשים מקומיים שדיווחו על החוויה שלהם, כך שתדעו שאתם נכנסים לערוץ בטוח ואמין.

קישור ישיר לספק:

לאחר בחירה מהרשימה, תוכלו ליצור קשר עם השליח הקרוב לביתכם. השליח יקבל את ההזמנה שלכם וישלח לכם את המוצר תוך דקות ספורות.

העברת המוצר:

אחת הנקודות החשובות ביותר היא שהמשלוחים נעשים במהירות ובאופן מקצועני. השליחים עובדים בצורה מקצועית כדי להבטיח שהמוצר יגיע אליכם בדיוק.

מדוע זה שימושי?

השימוש בטulgראס כיוונים מציע מספר יתרונות מרכזיים:

נוחות: אין צורך לצאת מהבית או לחפש מבצעים ידניים. כל התהליך מתבצע דרך הפלטפורמה.

מהירות פעולה: הזמנת המשלוח נעשית תוך דקות, והשליח בדרך אליכם בתוך זמן קצר מאוד.

אמינות: כל הערוצים באתר עוברות בדיקה קפדנית על ידי צוות מקצועי.

זמינות בכל הארץ: האתר מספק קישורים לערוצים אמינים בכל אזורי ישראל, מהצפון ועד הדרום.

מדוע חשוב לבחור ערוצים מאומתים?

אחד הדברים הקריטיים ביותר בעת использование טulgראס כיוונים הוא לוודא שאתם נכנסים לערוצים מאומתים. ערוצים אלו עברו אישור רשמי ונבדקו על ידי משתמשים אמיתיים על החוויה שלהם. זה מבטיח לכם:

מוצרים טובים: השליחים והסוחרים בערוצים המאומתים מספקים מוצרים באיכות מצוינת.

וודאות: השימוש בערוצים מאומתים מפחית את הסיכון להטעייה או לתשלום עבור מוצרים שאינם עומדים בתיאור.

תמיכה טובה: השליחים בערוצים המומלצים עובדים בצורה מקצועית ומספקים שירות מהיר ואמין.

האם זה מותר לפי החוק?

חשוב לציין כי השימוש בשירותים כמו טulgראס כיוונים אינו מאושר על ידי הרשויות. למרות זאת, רבים בוחרים להשתמש בשיטה זו בשל היעילות שהיא מספקת. אם אתם בוחרים להשתמש בשירותים אלו, חשוב לפעול בזהירות ולבחור ערוצים מאומתים בלבד.

סיכום: איך להתחיל?

אם אתם מעוניינים למצוא פתרון מהיר להשגת קנאביס בישראל, טulgראס כיוונים עשוי להיות הדרך הנוחה והיעילה. האתר מספק את כל required details, כולל קישורים מעודכנים לערוצים אמינים, מדריכים והסברים כיצד לפעול נכון. עם טulgראס כיוונים, שליח הקנאביס יכול להיות בדרך אליכם במהירות.

אל תחכו יותר – התחילו את החיפוש, מצאו את הערוץ המתאים לכם, ותוכלו להנות מחוויית קבלת השירות בקלות!

טלגראס כיוונים – הדרך לקבל את המוצר במהירות.

The thoroughness in this break down is noteworthy.

Prevent Vibration Damage – Get Professional Balancing with Balanset-1A

Unbalanced rotors can cause serious damage to your machinery. Bearings wear out faster, motors consume more power, and failures lead to expensive repairs. Balanset-1A provides professional-grade vibration diagnostics and balancing, helping businesses save money and improve reliability.

Key Benefits:

– Accurate & fast diagnostics – Identifies imbalance before it causes damage

– Portable & efficient – Suitable for field and workshop use

– User-friendly software – No special training required

Choose Your Kit:

Full Kit on Amazon – Includes all necessary sensors, software, and a protective case

Price: €2250

OEM Kit on Amazon – More affordable, comes with basic components

Price: €1978

Protect your equipment today with Balanset-1A!

order zithromax 250mg for sale – how to get zithromax without a prescription metronidazole price

buy semaglutide paypal – brand cyproheptadine 4mg cyproheptadine 4 mg usa

domperidone price – order tetracycline 250mg online cheap buy cyclobenzaprine pills for sale

Where Balanset-1A is Used

Balanset-1A balancing device is designed for dynamic balancing and vibration diagnostics of rotating machinery .

This versatile device is ideal for:

in-situ balancing of industrial equipment such as fans, compressors, generators, blowers, mills, turbines, and rotors of any type ,

diagnostic vibration measurement and defect detection ,

supporting predictive maintenance programs .

This instrument is the perfect solution for preventive and corrective balancing in any production facility, utility, or workshop environment .

Device Description

The supplied equipment includes:

a two-channel measurement unit ,

two single-axis vibration sensors (accelerometers) ,

a laser tachometer (phase sensor) ,

a magnetic holder for secure mounting ,

electronic digital scales ,

balancing software (on USB flash drive) ,

a sturdy transportation hard case .

All you need for operation is a standard Windows laptop or PC .

Technical Features

Vibrometer Mode:

Integrated FFT spectral analysis .

Balancing Mode:

Single- and two-plane (dynamic) balancing .

Advanced Functions:

Intuitive workflow for operators of any skill level .

Investment

Balanset-1A — EUR 1751

Product page: https://vibromera.eu/product/balanset-1/

Included in Delivery

Dual-channel measurement unit

2 vibration sensors (accelerometers)

Laser tachometer (phase sensor) with reflective tape

Magnetic holder

Electronic scales

Balancing software (USB flash drive)

Sturdy transport case

Logistics & Payment

Worldwide delivery:

CTT Standard (Portugal Post): EUR 36, 7–30 days, https://www.ctt.pt/

EMS Express Mail Service: EUR 250, 4–10 days, https://www.ems.post/

Payment options:

Bank transfer

Credit/Debit card

PayPal

Technical Assistance

1-year warranty: covers any manufacturing defects, with repair or replacement at no extra charge .

Extended technical support (subscription-based):

Direct WhatsApp chat with experts, photo/video troubleshooting, remote software and hardware setup guidance, vibration data interpretation, tailored recommendations for your equipment. Subscribe: https://vibromera.eu/pricing-all/

Request a Consultation

Website: https://vibromera.eu/shop/2/

Slotbom77

Balanset-1A: Cutting-edge Compact Balancer & Vibration Analyzer

High-precision Dynamic Balancing Solution

Balanset-1A constitutes an advanced solution for rotor balancing of rotors in their own bearings, created by Estonian company Vibromera OU. The device ensures professional equipment balancing at €1,751, which is substantially less expensive than traditional vibration analyzers while maintaining exceptional measurement accuracy. The system permits in-place balancing directly at the equipment’s working position without necessitating disassembly, which is essential for reducing production downtime.

About the Manufacturer

Vibromera OU is an Estonian company focusing in the design and production of equipment for technical diagnostics of industrial equipment. The company is registered in Estonia (registration number 14317077) and has representatives in Portugal.

Contact Information:

Official website: https://vibromera.eu/shop/2/

Technical Specifications

Measurement Parameters

Balanset-1A delivers accurate measurements using a dual-channel vibration analysis system. The device measures RMS vibration velocity in the range of 0-80 mm/s with an accuracy of ±(0.1 + 0.1?Vi) mm/s. The working frequency range is 5-550 Hz with potential extension to 1000 Hz. The system supports rotation frequency measurement from 250 to 90,000 RPM with phase angle determination accuracy of ±1 degree.

Working Principle

The device employs phase-sensitive vibration measurement technology with MEMS accelerometers ADXL335 and laser tachometry. Two uniaxial accelerometers measure mechanical vibrations proportional to acceleration, while a laser tachometer generates pulse signals for computing rotational speed and phase angle. Digital signal processing includes FFT analysis for frequency analysis and custom algorithms for automatic computation of balancing masses.

Full Kit Contents

The standard Balanset-1A delivery includes:

Measurement unit with USB interface – primary module with embedded preamplifiers, integrators, and ADC

2 vibration sensors (accelerometers) with 4m cables (optionally 10m)

Optical sensor (laser tachometer) with 50-500mm measuring distance

Magnetic stand for sensor mounting

Electronic scales for exact measurement of corrective masses

Software for Windows 7-11 (32/64-bit)

Plastic transport case

Complete set of cables and documentation

Performance Capabilities

Vibrometer Mode

Balanset-1A works as a complete vibration analyzer with abilities for measuring overall vibration level, FFT spectrum analysis up to 1000 Hz, determining amplitude and phase of the fundamental frequency (1x), and continuous data recording. The system offers visualization of time signals and spectral analysis for equipment condition diagnostics.

Balancing Mode

The device supports one-plane (static) and two-plane (dynamic) balancing with automatic calculation of corrective masses and their installation angles. The unique influence coefficient saving function enables substantial acceleration of subsequent balancing of similar equipment. A dedicated grinding wheel balancing mode uses the three-correction-weight method.

Software

The user-friendly program interface delivers step-by-step guidance through the balancing process, making the device accessible to personnel without specific training. Key functions include:

Automatic tolerance calculation per ISO 1940

Polar diagrams for imbalance visualization

Result archiving with report generation capability

Metric and imperial system support

Multilingual interface (English, German, French, Polish, Russian)

Usage Domains and Equipment Types

Industrial Equipment

Balanset-1A is effectively employed for balancing fans (centrifugal, axial), pumps (hydraulic, centrifugal), turbines (steam, gas), centrifuges, compressors, and electric motors. In production facilities, the device is used for balancing grinding wheels, machine spindles, and drive shafts.

Agricultural Machinery

The device represents exceptional value for agriculture, where reliable operation during season is essential. Balanset-1A is applied for balancing combine threshing drums, shredders, mulchers, mowers, and augers. The possibility to balance on-site without equipment disassembly enables avoiding costly downtime during peak harvest periods.

Specialized Equipment

The device is effectively used for balancing crushers of various types, turbochargers, drone propellers, and other high-speed equipment. The speed frequency range from 250 to 90,000 RPM covers practically all types of industrial equipment.

Advantages Over Similar Products

Economic Value

At a price of €1,751, Balanset-1A provides the functionality of devices costing €10,000-25,000. The investment pays for itself after preventing just 2-3 bearing failures. Cost reduction on third-party balancing specialist services reaches thousands of euros annually.

Ease of Use

Unlike complicated vibration analyzers requiring months of training, mastering Balanset-1A takes 3-4 hours. The step-by-step guide in the software permits professional balancing by personnel without specific vibration diagnostics training.

Portability and Independence

The complete kit weighs only 4 kg, with power supplied through the laptop’s USB port. This enables balancing in field conditions, at isolated sites, and in inaccessible locations without additional power supply.

Versatile Application

One device is adequate for balancing the widest spectrum of equipment – from small electric motors to large industrial fans and turbines. Support for one and dual-plane balancing covers all typical tasks.

Real Application Results

Drone Propeller Balancing

A user achieved vibration reduction from 0.74 mm/s to 0.014 mm/s – a 50-fold improvement. This demonstrates the remarkable accuracy of the device even on small rotors.

Shopping Center Ventilation Systems

Engineers successfully balanced radial fans, achieving reduced energy consumption, abolished excessive noise, and extended equipment lifespan. Energy savings recovered the device cost within several months.

Agricultural Equipment

Farmers note that Balanset-1A has become an indispensable tool preventing costly breakdowns during peak season. Decreased vibration of threshing drums led to decreased fuel consumption and bearing wear.

Investment and Delivery Terms

Current Prices

Complete Balanset-1A Kit: €1,751

OEM Kit (without case, stand, and scales): €1,561

Special Offer: €50 discount for newsletter subscribers

Bulk Discounts: up to 15% for orders of 4+ units

Ordering Options

Official Website: vibromera.eu (recommended)

eBay: verified sellers with 100% rating

Industrial Distributors: through B2B channels

Payment and Shipping Terms

Payment Methods: PayPal, credit cards, bank transfer

Shipping: 10-20 business days by international mail

Shipping Cost: from $10 (economy) to $95 (express)

Warranty: manufacturer’s warranty

Technical Support: included in price

Final Assessment

Balanset-1A stands as an optimal solution for organizations striving to establish an efficient equipment balancing system without substantial capital expenditure. The device makes accessible access to professional balancing, enabling small enterprises and service centers to deliver services at the level of large industrial companies.

The mix of affordable price, ease of use, and professional capabilities makes Balanset-1A an indispensable tool for modern technical maintenance. Investment in this device is an investment in equipment stability, lower operating costs, and enhanced competitiveness of your business.

ווייפים

וופ פנים – טכנולוגיה מתקדמת, קל לשימוש ובעל יתרונות בריאותיים למשתמש המודרני.

בעולם העכשווי, שבו דחיפות ושגרת יומיום קובעים את היום-יום, עטי אידוי הפכו לבחירה מועדפת עבור אלה המחפשים חווית אידוי איכותית, קלה וטובה לבריאות.

מעבר לטכנולוגיה החדשנית שמובנית במכשירים הללו, הם מציעים מספר רב של יתרונות משמעותיים שהופכים אותם לבחירה מועדפת על פני אופציות מסורתיות.

גודל קטן ונוח לנשיאה

אחד היתרונות הבולטים של מכשירי האידוי הוא היותם קטנים, בעלי משקל נמוך וקלים להעברה. המשתמש יכול לשאת את הVape Pen לכל מקום – לעבודה, לטיול או לאירועים – מבלי שהמוצר יפריע או יתפוס מקום.

הגודל הקטן מאפשר לאחסן אותו בתיק בפשטות, מה שמאפשר שימוש דיסקרטי ונוח יותר.

מתאים לכל הסביבות

מכשירי הוופ מצטיינים ביכולתם להתאים לשימוש במקומות שונים. בין אם אתם בעבודה או במפגש, ניתן להשתמש בהם בצורה שקטה וללא הפרעה.

אין עשן מציק או ריח חד שעלול להטריד – רק אידוי חלק וקל שנותן גמישות גם באזור הומה.

ויסות מיטבי בטמפרטורה

לעטי אידוי רבים, אחד המאפיינים החשובים הוא היכולת לשלוט את טמפרטורת האידוי באופן מדויק.

מאפיין זה מאפשרת לכוונן את הצריכה לסוג החומר – פרחים, שמנים או תמציות – ולבחירת המשתמש.

ויסות החום מספקת חוויית אידוי חלקה, איכותית ומקצועית, תוך שמירה על ההארומות הטבעיים.

אידוי נקי ובריא

בהשוואה לעישון מסורתי, אידוי באמצעות Vape Pen אינו כולל שריפה של החומר, דבר שמוביל לכמות נמוכה של רעלנים שנפלטים במהלך הצריכה.

מחקרים מצביעים על כך שוופינג הוא אופציה בריאה, עם פחות חשיפה לרעלנים.

בנוסף, בשל חוסר בעירה, ההארומות הטבעיים מוגנים, מה שמוסיף לחווית הטעם וה�נאה הכוללת.

פשטות הפעלה ואחזקה

עטי האידוי מיוצרים מתוך עיקרון של נוחות הפעלה – הם מתאימים הן לחדשים והן לחובבי מקצוע.

מרבית המוצרים פועלים בהפעלה פשוטה, והתכנון כולל חילופיות של חלקים (כמו טנקים או גביעים) שמפשטים על הניקיון והטיפול.

תכונה זו מאריכה את חיי המכשיר ומספקת תפקוד אופטימלי לאורך זמן.

סוגים שונים של עטי אידוי – מותאם לצרכים

המגוון בוופ פנים מאפשר לכל צרכן לבחור את המכשיר המתאים ביותר עבורו:

מכשירים לקנאביס טבעי

מי שמעוניין ב חווית אידוי אותנטית, ללא תוספים – ייעדיף מכשיר לקנאביס טחון.

המכשירים הללו מיועדים לשימוש בחומר גלם טבעי, תוך שימור מקסימלי על הריח והטעם הטבעיים של הקנאביס.

מכשירים לנוזלים

למשתמשים שרוצים אידוי מרוכז ועשיר ברכיבים כמו קנבינואים וCBD – קיימים מכשירים המיועדים במיוחד לנוזלים ותמציות.

המוצרים האלה מתוכננים לשימוש בחומרים צפופים, תוך יישום בטכנולוגיות מתקדמות כדי ללספק אידוי עקבי, חלק ומלא בטעם.

—

מסקנות

מכשירי וופ אינם רק אמצעי נוסף לצריכה בקנאביס – הם סמל לאיכות חיים, לחופש ולשימוש מותאם אישית.

בין היתרונות המרכזיים שלהם:

– עיצוב קטן ונוח לתנועה

– שליטה מדויקת בטמפרטורה

– חווית אידוי נקייה ונטולת רעלים

– קלות שימוש

– הרבה אפשרויות של התאמה לצרכים

בין אם זו הפעם הראשונה בעולם האידוי ובין אם אתם משתמש מנוסה – עט אידוי הוא ההמשך הלוגי לחווית שימוש איכותית, נעימה ובטוחה.

—

הערות:

– השתמשתי בספינים כדי ליצור וריאציות טקסטואליות מגוונות.

– כל הגרסאות נשמעות טבעיות ומתאימות לעברית מדוברת.

– שמרתי על כל המושגים ספציפיים (כמו Vape Pen, THC, CBD) ללא שינוי.

– הוספתי סימני חלקים כדי לשפר את הקריאות והארגון של הטקסט.

הטקסט מתאים לקהל היעד בישראל ומשלב שפה שיווקית עם מידע מקצועי.

עט אידוי נטען

וופ פנים – פתרון חדשני, פרקטי וטוב לבריאות למשתמש המודרני.

בעולם שלנו, שבו דחיפות ושגרת יומיום שולטים את היום-יום, עטי אידוי הפכו לאופציה אידיאלית עבור אלה המעוניינים ב חווית אידוי איכותית, נוחה ובריאה.

בנוסף לטכנולוגיה החדשנית שמובנית בהמוצרים האלה, הם מציעים מספר רב של יתרונות משמעותיים שהופכים אותם לאופציה עדיפה על פני אופציות מסורתיות.

גודל קטן ונוח לנשיאה

אחד היתרונות הבולטים של עטי אידוי הוא היותם קומפקטיים, קלילים ונוחים לנשיאה. המשתמש יכול לשאת את הVape Pen לכל מקום – למשרד, לנסיעה או למסיבות חברתיות – מבלי שהמכשיר יהווה מטרד או יתפוס מקום.

העיצוב הקומפקטי מאפשר להסתיר אותו בכיס בפשטות, מה שמאפשר שימוש לא בולט ונוח יותר.

התאמה לכל המצבים

עטי האידוי מצטיינים בהתאמתם לצריכה בסביבות מגוונות. בין אם אתם בעבודה או באירוע חברתי, ניתן להשתמש בהם באופן לא מורגש ובלתי מפריעה.

אין עשן מציק או ריח חד שמפריע לסביבה – רק אידוי עדין וקל שנותן חופש פעולה גם באזור הומה.

ויסות מיטבי בחום האידוי

לעטי אידוי רבים, אחד המאפיינים החשובים הוא היכולת לשלוט את חום הפעולה בצורה אופטימלית.

מאפיין זה מאפשרת לכוונן את הצריכה להמוצר – פרחים, נוזלי אידוי או תרכיזים – ולהעדפות האישיות.

ויסות החום מבטיחה חוויית אידוי נעימה, איכותית ואיכותית, תוך שמירה על הטעמים הטבעיים.

צריכה בריאה ובריא

בניגוד לצריכה בשריפה, אידוי באמצעות Vape Pen אינו כולל בעירה של המוצר, דבר שמוביל לכמות נמוכה של חומרים מזהמים שנפלטים במהלך הצריכה.

מחקרים מצביעים על כך שוופינג הוא פתרון טוב יותר, עם מיעוט במגע לחלקיקים מזיקים.

בנוסף, בשל חוסר בעירה, ההארומות ההמקוריים נשמרים, מה שמוסיף לחווית הטעם והסיפוק הצריכה.

קלות שימוש ואחזקה

מכשירי הוופ מיוצרים מתוך גישה של נוחות הפעלה – הם מיועדים הן לחדשים והן לחובבי מקצוע.

רוב המכשירים מופעלים בהפעלה פשוטה, והעיצוב כולל החלפה של חלקים (כמו מיכלים או קפסולות) שמקלים על הניקיון והאחזקה.

תכונה זו מגדילה את אורך החיים של המוצר ומבטיחה ביצועים תקינים לאורך זמן.

מגוון רחב של עטי אידוי – מותאם לצרכים

המגוון בעטי אידוי מאפשר לכל משתמש לבחור את המכשיר המתאים ביותר עבורו:

עטי אידוי לפרחים

מי שמעוניין ב חווית אידוי אותנטית, רחוקה ממעבדות – ייעדיף עט אידוי לקנאביס טחון.

המוצרים אלה מיועדים לשימוש בפרחים טחונים, תוך שימור מקסימלי על הארומה והטעם ההמקוריים של הצמח.

עטי אידוי לשמנים ותמציות

לצרכנים שמחפשים אידוי עוצמתי ועשיר ברכיבים כמו קנבינואים וקנאבידיול – קיימים מכשירים המתאימים במיוחד לשמנים ותרכיזים.

מכשירים אלו בנויים לשימוש בנוזלים מרוכזים, תוך שימוש בחידושים כדי לייצר אידוי עקבי, חלק ועשיר.

—

סיכום

עטי אידוי אינם רק אמצעי נוסף לשימוש בחומרי קנאביס – הם דוגמה לרמת חיים גבוהה, לחופש ולשימוש מותאם אישית.

בין היתרונות המרכזיים שלהם:

– גודל קומפקטי ונעים לנשיאה

– שליטה מדויקת בטמפרטורה

– חווית אידוי נקייה ונטולת רעלים

– הפעלה אינטואיטיבית

– הרבה אפשרויות של התאמה לצרכים

בין אם זו הההתנסות הראשונה בעולם האידוי ובין אם אתם צרכן ותיק – וופ פן הוא ההמשך הלוגי לצריכה איכותית, מהנה ובטוחה.

—

הערות:

– השתמשתי בסוגריים מסולסלים כדי ליצור וריאציות טקסטואליות מגוונות.

– כל הגרסאות נשמעות טבעיות ומתאימות לעברית מדוברת.

– שמרתי על כל המונחים הטכניים (כמו Vape Pen, THC, CBD) ללא שינוי.

– הוספתי כותרות כדי לשפר את ההבנה והארגון של הטקסט.

הטקסט מתאים לקהל היעד בישראל ומשלב שפה שיווקית עם מידע מקצועי.

Vapor Pen

וופורייזרים מומלצים

מכשירי אידוי – חידוש משמעותי, קל לשימוש ובעל יתרונות בריאותיים למשתמש המודרני.

בעולם המודרני, שבו קצב חיים מהיר והרגלי שגרה שולטים את היום-יום, וופ פנים הפכו לאופציה אידיאלית עבור אלה המעוניינים ב חווית אידוי מקצועית, נוחה ובריאה.

מעבר לטכנולוגיה המתקדמת שמובנית במכשירים הללו, הם מציעים מספר רב של יתרונות משמעותיים שהופכים אותם לבחירה מועדפת על פני שיטות קונבנציונליות.

עיצוב קומפקטי וקל לניוד

אחד ההיתרונות העיקריים של עטי אידוי הוא היותם קטנים, קלילים ונוחים לנשיאה. המשתמש יכול לקחת את העט האידוי לכל מקום – לעבודה, לטיול או לאירועים – מבלי שהמכשיר יפריע או יהיה מסורבל.

העיצוב הקומפקטי מאפשר להסתיר אותו בתיק בפשטות, מה שמאפשר שימוש דיסקרטי ונוח יותר.

התאמה לכל הסביבות

מכשירי הוופ מצטיינים ביכולתם להתאים לשימוש במקומות שונים. בין אם אתם במשרד או באירוע חברתי, ניתן להשתמש בהם באופן לא מורגש וללא הפרעה.

אין עשן מציק או ריח עז שעלול להטריד – רק אידוי עדין ופשוט שנותן חופש פעולה גם במקום ציבורי.

שליטה מדויקת בטמפרטורה

לעטי אידוי רבים, אחד היתרונות המרכזיים הוא היכולת ללווסת את טמפרטורת האידוי באופן מדויק.

מאפיין זה מאפשרת לכוונן את הצריכה לסוג החומר – פרחים, נוזלי אידוי או תמציות – ולהעדפות האישיות.

ויסות החום מספקת חוויית אידוי נעימה, טהורה ומקצועית, תוך שימור על הטעמים הטבעיים.

אידוי נקי וטוב יותר

בניגוד לצריכה בשריפה, אידוי באמצעות עט אידוי אינו כולל שריפה של החומר, דבר שמוביל לכמות נמוכה של חומרים מזהמים שמשתחררים במהלך השימוש.

נתונים מראים על כך שוופינג הוא פתרון טוב יותר, עם פחות חשיפה לחלקיקים מזיקים.

יתרה מכך, בשל היעדר שריפה, ההארומות ההמקוריים מוגנים, מה שמוסיף להנאה מהמוצר והסיפוק הצריכה.

קלות שימוש ותחזוקה

עטי האידוי מיוצרים מתוך עיקרון של קלות שימוש – הם מתאימים הן לחדשים והן למשתמשים מנוסים.

רוב המכשירים מופעלים בלחיצה אחת, והתכנון כולל חילופיות של חלקים (כמו מיכלים או גביעים) שמקלים על הניקיון והטיפול.

הדבר הזה מגדילה את אורך החיים של המוצר ומספקת תפקוד אופטימלי לאורך זמן.

מגוון רחב של עטי אידוי – התאמה אישית

הבחירה רחבה בעטי אידוי מאפשר לכל משתמש ללמצוא את המוצר המתאים ביותר עבורו:

עטי אידוי לפרחים

מי שמחפש חווית אידוי טבעית, ללא תוספים – ייעדיף מכשיר לקנאביס טחון.

המוצרים אלה מיועדים לשימוש בחומר גלם טבעי, תוך שמירה מלאה על הארומה והטעם ההמקוריים של הצמח.

עטי אידוי לשמנים ותמציות

למשתמשים שמחפשים אידוי מרוכז ומלא ברכיבים כמו THC וקנאבידיול – קיימים מכשירים המתאימים במיוחד לשמנים ותרכיזים.

המוצרים האלה מתוכננים לשימוש בנוזלים מרוכזים, תוך יישום בטכנולוגיות מתקדמות כדי ללספק אידוי עקבי, חלק ומלא בטעם.

—

מסקנות

עטי אידוי אינם רק עוד כלי לצריכה בחומרי קנאביס – הם סמל לרמת חיים גבוהה, לגמישות ולשימוש מותאם אישית.

בין היתרונות המרכזיים שלהם:

– גודל קומפקטי ונוח לתנועה

– שליטה מדויקת בטמפרטורה

– צריכה בריאה ובריאה

– הפעלה אינטואיטיבית

– הרבה אפשרויות של התאמה אישית

בין אם זו הפעם הראשונה בוופינג ובין אם אתם משתמש מנוסה – וופ פן הוא ההמשך הלוגי לחווית שימוש איכותית, נעימה וללא סיכונים.

—

הערות:

– השתמשתי בספינים כדי ליצור וריאציות טקסטואליות מגוונות.

– כל הגרסאות נשמעות טבעיות ומתאימות לשפה העברית.

– שמרתי על כל המושגים ספציפיים (כמו Vape Pen, THC, CBD) ללא שינוי.

– הוספתי כותרות כדי לשפר את הקריאות והארגון של הטקסט.

הטקסט מתאים למשתמשים בישראל ומשלב תוכן מכירתי עם פירוט טכני.

Cannabis Vaporizer

order augmentin 625mg pill – https://atbioinfo.com/ ampicillin canada

esomeprazole 20mg for sale – https://anexamate.com/ buy generic nexium over the counter

where can i buy medex – coumamide losartan ca

ck89

https://cucukakek89ck.click/

order mobic generic – mobo sin mobic pills

order prednisone 40mg generic – https://apreplson.com/ cost prednisone 40mg

Регистрация на официальном портале Up X

Регистрация в Up X — простой и быстрый процесс. Вам не придется выделять много времени, чтобы стать клиентом сервиса. Создатели платформы позаботились не только о стильном дизайне, но и о том, чтобы она воспринималась интуитивно. Минимализм и продуманный интерфейс — отличная комбинация. С созданием профиля не будет никаких проблем

https://skachatreferat.ru/

where to buy ed pills – fastedtotake sexual dysfunction

order amoxil for sale – buy amoxil medication buy amoxicillin pills

Wallet Address Checker Online

Crypto Wallet Validator

Use a secure wallet address checker online to scan your crypto wallet for risks like regulatory flags, theft incidents, or underground network leaks. Stay ahead of exchange freezes and avoid losing access to your assets. Instant results with bank-grade security — check now.

what is chicken road

Chicken Road: Real Player Feedback

Chicken Road is a gamblinginspired arcade game that has drawn interest due to its straightforward mechanics, impressive RTP (98%), and innovative cashout option. By analyzing user opinions, we aim to figure out whether this game deserves your attention.

Key Highlights According to Players

Numerous players commend Chicken Road for its quick, engaging action and userfriendly design. With its cashout feature offering strategy and an RTP of 98%, it feels like a fairer alternative to conventional slot games. The demo mode is a hit with beginners, allowing players to test the game riskfree. The game earns extra points for its mobile compatibility, running seamlessly on both new and older devices.

Melissa R., AU: “Unexpectedly enjoyable and balanced! The ability to cash out brings a layer of strategy.”

Nathan K., UK: “The retro arcade vibe feels invigorating. Plus, it works perfectly on my tablet.”

Gamers are also fond of the vibrant, retro aesthetic, making it both enjoyable and captivating.

Areas for Improvement

While it has many positives, Chicken Road does have some downsides. Some players find the gameplay repetitive and lacking depth. Some highlight sluggish customer service and a lack of additional options. A common complaint is misleading advertising—many expected a pure arcade game, not a gambling app.

Tom B., US: “Fun at first, but it gets repetitive after a few days.”

Sam T., UK: “Promoted as entertainment, yet it turns out to be a gambling product.”

Strengths and Weaknesses

Positive Aspects

Simple, fastpaced gameplay

An RTP of 98% guarantees a fair experience

Demo mode for riskfree learning

Optimized for flawless mobile play

Disadvantages

Gameplay can feel repetitive

Limited variety and features

Slow or unresponsive customer support

Misleading marketing

Final Verdict

Chicken Road stands out with its transparency, high RTP, and accessibility. Perfect for relaxed gaming sessions or newcomers to online betting. Still, the heavy emphasis on luck and minimal complexity could turn off some users. For the best experience, play on official, licensed platforms.

Rating: Four out of five stars

An enjoyable and equitable option, though it has areas to grow.

Wallet Address Checker Online

Crypto Wallet Validator

Use a trusted wallet address checker online to scan your crypto wallet for risks like regulatory flags, theft incidents, or underground network leaks. Stay ahead of exchange freezes and avoid losing access to your assets. Verified by crypto experts worldwide — check now.

Chicken Road: Honest User Opinions