- ETH price surged by 14.5% over the last week.

- Ethereum active addresses have hit 5 million over the past week as active buyers increased.

Since hitting a weekly low of $2,251 on 16th September, Ethereum [ETH] has been on an uptrend. In fact, as of this writing, ETH was trading at $2,641. This marked a 14.50% increase over the past week.

Prior to the uptick, Ethereum was on a downtrend trajectory over the past month.

The recent shift in market sentiment has left analysts talking about whether this uptrend is a part of a sustained recovery and what’s driving this surge. Analysts have suggested that the current uptrend arises from increased active buyers.

What market sentiment Says

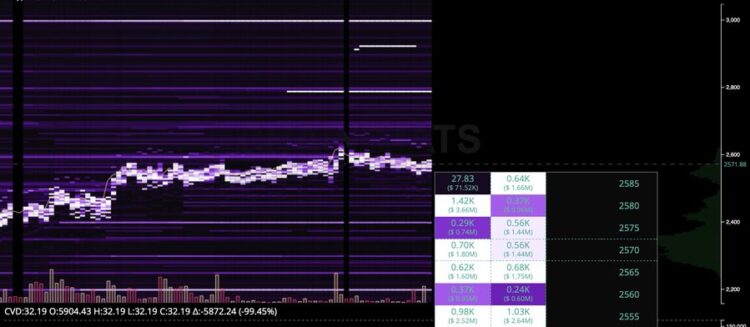

In their analysis, ChainStatsPro cited increased active buyers and spot limits bids.

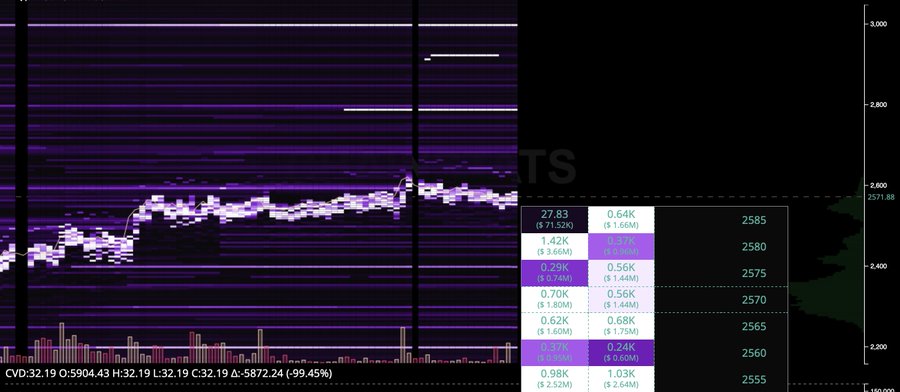

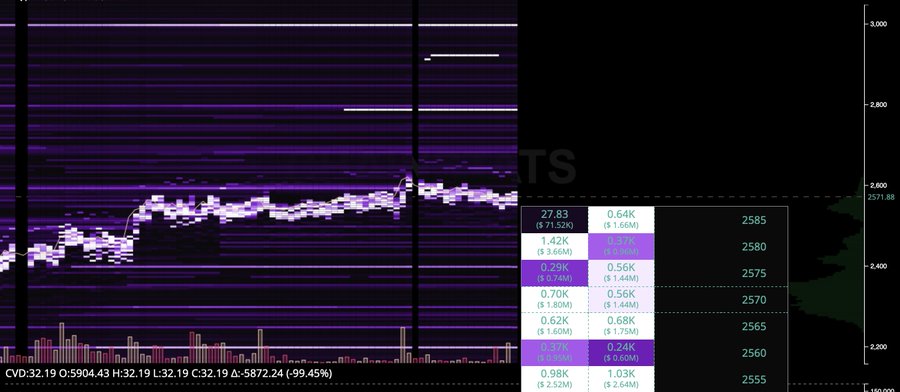

According to this analogy, liquidation hunts in the future markets for ETH have persisted while spot-limit bids are being filled. However, CVD remains flat, and bids and asks are accumulating at $2400 and $2790.

Source: ChainStatsPro

What this means is that active buyers are acquiring ETH at the current market rates suggesting increased demand. Thus, traders are positioning themselves to buy when ETH declines to $2400 and sell if it reaches $2790. These order bids suggest increased market activity.

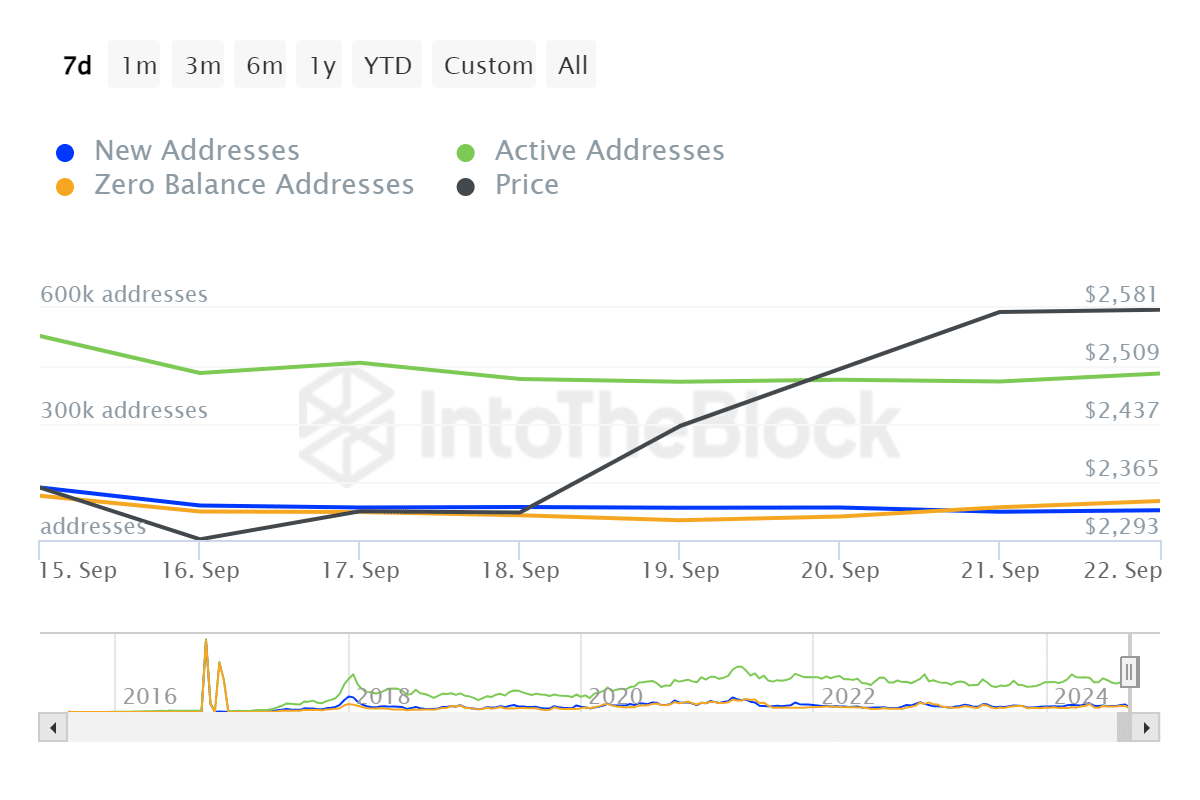

Source: IntoTheBlock

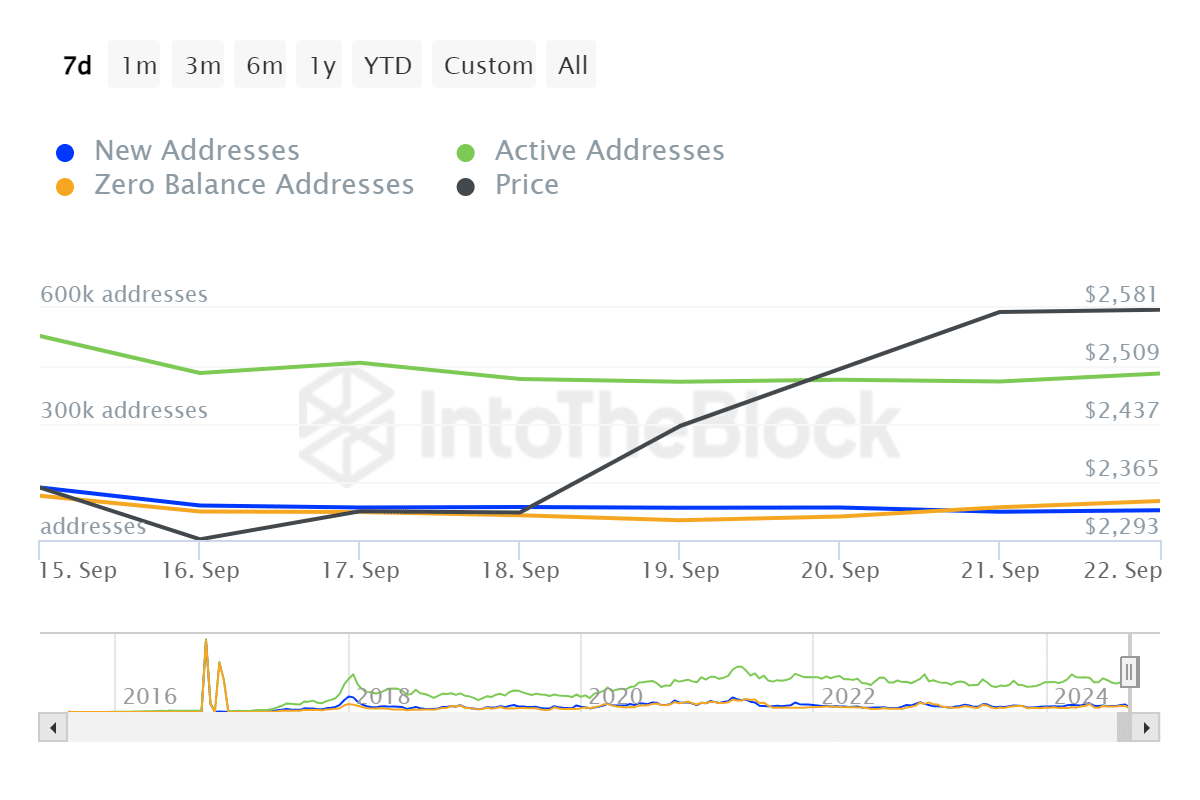

Looking further, the increase in active buyers and investors setting spot limits is illustrated by a higher number of active addresses over the past seven days.

According to IntoTheblock, active addresses have hit 5 million over the past week. This suggests increased transactions as more users are actively engaged with the network. This is a bullish market sentiment as a rise in active addresses lead to higher prices.

What ETH charts indicate…

As observed by ChainStatsPro, ETH has experienced a surge in transaction activity over the past week. These market conditions have pushed Ethereum to experience a sustained upward momentum over the past week.

Source: Tradingview

For starters, this increase in buying pressure has been further supported by a positive Chaikin Money Flow (CMF). At press time, Ethereum’s CMF was at 0.28 indicating buyers are actively accumulating the asset.

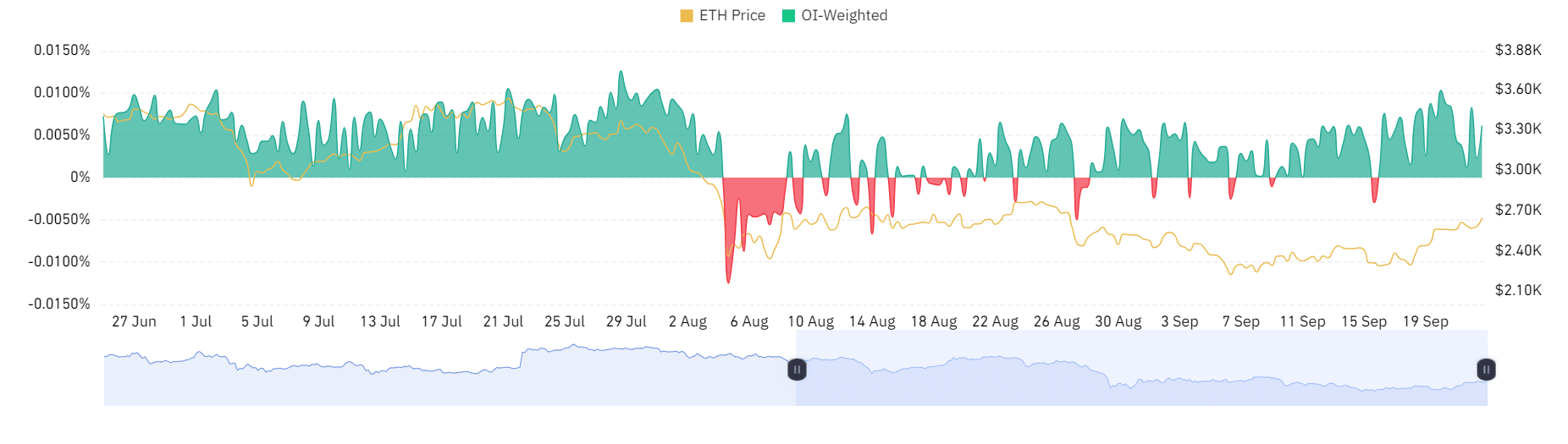

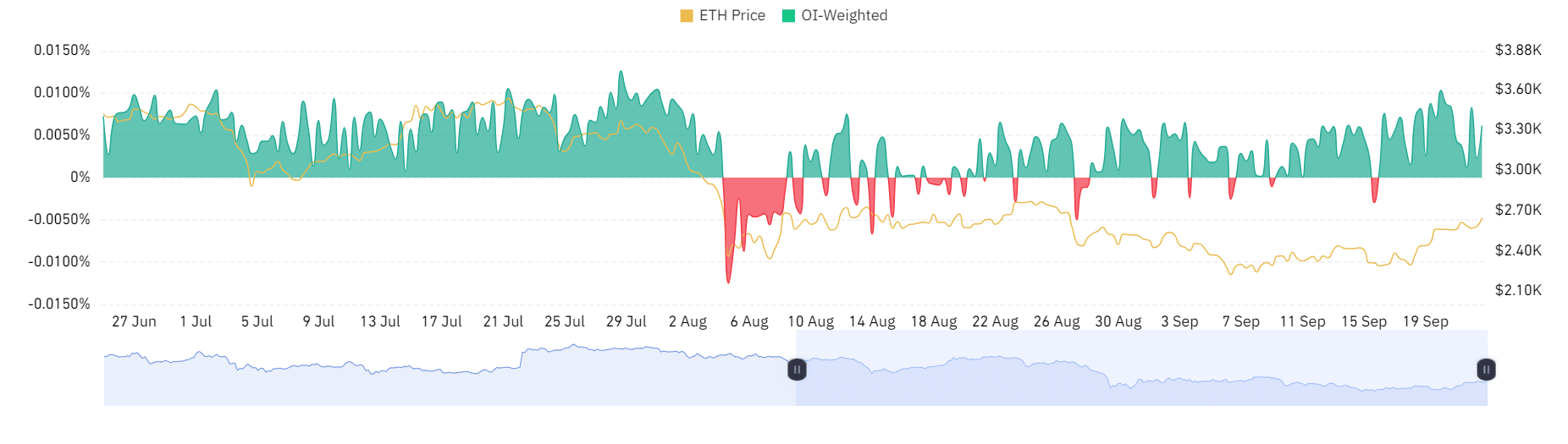

Source: Coinglass

Finally, Ethereum’s OI-weighted funding rate has been positive over the past week. A positive OI-weighted funding rate indicates increased demand for long positions with these holders paying shorts.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Therefore, as noted by ChainStatsPro, ETH is experiencing an increase in active buyers. This positive market sentiment positions the altcoin for further gains.

If the current conditions hold, ETH will attempt a $2800 resistance level in the short term.

- ETH price surged by 14.5% over the last week.

- Ethereum active addresses have hit 5 million over the past week as active buyers increased.

Since hitting a weekly low of $2,251 on 16th September, Ethereum [ETH] has been on an uptrend. In fact, as of this writing, ETH was trading at $2,641. This marked a 14.50% increase over the past week.

Prior to the uptick, Ethereum was on a downtrend trajectory over the past month.

The recent shift in market sentiment has left analysts talking about whether this uptrend is a part of a sustained recovery and what’s driving this surge. Analysts have suggested that the current uptrend arises from increased active buyers.

What market sentiment Says

In their analysis, ChainStatsPro cited increased active buyers and spot limits bids.

According to this analogy, liquidation hunts in the future markets for ETH have persisted while spot-limit bids are being filled. However, CVD remains flat, and bids and asks are accumulating at $2400 and $2790.

Source: ChainStatsPro

What this means is that active buyers are acquiring ETH at the current market rates suggesting increased demand. Thus, traders are positioning themselves to buy when ETH declines to $2400 and sell if it reaches $2790. These order bids suggest increased market activity.

Source: IntoTheBlock

Looking further, the increase in active buyers and investors setting spot limits is illustrated by a higher number of active addresses over the past seven days.

According to IntoTheblock, active addresses have hit 5 million over the past week. This suggests increased transactions as more users are actively engaged with the network. This is a bullish market sentiment as a rise in active addresses lead to higher prices.

What ETH charts indicate…

As observed by ChainStatsPro, ETH has experienced a surge in transaction activity over the past week. These market conditions have pushed Ethereum to experience a sustained upward momentum over the past week.

Source: Tradingview

For starters, this increase in buying pressure has been further supported by a positive Chaikin Money Flow (CMF). At press time, Ethereum’s CMF was at 0.28 indicating buyers are actively accumulating the asset.

Source: Coinglass

Finally, Ethereum’s OI-weighted funding rate has been positive over the past week. A positive OI-weighted funding rate indicates increased demand for long positions with these holders paying shorts.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Therefore, as noted by ChainStatsPro, ETH is experiencing an increase in active buyers. This positive market sentiment positions the altcoin for further gains.

If the current conditions hold, ETH will attempt a $2800 resistance level in the short term.

clomiphene tablets for sale where can i buy clomiphene no prescription how to buy clomid price can i buy cheap clomid no prescription where can i get clomid pill where buy generic clomiphene without dr prescription can you buy cheap clomiphene for sale

The reconditeness in this tune is exceptional.

More articles like this would frame the blogosphere richer.

cheap azithromycin 500mg – buy ofloxacin purchase metronidazole for sale

oral motilium – order motilium online cheap cyclobenzaprine ca

where can i buy amoxicillin – amoxil order order ipratropium pill

buy generic nexium – https://anexamate.com/ esomeprazole 40mg ca

coumadin for sale – anticoagulant losartan 50mg pills

order generic meloxicam – https://moboxsin.com/ meloxicam 7.5mg cheap

cost deltasone 10mg – inflammatory bowel diseases prednisone 5mg canada

new ed drugs – buy ed pills medicine erectile dysfunction

amoxicillin us – comba moxi amoxicillin online order

purchase diflucan online – fluconazole 100mg canada fluconazole 200mg price

cenforce oral – https://cenforcers.com/# generic cenforce

when will generic cialis be available – https://ciltadgn.com/# u.s. pharmacy prices for cialis

where to buy cialis cheap – this evolution peptides tadalafil

ranitidine order – buy generic ranitidine for sale buy generic zantac

viagra 50 milligrams – https://strongvpls.com/ 50 milligram viagra

The depth in this serving is exceptional. order amoxil without prescription

Thanks towards putting this up. It’s understandably done. https://ursxdol.com/prednisone-5mg-tablets/

Greetings! Extremely gainful advice within this article! It’s the petty changes which choice espy the largest changes. Thanks a lot in the direction of sharing! https://prohnrg.com/product/acyclovir-pills/

Thanks on putting this up. It’s understandably done. https://aranitidine.com/fr/sibelium/

More peace pieces like this would make the интернет better.

https://doxycyclinege.com/pro/topiramate/

I am in fact thrilled to gleam at this blog posts which consists of tons of profitable facts, thanks object of providing such data. https://sportavesti.ru/forums/users/pnlzn-2/

dapagliflozin generic – janozin.com dapagliflozin pill

order generic orlistat – on this site buy xenical 120mg generic