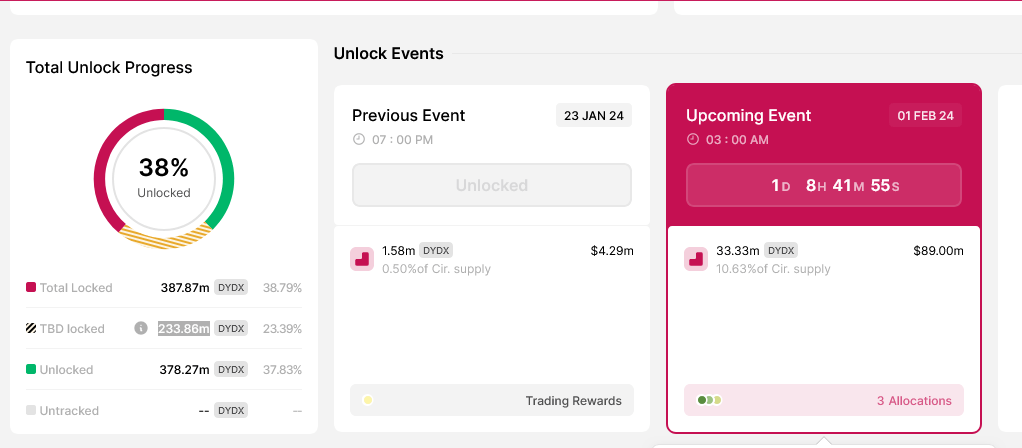

dYdX, a decentralized exchange (DEX), will unlock over 33 million DYDX worth approximately $90 million on February 1. This significant token unlock is the second event in the last week, following a previous unlocking on January 23.

dYdX To Unlock $90 Million Of Token: What Happens Next?

According to Token Unlocks on January 30, the release will see the protocol distribute $49 million of tokens to investors. At the same time, the team and future employees will each receive approximately $27 million and $12.5 million, respectively.

The upcoming token unlock event is part of dYdX’s ongoing cliff unlock schedule, which will continue for the next five months. During this period, more DYDX will be unlocked.

For token holders, the frequency and size of these token unlocks raise concerns about the potential impact on DYDX prices. While some experts believe that the gradual unlock schedule will help mitigate any adverse effects, others fear that a deluge of DYDX into the secondary market could lower prices.

So far, the token remains in a general uptrend, looking at the price action from a top-down preview. Presently, DYDX is changing hands at around $2.8. Though it is down 35% from the December 2023 peaks, bulls are optimistic. The token has support at about $2.3, and the uptrend formation remains valid, provided bulls reject any attempt lower below this reaction level.

The protocol still has over 60% of tokens locked up. Of this, 233.86 million have not been allocated a release timing. Additionally, Token Unlocks notes that in H2 2023, the protocol will decrease the amount of tokens it unlocks. For this reason, prices might stabilize and even rally should the market recover from the year’s rough start.

V3 Deployed, Adds New Features To Trading Platform

On January 29, dYdX Chain successfully deployed v3 at block height 7147832. The update introduced improvements impacting efficiency, trading performance, and general user experience.

A big addition is the introduction of the Interchain Accounts Host Module, which enhances interoperability, reducing the time taken for users to switch between blockchains and manage assets.

Moreover, the DYDX v3 sees the introduction of liquidation daemons. This system will make it easier for traders to manage their margin positions and execute liquidations. The protocol reduced their requirements to simplify margin management and onboard more users.

As of January 30, the protocol has generated over $545 million in trading volumes. More than $37 million in open interest and over 411,000 unique trades are posted on the platform.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

generic clomiphene walmart get cheap clomiphene without insurance can i get generic clomiphene for sale can i order clomiphene for sale where can i get clomiphene without dr prescription how to get cheap clomiphene no prescription where to get cheap clomid without prescription

More text pieces like this would make the web better.

I am actually enchant‚e ‘ to glance at this blog posts which consists of tons of of use facts, thanks towards providing such data.

azithromycin 250mg without prescription – ofloxacin oral flagyl sale

buy generic domperidone 10mg – buy generic flexeril for sale flexeril 15mg cheap

inderal 10mg pill – inderal without prescription order generic methotrexate 10mg

order amoxil pills – valsartan 80mg uk buy ipratropium online

augmentin order online – atbioinfo how to get ampicillin without a prescription

order esomeprazole 40mg pill – anexa mate cheap esomeprazole

buy cheap generic coumadin – https://coumamide.com/ buy hyzaar for sale

buy meloxicam 15mg – tenderness buy generic mobic for sale

purchase prednisone pills – adrenal deltasone 40mg cost

erectile dysfunction pills over the counter – https://fastedtotake.com/ male ed pills

cheap amoxicillin tablets – buy amoxil pills cheap amoxil without prescription

buy generic cenforce – oral cenforce 50mg order cenforce 100mg sale

cheap cialis canada – ciltad genesis cialis 5mg how long does it take to work

zantac 150mg us – order generic ranitidine 300mg order zantac 300mg online cheap

cialis leg pain – https://strongtadafl.com/ difference between cialis and tadalafil

I am in truth happy to glance at this blog posts which consists of tons of useful facts, thanks towards providing such data. donde comprar provigil

cheap viagra cialis uk – https://strongvpls.com/ viagra 100mg price

I couldn’t resist commenting. Adequately written! isotretinoin 30 mg