- Dormant ETH whale has reemerged, transferring 7,000 ETH to Kraken as it plunged to $1,760.

- Given the turbulence in risk assets, ETH traders should closely monitor exchange inflows.

Ethereum [ETH] has plunged below the $2,000 mark, erasing $46 billion in market value within a week. This drop brings ETH back to the $1,900 range for the first time in two years.

With a 10.64% weekly decline, ETH stands as the weakest performer among high-caps. But with RSI in oversold territory and trading volume surging 47%, could this be the perfect “dip-buying” opportunity?

Dormant ETH whale awakens

Ethereum’s market just saw a significant on-chain event. An ETH whale, dormant since the initial coin offering (ICO), has resurfaced, transferring 7,000 ETH ($13.8M) to Kraken.

This move coincided with ETH plummeting to $1,760 – its lowest level since October 2023.

Despite ETH rebounding to $1,900, the whale still holds 30,070 ETH ($50M). If more selling follows, ETH could face deeper corrections, which looks increasingly likely in the near-term.

Why? While declining exchange reserves confirm accumulation, the broader market downturn and rising liquidations could put ETH’s recovery at risk.

Over $110 million in ETH long positions were liquidated in the past 24 hours and ETH funding rates turning negative on three out of six top exchanges suggest short-sellers are tightening their grip.

Source: CryptoQuant

Adding to the bearish pressure, 180-day dormant circulation spiked as ETH broke below $2,100, indicating a surge in long-term holder sell-offs.

In a risk-off environment, this aligns with a distribution phase, further weighing on ETH’s short-term price action.

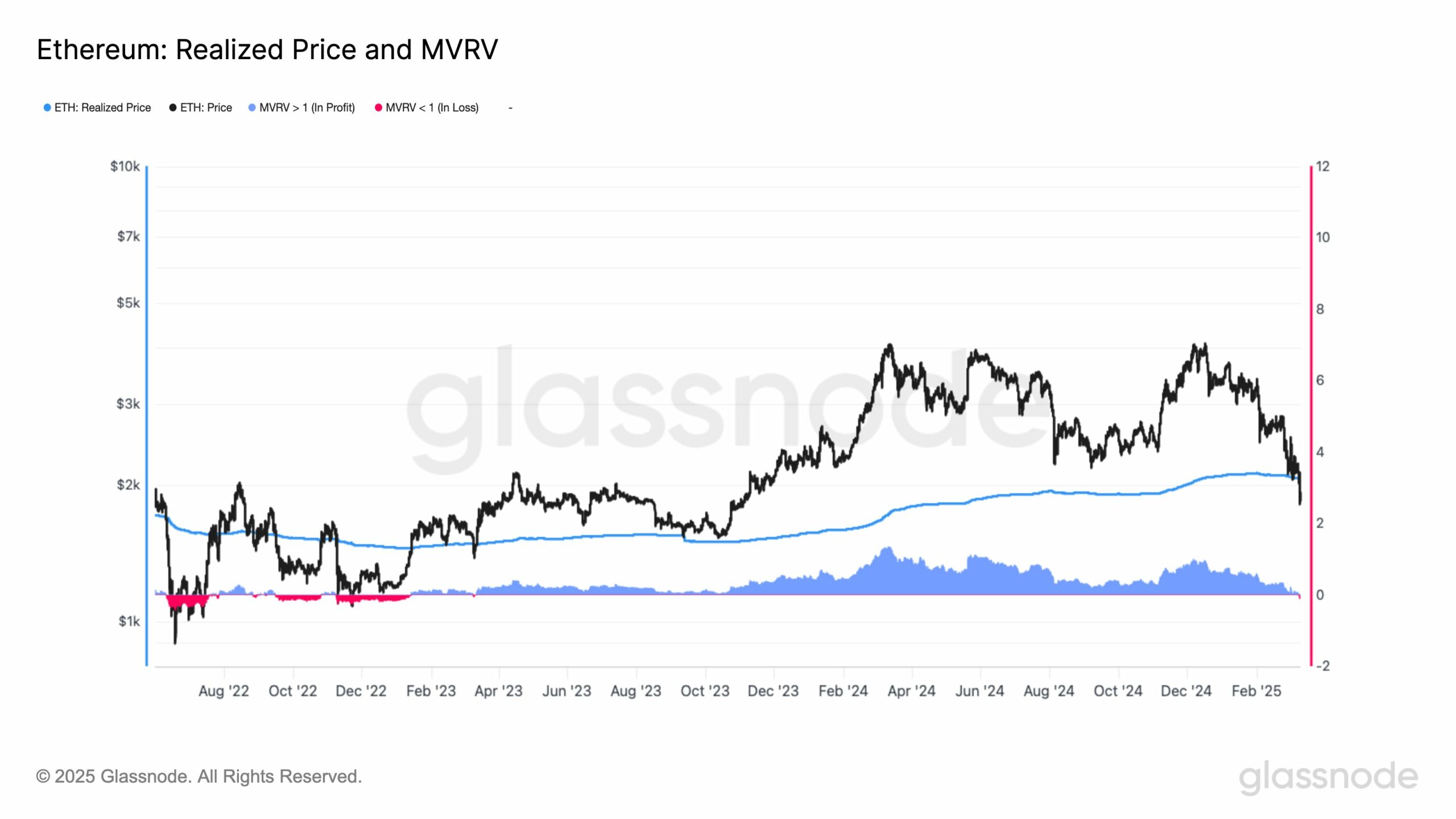

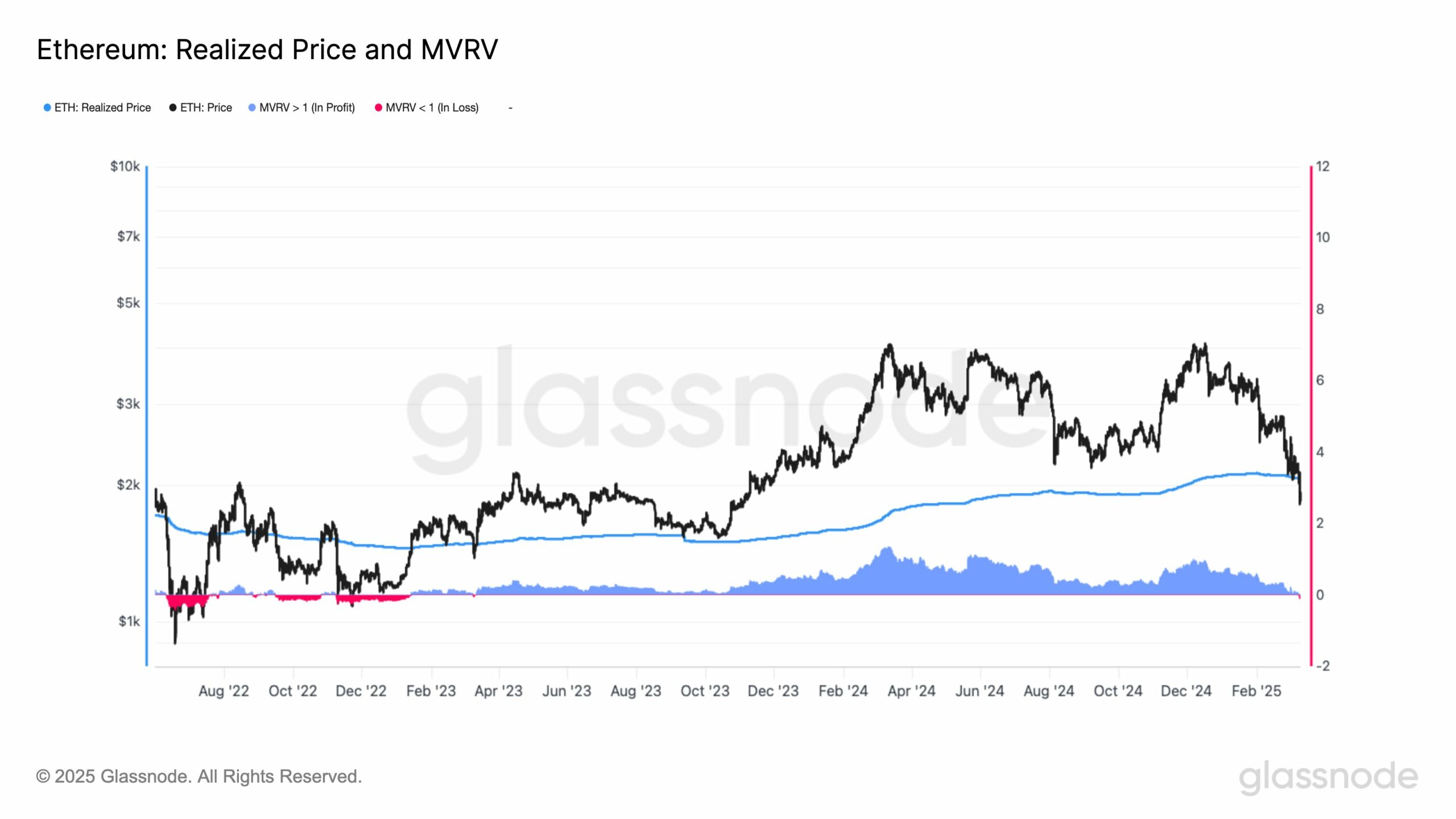

Identifying key support zone

Ethereum has fallen below its realized price for the first time in two years, meaning the average holder is now at an unrealized loss.

Currently trading at $1,917, ETH sits below the realized price of $2,058, pushing its MVRV ratio to 0.93, reflecting a 7% network-wide unrealized loss.

Source: Glassnode

Historically, dips below realized price have signaled capitulation zones. With dormant ETH whales selling off, this trend seems to be in place.

Immediate support rests at $1,592 – a break below this level could push 4.80 million ETH into loss. If breached, it could open the door for further downside.

- Dormant ETH whale has reemerged, transferring 7,000 ETH to Kraken as it plunged to $1,760.

- Given the turbulence in risk assets, ETH traders should closely monitor exchange inflows.

Ethereum [ETH] has plunged below the $2,000 mark, erasing $46 billion in market value within a week. This drop brings ETH back to the $1,900 range for the first time in two years.

With a 10.64% weekly decline, ETH stands as the weakest performer among high-caps. But with RSI in oversold territory and trading volume surging 47%, could this be the perfect “dip-buying” opportunity?

Dormant ETH whale awakens

Ethereum’s market just saw a significant on-chain event. An ETH whale, dormant since the initial coin offering (ICO), has resurfaced, transferring 7,000 ETH ($13.8M) to Kraken.

This move coincided with ETH plummeting to $1,760 – its lowest level since October 2023.

Despite ETH rebounding to $1,900, the whale still holds 30,070 ETH ($50M). If more selling follows, ETH could face deeper corrections, which looks increasingly likely in the near-term.

Why? While declining exchange reserves confirm accumulation, the broader market downturn and rising liquidations could put ETH’s recovery at risk.

Over $110 million in ETH long positions were liquidated in the past 24 hours and ETH funding rates turning negative on three out of six top exchanges suggest short-sellers are tightening their grip.

Source: CryptoQuant

Adding to the bearish pressure, 180-day dormant circulation spiked as ETH broke below $2,100, indicating a surge in long-term holder sell-offs.

In a risk-off environment, this aligns with a distribution phase, further weighing on ETH’s short-term price action.

Identifying key support zone

Ethereum has fallen below its realized price for the first time in two years, meaning the average holder is now at an unrealized loss.

Currently trading at $1,917, ETH sits below the realized price of $2,058, pushing its MVRV ratio to 0.93, reflecting a 7% network-wide unrealized loss.

Source: Glassnode

Historically, dips below realized price have signaled capitulation zones. With dormant ETH whales selling off, this trend seems to be in place.

Immediate support rests at $1,592 – a break below this level could push 4.80 million ETH into loss. If breached, it could open the door for further downside.

where buy clomid no prescription clomiphene tablets uses in urdu buy generic clomid price can you get clomid without insurance buy cheap clomiphene price where can i buy cheap clomiphene without prescription can i buy cheap clomiphene tablets

Thanks for sharing. It’s outstrip quality.

Thanks for sharing. It’s first quality.

buy zithromax – buy tetracycline medication buy metronidazole online

order semaglutide 14 mg sale – purchase periactin online cheap cyproheptadine online buy

buy cheap motilium – sumycin over the counter buy cyclobenzaprine no prescription

where to buy propranolol without a prescription – buy plavix online order methotrexate pill

oral amoxicillin – buy generic diovan online ipratropium 100 mcg cost

zithromax brand – buy azithromycin 250mg generic generic bystolic 20mg

purchase augmentin generic – https://atbioinfo.com/ purchase ampicillin

esomeprazole 20mg cost – https://anexamate.com/ buy esomeprazole pills for sale

buy coumadin 5mg – coumamide losartan 50mg price

buy mobic pills for sale – moboxsin.com cheap meloxicam 7.5mg

cost prednisone 10mg – https://apreplson.com/ purchase prednisone online

ed pills where to buy – hims ed pills buy pills for erectile dysfunction

buy amoxicillin online – comba moxi buy amoxicillin online cheap

buy diflucan generic – https://gpdifluca.com/ forcan for sale

cenforce 50mg for sale – https://cenforcers.com/ buy cenforce online

best place to buy tadalafil online – https://ciltadgn.com/# cialis from canadian pharmacy registerd

ranitidine 150mg pill – order ranitidine 300mg pill where to buy ranitidine without a prescription

tadalafil citrate research chemical – site cialis male enhancement

The sagacity in this ruined is exceptional. https://gnolvade.com/es/accutane-comprar-espana/

where can i buy viagra in manila – https://strongvpls.com/ generic sildenafil 50mg

I’ll certainly bring back to read more. https://ursxdol.com/prednisone-5mg-tablets/

More articles like this would remedy the blogosphere richer. https://prohnrg.com/product/omeprazole-20-mg/

Greetings! Very useful par‘nesis within this article! It’s the little changes which liking obtain the largest changes. Thanks a lot quest of sharing! stromectol c’est quoi