Because the launch of the Ordinals protocol by software program engineer Casey Rodarmar on January 21, 2023, virtually 2,000,000 “digital artifacts” have been created — starting from memes to large NFT tasks like Taproot Wizards. However regardless of the explosive rise and frenzied media protection of those seemingly new “Bitcoin NFTs,” builders have been targeted on enhancing the protocol’s performance since at the least as early as 2012.

In brief, there have all the time been methods to mint and launch property on Bitcoin’s underlying blockchain. These instruments started with issues like Bitcoin Colored Coins and, later, platforms like Counterparty in 2014, which helped lay the muse for tokenized property like Spells of Genesis and Rare Pepes to emerge in 2016.

On this respect, Ordinals characterize merely the newest development inside the ever-evolving Bitcoin ecosystem. To acknowledge the efforts of builders who’ve been diligently engaged on the chain, let’s discover the quite a few instruments and options that really represent the ecosystem.

Counterparty

Counterparty was based in 2014 by Robert Dermody, Adam Krellenstein, and Evan Wagner. The protocol, together with an inbuilt decentralized trade, was created to increase Bitcoin’s performance by figuratively “writing within the margins” of normal transactions.

In essence, as a Layer-2 resolution — a platform that works “on prime of the foundational Bitcoin mainnet (one thing that inherits the safety of the unique blockchain, however offers extra performance) — Counterparty offers the infrastructure for innovation and superior options. For instance, minting new Bitcoin-based property isn’t potential with bizarre Bitcoin software program.

Whereas surpassed by Ethereum and different standard NFT chains in recent times, Counterparty nonetheless has an lively neighborhood of supporters with near 30,000 Twitter followers and over 100,000 assets —a few of that are bridged to Ethereum by means of the Emblem Vault.

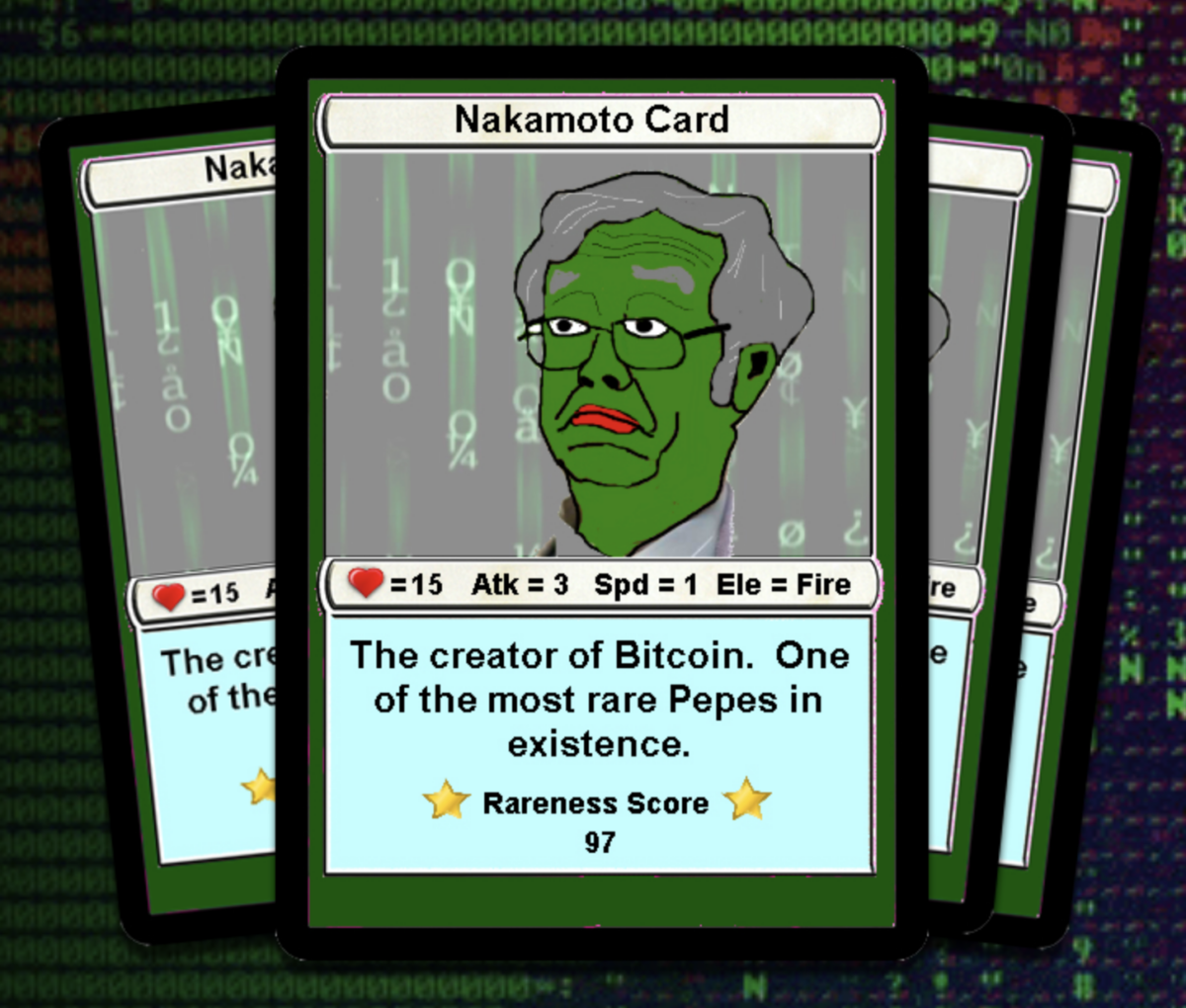

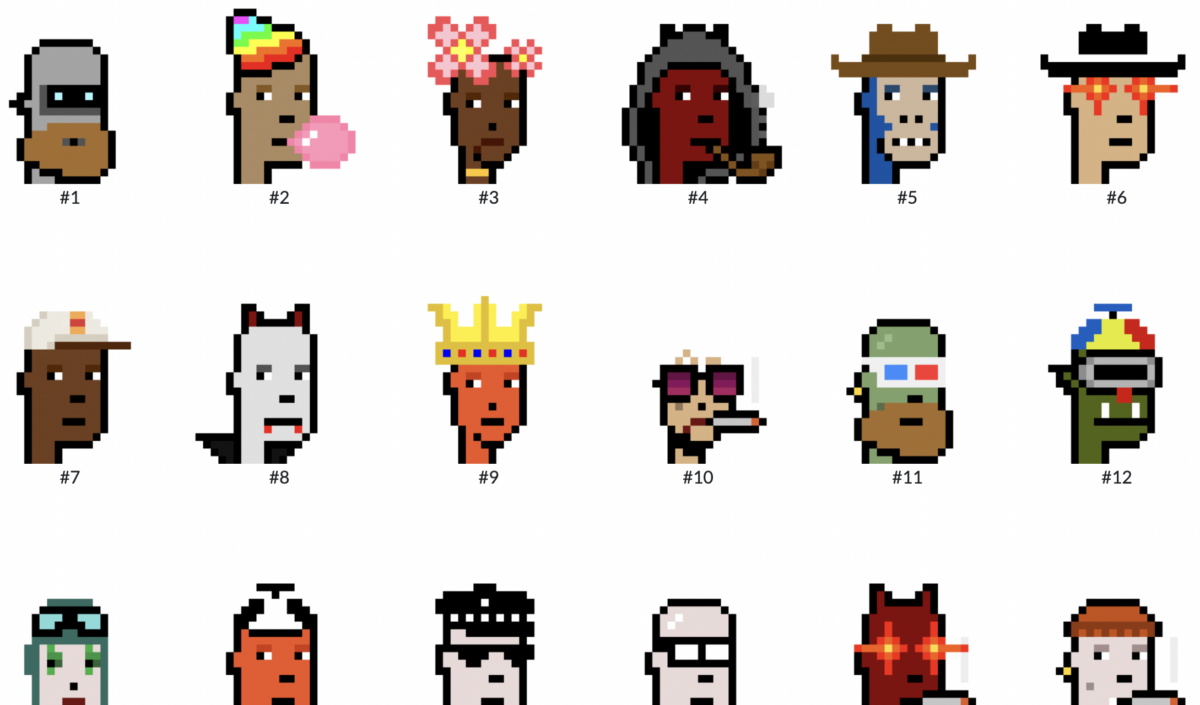

Extra importantly, Counterparty is finest often called the unique house for what ultimately got here to be often called the “CryptoArt movement” — a style of natural, decentralized, and verifiably uncommon art work and memes on Bitcoin largely catalyzed by means of property like Rare Pepes — tokenized variations of the Pepe the Frog meme by Matt Furie, which nonetheless command vital sums on secondary markets.

How does it work?

Much like how Ethereum token requirements outline how sure property work on its protocol, Counterparty provides the infrastructure that outlines how folks can create distinctive tokens on the Bitcoin blockchain. These property aren’t restricted to digital collectibles or tokens however something with a confirmed rarity — even bodily gadgets.

Counterparty is Bitcoin-native and may embed and use knowledge from the Bitcoin protocol when executing contracts, so transacting on the platform appears to be like simply as it could when utilizing BTC. Counterparty nodes merely interpret the info in these transactions based mostly on particular guidelines. From there, the protocol creates its native ledger of associated transactions that it has seen on the underlying Bitcoin community.

One other method to consider how transactions on Counterparty work is by way of the idea of Russian nesting dolls, whereby the Bitcoin transaction would comprise a smaller Counterparty transaction inside it. Added complexities apart, the transactions on Counterparty are the identical as Bitcoin and, due to this fact, simply as safe.

That mentioned, a notable distinction between Bitcoin and Counterparty is the connection between nodes. Not like Bitcoin nodes, Counterparty nodes don’t talk with one another and don’t provide a “peer-to-peer community.” Whereas all of them share the identical code and obtain the identical transaction knowledge, the first function of Counterparty nodes is to hook up with the Bitcoin software program.

As soon as linked, the nodes obtain and decode knowledge from every transaction whereas benefiting from Bitcoin’s safety and computing energy. As well as, as with gasoline on Ethereum, customers nonetheless have to pay mining charges when transacting on Counterparty.

How do dispensers work?

Shopping for and promoting property on Counterparty is commonly finished by way of computerized dispensers, which work like digital merchandising machines. Anybody can create a dispenser and resolve how a lot of a token or asset to promote, together with the value in BTC.

Shopping for property from these dispensers is akin to transferring tokens between digital wallets. Patrons simply have to scan the dispenser’s QR code or enter its pockets tackle after which ship the minimal required quantity of BTC for the gadgets they need to purchase. The dispenser will then ship the asset to the customer’s pockets.

Dispensers are fundamental sensible contracts with set guidelines that deal with and distribute property independently. To assist mitigate scams, a warning signal will present subsequent to an empty dispenser, informing potential consumers to not ship any BTC as a result of the dispenser is closed.

What’s XCP?

Shopping for property on Counterparty will also be finished utilizing the platform’s native XCP token. Not like extra standard strategies for launching tokens like crowd gross sales or preliminary coin choices (ICOs), Counterparty used the proof-of-burn (PoB) consensus protocol to problem XCP in January 2014.

To higher safe the community, miners burn a few of their cash to amass a digital mining rig, granting them the flexibility and authority to mine blocks on the Counterparty community. The extra cash a miner burns, the bigger their digital mining “platform” turns into.

The Counterparty group mentioned it settled on PoB to maintain the distribution of tokens as honest and decentralized as potential whereas avoiding potential authorized points. To generate XCP within the community, round 2,140 BTC—valued at over $2 million again then—had been destroyed or “burned” by sending them to a provably unspendable Bitcoin address with no identified personal key, making them completely misplaced. The XCP token can also be utilized in numerous methods within the Counterparty protocol, like serving to customers create new property, commerce, and make bets. XCP trades on exchanges like Dex-Trade and Zaif, paired with both BTC or the Japanese yen.

What are some disadvantages?

In comparison with extra mainstream marketplaces like OpenSea, the place one merely has to attach their MetaMask or Ethereum pockets, the consumer interface on Counterparty just isn’t as streamlined and requires a couple of extra steps to mint property. Additionally, as with gasoline wars on Ethereum, dispensers may be front-run, with transactions being prioritized over others if folks pay increased charges to miners.

Ordinals

Extending on the idea that originated in 2012 is Ordinals. This platform permits folks to inscribe messages or photos onto the smallest divisible models of Bitcoin, often called Satoshis (named after the pseudonymous creator, Satoshi Nakamoto). These distinctive inscriptions may be shared, traded, and preserved immediately on the Bitcoin blockchain. As of April 2023, over 1,900,000 Ordinals have been created.

For these unfamiliar with the mechanics, every Bitcoin is damaged into 100,000,000 models known as satoshis (or sats) or 1/100,000,000 of a BTC. Launched on the Bitcoin mainnet, the Ordinals protocol permits individuals who function Bitcoin nodes to inscribe every satoshi with knowledge (saved in a Bitcoin transaction’s signature), thus creating what’s often called an Ordinal.

That knowledge inscribed on Bitcoin can embrace sensible contracts, which, in flip, permits NFTs. In different phrases, Ordinals are NFTs or digital artifacts like photos, textual content, applications, and video video games you may mint or inscribe immediately onto the Bitcoin blockchain, in contrast to Counterparty, which features extra like a Layer-2 resolution (indirectly on the mainnet). Though the thought of inscriptions on Bitcoin isn’t something new, it’s largely potential due to the Taproot improve launched on the Bitcoin community on November 14, 2021.

How are Ordinals totally different from different NFTs?

Drawing parallels between Ordinals and NFTs can assist demystify an inherently advanced system, however it’s important to acknowledge the delicate distinctions between them. NFTs on blockchains like Ethereum or Solana sometimes level to off-chain knowledge on the Interplanetary File System (IPFS) — a decentralized storage resolution akin to an exterior laborious drive. This strategy permits for dynamic metadata updates, making it appropriate for tasks that want to reinforce picture high quality or alter the looks of their NFTs over time.

Nonetheless, this capacity to vary NFT metadata is the setback that Ordinals Rodarmor was making an attempt to enhance with the brand new protocol. In line with Rodarmor, NFTs are “incomplete” as they compromise integrity or safety with off-chain or exterior knowledge.

Compared, Ordinals are “full” as all the info is inscribed or saved immediately on the Bitcoin blockchain. Therefore the rationale behind naming them “digital artifacts” fairly than Bitcoin NFTs. One other distinction is that whereas most NFTs have creator royalties imbued within the contract or connected to the asset, Ordinals don’t. As said by Rodarmor, an Ordinal “is meant to mirror what NFTs ought to be, generally are, and what inscriptions all the time are, by their very nature.”

The best way to create and commerce Ordinals

Whereas nonetheless burdened by a slight technical barrier, inscribing on Bitcoin is changing into simpler. After establishing a pockets, some key strategies embrace:

- Run a Bitcoin node and inscribe an Ordinal your self.

Sometimes, these providers require customers to produce a BTC tackle to obtain the Ordinal, usually utilizing an Ordinal-compatible pockets like Sparrow. Customers are then knowledgeable of the variety of satoshis (smaller models of Bitcoin) wanted to cowl transaction and knowledge charges, in addition to a service price. Cost may be made in BTC, and an tackle for fee will probably be offered. The price of inscribing an Ordinal can range from beneath $50 in BTC to a number of hundred {dollars}, relying on the file dimension.

What are some disadvantages?

Customers ought to be aware that, in contrast to common BTC transactions, which normally full inside minutes, the possibly risk-laden means of sending BTC for an Ordinal may take hours and even days to finalize.

Nonetheless, the thought of filling Bitcoin blocks with JPEGs and movies — and even video video games — isn’t sitting effectively with some within the Bitcoin neighborhood who’ve voiced concerns that placing NFTs immediately on the Bitcoin community will drive up transaction prices.

Regardless of this divisiveness, Ordinals are one other methodology for anybody to protect their messages for posterity. Some technologists and builders have even began to seek out and inscribe satoshis with a particular historic date and inscribe distinctive messages on them with essential historic knowledge or details that will be subverted by means of standard mainstream media.

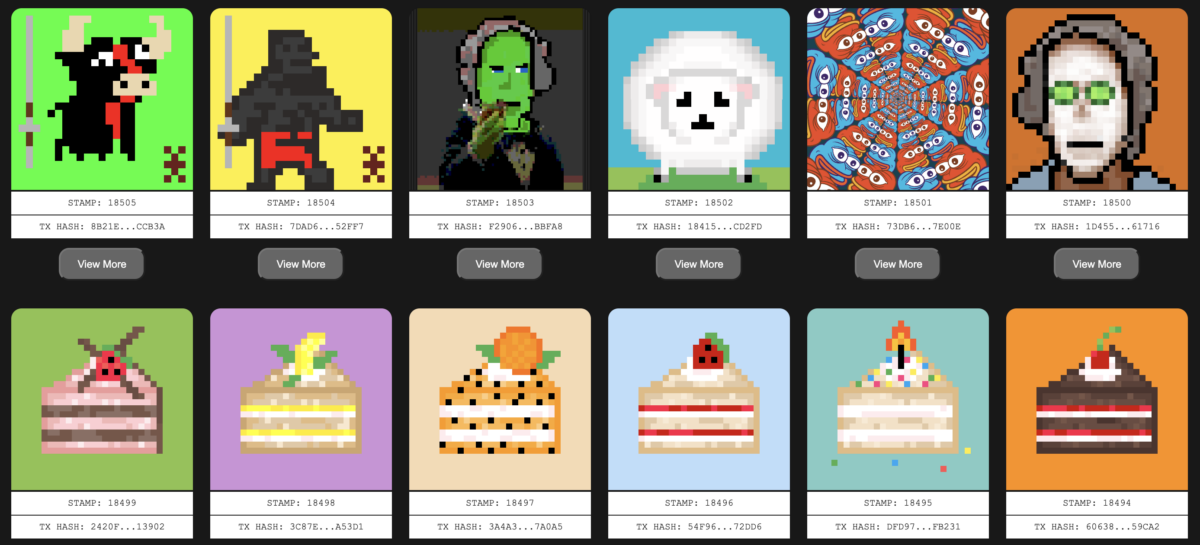

Bitcoin Stamps

Subsequent up is Bitcoin Stamps. One drawback and misnomer within the broader NFT world (together with Ordinals) is that storing “artwork on the Blockchain” is sufficient to obtain permanence. The fact is that the majority NFTs are merely picture tips that could centralized internet hosting or saved on-chain in prunable witness knowledge.

Bitcoin Stamps proposes a technique of embedding base64-formatted picture knowledge utilizing transaction outputs in a novel style. To place it extra merely, Bitcoin Stamps are digital collectibles much like ERC-1155 semi-fungible tokens saved on Bitcoin’s unspent transaction outputs (UTXOs) as a substitute of witness knowledge like Ordinals.

Bitcoin Stamps abide by the next guidelines:

- A Bitcoin Stamp needs to be a numeric asset, like this: [A1997663462583877600].

- You possibly can create a Bitcoin Stamp from an current numeric asset that wasn’t a stamp earlier than. To do that, replace the asset to incorporate the stamp:base64 string in a brand new transaction.

- You possibly can’t duplicate Bitcoin Stamps on the identical asset. If an asset is already a stamp, altering the outline area to a brand new base64 string received’t make it a brand new stamp. A brand new STAMP transaction will nonetheless be created on the blockchain, however the official STAMPS challenge received’t index it. That is to take care of a one-to-one relationship with the primary created stamp.

- The picture knowledge ought to be in jpg, png, gif, or webP format and encoded in base64.

How do Stamps differ from Ordinals?

There are a number of methods wherein Stamps differ from Ordinals:

- Storage: Bitcoin Stamps are saved on Bitcoin’s unspent transaction outputs (UTXOs), whereas Ordinals are saved within the witness knowledge.

- Protocol: Bitcoin Stamps use the Counterparty protocol, an open-source messaging protocol constructed on the Bitcoin blockchain, whereas Ordinals should not talked about to make use of this protocol. Moreover, Stamps is utilizing Counterparty naked multi-sig transactions for minting Bitcoin Stamps, permitting customers to securely ship BTC to a script-linked tackle.

- Minting price: The price of minting Bitcoin Stamps is roughly 4 occasions increased than inscribing Ordinals. Nonetheless, Counterparty permits for extra flexibility in minting bigger portions, which may result in economies of scale.

- Immutability: The encoded picture knowledge for Bitcoin Stamps dwell within the transaction outputs on the Bitcoin blockchain, requiring Bitcoin nodes to obtain all the info to take care of the blockchain. In distinction, Ordinals’ picture knowledge lives in witness knowledge, creating an surroundings the place the picture knowledge may be pruned.

- Flexibility: Counterparty offers much less consumer friction in minting a 1:1 or 1:100 at any given time, giving it extra feature-rich capabilities for on-chain Bitcoin protocols than Ordinals.

- Progress fee: Bitcoin Stamps have been rising quicker than Ordinals, possible because of the flexibility of minting bigger portions.

To mint Bitcoin Stamps, a picture is transformed to textual content, encoded as a Base64 file, and broadcasted to the Bitcoin community utilizing the Counterparty protocol. The information is then recompiled to recreate the unique picture.

What are some disadvantages?

Some controversy round Bitcoin Stamps revolves round knowledge permanence, UTXO set bloating, and disagreement about utilizing block area for digital art work. However, as with Ordinals, regardless of these debates, the emergence of Bitcoin Stamps as soon as once more highlights the capabilities of the Bitcoin blockchain as builders proceed to develop new functions and enhance consumer expertise.

Nostr

One other platform that leverages the performance of Ordinals is Nostr, a decentralized social community launched in 2021 by Bitcoin developer Joost Jager. Nostr permits customers to publish messages and content material immediately on the blockchain (utilizing the Ordinals system) in a censorship-resistant method, free from the constraints of any central authority or algorithmic censorship in any other case rampant on platforms like Twitter and Meta.

While still growing in adoption, the significance of Nostr invariably lies in its capacity to foster an surroundings the place free speech and expression can thrive unimpeded by the whims of centralized powers. In a world the place info is more and more managed and manipulated, Nostr provides a platform that upholds democracy, transparency, and autonomy, permitting customers to interact in open discourse, share concepts, and collaborate with out worry of censorship.

In different phrases, this decentralized strategy — tapping into the censorship-resistant nature of the Bitcoin blockchain — can reshape the way in which we work together on-line, giving voice to the unvoiced and paving the way in which for a extra equitable digital panorama.

A promising future

Whereas missing in comparative quantity compared with Ethereum, the regular rise of creativity and flexibility on the Bitcoin blockchain implies that builders and creators are provided a wider array of decisions totally free expression on-line. Furthermore, being classified as a commodity by the U.S. Commodity Futures Buying and selling Fee in September 2015 additional bolsters Bitcoin’s function in championing freedom. This classification affords it higher autonomy and fewer stringent rules than different cryptocurrencies deemed securities, enabling customers to specific themselves extra brazenly by means of the community.

Because the community expands with new nodes and as extra customers be part of to discover and have interaction with numerous ideas throughout all layers, the ecosystem turns into more and more safe and decentralized. And it’s by means of such revolutionary instruments that we inch nearer to a balanced and equitable digital panorama the place each consumer has the chance to thrive and thus foster an surroundings the place extra people can advance the reason for liberty within the digital age.

can you get cheap clomiphene without rx can you buy clomiphene online order clomiphene without a prescription where can i buy generic clomid without dr prescription can you buy cheap clomid for sale can i purchase generic clomid without insurance clomid tablets price in pakistan

This website exceedingly has all of the information and facts I needed about this subject and didn’t positive who to ask.

More posts like this would force the blogosphere more useful.

order zithromax 500mg pill – how to buy azithromycin order flagyl 400mg without prescription

brand semaglutide 14 mg – periactin 4 mg without prescription order cyproheptadine online cheap

purchase domperidone without prescription – tetracycline price oral cyclobenzaprine

inderal 20mg without prescription – buy cheap methotrexate methotrexate oral

amoxil brand – buy combivent 100 mcg generic buy combivent tablets

buy azithromycin 250mg – order nebivolol 20mg pills cheap nebivolol 20mg

nexium for sale – anexa mate buy generic esomeprazole

order coumadin sale – https://coumamide.com/ buy hyzaar sale

meloxicam price – https://moboxsin.com/ cost mobic 7.5mg

order deltasone 10mg sale – corticosteroid buy deltasone 40mg online cheap

ed pills no prescription – https://fastedtotake.com/ erection pills online

amoxicillin oral – cheap amoxicillin for sale amoxicillin online buy

diflucan 100mg drug – this diflucan medication

purchase cenforce generic – cenforce us order cenforce 50mg generic

cialis picture – ciltad gn is tadalafil as effective as cialis

ranitidine 300mg pill – https://aranitidine.com/ ranitidine order

cialis 5mg how long does it take to work – https://strongtadafl.com/# does medicare cover cialis for bph

This is the tolerant of advise I unearth helpful. https://buyfastonl.com/furosemide.html

This website absolutely has all of the tidings and facts I needed about this case and didn’t comprehend who to ask. https://ursxdol.com/amoxicillin-antibiotic/

The thoroughness in this piece is noteworthy. https://prohnrg.com/product/atenolol-50-mg-online/

The thoroughness in this draft is noteworthy. https://ondactone.com/product/domperidone/

The thoroughness in this section is noteworthy.

order celecoxib pills

More posts like this would bring about the blogosphere more useful. http://web.symbol.rs/forum/member.php?action=profile&uid=1171357

dapagliflozin 10 mg price – https://janozin.com/ order forxiga 10mg generic

xenical order – https://asacostat.com/ buy xenical 60mg generic

I couldn’t weather commenting. Warmly written! http://www.dbgjjs.com/home.php?mod=space&uid=533053