- Year-to-date inflows went past the $5.7 billion mark.

- The total assets under management hit a 26-week high.

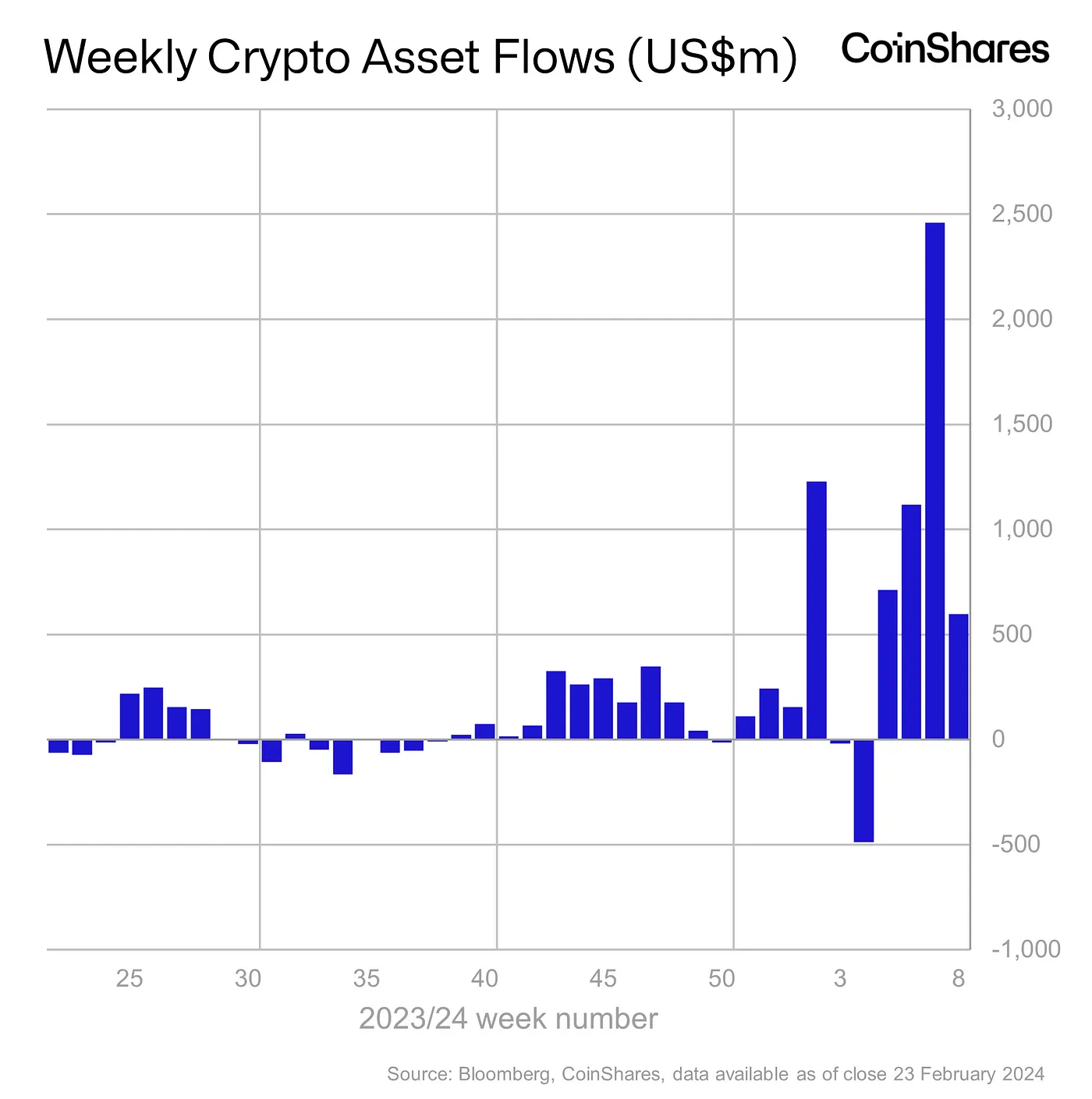

Digital asset investment products recorded the fourth straight week of net inflows as institutional interest in spot Bitcoin [BTC] continued to mount.

According to the latest report by crypto asset management firm CoinShares, investors poured $598 million into cryptocurrency-linked funds last week, taking the year-to-date (YTD) inflows past the $5.7 billion mark.

This figure already represented 55% of the record inflows seen during 2021 — the year when the crypto market achieved its top.

The total assets under management (AuM) hit a 26-week high of $68.3 billion, inching closer to the peak of $87 billion recorded in November 2021.

AUM is an important performance gradient of a fund. The higher the value of AuM, the more investments it tends to attract.

U.S. corners the majority of inflows

The U.S. remained the focus, with the recently-launched spot Bitcoin ETFs accounting for the bulk of the investments at $610 million.

To the market’s relief, outflows from Grayscale Bitcoin Trust (GBTC) ebbed considerably last week, totaling $436 million.

To add context to the decline, about $640 million was plugged out of the incumbent issuer on a single day last week.

Hits and misses

The largest institutional crypto product Bitcoin enjoyed investments of $570 million last week, bringing YTD inflows to $5.6 billion.

The leading crypto asset’s sideways trajectory impacted market sentiment, causing a marked drop from $2.3 billion inflows recorded in the week prior.

Funds linked to the second-largest cryptocurrency Ethereum [ETH] also saw impressive inflows, totaling $17 million last week.

On the other hand, the outage-induced FUD triggered a second consecutive week of outflows from Solana [SOL]-tied crypto products.

The global crypto market lifted 6.32% in the last 24 hours on significant gains made by leading assets, data from CoinMarketCap showed.

If the rally sustains, the upcoming week will likely see considerably higher inflows into the digital assets market.

- Year-to-date inflows went past the $5.7 billion mark.

- The total assets under management hit a 26-week high.

Digital asset investment products recorded the fourth straight week of net inflows as institutional interest in spot Bitcoin [BTC] continued to mount.

According to the latest report by crypto asset management firm CoinShares, investors poured $598 million into cryptocurrency-linked funds last week, taking the year-to-date (YTD) inflows past the $5.7 billion mark.

This figure already represented 55% of the record inflows seen during 2021 — the year when the crypto market achieved its top.

The total assets under management (AuM) hit a 26-week high of $68.3 billion, inching closer to the peak of $87 billion recorded in November 2021.

AUM is an important performance gradient of a fund. The higher the value of AuM, the more investments it tends to attract.

U.S. corners the majority of inflows

The U.S. remained the focus, with the recently-launched spot Bitcoin ETFs accounting for the bulk of the investments at $610 million.

To the market’s relief, outflows from Grayscale Bitcoin Trust (GBTC) ebbed considerably last week, totaling $436 million.

To add context to the decline, about $640 million was plugged out of the incumbent issuer on a single day last week.

Hits and misses

The largest institutional crypto product Bitcoin enjoyed investments of $570 million last week, bringing YTD inflows to $5.6 billion.

The leading crypto asset’s sideways trajectory impacted market sentiment, causing a marked drop from $2.3 billion inflows recorded in the week prior.

Funds linked to the second-largest cryptocurrency Ethereum [ETH] also saw impressive inflows, totaling $17 million last week.

On the other hand, the outage-induced FUD triggered a second consecutive week of outflows from Solana [SOL]-tied crypto products.

The global crypto market lifted 6.32% in the last 24 hours on significant gains made by leading assets, data from CoinMarketCap showed.

If the rally sustains, the upcoming week will likely see considerably higher inflows into the digital assets market.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

can you buy generic clomiphene pills can you get clomid without a prescription can you buy clomiphene online clomiphene tablet price how to buy clomid price can you get clomid pills where can i get generic clomiphene

I’ll certainly carry back to read more.

More posts like this would create the online space more useful.

order zithromax 500mg online – buy zithromax 250mg pills buy metronidazole 400mg online cheap

rybelsus 14 mg us – periactin 4mg oral cyproheptadine 4mg canada

motilium 10mg uk – domperidone us buy generic flexeril

inderal 10mg brand – order inderal pills buy methotrexate generic

amoxil cost – combivent 100mcg drug combivent 100mcg drug

amoxiclav order – https://atbioinfo.com/ buy ampicillin medication

buy esomeprazole 40mg pills – https://anexamate.com/ buy esomeprazole 20mg generic

buy medex medication – https://coumamide.com/ purchase losartan pills

buy mobic 7.5mg without prescription – https://moboxsin.com/ meloxicam 7.5mg canada

deltasone for sale online – aprep lson buy prednisone 20mg generic

buy ed medication – top erection pills ed pills gnc

buy amoxil online cheap – combamoxi.com amoxil pills

fluconazole 200mg price – how to get forcan without a prescription purchase forcan generic

buy cenforce 50mg online cheap – https://cenforcers.com/# cenforce order

cialis and grapefruit enhance – https://ciltadgn.com/# tadalafil review forum

cialis daily review – https://strongtadafl.com/ can cialis cause high blood pressure