- AAVE’s price surged by 4% in the last seven days.

- UNI’s daily chart turned red as its value plummeted by over 13%.

During the last few weeks, AI tokens created a buzz in the crypto space as the values of several AI cryptos skyrocketed.

However, over the last few days, the narrative has shifted towards DeFi. This allowed multiple DeFi tokens like Uniswap [UNI] and AAVE to pump their prices substantially.

DeFi tokens are shining

A few days ago, AMBCrypto reported that AI tokens like Worldcoin [WLD] gained traction and surged by over 90% in a single week. The hype around AI tokens was driven by OpenAI’s Sora launch.

But over the next few days, DeFi tokens came into the limelight. Daan Crypto Trades, a popular crypto trader, recently posted a tweet highlighting the shift of capital flow from AI tokens to DeFi tokens.

The shift was evident in terms of price action too, as Uniswap showcased commendable performance.

AMBCrypto had earlier reported that the DeFi token’s price surged by more than 65% in just a single day, allowing it to enter the list of the top 20 cryptos by market capitalization.

To better understand how these DeFi tokens were performing, we checked their weekly performances.

The bigger picture

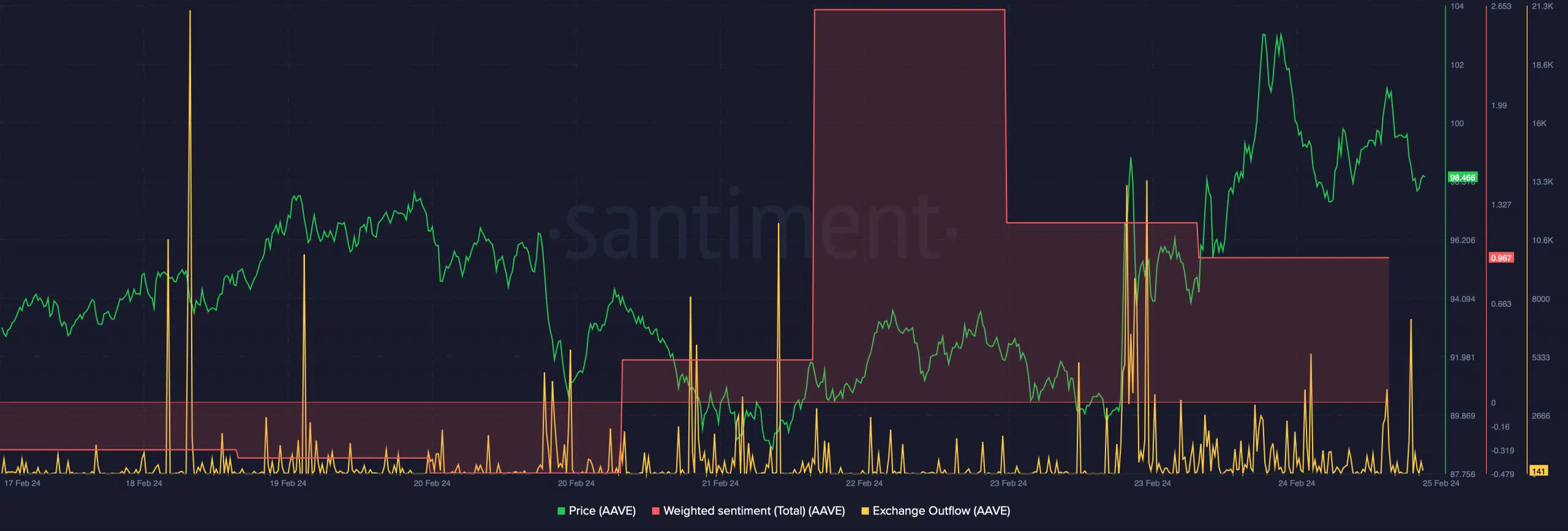

Apart from UNI, AAVE’s performance also looked promising, as its value shot up by more than 4% in the last seven days. At press time, it was trading at $98.14 with a market cap of over $1.4 billion.

It was surprising to note that despite the price rise, bearish sentiment around the token increased, as after a spike on the 22nd of February 2024, AAVE’s Weighted Sentiment dropped.

Its exchange outflow also dropped last week, signifying less buying pressure.

Though AAVE’s weekly chart was green, Maker’s [MKR] fate was different. The DeFi token’s value plummeted by more than 4.5% over the last seven days.

CoinMarketCap noted that MKR was trading at $2,030.17 with a market cap of over $1.8 billion at press time.

Read Uniswap’s [UNI] Price Prediction 2024–25

If the latest data is to be considered, UNI and AAVE’s bull rallies also came to an end. In the last 24 hours alone, UNI was down by more than 13%, while AAVE’s value dropped marginally.

It will thus be interesting to watch whether the hype around DeFi will help these tokens initiate another bull rally in the upcoming week.

- AAVE’s price surged by 4% in the last seven days.

- UNI’s daily chart turned red as its value plummeted by over 13%.

During the last few weeks, AI tokens created a buzz in the crypto space as the values of several AI cryptos skyrocketed.

However, over the last few days, the narrative has shifted towards DeFi. This allowed multiple DeFi tokens like Uniswap [UNI] and AAVE to pump their prices substantially.

DeFi tokens are shining

A few days ago, AMBCrypto reported that AI tokens like Worldcoin [WLD] gained traction and surged by over 90% in a single week. The hype around AI tokens was driven by OpenAI’s Sora launch.

But over the next few days, DeFi tokens came into the limelight. Daan Crypto Trades, a popular crypto trader, recently posted a tweet highlighting the shift of capital flow from AI tokens to DeFi tokens.

The shift was evident in terms of price action too, as Uniswap showcased commendable performance.

AMBCrypto had earlier reported that the DeFi token’s price surged by more than 65% in just a single day, allowing it to enter the list of the top 20 cryptos by market capitalization.

To better understand how these DeFi tokens were performing, we checked their weekly performances.

The bigger picture

Apart from UNI, AAVE’s performance also looked promising, as its value shot up by more than 4% in the last seven days. At press time, it was trading at $98.14 with a market cap of over $1.4 billion.

It was surprising to note that despite the price rise, bearish sentiment around the token increased, as after a spike on the 22nd of February 2024, AAVE’s Weighted Sentiment dropped.

Its exchange outflow also dropped last week, signifying less buying pressure.

Though AAVE’s weekly chart was green, Maker’s [MKR] fate was different. The DeFi token’s value plummeted by more than 4.5% over the last seven days.

CoinMarketCap noted that MKR was trading at $2,030.17 with a market cap of over $1.8 billion at press time.

Read Uniswap’s [UNI] Price Prediction 2024–25

If the latest data is to be considered, UNI and AAVE’s bull rallies also came to an end. In the last 24 hours alone, UNI was down by more than 13%, while AAVE’s value dropped marginally.

It will thus be interesting to watch whether the hype around DeFi will help these tokens initiate another bull rally in the upcoming week.

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/en/register?ref=JHQQKNKN

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

clomiphene bula homem cost of cheap clomid prices can i buy clomiphene price can you get generic clomid prices can you buy cheap clomiphene without a prescription where to buy cheap clomiphene no prescription clomid price

This is the description of content I get high on reading.

More content pieces like this would insinuate the web better.

azithromycin online order – buy generic metronidazole metronidazole 200mg price

semaglutide 14mg cheap – buy generic cyproheptadine 4 mg order cyproheptadine 4mg online cheap

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

brand motilium 10mg – buy flexeril without prescription flexeril order

where to buy propranolol without a prescription – clopidogrel 150mg uk buy methotrexate pill

cheap amoxicillin tablets – buy amoxicillin sale buy combivent without prescription

zithromax 250mg sale – nebivolol where to buy buy bystolic 5mg sale

order amoxiclav pill – atbioinfo ampicillin antibiotic online

buy esomeprazole 40mg online – https://anexamate.com/ nexium 40mg uk

warfarin 2mg pill – https://coumamide.com/ buy generic cozaar over the counter

meloxicam order – https://moboxsin.com/ meloxicam online order

order prednisone without prescription – apreplson.com order prednisone 5mg online

men’s ed pills – best ed pills online buy ed pills tablets

how to get amoxicillin without a prescription – https://combamoxi.com/ amoxil online order

diflucan over the counter – https://gpdifluca.com/# how to buy fluconazole

buy cenforce medication – cenforcers.com cenforce drug

cialis how long – this cialis canadian pharmacy

buy cialis with american express – https://strongtadafl.com/ what is cialis prescribed for

This is the stripe of topic I enjoy reading. https://gnolvade.com/

order real viagra line – buy viagra new zealand viagra pill 50mg

This website positively has all of the low-down and facts I needed to this case and didn’t know who to ask. generic lasix

With thanks. Loads of conception! https://ursxdol.com/sildenafil-50-mg-in/

More articles like this would remedy the blogosphere richer. https://prohnrg.com/product/cytotec-online/

Your article helped me a lot, is there any more related content? Thanks!

More delight pieces like this would make the web better. https://aranitidine.com/fr/en_france_xenical/

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

This website absolutely has all of the bumf and facts I needed about this participant and didn’t positive who to ask. https://ondactone.com/spironolactone/

I am actually thrilled to gleam at this blog posts which consists of tons of profitable facts, thanks for providing such data. http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4271948&do=profile

dapagliflozin 10mg cheap – https://janozin.com/ buy dapagliflozin pills for sale

orlistat pills – click order orlistat 60mg generic

I am in point of fact delighted to gleam at this blog posts which consists of tons of profitable facts, thanks representing providing such data. http://seafishzone.com/home.php?mod=space&uid=2331375