- Short-term holders began to accumulate large amounts of BTC.

- Whale accumulation of BTC slowed down.

Bitcoin [BTC] witnessed a massive bump in price over the last few days, causing a surge in optimism amongst traders. But it wasn’t just traders that were showing optimism around BTC.

Short term holders move in

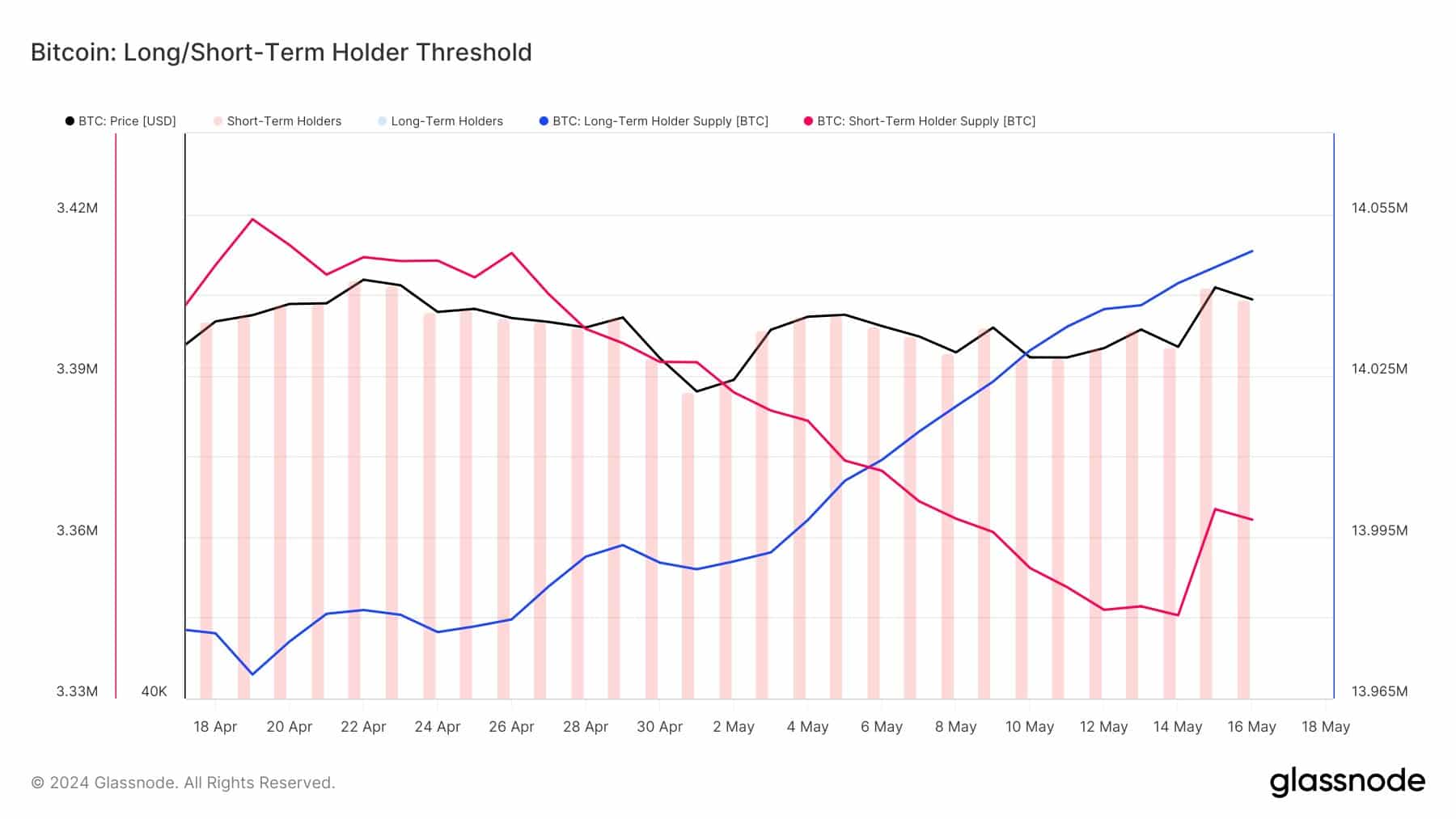

In the last few days, the Short Term Holders (STH) supply saw a net increase of over 20,000 Bitcoin.

U.S. ETFs accumulated 11,000 Bitcoin during the same period, even when considering outflows from the Hong Kong ETFs. This suggested significant demand from other sources, as reflected in the price movement.

This increased demand from STHs creates a positive feedback loop. As more people buy in, the price goes up, attracting even more buyers. This can accelerate price increases.

However, it’s important to remember that STHs are typically more likely to sell quickly on price dips, potentially leading to higher volatility.

So, while STH accumulation is a positive sign for Bitcoin’s short-term momentum, it could affect BTC’s long term growth.

Source: glassnode

What are holders up to?

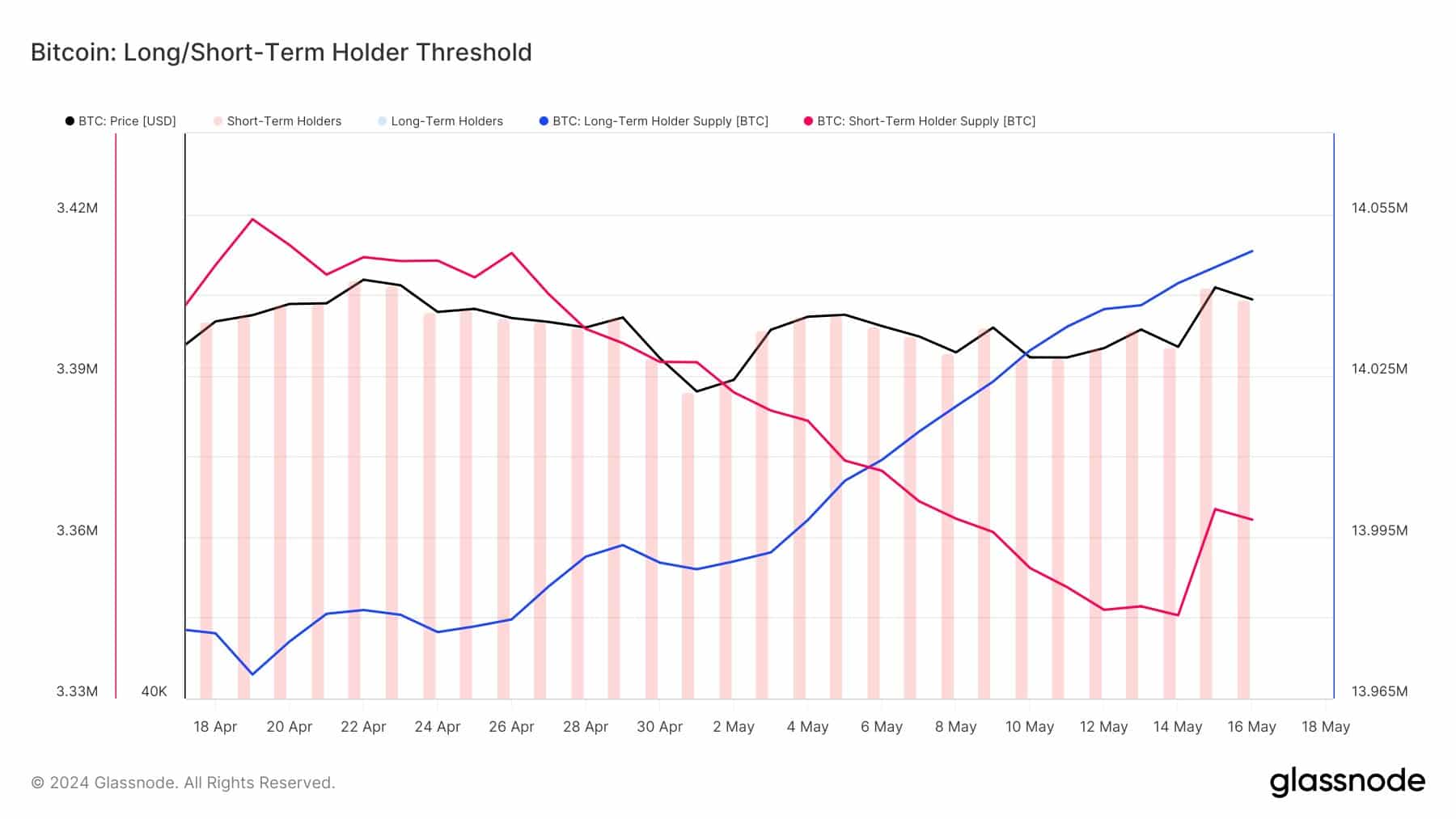

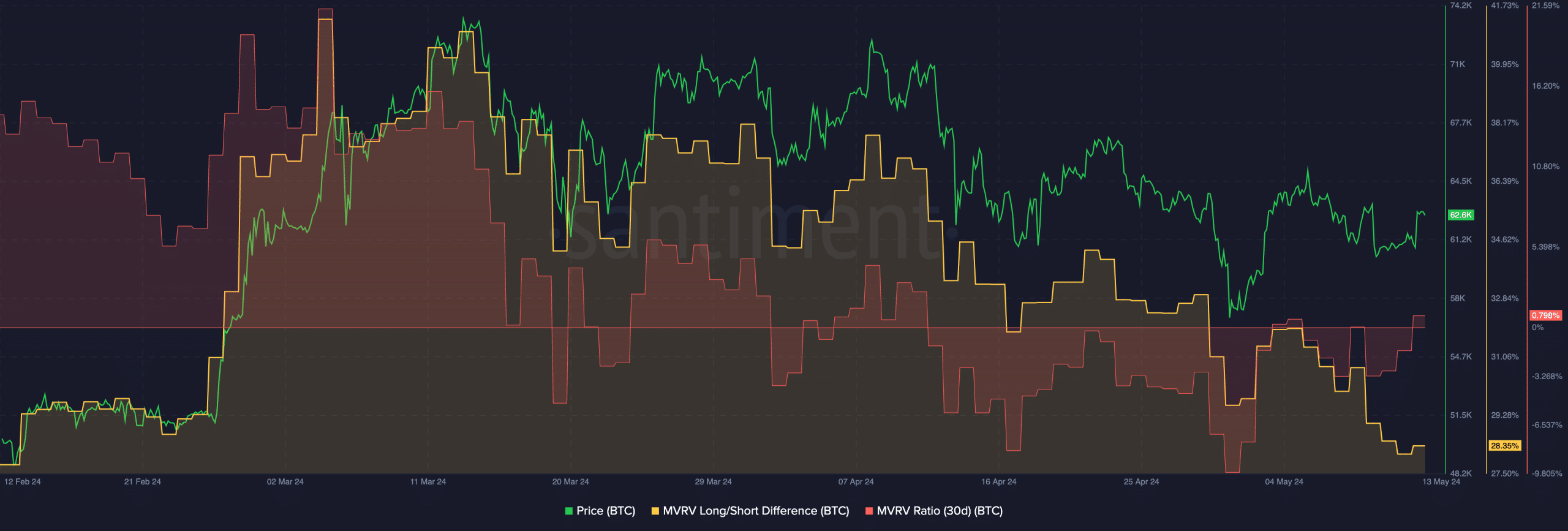

Another indicator of the rising number of Short Term Holders would be the declining Long/Short ratio. A falling long/short ratio suggested that the number of long-term holders accumulating BTC were declining.

These long-term holders are more likely to keep their holdings during violent price fluctuations, which could also impact BTC negatively in the long run.

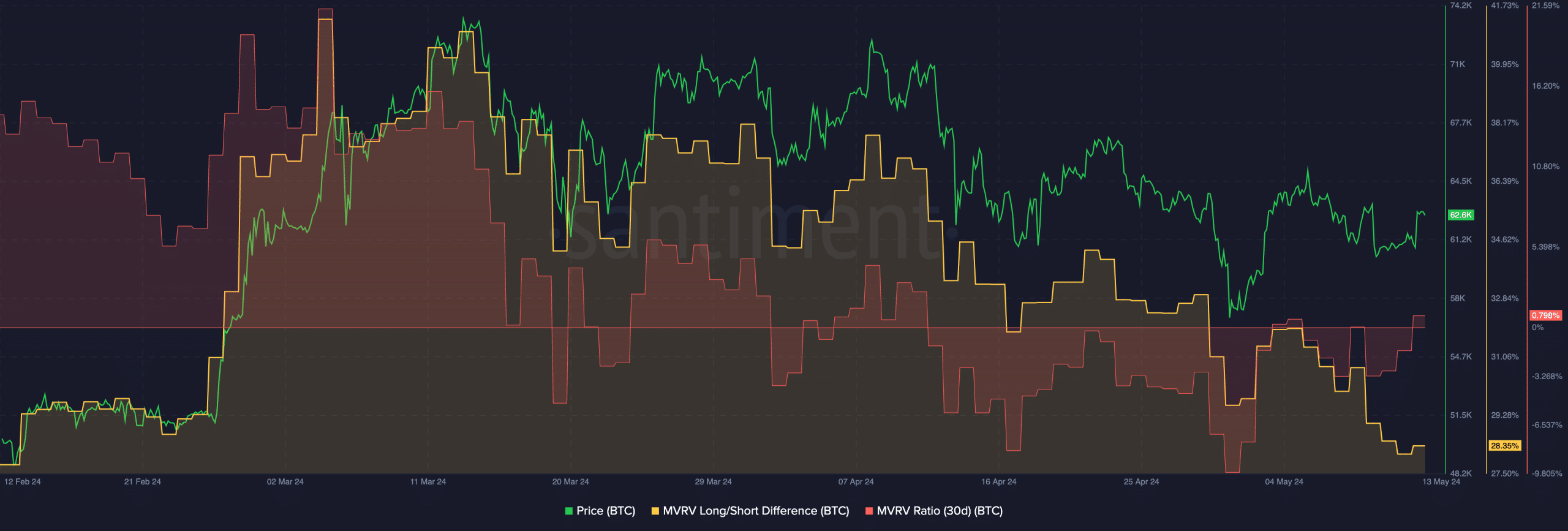

The MVRV ratio for BTC had surged in the last few days, indicating that a large number of addresses holding BTC had turned profitable.

This could add selling pressure on BTC, as STHs may be incentivized to sell their holdings for profit.

Source: Santiment

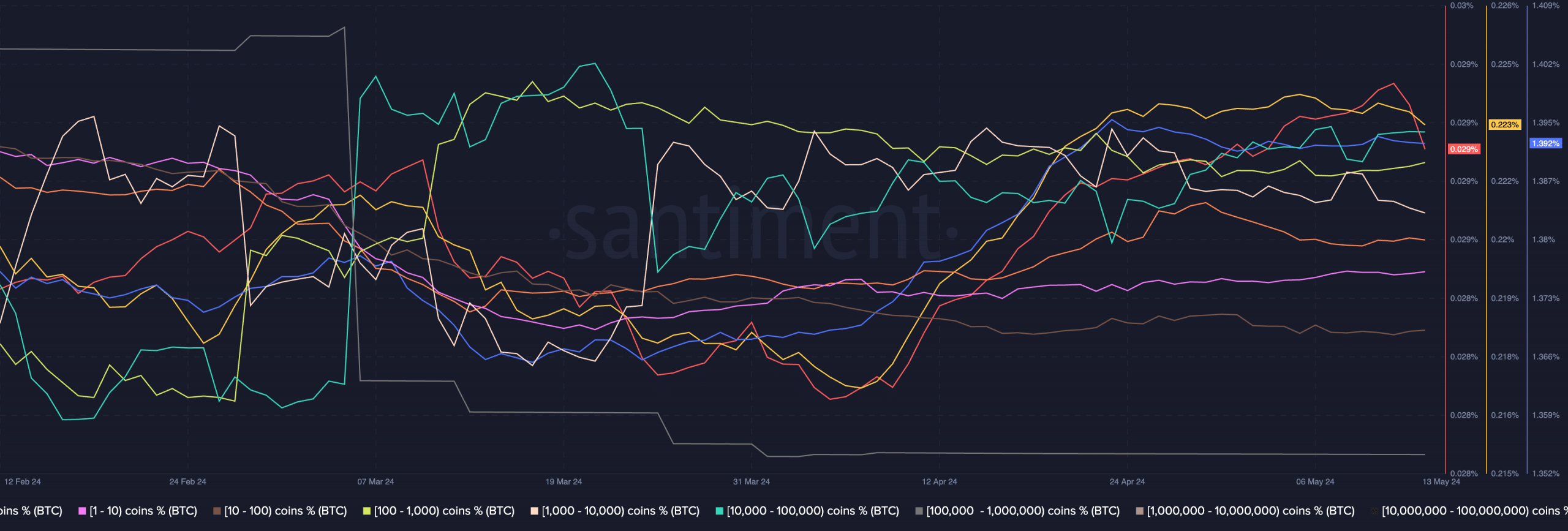

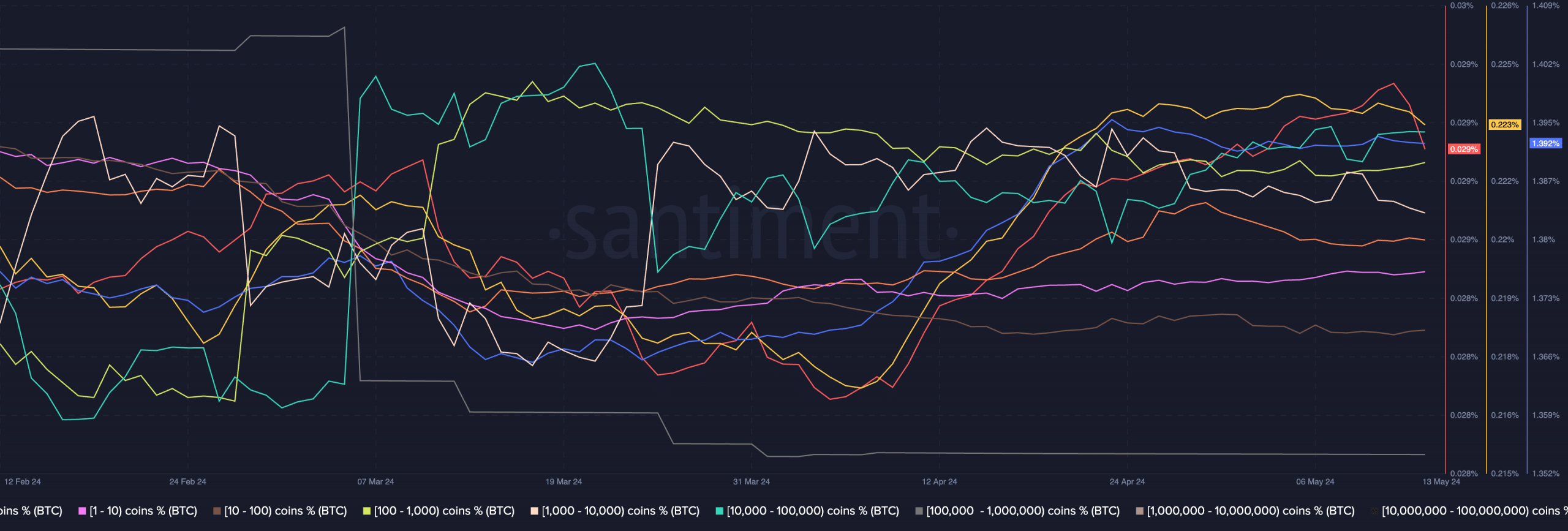

Whale behavior would also play a great role in determining the price of BTC in the future. In the last few days, whales have been stagnant in terms of accumulation of BTC.

They have not sold any of their holdings, but have shown no interest in accumulating BTC at this price level.

Is your portfolio green? Check out the BTC Profit Calculator

Retail traders, on the other hand, have been observed to buying Bitcoin en masse, which may have also contributed to the recent surge in BTC’s price.

At the time of writing, BTC was trading at $67,110.39 and its price had grown by 1.17% in the last 24 hours.

Source: Santiment

- Short-term holders began to accumulate large amounts of BTC.

- Whale accumulation of BTC slowed down.

Bitcoin [BTC] witnessed a massive bump in price over the last few days, causing a surge in optimism amongst traders. But it wasn’t just traders that were showing optimism around BTC.

Short term holders move in

In the last few days, the Short Term Holders (STH) supply saw a net increase of over 20,000 Bitcoin.

U.S. ETFs accumulated 11,000 Bitcoin during the same period, even when considering outflows from the Hong Kong ETFs. This suggested significant demand from other sources, as reflected in the price movement.

This increased demand from STHs creates a positive feedback loop. As more people buy in, the price goes up, attracting even more buyers. This can accelerate price increases.

However, it’s important to remember that STHs are typically more likely to sell quickly on price dips, potentially leading to higher volatility.

So, while STH accumulation is a positive sign for Bitcoin’s short-term momentum, it could affect BTC’s long term growth.

Source: glassnode

What are holders up to?

Another indicator of the rising number of Short Term Holders would be the declining Long/Short ratio. A falling long/short ratio suggested that the number of long-term holders accumulating BTC were declining.

These long-term holders are more likely to keep their holdings during violent price fluctuations, which could also impact BTC negatively in the long run.

The MVRV ratio for BTC had surged in the last few days, indicating that a large number of addresses holding BTC had turned profitable.

This could add selling pressure on BTC, as STHs may be incentivized to sell their holdings for profit.

Source: Santiment

Whale behavior would also play a great role in determining the price of BTC in the future. In the last few days, whales have been stagnant in terms of accumulation of BTC.

They have not sold any of their holdings, but have shown no interest in accumulating BTC at this price level.

Is your portfolio green? Check out the BTC Profit Calculator

Retail traders, on the other hand, have been observed to buying Bitcoin en masse, which may have also contributed to the recent surge in BTC’s price.

At the time of writing, BTC was trading at $67,110.39 and its price had grown by 1.17% in the last 24 hours.

Source: Santiment

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

This website is my aspiration, real great design and style and perfect subject matter.

Purdentix

Purdentix

Purdentix reviews

It provides an excellent user experience from start to finish.

This site truly stands out as a great example of quality web design and performance.

I love how user-friendly and intuitive everything feels.

The content is engaging and well-structured, keeping visitors interested.

The layout is visually appealing and very functional.

I’m really impressed by the speed and responsiveness.

I love how user-friendly and intuitive everything feels.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The content is engaging and well-structured, keeping visitors interested.

This site truly stands out as a great example of quality web design and performance.

This website is amazing, with a clean design and easy navigation.

The design and usability are top-notch, making everything flow smoothly.

The design and usability are top-notch, making everything flow smoothly.

The content is engaging and well-structured, keeping visitors interested.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why waste your intelligence on just posting videos to your weblog when you could be giving us something informative to read?

It’s really a great and useful piece of information. I am glad that you simply shared this helpful info with us. Please keep us informed like this. Thank you for sharing.

Yeah bookmaking this wasn’t a risky decision outstanding post! .

I like this web blog its a master peace ! Glad I discovered this on google .

can i buy generic clomid no prescription buy generic clomid tablets how to buy cheap clomiphene how can i get clomid without dr prescription order generic clomid pills where can i buy clomiphene clomiphene nz prescription

This is the stripe of glad I have reading.

Greetings! Very useful recommendation within this article! It’s the crumb changes which will obtain the largest changes. Thanks a lot in the direction of sharing!

how to buy azithromycin – buy azithromycin 250mg without prescription buy metronidazole 400mg online cheap

rybelsus where to buy – periactin cheap periactin 4 mg pills

order motilium pill – flexeril brand buy flexeril online cheap

Having read this I thought it was very informative. I appreciate you taking the time and effort to put this article together. I once again find myself spending way to much time both reading and commenting. But so what, it was still worth it!

buy augmentin 375mg online cheap – https://atbioinfo.com/ buy ampicillin

esomeprazole over the counter – https://anexamate.com/ esomeprazole online order

buy coumadin tablets – blood thinner buy losartan 50mg

I have been browsing online greater than three hours lately, but I by no means discovered any interesting article like yours. It is beautiful worth enough for me. In my opinion, if all website owners and bloggers made excellent content as you probably did, the web shall be a lot more useful than ever before.

mobic cost – https://moboxsin.com/ meloxicam 7.5mg uk

deltasone 40mg drug – https://apreplson.com/ oral prednisone 10mg

new ed drugs – https://fastedtotake.com/ buy ed pills generic

cheap amoxil tablets – comba moxi oral amoxicillin

With havin so much content and articles do you ever run into any problems of plagorism or copyright infringement? My website has a lot of unique content I’ve either created myself or outsourced but it appears a lot of it is popping it up all over the internet without my permission. Do you know any methods to help stop content from being stolen? I’d certainly appreciate it.

purchase fluconazole online cheap – this forcan online

cenforce 50mg price – https://cenforcers.com/# buy cenforce paypal

Howdy! This is my first comment here so I just wanted to give a quick shout out and tell you I really enjoy reading through your blog posts. Can you recommend any other blogs/websites/forums that cover the same subjects? Thanks!

order ranitidine 150mg online – this cheap ranitidine 300mg

cialis max dose – strongtadafl cialis vs flomax for bph

More posts like this would make the blogosphere more useful. accutane ansiedad

generic viagra – https://strongvpls.com/ buy sildenafil citrate 50mg

More posts like this would add up to the online elbow-room more useful. https://buyfastonl.com/amoxicillin.html

More posts like this would add up to the online space more useful. https://ursxdol.com/amoxicillin-antibiotic/

I couldn’t weather commenting. Well written! https://prohnrg.com/product/rosuvastatin-for-sale/

Thanks for one’s marvelous posting! I quite enjoyed reading it, you can be a great author.I will be sure to bookmark your blog and definitely will come back from now on. I want to encourage you to definitely continue your great work, have a nice holiday weekend!

More articles like this would make the blogosphere richer. https://aranitidine.com/fr/viagra-100mg-prix/

Thanks towards putting this up. It’s okay done. https://ondactone.com/simvastatin/

More articles like this would remedy the blogosphere richer.

order medex sale

I enjoy your writing style genuinely loving this site.

Hiya very nice site!! Guy .. Excellent .. Wonderful .. I’ll bookmark your website and take the feeds additionally?KI am happy to find a lot of useful information here within the submit, we’d like work out more strategies in this regard, thank you for sharing. . . . . .

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

Admiring the hard work you put into your site and in depth information you present. It’s nice to come across a blog every once in a while that isn’t the same unwanted rehashed information. Excellent read! I’ve saved your site and I’m adding your RSS feeds to my Google account.

This is the compassionate of criticism I truly appreciate. https://experthax.com/forum/member.php?action=profile&uid=124580

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

I really appreciate this post. I?¦ve been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thx again

Thank you for sharing excellent informations. Your web-site is very cool. I’m impressed by the details that you have on this web site. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for more articles. You, my friend, ROCK! I found simply the info I already searched everywhere and just couldn’t come across. What a perfect website.

Thank you for another great post. Where else could anyone get that type of information in such a perfect way of writing? I’ve a presentation next week, and I am on the look for such information.

order dapagliflozin 10mg sale – dapagliflozin 10 mg cheap buy forxiga generic

I have been reading out a few of your posts and i can claim clever stuff. I will make sure to bookmark your site.

I genuinely enjoy studying on this internet site, it contains fantastic blog posts. “A short saying oft contains much wisdom.” by Sophocles.

It’s a shame you don’t have a donate button! I’d certainly donate to this excellent blog! I suppose for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to new updates and will talk about this website with my Facebook group. Talk soon!

I couldn’t turn down commenting. Profoundly written! http://www.dbgjjs.com/home.php?mod=space&uid=532966

You got a very great website, Gladiolus I noticed it through yahoo.